How does contract length impact ARPU and churn?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: June 19, 2019

Relationships are where the beauty of the subscription economy truly shines. For the first time in the history of business, we have a revenue model where the relationship with the customer is baked right into how you make money. Interestingly enough though, we don’t have to test that relationship on a month to month basis – we can (and should) lock in a longer term. What’s the best term though? 1 year? 2 years?

As to not bury the lede - increasing the guaranteed subscription term absolutely lowers churn.

Regardless of ARPU, those companies with a higher percentage of annual contracts see significantly lower churn. This is because these customers have only one purchasing decision per year (albeit a larger one) whereas their monthly counterparts have 12 purchasing decisions per year. Note that the correlation is pretty strong here with those companies that have 100% annual contracts seeing 80% lower churn than those who only do monthly.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

We don’t have enough data on multi-year contracts, but qualitatively we’ve seen the effects to be similar with one important exception. As you increase the term beyond 1 year, the reduction in customer attrition is minimal, meaning there isn’t much to be gained in terms of retention for 2+ year contracts.

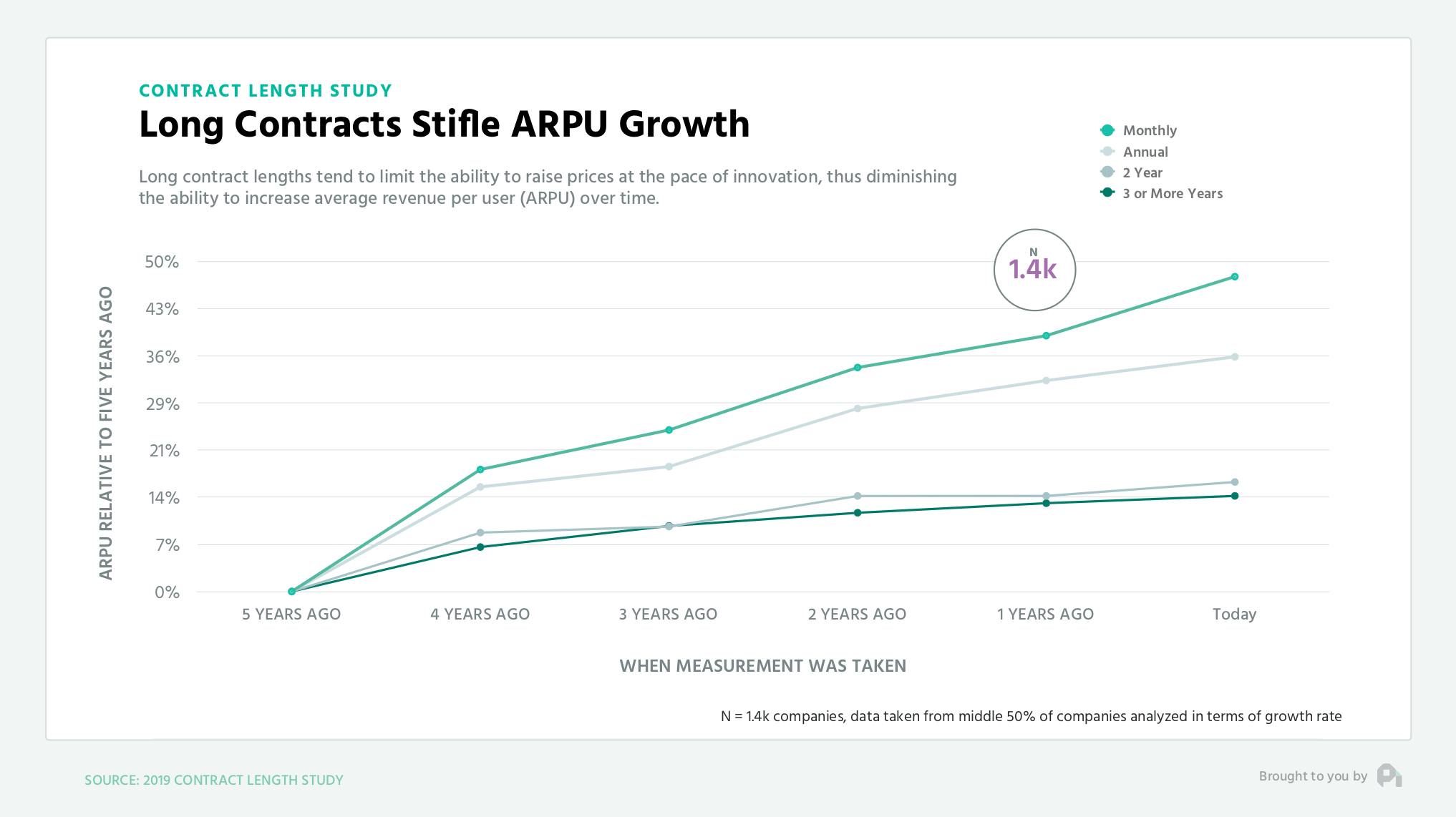

There is much to be lost though with longer term contracts. While many people use two or more year contracts to guarantee they recover acquisition costs, the impact is you lose out on the ability to increase prices or your overall average revenue per user.

Note how those companies using monthly or annual contracts tend to have some fairly decent increases in ARPU over the years. The flexibility of these contracts ensures that as the product improves, the price can also improve. Remember, your price is the exchange rate on the value you’re providing. Those with longer term contracts tend to have fairly flat ARPU, mainly because so much focus is being put on the longer contract that these terms don’t provide a lot of flexibility.

Of course, a big lurking variable here is longer term contracts tend to be used for much larger deals, so what should you do?

Well, in most situations you should definitely optimize for a healthy dose of annual contracts. Axiomatically I would say that most companies out there should avoid contracts longer than a year, strictly because you want to be able to raise prices over time. Some industries won’t be able to avoid the long term contracts due to constraints from the cost of acquisition, but these folks should then make sure contract terms are flexible enough to warrant price increases, especially as the product improves

