Pricing for Bottom Line Growth

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: February 12th, 2018

Main Takeaways:

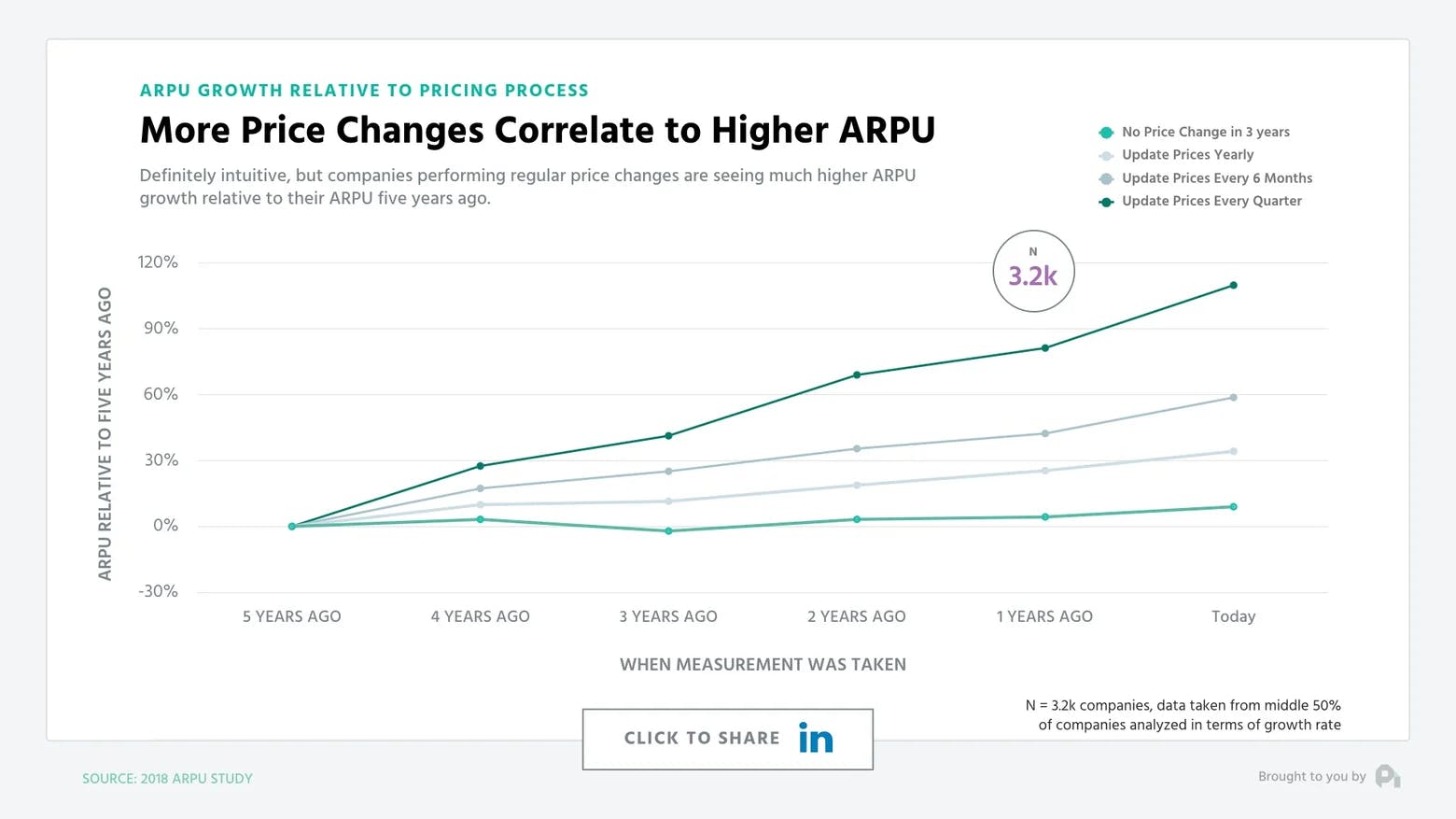

- Updating pricing quarterly can result in 2-4X higher ARPU.

