Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out of business. Here's what you need to know.

- Definition of pricing

- What are pricing strategies?

- Importance of pricing strategy

- Top 7 pricing strategies

- 3 real-world examples

- How to create your strategy

- Determine value metric

- Customer profiles & segments

- User research & experiments

- Bonus: 10 data-driven tips

- Industry differences

- Final takeaway

- Pricing strategies FAQs

Too many businesses set their pricing without putting much thought into it. This is a mistake causing them to leave money on the table from the beginning. The good news is that taking the time to get your product pricing right can act as a powerful growth lever. If you optimize your pricing strategy so that more people are paying a higher amount, you'll end up with significantly more revenue than a business who treats pricing more passively. This sounds obvious, but it's rare for businesses to put much effort into finding the best pricing strategy.

This guide will cover everything you need to know about setting a pricing strategy that works for your business.

Check out this introduction video made by the Paddle Studios team.

Definition of pricing

Pricing is defined as the amount of money that you charge for your products, but understanding it requires much more than that simple definition. Baked into your pricing are indicators to your potential customers about how much you value your brand, product, and customers. It's one of the first things that can push a customer towards, or away from, buying your product. As such, it should be calculated with certainty.

What are pricing strategies?

Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be. There are different pricing strategies to choose from but some of the more common ones include:

- Value-based pricing

- Competitive pricing

- Price skimming

- Cost-plus pricing

- Penetration pricing

- Economy pricing

- Dynamic pricing

Pricing is an underutilized growth lever

Many companies focus on acquisition to grow their business, but studies have shown that small variations in pricing can raise or lower revenue by 20-50%. Despite that, even among Fortune 500 companies, fewer than 5% have functions dedicated to setting the best price possible. There's a missed opportunity in the business world to see immediate growth for relatively little effort.

Navigating PLG billing and pricing? Read our latest guide on product-led SaaS

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

The importance of nailing your pricing strategy

Having an effective pricing strategy helps solidify your position by building trust with your customers, as well as meeting your business goals. Let's compare and contrast the messaging that a strong pricing strategy sends in relation to a weaker one.

A winning pricing strategy:

- Portrays value

The word cheap has two meanings. It can mean a lower price, but it can also mean poorly made. There's a reason people associate cheaply priced products with cheaply made ones. Built into the higher price of a product is the assumption that it's of higher value.

- Convinces customers to buy

A high price may convey value, but if that price is more than a potential customer is willing to pay, it won't matter. A low price will seem cheap and get your product passed over. The ideal price is one that convinces people to purchase your offering over the similar products that your competitors have to offer.

- Gives your customers confidence in your product

If higher-priced products portray value and exclusivity, then the opposite follows as well. Prices that are too low will make it seem as though your product isn't well made.

A weak pricing strategy:

- Doesn't accurately portray the value of your product

If you believe you have a winning product, and you should if you are selling it, then you need to convince customers of that. Setting prices too low sends the opposite message.

- Makes customers feel uncertain about buying

Just as the right price is one that customers will pull the trigger on quickly, a price that's too high or too low will cause hesitation.

- Targets the wrong customers

Some customers prefer value, and some prefer luxury. You have to price your product to match the type of customer it is targeted towards.

Top 7 pricing strategies

Let's now take a closer look at the seven most common pricing strategies that were outlined above with more from Paddle Studios.

Click on any of the links below for a more in-depth guide to that particular pricing strategy.

1. Value-based pricing

With value-based pricing, you set your prices according to what consumers think your product is worth. We're big fans of this pricing strategy for SaaS businesses.

2. Competitive pricing

When you use a competitive pricing strategy, you're setting your prices based on what the competition is charging. This can be a good strategy in the right circumstances, such as a business just starting out, but it doesn't leave a lot of room for growth.

3. Price skimming

If you set your prices as high as the market will possibly tolerate and then lower them over time, you'll be using the price skimming strategy. The goal is to skim the top off the market and the lower prices to reach everyone else. With the right product it can work, but you should be very cautious using it.

4. Cost-plus pricing

This is one of the simplest pricing strategies. You just take the product production cost and add a certain percentage to it. While simple, it is less than ideal for anything but physical products.

5. Penetration pricing

In highly competitive markets, it can be hard for new companies to get a foothold. One way some companies attempt to push new products is by offering prices that are much lower than the competition. This is penetration pricing. While it may get you customers and decent sales volume, you'll need a lot of them and you'll need them to be very loyal to stick around when the price increases in the future.

