NPS Revenue Correlation: Impact of NPS on Revenue Expansion

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: July 25th, 2018

Customer satisfaction isn’t everything, but it’s hard to imagine a successful business that doesn’t take customer sentiment into strong consideration. That being said, the cult following around customer satisfaction utilizing Net Promoter Score or NPS is admirable, but as we’ll see in the data, NPS is not infallible.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

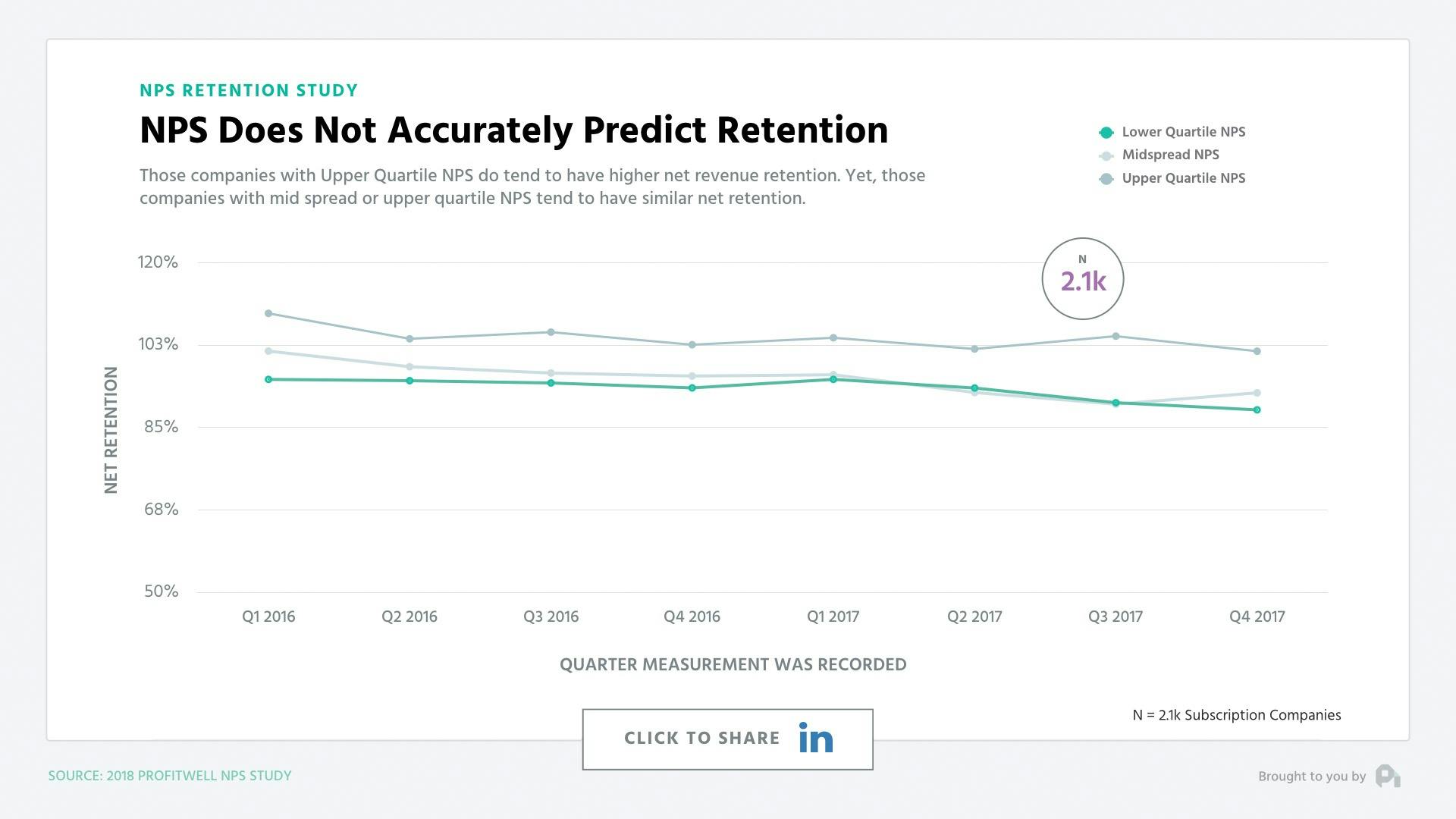

NPS Doesn't Predict Retention Accurately

As to not bury the lede, NPS, as an aggregate measure of customer satisfaction, is not a strong indicator of retention. I know that's going to be shocking to the NPS acolytes out there, but when we look at the data, you'll notice that those companies who have an NPS score in the lower quartile or in the midspread of their industry have essentially the same retention with mild acceptable variations here and there.

We broke out the striations of NPS across the spectrum and consistently the only indicator of any strong correlation in one direction or another is if your NPS was in the upper quartile of your industry. You then tended to have 5 to 10% higher retention on an absolute basis.

