Average Revenue Churn Rate Benchmarks

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: June 11th, 2018

It's the silent killer in our recurring revenue businesses. But while churn is something all of us in the subscription world must deal with, knowing what does and does not influence it can help us survive and build a faster growing business.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

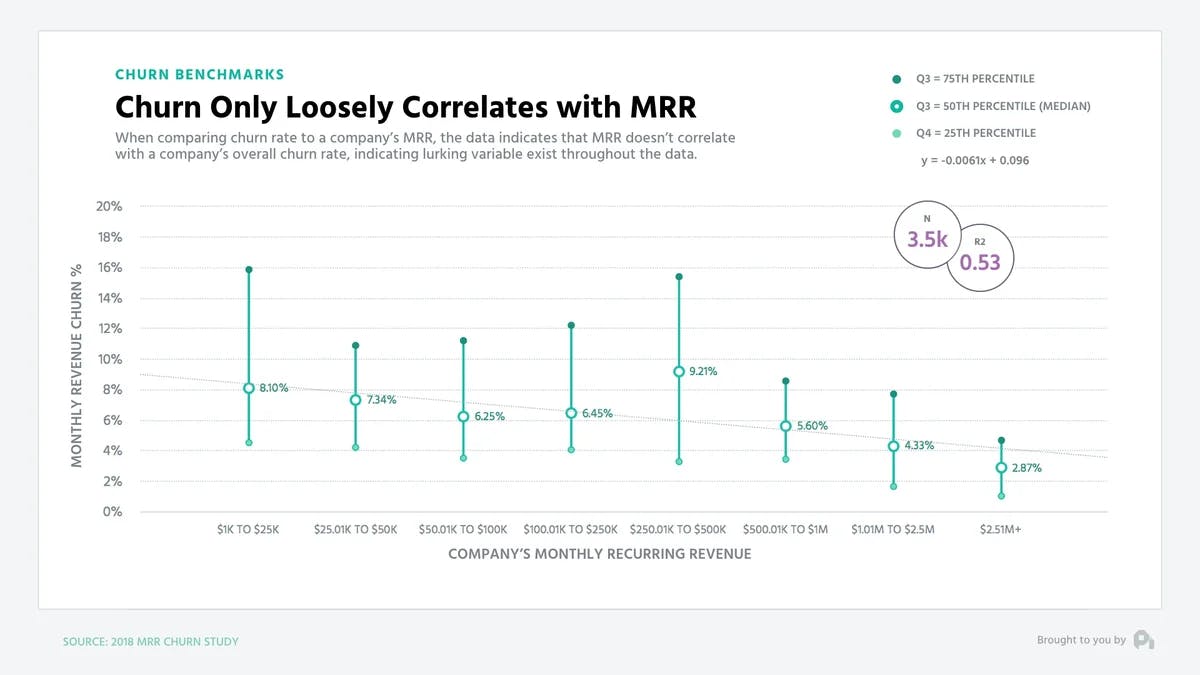

Churn Loosely Correlates with MRR

Interestingly enough, churn is actually much higher than you typically see publicly disclosed. When looking at churn based on the size of the company, you’ll notice that churn only loosely correlates with a company’s monthly recurring revenue with wide interquartile ranges that fluctuate between 5% and 16% gross revenue churn on the low end of MRR and 2% to 8% on the high end of MRR.

You’d expect that as a company grows, they’d be figuring out their churn, which in kind would help them grow quicker. Yet, this isn’t the case.