6. Economy pricing

This strategy is popular in the commodity goods sector. The goal is to price a product cheaper than the competition and make the money back with increased volume. While it's a good method to get people to buy your generic soda, it's not a great fit for SaaS and subscription businesses.

7. Dynamic pricing

In some industries, you can get away with constantly changing your prices to match the current demand for the item. This doesn't work well for subscription and SaaS business, because customers expect consistent monthly or yearly expenses.

Three real-world pricing strategy examples

Real-world pricing strategy examples are the best way for a business to better understand the above-listed pricing strategies. Evaluating other businesses' approaches can be a good starting point but keep in mind that the right pricing strategy is based on math, market research, and consumer insights. For now, let’s look at the pricing strategy examples of some of the biggest brands of today:

1. Streaming services

Have you noticed that you pay roughly the same amount for Netflix, Amazon Prime Video, Disney+, Hulu, and other streaming services? That's because these companies have adopted competitive pricing, or at least a form of it, called market-based pricing.

2. Salesforce

When Salesforce first came out, they were the only CRM in the cloud. (It wasn't even called 'the cloud' back then!) Armed with ground-breaking deployment and a target customer of a large enterprise, Salesforce could charge what they wanted. Later, after they'd grown, they were able to lower prices so small businesses could sign up. This is a classic example of price skimming.

3. Dollar Shave Club

At one time, you couldn't turn on your TV without an ad for Dollar Shave Club telling you how much cheaper they were than razors at the store. Although an aggressive marketing strategy and advertising like that is unusual for the pricing model, they were nevertheless employing economy pricing. It worked out well for them. They were acquired by Unilever in 2016 for a reported $1 billion.

How to create a winning pricing strategy

In the beginning, the actual number you're charging isn't that important.

There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.

Instead, understanding the following is much more important:

- Finding your value metric

- Setting your ideal customer profiles and segments

- Completing user research + experimentation

This video from Paddle Studios goes deep on mastering a winning pricing strategy.

Step 1: Determine your value metric

A “value metric” is essentially what you charge for. For example: per seat, per 1,000 visits, per CPA, per GB used, per transaction, etc.

If you get everything else wrong in pricing, but you get your value metric right, you'll do ok. It's that important. Partly because it bakes lower churn and higher expansion revenue into your monetization.

