B-Side: A compact guide to pricing strategy

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

A Compact Pricing Strategy

This was originally posted on "Lenny's Newsletter - Issue 49". I wanted to re-share it here as it's a good, compact primer on subscription pricing.

Pricing is one of those topics that sits at the nexus of uncomfortable and long term, which means companies often don’t think about it for far too long. Even when they eventually figure it out, they don’t touch it again for years.

The most successful companies optimize monetization in some manner every quarter. You may be thinking, “They change their price every three months!?” No, and that's the first lesson of monetization: pricing goes so much further than the actual price. Let me explain.

If we go to a thirty-thousand foot view, you have to think about what you're actually doing with pricing. No matter the business you're in—non-profit, retail, SaaS, DTC, B2B, whatever —you've created some sort of value. You attach a unit of measurement to the value you created: your price. Put simply, your price is the exchange rate on the value you're creating in the world.

But price doesn’t live in a vacuum. Everything in your business—from sales and marketing to product and finance—is used to drive someone to buy the product at the price you're offering. Dozens of aspects of your business influence your price, and how effectively it converts customers:

- The segment and vertical you are targeting: You can go upmarket to customers who have higher willingness to pay, shift to a vertical that sees more value in your offering, or even change the ideal customer profile entirely.

undefinedundefined

These are not the only axes when it comes to pricing, but the point is anything that influences the value of your product is involved in pricing and monetization. Cool—I've now given you a college lecture worthy of a tweed blazer, so let's dig into where you should start.

In the beginning, the actual number you're charging isn't that important.

There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.

What matters much more are two other questions:

- Your value metric

- Your ideal customer profiles and segments

These two elements are the foundation of your monetization and pricing strategy. Let’s explore them individually.

Step 1: Determine your Value Metric

A “value metric” is essentially what you charge for. For example: per seat, per 1,000 visits, per CPA, per GB used, per transaction, etc. If you get everything else wrong in pricing, but you get your value metric right, you'll do ok. It's that important. Partly because it bakes lower churn and higher expansion revenue into your monetization.

Pricing based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

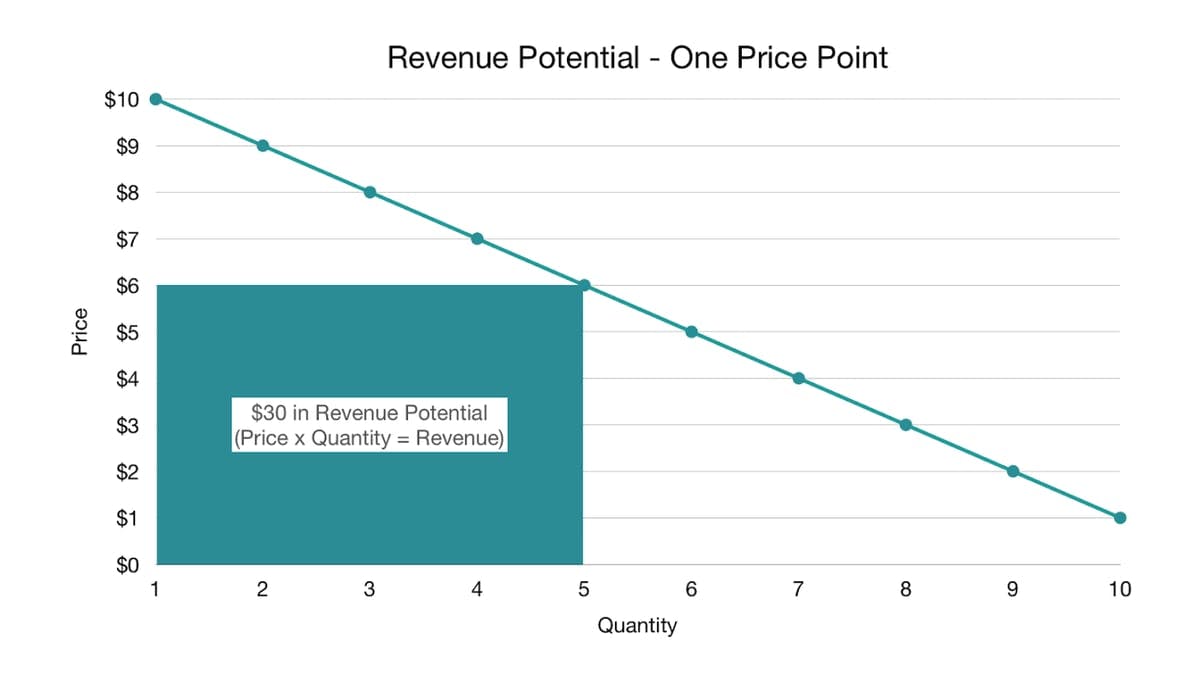

If you remember back to your high school or college economics class, the professor put a point on a demand curve for the perfect price and said “the revenue a firm gets is the area under that point.” The problem here is: what about all that other area under the curve? You’re missing out on that revenue by charging a flat monthly fee.

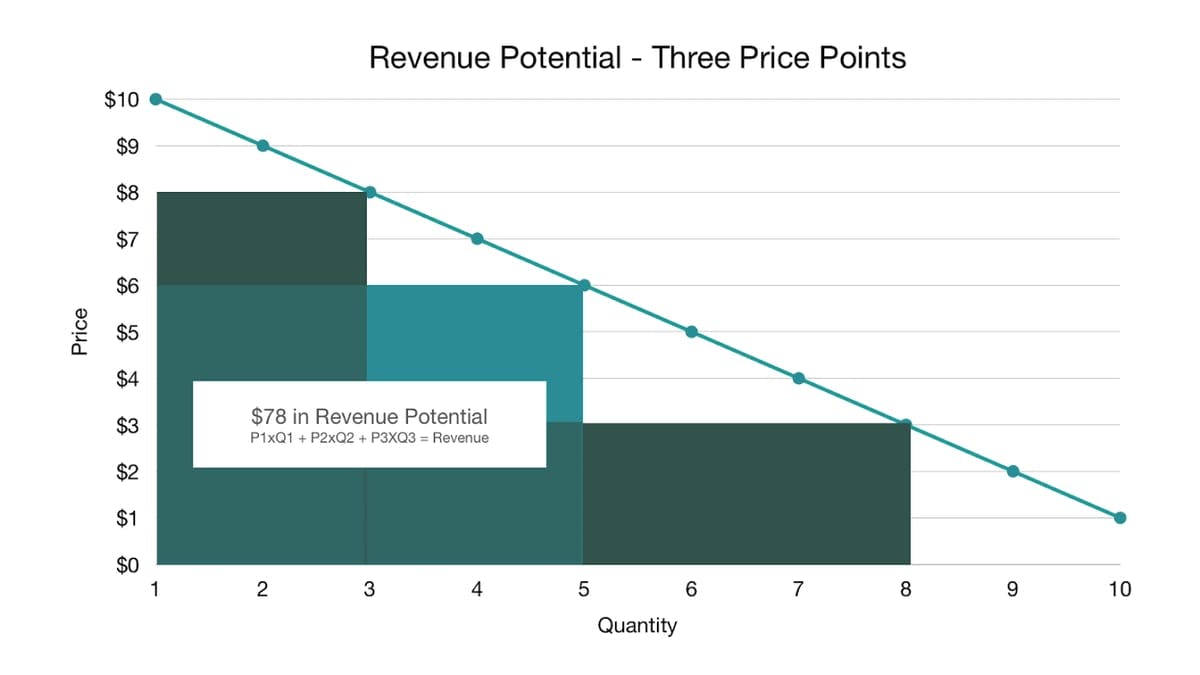

“Good, better, best” pricing is a bit more advantageous, because you end up with three points on our trusty demand curve, and thus more revenue potential. You see this in a lot of retail products who are constrained by being physical goods—the car with the basic package vs. the car with the stereo and sunroof vs. the car with everything. In software, it’s thankfully dying out, but you’ll still see it with mass-market products: Netflix, Adobe Creative Cloud, etc.

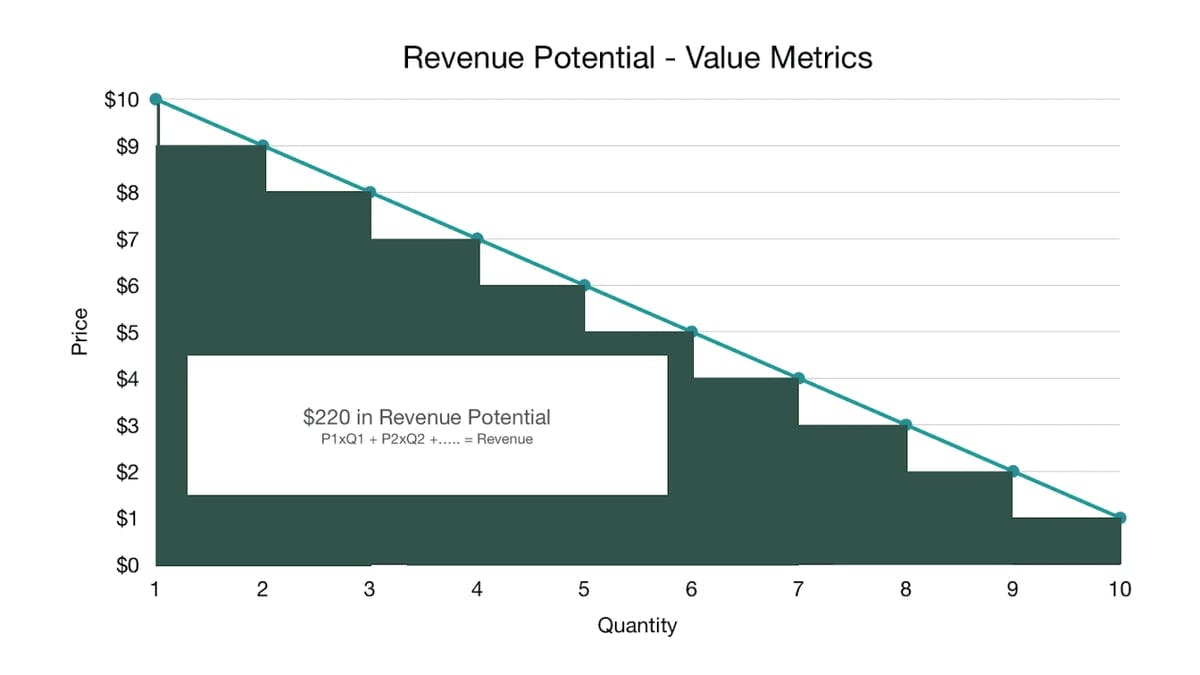

A value metric, however, allows you to have essentially infinite price points—maximizing your revenue potential. In practice, you’ll never show infinite price points on your pricing page, sales deck, or mobile conversion page, but you may have a customer come in at a certain level and then grow.

