Which Tactics Will Increase Willingness to Pay?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: July 9th, 2019

To answer this question, we looked at the data from just over one million different subscription consumers and just under two thousand companies. Here’s what we found.

Your price is the exchange rate on the value you’re providing. A phenomenal aspect of the subscription and SaaS economy is that we now have the ability to build features and other value adding functionality into our products extremely quickly.

Yet, understanding what your customers or target customers value and making sure you’re using data to get to persona-pricing fit can take quite some time, as it’s an ongoing process of continual price optimization. We all know that, especially if you’ve read almost anything we’ve published.

To answer this question, we looked at the data from just over one million different subscription consumers and just under two thousand companies. Here’s what we found.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

First up, one of the highest impact drivers of willingness to pay is getting your brand and support in order. When measuring a customer’s affinity for a company’s brand and then cross referencing that data with the customer’s willingness to pay we found that those customers who perceived a company’s brand positively had between a 16% and 41% higher willingness to pay than the median. Those on the negative perception side had 15-33% lower willingness to pay. Based on this data, brand not only drives higher willingness to pay, but also can very much detract from your ability to sell to your customers at the level necessary to succeed.

Similarly on the support front, those customers who perceived a company’s support positively had between a 12% and 36% higher willingness to pay than the median. Those on the negative perception side had 8 to 16% lower willingness to pay. This indicates that bad support isn’t taking away from willingness to pay as much as good support is driving willingness to pay.

