How Australian Subscription Companies Differ from American Ones

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: July 17th, 2019

One beauty of the subscription and SaaS world is the way companies have been popping up and flourishing all over the world–not just in Silicon Valley. One fascinating place with massive success stories has been Australia and New Zealand, where companies like Atlassian, Canva, SafetyCulture, and even Xero have pushed this region into the forefront of the subscription economy.

While Australian companies may not be the fastest growing, they tend to focus on experience and customer retention much better than their U.S. counterparts.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

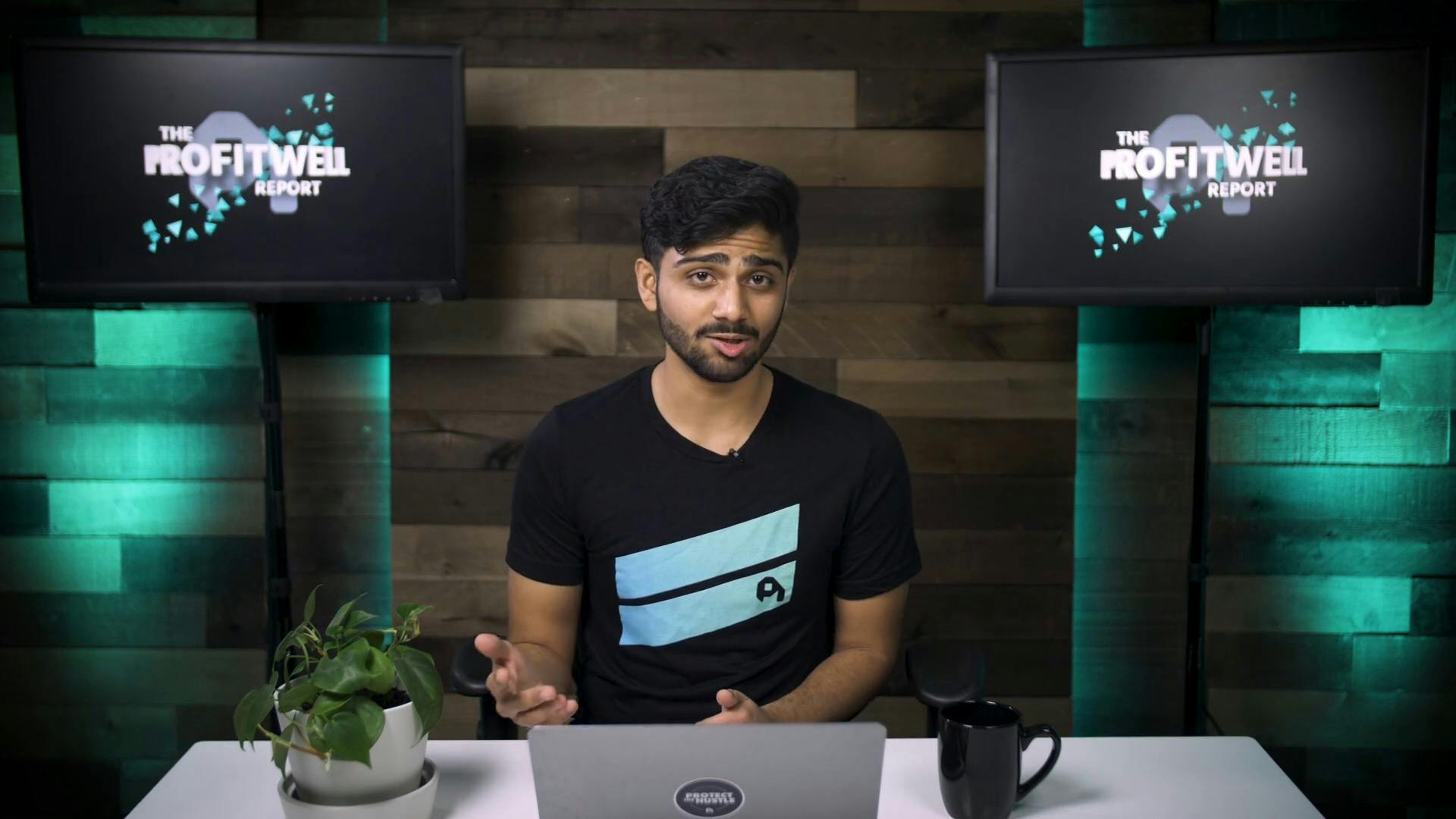

From a net promoter score standpoint, which is a measure of customer satisfaction, Australian companies in both B2B and in the consumer spaces are noticeably better than U.S. companies in similar industries. While all NPS scores have fallen over time, Australian NPS scores tend to be 15% to 30% higher.

