We're sure most of you have suffered from it at some point.

An unexpected charge shows up on your credit card without warning. An automatic subscription renewal charge for a subscription you’re no longer using or that you don't even remember signing up for.

Even worse, you go to cancel your subscription, only to discover it's nearly impossible.

For subscription companies, it’s tempting to resort to questionable subscription renewal tactics like these to keep customers around for as long as possible, since churn can be so disastrous to your bottom line. And while these tactics might technically be legal, they sure aren’t ethical. Yes, they might kick the can down the road a little longer, but they only delay the inevitable while giving customers an awful experience in the meantime.

Of course, you know better. A bulletproof subscription renewal and revenue recovery process is something every SaaS founder should strive for—the right renewal process can boost your bottom line and ensure that customers stick with your company for the long haul.

Let’s take a look at why customers fail to renew their subscriptions, what different methods you can choose for subscription renewals, and what ethical tactics can increase your subscription renewal rate.

What is a subscription renewal?

The key feature separating subscription businesses from their more standard counterparts is the recurring nature of payments. In the subscription business model, customers pay a recurring amount in exchange for access to a product or service. For example, SaaS customers pay a monthly or annual subscription fee for access to software.

Subscription renewal is the process each customer goes through when continuing their subscription into the next billing cycle.

Subscription renewals happen through the following steps:

- Generating an order record within the subscription billing platform to track the renewal

- Emailing customers to inform them of the pending charge

- Charging a customer’s credit card

- Shipping the product to customers (for ecommerce subscriptions)

- Marking the order record as complete within the subscription billing platform

Each subscriber goes through this renewal process monthly, annually, or sometimes longer, depending on the chosen contract length.

