Ideal Customer Target Size for a New SaaS Company

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: May 9th, 2018

There are many factors that go into which company size is an ideal target for SaaS companies. As the data suggests, there are different trade-offs when it comes to looking at potential retention rates, CAC (customer acquisition cost), and willingness to pay across the different market segments of SMB, Mid-Market, and Enterprise sized companies.

On this episode of the ProfitWell Report, Matt Smith, Founder of Later, asks Patrick a tough one: Which size company would he target as customers if he were to start a new company? To answer his question, let’s look at the data and unit economics from just over 5,000 companies and the willingness to pay for 1.2M subscription consumers.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

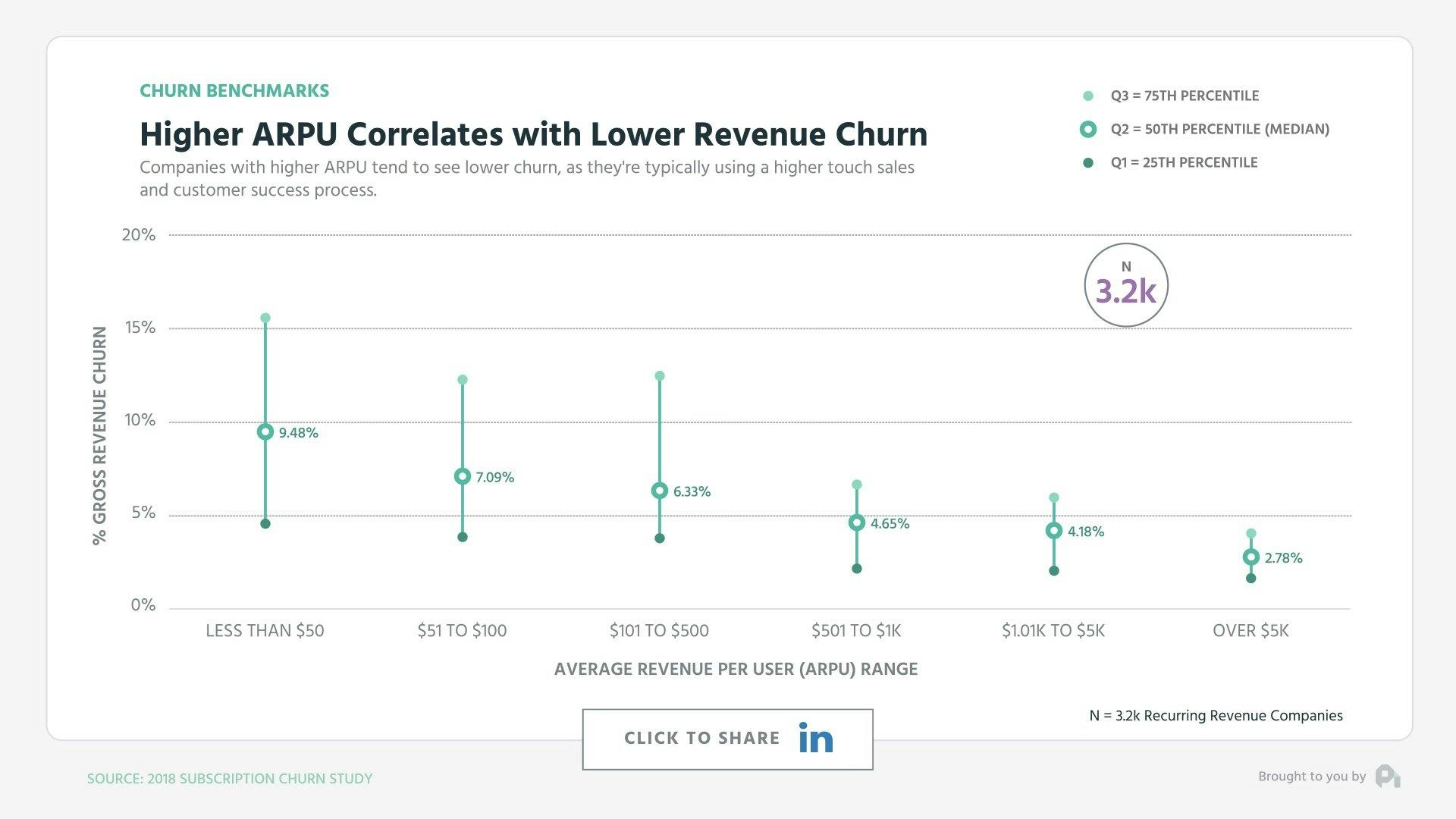

Higher ARPU Companies Have a Retention Advantage

There are a lot of vectors to consider here, but let’s assume we’re taking the baseline of building a business - acquiring a customer, keeping them around, and monetizing them accordingly. On the revenue retention front, larger ARPU (average revenue per user) companies have an advantage.