While we don’t have data that exactly gets to the why this is happening, qualitatively we tend to see that support and design quality are much better with Australian companies, where even the nerdiest enterprise B2B software products get lots of user experience love.

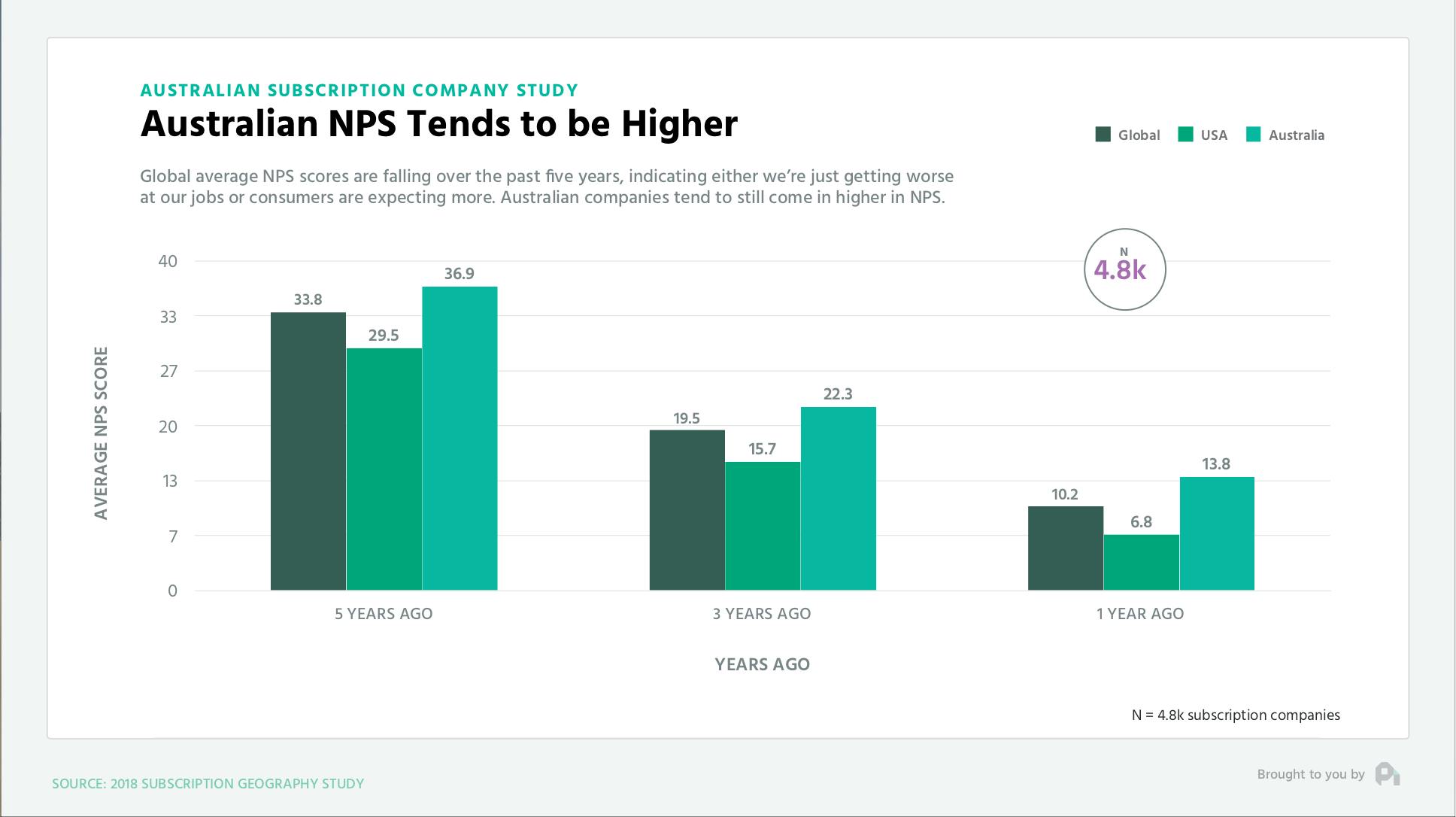

You see this when comparing retention numbers as well. When comparing gross revenue retention across companies selling different levels of products, you’ll notice that Australian companies consistently have 10 to 23% lower churn than their US counterparts in both B2B and B2C.

