How Do Subscription Companies in EU Differ from Those in the USA?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: July 19th, 2019

Subscription and SaaS ecosystems have popped up–and flourished–everywhere in the past few decades. While the United States continues to dominate when it comes to the subscription economy, Europe in particular is enjoying an upswing in the past few years spurred by the ecosystem getting injected with talent coming from the European headquarters of U.S. tech companies.

The problem is, looking at Europe as one block is a bit tough.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

The U.K., Western Europe, Eastern Europe, and Scandinavia all act a bit differently, particularly in what they prioritize within their companies. For instance, Eastern European companies tend to be very efficient and resourceful, a result of dealing with older equipment in the post-Soviet era, while the Nordics are very much focused on design and experience.

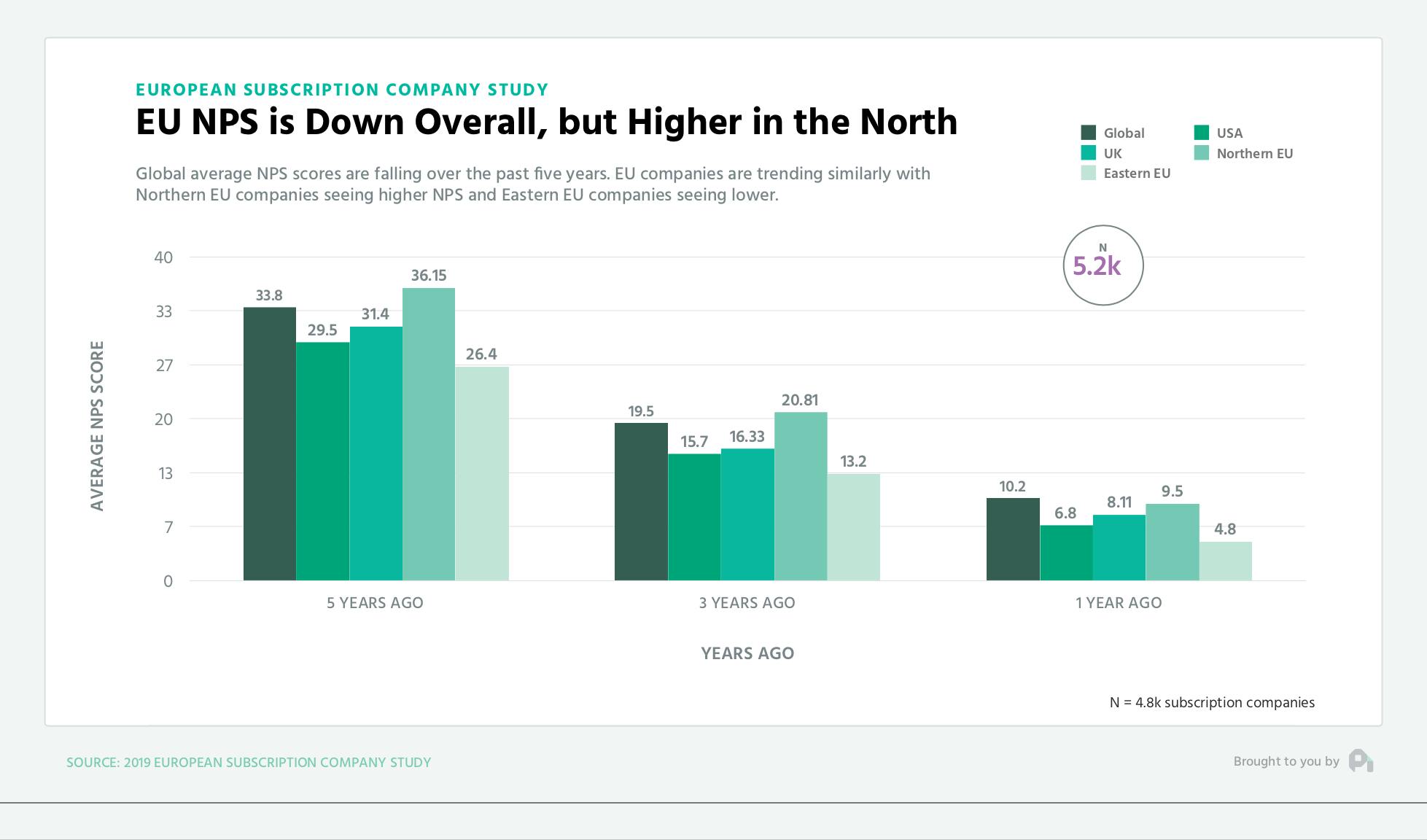

You see these differences pop up when comparing net promoter scores, a measure of customer satisfaction. Note that while NPS has gone down across the board, U.K. NPS tracks essentially spot on with U.S. NPS, Northern European subscription companies tend to see 20% higher NPS, and Eastern European companies see 15% lower NPS.

