Revenue recovery is very important in the subscription business; Disregard it, and you’ll end up with high churn rates and lose business fast.

If it ain’t broke, don’t fix it—and try not to replace it either.

For subscription businesses, churn rate is everything. They want their subscribers to sign up and stay signed up, but customers sometimes need a little extra encouragement if they’re going to stick with a subscription. This encouragement is part of churn management, a process that businesses implement in the name of revenue recovery.

What is revenue recovery?

Revenue recovery is the combination of strategies that subscription businesses use in order to keep customers subscribed to their services. It is meant to combat customer attrition and increase retention.

In order to achieve revenue recovery through churn management, businesses must first identify which customers have recoverable revenue, then decide on a churn management method that works for them. Keep reading to learn about common revenue recovery methods and tips on how to implement them at your business. Throughout this article, I’ll unpack common revenue recovery methods and tips on how to implement them in your business.

Which customers have recoverable revenue?

Let’s face it: you’re not going to be able to recover revenue from every single customer. Once you accept that, you can move on to identifying which customers you have the best chance of retaining. Customers typically fall into one of three categories:

1. Involuntary churned customers

Involuntary churn is usually due to a credit card being expired or lacking funds. Some of these customers don’t have money to be spending on your product and service anyway, so they aren’t worth pursuing in revenue recovery. However, others might just need to update their payment information. So, be sure you’re up to date on your customers’ information.

2. Customers close to churning

Customers who show early signs of churn are recoverable with ProfitWell Retain. This type of customer might be on the fence about buying for one reason or another. Maybe your product or service is not living up to their expectations. Maybe they’ve been thinking of switching to one of your competitors. These customers might just need a little bit of convincing.

3. Customers with contracts close to renewal dates

Customers with contracts that renew soon always have the possibility of leaving instead of staying on board. Make sure you stay on top of your customers’ renewal schedules so you can give them an extra push at the end to ensure they don’t churn.

The traditional way to find recoverable revenue

Preventing churn and encouraging revenue retention requires more than just thoughts and prayers. Traditionally, companies use the following process to reduce their churn rates.

1. Find patterns in churn

The first step in reducing churn is observation. Take a good, hard look at your customers’ behavior and find different variables that may be contributing to churn. This could be a number of things from onboarding completion to usage amount.

2. Consistently check for data patterns

Now that you have identified some signs indicating a person is about to churn, be alert to when those signs show up. Check in on your data each week to see if any warning signs of customer churn have emerged and make sure it’s backed up to provide your team visibility.

3. Look for expiring credit cards

A customer with an expired credit card on their account cannot pay you. When you aren’t looking for churn variables, you can look for credit cards that are about to expire so you can save the customer the trouble of having their card declined. In the process, sell them on your product or service. In the end, you’ll have a renewed customer with a valid credit card.

4. When potential churn is found, start dunning

You’ve looked at the data, crunched the numbers, and found customers who could potentially churn—now it’s time to stop them. Send dunning and post-dunning emails in order to keep customers activated. A drip campaign could be useful in this stage in the process.

5. Start to reach out personally

If your email campaigns and other churn prevention techniques haven’t worked, get personal. It doesn’t hurt to send out a personalized email or schedule a video meeting to see why a customer’s usage time is down. In addition to potentially retaining one more customer, you could gain insight beyond what you’ve gleaned from your data.

6. Recover the customer

If you’ve followed these churn management steps correctly, you should be able to recover the customer and their revenue. Do this for as many customers as possible and you’ll be well on your way to revenue recovery for your business.

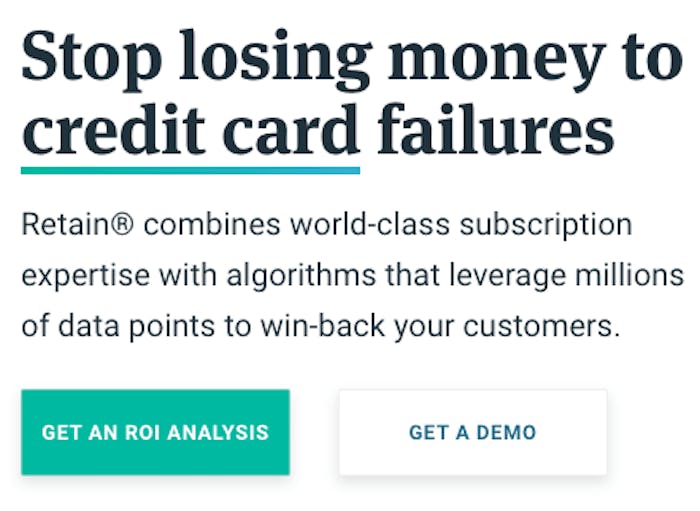

The modern way to recover revenue: ProfitWell Retain

The above steps to reduce churn rate are proven to be effective, but are they efficient? Not really. Between identifying signs of churn, constantly checking in on your data, and setting up email campaigns, churn management can become an overwhelming and expensive process.

ProfitWell Retain, churn reduction software, is a time and cost-saving solution. It’s powered by algorithms that enable you to use customer data more productively than you could by using traditional revenue recovery methods.

The software eliminates the need to manually identify churn patterns, and can automatically scan data and alert you when it finds them. Plus, it integrates seamlessly into your billing system and is PCI compliant, so the customer’s experience stays the same—you just get more insight from their data.

5 tips for revenue recovery

Now that you know how to use churn management at your business, you’re probably itching to jump in and begin the revenue recovery process. Before you start; however, check out these tips that could save you some grief (and resources).

1. Look back at customer support chats

Look back at customer support chats and see if a customer brought up a specific problem that they couldn’t get past. In your campaign to retain their business, point out how you can help solve their problem.

2. Follow up earlier rather than later

Follow up early with customers who seem like they are about to churn. A month out from a renewal date is far better than three days out, plus reaching out well in advance lowers the likelihood of a customer switching to one of your competitors.

3. Know when to stop

Don’t keep dunning over and over again for months, that will definitely push a customer away. After you’ve done everything you can to attempt to convince a customer to stay, spending any more time trying to convince them is a waste. Just move on to the next one.

4. Be aware of delinquent accounts

We discussed checking in with customers whose credit cards are expiring soon, but as you probably already know, expiration isn’t the only reason that cards get declined. If you find a customer with a delinquent account, start a dunning campaign to encourage them to update their method of payment.

5. Know your demographics

You might find that some of your customer demographics are more ripe for revenue recovery than others. Or perhaps you just need to use different methods for different types of customers. Make sure you are using the right tactics with the right customers.

Feel the churn?

A reduction in churn is a great sign for a subscription-based business, so the revenue recovery process is crucial. Using the latest churn-reduction methods and software is paramount to subscription success.