- Monetization has nearly 8X the impact of acquisition.

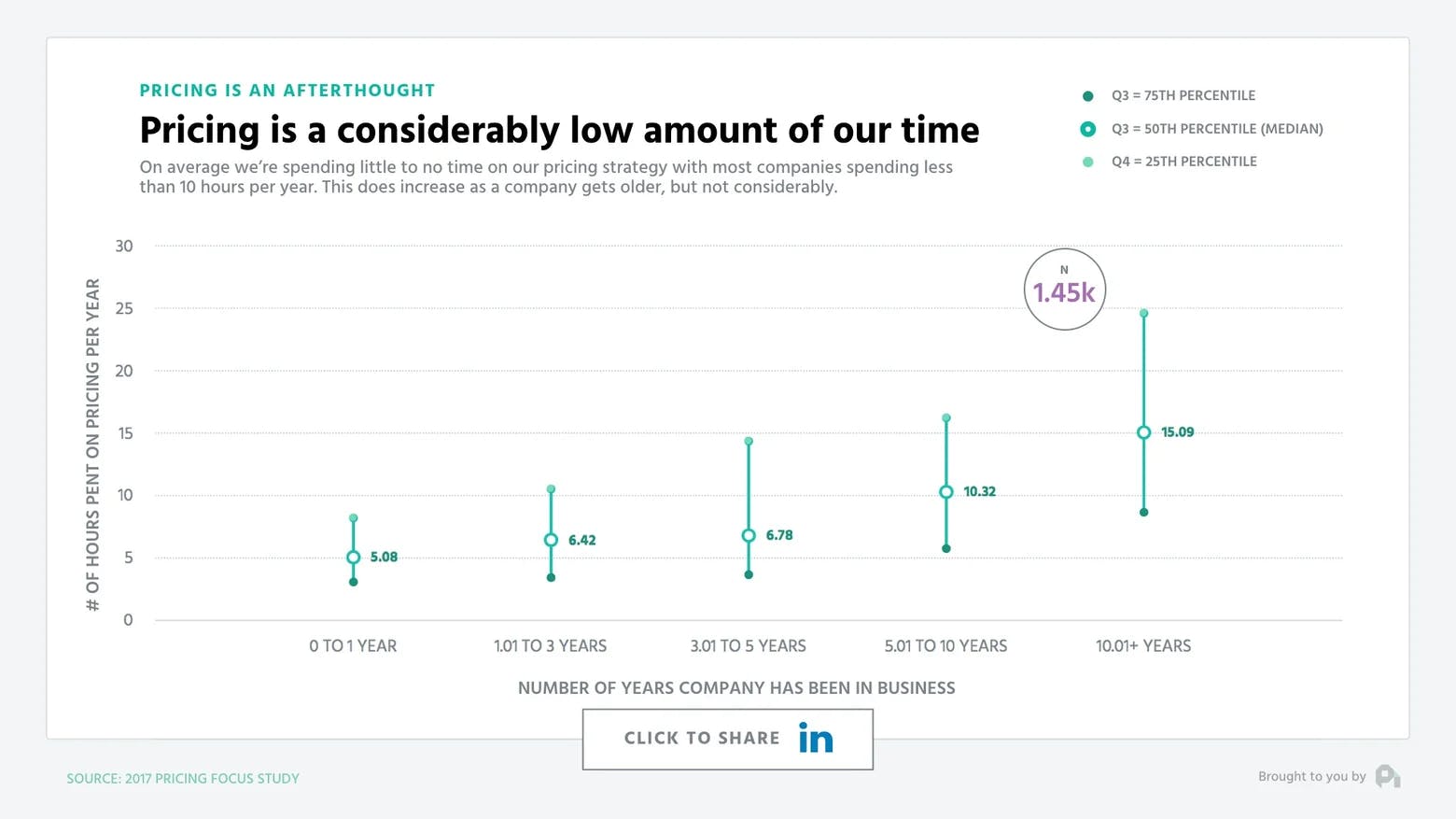

- Companies spend less than 10 hours per year on pricing.