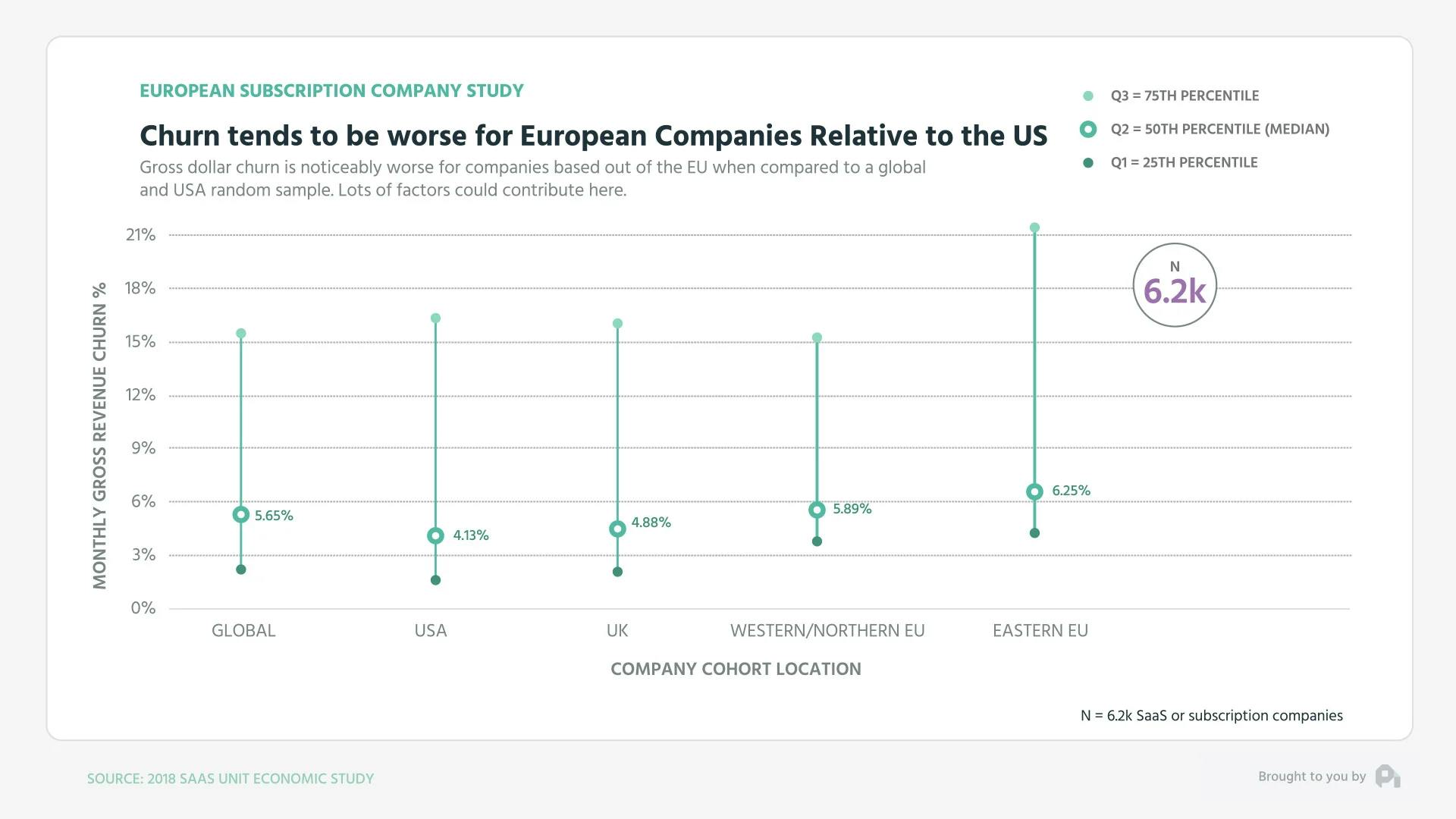

You see a similar relationship when comparing retention numbers as well. Gross revenue retention across Europe is actually much worse than subscription companies in the United States, with Eastern European companies seeing roughly 25% higher churn, the Nordics and Western Europe seeing roughly 15% higher churn, and the U.K. tracking at about 5 to 10% higher than their U.S. counterparts.