Automatic versus manual subscription renewals

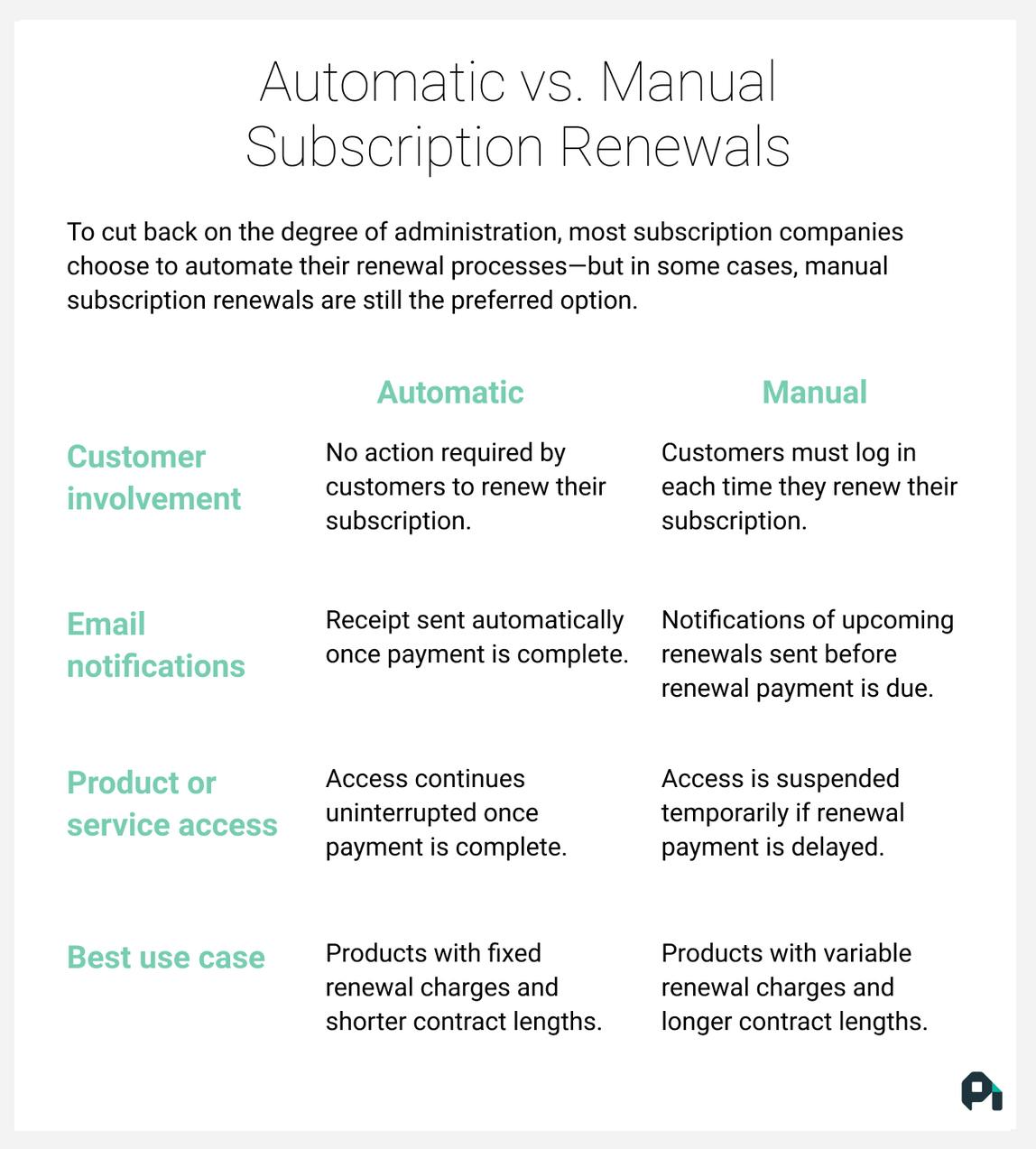

Manual renewal processes quickly add up to a significant time investment for subscription companies. To cut back on the degree of administration, most subscription companies choose to automate their renewal processes, but in some cases, manual subscription renewals are still the preferred option.

Automatic subscription renewals

Automatic subscription renewals make life easier for both you and your customers.

Instead of manually paying an invoice each month, customers store a credit card or other payment method with the company and agree to have that payment method charged for the recurring amount. Customers only need to log in to update their payment information or cancel their subscription. When each customer’s contract expires, their card is automatically charged, and access to the product or service continues uninterrupted.

Automatic renewals prevent forgotten payments, which helps improve retention and combat customer churn. Knowing exactly when customers will pay also simplifies revenue predictions for your company. Many companies will pass on these benefits of automatic renewals to customers, giving a small discount to those who sign up for auto-pay.

The vast majority of subscription companies choose to process renewals automatically, including most SaaS companies, cable TV or internet service providers, cell phone companies, and streaming music or video subscriptions.

As with everything business-related, there are still a few downsides to auto-renewals. If customers forget about their subscription, they might be charged unexpectedly, leading to disappointed customers, angry support calls, and refunds. Automatic payments also work best when your customers are paying a flat monthly fee; variable charges each month also lead to upset customers.

Manual subscription renewals

Instead of charging customers automatically at the end of each subscription billing cycle, some companies choose to process renewals and payments manually. When each customer’s contract expires, their subscription is suspended temporarily, and a new order is sent to the customer. Customers must then log into the subscription management platform and agree to the charge before the renewal is completed and access to the service is restored.

Manual subscription renewals work best in a few different cases:

1. When the subscription fee varies from month to month

2. When longer contracts make it more likely for customers to forget about pending charges

3. When sales teams apply variable discounts to customer accounts

Your monthly utility bill is a great example of manual subscription renewals. You definitely don’t want your electricity and gas cut off for forgetting to pay, but you usually want to process payment manually each month (or at least review your bill) to make sure you’re not being charged large amounts unexpectedly.

Why customers fail to renew their subscriptions

Involuntary churn tends to sneak up on your SaaS company without warning. In an ideal world, every customer would renew their subscription when it’s due. But like any subscription service, customers frequently fail to renew their subscriptions for all kinds of reasons. Here are four:

1. Unaware membership ended

Often customers simply forget their subscription is up for renewal. This is less of an issue for customers on automatic subscription renewals, since there’s no need to remember to complete payment before a subscription expires. But for longer contracts, which customers often renew manually, it can quickly become a big problem.

2. Low usage of the product or service

Customers who aren’t achieving their desired outcome with your product are more likely to stop using it entirely. For manual renewals, they’ll often let their subscription lapse—but for automatic renewals, they could end up becoming a “zombie” customer who continues paying for a product without using it (which we’ll look at in more detail shortly).