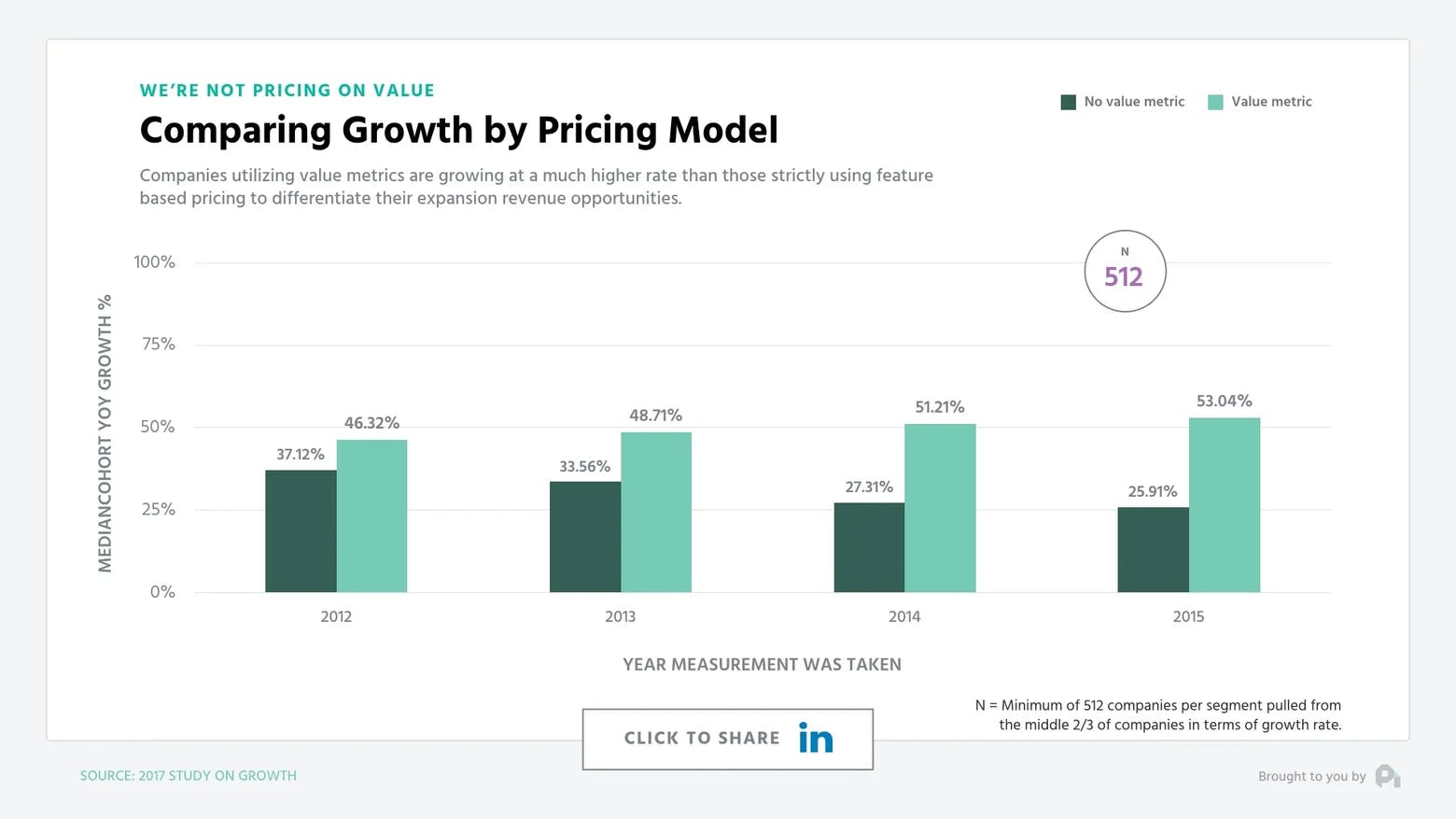

- Companies using a value metric grow 2X faster.

