It’s time to throw the age-old theory of “one product, one price” out the window.

Sure, a single package at a fixed price might attract customers and spur growth and keep things simple in the early days of your company. But, ultimately, failing to get scaled pricing right is a death knell for SaaS products.

It’s because customers are human—and humans are fickle. Some know the precise features and benefits they need, and they are willing to pay a premium to get it. Others run a tight ship, only paying for what they need and shunning what they don’t.

Every customer has different needs and is willing to pay a different amount—and your pricing needs to accommodate all of them. It sounds simple, but the mind boggles at how many SaaS founders ignore this simple tidbit. Even if you did happen across a simple, static pricing model that worked for everyone, you’d end up leaving huge revenues on the table.

So how do you design a scaled pricing strategy that covers a wide range of customers while still maximizing your revenue? How can you engineer your pricing for revenue growth, make more money per customer, and protect your business against inevitable slow periods?

Let’s find out.

What is scaled pricing?

Scaled pricing, also known as tiered pricing, lets subscription companies target a wide variety of customer types with differing product needs and willingness to pay. With scaled pricing, customers are given the option of paying more for additional value—whether that value comprises more users, extra features, or higher product usage—all of which helps boost your revenue.

For customers, a well-engineered price scale offers flexibility compared with a simpler pricing scheme. Small customers can get started with a service they can afford and then scale how much they pay as they inevitably expand.

For you, scaled pricing means more revenue. Larger customers that extract more value from your service (whether by seats, feature usage, or utilization) pay more, and the clear upgrade path means you automatically gain more revenue from customers as they grow.

How scaled pricing can drive growth

Scaled pricing is one of the biggest growth levers for SaaS companies. On top of driving more up-front revenue from new customers, a well-architected pricing strategy can increase how much you’re earning from existing customers, offsetting customer churn and helping you weather slowdowns in your business.

Revenue growth

Your software is valuable, and your pricing should match that value. I’ll never stop beating the value-based pricing drum. After all, a 1% improvement in price optimization results in an average profit boost of 11.1%. That’s no small change.

Scaling your pricing lets you earn more revenue from customers willing to pay for it. It’s why car manufacturers offer different spec levels within the same model, why organic vegetables are more expensive than their nonorganic counterparts, and why enterprise companies have very different purchasing habits than small business owners. Create more value, charge more money.

More revenue per customer

Growth doesn’t always mean “more customers." You can also grow through expansion revenue and upsells. Customers inevitably need to expand, and when they do, your pricing should accommodate that growth.