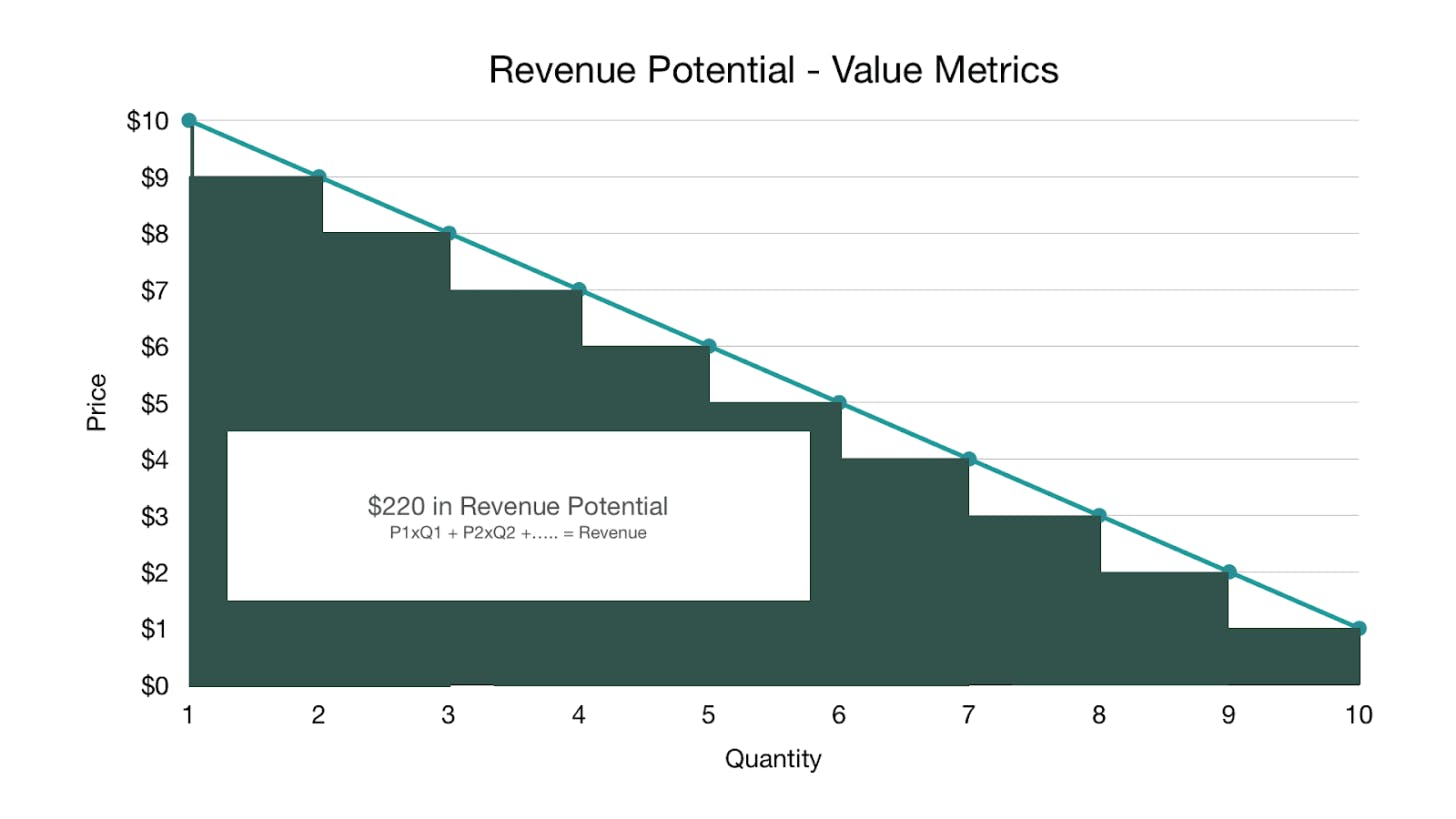

A pricing strategy based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

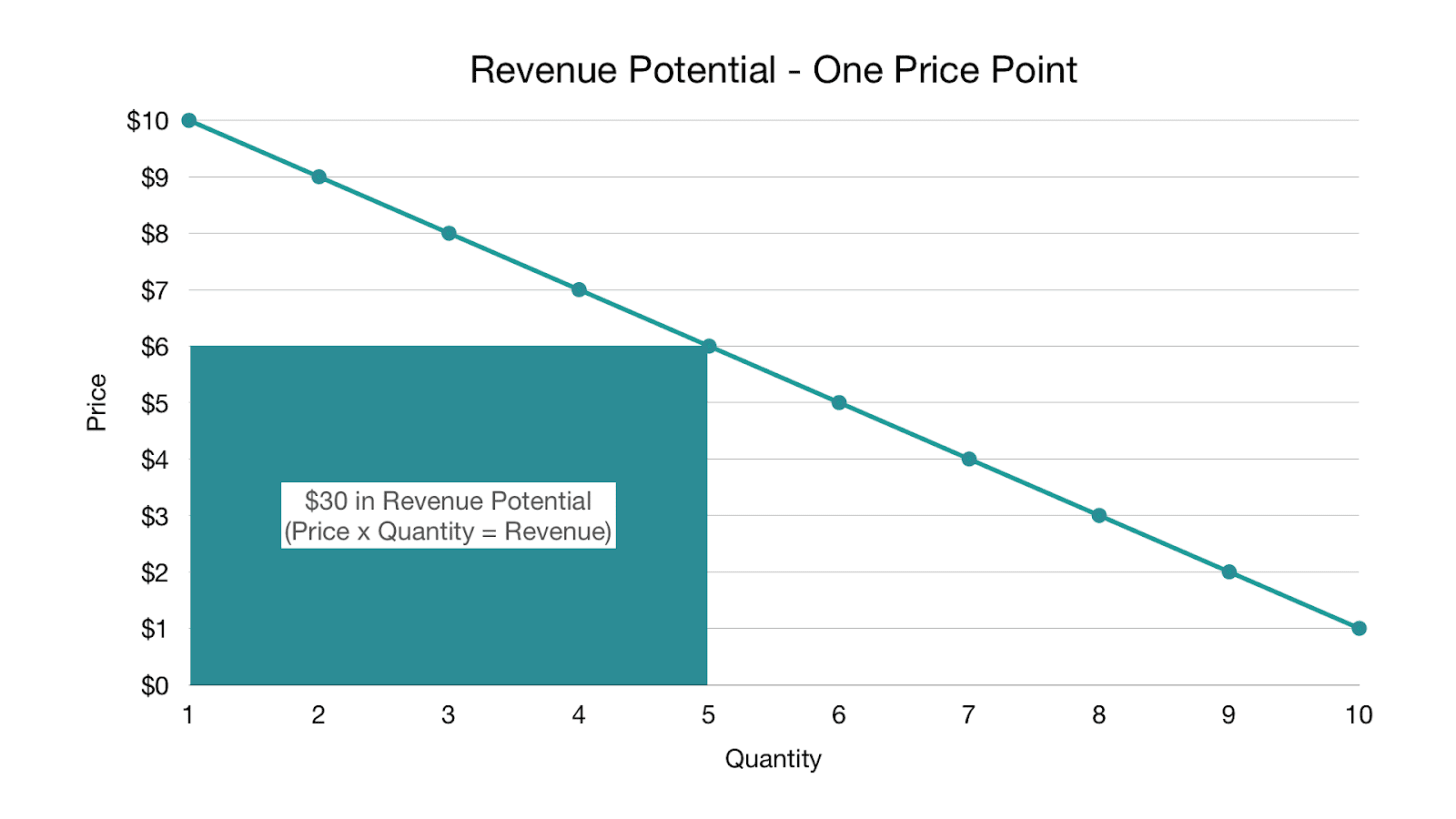

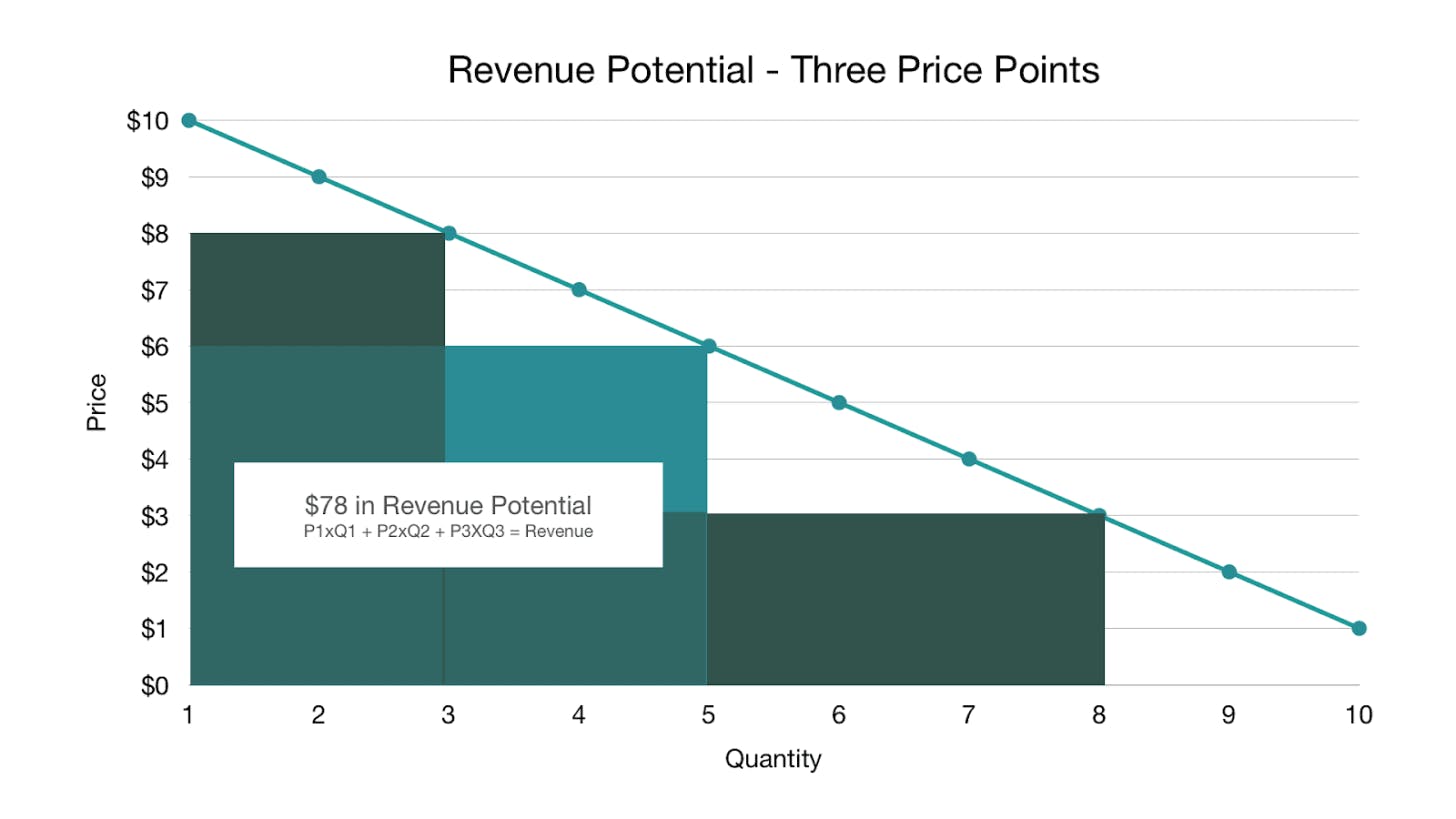

If you remember your high school or college economics class, the professor put a point on a demand curve for the perfect price and said “the revenue a firm gets is the area under that point.” The problem here is: what about all that other area under the curve? You’re missing out on that revenue by charging a flat monthly fee.