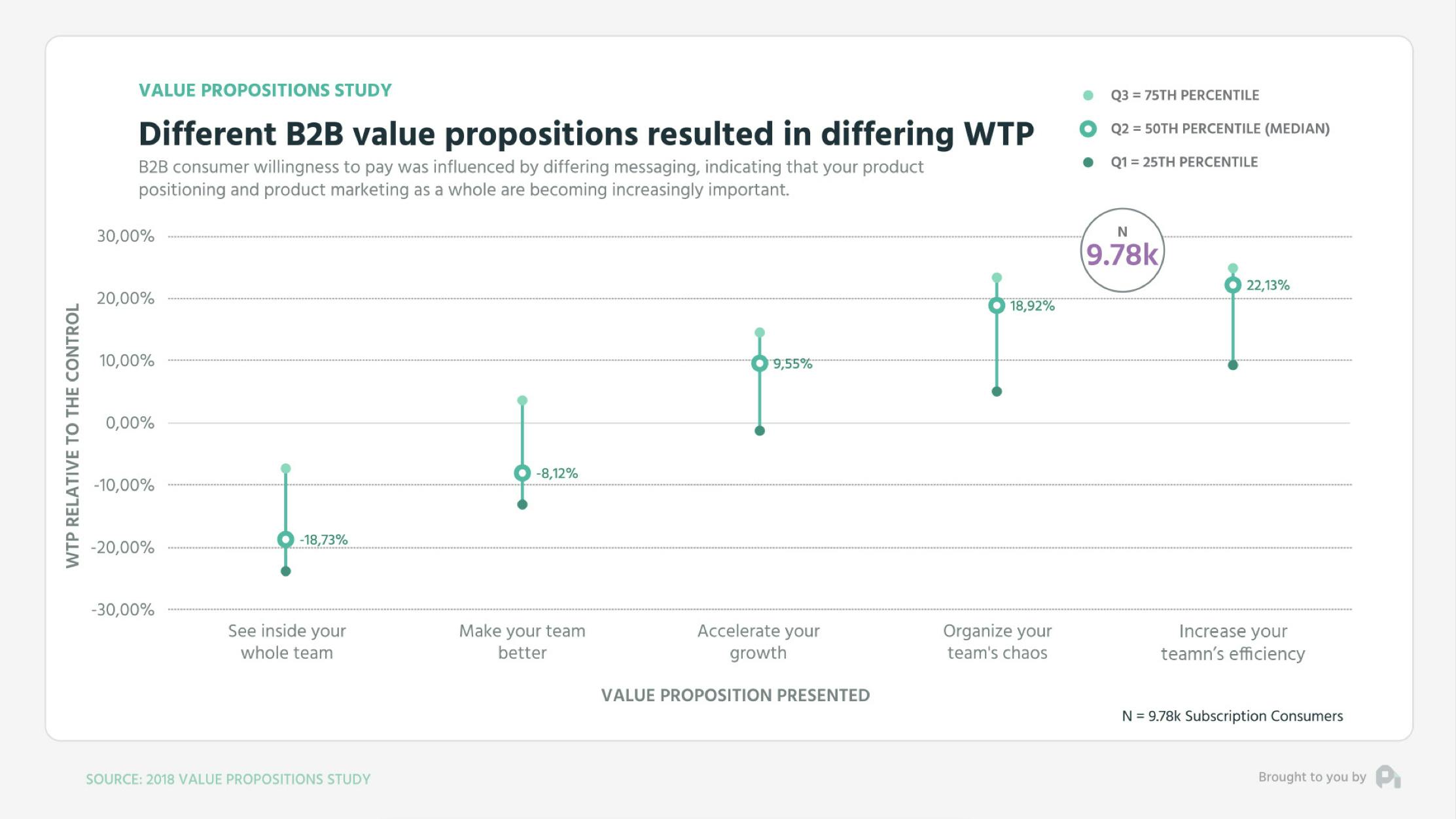

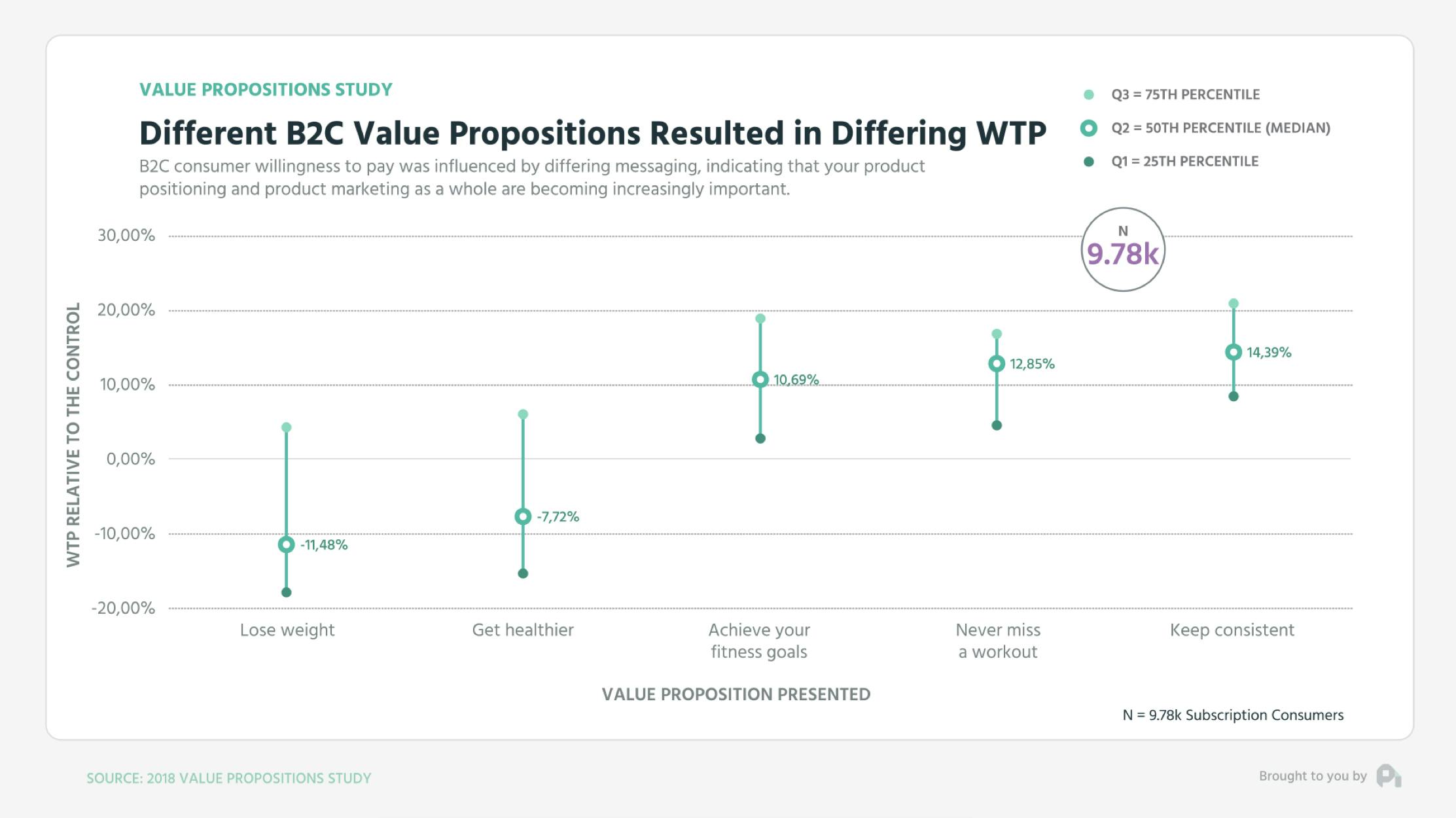

If you need a more tactical focus on willingness to pay, you should attack your value proposition. In a previous set of studies we looked at a fake B2B sales product and a fake B2C fitness product, we kept all copy and descriptions the same except we varied the value proposition. For both products we found that the value proposition caused a large variance in willingness to pay.