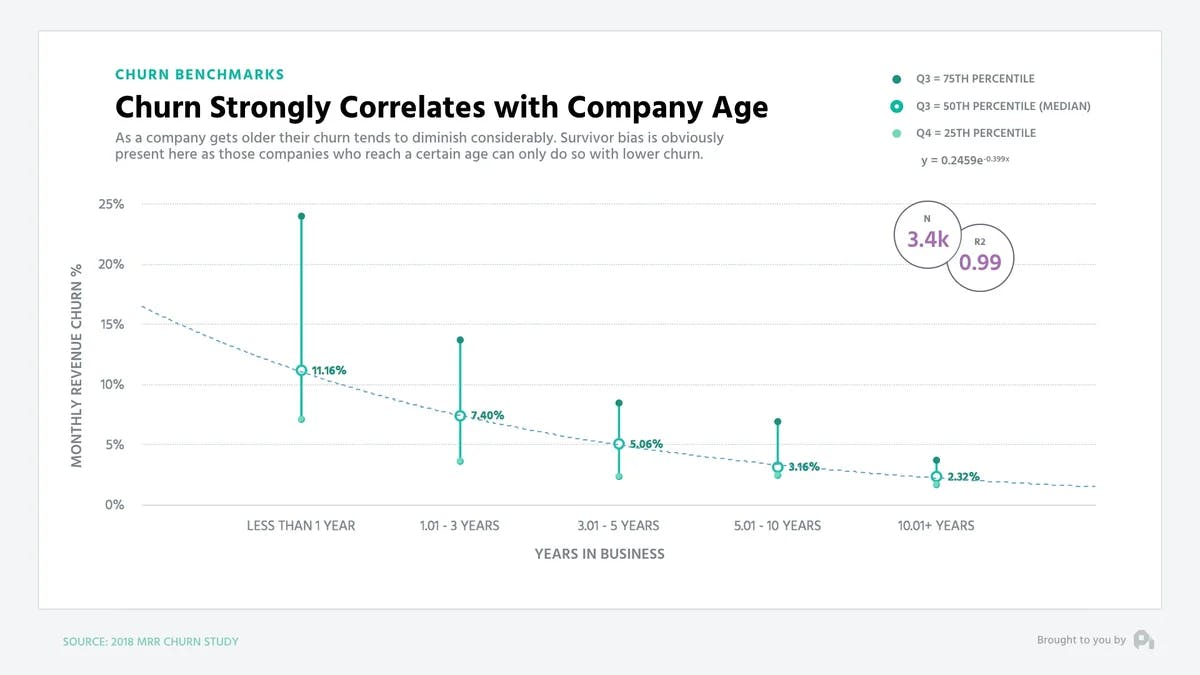

Company Age Shows Survivor Bias

Digging deeper down the the churn rabbit hole though we find that company age does present us with some good survivor bias when it comes to churn. Those companies who are older have dramatically lower churn than their younger counterparts. Companies who are less than three years old are seeing the interquartile range spread from 4% to a whopping 24% whereas companies who are 10 plus years old are seeing churn in the 2% to 4% range.

While the model fits quite nicely, these companies of course survive through properly figuring out churn, because by that time, funding, patience, or at the very least interest will dry up with poor unit economics.

