How Do Bay Area Companies Compare to Those Outside It?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: April 25, 2019

After spending a ton of time in the Bay Area over the past few years, and having offices in both Boston and Rosario, Argentina, I’ve learned that us operators outside of Silicon Valley love to compare our ecosystems to the Bay Area, but no one in the Bay Area is comparing themselves to Boston, New York, London, or any of the other ecosystems out there.

Silicon Valley is the Mecca after all, so comparisons probably just don’t make much sense.

Yet, as costs of living increase substantially in Silicon Valley, more operators are getting fed up and moving on, which may be a mistake when it comes to growth.

No matter how you slice it, companies in the Bay Area grow quicker on average than companies outside of the Bay Area.

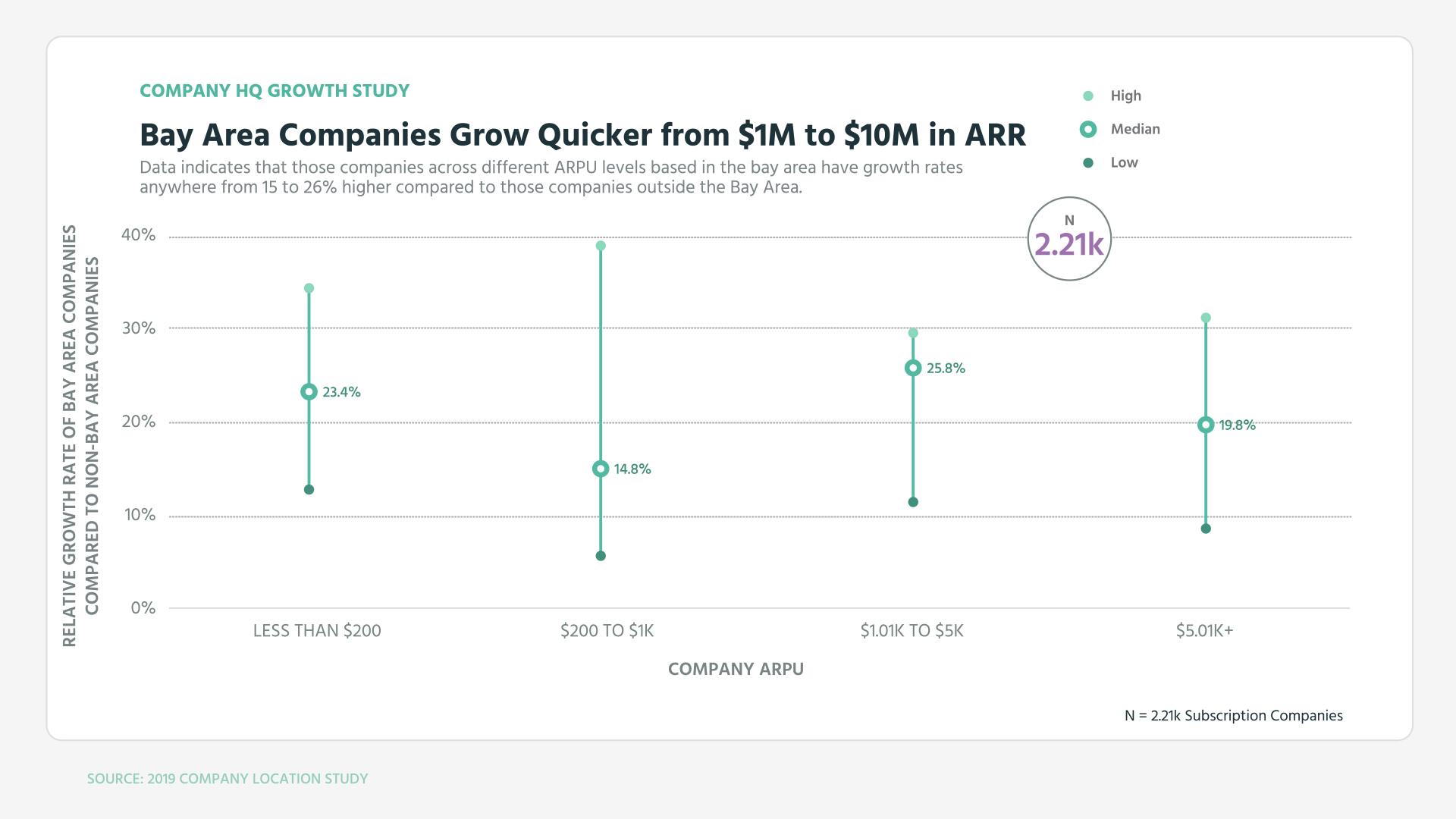

When looking at the journey from $1M to $10M, those companies across different average revenues per user based in the bay area have growth rates anywhere from 15 to 26% higher compared to those companies outside the Bay Area.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

