A comprehensive guide to SaaS finance (bookings vs. revenue vs. collections vs. MRR)

by Patrick Campbell

Finance and accounting team members are the unsung heroes of the subscription and SaaS world, because people relegate them to just being “bookkeepers” or the people that “keep us out of trouble with our taxes.” In reality though, an A-list accountant or finance manager at your company is likely one of your most prized assets.

They’re so valuable because they are the spreadsheet scientists who truly understand the pulse of your business. Through your financials, these members of your team can predict where you’re headed and ensure you’re investing exactly the right amount at the right time.

A bad accountant or finance manager can spell doom for your company though by causing you to not invest cash that you should be or worse - spending money you don’t have in the bank. This is why you need to know your SaaS accounting chops, too. To help, let’s walk through a breakdown of how revenue flows through your business from a booking all the way to cash collected.

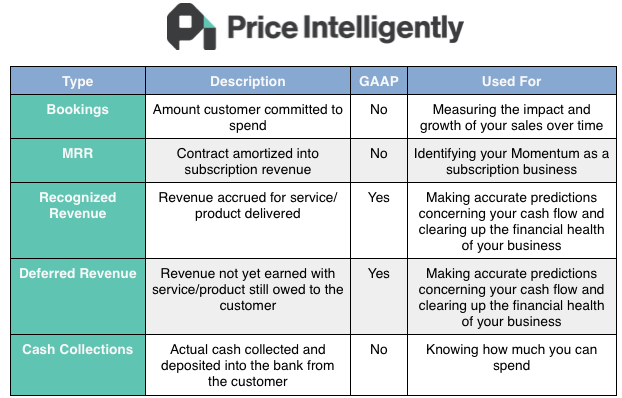

Bookings vs. Revenue vs. Cash vs. MRR

Bookings

Put simply, a booking exists when a customer agrees to spend money with you. A contract isn’t required to have a booking, as someone who signs up for a month of your SaaS offering is committing to that month of service without signing anything.