One theory here is that if you take a step back and think about how the Australian subscription economy developed, there may be a bit of a Goldilocks effect. Atlassian’s rise (Australia’s major anchor company) happened at just the right time and resulted in many other companies popping up or having an ecosystem that supported them. This all happened in the past ten years, which is right when design and great support started to be even more important. U.S. companies got that memo later, because they were able to rest on their laurels of the old guard.

So is everything better for Australian subscription companies?

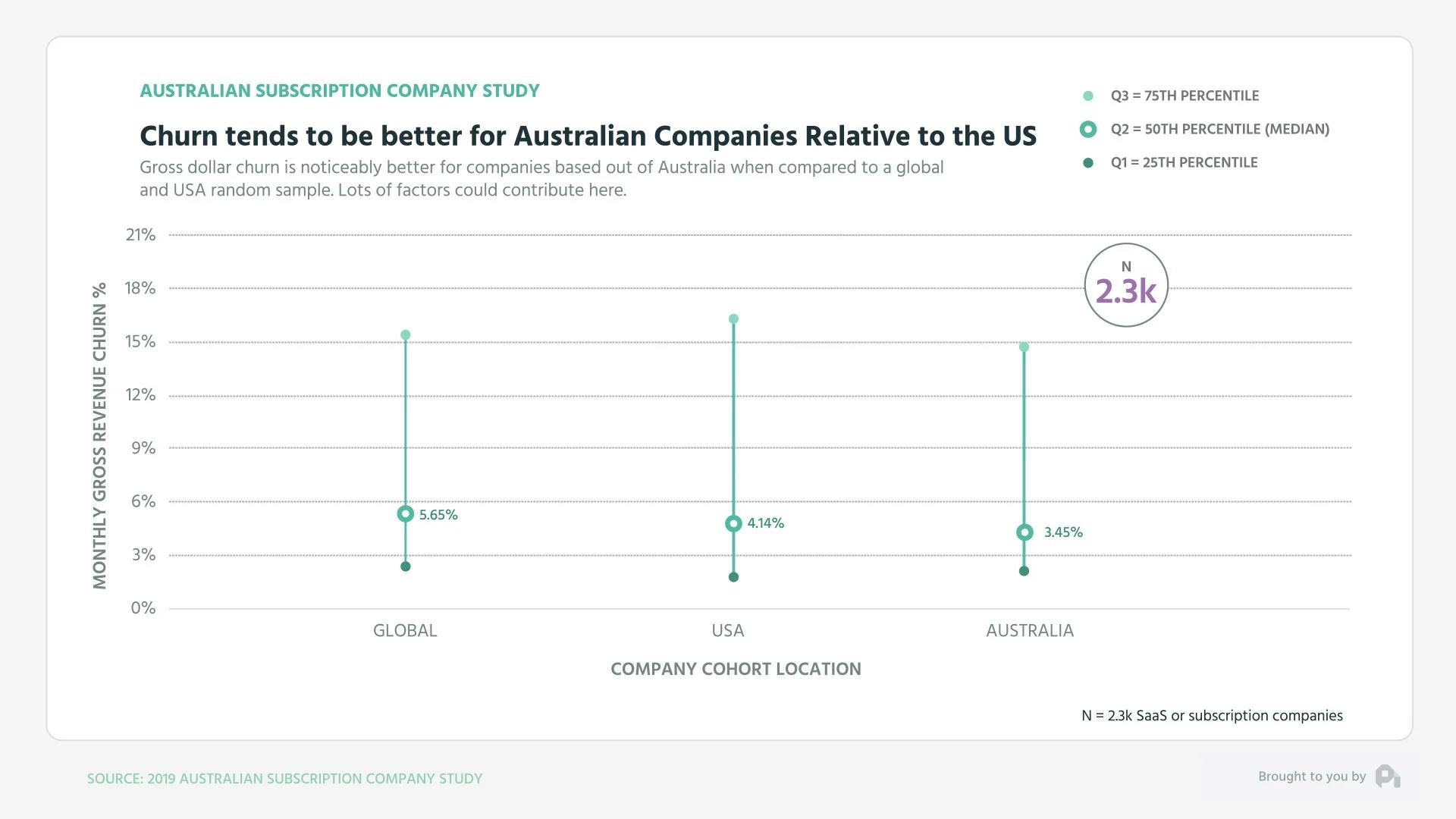

Well, not exactly. Australian companies actually have much bigger problems when it comes to extracting value from their customers. When looking at the growth – or lack thereof – of the average revenue per user (ARPU) you’ll notice that overall, Australian companies are stagnant or trailing their U.S. counterparts pretty considerably.

This is important to note, because your ARPU is an individualized proxy for growth when it comes to your pricing, target customer subset, and even your upgrade trajectories. If Australian companies aren’t able to grow their ARPU, then they’re running into potential problems when it comes to growth.

All that being said, the Australian ecosystem is strong, particularly because of their focus on activities that procure higher NPS and retention. There’s some work to do on actually getting the revenue that these companies are worth, but I’d rather start from a place of strength of experience than one with unhappy, churning customers.

Want to learn more? Check out our recent episode on Which Tactics Will Increase Willingness to Pay? and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,595 --> 00:00:11,875

Hey, Neil. This is Sancho,

VP of marketing at Typeform.

4

00:00:11,875 --> 00:00:16,735

My question is, how do Australian

subscription companies differ from the US?

5

00:00:16,960 --> 00:00:19,500

Welcome back, everyone.

Neil here from ProfitWell.

6

00:00:19,600 --> 00:00:21,990