There are an enormous amount of lurking variables here as to why we’re seeing this. There’s certainly more funding in Silicon Valley compared to the rest of the world, there tends to be more companies than the rest of the world, and you have many more anchor companies feeding talent to the ecosystem like Facebook, Google, et al.

Yet, with the rise of costs, maybe slower growth is ok for longer term gains. I know that’s a bit of blasphemy, but the growth at all costs mindset is dissipating more and more as our markets mature in the favor of smarter growth and better retention.

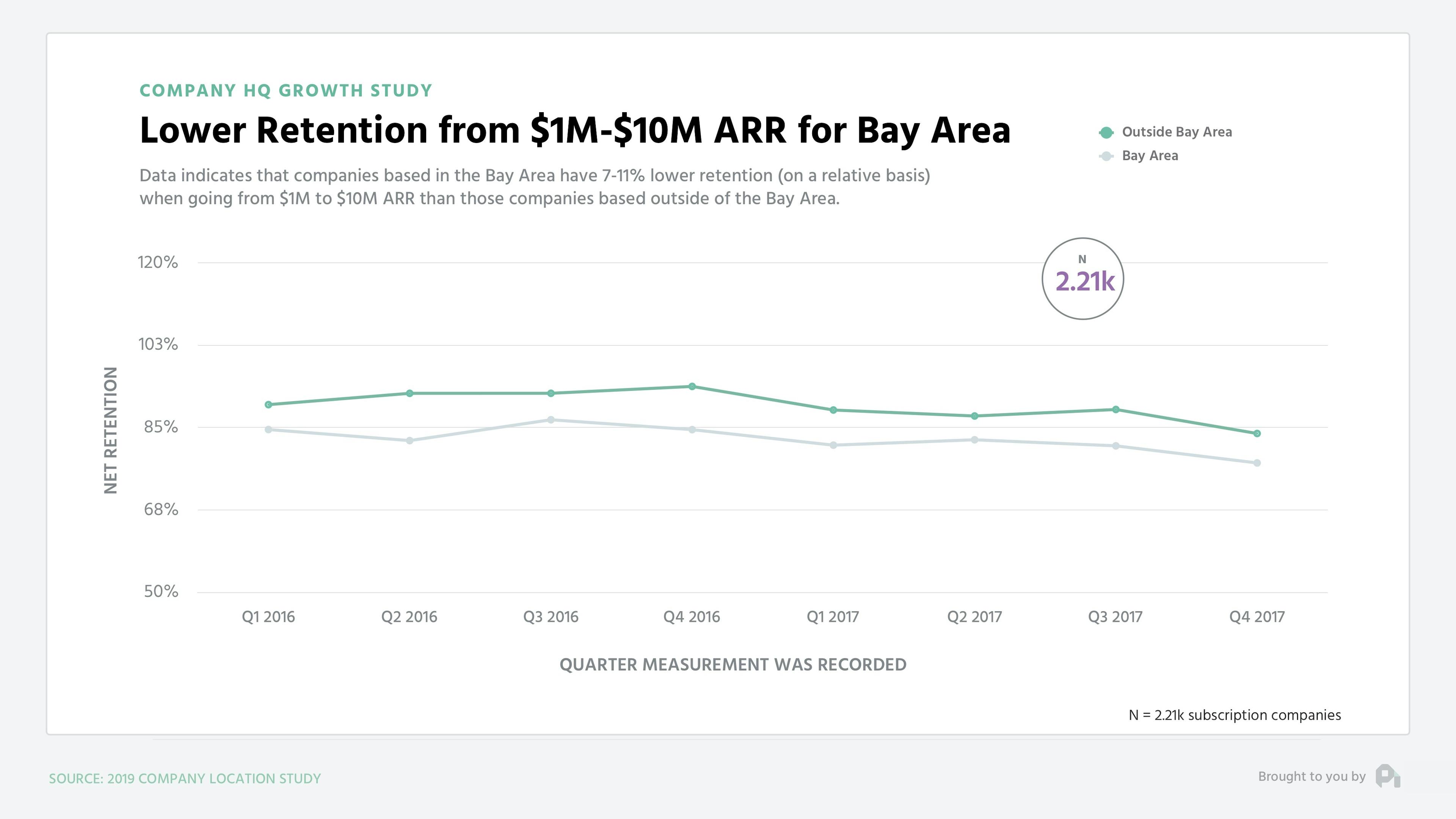

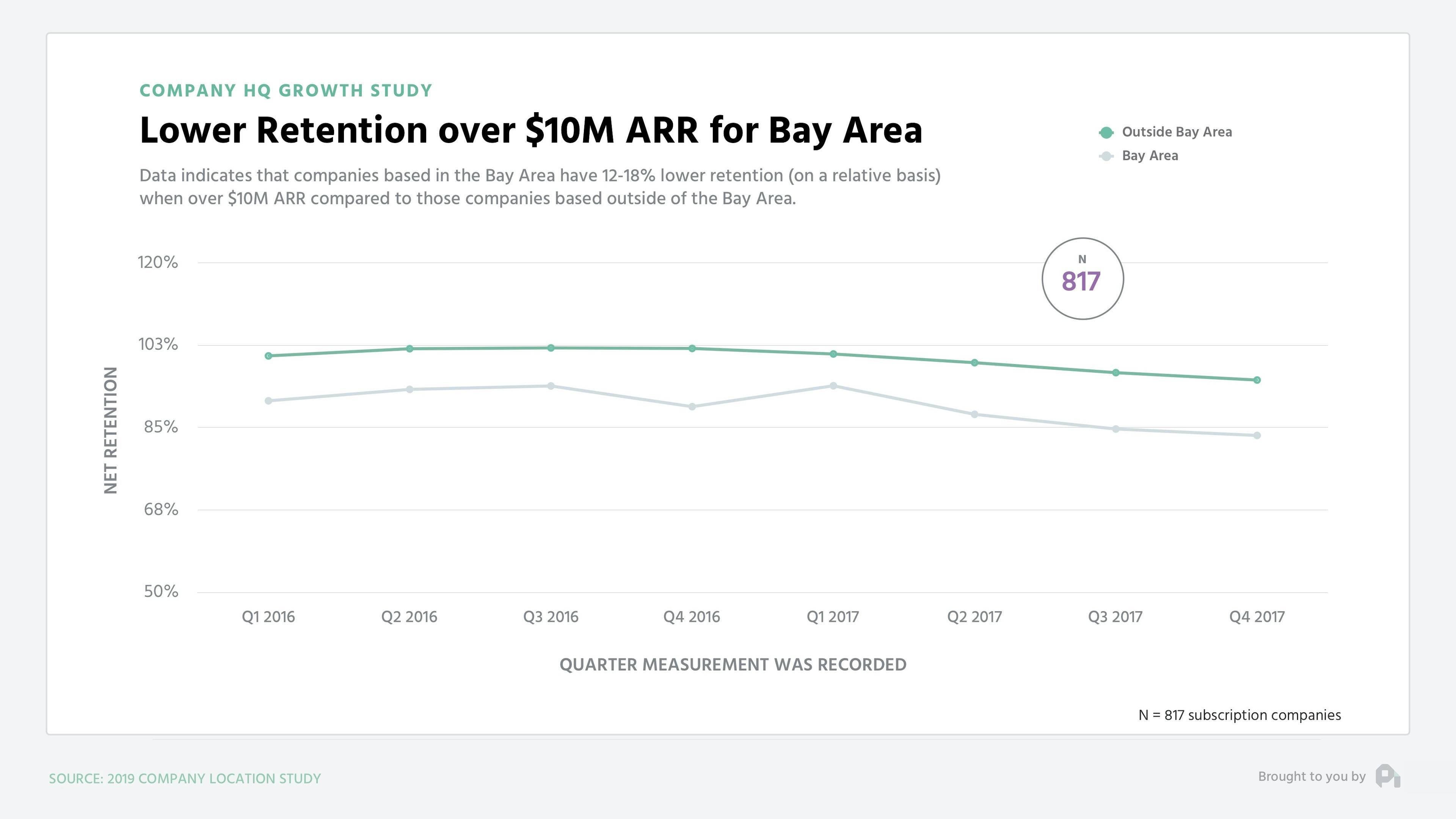

On this axis, the Bay Area is actually losing. Take a look at the retention rates of our different groups. Those companies outside the Bay Area tend to have noticeably better retention when between $1M and $10M in revenue, as well as when over $10M in revenue.

