By intelligently identifying customer card failure reasons and adjusting customer plans, Retain can:

- Prevent more of your customers from churning

- Help more of your customers convert from free trials onto paid plans

Here's how it works

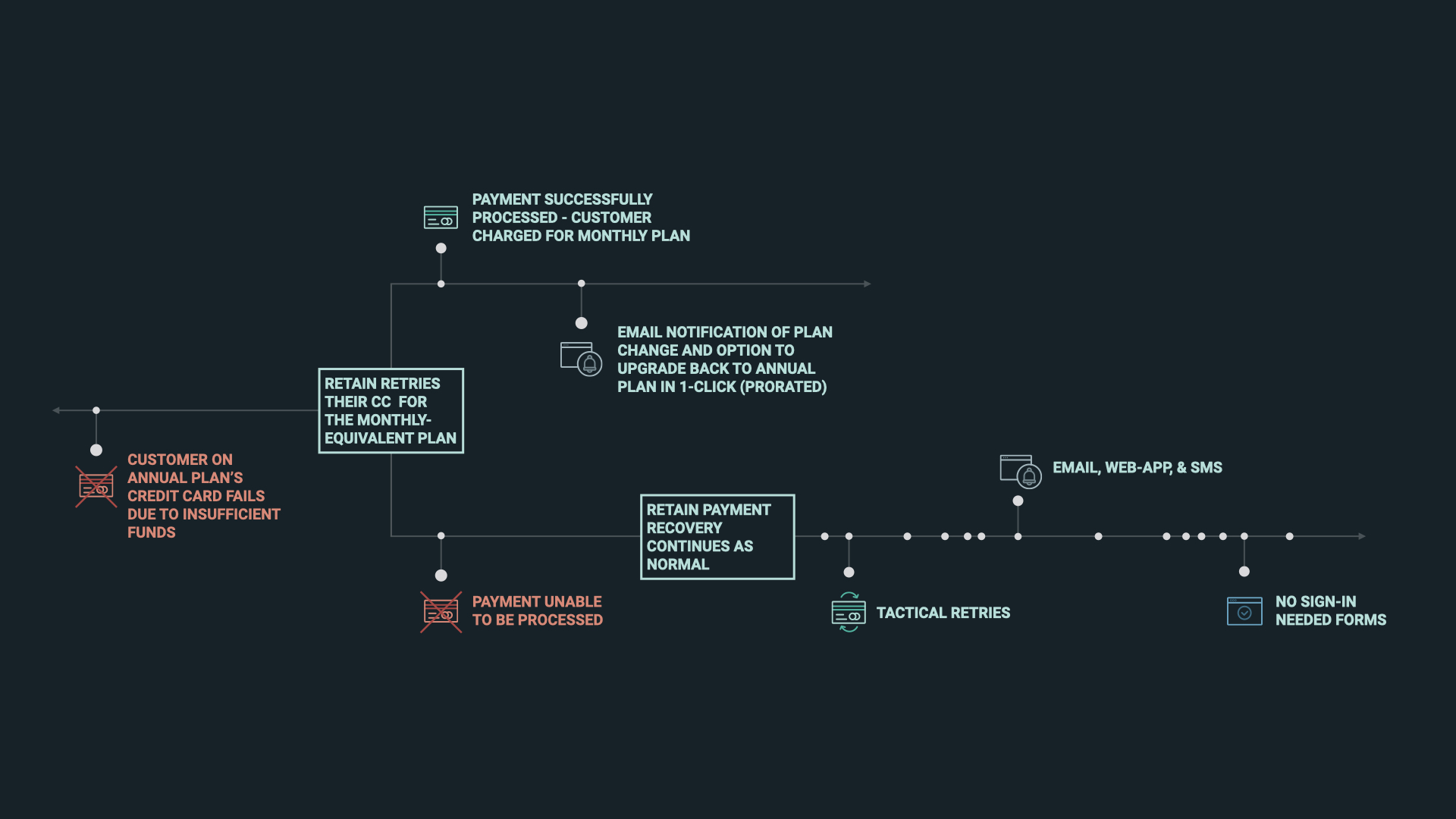

Let's say a customer on an annual plan's card fails due to insufficient funds and we can’t bill them for the full (yearly) amount - we'll try billing them for the monthly equivalent of their plan.

What happens if it goes through?

If we succeed, we now charge them for the month, and we send them an email with a link where they can take themselves back onto their annual plan while paying just a prorated amount in 1-click:

Hey {{name}},

We just tried to process your payment for your annual subscription of $X, but unfortunately it didn't go through.

We don't want you to miss out on a single day of your X subscription, so instead of charging you for the full year upfront, we charged you just for this month.

Click here to get 2 free months by going back on an annual plan.

—

{{signature}}

For example, if the annual plan they were on was $100/year, and the monthly equivalent is $10/month, then we’ll charge them $90 and put them back on an annual plan.

What happens if it doesn't go through?

If we fail, nothing else happens. Retain's Payment Recovery process continues as normal:

To use our Rollback Recovery feature, you need to have Term Optimization installed.

Full overview