“Good, better, best” pricing strategy is a bit more advantageous, because you end up with three points on our trusty demand curve, and thus more revenue potential. You see this problem among many eCommerce businesses and retailers whose products are constrained by being physical goods—the car with the basic package vs. the car with the stereo and sunroof vs. the car with everything. In software, it’s thankfully dying out, but you’ll still see it with mass-market products: Netflix, Adobe Creative Cloud, etc.

A value metric, however, allows you to have essentially infinite price points—maximizing your revenue potential. In practice, you’ll never show infinite price points on your pricing page, sales deck, or mobile conversion page, but you may have a new customer come in at a certain level and then grow.

Value metrics also bake growth directly into how you charge because as usage or the amount of value received goes up (and those are not the same thing), the customer pays more. If they end up using or consuming less, they pay less (and thus avoid churning). This is why companies using value metrics are typically growing at double the rate with half the churn and 2x the expansion revenue when compared to companies that charge a flat fee or where the only difference between their pricing tiers are features.

To determine your value metric, think about the ideal essence of value for your product—what value are you directly providing your customer?

In B2B, it's likely going to be money saved, revenue gained, time saved, etc. In DTC, it may be the joy you bring them, fitness achieved, increased efficiency, etc. Obviously, we can't measure all of these, but if you can, and your customer trusts your measurement (meaning you say you saved them $100 and they agree you saved them $100), that’s your value metric.