3. Hard declines due to stolen credit card information

Credit card and identity theft continue to rise. In 2018 alone, 1,244 data breaches led to over 446 million records exposed. Each time a card is reported stolen, customers need to update their billing information across a wide range of recurring subscriptions, making it easy to forget some in the shuffle. False-positives are also a frequent occurrence, because credit card issuers become more vigilant about flagging potentially fraudulent transactions before they become a big problem for their own customers.

4. Expired payment information

Antifraud laws mandate that credit cards expire every three years, meaning around one in three customers needs to update payment information within the next year by providing the new expiration date. It’s easy for customers to forget to update all their services and subscriptions each time their card is updated.

On the surface, none of these problems feel all that difficult to deal with. The real issues begin as you scale—once you have a large subscriber base, even small problems like expired credit cards can create a huge involuntary churn headache.

Deceptive subscription renewal tactics to avoid

In an effort to curb churn and juice their numbers, some companies cross an ethical line, resorting to questionable churn reduction tactics, like renewing customers’ subscriptions without properly informing them, or making it difficult for customers to cancel their accounts. These deceptive practices aren’t a great way to build a sustainable and profitable SaaS company.

Sneaky credit card charges

Most companies choose to send an email receipt each time the subscription renews. Others, however, choose to renew on the sly without sending customers a reminder that they’re being charged. The worst offenders start their service as a free trial before automatically “renewing” and charging customers for their paid service. While they must legally disclose this when a customer signs up, it’s often easy to miss this warning and assume a service is free until unexpected charges show up.

Eliminating your cancellation button

Removing the cancellation option from your app might kick the churn can down the road for a little longer, but it will come back to bite your business. You’re essentially holding your customer hostage, which violates the original intent of your auto-renew agreement. Instead, offer a streamlined cancellation process that collects info on why they're leaving and tries to win them back if possible.

Continuing to charge inactive customers

Every SaaS company eventually ends up with some number of “zombie” accounts—customers who remain subscribed but aren’t getting value from your product. Zombie customers technically haven't canceled their accounts and presumably are still getting receipts that they’re paying for your service—but they aren't using your product.

The problem? These customers might account for millions in annual recurring revenue, making it a difficult choice to proactively cancel their service. It’s a difficult problem to fix, since the ultimate solution for businesses with a large number of inactive users is to charge based on volume—just as Slack charges for active users, or Clearbit charges for records enriched—instead of charging by account access.

While these strategies might reduce churn in the short term—and they might technically be legal—they create an awful experience for customers and potentially lead to disastrous PR for your company—not to mention the ongoing churn problem you’ll still need to address eventually.

5 ethical tactics for increasing your subscription renewal rate

With the right tactics, though, involuntary churn is almost entirely preventable, and it’s one of the quickest and easiest ways to increase customer lifetime value (LTV). Here are a few tips on how you can make sure customers renew their subscriptions, without resorting to questionable tactics.