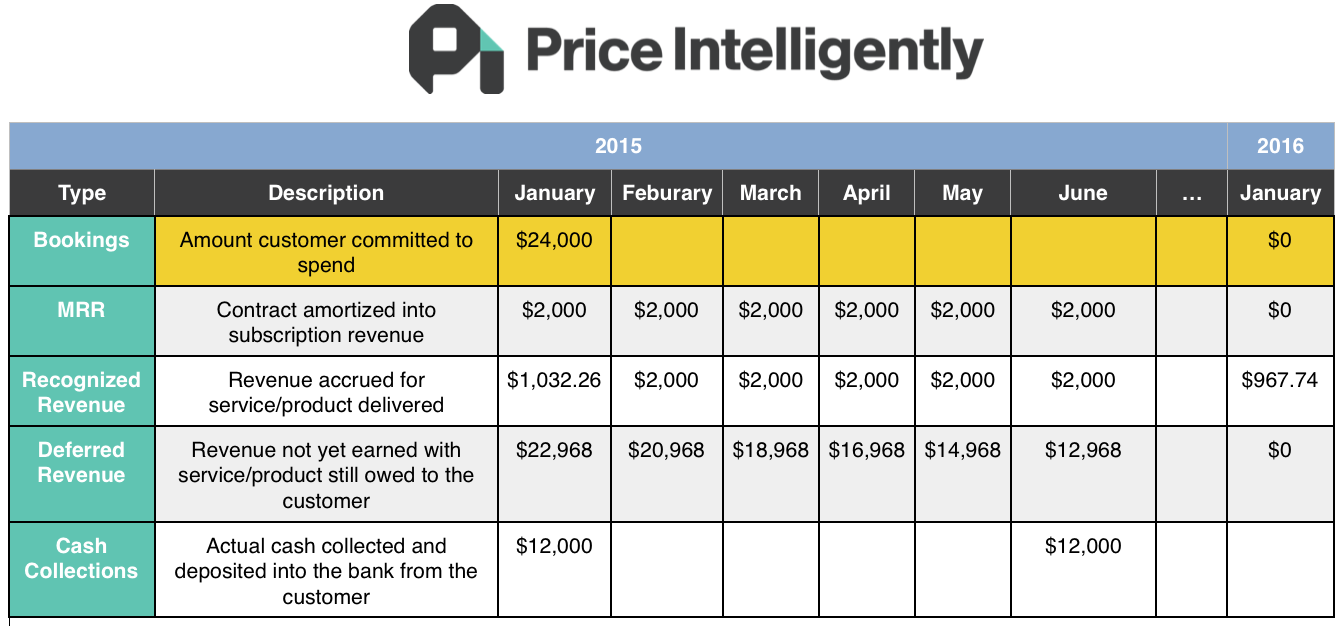

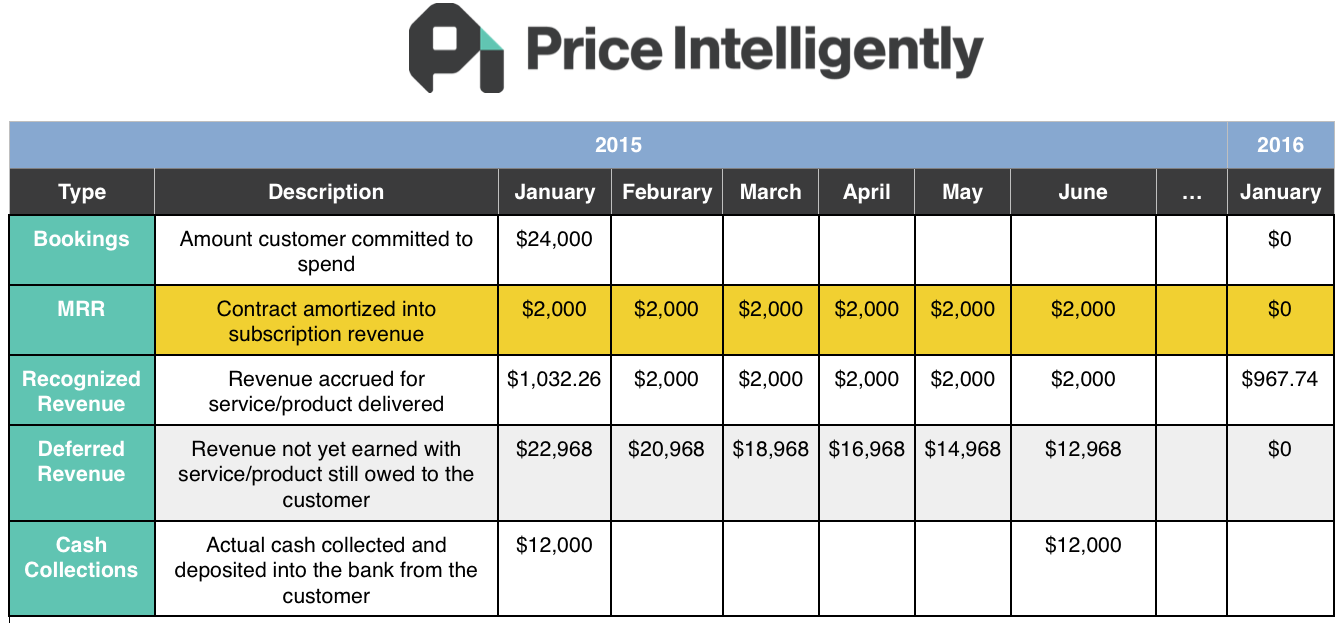

Example: A customer just signed an annual contract (12 months) on January 15 to use your app for $24,000 at $2,000 per month.

What is this used for? Why do you need to track it?

Bookings are the tip of the spear when it comes to measuring how revenue flows through your business from when your sales/marketing team converts a prospect/opportunity to an actual paying customer. In this light, bookings measure the impact and growth of your sales over time and when broken down by plans, sales rep, etc. can give you an enormous amount of insight into your efficiency and effectiveness in acquiring customers.

Bookings are also important to track in context with your recognized revenue (explained a bit more below). If you’re booking a lot of business, but not recognizing that revenue (delivering the product to your customer) you may have major implementation issues. If you’re not booking a lot relative to your revenue, then tough times may be on the horizon.

