How To: Burn the Churn

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: April 3rd, 2019

Churn is a fact of life in the subscription game, but the beauty of the subscription model is that for the first time in the history of business, the relationship is baked right into how we make money. If a customer no longer sees the value in what we’re providing, they can easily cancel when the term comes up for renewal.

Yet, just because churn is a fact of life, doesn’t mean we can’t optimize for tactics that reduce churn considerably. Lets get to the data we gathered.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

First up, the number one thing a lot of us need to attack yesterday is our failed payments.

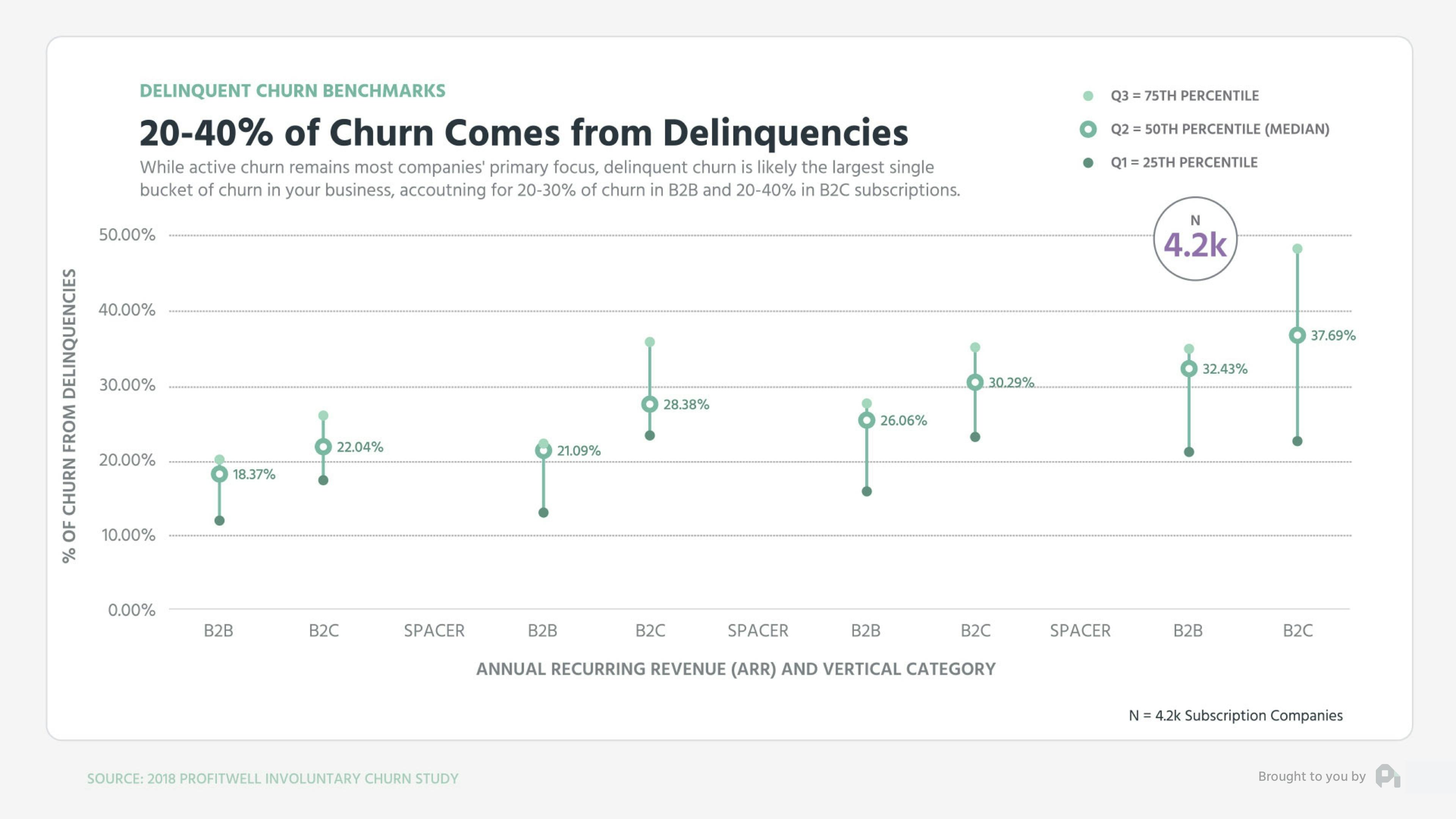

Credit cards are mechanical devices subject to failure and delinquencies. Failed credit cards account for 20 to 40% of your churn when looking at both B2B and B2C companies. Note that as you get larger, the proportion of your churn that comes from delinquencies actually increases.