1. Avoid involuntary churn and recapture lost revenue

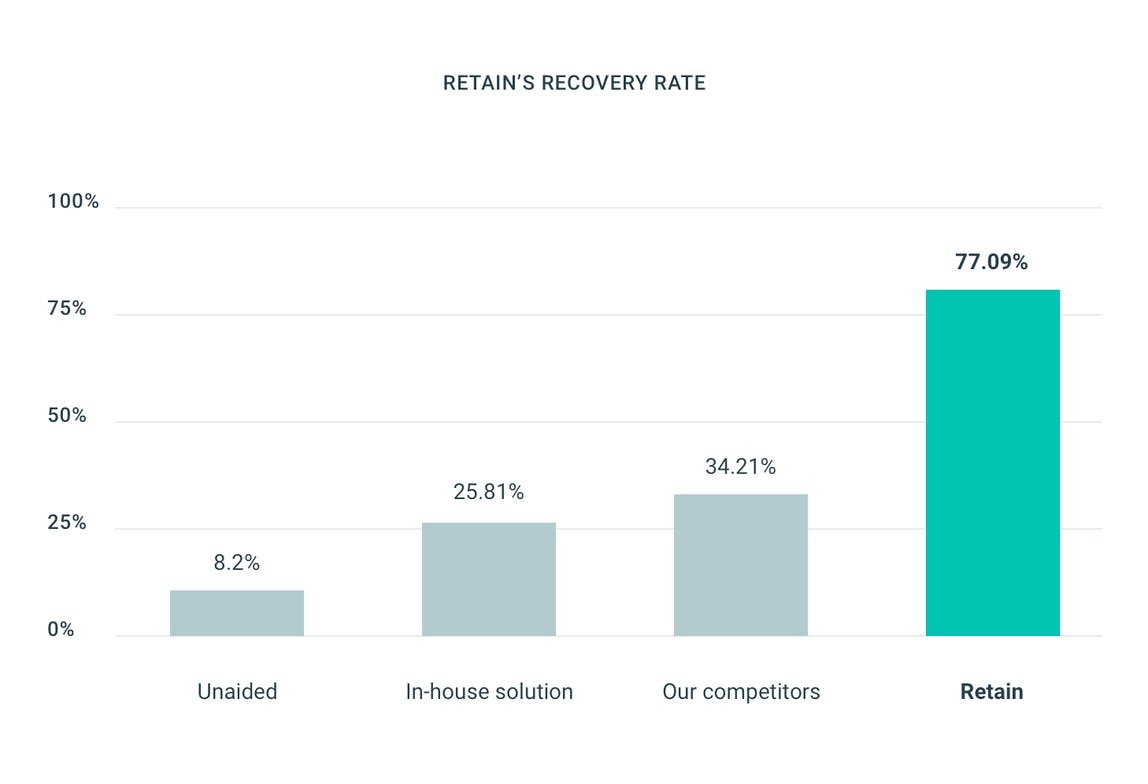

As your subscriber base grows, credit card delinquencies account for a larger portion of your churn—sometimes up to 40% of overall churn. Fortunately, most of this lost revenue is easy to recapture.

Early-stage companies can manually reattempt failed credit card charges or send payment request emails to customers—even a basic email campaign can save up to 30% of involuntary (delinquent) churn. As you grow, though, you’ll want to invest in a solution to capture these failed payments automatically. An effective automated dunning process can save you potential customers, recover lost revenue, and drive down delinquent churn.

Dunning is the process of asking customers for money they owe the company. This usually happens after a credit card has been declined, a subscription service has encountered an error when charging the customer, or the customer has insufficient funds in their account.

Tools like Paddle Retain can help you recover nearly 80% of lost revenue automatically.

2. Be proactive, be empathetic

The reason dunning gets such a bad rap stems from the way many companies manage the process. Companies frequently abandon best practices of customer service when approaching their users about failed payments. Instead, they play the role of the cold-hearted debt collector.

Sending over 1.4 million dunning messages and recovering nearly $5m in lost revenue for Paddle Retain customers taught us an important lesson: always put the customer first. In all your interactions, from email receipts to failed payment notifications, the dunning process is an opportunity to recover lost revenue, not a channel to harass customers into paying up.

If a payment fails, don’t blame your customers. They’re most likely completely unaware their payment didn’t go through, let alone why. Explain why their payment wasn’t made, with as many details as you can provide; let them know if you plan to recharge them automatically, explain how they can update their credit card details first if needed, and give them options for moving forward.

Even before payments fail, it’s important to be proactive with your communications. The best way to combat forgotten renewals is by sending friendly reminder emails before each customer’s subscription expires. Jason Lemkin of SaaStr suggests that enterprise SaaS companies send out multiple renewal notifications 60 days in advance of their renewal date, 30 days in advance, and then a final notice 5-15 days before the subscription lapses.