One deep beauty of the

subscription economy is that in

7

00:00:21,990 --> 00:00:24,275

the wake of place

8

00:00:32,285 --> 00:00:34,940

with massive success place with

massive success stories has

9

00:00:34,940 --> 00:00:38,220

been Australia and New Zealand,

where companies like Elysian,

10

00:00:38,220 --> 00:00:39,660

Canva, SafetyCulture,

11

00:00:39,660 --> 00:00:42,335

and even Xero have pushed this

region into the forefront of

12

00:00:42,335 --> 00:00:43,775

the subscription economy.

13

00:00:43,775 --> 00:00:46,735

Let's explore how companies

on the Australian continent stack

14

00:00:46,735 --> 00:00:50,640

up to the US by looking at the data

from over five thousand companies.

15

00:00:50,640 --> 00:00:53,600

While Australian companies may

not be the fastest growing,

16

00:00:53,600 --> 00:00:55,920

they tend to focus on

experience and customer

17

00:00:55,920 --> 00:00:58,320

retention much better

than the US counterparts.

18

00:00:58,320 --> 00:00:58,960

From a net

19

00:00:58,960 --> 00:01:00,385

promoter score standpoint,

20

00:01:00,385 --> 00:01:03,005

which is a measure of

customer satisfaction,

21

00:01:03,105 --> 00:01:05,905

Australian companies in both

b two b and in the consumer

22

00:01:05,905 --> 00:01:10,310

spaces are noticeably better than

US companies in similar industries.

23

00:01:10,310 --> 00:01:12,950

While NPS scores have

fallen over time,

24

00:01:12,950 --> 00:01:16,795

Australian NPS scores tend to be

fifteen to thirty percent higher.

25

00:01:16,795 --> 00:01:19,355

While we don't have data that

exactly gets to why this is

26

00:01:19,355 --> 00:01:20,715

happening, qualitatively,

27

00:01:20,715 --> 00:01:23,515

we tend to see that support and

design quality are much higher

28

00:01:23,515 --> 00:01:26,690

with Australian companies where

even the nerdiest enterprise b

29

00:01:26,690 --> 00:01:29,730

to b software products get

lots of user experience love.

30

00:01:29,730 --> 00:01:32,345

You see this when comparing

retention numbers as well.