This is likely because you’re getting a bit better at regular churn, but also because you don’t get economies of scale with more credit cards.

To make matters worse, we’re actually pretty bad at recovering these failed payments.

No matter the size of the company, we’re recovering only around 30% of those individuals that have a failed payment.

To put it another way - for every 10 people who have a payment failure, you’re only recovering 3, leaving 7 to basically be flushed down the tubes.

After fixing up your delinquencies, I’d start to optimize annual payments. As the data indicates, those companies with more annual customers see lower churn, sometimes 5x lower, mainly because these customers have one purchasing decision per year versus 12 per year.

This obviously won’t hack your way out of not having a great product, but it certainly will help if you already have the right foundation.

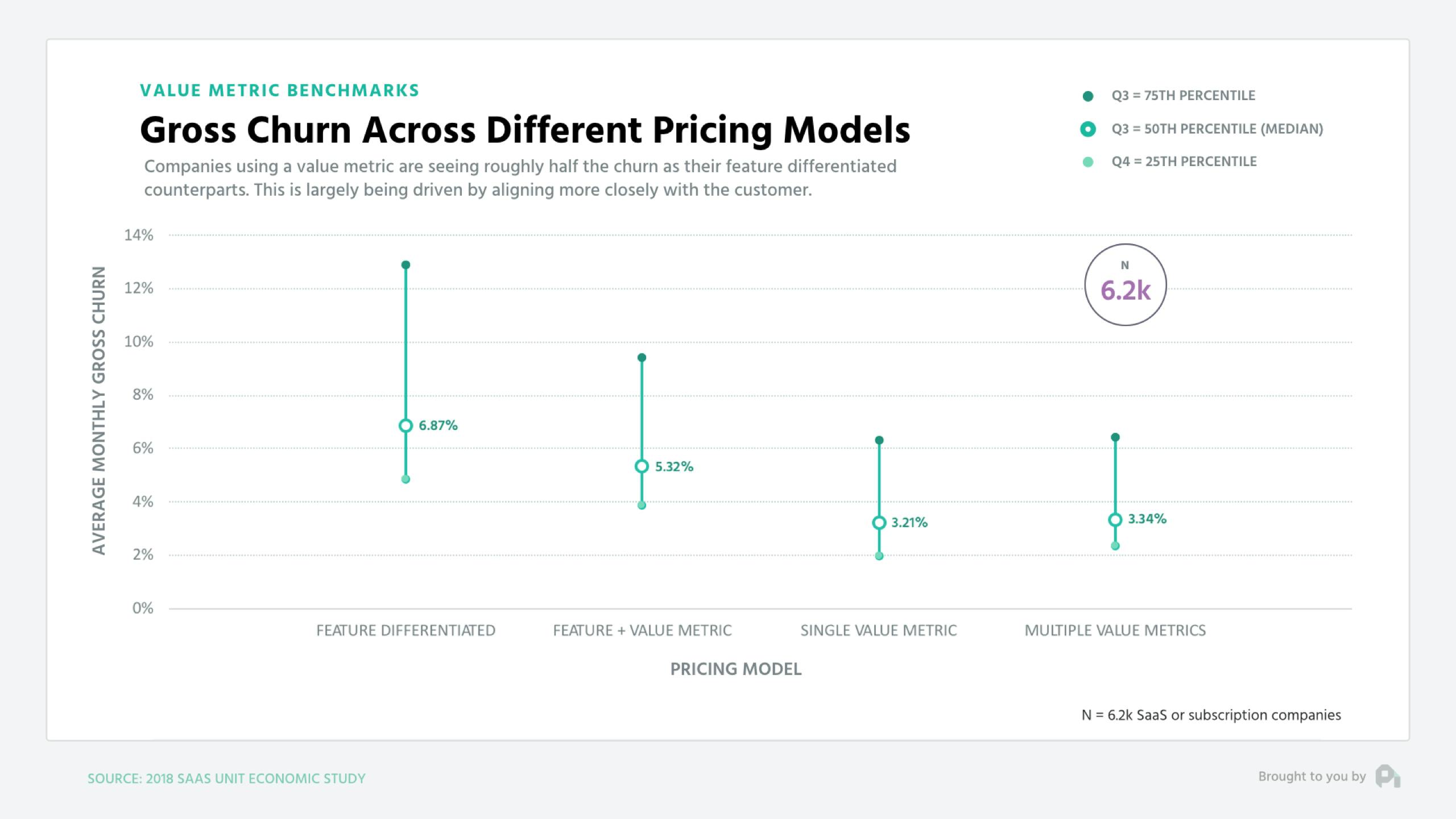

Next is a bit more difficult to implement, meaning it’s not a quick fix, but one of the highest impact shifts you can make is utilizing a value metric in your pricing strategy. A value metric is what you charge for - per user, per 100 visits, per 1,000 videos - could be a whole host of things.

Those companies utilizing a value metric tend to see half the gross churn of their feature differentiated counterparts.

This is mainly because with a value metric your users are paying for what they’re using and presumably if they’re using more, they’ll pay more. If they’re using less, they’ll pay less. Most importantly though, they’re paying for the value they’re receiving, so there isn’t a reason to churn.

Ultimately, your gross churn is an incredibly tricky problem to attack that no amount of tactics is going to solve. Yet, there are very mechanical pieces of churn and classic positioning strategies with value metrics and annuals that can help you stack the deck and compound the churn reduction value that your product team is already implementing.

Want to learn more? Check out our recent episode: Your Open Office Space May be Tainting Your Subscription Growth and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,520

You've got the questions,

and we have the data.

2

00:00:03,520 --> 00:00:06,620

This is the ProfitWell Report.

3