For the B2B product, certain value proposition were able to decrease willingness to pay by 20% while other were able to increase willingness to pay by 20%.

Our B2C example saw the same effect with a negative 10% to a plus 15% swing based on the value proposition. Essentially, how you position your product can greatly influence the value perception from a customer.

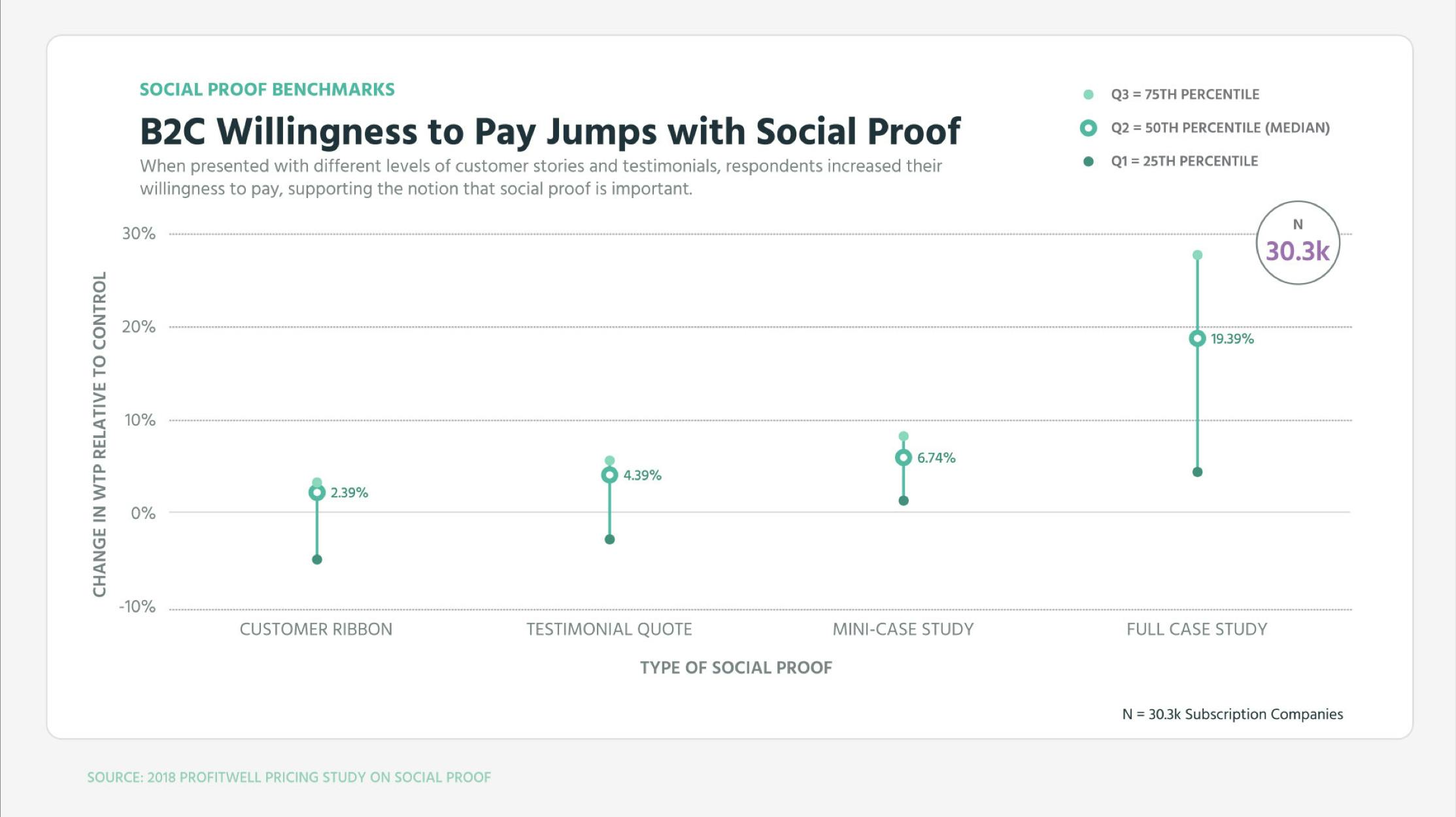

Finally, make sure you revisit the social proof you’ve implemented around your product and purchasing funnel. In both B2B and B2C displaying customer logos and providing testimonials increased willingness to pay considerably.