Value metrics also bake growth directly into how you charge because as usage or the amount of value received goes up (and those are not the same thing), the customer pays more. If they end up using or consuming less, they pay less (and thus avoid churning). This is why companies using value metrics are typically growing at double the rate with half the churn and 2x the expansion revenue when compared to companies that charge a flat fee or where the only difference between their pricing tiers are features.

How to determine your value metric

To determine your value metric, think about the ideal essence of value for your product—what value are you directly providing your customer?

In B2B, it's likely going to be money saved, revenue gained, time saved, etc. In DTC, it may be the joy you bring them, fitness achieved, increased efficiency, etc. Obviously, we can't measure all of these, but if you can, and your customer trusts your measurement (meaning you say you saved them $100 and they agree you saved them $100), that’s your value metric.

As an example, the perfect value metric for ProfitWell Retain (our churn recovery product) is how much churn we recover for you. We can measure this, and our customers agree to the measurement, so we can charge on that axis. Other pure value metric products include MainStreet, which handles government paperwork to automatically get you back tax credits—you pay a percentage of the money saved.

Most of you won't have a pure value metric, so the next step is to find a proxy for that metric. Take for example HubSpot’s marketing product. Their pure value metric is the amount of revenue their tool drives for your business. This is hard to measure and hard for the customer to agree to in terms of what percentage of credit HubSpot deserves for revenue from a blog post. Proxies for HubSpot are things like the number of contacts, number of visits, number of users, etc.

To find the right proxy metric, you want to come up with 5-10 proxies and then talk to your customers and prospects. You’ll typically find 1-2 of these pricing metrics will be most preferred amongst your target customers. You then want to make sure those 1-2 also make sense from a growth perspective. Your larger customers should be using/getting more of the metric, whereas your smaller customers should be using/getting less of the metric. You also want to make sure the metric encourages retention.

When we look at HubSpot, if they were to primarily price on “number of seats”, folks could share a login and HubSpot wouldn’t make much more money on large customers vs. small. Ironically they wouldn’t get as many people invested into HubSpot, because there’d be friction to adding additional seats. Instead, if they give unlimited seats and price based on “number of contacts” there’s minimal friction to getting as many people into HubSpot as possible to do activities (e.g., blog posts, email campaigns, landing pages, etc.) that then produce contacts.

The result: HubSpot’s marketing product’s value metric is “contacts”, which ensures growth is baked directly into how they make money. The usage drives the metric, which therein drives revenue. Most importantly customers small, medium, and large are all paying at the point they see value and then can grow.

Some other examples:

- Wistia charges by the number of videos or channels you use/have

- Zapier invented the concept of zap (connection of software) and charge based on time to connect

- Theater in Barcelona charged based on the number of laughs

- Husqvarna charges based on time for lawn care products vs. making you buy them

- Rolls Royce charges per mile for airplane engines. They own the engines on the plane you own and do all the maintenance. Cool model.

- Fresh Patch charges based on the amount of grass you want per month for your dog—yes they deliver grass to you monthly

As a side note, you should stop pricing based on seats for products where each seat doesn’t provide a unique experience. For instance, in a CRM if I log in to the AE sitting next to me’s account, I can’t really do my work because I’m only seeing their leads and accounts. Conversely, if I log in to our marketing manager’s account in HubSpot, I can do all the work I need. Thus, for the latter, seats is not the right value metric.

Per-seat pricing is a relic of the perpetual license era when we couldn’t measure usage or value enough within our products. We’re beyond that point, so use the above as a good litmus test.

Step 2: Determine your customer profiles and segments

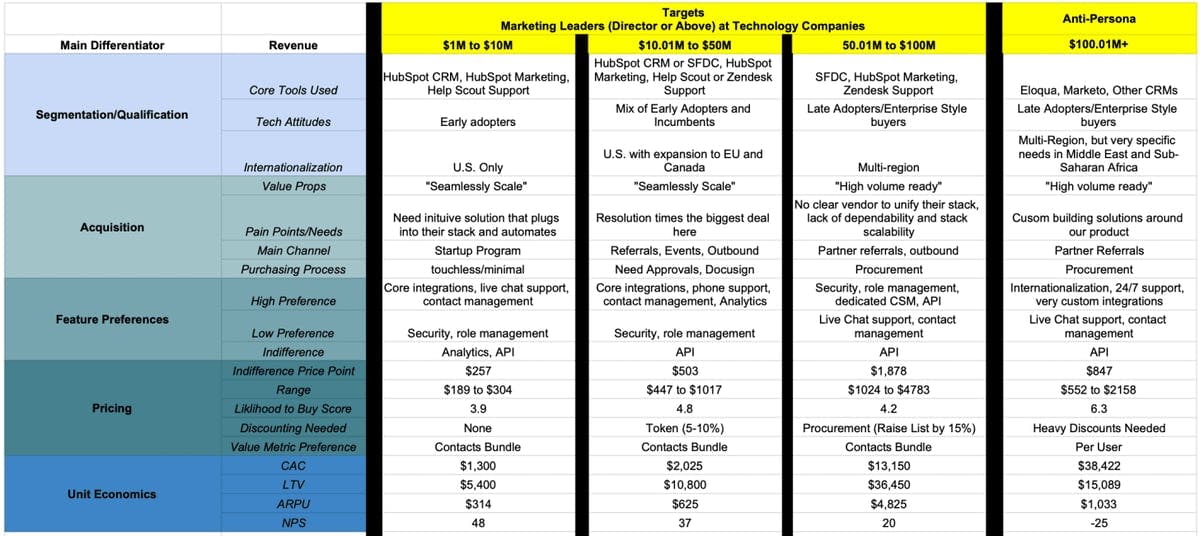

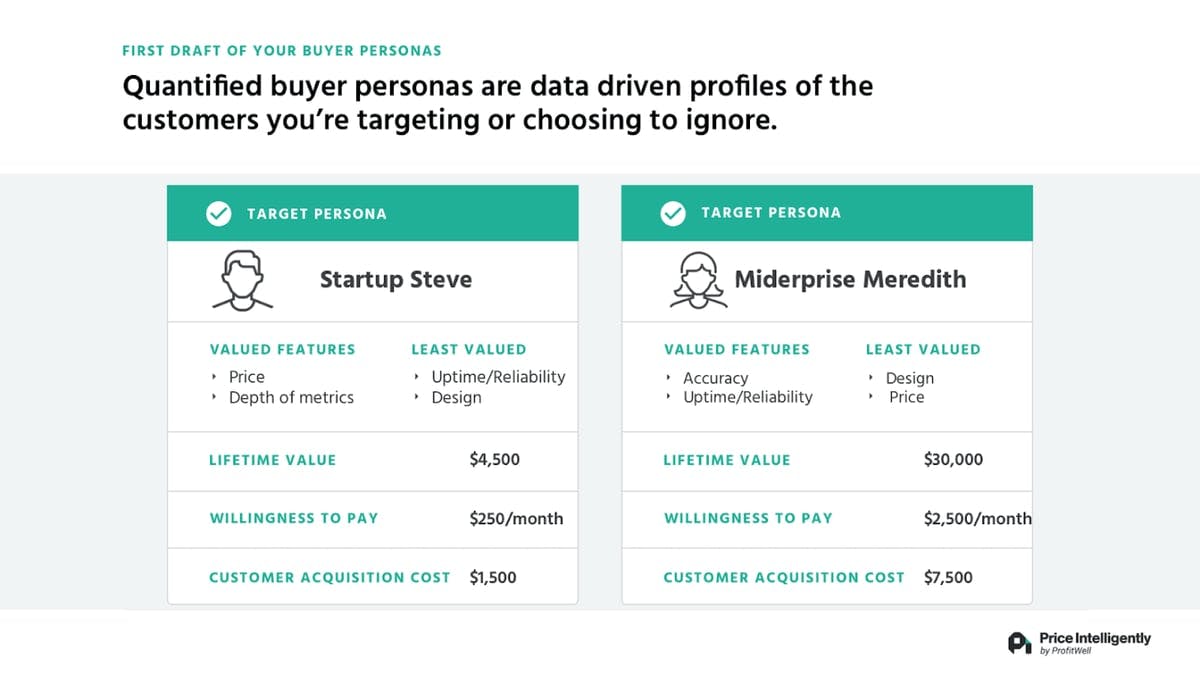

The second key component of your pricing strategy is determining your target segment and ideal customer profile. We've all heard about personas, and you may be rolling your eyes at the concept, but most personas are useless because they aren’t quantitative enough. When used properly, quantified personas and segments are beautiful tools. The information needs to go beyond just cute names like “Startup Steve" with a cute avatar, and cute meetings where people tell you they’re targeting "developers."

To get quantified personas, you need to pull out a spreadsheet. Here’s a template you can use.

1. Columns: Customer profiles you're targeting

These can take many forms, but the ultimate goal is to be as specific as possible so that you not only know who you’re targeting but how to monetize and retain them. Pragmatically, you typically separate these profiles based on size or role (or both). For example, a marketing automation product may target the following profiles:

- Marketing leaders (Director and higher) at companies $1M to $10M

- Marketing leaders (Director and higher) at companies $10.01M to $50M

- Marketing leaders (Director and higher) at companies $50.01M to $100M

The point is you can’t be everything to all people and you need to understand who you’re targeting in order to make better decisions.

2. Rows: Characteristics of each profile to help you differentiate between them

- Most valued features

- Least valued features

- Willingness to pay

- Lifetime value (LTV)

- Customer acquisition costs (CAC)

- ... and any other metric or category you think could be useful

If you're just starting out or you don't have some of this data, it’s fine. Still fill it out though with your hypotheses. You know something about your customers.

Next, you then need to validate (or invalidate) the most pressing hypothesis in that spreadsheet based on the decisions you’re going to make. If you're going to validate a new feature for a particular segment, then that's where you should start. Price point the biggest question? Start by researching the price point with each of these roles/segments.