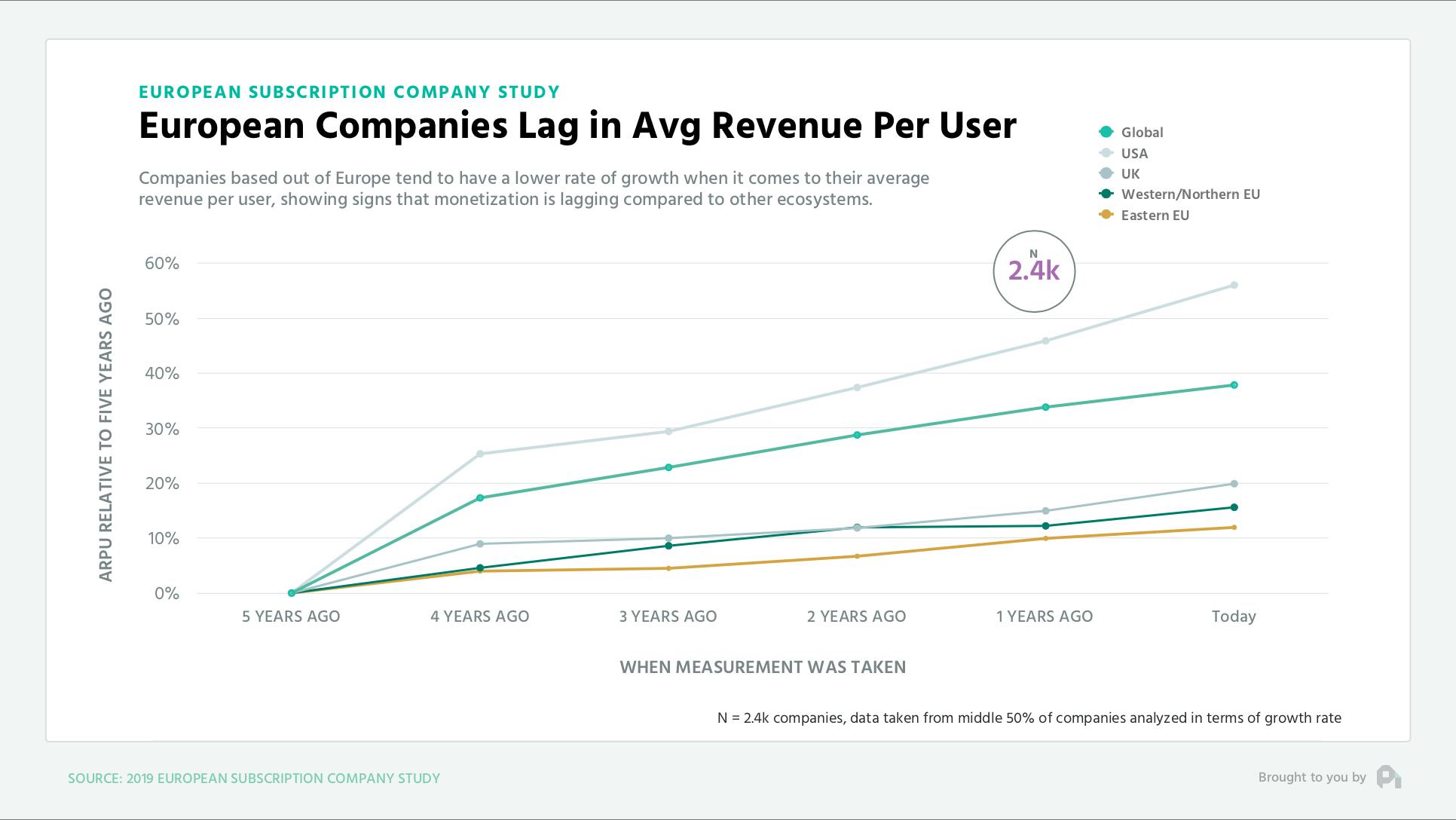

Further, the differences also exist when looking at the growth of company average revenue per user, which is an individualized proxy for how good or bad a company is at extracting value from their target customer base. Note that across the board, ARPU remains relatively flat, with the U.K., Nordics, and Western Europe seeing some gains, but they’re very minimal, and Eastern Europe actually seeing their collective ARPU decrease over time.

So is Europe doomed as a subscription and SaaS ecosystem? Well, of course not. We need to keep in mind that while Europe has been around for much longer than the United States, the subscription and SaaS markets are much younger than American ones, resulting in Europe being slightly behind the times when it comes to the tactics and strategies needed to grow a subscription business.

Sure, the internet reduces those barriers considerably, but the talent gap is where the impact truly exists. With time this will continue to close and I’m sure these numbers will look much cleaner as we continue to march into the adolescence of the subscription economy.

Want to learn more? Check out our recent episode on How Australian Companies Differ from US Companies and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,625 --> 00:00:09,265

Hey, Neil.

4

00:00:09,265 --> 00:00:13,185

This is Chris from Visibly,

and I would like to ask, how do

5

00:00:13,185 --> 00:00:16,760

EU subscription companies

differ from the US?

6

00:00:16,880 --> 00:00:19,440

Welcome back, everyone.

Neil here from ProfitWell.

7

00:00:19,440 --> 00:00:22,160

Subscription and SaaS

ecosystems have popped up and

8

00:00:22,160 --> 00:00:24,880

flourished everywhere in