31

00:01:32,345 --> 00:01:34,985

When comparing gross revenue

retention across companies

32

00:01:34,985 --> 00:01:36,585

selling different

levels of products,

33

00:01:36,585 --> 00:01:40,090

you'll notice that Australian

companies consistently have ten

34

00:01:40,090 --> 00:01:42,410

to twenty three percent

lower churn than their US

35

00:01:42,410 --> 00:01:45,130

counterparts in both

b to b and b to c.

36

00:01:45,130 --> 00:01:47,770

One theory here is that if

you take a step back and think

37

00:01:47,770 --> 00:01:51,065

about how the Australian

subscription economy developed,

38

00:01:51,065 --> 00:01:53,945

there may be a bit of a

Goldilocks effect where at

39

00:01:53,945 --> 00:01:57,130

least in rise Australia's

major anchor company happened

40

00:01:57,130 --> 00:01:59,432

happened at just the right

time and resulted in many other companies

41

00:01:59,432 --> 00:01:59,436

popping up or having an

ecosystem that supported

42

00:01:59,436 --> 00:01:59,439

them in the past ten years,

43

00:01:59,439 --> 00:01:59,445

which is right when designing

great support started to be even

44

00:01:59,445 --> 00:01:59,446

more important.

45

00:01:59,446 --> 00:02:00,090

Companies in the US

got that memo later.

46

00:02:00,090 --> 00:02:01,190

So

47

00:02:06,645 --> 00:02:08,405

to be even more important.

48

00:02:08,405 --> 00:02:10,645

Companies in the US

got that memo later.

49

00:02:10,645 --> 00:02:13,285

So is everything better for

Australian subscription companies?

50

00:02:13,285 --> 00:02:14,890

Well, not exactly.

51

00:02:14,890 --> 00:02:17,370

Australian companies actually

have much bigger problems when

52

00:02:17,370 --> 00:02:19,770

it comes to extracting

value from their customers.

53

00:02:19,770 --> 00:02:23,555

When looking at the growth or

lack thereof of the average

54

00:02:31,130 --> 00:02:33,930

important to note because your

ARPU is an individualized proxy

55

00:02:33,930 --> 00:02:36,010

for growth when it

comes to your pricing,

56

00:02:36,010 --> 00:02:39,210

target customer subset, and

even your upgrade trajectories.

57

00:02:39,210 --> 00:02:41,915

If Australian companies aren't

able to grow their ARPU,

58

00:02:41,915 --> 00:02:44,955

then they're running into potential

problems when it comes to growth.

59

00:02:44,955 --> 00:02:48,530

All that being said, the

Australian ecosystem is strong,

60

00:02:48,530 --> 00:02:50,850

particularly because of their

focus on activities that

61

00:02:50,850 --> 00:02:53,330

procure higher

NPS and retention.

62

00:02:53,330 --> 00:02:55,410

There's some work to do on

actually getting the revenue

63

00:02:55,410 --> 00:02:56,690

that these companies are worth,

64

00:02:56,690 --> 00:02:59,605

but I'd rather start from a

place of strength of experience

65

00:02:59,605 --> 00:03:02,385

than one with unhappy

churning customers.

66

00:03:02,485 --> 00:03:03,845

Well, that's it for now.

67

00:03:03,845 --> 00:03:04,885

If you have any questions,

68

00:03:04,885 --> 00:03:07,720

send me an email or video to

neil at profitable dot dot com.

69

00:03:07,720 --> 00:03:10,200

If you got value today

or any other episode,

70

00:03:10,200 --> 00:03:12,680

we appreciate any and all

shares on Twitter and LinkedIn

71

00:03:12,680 --> 00:03:14,465

because that's how we

know to keep going.

72

00:03:14,465 --> 00:03:16,525

I will see you next week.

73

00:03:18,385 --> 00:03:20,945

This week's episode is

brought to you by ClassPass.

74

00:03:20,945 --> 00:03:22,790

Committing is hard, so don't.

75

00:03:22,790 --> 00:03:24,950

Work out at any gym,

try any workout,

76

00:03:24,950 --> 00:03:26,710

and do it all with one app.

77

00:03:26,710 --> 00:03:30,850

Try ClassPass absolutely

free. Classpass dot com.