If you don't know who your key roles/segments are, there's no way in hell you’ll set up an efficient growth flywheel, let alone an optimized pricing strategy. Personas act as a constitution within your business to centralize your focus and arguments about direction.

If you don't do segment and persona analysis, you better be able to raise a ton of money. I guarantee you there's some persona or segment on some vision document or in that euphoric part of your entrepreneurial brain that is completely wrong for your business. I see it all the time. Even I—someone who thinks about segments and customer research all the time—fall prey to being an absolute idiot with who we should target.

When we built ProfitWell Metrics (our free subscription metrics tool) I thought we were geniuses who were going to be billionaires. Turns out analytics products are terrible. Willingness to pay for them is terrible; retention for them is terrible; NPS is terrible. Everything is just terrible, mainly because customers don't appreciate graphs or at least aren't willing to pay much for them. When we did our research this became obvious and put us 18 months ahead of our competitors, pushing us to change up the positioning of the product to freemium, which has fueled our business ever since (oh and our NPS is 70, because we massively over-deliver a free product better than the paid competition).

Never underestimate the power of focusing on the customer through research. You should never, ever just do what they ask, but you need to be an anthropologist who knows them better than anyone else.

Step 3: User research + experimentation

Beyond your value metric and core segments, the monetization game becomes extremely tactical and research-based. Figuring out your price point involves researching those segments and then making decisions in the field. Same with discounting, add-on, and packaging strategies. The point: monetization is never finished because it’s the very essence of translating your value into an optimal framework for your target customer segments.

Practically this is why you should be experimenting with your monetization every quarter. Experimentation can get tricky and have a few quirks, but you’ll find it’s similar to most growth frameworks out there (which are all versions of the scientific method).

Here’s a good prioritization list of what you should attack in optimizing your monetization strategy once you have your core segments and value metric figured out:

Priority 1: Foundational [see above]

- Core customer segments

- Value metrics

Priority 2: Core

- Order of magnitude price point (are you a $10 product vs. a $500 product)

- Positioning and value props

- Packaging

Priority 3: Optimizations

- Add-on strategy

- Specific price point (are you a $10 product vs. a $11 product)

- Price localization/internationalization

- Discounting strategy

- Contract Term optimization

Priority 4: Growth accelerators

- Freemium

- Market expansion (going up or down market)

- Vertical expansion

- Multi-Product

Your true order of operations with monetization will vary, but for the most part, all companies should work through the foundational and core sections before moving to the optimizations and growth accelerators. If you’re larger or there’s a fire, you may start with an optimization. In fact, this is sometimes a good idea. Something more scoped like “price localization” can help get momentum, be a forcing function to clean up tech and experimentation stacks, and mitigate political conversations. Remember, monetization is something that’s important, uncomfortable, and something you likely don’t know much about, so progress is better than nothing. Start small. You can (and should) always do more.

Rapid-fire bonus advice ⚡

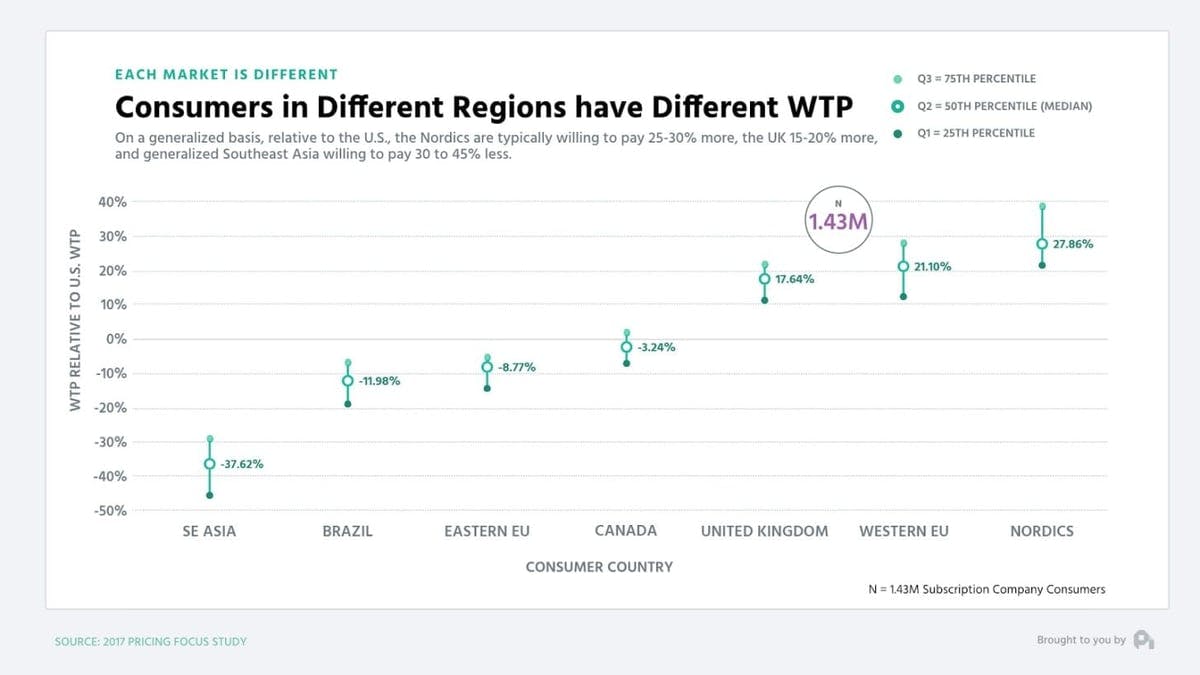

1. You should localize your pricing to the currency and willingness to pay of the prospect's region

- Revenue per customer is 30% higher when you just use the proper currency symbol

- Having different price points in different regions increases revenue per customer further, and is justified based on different demand environments in different regions

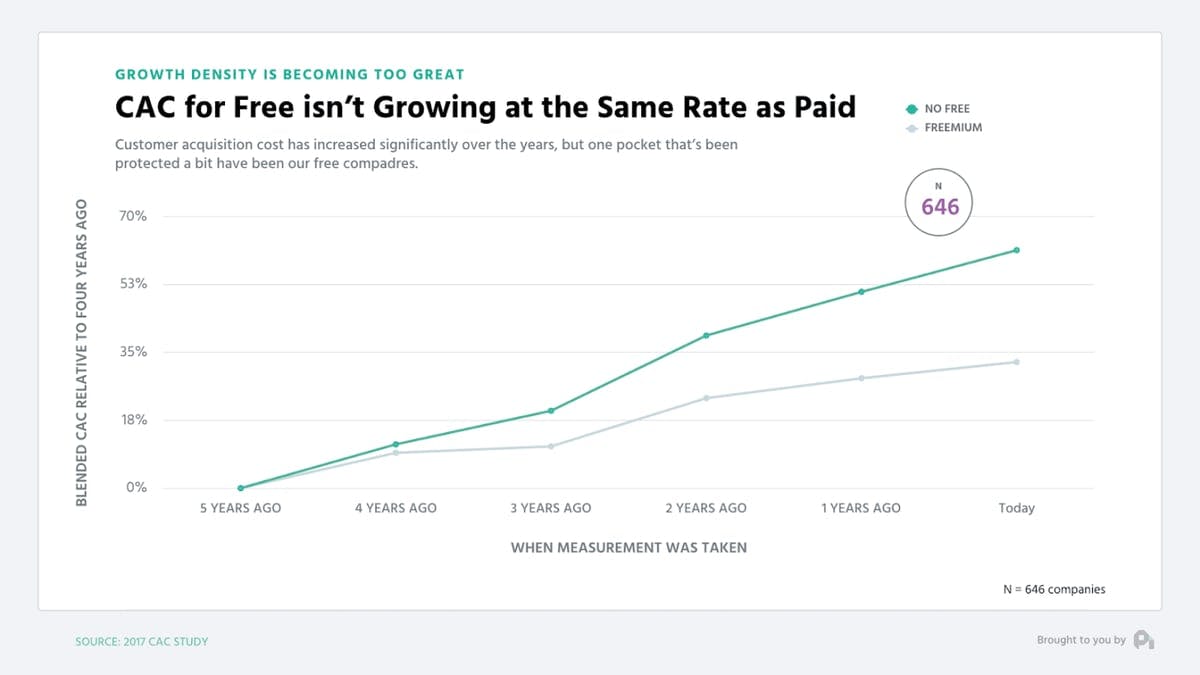

2. Freemium is an acquisition model, not a part of pricing

- Think of freemium as a premium ebook driving leads, not another pricing tier

- Don't do freemium until you truly understand how to convert leads to customers, because you’ll end up increasing noise or false positives when you’re trying to figure out your segment beachheads. The best folks who deploy free typically don’t implement freemium until two to three years into their business. The exceptions to this notion are if you have a very specific need or network effect (eg., marketplaces, social networks, etc.) or if you have a top 50 growth person on your team.

- To be clear, I'm not saying DON’T do freemium. I'm saying it's a scalpel, not a sledgehammer that requires thought. A lot of people end up reading our articles on freemium and end up going, “Cool, let’s do freemium and we’ll be a unicorn.” I’m being pragmatic in that you need to realize freemium is fantastic, but doing freemium properly takes a lot of effort and nuance.

- Paid users who convert from free tend to have higher NPS, better retention, and much lower CAC.