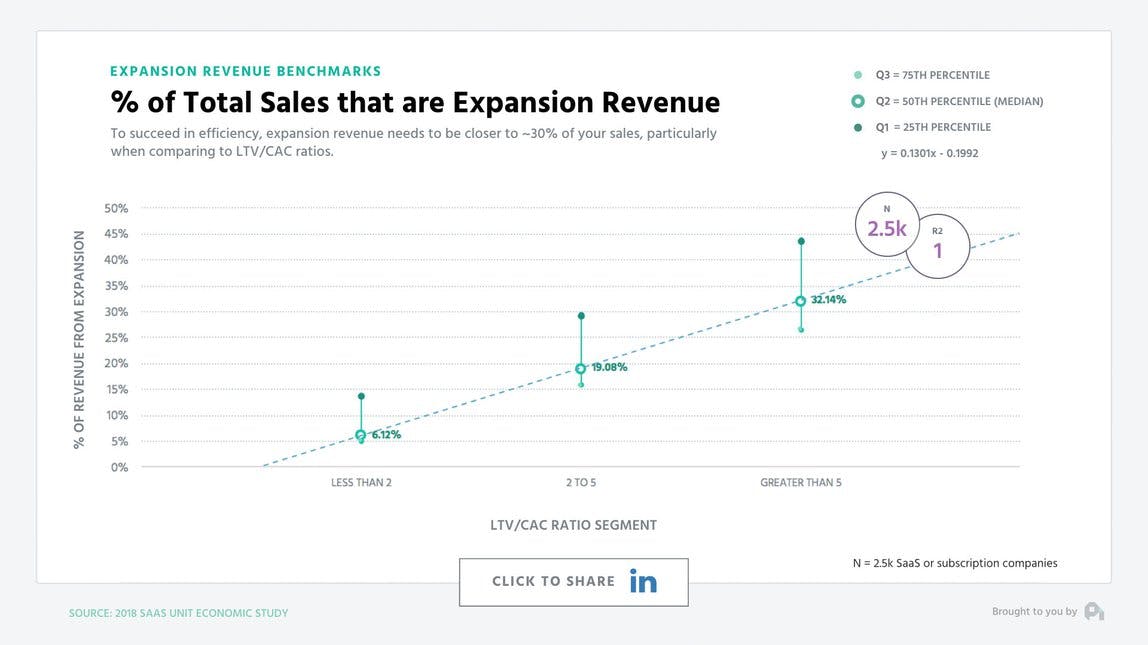

The most efficient SaaS companies—when looking at their lifetime value (LTV) to customer acquisition cost (CAC)—are fueling that efficiency from expansion revenue. There’s a clear relationship between expansion revenue and the ratio of LTV to CAC—the top companies (those with an LTV to CAC above five) see almost one-third of their total revenue from expansion.

Expansion revenue accounts for over 30% of total sales for top SaaS companies.

As a customer consumes more and more of what you’re selling, he or she is more than happy to pay more. And eventually, all that sweet expansion revenue means your revenue churn rate drops through the floor.

Negative revenue churn

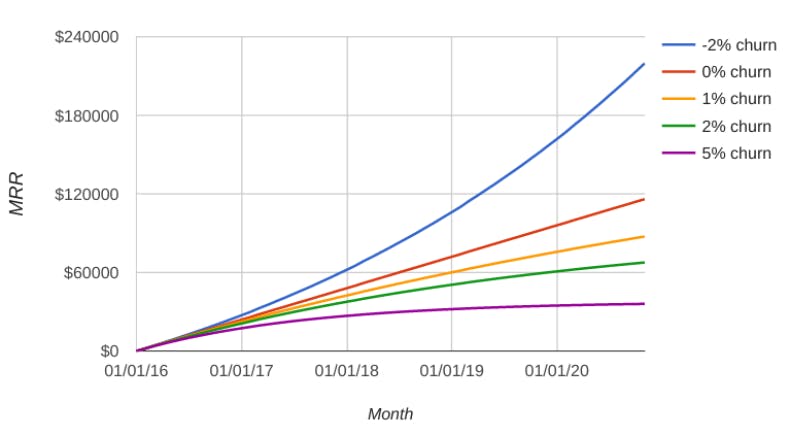

Scaled pricing lets you offset much or all of the revenue you’re losing to customer churn through expansion revenue. Baking expansion revenue into your pricing model means your average revenue per user (ARPU) increases automatically as users grow their businesses and consume more of your service.

Average revenue per user increases, revenue churn drops, and eventually you reach the holy grail of negative churn that so many SaaS founders seek.

Scaled pricing can lead to negative revenue churn and a sustainable SaaS business.

Tom Tunguz compares the life cycle of companies with net negative churn rates to “high-yield savings accounts,” and it's an apt comparison. Scaled pricing makes it much easier for your company to achieve negative churn and continue to thrive during those inevitable periods of slow growth and high churn.

How should pricing be scaled

Finding the right ways to scale your pricing is vital to SaaS success. Execute well and you can scale to enable both the smallest and largest customers. Done poorly, you’ll leave a lot of money on the table.

Let’s look at the different axes you can use to scale your pricing, and some examples of companies finding success with each method.

Scale based on user count

Scaling pricing based on the number of users is super common among SaaS companies, but it’s often the least profitable scaling method as well.