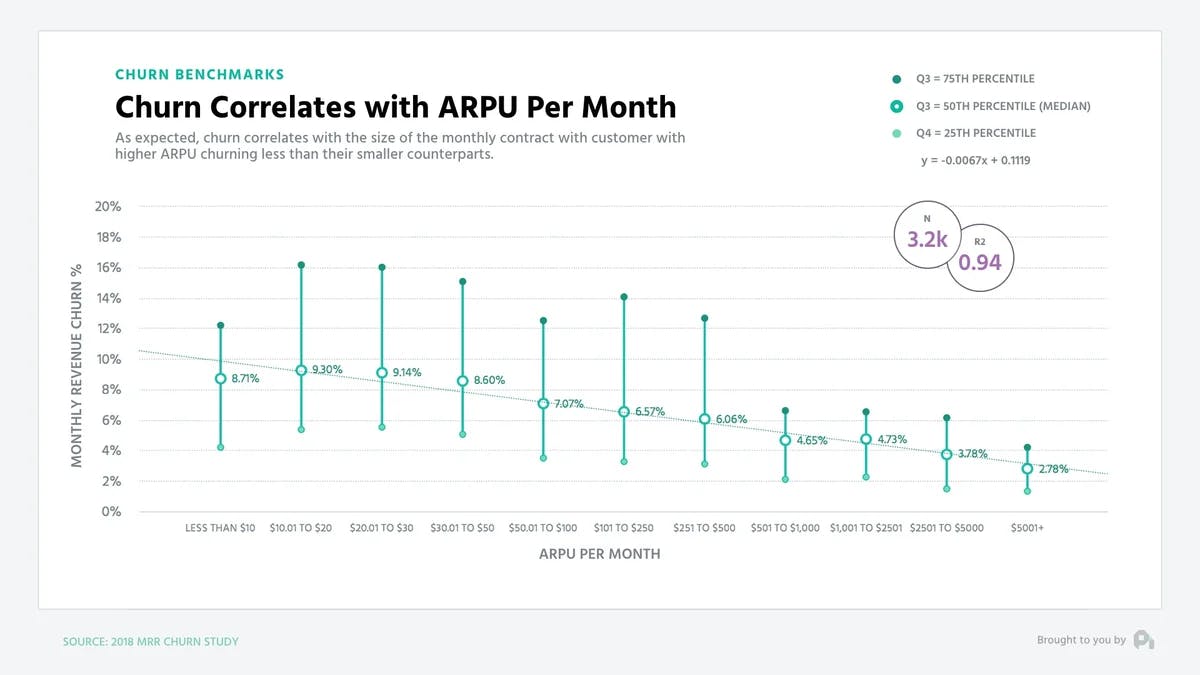

Influence Churn Through Your Pricing

That being said, you can’t control your age or your MRR with the flick of a switch. You do have significant influence over your ARPU through your pricing though - and it may be time to revisit that pricing to control churn.

Those companies with low ARPUs see much higher churn than those with larger ARPU. If your average revenue per user per month is below $100, you’re likely seeing monthly gross dollar churn rates between 3 and 16% with a median between 6 and 9%. That’s a lot of churn. Yet, ARPUs over $500 see significantly less revenue churn with a range of roughly 2 to 6% and a median closer to 3-4%.

Of course, this is intuitive, as those higher ARPUs tend to come with more hand holding, annual contracts, and a deeper relationship with your customer - that which is afforded through higher revenues per user.

Ultimately though, you need to pick your poison when it comes to the company you’re building and the implications those decisions have on churn. Less churn is always more success though, and you should be fighting to reduce your churn as much as humanly possible.

Want to learn more? Check out our recent episode on Value props and willingness to pay and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,935 --> 00:00:09,655

Hey, Patrick.

4

00:00:09,655 --> 00:00:12,295

This is a buy from Feather

in Gainesville, Florida.

5

00:00:12,295 --> 00:00:17,360

I'm curious about what data

you have about average logo and

6

00:00:17,360 --> 00:00:20,960

dollar churn, across

dimensions like company

7

00:00:20,960 --> 00:00:23,040

age and price point of product.

8

00:00:23,040 --> 00:00:24,645

Phenomenal question, Abe.

9

00:00:24,645 --> 00:00:28,245

Because churn is the silent killer

in our recurring revenue businesses.

10

00:00:28,245 --> 00:00:29,205

So to answer your question,

11

00:00:29,205 --> 00:00:31,685

we studied just over three

thousand subscription companies

12

00:00:31,685 --> 00:00:33,680

of all shapes,

sizes, and verticals.

13

00:00:33,680 --> 00:00:35,760

Let's jump in and

see what we found.

14

00:00:35,760 --> 00:00:36,720

Interestingly enough,

15

00:00:36,720 --> 00:00:40,240

churn is actually much higher than

you typically see publicly disclosed.

16

00:00:40,240 --> 00:00:42,785

When looking at churn based

on the size of the company,

17

00:00:42,785 --> 00:00:44,945

you'll notice that churn only

loosely correlates with the

18

00:00:44,945 --> 00:00:47,585

company's monthly recurring

revenue with wide inter

19

00:00:47,585 --> 00:00:50,470

quartile ranges that fluctuate

between five and sixteen

20

00:00:50,470 --> 00:00:53,750

percent gross revenue churn on

the low end and two to eight

21

00:00:53,750 --> 00:00:55,910

percent on the high end of MRR.

22

00:00:55,910 --> 00:00:57,990

You'd expect that

as a company grows,

23

00:00:57,990 --> 00:00:59,715

they'd be figuring

out their churn,

24

00:00:59,715 --> 00:01:01,795

which in kind would

help them grow quicker.

25

00:01:01,795 --> 00:01:03,635

Yet, this just isn't the case.

26

00:01:03,635 --> 00:01:05,555

Digging deeper down the

churn rabbit hole though,

27

00:01:05,555 --> 00:01:09,050

we find that a company age does

actually present us with some

28

00:01:09,050 --> 00:01:11,610

good survivor bias

when it comes to churn.