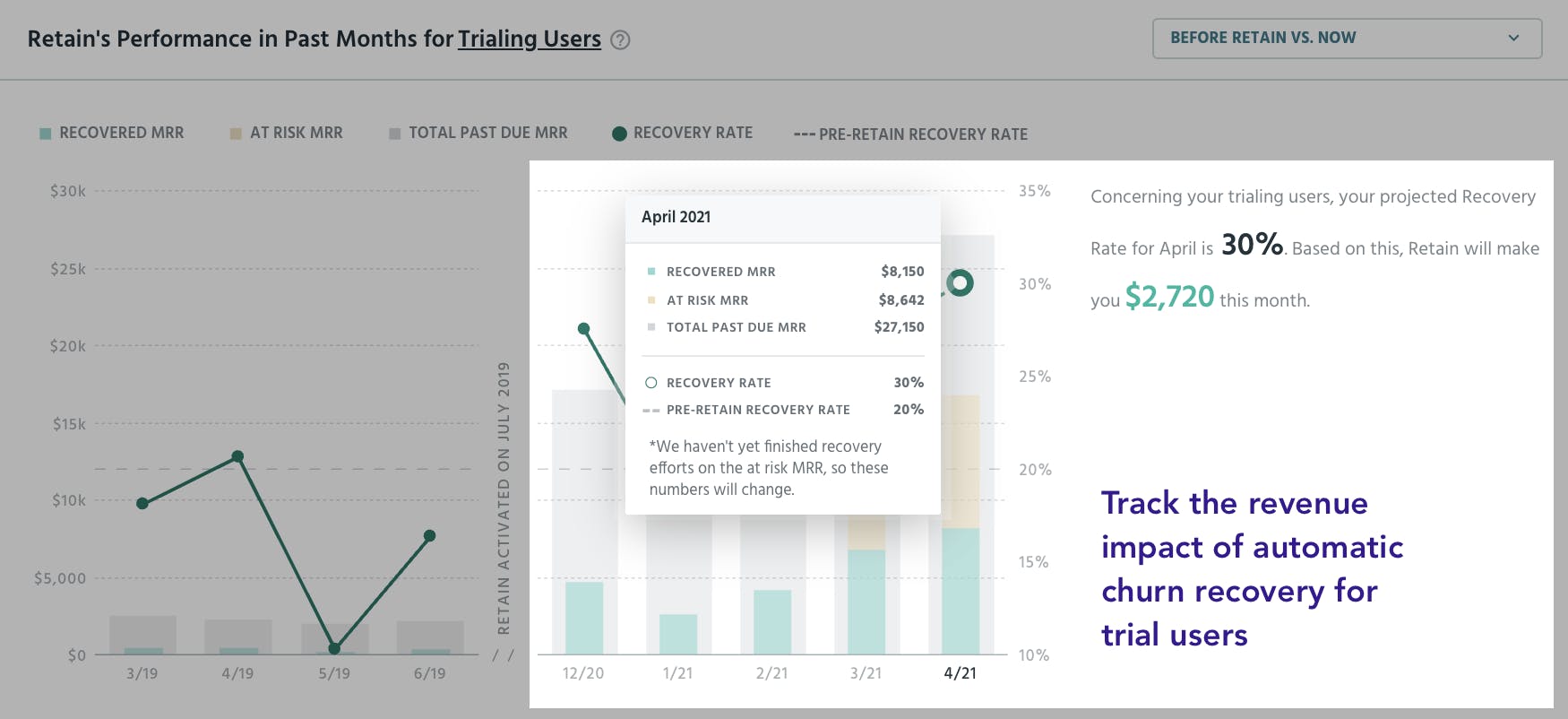

As an example, the perfect value metric for Paddle Retain (our churn recovery product) is how much churn we recover for you. We can measure this, and our customers agree to the measurement, so we can charge on that axis. Other pure value metric products include MainStreet, which handles government paperwork to automatically get you back tax credits—you pay a percentage of the money saved.

Most of you won't have a pure value metric, so the next step is to find a proxy for that metric. Take for example HubSpot’s marketing product. Their pure value metric is the amount of revenue their tool drives for your business. This is hard to measure and hard for the customer to agree to in terms of what percentage of credit HubSpot deserves for revenue from a blog post. Proxies for HubSpot are things like the number of contacts, number of visits, number of users, etc.

To find the right proxy metric, you want to come up with 5-10 proxies and then talk to your customers and prospects. You’ll typically find 1-2 of these pricing metrics will be most preferred amongst your target customers. You then want to make sure those 1-2 also make sense from a growth perspective. Your larger customers should be using/getting more of the metric, whereas your smaller customers should be using/getting less of the metric. You also want to make sure the metric encourages retention.

When we look at HubSpot, if they were to primarily price on “number of seats”, folks could share a login and HubSpot wouldn’t make much more money on large customers vs. small. Ironically they wouldn’t get as many people invested in HubSpot, because there’d be friction to adding additional seats. Instead, if they give unlimited seats and price based on “number of contacts” there’s minimal friction to getting as many people into HubSpot as possible to do activities (e.g., blog posts, email campaigns, landing pages, etc.) that then produce contacts.

The result: HubSpot’s marketing product’s value metric is “contacts”, which ensures growth is baked directly into how they make money. The usage drives the metric, which therein drives revenue. Most importantly customers small, medium, and large are all paying at the point they see the value and then can grow.

Some other examples:

- Wistia charges by the number of videos or channels you use/have

- Zapier invented the concept of zap (connection of software) and charge based on time to connect

- Theater in Barcelona charged based on the number of laughs

- Husqvarna charges based on time for lawn care products vs. making you buy them

- Rolls Royce charges per mile for airplane engines. They own the engines on the plane you own and do all the maintenance. Cool model.

- Fresh Patch charges based on the amount of grass you want per month for your dog—yes they deliver grass to you monthly

As a side note, you should stop pricing based on seats for products where each seat doesn’t provide a unique experience. For instance, imagine you're an AE using a CRM. If you log into the account of the AE sitting next to you, you can’t really do your work because you are only seeing their leads and accounts. Conversely, if you were a marketing exec and were to log in to another marketing manager’s account in HubSpot, you could do all the work you need to. Thus, for the latter, seats are not the right value metric.

Per-seat pricing is a relic of the perpetual license era when we couldn’t measure usage or value enough within our products. We’re beyond that point, so use the above as a good litmus test.