the past couple of decades,

9

00:00:24,880 --> 00:00:26,865

riding the wave of

interconnectedity brought by

10

00:00:26,865 --> 00:00:28,465

the Internet and social media.

11

00:00:28,465 --> 00:00:30,625

While the United States

continues to dominate when it

12

00:00:30,625 --> 00:00:32,625

comes to the

subscription economy,

13

00:00:32,625 --> 00:00:35,420

Europe in particular is

enjoying an upswing in the past

14

00:00:35,420 --> 00:00:38,380

few years spurred by the

ecosystem getting injected with

15

00:00:38,380 --> 00:00:40,620

talent that's strafing off

from the US tech company,

16

00:00:40,620 --> 00:00:42,115

European headquarters.

17

00:00:42,115 --> 00:00:44,995

Let's explore how European

subscription economies stack up

18

00:00:44,995 --> 00:00:47,875

to their US counterparts by

looking at the data from over

19

00:00:47,875 --> 00:00:50,010

five thousand

subscription companies.

20

00:00:50,290 --> 00:00:53,890

Looking at Europe as one block

is a bit tough because the UK,

21

00:00:53,890 --> 00:00:55,490

Western Europe, Eastern Europe,

22

00:00:55,490 --> 00:00:57,925

and Northern Europe all

act a bit differently,

23

00:01:05,085 --> 00:01:08,080

result of dealing with older

equipment in the past Soviet area,

24

00:01:08,080 --> 00:01:11,280

while the Nordics are a bit more

focused on design and experience.

25

00:01:11,280 --> 00:01:13,840

You see these differences pop

up when comparing net promoter

26

00:01:13,840 --> 00:01:16,335

score, a measure of

customer satisfaction.

27

00:01:16,335 --> 00:01:20,255

Note that while NPS has gone

down across the board, UK NPS

28

00:01:20,255 --> 00:01:22,839

tracks essentially

spot on with US NPS.