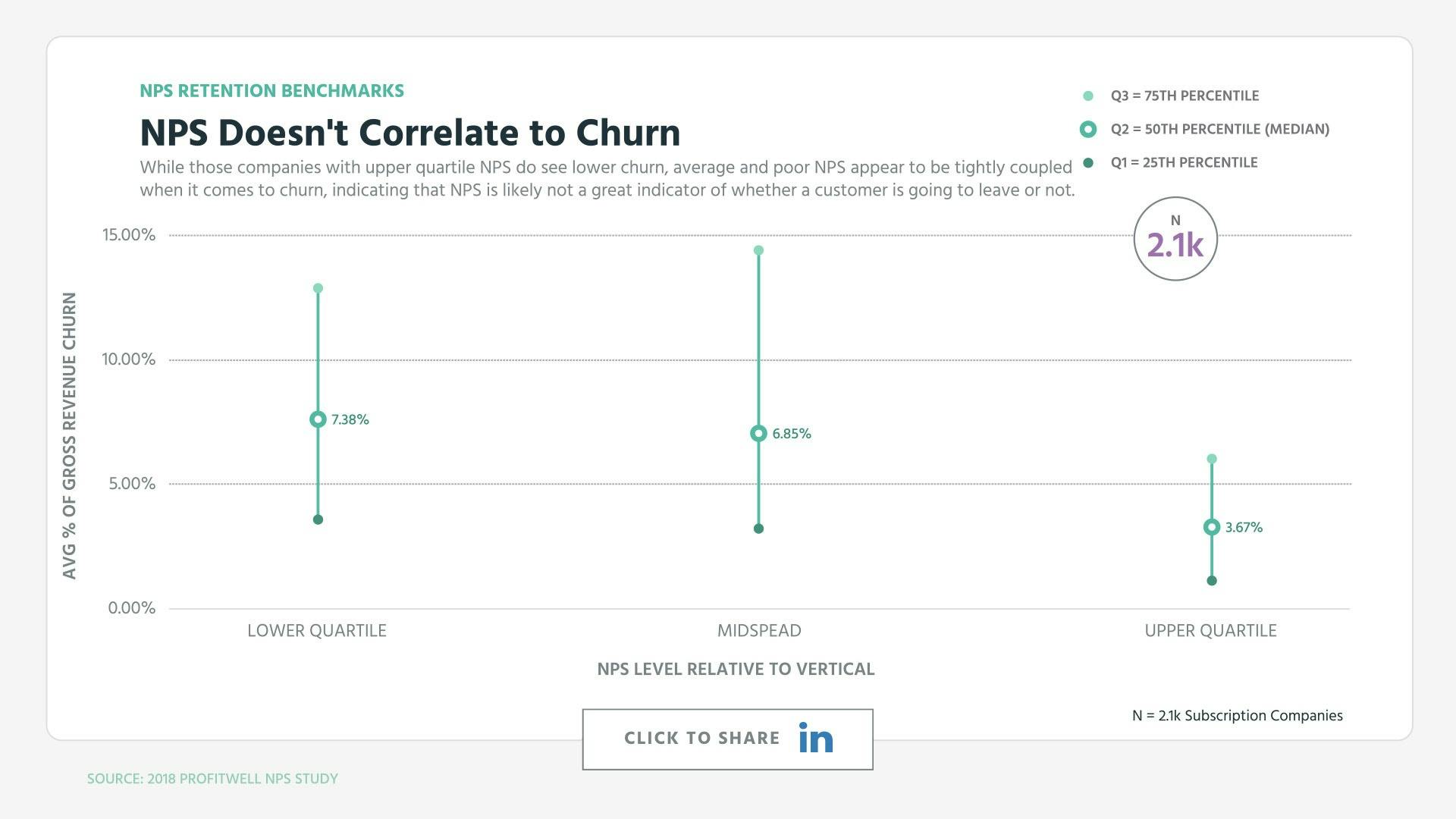

NPS And Churn Rarely Correlate

Note that this trend is also consistent when you look at gross churn rate, where upper quartile NPS companies have noticeably lower churn, but median and bad NPS companies are essentially the same.