Admittedly, the gain isn’t a home run and could be attributed to a whole host of factors, but companies in the Bay Area typically have a culture of spend, spend, and spend, which is the job of a heavily funded company - deploy capital.

This spending can lead to poor unit economics and acquiring the wrong types of customers who then end up churning.

Ultimately, Silicon Valley is Silicon Valley for a reason. It’s our cradle of innovation, spurring almost all of the greatest hits in our industry. It’s certainly possible to build a successful company outside of the Bay Area and we’re seeing the rise of the rest, but until these other ecosystems have the necessary ingredients, the Bay Area will still continue to win out.

Want to learn more? Check out our recent episode: Is All Software Going to $0? and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,775 --> 00:00:09,495

Hey, Neil.

4

00:00:09,495 --> 00:00:12,455

Sameen here from Eventable with

a quick question for you about

5

00:00:12,455 --> 00:00:14,835

how companies

differ by geography.

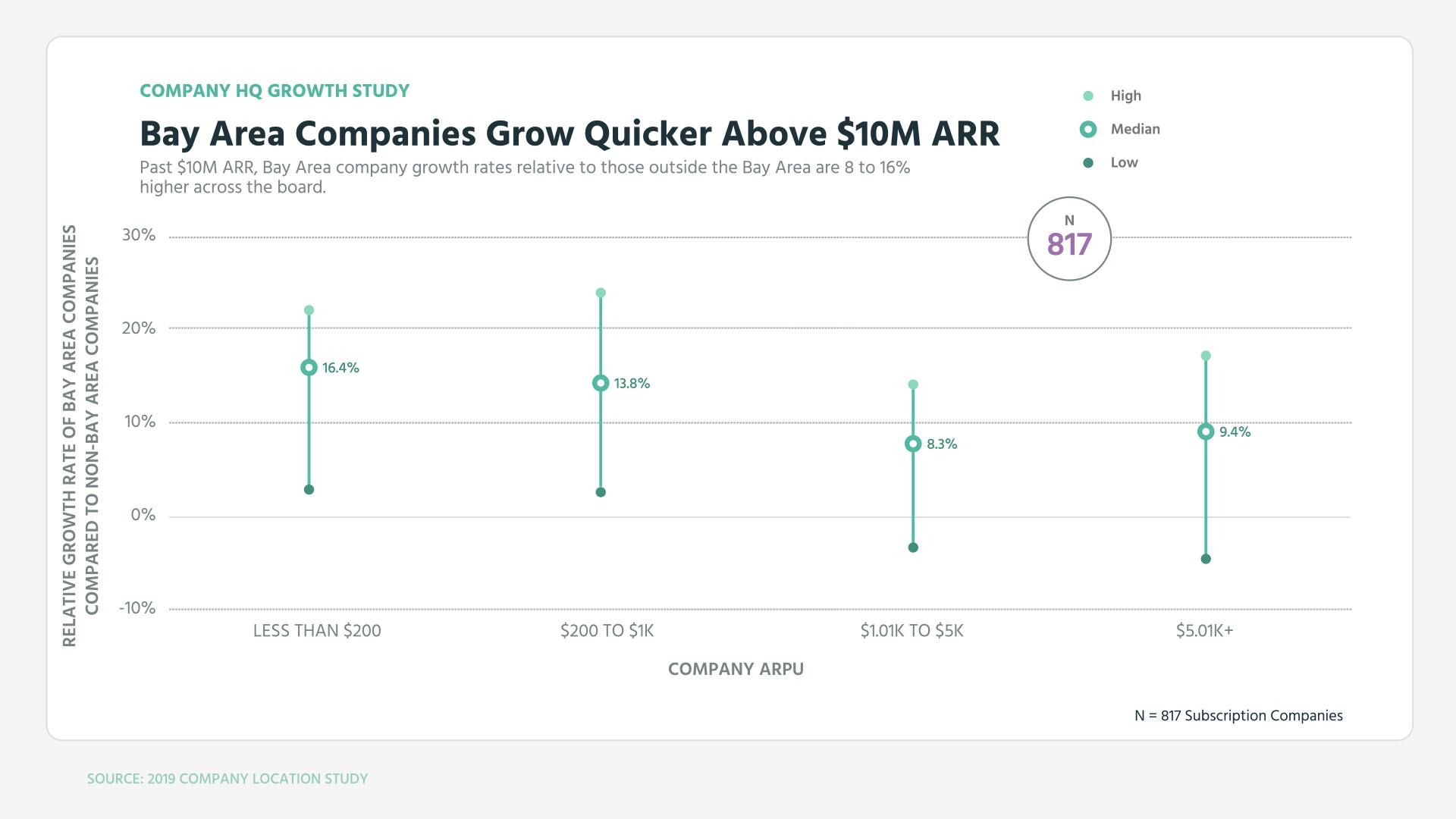

6

00:00:15,070 --> 00:00:16,830

In the data that

you guys have seen,

7

00:00:16,830 --> 00:00:21,290

how do companies in the Bay Area

compare to those outside the Bay Area?

8

00:00:21,390 --> 00:00:24,675

Welcome back, everyone. Neil

here for the Profitable Report.

9

00:00:24,675 --> 00:00:27,235

After spending a ton of time

thinking about the Bay Area

10

00:00:27,235 --> 00:00:28,675

over the last few years,

11

00:00:28,675 --> 00:00:32,895

but also having our offices here

in Boston and Rosario, Argentina,

12

00:00:32,920 --> 00:00:36,360

I've learned that us operators

outside of Silicon Valley love

13

00:00:36,360 --> 00:00:39,000

to compare our ecosystem

to the Bay Area.

14

00:00:39,000 --> 00:00:42,365

But no one in the Bay Area is

comparing themselves to Boston,

15

00:00:42,365 --> 00:00:45,965

New York, London, or any of

the other ecosystems out there.

16