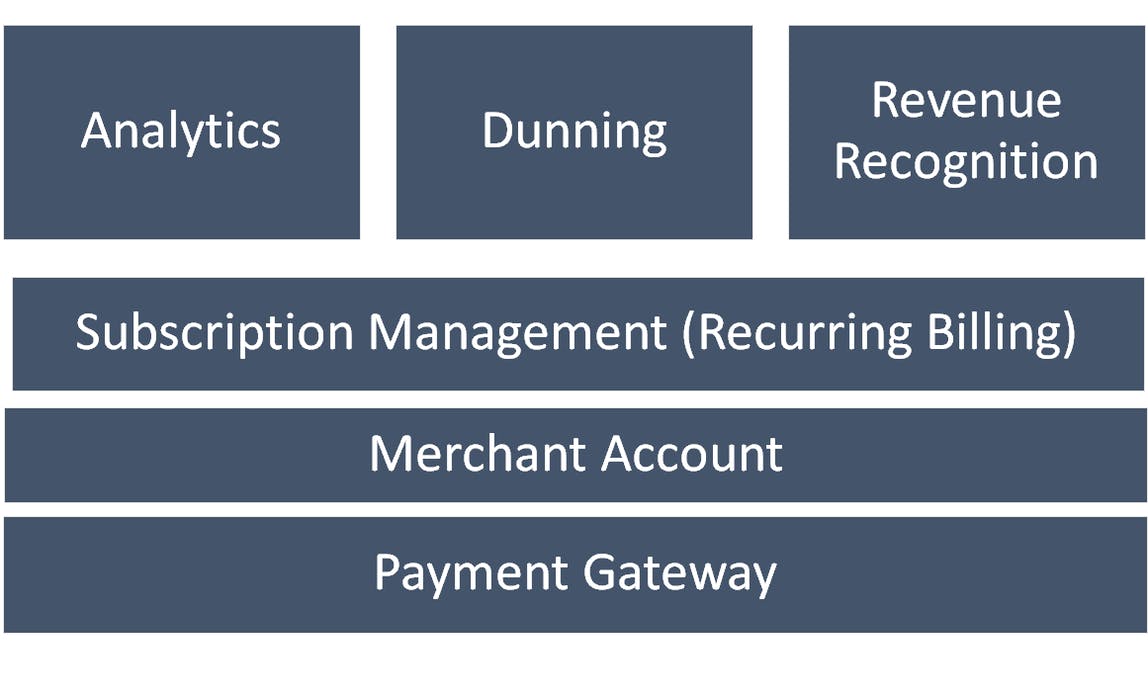

3. Choose the right subscription billing platform early

In the rush to get a new product launched, SaaS founders don’t spend enough time choosing a billing platform that will meet their long-term needs. Instead, most end up with a Frankenstein’s monster of manual billing—one that makes everything more difficult, from reminding customers of upcoming payments to notifying them of declined payments and rerunning the charges.

Patchwork billing systems might work for a short time, but every SaaS founder should choose a strong billing stack that can scale with your company, and avoid the need for shifting platforms down the road.

Every subscription billing platform worth its salt should include six main components:

- Payment gateways to connect with credit card companies and make it easy to accept payments

- Merchant accounts to allow your business to accept credit card payments (often this is integrated with the payment gateway)

- Subscription management services to make sure the right accounts are charged every month

- Analytics tools to track data and help optimize everything from pricing to retention

- Dunning tools to mitigate the impact of failed payments

- Revenue recognition systems to automate legally mandated accounting processes

Make cancellation easy—but make sure you’re learning

Putting up walls to make it more difficult for customers to cancel might reduce churn in the short term, but it will eventually come back to bite you, in the form of unhappy customers, negative PR, and higher churn.

Instead, offer a streamlined cancellation process that collects info on why they're leaving and tries to win them back if possible. Use automated email surveys to learn why customers are choosing to leave, or reach out directly via phone. Collecting these details gives you insight into the common reasons customers churn, allowing you to properly build systems to keep those customers around.

It’s also crucial that you give customers the opportunity (and incentive) to stick around. For instance, if they say the product is too expensive, you can offer a targeted, expiring discount to try to keep them around for a bit longer to get hooked.

Know when to stop

While you should see it as an opportunity to recover lost revenue, there’s still a point where you have to let go and accept that a customer may be lost. After all, the verb “to dun” literally means to harry someone with unwanted information.

Don’t be one of those companies that resorts to questionable tactics to reduce churn rate. Instead, analyze retention by choosing on the right metrics and focus on building a bulletproof retention process, and use the right tools to recover as many accounts as you can. And if you reach the point where you’ve sent four emails over the last failed payment with no response, it might be a good time to stop and terminate the service you’re providing to that customer.

Fight involuntary churn the right way

Automatic subscription renewals are wonderful for SaaS companies, boosting renewal rates and ensuring that payments are received on time. But there’s a fine line between ethical renewals and deceiving customers into sticking around.

If you choose to renew customers’ subscriptions automatically, do it the right way. Be transparent with customers, make it easy for them to leave if they choose, and recover lost revenue where possible. Your retention rate will thank you for it.