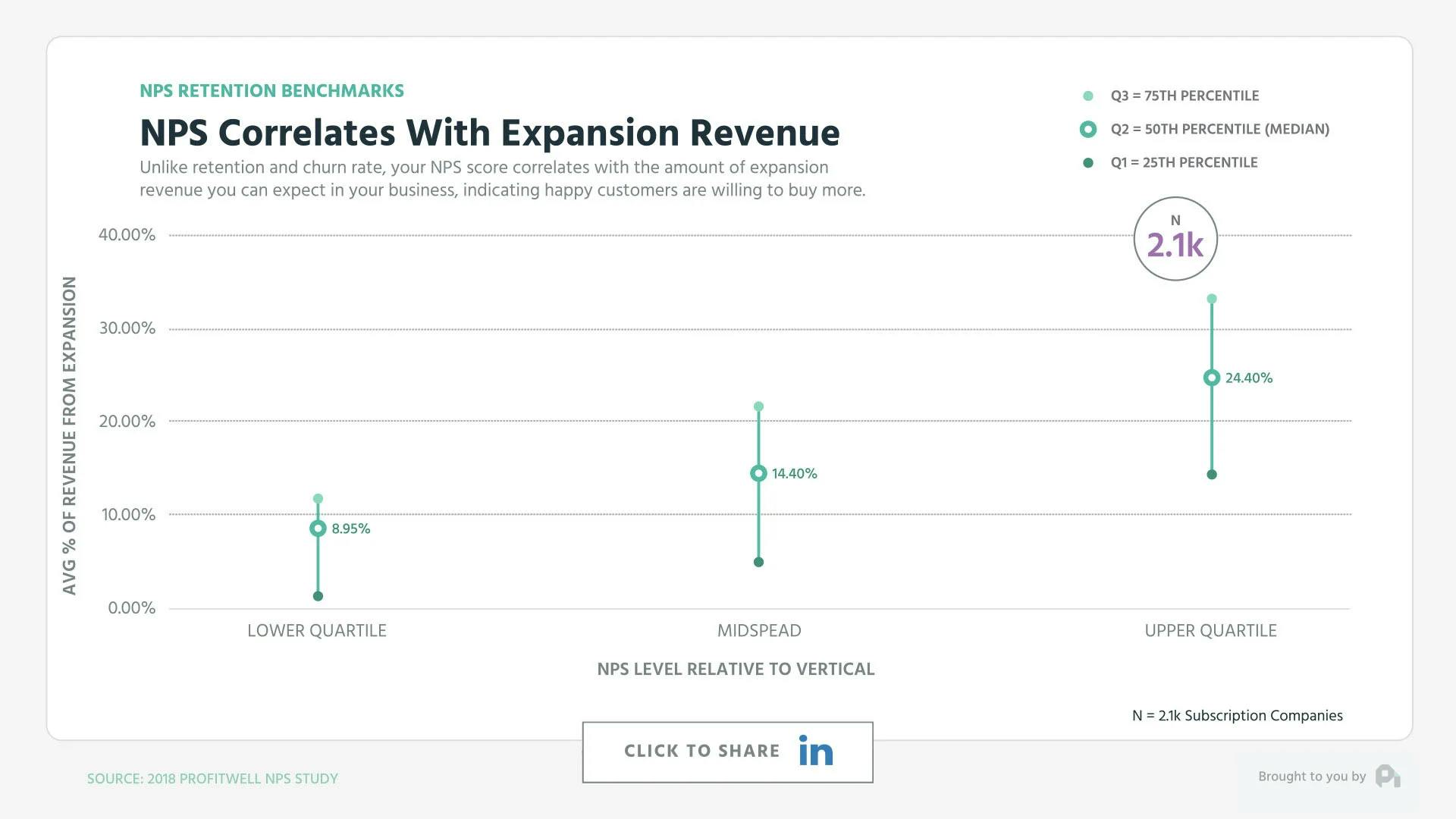

NPS Correlates With Expansion Revenue

Things get interesting though when looking at expansion revenue, where as a company has higher NPS there is a stronger correlation to having more expansion revenue with lower quartile NPS companies seeing a median of 9% monthly revenue coming from expansion, the midspread seeing 14% and the upper quartile 24%.

So what does this mean for NPS?

Well, it means that in aggregate NPS is very much a reactionary metric that lacks enough sensitivity to be useful as a measure of momentum. If you have high NPS, it’s great, but there’s likely a lot of lurking variables that contribute to your retention that NPS is simply measuring. This also means that if you have above average NPS it doesn’t necessarily mean you’re better off than a company with bad NPS, which is unsettling for our industries obsession with such an insensitive metric.

NPS is still useful, but likely only as a framework for identifying those customers on an individual basis who are raising their hands in frustration and as a blunt metric that when looked at in aggregate or on a segmented basis you want going up over time. Put another way, collect NPS, but your actual financial and retention metrics are an order of magnitude more important.

That's all for this week. Want to learn more? Check out our latest episode on MultiProduct vs. Single Product Strategies and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:09,315 --> 00:00:10,115

Hey, Patrick.

4

00:00:10,115 --> 00:00:13,695