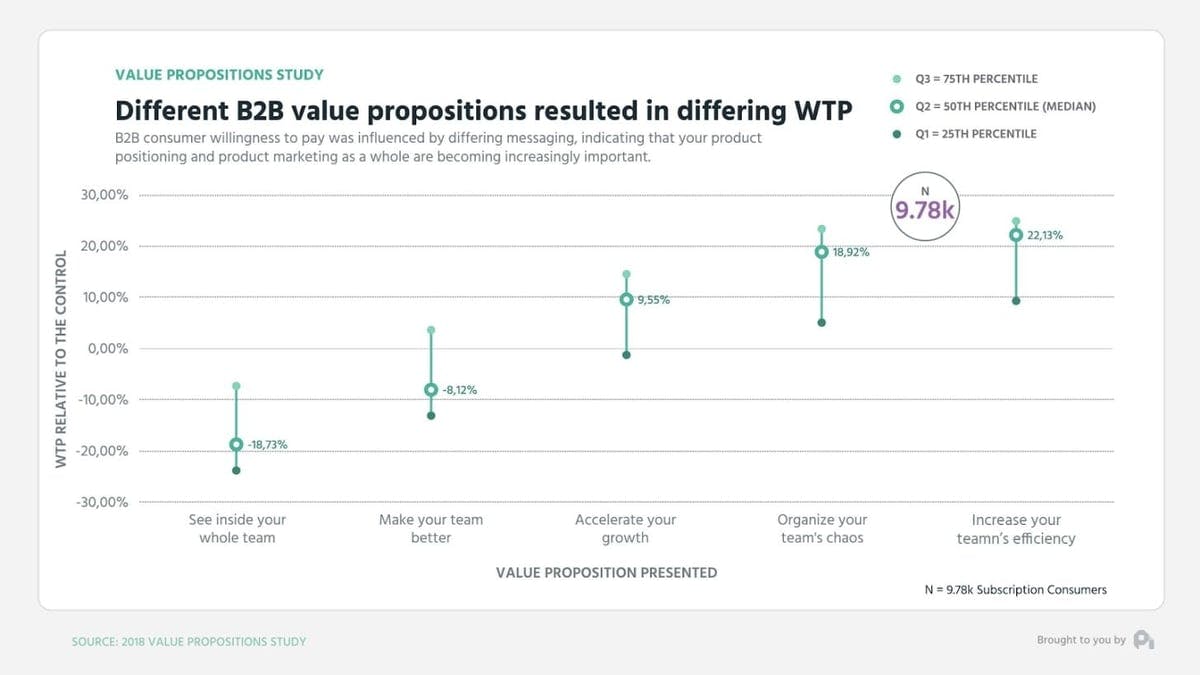

3. Value propositions matter oh so much

In B2B value propositions can swing willingness to pay ±20%, in DTC it's ±15%

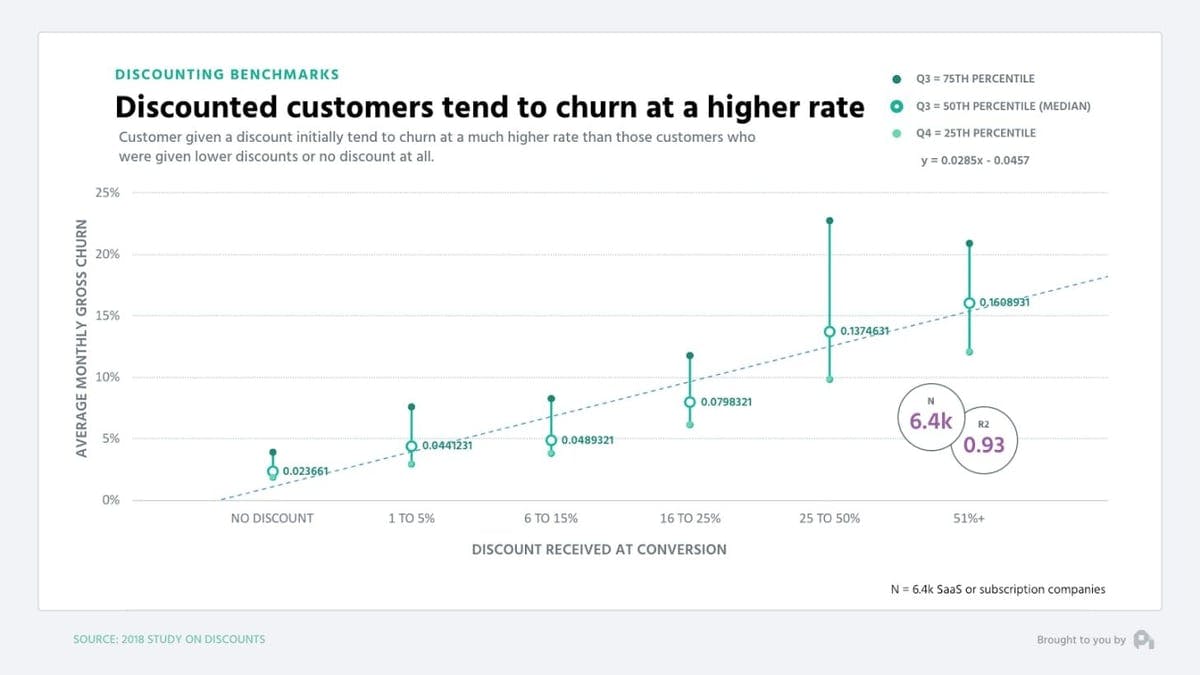

4. Don't discount over 20%

In some verticals discounting over 20% may be fine, but you're likely not in one of them (although you may think you are), but the size of the discount almost perfectly correlates with higher churn. Large discounts get people to convert, but they don't stick around.

5. For upgrades to annual discounts, don't use percentages and try offers

Percentages don't work as well as whole dollar amounts for discounts (ie., "one month" will work better than "X percent off"). Annuals see much lower churn rates.

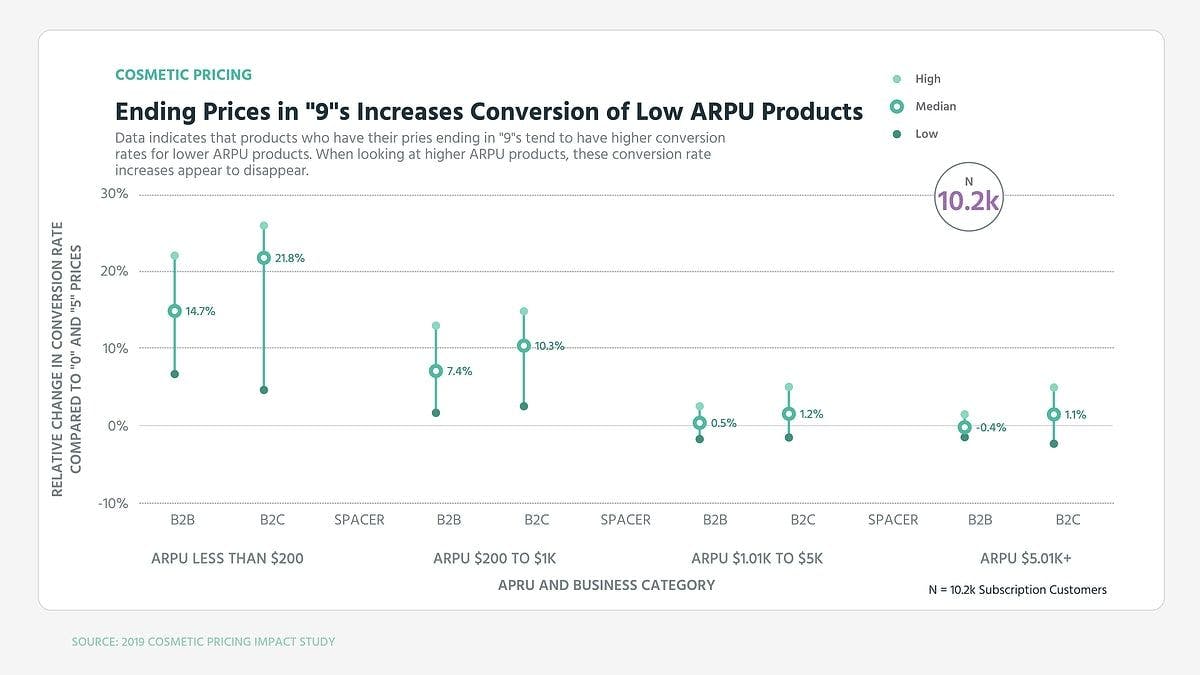

6. Should you end your price in 9s or 0s? Depends on your price point

Ending your prices in 9s evokes a discount brand, making the customer feel like they're getting something. Ending in 0 evokes luxury or premium. Studies on this for technology products is inconclusive. We have seen it increase conversion in lower priced products, but retention isn't as good with those customers.

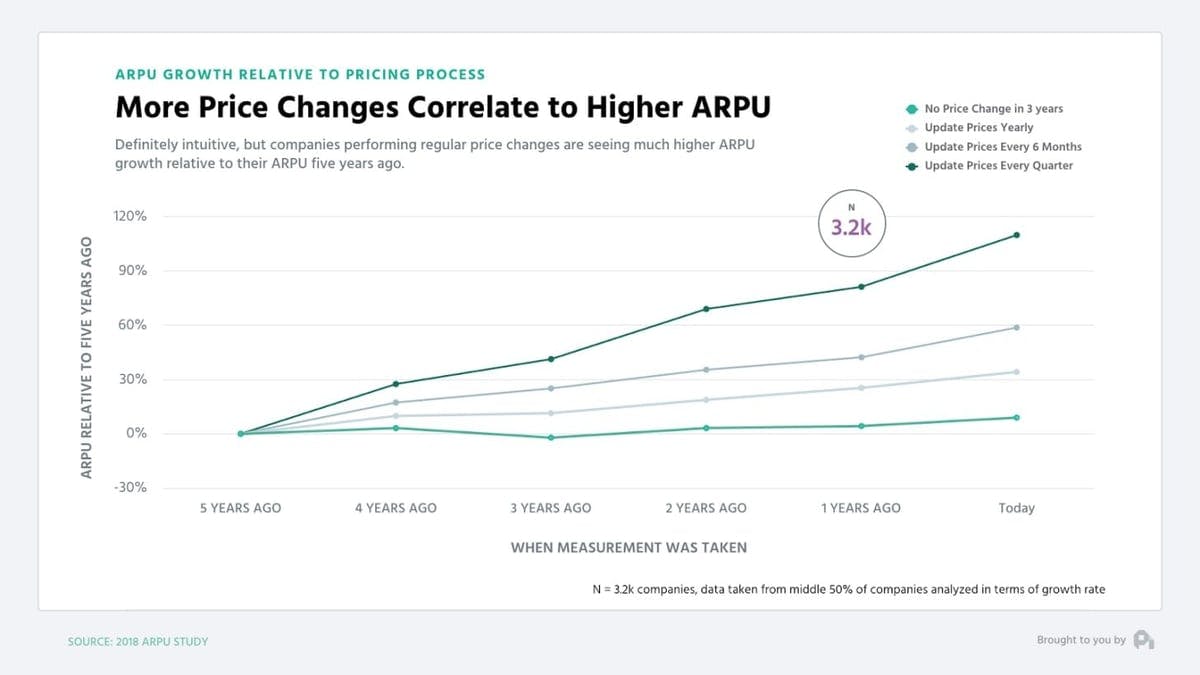

7. You should experiment with your pricing in some manner every quarter

This doesn't mean change the price point each quarter, but experiment with something. More changes correlates with increasing revenue per customer. Like all things, focusing on something makes you improve it.