As a company’s ARPU increases - correlating with becoming more Enterprise - gross revenue retention reduces dramatically. Sub $100 products see revenue churn at 7 to 9% which balloons in comparison to the median of nearly 3% gross revenue churn for those getting into five thousand dollar plus ARPU.

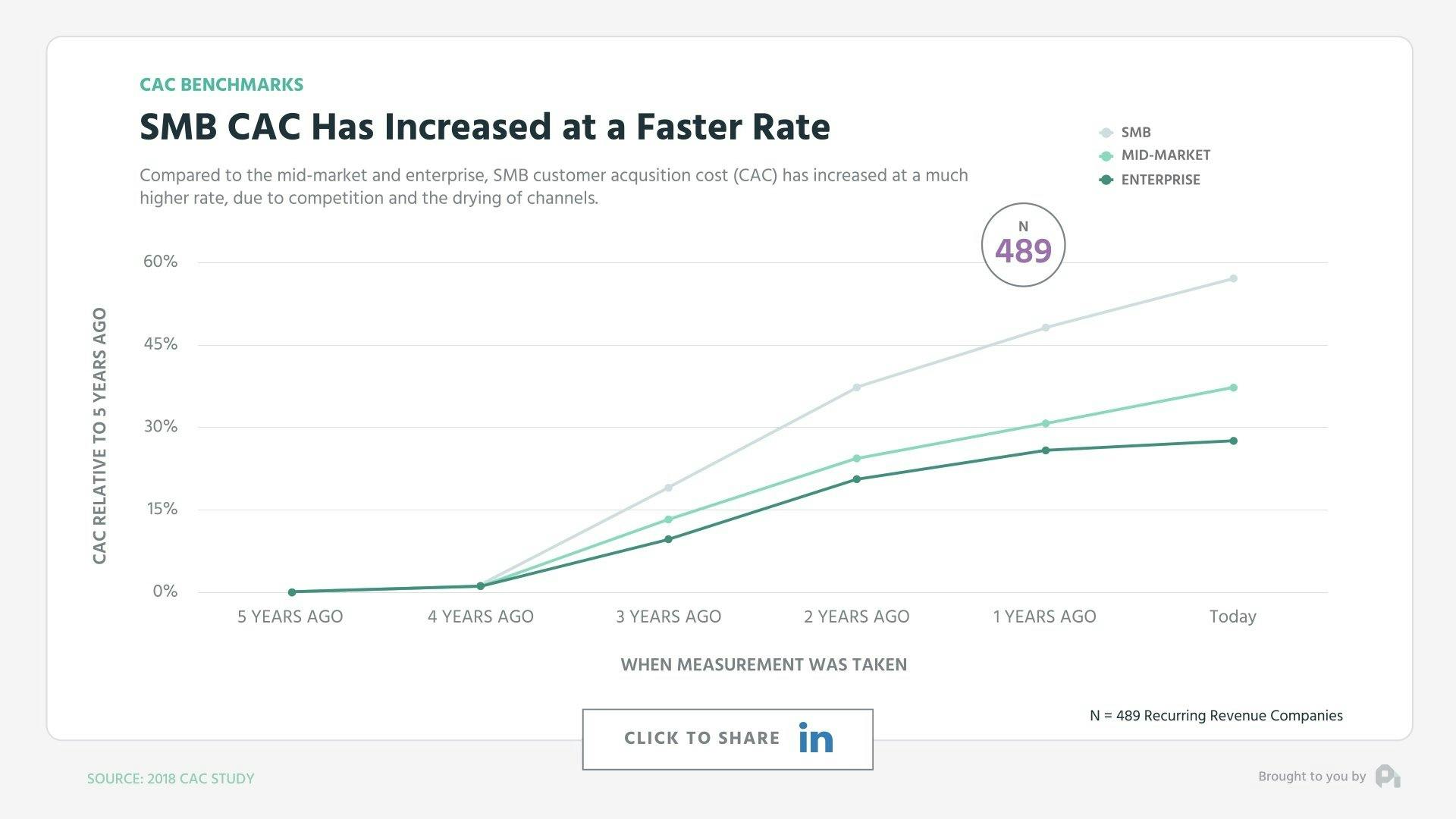

CAC is rising across the board, but especially for SMB

Beyond retention, acquisition is a really big factor here, so we need to consider CAC, and here’s where things get really interesting.