00:00:45,965 --> 00:00:48,685

Yet as cost of living increase

substantially in Silicon

17

00:00:48,685 --> 00:00:51,700

Valley, more operators are

getting fed up and moving on,

18

00:00:51,700 --> 00:00:53,940

which may be a mistake

when it comes to growth.

19

00:00:53,940 --> 00:00:55,460

So to answer this

week's question,

20

00:00:55,460 --> 00:00:58,020

we looked at the growth data

from just over three thousand

21

00:00:58,020 --> 00:01:00,385

companies from all

over the world.

22

00:01:00,385 --> 00:01:01,905

As to not bury the lead,

23

00:01:01,905 --> 00:01:04,465

companies in the Bay Area

grow quicker on average than

24

00:01:04,465 --> 00:01:06,600

companies outside

of the Bay Area,

25

00:01:06,600 --> 00:01:08,760

no matter how you

slice the data.

26

00:01:08,760 --> 00:01:11,640

When looking at the journey

from one million to ten million,

27

00:01:11,640 --> 00:01:14,120

those companies across

different average revenues per

28

00:01:14,120 --> 00:01:17,165

user based in the Bay Area

have growth rates anywhere from

29

00:01:17,165 --> 00:01:20,125

fifteen to twenty six percent

higher compared to those

30

00:01:20,125 --> 00:01:21,885

outside the Bay Area.

31

00:01:21,885 --> 00:01:25,860

Note, though, that these gains don't seem

to correlate with the size of the customer,

32

00:01:25,860 --> 00:01:28,740

meaning it's not as if SMB

focused companies are better

33

00:01:28,740 --> 00:01:31,055

than enterprise

companies in the region.

34

00:01:31,055 --> 00:01:33,375

When you get past ten

million in annual revenue,

35

00:01:33,375 --> 00:01:36,095

you'll notice that the growth

rates relative to those outside

36

00:01:36,095 --> 00:01:38,255

of the Bay Area do slow a bit,

37

00:01:38,255 --> 00:01:40,740

but they're still growing at

a higher rate than those outside

38

00:01:40,740 --> 00:01:43,780

of the Bay Area with

eight to sixteen percent higher growth

39

00:01:43,780 --> 00:01:45,460

rates across the board.