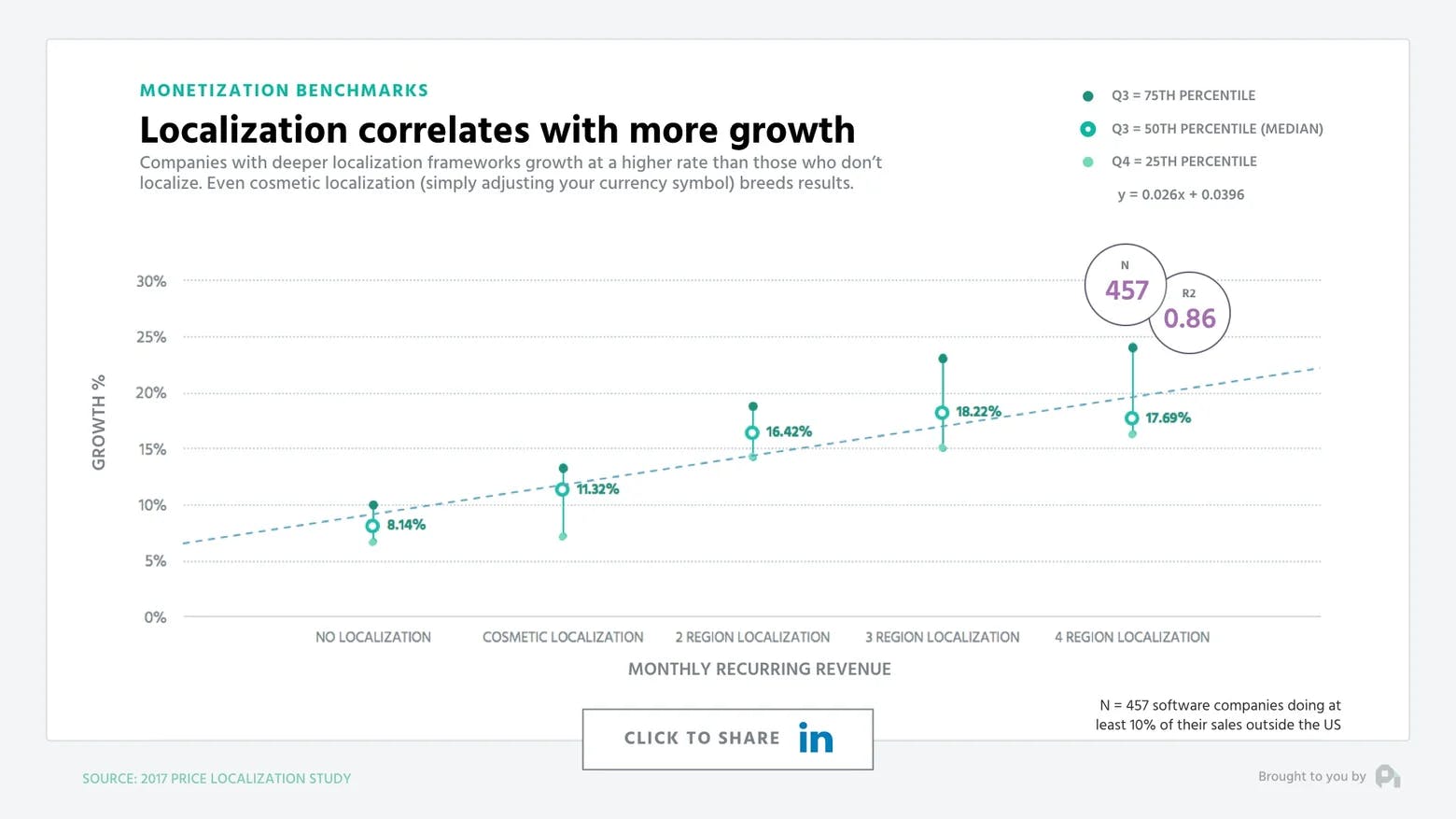

- Localizing pricing results in 25-50% higher growth rates.

Pricing remains one of the most important growth levers in business today, yet we still fail to spend the time and effort required to leverage monetization for growth.