What's the relationship

between NPS and retention?

5

00:00:13,715 --> 00:00:16,220

Customer satisfaction

isn't everything,

6

00:00:16,220 --> 00:00:18,620

but it's hard to imagine

a successful business that

7

00:00:18,620 --> 00:00:21,960

doesn't take customer sentiment

into strong consideration.

8

00:00:21,980 --> 00:00:25,765

That being said, the cult following

around customer satisfaction utilizing

9

00:00:25,765 --> 00:00:28,565

Net Promoter Score

or NPS is admirable,

10

00:00:28,565 --> 00:00:32,360

but as we'll see in the

data, NPS is not infallible.

11

00:00:32,360 --> 00:00:33,720

To answer Chirag's question,

12

00:00:33,720 --> 00:00:36,760

we looked at the data from two

thousand companies and over ten

13

00:00:36,760 --> 00:00:39,060

thousand subscription consumers.

14

00:00:39,160 --> 00:00:40,600

As to not bury the lead,

15

00:00:40,600 --> 00:00:44,645

NPS as an aggregate measure

of customer satisfaction is not a

16

00:00:44,645 --> 00:00:46,565

strong indicator of retention.

17

00:00:46,565 --> 00:00:49,560

I know that's gonna be shocking

to some of the NPS acolytes out

18

00:00:49,560 --> 00:00:51,160

there, but when we

look at the data,

19

00:00:51,160 --> 00:00:53,720

you'll notice that those

companies who have an NPS score

20

00:00:53,720 --> 00:00:56,925

in the lower quartile or in the

mid spread of their industry

21

00:00:56,925 --> 00:01:01,965

have essentially the same retention

with mild variations here and there.