29

00:01:11,610 --> 00:01:14,685

Those companies who are

older have dramatically lower churn

30

00:01:14,685 --> 00:01:16,365

than their younger counterparts.

31

00:01:16,365 --> 00:01:18,605

Companies who are less than

three years old are seeing the

32

00:01:18,605 --> 00:01:22,740

interquartile range spread from four

to a whopping twenty four percent,

33

00:01:22,740 --> 00:01:25,460

whereas companies who are ten

plus years old are looking at a

34

00:01:25,460 --> 00:01:28,580

range of two to four

percent for the median.

35

00:01:28,580 --> 00:01:30,340

While the model

fits quite nicely,

36

00:01:30,340 --> 00:01:32,725

those companies of course

survive through properly

37

00:01:32,725 --> 00:01:33,845

figuring out their churn,

38

00:01:33,845 --> 00:01:36,885

because that time funding

patients or at least interest

39

00:01:36,885 --> 00:01:39,125

will dry up with

poor unit economics.

40

00:01:39,125 --> 00:01:43,600

That being said, you can't control your

age or your MRR with the flick of a switch.

41

00:01:43,600 --> 00:01:46,080

You do have significant

influence over your ARPU

42

00:01:46,080 --> 00:01:48,240

though, and particularly

your pricing.

43

00:01:48,240 --> 00:01:51,625

And it may be time to revisit that

pricing to control your churn.

44

00:01:51,625 --> 00:01:54,425

Those companies with lower

ARPUs see much higher churn

45

00:01:54,425 --> 00:01:56,345

than those with larger ARPU.

46

00:01:56,345 --> 00:02:00,090

If your average revenue per user per

month is below a hundred dollars,

47

00:02:00,090 --> 00:02:02,490

you're likely seeing monthly

gross dollar churn rates

48

00:02:02,490 --> 00:02:05,450

between three and sixteen

percent with a median between

49

00:02:05,450 --> 00:02:06,890

six and nine percent.

50

00:02:06,890 --> 00:02:08,415

That's a lot of churn.

51

00:02:08,415 --> 00:02:11,855

Yet ARPUs over five hundred

dollars see significantly lower

52

00:02:11,855 --> 00:02:14,815

revenue churn rates with a

range of roughly two to six

53

00:02:14,815 --> 00:02:18,080

percent and a median closer

to three and four percent.

54

00:02:18,080 --> 00:02:21,440

Of course, this is intuitive as

those higher ARPUs tend to come with

55

00:02:21,440 --> 00:02:24,080

more hand holding annual

contracts and a deeper

56

00:02:24,080 --> 00:02:25,865

relationship with your customer,

57

00:02:25,865 --> 00:02:29,145

that which is afforded through

higher revenues per user.

58

00:02:29,145 --> 00:02:29,865

Ultimately though,

59

00:02:29,865 --> 00:02:32,105

you need to pick your poison

when it comes to the company

60

00:02:32,105 --> 00:02:34,610

that you're trying to build

and the implications those

61

00:02:34,610 --> 00:02:36,290

decisions have on churn.

62

00:02:36,290 --> 00:02:39,090

Less churn is always

more success though,

63

00:02:39,090 --> 00:02:41,490

and you should be fighting to

reduce your churn as much as

64

00:02:41,490 --> 00:02:42,855

humanly possible.

65

00:02:42,855 --> 00:02:44,055

Ship us a question

on that front,

66

00:02:44,055 --> 00:02:46,935

and we'll show you the data

to tell you actually how.

67

00:02:46,935 --> 00:02:48,135

Well, that's all for now.

68

00:02:48,135 --> 00:02:49,015

If you have a question,

69

00:02:49,015 --> 00:02:51,930

shoot me an email or video

to p c at profitable dot com.

70

00:02:51,930 --> 00:02:54,090

Let's also thank Abe

from Feather for sparking this

71

00:02:54,090 --> 00:02:56,250

research by clicking on the

link below to give him a nice

72

00:02:56,250 --> 00:02:57,130

little shout out.

73

00:02:57,130 --> 00:02:58,950

We'll see you next week.