00:00:08,655 --> 00:00:12,575

This is Nathan Beckert, CEO of

founder suite dot com, and I

4

00:00:12,575 --> 00:00:15,310

wanna know what would

you do to combat churn.

5

00:00:15,310 --> 00:00:18,590

Welcome back, everyone. Neil

here for the profitable report.

6

00:00:18,590 --> 00:00:21,390

Churn is a fact of life

in the subscription game.

7

00:00:21,390 --> 00:00:23,870

But the beauty of the

subscription model is that for

8

00:00:23,870 --> 00:00:26,215

the first time in the

history of business,

9

00:00:26,215 --> 00:00:29,655

the relationship is baked

right into how we make money.

10

00:00:29,655 --> 00:00:32,860

If a customer no longer sees the

value of what we're providing,

11

00:00:41,685 --> 00:00:43,425

reduce churn considerably.

12

00:00:43,525 --> 00:00:45,205

So to answer this question,

13

00:00:45,205 --> 00:00:48,085

we're gonna go deep into the

data by studying just over

14

00:00:48,085 --> 00:00:50,430

eight thousand

subscription companies.

15

00:00:50,430 --> 00:00:54,190

First up, the number one thing a lot

of us need to attack yesterday is

16

00:00:54,190 --> 00:00:55,770

our failed payments.

17

00:00:55,870 --> 00:01:00,465

Credit cards are mechanical devices

subject to failure and delinquencies.

18

00:01:00,465 --> 00:01:03,585

Failed credit cards account for

twenty to forty percent of your

19

00:01:03,585 --> 00:01:07,645

churn when looking at both

b to b and b to c companies.

20

00:01:07,860 --> 00:01:09,380

Note that as you get larger,

21

00:01:09,380 --> 00:01:12,100

the proportion of your churn

that comes from delinquencies

22

00:01:12,100 --> 00:01:13,680

actually increases.

23

00:01:13,860 --> 00:01:16,905

This is likely because you're getting

a bit better at regular churn,

24

00:01:16,905 --> 00:01:20,825

but also because you don't get economies

of scale with more credit cards.

25

00:01:20,825 --> 00:01:21,945

To make matters worse,

26

00:01:21,945 --> 00:01:25,590

we're actually pretty bad at

recovering these failed payments.

27

00:01:25,590 --> 00:01:27,430

No matter the size

of the company,

28

00:01:27,430 --> 00:01:29,910

we're recovering only around

thirty percent of those

29

00:01:29,910 --> 00:01:32,310

individuals that have

had a failed payment.