Step 2: Determine your customer profiles and segments

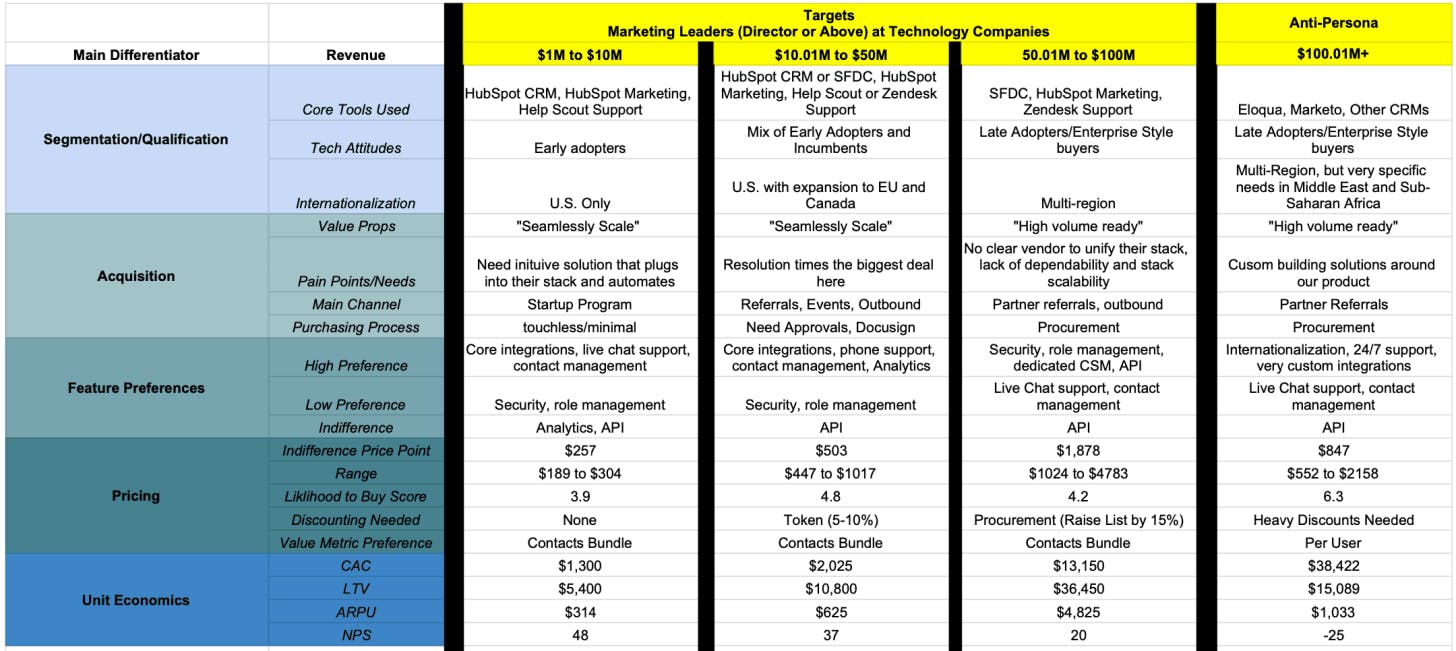

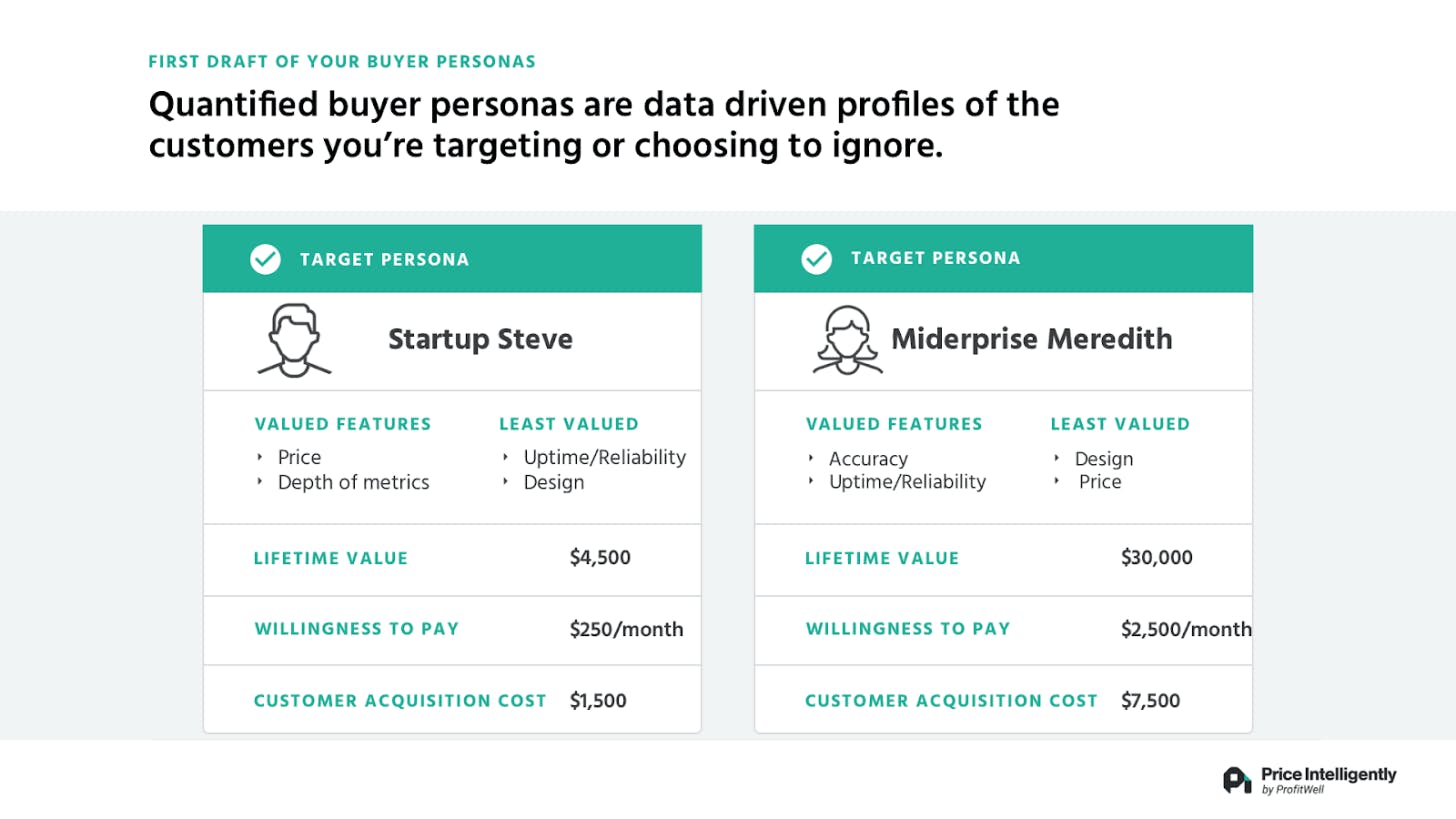

The second key component of your pricing strategy is determining your target segment and ideal customer profile. We've all heard about personas, and you may be rolling your eyes at the concept, but most personas are useless because they aren’t quantitative enough. When used properly, quantified personas and segments are beautiful tools. The information needs to go beyond just cute names like “Startup Steve" with a cute avatar, and cute meetings where people tell you they’re targeting "developers."

To get quantified personas, you need to pull out a spreadsheet. Here’s a template you can use.

1. Columns: Customer profiles you're targeting

These can take many forms, but the ultimate goal is to be as specific as possible so that you not only know who you’re targeting but how to monetize and retain them. Pragmatically, you typically separate these customer profiles based on size or role (or both). For example, a marketing automation product may target the following profiles:

- Marketing leaders (Director and higher) at companies $1M to $10M

- Marketing leaders (Director and higher) at companies $10.01M to $50M

- Marketing leaders (Director and higher) at companies $50.01M to $100M

The point is you can’t be everything to all people and you need to understand who you’re targeting in order to make better decisions.

2. Rows: Characteristics of each profile to help you differentiate between them

- Most valued features

- Least valued features

- Willingness to pay

- Lifetime value (LTV)

- Customer acquisition costs (CAC)

- ... and any other metric or category you think could be useful

If you're just starting out or you don't have some of this data, it’s fine. Still fill it out though with your hypotheses. You know something about your customers.