On this episode of the ProfitWell Report, we set out to answer a question from Jeanne Hopkins, CMO at Ipswitch: How should you price to have the biggest impact on your bottom line?

Pricing is one of the most important growth levers in your business, so to answer Jeanne's questions, we're going to dig into the data from nearly five thousand companies and over one million transactions.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Pricing is a process of incremental gains

When comparing companies who regularly update their prices with those who don't, those companies updating their pricing at least once every 6 months are seeing nearly double the ARPU gain than those who upgrade their pricing only once per year or longer.

Your price is the exchange rate on the value you provide, so as your product and company improves, your price should be tracking alongside that improvement.

Impact of monetization on your bottom line

Similarly, when isolating and normalizing the microeconomic impact of improving your main growth levers, you'll find that Monetization has nearly 8x the impact of improving something like your acquisition.

Amount of time companies spend on pricing

Here's the rub though. We don't historically care about pricing. The average amount of time a company spends per year on pricing is less than 10 hours. There's a multitude of reasons why this is the case - pressures to grow at all cost, significant knowledge gaps on how to price, and countless others.

Yet, there are some easy things you can focus on to ease yourself into high growth price optimization based on the data.

Unlocking growth by using a value metric

First, make sure you're using a value metric. A value metric is what you charge for - per seat, per 100 visits, per gigabyte, etc. Data indicates that those companies utilizing a value metric are growing at nearly double the rate of those who are merely feature differentiated, and the divide is widening. Plus, this bakes expansion revenue into your pricing model to make retention easier, as well.

Leveraging price localization for growth

Further, another quick win is to utilize price localization and internationalization, which means both updating your pricing cosmetically to use the currency symbol of the buyer, as well as updating the relative price of the product for the market density. This is a relatively easy way to quickly gain 25-50% higher growth rates.

We could go on for days - and we did in our 150 page book we wrote on pricing.

That's all for this week. Want to learn more? Check out our recent episode: 10,000 Blogs Show Content Marketing CAC is on the Rise and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,060

You've got the questions,

and we have the data.

2

00:00:03,680 --> 00:00:04,240

Each week,

3

00:00:04,240 --> 00:00:07,440

we dive deep on benchmarks

of the subscription economy that

4

00:00:07,440 --> 00:00:09,575

you just can't

get anywhere else.

5

00:00:10,835 --> 00:00:13,415

This is the profit well report.

6

00:00:15,770 --> 00:00:17,690

Hey, Patrick. I had

a quick question.

7

00:00:17,690 --> 00:00:21,690

What do you think about pricing when

you're trying to impact the bottom line?

8

00:00:21,690 --> 00:00:25,075

What's the best way to take

a look at great question.

9

00:00:25,075 --> 00:00:26,035

As some of you know,

10

00:00:26,035 --> 00:00:30,035

we can literally talk for

hours and probably days about this.

11

00:00:30,035 --> 00:00:32,595

Pricing is one of the most

important growth levers in your

12

00:00:32,595 --> 00:00:34,390

business. To answer

Jean's questions,

13

00:00:34,390 --> 00:00:36,950

we're going to dig into

the data from nearly five thousand

14

00:00:36,950 --> 00:00:39,590

different subscription

companies in over one million

15

00:00:39,590 --> 00:00:40,845

different trans patients.

16

00:00:40,845 --> 00:00:43,645

Pricing is a process

of incremental gains.

17

00:00:43,645 --> 00:00:46,365

So when we compare

companies who regularly update their

18

00:00:46,365 --> 00:00:48,450

prices, those who don't,

19

00:00:48,450 --> 00:00:51,810

those companies updating their pricing

at least once every six

20

00:00:51,810 --> 00:00:55,075

months are seeing nearly double

the ARPU gain than those who

21

00:00:55,075 --> 00:00:58,195

upgrade their pricing only

once per year or longer.

22

00:00:58,195 --> 00:01:01,875

Your price is the exchange rate

on the value that you provide.

23

00:01:01,875 --> 00:01:04,130

So as your product

and company improves,

24

00:01:04,130 --> 00:01:07,190

your price should be

tracking alongside that improvement.