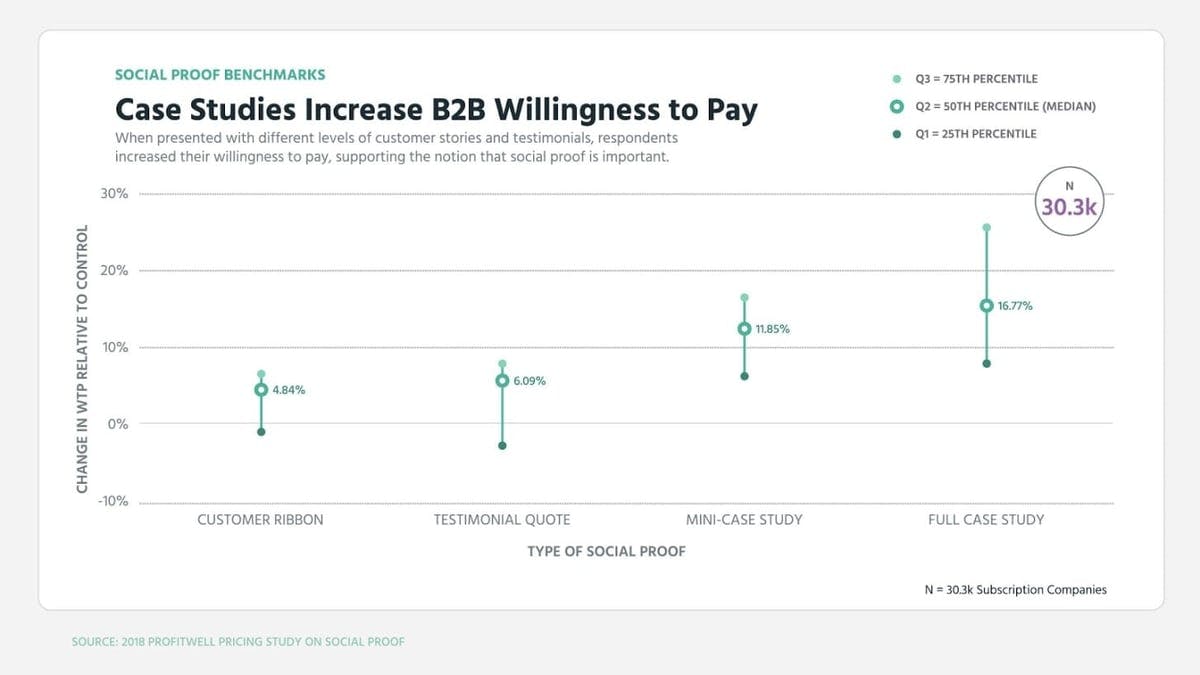

8. Case studies boost willingness to pay quite a bit

Social proof is important. Case studies can boost willingness to pay by 10-15% in both B2B and in DTC

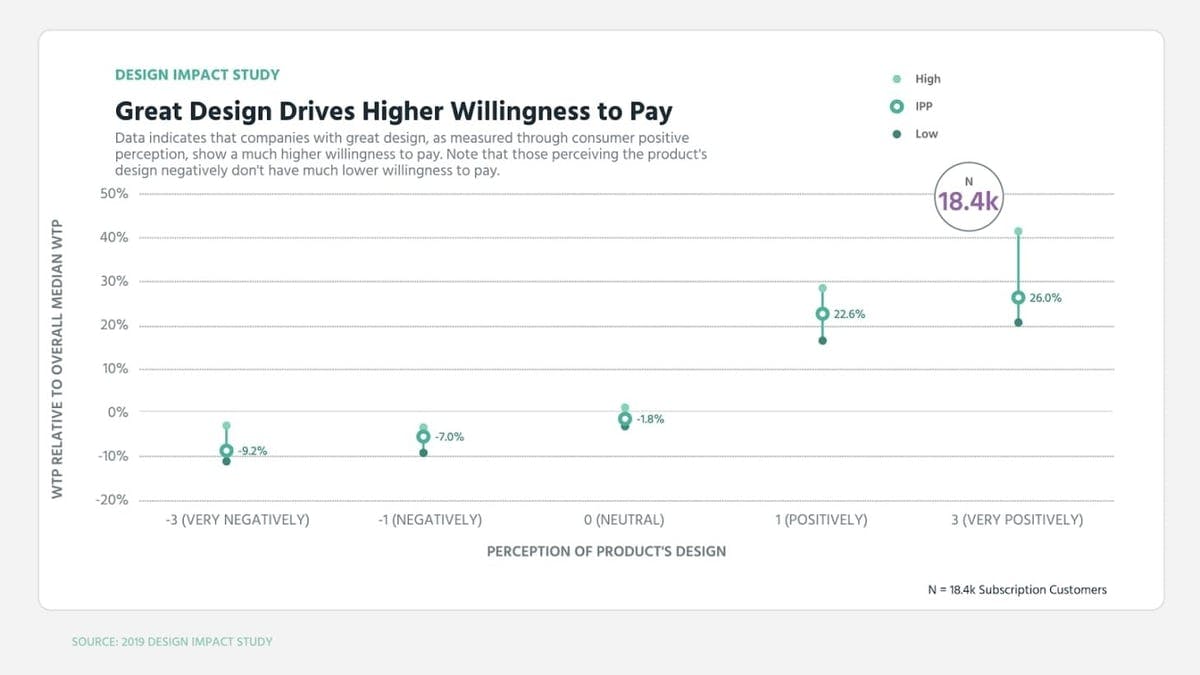

9. Design helps boost willingness to pay by 20%

This graph didn't look this way 10 years ago when design didn't do much for willingness to pay. Today, affinity for a company's design can boost willingness to pay considerably.

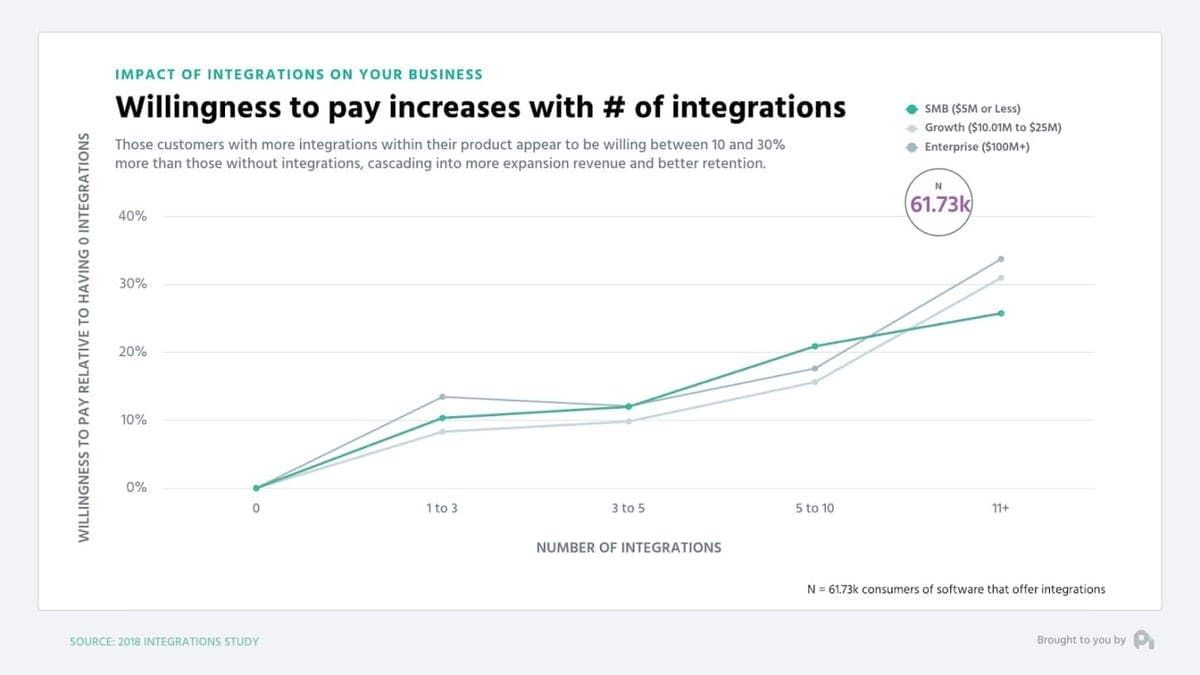

10. Integrations boost retention and willingness to pay

The more integrations a customer is using, typically the higher their willingness to pay and the better their retention. I wouldn't charge for the integrations, but I'd use this as a tool to get people hooked in and paying more or buying different add-ons.

Still here? Ok, if you ever have any questions about pricing, retention, or subscription benchmarks, hit me up on Twitter or just reply to this email (it's my personal one).

Do us a favor?

Part of the way we measure success is by seeing if our content is shareable. If you got value from this episode and write up, we'd appreciate a share on Twitter or LinkedIn.

00;00;00;00 - 00;00;12;23

Patrick Campbell

There's some judgment calls that you're going to have to make where, for example, if you want to charge based on per user, but your product isn't really great for per user pricing, you might actually hinder people from adding more people to the product and therefore your retention is going to suffer.

00;00;14;04 - 00;00;29;21

Ben Hillman

From profit will recur. It's protect the hustle or we explore the truth behind the strategy and tactics of B2B SaaS growth to make you an outstanding operator. On today's episode, we're diving deep on pricing strategy. Patrick, take it away.

00;00;34;01 - 00;00;59;22

Patrick Campbell

All right, everybody, Welcome back. Another episode of Protect the Hustle voice you're hearing is Patrick Campbell, co-founder of Profit. Well, a couple of housekeeping items. I am traveling. So apologies for the poor audio quality. I know Ben, our production producer, is going to yell at me for it, but the nice microphone is buried deep in the trunk right now and I'll try to get it back held for everybody at some point here.

00;00;59;22 - 00;01;22;06

Patrick Campbell

But a couple of other action items here I've been thinking about finally raising money for proper Well, we have been customer funded, bootstrapped up until this point. The market is out of control. So I feel kind of like an idiot. I'm fiscally irresponsible for not raising probably is just the insecure kind of vulnerability and emotions here, but would love kind of anyone's take.