CAC has increased substantially with both B2B and B2C seeing 55 to 65% higher than five years ago overall. Yet, the story unfolds very differently when you look at our three sized categories.

On a relative basis, SMB CAC has grown at a far quicker and higher rate than CAC in the mid-market and enterprise. While maybe not immediately intuitive, the big reason this has happened really centers around the fact that mid-market and enterprise CAC has always been high and there’s been gains in some efficiency with these types of sales processes over the years.

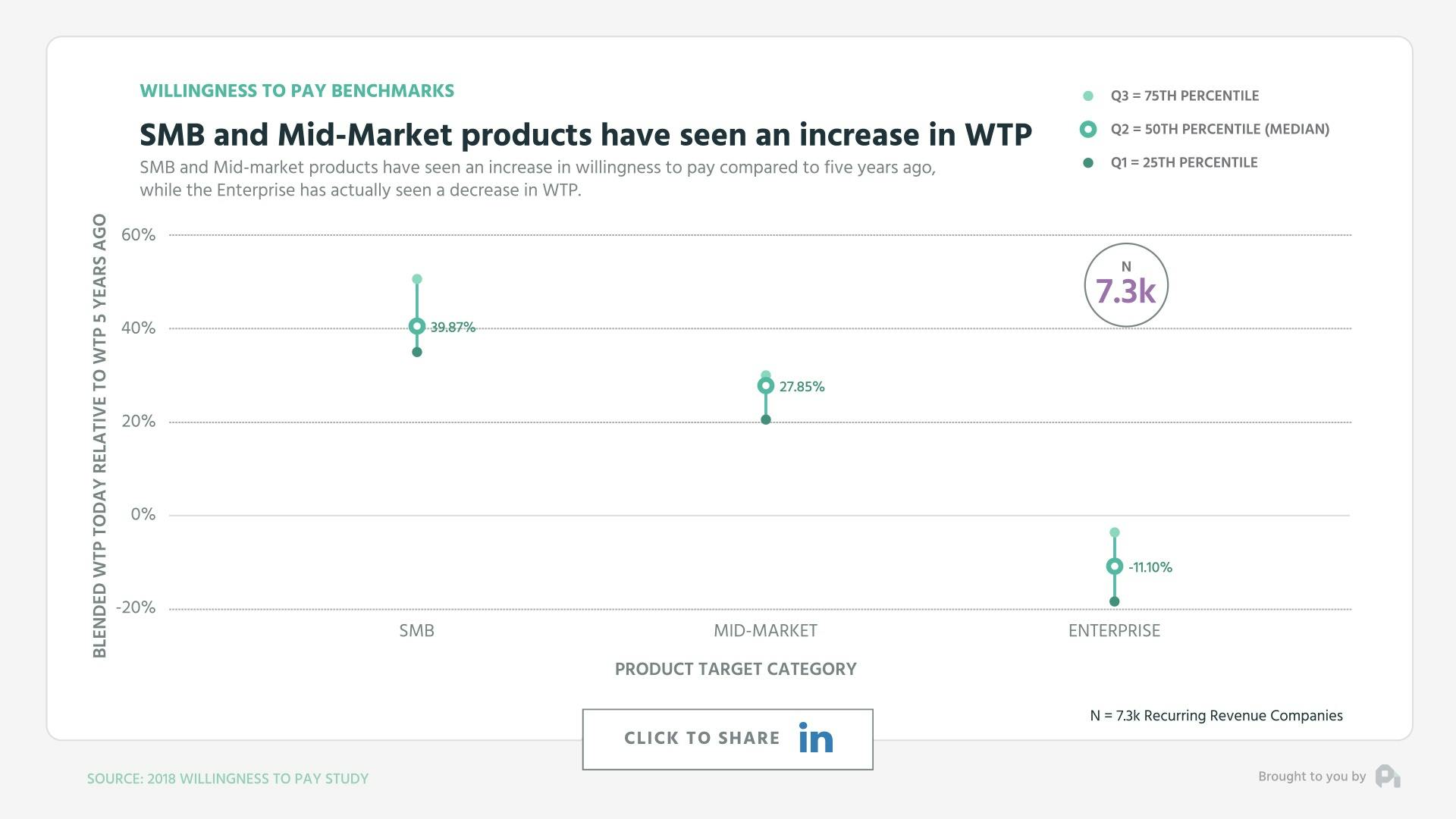

SMB and Mid-Market WTP has increased

Our third vector though around willingness to pay is where things get tricky. Interestingly enough, SMB and mid-market willingness to pay has actually increased in the aggregate while enterprise willingness to pay has decreased over time.

Compared to five years ago, the median willingness to pay for an SMB buyer has actually increased by 35 to 50%. Mid-market shows a similar path with an increase of 20 to 30%, but Enterprise has actually decreased by just over 10%.

Keep in mind that we’re blending B2B and B2C here and happy to go deeper there if you send us a question to, but the trend stands to reason considering the technical and information asymmetry moats we once enjoyed in the enterprise don’t exist as much as they used to.

So what should we do? Well, controlling for market size, which is expanding on all fronts, I believe the answer still comes down to the DNA of you and your company. No particular trend indicated there was a gold rush of opportunity and similarly no trend indicated you should be running for the hills. Instead, the trends indicated in context of one another it’s getting harder for everyone out there, so now more than ever you need to specialize and utilize your frameworks and data to grow as effectively as possible.

Want to learn more? Check out our recent episode: Price Tier Anchoring Benchmarks and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,440

You've got the questions,

and we have the data.

2