29

00:01:22,839 --> 00:01:25,477

Northern European subscription

companies tend to see twenty

30

00:01:25,477 --> 00:01:26,467

percent higher NPS,

31

00:01:26,467 --> 00:01:29,755

and Eastern European companies

see fifteen percent lower NPS.

32

00:01:29,755 --> 00:01:33,515

You see a similar relationship when

comparing retention numbers as well.

33

00:01:33,515 --> 00:01:36,635

Gross revenue retention across

Europe is actually much worse

34

00:01:36,635 --> 00:01:38,670

than subscription

companies in the US,

35

00:01:38,670 --> 00:01:41,230

with Eastern European companies

seeing roughly twenty five

36

00:01:41,230 --> 00:01:42,430

percent higher churn,

37

00:01:42,430 --> 00:01:45,525

the Nordics in Western Europe seeing

roughly fifteen percent higher churn,

38

00:01:45,525 --> 00:01:48,085

and the UK tracking at about

five to ten percent higher than

39

00:01:48,085 --> 00:01:49,665

the US counterparts.

40

00:01:50,005 --> 00:01:52,965

Further, the differences also

exist when looking at the growth of

41

00:01:52,965 --> 00:01:54,570

average revenue per user,

42

00:01:54,570 --> 00:01:57,690

which is an individualized

proxy for how good or bad a

43

00:01:57,690 --> 00:02:00,970

company is extracting value

from the target customer base.

44

00:02:00,970 --> 00:02:02,625

Note that across the board,

45

00:02:02,625 --> 00:02:05,345

remains relatively flat

with the UK, Nordics,

46

00:02:05,345 --> 00:02:07,185

and Western Europe

seeing some gains,

47

00:02:07,185 --> 00:02:08,705

but they're very minimal,

48

00:02:08,705 --> 00:02:11,430

and Eastern Europe actually

seeing their collective ARPU

49

00:02:11,430 --> 00:02:12,550

decrease over time.

50

00:02:12,550 --> 00:02:15,990

So is Europe doomed as a

subscription and SaaS ecosystem?

51

00:02:15,990 --> 00:02:17,270

Well, of course not.

52

00:02:17,270 --> 00:02:19,925

We need to keep in mind

that while Europe has been

53

00:02:21,325 --> 00:02:21,574

around for much

longer than the US,

54

00:02:21,574 --> 00:02:23,485

the subscription and SaaS

markets are much younger than

55

00:02:23,485 --> 00:02:24,605

most of the US,

56

00:02:24,605 --> 00:02:27,085

resulting in Europe being

slightly behind the times when

57

00:02:27,085 --> 00:02:29,820

it comes to the tactics and

strategies needed to grow

58

00:02:29,820 --> 00:02:31,180

subscription business.

59

00:02:31,180 --> 00:02:31,500

Sure.

60

00:02:31,500 --> 00:02:33,980

The Internet reduces those

barriers considerably,

61

00:02:33,980 --> 00:02:37,340

but the talent gap is where

the impact truly exists.

62

00:02:37,340 --> 00:02:39,165

With time, this this

will continue to close,

63

00:02:39,165 --> 00:02:41,405

and I'm sure that those numbers

will look much cleaner as we

64

00:02:41,405 --> 00:02:45,385

continue to march into the adolescence

of the subscription economy.

65

00:02:45,450 --> 00:02:46,810

Well, that's it for now.

66

00:02:46,810 --> 00:02:47,850

If you have any questions,

67

00:02:47,850 --> 00:02:50,810

send me an email or video

to neil at profit well dot com.

68

00:02:50,810 --> 00:02:53,050

If you got value today

or any other report,

69

00:02:53,050 --> 00:02:55,635

we appreciate you sharing

on Twitter and LinkedIn because

70

00:02:55,635 --> 00:02:57,315

that's how we know

to keep going.

71

00:02:57,315 --> 00:02:59,615

Thanks, and I'll

see you next week.

72

00:03:01,475 --> 00:03:04,160

This week's episode is

brought to you by MasterClass,

73

00:03:04,160 --> 00:03:06,960

online class taught by the

world's greatest minds.

74

00:03:06,960 --> 00:03:09,020

MasterClass dot com.