00;01;22;06 - 00;01;43;25

Patrick Campbell

Good idea, terrible idea. We're not against raising money and it's not against this thing. Customer funded is just one of those things that that's that's really interesting given the market right now. Also, you know, just on the travel bug, I'm going to be going back to Utah here via car from Florida. So I'll be stopping in New Orleans, Houston, Austin, Denver, a couple of other places.

00;01;43;25 - 00;02;10;19

Patrick Campbell

If you're in those areas and you want to safely hang out, let me know. Yeah, with that, let's jump into it. I I'm going to be talking through pricing strategy here. And more specifically, I'm going to be talking through kind of a compact guide to pricing strategy. I wrote this post a little while back for Lenny's newsletter. And Lenny, if you guys don't know, is it kind of a, you know, kind of perennial growth person kind of in the world here and you get this really popular newsletter, asked me to write a post on pricing.

00;02;10;29 - 00;02;27;22

Patrick Campbell

It did so and it's one of kind of the most comprehensive yet compact posts that I've written. And so I kind of want to talk through the thoughts from there. And if you go to a particular also dot com, you can actually get all of the graphs and everything like that that I'm going to reference and also sign up to get the the email or you don't even have to leave the email to get all of the information.

00;02;27;22 - 00;02;51;18

Patrick Campbell

But we're going to be talking through this mainly because it's is a lot of, you know, if you listen to anything that I've put out in the past couple of years, your pricing is one of those topics that's it's kind of at the nexus of both uncomfortable and long term. And because of that, a lot of companies, they don't think about it often enough and they don't adjust this growth ladder until it's not quite it's too late, but they just don't take advantage of this growth lover.

00;02;51;18 - 00;03;18;02

Patrick Campbell

And even when they eventually figure it out, they don't really like touch it regularly and the reason for that is because a lot of us, we think that pricing is just a single point. We think it's just a number. Monetization is just how much you actually charge when in reality it's so, so much more than that. In the best companies in the world, they're adjusting pricing and monetization probably once every quarter, if not every single month in a lot of your thinking, too, to the point that I just made.

00;03;18;02 - 00;03;42;12

Patrick Campbell

Oh my gosh, they're they're changing the price every three months. Their customers are prospects must be aggravated. And that's that's not really what's happening and that's the first lesson here as as I kind of already alluded to, it's so much more than the number. And to explain that, let's let's go to kind of a 30,000 foot or a 30,000 meter view for for a lot of the folks outside of the U.S. who listen in and watch you, no matter what business you're in, it doesn't matter what business you're in.

00;03;42;12 - 00;04;19;18

Patrick Campbell

B2B, SAS, retail, do you see nonprofit, You're creating some sort of value. And because we don't treat goats for wheat in most of the economies that we plan, you're ascribing some sort of unit of measurement to that value, and that's your price, right? So your price is the exchange rate and the value that you've created. And then you that sounds super fluffy and super high level, but that's the premise that I think a lot of us need to start from, because your price then has a lot of influences on it, because anything that influences the perceived value of your product is all of a sudden going to actually influence what that that perception is and

00;04;19;18 - 00;04;40;02

Patrick Campbell

ultimately what that conversion looks like. And that means everything in your business from your sales and your marketing all the way down to your product and finance to is used to either drive someone to a point of conversion or to justify and defend the product or the price that you're offering. And so there's a lot of things that influence this, but three really big ones that a lot of people, you know, kind of kind of don't realize.

00;04;40;02 - 00;04;54;19

Patrick Campbell

And if you notice, what I'm trying to do is I'm trying to expand your knowledge of what actually is involved with monetization. But first there's the segment or the vertical that you're targeting, who you're targeting, using the market, and all of a sudden they have higher willingness to pay. You can go down market and go for a volume play.

00;04;55;06 - 00;05;14;15

Patrick Campbell

You can shift the vertical that you're going after. So all of a sudden you start selling to, you know, soccer moms and dads and they're willing to pay for your product a lot more a lot differently than when you were selling to auto mechanics. You could also just change the ideal customer that you target, you know, entirely. The second big thing here is your products, your features, your positioning, your packaging.

00;05;14;15 - 00;05;30;12

Patrick Campbell

All of these things influence their value heavily because you can not only come out with new features, but you can move features to different tiers. You can pull features out and make them add ons, You can change up your value propositions. There's a whole host of things you can do to actually influence that value perception. And then of course, there's the actual number.

00;05;30;12 - 00;05;49;03

Patrick Campbell

The final big piece here is the actual number. If you move that price up or down, obviously going to impact conversion, but it also impacts the perception of your brand. If I am a premium brand, but my price to the customer that I'm going after is perceived as too cheap. It doesn't matter if they're willing to pay for it, they're just not going to go because they don't trust your product.

00;05;49;13 - 00;06;11;20

Patrick Campbell

And these are not the only axes out there when it comes to pricing. But the point that I'm trying to make here is you have dozens of different things that you can be doing to experiment with monetization. I think that the big thing that we always fixate on is the actual number. And for most of us, I would argue when it comes to prowess, your number that you're charging probably doesn't matter as much as all of the other things.

00;06;12;10 - 00;06;40;16

Patrick Campbell

And what I mean by that is, is you should be figuring out of my $10 product, $100 product, $1,000 product, don't waste time debating. Am I a $500 product or my $505 product? Because that probably doesn't matter as much as the other pieces we're going to talk about in terms of foundation. And so stop fixating on that. And the two really big things I think you should fixate on, and I'm going to give you an order of operations after this that you can go through the two biggest things your value metric and your ideal customer profile and segments.

00;06;40;16 - 00;07;01;21

Patrick Campbell

These are the two things that you should worry about. And until you have this figured out, don't worry about all the other things that you can be doing to improve your pricing. And we're going to talk more deeply about both of these. The first one here is determining your value metric. A value metric is essentially what you charge for could be perceived per 1000 visits per KPA per gigabyte used per transactions.

00;07;02;05 - 00;07;21;28

Patrick Campbell

It could be a whole host of things. So just to give you a couple of examples of different value metrics, Wistia, they are a video hosting an index platform. They charge by the number of videos or channels that you use Zapier, they help you connect different apps and do run different tasks amongst those apps. And this integrations, they invented their value metric.

00;07;21;28 - 00;07;38;02

Patrick Campbell

It's the concept of a ZAP, basically connections of software they charge based on how often those apps are used. There's a theater in Barcelona. It's a comedy theater where they actually put a camera on the seat in front of you and they measure how often you laugh. And then based on how often you laugh, that's how much they charge you.

00;07;38;09 - 00;08;02;02

Patrick Campbell

Husqvarna maker of lawn care equipment, instead of charging you just to buy the actual lawn mower or the lawn care equipment, they charge you how much time you actually use it. Royce Particularly their airplane engine division, they basically charge you based on the number of miles. So when you're flying in that airplane, the brand that you're flying, if they're using Rolls-Royce engines, doesn't actually own those engines.

00;08;02;09 - 00;08;22;06

Patrick Campbell

Those engines are still owned by Rolls Royce and they charge based on mileage. And that means they do all of the maintenance, even fresh patch. Another company out there, they charge you based on the amount of grass that you want delivered for your dog basically to put on your balcony if you don't have a yard so that your dog can have some grass to play on or, you know, to use the bathroom with.

00;08;22;06 - 00;08;40;21

Patrick Campbell

But these are some examples of value metrics and to kind of, you know, not bury the lead if you get everything else wrong but your value metric right, you end up doing okay. It's that important. It's one of the most important pieces out there. And it is mainly because it takes a lower churn and higher expansion revenue into your monetization.

00;08;41;09 - 00;09;10;07

Patrick Campbell

And I'll explain that a bit more in a second. But the basic idea is, is that your value metric, when you charge based on some sort of metric, you ensure that you don't charge a giant customer the same price as you charge a small customer. And how does this work? Well, if you remember back to your high school or your college economics class, your professor or a teacher, he or she drew a demand curve, you know, the curve that basically, you know, they draw the X and Y axis and then the curve goes from high on the left down to low on the right.

00;09;10;20 - 00;09;32;16

Patrick Campbell

And then basically along the y axis, the vertical axis, that was price, right? So he or she marks a point on that curve, that line, which was your price point and basically shaded in everything underneath that particular curve and said, okay, this is your revenue. If you charged $6 a month or $6 for this product. Right. And then this is the quantity you're going to sell, right?

00;09;32;16 - 00;09;49;18

Patrick Campbell

And all these visuals are in the actual posts that protect the houses dot com or the email that you receive. But basically you only have one price point. Well, a lot of price practitioners that came along and they said, Oh, hey, you should have more than one price point. Right? And this is where good, better, best pricing came, right where you basically had three price points, right?

00;09;49;18 - 00;10;01;18

Patrick Campbell

So we're going to have a high price point for the high end people. We're going to have the mid price point hopefully to capture as many people as possible. And we're going to have the low price point, which is going to capture our tire kickers or the people who are just going to come in and like see what's going on.

00;10;01;18 - 00;10;21;01

Patrick Campbell

Right. And all of a sudden that was good, better best because now your revenue expanded because you basically shaded in all of the extra bars underneath that curve and that was extra revenue. Well, what a value metric does is basically puts infinite or seemingly infinite points on that curve. So if someone wants a thousand seats, they're paying a different price than someone who wants 999.

00;10;21;01 - 00;10;46;28

Patrick Campbell

And that's a different price than the person who just wants five seats. Someone just called me during the podcast band. I don't know if you're going to leave this in there, but someone just called me. And what's brilliant about some of this new sales call software is basically they will when you hit stop calling me or like ignore, they just immediately recall and they do it three different times and they just want to sometime pick up the phone and say, Hey, if you continue to call me, I will never buy your product ever.

00;10;47;03 - 00;11;09;14

Patrick Campbell

But anyways, value metrics also big growth directly into how you charge, because as usage or the amount of value received goes up, they pay more. And as you said, your value goes down, they pay you less. And this is why companies using value metrics typically grow at about double the rate as those who aren't using value metrics, they have half the churn, typically half the cancellations, and they have to ex the expansion.

00;11;09;14 - 00;11;27;11

Patrick Campbell

Revenue makes growth directly into how you make money. So how do you figure out your value metric? Well, that's that's the age old question. And so the first step is what is the ideal essence of value for your product? And I know that sounds really, really fluffy, but what, what is like the purest form of value you're providing, that's the first step is to think through that.