On the B2B side case studies increased willingness to pay by 10 to 15%. In B2C these case studies boosted willingness to pay from 5 to 20% with specific case studies having the biggest effect.

Remember with all of these tactics your aim is to make sure your prospect or customer understands the value they’re getting when it comes to your product. Since price is the exchange rate on the value you’re providing, these pieces of communication allow your prospect and customer to understand your value at a deep level, which ultimately allows you to get what you’re worth.

Want to learn more? Check out our recent episode on How to Increase Expansion Revenue Quickly and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,545 --> 00:00:09,185

Hi, Neil.

4

00:00:09,185 --> 00:00:11,905

This is Leo, head of business

intelligence at Chartbeat,

5

00:00:11,905 --> 00:00:15,585

and I wanted to ask you

which tactics will increase

6

00:00:15,585 --> 00:00:17,105

willingness to pay.

7

00:00:17,105 --> 00:00:17,900

Welcome

8

00:00:23,380 --> 00:00:25,915

phenomenal aspect of the

subscription and SaaS economy

9

00:00:25,915 --> 00:00:28,955

is that we now have the ability

to build features and other

10

00:00:28,955 --> 00:00:32,395

value adding functionality into

our products extremely quickly.

11

00:00:32,395 --> 00:00:35,570

Yet understanding what your

customers or target customers

12

00:00:35,570 --> 00:00:38,770

value and making sure you're

using data to get the persona

13

00:00:38,770 --> 00:00:42,315

pricing fit can take quite some

time as it's an ongoing process

14

00:00:42,315 --> 00:00:44,535

of continual price optimization.

15

00:00:44,715 --> 00:00:45,435

We all know that,

16

00:00:45,435 --> 00:00:48,615

especially if you've read

almost anything we've published.

17

00:00:48,680 --> 00:00:49,800

While you're doing this,

18

00:00:49,800 --> 00:00:53,320

what tactical things can you

do to increase willingness to pay?

19

00:00:53,320 --> 00:00:54,360

To answer this question,

20

00:00:54,360 --> 00:00:57,005

we looked at the data from

just over one million different

21

00:00:57,005 --> 00:01:00,605

subscription consumers and just

under two thousand companies.

22

00:01:00,605 --> 00:01:02,285

Here's what we found.

23

00:01:02,285 --> 00:01:05,390

First up, one of the highest impact

drivers of willingness to pay

24

00:01:05,390 --> 00:01:07,950

is getting your brand

and support in order.

25

00:01:07,950 --> 00:01:10,510

When measuring a customer's

affinity for a company's brand

26

00:01:10,510 --> 00:01:12,955

and then cross referencing

that data with the customer's

27

00:01:12,955 --> 00:01:14,395

willingness to pay,

28

00:01:14,395 --> 00:01:17,435

we found that those customers

who perceived a company's brand

29

00:01:17,435 --> 00:01:20,555

positively had between a

sixteen and forty one percent

30

00:01:20,555 --> 00:01:22,720

higher willingness to

pay than the median.

31

00:01:22,840 --> 00:01:25,320

Those on the negative

perception side had fifteen to

32

00:01:25,320 --> 00:01:27,880

thirty three percent

lower willingness to pay.

33

00:01:27,880 --> 00:01:29,080

Based on this data,

34

00:01:29,080 --> 00:01:31,595

brand not only drives a

higher willingness to pay,

35

00:01:31,595 --> 00:01:34,475

but can also very much detract

from your ability to sell to

36

00:01:34,475 --> 00:01:37,675

your customers at the

level necessary to succeed.

37

00:01:37,675 --> 00:01:39,480

Similarly, on the support front,

38

00:01:39,480 --> 00:01:42,920

those customers who perceived

a company's support positively

39

00:01:42,920 --> 00:01:46,040

had between a twelve and thirty

six percent higher willingness

40

00:01:46,040 --> 00:01:47,480

to pay than the median.

41

00:01:47,480 --> 00:01:50,725

Those on the negative side

had eight to sixteen percent lower

42

00:01:50,725 --> 00:01:51,925

willingness to pay.

43

00:01:51,925 --> 00:01:54,565

This indicates that bad

support isn't taking away from

44

00:01:54,565 --> 00:01:57,205

willingness to pay as much

as good support is driving

45

00:01:57,205 --> 00:01:58,700

willingness to to pay.