25

00:01:07,730 --> 00:01:10,790

Similarly, when isolating

and normalizing the microeconomic

26

00:01:11,655 --> 00:01:13,815

of improving your

main growth levers,

27

00:01:13,815 --> 00:01:17,015

you'll find that monetization

has nearly eight times the

28

00:01:17,015 --> 00:01:20,470

impact of improving something

like your acquisition and it's

29

00:01:20,470 --> 00:01:24,630

only accelerating as time goes

on. Here's the rub though. We

30

00:01:24,630 --> 00:01:28,235

don't historically care as

a community about pricing.

31

00:01:28,235 --> 00:01:30,795

The average amount of time

a company spends per year on

32

00:01:30,795 --> 00:01:34,155

pricing is less than

ten hours in total.

33

00:01:34,155 --> 00:01:36,690

There's a lot of reasons

for this including things like

34

00:01:36,690 --> 00:01:38,130

pressures to grow at all costs,

35

00:01:38,130 --> 00:01:40,930

significant knowledge gaps

on how to price and just a

36

00:01:40,930 --> 00:01:44,935

multitude of others. But some easy

thing you can focus on to

37

00:01:44,935 --> 00:01:48,215

ease yourself into high growth

price optimization are based on

38

00:01:48,215 --> 00:01:50,055

the following data. First,

39

00:01:50,055 --> 00:01:52,280

make sure you're

using a value metric.

40

00:01:52,280 --> 00:01:54,120

Value metric is

what you charge for.

41

00:01:54,120 --> 00:01:57,000

It could be per seat, per

hundred visits, per gigabyte.

42

00:01:57,000 --> 00:01:59,560

And the data indicates

that those companies utilizing a

43

00:01:59,560 --> 00:02:02,665

value metric are growing at

nearly double the rate as those

44

00:02:02,665 --> 00:02:04,585

who are merely feature

differentiated,

45

00:02:04,585 --> 00:02:08,745

and the divide is widening

over time. Plus, this base expansion

46

00:02:08,745 --> 00:02:12,010

revenue right into your revenue

model to help with your overall

47

00:02:12,010 --> 00:02:13,530

retention as well. Further,

48

00:02:13,530 --> 00:02:16,890

another really quick win

is to utilize price localization,

49

00:02:16,890 --> 00:02:19,815

which means both updating your

price cosmetically to use the

50

00:02:19,815 --> 00:02:21,335

currency symbol of the buyer,

51

00:02:21,335 --> 00:02:24,455

as well as updating the

relative price of the product

52

00:02:24,455 --> 00:02:27,415

for the market density that

you're facing in that region.

53

00:02:27,415 --> 00:02:31,160

This is a relatively easy way

to quick gain twenty five to

54

00:02:31,160 --> 00:02:34,520

fifty percent higher growth

rates depending on your overall

55

00:02:34,520 --> 00:02:35,880

acquisition strategy.

56

00:02:35,880 --> 00:02:39,165

We could literally go on

for days about this data.

57

00:02:39,165 --> 00:02:41,725

And we actually did in our

hundred and fifty page book we

58

00:02:41,725 --> 00:02:43,805

wrote on pricing that's

in the show notes,

59

00:02:43,805 --> 00:02:45,320

but that's all for now.

60

00:02:45,320 --> 00:02:48,760

If you want us to dig further into

this data or any other data out there,

61

00:02:48,760 --> 00:02:51,800

ship me an email or video to

p c at profitable dot com.

62

00:02:51,800 --> 00:02:54,785

And let's also be sure to

thank Jean for sparking this research

63

00:02:54,785 --> 00:02:57,505

by clicking the tweet in the

link below to give her a shout

64

00:02:57,505 --> 00:02:59,765

out. We'll have more

data for you next week.

65

00:03:02,700 --> 00:03:05,020

This episode of the profitable

report is brought to you by

66

00:03:05,020 --> 00:03:08,300

Wistia. Better video hosting

that's built for business,

67

00:03:08,300 --> 00:03:09,840

wistia dot com.