Want to learn more? Check out our recent episode on Founder Sleep and Growth and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,945 --> 00:00:11,905

Hi, Neil. This is Vinish,

cofounder of White.

4

00:00:11,905 --> 00:00:17,380

My question is, how does the

contract plan impact ARPU and churn?

5

00:00:17,380 --> 00:00:18,480

Thanks.

6

00:00:18,500 --> 00:00:20,980

Welcome back, everyone.

Neil here from ProfitWell.

7

00:00:20,980 --> 00:00:23,380

Relationships are where the

beauty of the subscription

8

00:00:23,380 --> 00:00:25,275

economy truly shines.

9

00:00:25,275 --> 00:00:27,275

For the first time in

the history of business,

10

00:00:27,275 --> 00:00:29,675

we have a revenue model where

the relationship with the

11

00:00:29,675 --> 00:00:32,770

customer is baked right

into how we make money.

12

00:00:32,770 --> 00:00:34,130

Interestingly enough, though,

13

00:00:34,130 --> 00:00:37,410

we don't have to test our relationship

on a month to month basis.

14

00:00:37,410 --> 00:00:39,890

We can actually log

in a longer term.

15

00:00:39,890 --> 00:00:41,915

What's the best term

length, though? One year?

16

00:00:41,915 --> 00:00:42,955

Two years?

17

00:00:42,955 --> 00:00:44,075

To answer these questions,

18

00:00:44,075 --> 00:00:46,715

we looked at the data from over

three thousand subscription

19

00:00:46,715 --> 00:00:48,940

companies, and

here's what we found.

20

00:00:48,940 --> 00:00:50,300

As to not bury the lead,

21

00:00:50,300 --> 00:00:52,860

increasing the guaranteed term

of your contract with your

22

00:00:52,860 --> 00:00:55,020

customers absolutely

lowers churn.

23

00:00:55,020 --> 00:00:56,540

Regardless of ARPU,

24

00:00:56,540 --> 00:00:59,505

those companies with a higher

percentage of annual contracts

25

00:00:59,505 --> 00:01:01,345

see significantly lower churn.

26

00:01:01,345 --> 00:01:03,905

This is because these customers

have only one purchasing

27

00:01:03,905 --> 00:01:06,780

decision per year,

albeit a larger one,

28

00:01:06,780 --> 00:01:08,780

whereas their monthly

counterparts have twelve

29

00:01:08,780 --> 00:01:10,380

purchasing decisions per year.

30

00:01:10,380 --> 00:01:12,620

Note that the correlation is

pretty strong here with those

31

00:01:12,620 --> 00:01:15,825

companies that have one hundred

percent annual contracts,

32

00:01:15,825 --> 00:01:19,025

seeing eighty percent lower churn

than those who only do monthly.