46

00:01:58,700 --> 00:02:01,260

If you need a more tactical

focus on willingness to pay,

47

00:02:01,260 --> 00:02:03,500

you should attack your

value proposition.

48

00:02:03,500 --> 00:02:04,700

In a previous set of studies,

49

00:02:04,700 --> 00:02:07,785

we looked at a fake b to b

sales product and a fake b to c

50

00:02:07,785 --> 00:02:08,985

fitness product,

51

00:02:08,985 --> 00:02:11,545

and we kept all of the copy

and descriptions the same,

52

00:02:11,545 --> 00:02:14,025

except we varied the

value proposition.

53

00:02:14,025 --> 00:02:14,905

For both products,

54

00:02:14,905 --> 00:02:17,110

we found that the value

proposition caused a large

55

00:02:17,110 --> 00:02:18,790

variance in willingness to pay.

56

00:02:18,790 --> 00:02:19,830

For the b to b product,

57

00:02:19,830 --> 00:02:22,470

certain value propositions were

able to decrease willingness to

58

00:02:22,470 --> 00:02:23,750

pay by twenty percent,

59

00:02:23,750 --> 00:02:27,655

while others were able to increase

willingness to pay by twenty percent.

60

00:02:27,675 --> 00:02:30,555

Our b to c examples have the

same effect with a negative ten

61

00:02:30,555 --> 00:02:33,755

to fifteen percent swing based

on that value proposition.

62

00:02:33,755 --> 00:02:37,260

Essentially, how you position your

product can greatly influence the value

63

00:02:37,260 --> 00:02:39,180

perception from a customer.

64

00:02:39,180 --> 00:02:42,380

Finally, make sure you revisit the

social proof you've implemented

65

00:02:42,380 --> 00:02:44,735

around your product

and purchasing funnel.

66

00:02:44,735 --> 00:02:46,735

In both b to b and b to c,

67

00:02:46,735 --> 00:02:49,935

displaying customer logos and

providing testimonials increase

68

00:02:49,935 --> 00:02:51,915

willingness to pay considerably.

69

00:02:51,970 --> 00:02:53,170

On the b to b side,

70

00:02:53,170 --> 00:02:56,990

case studies increased willingness

to pay by ten to fifteen percent.

71

00:02:57,010 --> 00:02:58,050

In b to c,

72

00:02:58,050 --> 00:03:01,090

these case studies boosted willingness

to pay from five to twenty percent,

73

00:03:01,090 --> 00:03:04,615

with specific case studies

having the biggest impact.

74

00:03:04,875 --> 00:03:06,635

Remember, with

all these tactics,

75

00:03:06,635 --> 00:03:09,035

your aim is to make sure

your prospect or customer

76

00:03:09,035 --> 00:03:12,810

understands the value they're getting

when it comes to your product.

77

00:03:12,810 --> 00:03:15,610

Since price is literally the

exchange rate on the value

78

00:03:15,610 --> 00:03:16,650

you're providing,

79

00:03:16,650 --> 00:03:20,545

these pieces of communication allow

your prospecting customer deep level,

80

00:03:20,545 --> 00:03:21,603

which ultimately allows you

to get what you're worth.

81

00:03:21,603 --> 00:03:22,191

Well, that's it for now.

82

00:03:22,191 --> 00:03:23,665

If you have any questions,

83

00:03:23,665 --> 00:03:26,685

send me an email or

video to neil at profilol

84

00:03:29,400 --> 00:03:29,800

dot com.

85

00:03:29,800 --> 00:03:32,760

And if you got value here or

any other week of the report,

86

00:03:32,760 --> 00:03:35,240

we appreciate you sharing

on Twitter and LinkedIn because

87

00:03:35,240 --> 00:03:37,320

that's how we know if we

should keep doing this.

88

00:03:37,320 --> 00:03:39,145

I'll see you next week.

89

00:03:41,105 --> 00:03:44,065

This week's episode is brought

to you by Chorus dot ai.

90

00:03:44,065 --> 00:03:47,380

Chorus dot ai is the market

leading conversation cloud

91

00:03:47,380 --> 00:03:49,140

built to securely

capture, store,

92

00:03:49,140 --> 00:03:52,420

and analyze your team's calls

and meetings so your team could

93

00:03:52,420 --> 00:03:53,940

focus on what really matters,

94

00:03:53,940 --> 00:03:55,786

your customers

and your business.

95

00:03:55,786 --> 00:03:57,891

Chorus dot a I.