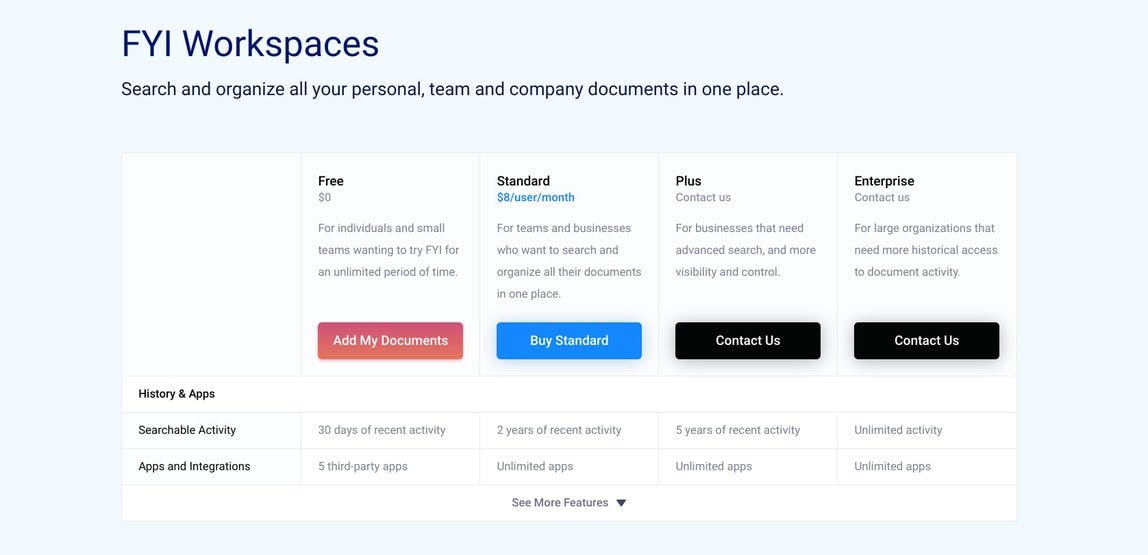

It’s popular because it’s easy for users to understand, and it’s subsequently an easy sell. The predictability is also a boon for fast-growing SaaS companies—revenue forecasts become easy when they’re only based on one factor. Check out this example from document organization tool FYI:

FYI scales its pricing based on user count.

The problem? The number of users is rarely where value is derived for SaaS companies. Adding one more person makes no real difference to the value the software provides. Instead, scaling around feature tiers, product utilization, or customer willingness to pay can be far more profitable.

Scale based on feature tiers

Just about every SaaS company you happen across uses some kind of product or feature tiers to scale their pricing.

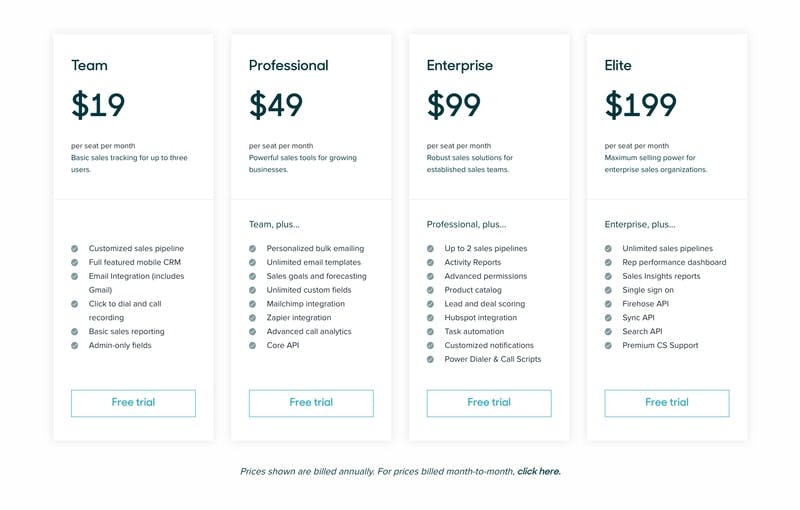

Customer support platform Zendesk offers different pricing tiers for its Sell CRM software that unlock more features as customers scale:

Zendesk Sell scales its pricing based on feature tiers.

Feature-based pricing tiers can be super effective. The most successful SaaS companies closely match their feature tiers to their target customer personas, tailoring their offering to meet the needs of both the smallest businesses and largest enterprises.

Although offering too many tiers can sometimes confuse customers, this approach lets you align your pricing more closely with your value metric, allowing you to capture more value (and revenue) as customers expand.

Another downside of feature-based pricing is that it places an arbitrary upper bound on how much you can charge heavy users. If your biggest customers reach the top tier and continue needing more, you need a way to capture that value—and that’s where scaling based on product usage comes in handy.

Scale based on product usage

If your core value metric is based on how much of your service your customers use each month, you should be charging based on utilization. Metrics like the number of mailing list subscribers, database records, or network bandwidth are all great options for scaling your pricing.