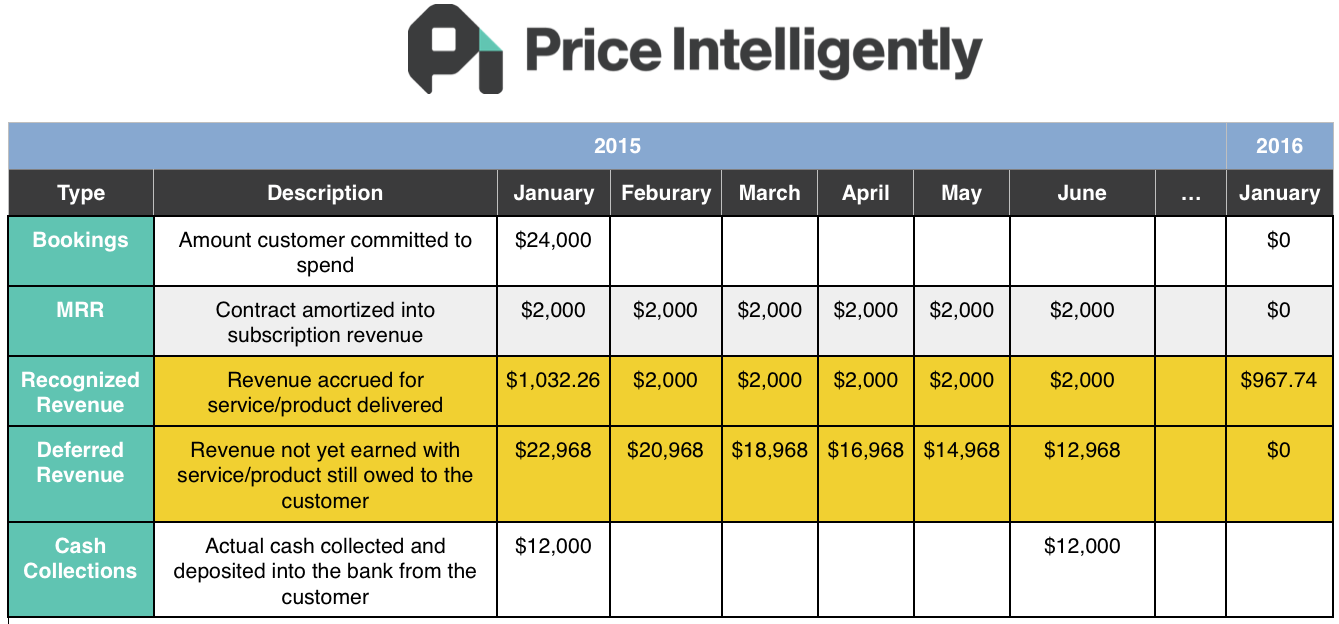

Recognized Revenue and Deferred Revenue

You may be super excited about that $24,000 booking you made with that contract, but from an accounting perspective, you don’t get to count that as revenue until you deliver what you sold the customer. In the case of our example, this mean that booking will turn into revenue gradually as the customer’s subscription progresses. Each month you will recognize that you accrued $2,000 in exchange for delivering your app/product/etc to the customer until the contract is up. In this manner, recognized revenue is the point at which a booking becomes actual revenue by you delivering the product promised to your customer and goes into your accounts receivables.

What about the rest of the booking while you’re waiting for their subscription to progress over time? How do we track that properly? That’s called deferred revenue, which is essentially the revenue you’re expecting from your booking, but you haven’t delivered on the agreement to the customer quite yet, so you still can’t quite count this as revenue.

Example: You received the $24,000 contract that you booked (the booking) on January '15. You accrue revenue for each day you fulfill the contract with your customer, recognizing that revenue in your receivables. The rest of the revenue on the contract is deferred revenue until you deliver.

What is this used for? Why do you need to track it?

Accrual accounting seems overly complicated, right? Why are accountants trying to make our lives hard here? Turns out they’re actually trying to make your life much easier by allowing you to make accurate predictions concerning your cash flow and clearing up the financial health of your business.

Accountants are able to do this because they’re matching your revenues/expenses when a transaction actually occurs, rather when you receive the actual cash from your customer. Why is that good? Well, in my pedantic example of one $24,000 contract it’s actually more complicated than needed because you can easily track $24,000. In a large business (even $1M or more) transactions, sales, and the timeline of a subscription contract make things super complicated and potentially muddled.

Imagine thousands of subscriptions and millions of dollars in revenue. Managing your recognized and deferred revenue will actually help you predict where you’re going and how quickly you can grow your expenses. In this manner, your accountant is more of a master strategist, rather than “some guy/gal who makes sure our taxes get done."