22

00:01:01,965 --> 00:01:05,880

We broke out the striations

of NPS across the spectrum and

23

00:01:05,880 --> 00:01:09,320

consistently the only indicator

of any strong correlation in

24

00:01:09,320 --> 00:01:12,440

one direction or another is

if your NPS was in the upper

25

00:01:12,440 --> 00:01:14,255

quartile of your industry.

26

00:01:14,255 --> 00:01:17,775

You then tended to have five

to ten percent higher retention on

27

00:01:17,775 --> 00:01:19,375

an absolute basis.

28

00:01:19,375 --> 00:01:22,560

Note that this trend is also

consistent when you look at

29

00:01:22,560 --> 00:01:25,920

gross churn rate where upper

quartile NPS companies have

30

00:01:25,920 --> 00:01:29,680

noticeably lower churn, but

median and bad NPS companies

31

00:01:29,680 --> 00:01:31,695

are essentially the same.

32

00:01:31,695 --> 00:01:34,735

Things get interesting though

when looking at expansion revenue.

33

00:01:34,735 --> 00:01:37,295

Whereas a company, if

you have higher NPS,

34

00:01:37,295 --> 00:01:41,010

there's a stronger correlation

to more expansion revenue where

35

00:01:41,010 --> 00:01:44,370

lower quartile NPS companies

are seeing a median of nine

36

00:01:44,370 --> 00:01:48,175

percent monthly expansion where

mid spread see fourteen percent

37

00:01:48,175 --> 00:01:50,575

and upper quartile

see twenty four.

38

00:01:50,575 --> 00:01:52,255

So what does this mean then?

39

00:01:52,255 --> 00:01:53,935

Well, it means

that in aggregate,

40

00:01:53,935 --> 00:01:57,770

NPS is very much a reactionary

metric that lacks enough

41

00:01:57,770 --> 00:02:00,490

sensitivity to be useful

as a measure of momentum.

42

00:02:00,490 --> 00:02:02,010

If you have high

NPS, it's great,

43

00:02:02,010 --> 00:02:04,250

but there's probably a lot

of lurking variables that

44

00:02:04,250 --> 00:02:06,255

contribute to your

high retention.

45

00:02:06,255 --> 00:02:08,895

This also means that if

you have above average NPS,

46

00:02:08,895 --> 00:02:11,295

it doesn't necessarily mean

that you're better off than

47

00:02:11,295 --> 00:02:16,000

those who have bad NPS

which is unsettling given our industry's

48

00:02:16,000 --> 00:02:18,640

obsession with such

an insensitive metric.

49

00:02:18,640 --> 00:02:22,640

NPS is still useful just

likely only as a framework for

50

00:02:22,640 --> 00:02:25,975

identifying those customers on an

an individual basis who are

51

00:02:25,975 --> 00:02:29,015

having problems and raising

their hands and frustration.

52

00:02:29,015 --> 00:02:32,135

And a blunt metric that when

used in aggregate or on a

53

00:02:32,135 --> 00:02:35,620

segmented basis really means

that you wanna be moving up

54

00:02:35,620 --> 00:02:38,180

into the right with

this metric over time.

55

00:02:38,180 --> 00:02:40,500

Put another way, collect NPS,

56

00:02:40,500 --> 00:02:44,185

but your actual financial and

retention metrics are an order

57

00:02:44,185 --> 00:02:46,485

of magnitude more important.

58

00:02:46,505 --> 00:02:47,625

Well, that's all for now.

59

00:02:47,625 --> 00:02:48,665

If you have a question,

60

00:02:48,665 --> 00:02:51,800

shoot me an email or video to

p c at profit well dot com.

61

00:02:51,800 --> 00:02:54,760

And let's also thank Shirod

from Datorama for sparking this

62

00:02:54,760 --> 00:02:58,965

research by clicking the link below to

share and give him a good shout out.

63

00:02:58,965 --> 00:03:00,545

We'll see you next

64

00:03:00,965 --> 00:03:02,065

week.

65

00:03:02,485 --> 00:03:04,645

This week's episode is

brought to you by Later.

66

00:03:04,645 --> 00:03:09,379

Visually plan and schedule

Instagram posts. Later dot com.