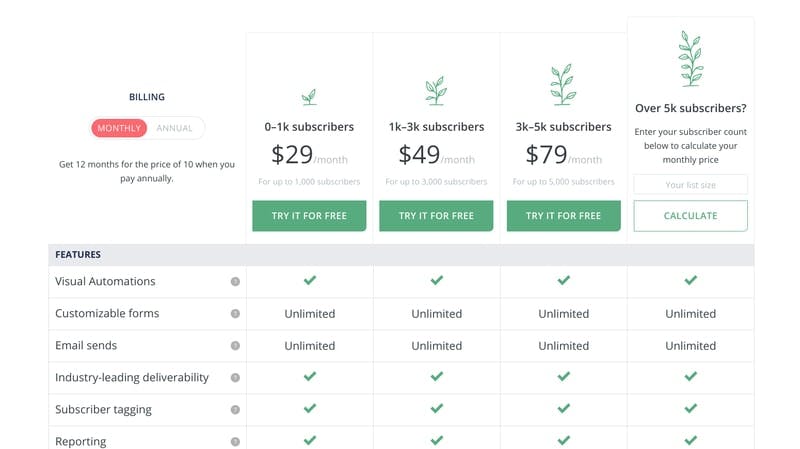

Email service provider ConvertKit, for example, scales its pricing based on the number of email subscribers:

ConvertKit scales pricing based on product usage.

As customers expand, there are two different options for scaling prices even further. You can choose either tiered usage pricing, so once you fill up a tier, all units from the next tier cost less, or you can choose volume pricing, so once you hit a particular number, all units cost less.

Pricing based on utilization can be highly profitable, but it hasn’t caught on as a popular pricing strategy for most SaaS companies. The usage model works best for companies where more use equals more value, like email service providers or hosting companies, but it isn’t super common in SaaS. Because usage-based pricing disconnects the value of your service from the product itself, though, it’s harder to see how valuable your product really is to customers. For that, we turn to scaling based on willingness to pay.

Willingness to pay

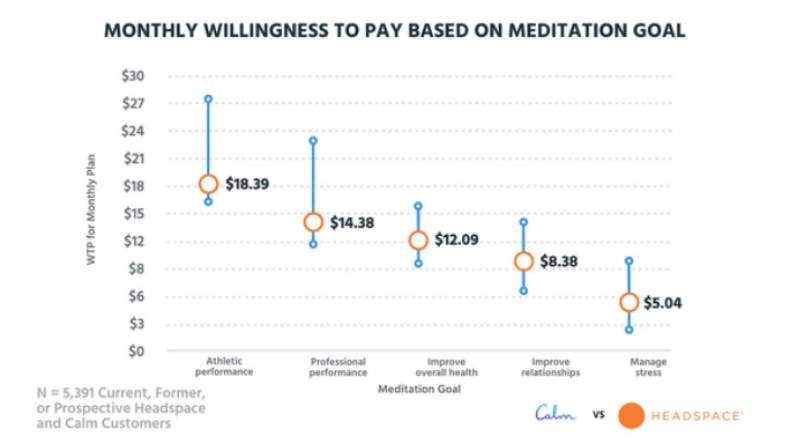

Regardless of whether you’re selling software or soft serve, every customer is different, and each customer type is willing to pay a different amount for the value you provide.

Willingness to pay depends on a number of factors, with customers’ budgets and perceived status being two of the strongest contributors.

Everyone has a different history that informs their perception of your pricing. For example, many customers are willing to pay top dollar for the (perceived) best and will always favor a premium or enterprise solution, even if it’s offered at a high price. Some customers are more budget-conscious and demand a low-cost option.

Willingness to pay is also driven by the seriousness of the problem you’re solving for customers. Think about painkillers versus vitamins. If your product is a painkiller that customers simply cannot continue doing business without (like an enterprise CRM), they’ll always buy the best possible solution for their problem; consequently, you should price higher. If your software is a “vitamin” product, like the meditation app Headspace, you might only charge a few dollars a month.

You should always scale your pricing according to customers’ willingness to pay.

No matter which end of the spectrum your product falls on, you should always keep in mind the perceived importance of your product when scaling your pricing.

Mix and match

The best part about scaled pricing models? You don’t have to pick just one. Ecommerce conversion recovery platform CartHook, for example, leverages a hybrid pricing strategy. It charges a base monthly access fee plus a percentage of sales revenue recovered by the service. And since the percentage is lower than what CartHook recovers, the service is a no-brainer for many ecommerce stores.

Often, a hybrid model that scales along multiple axes—say, user count and feature tiers—can be the most profitable.

Scale your pricing for SaaS success

Effective pricing is an art and a science. Get it right and you’ll set yourself up for success and create a prosperous and profitable business. Get it wrong and you’ll stunt your growth and lose out on potential revenue.

Grab your free Profitwell Metrics account, and take a hard look at your pricing, and whether you’re scaling your prices for maximum growth and profit. Make sure your pricing appeals to all of your different customer types, and that it’s engineered for expansion as your customers grow.

The payoff is worth it, I promise.