00;11;27;15 - 00;11;48;03

Patrick Campbell

So in B2B, it's likely you saving money, gaining money. Time saves time as time earned for your actual customer, right? In a consumer business, it could be the joy you bring them to fitness, achieve the efficiency that they get. It could be a whole host of things. The point is, it doesn't have to be perfect at this stage, but the first step is what is the perfect measure of value?

00;11;48;22 - 00;12;10;26

Patrick Campbell

Now, when you've come up with that, if you can measure it and your customer trust your measurement, that's how you should charge. You have the ideal pure value metric for your business. So to give you an example, Buffalo retain, it's our churn recovery product. Basically we charge and we can measure how much churn, how many cancellations do we prevent and how much churn do we recover.

00;12;11;04 - 00;12;28;26

Patrick Campbell

Our customer can agree to that measurement and then therefore we can charge based on that amount. There's other companies out there, Mainstreet, who just raised a bunch of money. They basically help you get tax credits. They can measure how many tax credits they get for you and they work for you. Then they can also basically make sure they take a percentage of that and you trust them.

00;12;28;27 - 00;12;42;25

Patrick Campbell

Now, most of us aren't going to be able to use value metrics that are pure. Probably about 10% of us. And that number is going up, particularly as billing systems get better and better. But for most of us, what we're going to do is take that value metric and take a step back and find a proxy for it.

00;12;43;09 - 00;13;03;21

Patrick Campbell

So for HubSpot, their marketing product will speak about particularly the pure value metric is the amount of revenue that the tool drives for your business and this is really hard to measure and it's also hard for the customer to agree to because how much credit does HubSpot basically get for any revenue that this blog post or this podcast episode brings in?

00;13;03;22 - 00;13;20;03

Patrick Campbell

It's hard because I did the work, I wrote the blog post, I did the recording, our production team put everything together. So it's hard, right? So proxies then for HubSpot are things like the number of contacts that we have, the number of visits that we bring in, the number of users. That's a good proxy for the value because it's measurable.

00;13;20;03 - 00;13;38;07

Patrick Campbell

They can get me to agree to it. And also they can kind of, you know, basically measure it. Everyone can kind of measure the value they're getting. So to find the right proxy metric, I typically recommend you come up with 5 to 10 proxies for whatever that pure value metric is, and you'll start to notice that there's like one, two, two of them that are probably most preferred.

00;13;38;28 - 00;13;53;18

Patrick Campbell

And I would go to, you know, your customers and I would basically figure out, ask them some of these max stuff questions and I can share some resources if anyone's interested and how to actually measure this. And I would go out and say, Hey, we've got these five ways that we can charge. What's the most preferred way that we could charge?

00;13;53;18 - 00;14;10;28

Patrick Campbell

What's the least preferred? And you start to get some answers and there's some other things that you want to do. I probably want to measure willingness to pay and just make sure people have more of this metric, are willing to pay more than those who have less than this metric. I probably also want to kind of look at a histogram analysis and I'll do a deeper post on value metrics in a bit.

00;14;11;11 - 00;14;34;19

Patrick Campbell

But the basic idea is, is that I want to find that ideal proxy and I also want to make sure that this metric encourages retention. It doesn't discourage retention. So there's some judgment calls that you're going to have to make where, for example, if you want to charge based on per user, but your product isn't really great for per user pricing, you might actually hinder people from adding more people to the product and therefore your retention is going to suffer.

00;14;35;12 - 00;14;53;10

Patrick Campbell

And to give you an example, when we look at HubSpot, if they were primarily to price on number of seats, number of users, basically anyone could share a log in and HubSpot wouldn't really make much more money on their larger customers versus the small. And ironically, they wouldn't get as many people invested into HubSpot because there would be friction to adding additional seats.

00;14;53;25 - 00;15;13;03

Patrick Campbell

Now. Instead, if they gave a limited users and price based on number of contacts, there's minimal friction to getting as many people to HubSpot as possible to do activities, blog posts, emails, etc. that then produce contacts. So the result here is when we look at HubSpot, it makes sense for them to use something like number of contacts. It ensures that growth is baked directly into how they make money.

00;15;13;16 - 00;15;27;08

Patrick Campbell

In this usage metric, it drives the metrics which they are and drives revenue. And most importantly, customers small, medium and large are all paying at the point that they see value and they can then grow. And there's a lot of nuances here. So I know some of you are going to be like, Well, what about this? Or what about that?

00;15;27;28 - 00;15;47;08

Patrick Campbell

The important points that I would say is don't try to be everything to all people. There are definitely customers out there that have low number of contacts, but the value per contact is very high. It's just there's a lot more people out there where more contacts means the value goes up and that's what HubSpot goes after. The other thing is, is can we use multiple value metrics?

00;15;48;02 - 00;16;07;20

Patrick Campbell

Yeah, you can, but you have to be careful depending on your sales model, the sophistication of your buyer, if you're selling to a developer or something like IWC, I can use a lot of really complicated value metrics if I'm selling them to a marketing person who isn't really technical, I probably can't get away with more than two value metrics because it gets really, really confusing.

00;16;08;05 - 00;16;27;02

Patrick Campbell

So I'll go deeper and value metrics if you have any questions on these specifically, I'm going to be writing a pretty deep kind of post on value metrics in a bit, this reply to to the email. And if you're not on the email, just go to protect parcel dot com and sign up and you can you can email me and the other big piece of pricing here that that heavily influences success or failure.

00;16;27;02 - 00;16;41;13

Patrick Campbell

And the thing I wanted to be super clear on, if you get your value metric right and I don't know if I said this, but it bears repeating, but you get everything else wrong. You tend to actually end up being okay. And so that's a really big thing to think about. That's why it's so important to focus on that first.

00;16;41;25 - 00;17;03;19

Patrick Campbell

And the other thing is, is going after your ideal customer profile segment. And I get that you have heard about personas, I get that you've heard about segments. There's so many of you who still don't do anything around this concept, and that's what sucks. And I'm a big proponent of basically just getting a spreadsheet out. And I don't even care if you're going to collect the data.

00;17;03;19 - 00;17;26;21

Patrick Campbell

I think you should collect data at some point, but I think you got to get a spreadsheet out over the columns, put whoever the customer profiles you're targeting, and there's a template included with the post that you can check out. But these can take many forms. You can separate them out based on size, meaning marketing leaders at small companies, medium companies, large companies you can separate out based on roles so marketing leaders, sales leaders, etc. You can do both.

00;17;26;21 - 00;17;43;24

Patrick Campbell

You know, marketing leaders at the side, sales leaders at the site, so on and so forth. But the columns are specifically the profiles now along the rows. I want to basically fill out what are kind of the the firmer graphics or demographics of each of these folks. How do I know when I found them? What are the acquisition numbers?

00;17;43;24 - 00;18;04;11

Patrick Campbell

What are the value propositions that resonate with them? What are the features that resonate them? What's the pricing? I can expect? What is the willingness to pay? What are my unit economics? Either guessing or actually, no. But the point is, is that I want to have this central constitution within my customer base where I can basically look at, Hey, these are the people we're targeting, these are the people we're building for.

00;18;04;11 - 00;18;30;27

Patrick Campbell

And if they're not on this list or they don't exist, then we're not doing something. We're not we're not going after them. Right. And once you have this and the reason that you have this is that, remember, everything you're doing is driving a customer to a point, a conversion or justifying the product or the price. If you don't know who that customer is, you don't know who that segment is, you don't know how to build for them, there's no way you're going to be able to have an efficient funnel or flywheel, let alone an efficient pricing page, let alone an efficient pricing strategy.

00;18;31;21 - 00;18;45;11

Patrick Campbell

So it's that important and it's not going to ever be perfect. And this is the thing a lot of people, they think it's going to be perfect. We like there's this like one lead that we occasionally get that comes in is worth a lot of money and like that defies this entire paradigm. It's like, yeah, I know the paradigm.

00;18;45;18 - 00;19;03;15

Patrick Campbell

There's always things that defy a pair type, but the paradigm is there for the 95% of the time that you're getting leads at the door. And if you're just starting out, you don't have data on these things or you're not necessarily going to have the budget to go validate these things, that's fine. It's okay because you know something about your customers.

00;19;03;15 - 00;19;26;13

Patrick Campbell

It's just get it down on some sort of virtual piece of paper here. Now, you should then go validate and invalidate these different pieces, particularly the most pressing pieces within this sheet, depending on the decisions you're going to make. So if you're going to change up your price point, probably want to start by validating willingness to pay. Now, if you don't know who your key roles or segments are, like, it's going to be really, really hard to have that efficient flywheel.

00;19;26;13 - 00;19;45;17

Patrick Campbell

So you want to make sure that you're actually doing some of this validation. There's a lot of things that we've talked about with here, but just to give you kind of an example here, you don't want to fall prey to being just a complete idiot when it comes to who you're targeting. And it's really easy to because you have this vision and you're confident in your vision because you're crazy enough to think that this is going to work.

00;19;45;17 - 00;20;02;00

Patrick Campbell

Right? And that's what makes it beautiful, is that you're pushing forward not only in entrepreneur, but also as an executive. The problem is, is that if we don't validate that vision, oftentimes we we we miss out on something that we didn't know about. So to give you an example, we built profile metrics, which is our free subscription metrics tool.

00;20;02;12 - 00;20;23;17

Patrick Campbell

I thought we were geniuses who were going to be billionaires, right? You know, and it turns out that building analytics is a terrible, terrible business. Willingness to pay for them is terrible retention for analytics products is terrible and typically is terrible. Everything is typically just terrible, mainly because customers don't appreciate, you know, graphs or at least they aren't willing to pay much for them.

00;20;24;05 - 00;20;48;21

Patrick Campbell

And when we did our research, we basically found out that we were completely wrong and how we were thinking. And it put us 18 months ahead of our competitors because they were just guessing and checking their way to success rather than actually doing the research and pushing things forward. And so that's what led us to eventually give away powerful metrics for free because we were either going to shut it down, give it away for free, or ultimately trying to go upmarket, which is so what some of our competitors have done.

00;20;49;09 - 00;21;10;20

Patrick Campbell

But it's one of those things that that customer research shouldn't be under underestimated, particularly when it comes to understanding what's going on with who you're targeting. And a lot of people go, well, they're never really going to tell me what they want, and these are just like really crappy excuses. Like if we basically weren't going to do research, there would be nothing around us.