40

00:01:45,460 --> 00:01:48,475

There are an enormous amount

of lurking variables here as to

41

00:01:48,475 --> 00:01:49,675

why we're seeing this.

42

00:01:49,675 --> 00:01:52,075

There's certainly more funding

in Silicon Valley compared to

43

00:01:52,075 --> 00:01:53,115

the rest of the world.

44

00:01:53,115 --> 00:01:55,730

There tends to be more companies

than the rest of the world.

45

00:01:55,730 --> 00:01:59,810

You have many, many more anchor

companies feeding talent to the ecosystem

46

00:01:59,810 --> 00:02:01,810

like Facebook,

Google, and others.

47

00:02:01,810 --> 00:02:03,445

Yet with the rise of costs,

48

00:02:03,445 --> 00:02:07,025

maybe a bit of slower growth

is okay for longer term gains.

49

00:02:07,205 --> 00:02:08,805

I know that's a

bit of blasphemy,

50

00:02:08,805 --> 00:02:11,765

but the growth at all costs of

mindset is dissipating more and

51

00:02:11,765 --> 00:02:14,920

more as our markets mature in

the favor of smarter growth and

52

00:02:14,920 --> 00:02:16,340

better retention.

53

00:02:16,360 --> 00:02:19,080

On this axis, the Bay

Area is actually losing.

54

00:02:19,080 --> 00:02:22,125

Take a look at the retention

rates of our different groups.

55

00:02:22,125 --> 00:02:25,405

Those companies based outside

of the Bay Area tend to have

56

00:02:25,405 --> 00:02:28,125

noticeably better retention

when between one million and

57

00:02:28,125 --> 00:02:32,570

ten million in revenue as well as

when over ten million in revenue.

58

00:02:32,570 --> 00:02:35,850

Admittedly, the gain isn't a home run

and could be attributed to a whole

59

00:02:35,850 --> 00:02:38,785

host of but companies in the

Bay Area typically have a

60

00:02:38,785 --> 00:02:40,305

culture of spend, spend, spend,

61

00:02:40,305 --> 00:02:44,065

which is a job of a heavily

funded company deploy capital.

62

00:02:44,065 --> 00:02:46,690

This spending can lead to poor

unit economics and acquiring

63

00:02:46,690 --> 00:02:49,650

the wrong type of customers

who then end up churning.

64

00:02:49,650 --> 00:02:52,965

Ultimately, Silicon Valley is

Silicon Valley for a reason.

65

00:02:52,965 --> 00:02:54,485

It's a cradle of innovation,

66

00:02:54,485 --> 00:02:57,205

spurring almost all of the

greatest hits in our industry.

67

00:02:57,205 --> 00:02:59,205

It's certainly possible to

build a successful company

68

00:02:59,205 --> 00:03:00,450

outside of the Bay Area,

69

00:03:00,450 --> 00:03:02,210

and we're seeing the

rise of the rest.

70

00:03:02,210 --> 00:03:04,770

But until these other

ecosystems have the necessary

71

00:03:04,770 --> 00:03:08,195

ingredients, the Bay Area will

still continue to win out.

72

00:03:08,195 --> 00:03:09,395

Well, that's it for now.

73

00:03:09,395 --> 00:03:11,075

If you have any

questions at all,

74

00:03:11,075 --> 00:03:13,955

send me an email or video

to neil at profit well dot com.

75

00:03:13,955 --> 00:03:16,860

And if you got value here or

any other week of the report,

76

00:03:16,860 --> 00:03:19,500

we appreciate any and all

shares to Twitter and LinkedIn

77

00:03:19,500 --> 00:03:22,040

because that's how we

know to keep going.

78

00:03:23,580 --> 00:03:26,895

This week's episode is brought

to you by ProfitWell recognized.

79

00:03:26,895 --> 00:03:29,775

Make your accounting team

heroes with one click audit

80

00:03:29,775 --> 00:03:31,535

proof revenue recognition.

81

00:03:31,535 --> 00:03:33,549

Profitwell dot com.