00:00:03,440 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:09,295 --> 00:00:11,695

Hey, Patrick. Matt

from Later here.

4

00:00:11,695 --> 00:00:13,375

If you're gonna start

a company tomorrow,

5

00:00:13,375 --> 00:00:16,415

would you go into SMB,

mid market, or enterprise?

6

00:00:16,415 --> 00:00:17,515

Thanks.

7

00:00:17,520 --> 00:00:20,320

This is a terribly difficult

question because there's so

8

00:00:20,320 --> 00:00:21,920

many axes to consider.

9

00:00:21,920 --> 00:00:23,280

Thanks for a toughie, Matt.

10

00:00:23,280 --> 00:00:24,480

But to answer your question,

11

00:00:24,480 --> 00:00:27,235

we looked at the unit economics

of just over five thousand

12

00:00:27,235 --> 00:00:29,555

companies and the willingness

to pay for one point two

13

00:00:29,555 --> 00:00:32,675

million subscription consumers,

and here's what we found.

14

00:00:32,675 --> 00:00:34,515

There's a lot of vectors

here to consider,

15

00:00:34,515 --> 00:00:37,050

but let's assume we're taking

the baseline of building a

16

00:00:37,050 --> 00:00:39,930

business, acquiring a

customer, keeping them around,

17

00:00:39,930 --> 00:00:41,905

and monetizing them accordingly.

18

00:00:41,905 --> 00:00:43,345

On the revenue retention front,

19

00:00:43,345 --> 00:00:45,505

larger ARPU companies

have an advantage.

20

00:00:45,505 --> 00:00:47,345

As a company's ARPU increases,

21

00:00:47,345 --> 00:00:49,585

correlating with

becoming more enterprise,

22

00:00:49,585 --> 00:00:51,780

gross revenue retention

reduces dramatically.

23

00:00:51,780 --> 00:00:54,144

For those

24

00:00:54,308 --> 00:00:56,672

getting five

25

00:00:56,836 --> 00:00:59,520

thousand dollar plus ARPU.

26

00:00:59,855 --> 00:01:00,435

Beyond retention,

27

00:01:00,435 --> 00:01:03,395

for those getting five

thousand dollar plus ARPU.

28

00:01:03,395 --> 00:01:06,435

Beyond retention, acquisition

is a really big factor here.

29

00:01:06,435 --> 00:01:07,940

So we need to consider CAC,

30

00:01:07,940 --> 00:01:10,660

and here's where things

get really interesting.

31

00:01:10,660 --> 00:01:13,860

CAC has increased substantially

with both b to b and b to c

32

00:01:13,860 --> 00:01:17,335

companies seeing fifty five to

sixty five percent higher CAC

33

00:01:17,335 --> 00:01:18,695

than five years ago.

34

00:01:18,695 --> 00:01:21,735

Yet, the story unfolds very

differently when you look at

35

00:01:21,735 --> 00:01:23,440

our three size categories.

36

00:01:23,440 --> 00:01:24,640

On a relative basis,

37

00:01:24,640 --> 00:01:28,160

SMB CAC has grown at a far

quicker and higher rate than

38

00:01:28,160 --> 00:01:30,615

CAC in the mid market

and enterprise.

39

00:01:30,615 --> 00:01:32,695

Well, maybe not

immediately intuitive.

40

00:01:32,695 --> 00:01:35,495

The big reason this has

happened really centers around

41

00:01:35,495 --> 00:01:38,935

the fact that mid market and

enterprise CAC has always been high,

42

00:01:38,935 --> 00:01:41,770

and there's been gain in some

efficiency with these types of

43

00:01:41,770 --> 00:01:44,010

sales processes over the years.

44

00:01:44,010 --> 00:01:46,490

Our third vector around

willingness to pay is where

45

00:01:46,490 --> 00:01:48,415

things get a little bit tricky.

46

00:01:48,415 --> 00:01:49,295

Interestingly enough,

47

00:01:49,295 --> 00:01:53,135

SMB and mid market willingness to pay

has actually increased in aggregate,

48

00:01:53,135 --> 00:01:56,550

while enterprise willingness

to pay has decreased over time.

49

00:01:56,550 --> 00:01:57,590

Compared to five years ago,

50

00:01:57,590 --> 00:02:00,710

the median willingness to pay

for an SME buyer was actually

51

00:02:00,710 --> 00:02:03,270

increasing by thirty

five to fifty percent.

52

00:02:03,270 --> 00:02:06,125

Mid market shows a similar path

with an increase of twenty to

53

00:02:06,125 --> 00:02:08,525

thirty percent, but on

the enterprise basis,

54

00:02:08,525 --> 00:02:11,005

it's actually reduced

by ten percent.

55

00:02:11,005 --> 00:02:13,805

Keep in mind, we're blending

b to b and b to c here,

56

00:02:13,805 --> 00:02:17,070

and we're happy to go deeper

there if you send us a question,

57

00:02:17,070 --> 00:02:20,190

but the trend stands to reason

considering the technical and

58

00:02:20,190 --> 00:02:24,265

information asymmetry modes we

once enjoyed in the enterprise

59

00:02:24,265 --> 00:02:26,505

don't really exist as

much as they used to.

60

00:02:26,505 --> 00:02:27,945

So what should you do?

61

00:02:27,945 --> 00:02:29,865

Well, controlling

for market size,

62

00:02:29,865 --> 00:02:32,220

which is expanding

on all fronts,

63

00:02:32,220 --> 00:02:35,500

I believe the answer still

comes down to the DNA of the

64

00:02:35,500 --> 00:02:38,140

company that you're

seeking and yourself.

65

00:02:38,140 --> 00:02:40,215

No particular trend it's

66

00:02:46,715 --> 00:02:47,595

getting harder for

everyone out there.

67

00:02:47,595 --> 00:02:47,728

So now more than ever,

68

00:02:47,728 --> 00:02:50,420

we need to it's getting

harder for everyone out there.

69

00:02:50,420 --> 00:02:51,460

So now more than ever,

70

00:02:51,460 --> 00:02:54,580

we need to specialize and

utilize the frameworks and data

71

00:02:54,580 --> 00:02:57,345

to grow as effectively

as possible.

72

00:02:57,345 --> 00:02:58,385

Well, that's all for now.

73

00:02:58,385 --> 00:02:59,265

If you have a question,

74

00:02:59,265 --> 00:03:02,145

shoot me an email or video to

p c at profit well dot com.

75

00:03:02,145 --> 00:03:04,305

And let's also thank Matt

from later for sparking this

76

00:03:04,305 --> 00:03:07,473

research by clicking the link below

to give him a nice little shout out.

77

00:03:07,473 --> 00:03:09,293

We'll see you next week.