00;21;10;20 - 00;21;41;25

Patrick Campbell

There would be no scientific progress, there would be no, like business push forward. And yes, you're never truly going to absolutely know 100% of something works until you do it. But the point of research isn't to know with certainty if something's going to happen or not. It's to reduce and hedge risk. And if I'm making a $10 million decision, let alone a $100 million decision, I want to make sure I do some research so I don't just, you know, shoot from the hip as they say, and all of a sudden, you know, make a $100 million mistake or $10 million mistake or even $1,000,000 mistake where it could have been avoided by doing some basic

00;21;41;25 - 00;22;05;11

Patrick Campbell

research in the market. I think it comes from people thinking that everything needs to be perfect. Research is never perfect and it doesn't mean you don't do it. Attribution is never going to be perfect, doesn't mean you don't try to do it, doesn't mean you don't get a basic understanding. But that's the big thing. Understand the segments now in terms of like going forward, the next thing and this is where it's going to break apart a little bit can be a little bit more general.

00;22;05;15 - 00;22;22;24

Patrick Campbell

It comes down to user research and experimentation. So beyond your value metric and core segments. So those are two really big points. So we talked about the monetization game. It becomes extremely tactical and research based. You want to figure out your price point, you want to figure out the segments, you want to figure out. You're discounting your add on strategy, your packaging strategy.

00;22;23;05 - 00;22;42;08

Patrick Campbell

It's something that's never finished because again, it's that the very essence of translating your value into an optimal framework for your target customer segments until practically this means you should be experimenting something about your pricing every single quarter. And we're give you a little bit of an order of operations here in a second. But here's here's basically a list to go through.

00;22;42;08 - 00;23;00;27

Patrick Campbell

So priority one, these are the foundational pieces. Who are you targeting, at least even in a general sense? What's your value metric? Those are the two big things that we just talk through. Priority two, this gets into what is the order of magnitude price point, meaning are you a $10 product, a $500 product, etc. your positioning in your value, props and your packaging.

00;23;01;06 - 00;23;28;16

Patrick Campbell

So positioning in value props is like what best communicates what we're doing packaging. What should the feature differentiation look like? Should we have? This is an add on, should we not? Should we include it with this tier? What are the things that are actually driving willingness to pay with our product? Prior three optimizations, this next bucket, things like add ons, specific price points or your $10 product versus an $11 product price, localization, internationalization, discounting strategy, contract term optimization.

00;23;28;28 - 00;23;55;11

Patrick Campbell

These are all things that get into more and more practical pieces. And if you're in like a very like highly political environment, a.k.a if you're a company that has, you know, more than 100 team members, you might want to actually start with one of these like priority three optimizations, not because you're going to get the biggest lift, but mainly because they're easier projects to go through with all the stakeholders involved than going through, you know, trying to trying to like really go through like something that's super, super complicated.

00;23;55;24 - 00;24;19;21

Patrick Campbell

And then the fourth priority is typically things like these growth accelerators. So market expansion going upmarket or down market vertical expansion, which verticals should you go after, multiproduct, freemium, these types of things, your actual order of operations here, it's going to vary a little bit, but for most companies this is the order that I recommend going through. You know, obviously if there's a fire or you're larger and you have some of these things established, obviously you can skip around a little bit.

00;24;20;00 - 00;24;38;16

Patrick Campbell

But this is kind of the way that I would look at things. And the biggest thing that I would recommend is really, really starting small. You can and always should obviously do more. So that's a really, really big thing to kind of think about. And here's some some rapid fire. So that's kind of like overall, like some good foundations.

00;24;38;16 - 00;24;54;22

Patrick Campbell

Obviously within go deep into everything. But again, this is supposed to be a compact guide. Let me know if you want to go deeper into anything in particular. But here's some common questions and some some rapid fire data and all the data and graphs. I'm not going to be able to go through them in in detail kind of on the audio version of this.

00;24;55;04 - 00;25;20;25

Patrick Campbell

So make sure you sign up to protect the house dot com or, you know, just find me on Twitter or something like that. I'm more than happy to kind of share some information, but here's some rapid fire. So first up, localization of your pricing is huge. So revenue per customer is 30% higher. When you just use the proper currency, you probably shouldn't localize until you have like 20 to 30% or more of your of your customers coming from somewhere outside of your home region.

00;25;21;08 - 00;25;39;26

Patrick Campbell

But doing region based localization pushes that 30% gain even further, meaning you have a different price point in different regions. But localization is huge and it's mainly huge just because we all have different densities, we all different densities, we all have different willingness to pay, we all different cost of living in our different regions. So something to just think through.

00;25;40;19 - 00;26;03;11

Patrick Campbell

Second big point here, I get a lot of questions in freemium. Freemium is an acquisition model. It's not a part of your pricing. You want to think about freemium as a premium e-book that drives leads, not another pricing tier. And I'm a big fan of do not do freemium until you truly understand how to convert leads to customers because you're just going to end up with a bunch of noise and false positives when you're trying to figure out your kind of beachheads.

00;26;03;19 - 00;26;30;13

Patrick Campbell

The best folks I see, they typically are about 2 to 3 years into their business before they have some sort of freemium plan. And there are exceptions here. If you have a product that needs some network effect, if you have a top 50 growth person in your team, it's just a scalpel. It's not a sledgehammer. And when you do a freemium, just to be clear, though, you typically have much better NPS for those customers who converted from free versus those who converted from sales, you have better retention for the same bucket and you typically have much, much lower cap customer acquisition costs.

00;26;30;21 - 00;26;51;20

Patrick Campbell

Third, big point value propositions, they matter so much more than you think they do, plus or -20 to 15% depending on the industry when it comes to willingness to pay. So put another way, if you have a certain value proposition, you might diminish your willingness to pay the 15% in other value propositions. You might increase your willingness to pay by 15%.

00;26;52;10 - 00;27;11;20

Patrick Campbell

And so it's just it's just important to get those right. For thing, don't discount over 20% in some verticals. Discounting over 20% may be okay, but you're likely not in one of them, although you probably think you are because everyone's like, Oh, we need the sales. Then we discount. The problem with discounts is you typically have much higher cancellation rates.

00;27;12;10 - 00;27;31;26

Patrick Campbell

Put another way, if you want to play this multi move game and if you have a discount in play that typically goes over 50 20%, I should say even 15% starts to increase. You start to notice basically double the cancellation rate because a lot of those people are just converting to the discount. They're not converting for the actual product and those are kind of not great customers.

00;27;31;26 - 00;27;54;14

Patrick Campbell

So maybe wait a month or two when they become great fits for your product. At this point for upgrades to annual discounts, don't use percentages and make sure you try offers. So what I mean by that is offer up one month's or $100 off. That's so much better than x percent off humans. We don't understand percentages as much as well as we think we do, or at least it takes a few seconds.

00;27;54;22 - 00;28;13;09

Patrick Campbell

We don't think about it as a physical item, whereas $100 off or a one month off that look that feels physical to us. And also annuals, they see much lower churn rates, typically about 20 to 30% lower churn than monthly churn. So it's something that you want to optimize for annuals and you want to do that beyond just the initial conversion.

00;28;13;21 - 00;28;32;00

Patrick Campbell

A lot of people, they just convert or they just ask people when they sign up for an annual, that's kind of not the greatest top six. Should you and your prices a nine zeros? I get asked this question a lot. This is a very small optimization. You shouldn't worry about it. So I know your prices and nines typically evokes a discount brand.

00;28;32;27 - 00;28;49;16

Patrick Campbell

And this is something like J.C. Penney, Macy's, a lot of people have studied over the past century, and it makes the customer feel like they're getting a deal because it's like a little bit less than the whole number. When you end in zeros or even fives, you're a luxury brand. So when we look at this in software products, typically there's not much different.

00;28;49;16 - 00;29;18;27

Patrick Campbell

Once you start getting over a $200 price point, meaning people aren't really reacting to it that much. But it's one of those things you probably have to test, But that's at least a theory. Seventh point you should experiment with your pricing every single quarter. And I know I like really belabor that point already, but the data that you're seeing, if you're looking at the email or the blog post, basically those folks who change their prices every every quarter, they're typically seeing the highest revenue per customer growth rates.

00;29;19;20 - 00;29;41;18

Patrick Campbell

And then put another way, if you look at your current RPU, ACV, however, you're measuring revenue per customer. If that number is flat, you're not taking advantage of pricing power. And that's something that you should be doing. Eighth point case studies, they do boost willingness to pay about 15 to 20%. So make sure you're using case studies. Even if you're using testimonials, it increases things by about 5 to 10%.

00;29;42;08 - 00;30;04;28

Patrick Campbell

Social proof is is important. Ninth point design having proper design for your product. And again, this does not mean it necessarily looks pretty. It's just good. It's well-designed for the customer base. You're going after increased willingness to pay by about 20 to 25% and in the most extreme cases can actually increase willingness to pay by 30%. So just make sure you're taking care of your user experience through design seriously.

00;30;05;10 - 00;30;23;14

Patrick Campbell

And in the last point, this is and the last one, I kind of get questions about integrations that boost retention and willingness to pay. So I'll put another way, the more integrations a customer is using of your product, they typically have a higher willingness to pay and they're also retained at a much, much higher rate. This feels super intuitive, obviously, but we actually have some data on it.

00;30;23;14 - 00;30;46;26

Patrick Campbell

You actually increase willingness to pay by about 10 to 30% depending on the number of integrations. And retention, I believe is boosted by about 10 to 15% on an absolute basis as well. So it's super, super powerful. And so with that, hopefully you got the core value metrics for your customers. And then we went through a bunch of different fun little pieces and they often get questions about and if you have some questions and some of those obviously let me know.

00;30;46;26 - 00;31;01;03

Patrick Campbell

But with that help, you're all going to have a good rest of the week here. I've enjoyed my time going through all this, you know, brain dumping of all this knowledge. But if you have any other questions, obviously respond to the email, make sure you're signed up for the email to get all the data and fun stuff and protect.

00;31;01;03 - 00;31;12;00

Patrick Campbell

Also dot com. And I will see you all or hear you see you all. I guess I won't see you, but I will. I will communicate with you all next week. Have a good rest of the week after weekend. We'll see.

00;31;16;14 - 00;31;45;03

Ben Hillman

Thanks for listening. If you enjoyed this episode, we'd really appreciate it if you left a five star review of this podcast or the equivalent rating wherever you listen or watch. Also, make sure you subscribe to and tell your friends about Protect the Hustle, a podcast from Al Roker, the largest, fastest growing media network dedicated to the world of subscriptions.