30

00:01:32,310 --> 00:01:33,510

To put it another way,

31

00:01:33,510 --> 00:01:35,765

for every ten people who've

had a failed payment,

32

00:01:35,765 --> 00:01:37,845

you're only recovering three,

33

00:01:37,845 --> 00:01:41,265

leaving seven to be basically

flushed down the twos.

34

00:01:41,365 --> 00:01:43,050

After fixing up

your delinquencies,

35

00:01:43,050 --> 00:01:45,850

I'd start to optimize

for annual payments.

36

00:01:45,850 --> 00:01:47,290

As the data indicates,

37

00:01:47,290 --> 00:01:50,010

those companies with more

annual customers see lower

38

00:01:50,010 --> 00:01:52,975

churn, sometimes five

times lower churn,

39

00:01:52,975 --> 00:01:56,095

mainly because these customers

have one purchasing decision

40

00:01:56,095 --> 00:01:58,415

per year versus twelve per year.

41

00:01:58,415 --> 00:02:01,440

This obviously won't hack your way

out of not having a good product,

42

00:02:01,440 --> 00:02:05,180

but it'll certainly help if you

already have the right foundation.

43

00:02:05,360 --> 00:02:07,680

Next, it's a bit more

difficult to implement,

44

00:02:07,680 --> 00:02:09,485

meaning it's not a quick fix,

45

00:02:09,485 --> 00:02:12,765

but one of the highest

impact shifts you can make is

46

00:02:12,765 --> 00:02:15,965

utilizing a value metric

in your pricing strategy.

47

00:02:15,965 --> 00:02:18,170

A value metric is

what you charge for.

48

00:02:18,170 --> 00:02:21,450

Per user, per thousand visits,

per one hundred videos,

49

00:02:21,450 --> 00:02:22,810

could be a whole host of things.

50

00:02:22,810 --> 00:02:23,530

Right?

51

00:02:23,530 --> 00:02:26,890

Those companies utilizing a

value metric tend to see half

52

00:02:26,890 --> 00:02:30,075

the gross churn of their feature

differentiated counterparts.

53

00:02:30,075 --> 00:02:32,315

This is mainly because

with the value metric,

54

00:02:32,315 --> 00:02:34,395

your users are paying

for what they're using.

55

00:02:34,395 --> 00:02:37,210

And, presumably, if they're

using more, they'll pay more.

56

00:02:37,210 --> 00:02:39,450

If they're using less,

they'll pay less.

57

00:02:39,450 --> 00:02:40,570

Most importantly, though,

58

00:02:40,570 --> 00:02:42,810

they're paying for the

value they're receiving,

59

00:02:42,810 --> 00:02:45,245

so there isn't a

reason to churn at all.

60

00:02:45,245 --> 00:02:49,485

Ultimately, your gross churn is

incredibly tricky problem to attack that

61

00:02:49,485 --> 00:02:51,645

no amount of tactics

is gonna solve.

62

00:02:51,645 --> 00:02:54,390

Yet, they're very mechanical

pieces of churn and classic

63

00:02:54,390 --> 00:02:57,430

positioning strategies with

value metrics and annuals that

64

00:02:57,430 --> 00:03:00,230

can help stack the deck and

compound the churn reduction

65

00:03:00,230 --> 00:03:03,095

value that your product team

has already implemented.

66

00:03:03,095 --> 00:03:04,695

Well, that's all for now.

67

00:03:04,695 --> 00:03:05,575

If you have a question,

68

00:03:05,575 --> 00:03:08,375

send me an email or video to

neil at profitable dot com.

69

00:03:08,375 --> 00:03:11,900

And as always, if you got value

out of this report or any others,

70

00:03:11,900 --> 00:03:14,940

we'd appreciate any shares on

Twitter and LinkedIn because

71

00:03:14,940 --> 00:03:16,865

that's how we know

to keep doing this.

72

00:03:16,865 --> 00:03:20,845

I will see you next week.

73

00:03:20,945 --> 00:03:23,665

This week's episode is

brought to you by Mixmax,

74

00:03:23,665 --> 00:03:27,073

powerful analytics automation

and enhancements for your

75

00:03:27,073 --> 00:03:28,733

outbound communications.

76

00:03:28,833 --> 00:03:30,973

Mixmax dot com.