33

00:01:19,025 --> 00:01:21,425

We don't have enough data

on multiyear contracts,

34

00:01:21,425 --> 00:01:22,625

but qualitatively,

35

00:01:22,625 --> 00:01:25,890

we've seen the effects to be similar

with one important exception.

36

00:01:25,890 --> 00:01:27,970

As you increase the

term beyond one year,

37

00:01:27,970 --> 00:01:29,730

the reduction in

churn is minimal,

38

00:01:29,730 --> 00:01:32,290

meaning there isn't much to be

gained in terms of retention

39

00:01:32,290 --> 00:01:34,135

for two plus year contracts.

40

00:01:34,135 --> 00:01:37,415

There is much to be lost though

with longer term contracts.

41

00:01:37,415 --> 00:01:39,975

While many people use two

or more year contracts to

42

00:01:39,975 --> 00:01:42,510

guarantee they recover

acquisition cost,

43

00:01:42,510 --> 00:01:45,470

the impact is you lose out on

the ability to increase prices

44

00:01:45,470 --> 00:01:47,950

on your overall average

revenue per user.

45

00:01:47,950 --> 00:01:50,910

Note how those companies using

monthly or annual contracts

46

00:01:50,910 --> 00:01:54,635

tend to have some fairly decent

increases in ARPU over the years.

47

00:01:54,635 --> 00:01:57,275

The flexibility of these

contracts ensures that as a

48

00:01:57,275 --> 00:02:00,075

product improves, the

price can also improve.

49

00:02:00,075 --> 00:02:03,480

Remember, your price range is

the exchange rate on the value

50

00:02:03,480 --> 00:02:04,600

you're providing.

51

00:02:04,600 --> 00:02:07,560

Those with longer term contracts

tend to have fairly flat ARPU,

52

00:02:07,560 --> 00:02:10,005

mainly because so much focus

is being put on the longer

53

00:02:10,005 --> 00:02:13,365

contract that those terms don't

provide a lot of flexibility.

54

00:02:13,365 --> 00:02:16,805

Of course, a big lurking variable

here is longer term contracts tend to

55

00:02:16,805 --> 00:02:18,770

be used for much larger deals.

56

00:02:18,770 --> 00:02:19,970

So what should you do?

57

00:02:19,970 --> 00:02:21,250

Well, in most situations,

58

00:02:21,250 --> 00:02:24,850

you should definitely optimize for

a healthy dose of annual contracts.

59

00:02:24,850 --> 00:02:27,955

Axiomatically, I would say that most

companies out there should avoid

60

00:02:27,955 --> 00:02:29,155

contracts longer than a year,

61

00:02:29,155 --> 00:02:32,355

certainly because you wanna be

able to raise prices over time.

62

00:02:32,355 --> 00:02:34,675

Some industries won't be

able to avoid the long term

63

00:02:34,675 --> 00:02:37,770

contracts due to constraints

from the cost of acquisition,

64

00:02:37,770 --> 00:02:40,250

but these folks should then

make sure contract terms are

65

00:02:40,250 --> 00:02:42,810

flexible enough to

warrant price increases,

66

00:02:42,810 --> 00:02:45,030

especially as the

product improves.

67

00:02:45,050 --> 00:02:46,495

Well, that's it for now.

68

00:02:46,495 --> 00:02:47,455

If you have any questions,

69

00:02:47,455 --> 00:02:49,855

send me an email or video

to neil at profit well dot com.

70

00:02:49,855 --> 00:02:52,815

And if you got value here or

any other week of the report,

71

00:02:52,815 --> 00:02:55,120

we'd love any shares on

Twitter and LinkedIn because that's how

72

00:02:55,120 --> 00:02:56,320

we know to keep going.

73

00:02:56,320 --> 00:02:58,860

Thanks, and I will

see you next week.

74

00:03:00,720 --> 00:03:03,175

This week's episode is

brought to you by PandaDoc.

75

00:03:03,175 --> 00:03:06,855

Empower your sales team to

create, send, track, and esign

76

00:03:06,855 --> 00:03:08,775

beautiful proposals and quotes.

77

00:03:08,775 --> 00:03:10,755

PandaDoc dot com.