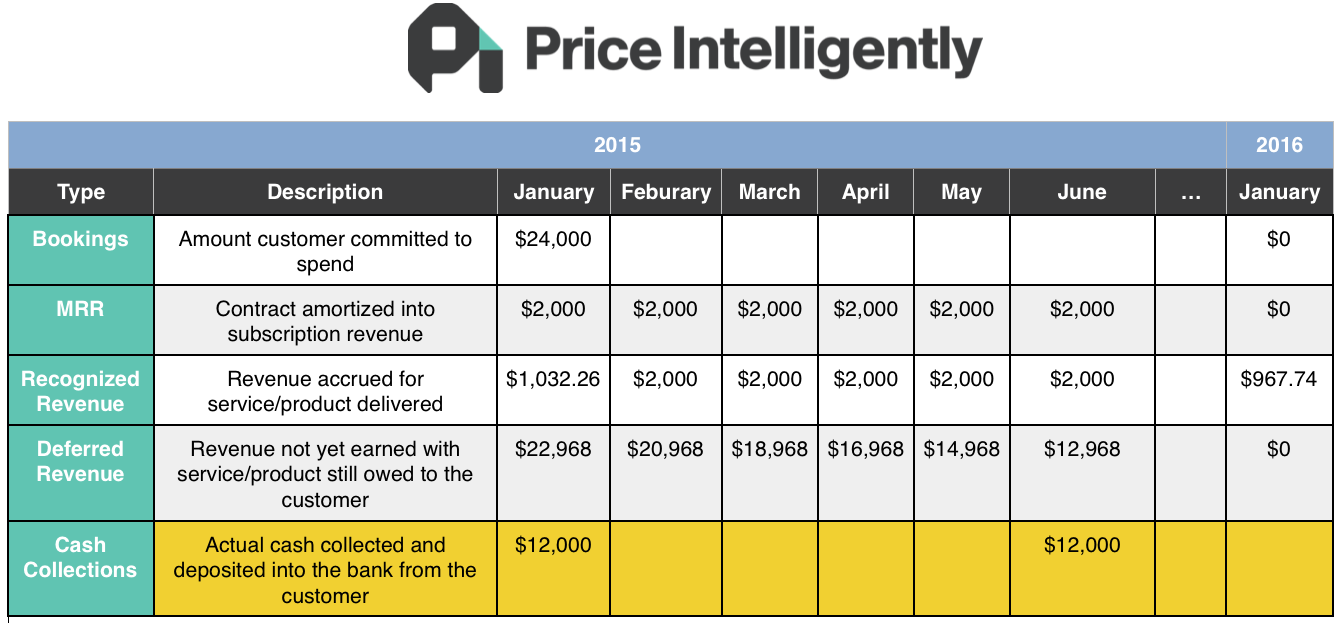

Cash Collections

Your cash collections are probably the simplest to understand. This occurs when cash hits your bank account from your customer. The definition isn’t predicated on when that cash is collected though, so collections can occur at the beginning of a contract or along any terms you set with your customer.

Keep in mind that if you complete a booking with a customer (customer agrees to spend money with you) and you collect all of that cash upon your customer’s agreement, that revenue still isn’t recognized until you deliver the product/subscription. Mistaking cash collections with revenue is probably the biggest mistake we see in transitioning from SaaS metrics to GAAP metrics.

Remember though, if you haven’t delivered on what you promised your customer, the revenue is still a liability (deferred revenue), because you could implode tomorrow and not be able to deliver on your promise with your customer. In that case, you technically never earned that revenue.

Example: Continuing our example, we booked a $24,000 contract on January 15 where we agreed with the customer to collect payment on a quarterly basis. Giving us $6,000 per quarter. Note how our recognized and deferred revenue does not change.

What is this used for? Why do you need to track it?

Cash is the lifeblood of your company. Nothing gets done without cash, and you can’t re-invest into your growth without cash. Tracking your cash flow allows you to know how much you can spend in your company (through cash on hand). When comparing with your accounts receivables and deferred revenue, you can also start to predict how your cash flow will ebb and flow.

Measuring cash can also keep you out of trouble, as we’ve seen plenty of companies that get a flood of bookings and needed to expand the company quickly. Yet, their terms indicated that they didn’t collect payment up-front, so they were lurched into a cash bind. They knew their deferred revenue was certainly going to come, but they had to dip into their debt because the cash to invest wasn’t available immediately.

MRR/ARR

Your monthly recurring revenue (MRR) or the annual equivalent (annual recurring revenue) quite literally have nothing to do with any of these other three from an accounting perspective. MRR isn’t part of GAAP because there is no specific delineation of GAAP for subscription or SaaS businesses. The lack of standards doesn’t mean MRR isn’t important though.

MRR is a product and marketing focused metric that tracks the monthly recurring revenue customers have committed to spend in your business. ARR is simply the annualized version of MRR. In this manner, MRR and ARR are closer to bookings than any of the other GAAP metrics.

Example: Our $24,000 contract equates to $2,000 per month in Monthly Recurring Revenue or MRR.

What is this used for? Why do you need to track it?

We need to track MRR and ARR separate from our accounting metrics, because this metric is a more accurate representation of your momentum as a subscription business. MRR more readily predicts where you’re headed with overall growth, because you overlay your MRR with things like MRR churn, LTV, etc. You also slice and dice your MRR across every axes under the sun to find pockets of insight to exploit (which plan is growing the quickest, expansion vs. net-new revenue, etc.).

Keep in mind that in SaaS and the subscription economy, we’re tracking subscriptions. This is also why MRR is crucial to track, because while accrual accounting is important, it’s not built specifically for SaaS/subscription. Seeing momentum is difficult if you’re only tracking bookings and deferred/recognized revenue, because you won’t see the subscriptions build as readily over time.

Accounting and finance are exceptionally important to SaaS

As we continue to hammer home, finance and accounting are offensive tools to your SaaS business, not reactive bookkeeping. You simply need to know how each piece of the puzzle works and impacts the different areas of your business. To help summarize, we’ve put together this nifty little chart: