Venture Funded Companies Have Higher Churn, Less Growth

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: August 14, 2018

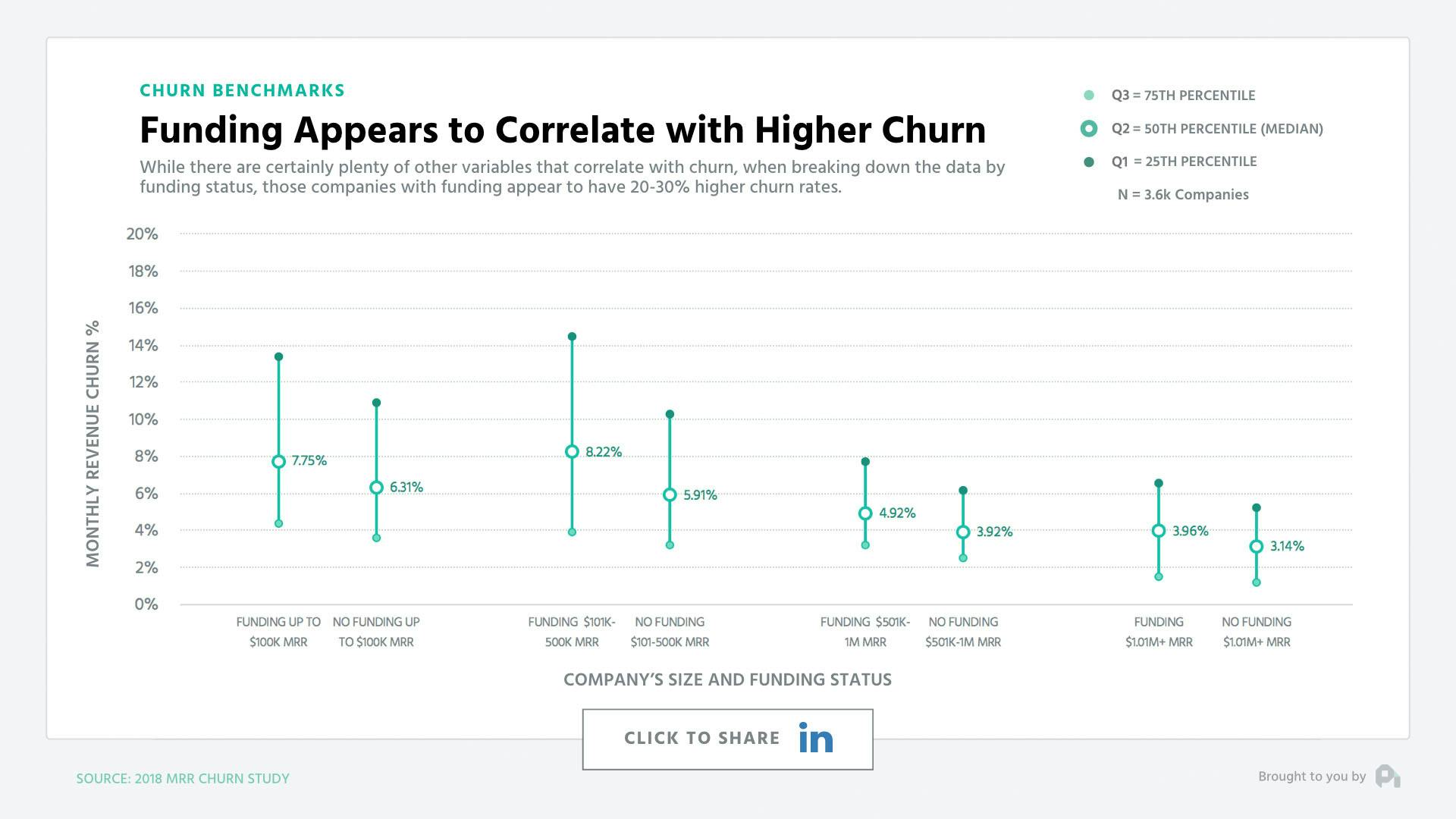

Let’s start with arguably one of the most important metrics in a subscription business - churn.

When comparing companies who took on funding to those who haven’t, you’ll note that at most stages of the growth lifecycle funded companies have higher churn with an average of 20 to 30% higher monthly gross revenue churn compared to their non-funded counterparts.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

There are certainly plenty of lurking variables here, but non-funded companies likely have a bit of survivor bias baked into these numbers simply because they don’t have funding to float them through higher experimentation that is likely taking place amongst funded companies. At least that’s the most charitable interpretation of this data, as there are certainly funded companies that just use the money as a crutch instead of figuring out how to make sure they sell the right product to the right customer and keep that customer around.

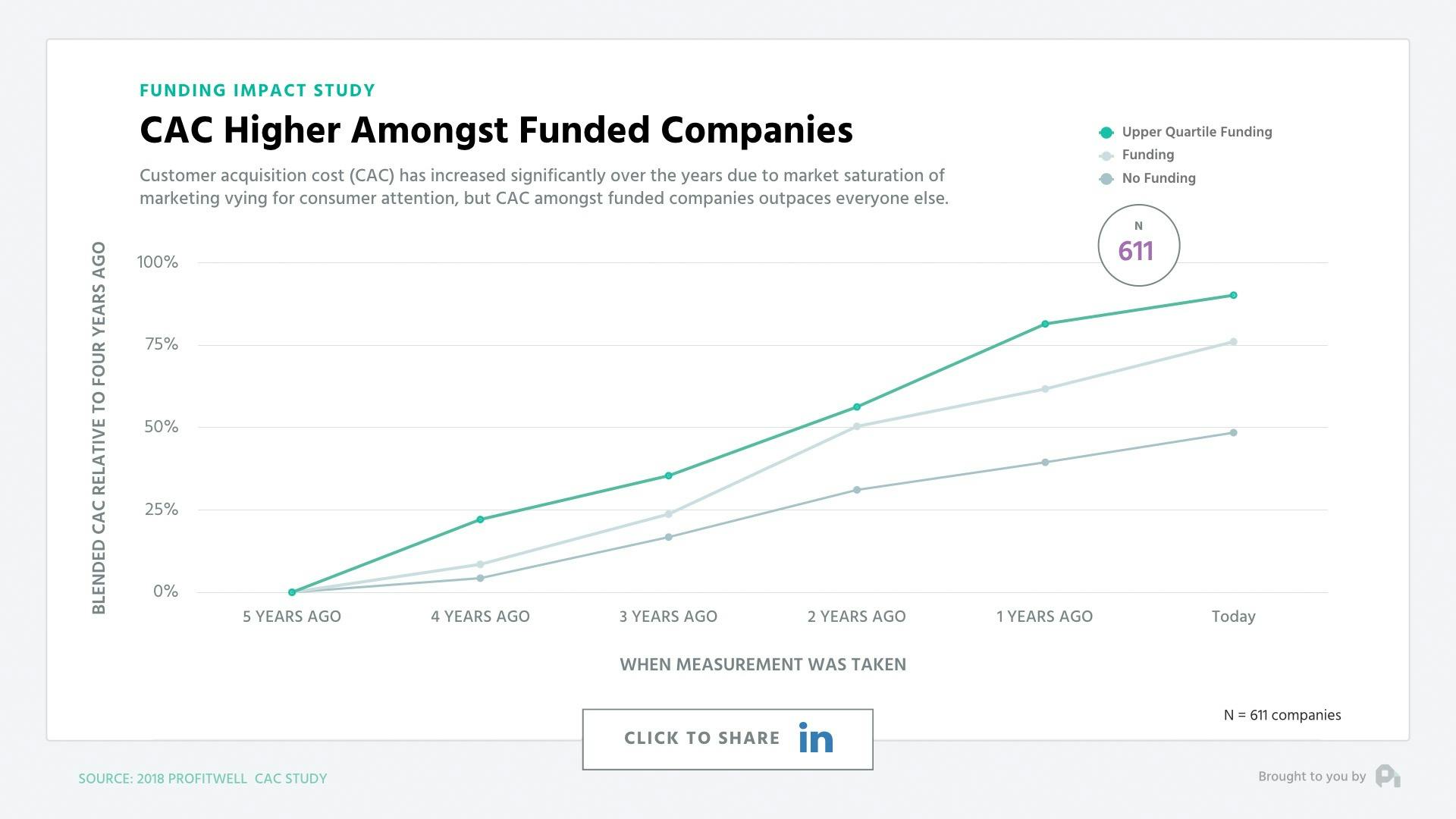

When comparing customer acquisition cost data amongst these groups both interpretations are supported.

CAC is going up for everyone, but amongst funded companies we’re seeing 50 to 75% higher CAC than non-funded companies. Funded companies likely haphazardly or more targetedly use a good amount of their funding to pursue high cost channels or just more channels in general.

We’re essentially seeing different strategies along an axis of conservatism and risk. That being said, CAC and Churn obviously matter, but a common argument is that those two metrics can be optimized later - it’s all about growth. Yet, the data is mixed on whether that notion is true or not.

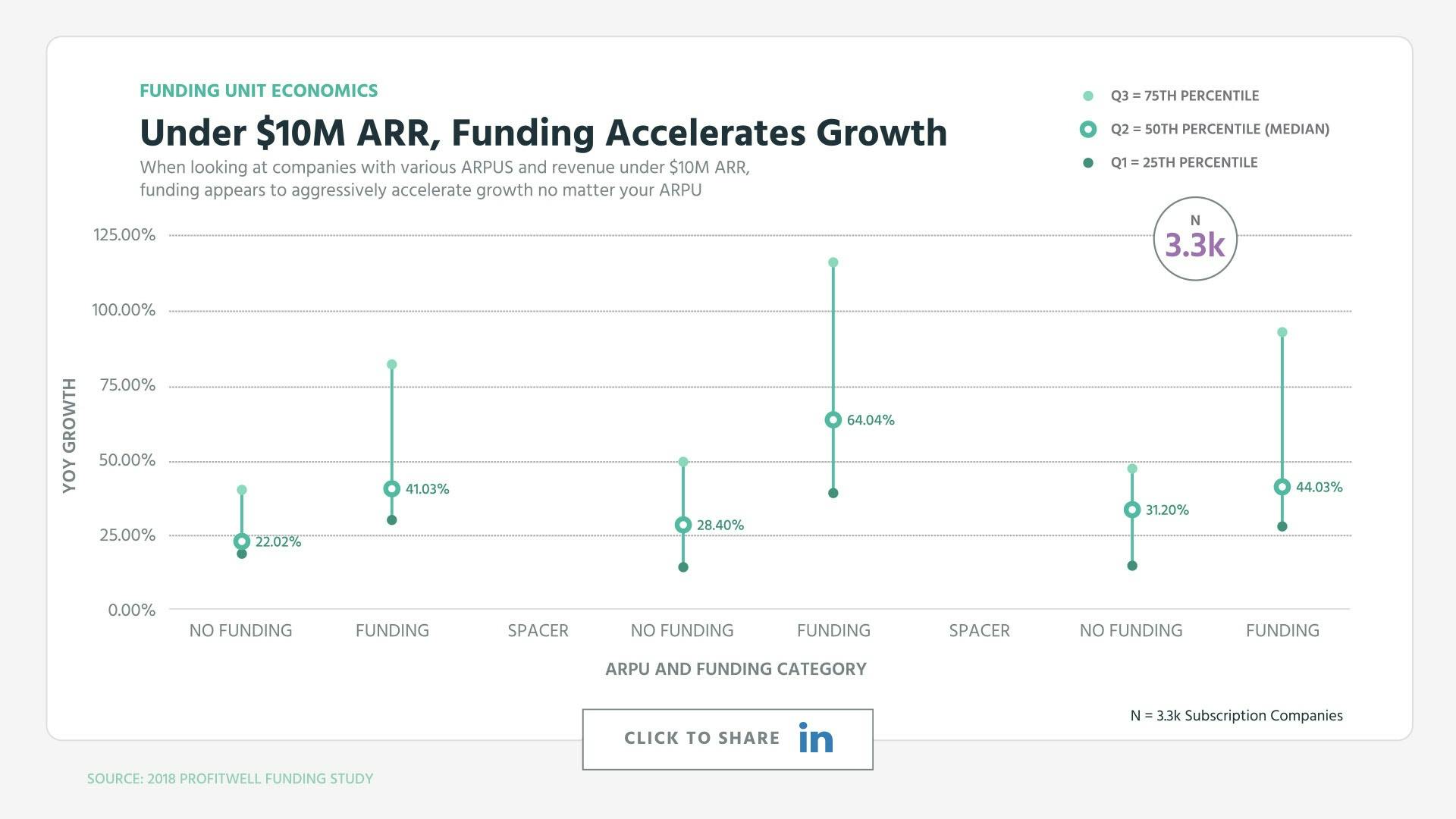

When we look at companies under $10M ARR it certainly is true.

Funded companies handedly are growing faster than non-funded companies. There’s no question. No matter the ARPU funded companies are growing at a rate of 40 to 100% more per year than non-funded companies with massive variance where some companies are growing at 5x that of their funded counterparts.

A counter view to this though is that there’s a massive amount of indie and lifestyle businesses that are under the $10M ARR threshold that just never want to be that large.

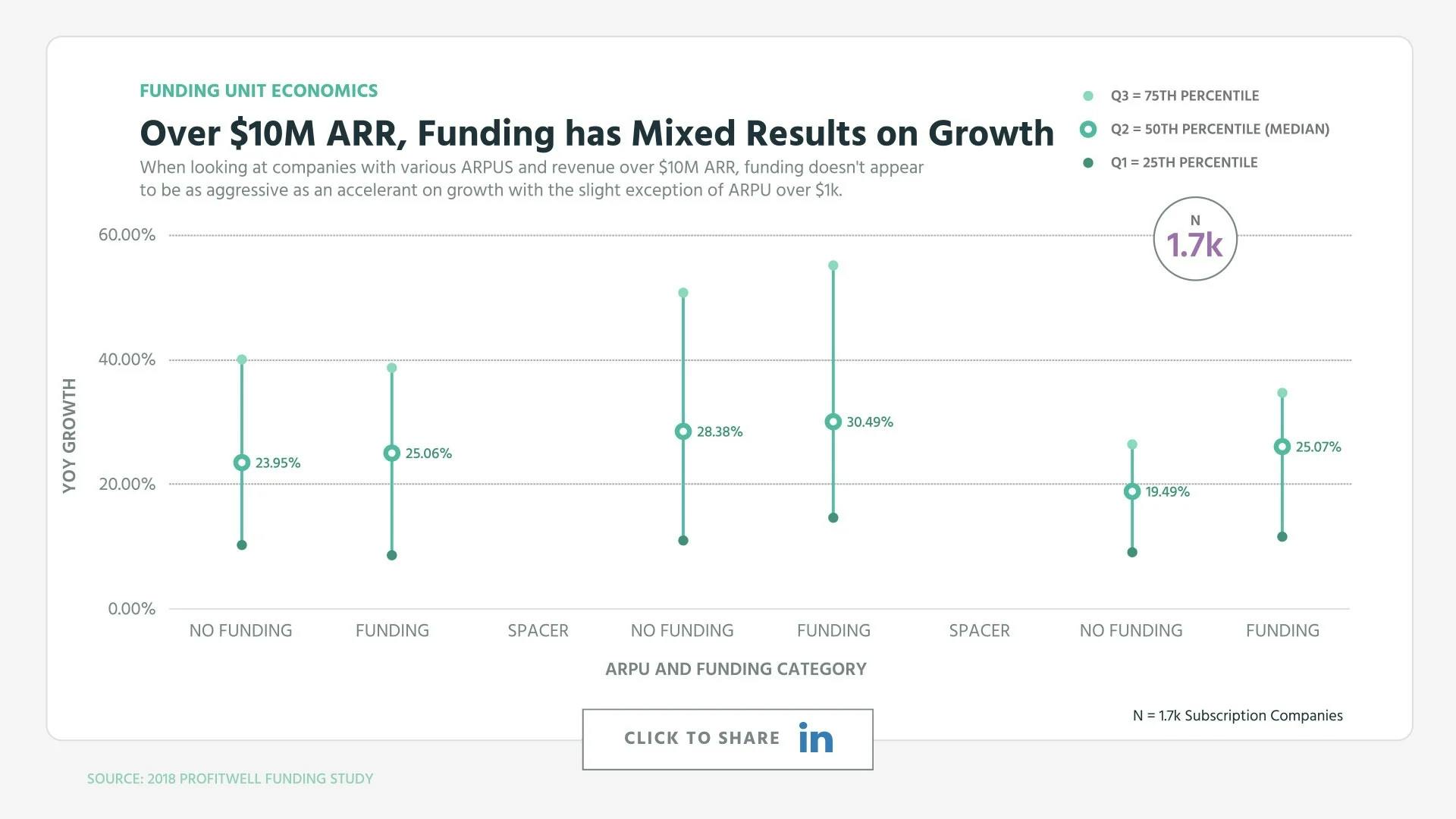

While not directly supporting this thesis, these gains from funding once we go over $10M in ARR seems to dissipate quite considerably.

With the slight exception of four figure or more MRR businesses, funded and non-funded companies with more than $10M ARR are essentially growing at the same rate, even when taking the entire mid-spread of the data into consideration.

So where does this put us as an industry? Well, in a sense we’re right back where we started with funding being a tool that when used properly can greatly increase your odds of reaching $10M or more.

Yet, some of the differences amongst the core unit economics, as well as how similar companies are when you reach the greater than $10M range suggest that in more cases than the industry is probably willing to admit, funding can create moral hazard and not always in the “let’s make sure we’re comfortable taking the right risk” way. Instead, funding masks core problems that simply get bigger as the company gets bigger, in essence letting you use a sledgehammer when you really should be using a scalpel.

Want to learn more? Check out our recent episode: Expansion Revenue Benchmarks and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,655 --> 00:00:10,735

Hey, Patrick. It's Jeff

Wagner from Accomplice.

4

00:00:10,735 --> 00:00:11,775

Hope you're doing well.

5

00:00:11,775 --> 00:00:14,895

Big fan of your work, and

congrats on all the success.

6

00:00:14,895 --> 00:00:17,360

My question is whether you

guys have data or analysis that

7

00:00:17,360 --> 00:00:20,320

shows how venture capital

funding can impact a startup

8

00:00:20,320 --> 00:00:22,460

company's core unit economics.

9

00:00:22,560 --> 00:00:24,975

I, for one, would

love to know. Thanks.

10

00:00:25,095 --> 00:00:25,575

Okay.

11

00:00:25,575 --> 00:00:28,615

Jeff, you're asking me a question

that's absolutely going to get

12

00:00:28,615 --> 00:00:33,550

me in trouble because I'm both a VC

apologist and a bootstrap founder.

13

00:00:33,550 --> 00:00:36,270

And as we all know,

funding is a tool.

14

00:00:36,270 --> 00:00:37,870

It's not bad or good,

15

00:00:37,870 --> 00:00:40,510

but just like if you're using

a sledgehammer when you should be

16

00:00:40,510 --> 00:00:44,175

using a scalpel, you can

use the tool incorrectly.

17

00:00:44,195 --> 00:00:45,635

So to answer Jeff's question,

18

00:00:45,635 --> 00:00:48,115

we looked at the data

from three point seven thousand

19

00:00:48,115 --> 00:00:51,570

companies within the subscription

space and here's what we found.

20

00:00:51,570 --> 00:00:55,330

Let's start with arguably one

of the most important metrics

21

00:00:55,330 --> 00:00:57,985

within a subscription

business, churn.

22

00:00:57,985 --> 00:01:01,425

When comparing companies who took

on funding to those who haven't,

23

00:01:01,425 --> 00:01:04,785

you'll notice that at most

stages of the growth life cycle,

24

00:01:04,785 --> 00:01:05,301

funded companies have higher

churn with an average of twenty

25

00:01:05,301 --> 00:01:06,845

to thirty percent higher

26

00:01:12,320 --> 00:01:13,420

funded

27

00:01:14,135 --> 00:01:16,455

certainly plenty of

lurking variables here,

28

00:01:16,455 --> 00:01:19,895

but non funded companies likely

have a bit of survivor bias

29

00:01:19,895 --> 00:01:23,430

baked into these numbers simply

because they don't have funding

30

00:01:23,430 --> 00:01:26,050

to float them through

higher experimentation

31

00:01:26,150 --> 00:01:29,165

that is likely taking place

amongst funded companies.

32

00:01:29,165 --> 00:01:31,725

At least that's the most

charitable interpretation of

33

00:01:31,725 --> 00:01:34,685

this data as there are

certainly funded companies that

34

00:01:34,685 --> 00:01:38,040

just use the money as a

crutch instead of figuring out how to

35

00:01:38,040 --> 00:01:41,000

make sure they sell the

right product to the right customer

36

00:01:41,000 --> 00:01:43,240

and keep that customer around.

37

00:01:43,240 --> 00:01:46,120

When comparing customer

acquisition cost data amongst

38

00:01:46,120 --> 00:01:49,465

these groups, both

interpretations are supported.

39

00:01:49,465 --> 00:01:52,825

CAC is going up for

everyone, but amongst funded companies,

40

00:01:52,825 --> 00:01:56,390

we're seeing fifty to seventy

percent higher CAC than non

41

00:01:56,390 --> 00:01:57,590

funded companies.

42

00:01:57,590 --> 00:02:00,950

Funded companies likely

haphazardly or more targetedly

43

00:02:00,950 --> 00:02:04,070

use a good amount of their

funding to pursue higher cost

44

00:02:04,070 --> 00:02:06,995

channels or just more

channels in general.

45

00:02:06,995 --> 00:02:10,355

We're essentially seeing

different strategies along an

46

00:02:10,355 --> 00:02:13,360

axis of conservatism and risk.

47

00:02:13,360 --> 00:02:17,360

That being said, CAC and

churn obviously matter, but a common

48

00:02:17,360 --> 00:02:20,975

argument is that these two

metrics can be optimized later.

49

00:02:20,975 --> 00:02:23,215

It's all about growth now.

50

00:02:23,215 --> 00:02:27,775

Yet the data is mixed on whether

that notion is true or not.

51

00:02:27,775 --> 00:02:30,810

When we look at companies

under ten million ARR,

52

00:02:30,810 --> 00:02:32,730

it certainly is true.

53

00:02:32,730 --> 00:02:36,785

Funded companies handedly are growing

faster than non funded companies.

54

00:02:36,785 --> 00:02:38,705

There's just no question.

55

00:02:38,705 --> 00:02:40,065

No matter the ARPU,

56

00:02:40,065 --> 00:02:42,945

funded companies are growing

at a rate of forty to a hundred

57

00:02:42,945 --> 00:02:46,710

percent more per year than non

funded companies with massive

58

00:02:46,710 --> 00:02:50,150

variance where some companies are

growing at five x that of

59

00:02:50,150 --> 00:02:52,290

their non funded counterparts.

60

00:02:52,295 --> 00:02:55,495

A counter view to this though

is that there's a massive

61

00:02:55,495 --> 00:02:58,935

amount of indie and lifestyle

businesses that are under the

62

00:02:58,935 --> 00:03:02,770

ten million dollar ARR

threshold that just never want

63

00:03:02,770 --> 00:03:04,450

to be that large.

64

00:03:04,450 --> 00:03:08,450

Well, not directly supporting

this thesis, these gains from

65

00:03:08,450 --> 00:03:12,755

funding once we go over ten

million dollars in ARR seem to

66

00:03:12,755 --> 00:03:14,895

dissipate quite considerably.

67

00:03:14,915 --> 00:03:19,060

With the slight exception of four

figure or more MRR businesses,

68

00:03:19,060 --> 00:03:23,220

funded and nonfunded companies with

more than ten million ARR

69

00:03:23,220 --> 00:03:27,035

are essentially growing at the

same rate even when taking the

70

00:03:27,035 --> 00:03:30,155

entire mid spread of the

data into consideration.

71

00:03:30,155 --> 00:03:32,475

So where does this

put us as an industry?

72

00:03:32,475 --> 00:03:33,355

Well, in a sense,

73

00:03:33,355 --> 00:03:36,310

we're right back where we

started with funding being a

74

00:03:36,310 --> 00:03:39,830

tool that when used properly

can greatly increase your odds

75

00:03:39,830 --> 00:03:42,230

of reaching ten million

dollars or more.

76

00:03:42,230 --> 00:03:45,035

It's some of the differences

amongst the core unit economics

77

00:03:45,035 --> 00:03:48,235

as well as how similar

companies are when you reach

78

00:03:48,235 --> 00:03:51,860

greater than ten million

dollars suggests that in more

79

00:03:51,860 --> 00:03:55,460

cases than the industry

is probably willing to admit,

80

00:03:55,460 --> 00:03:59,380

funding can create moral hazard

and not always in the quote,

81

00:03:59,380 --> 00:04:02,085

let's make sure we're

comfortable taking the right

82

00:04:02,085 --> 00:04:04,085

risk unquote way.

83

00:04:04,085 --> 00:04:08,165

Instead, funding masks core problems

that simply get bigger as the

84

00:04:08,165 --> 00:04:09,660

company gets bigger.

85

00:04:09,660 --> 00:04:15,180

In essence, letting you use a sledgehammer

when you really should be using a scalpel.

86

00:04:15,180 --> 00:04:16,300

Well, that's all for now.

87

00:04:16,300 --> 00:04:17,485

If you have a question,

88

00:04:17,485 --> 00:04:20,525

ship me an email or video to

p c at profit well dot com.

89

00:04:20,525 --> 00:04:22,925

And let's also thank Jeff

for sparking this research by

90

00:04:22,925 --> 00:04:25,085

clicking the link below to

share and give him a nice

91

00:04:25,085 --> 00:04:26,150

little shout out.

92

00:04:26,150 --> 00:04:28,050

We'll see you next week.

93

00:04:29,910 --> 00:04:32,958

This week's episode is brought

to you by Protect the Hustle,

94

00:04:32,958 --> 00:04:37,738

a podcast about those who are in the

trenches actually doing the work.