Next, you then need to validate (or invalidate) the most pressing hypothesis in that spreadsheet based on the decisions you’re going to make. If you're going to validate a new feature for a particular segment, then that's where you should start. Price point the biggest question? Start by researching the price point with each of these roles/segments.

If you don't know who your key roles/segments are, there's no way in hell you’ll set up an efficient growth flywheel, let alone an optimized pricing strategy. Personas act as a constitution within your business to centralize your focus and arguments about direction.

If you don't do segment and persona analysis, you better be able to raise a ton of money. I guarantee you there's some persona or segment on some vision document or in that euphoric part of your entrepreneurial brain that is completely wrong for your business. I see it all the time. Even I—someone who thinks about segments and customer research all the time—fall prey to being an absolute idiot with who we should target.

When we built ProfitWell Metrics (our free subscription metrics tool) I thought we were geniuses who were going to be billionaires. Turns out analytics products are terrible. Willingness to pay for them is terrible; retention for them is terrible; NPS is terrible. Everything is just terrible, mainly because customers don't appreciate graphs or at least aren't willing to pay much for them. When we did our research this became obvious and put us 18 months ahead of our competitors, pushing us to change up the positioning of the product to freemium, which has fueled our business ever since (oh and our NPS is 70, because we massively over-deliver a free product better than the paid competition).

Never underestimate the power of focusing on the customer through research. You should never, ever just do what they ask, but you need to be an anthropologist who knows them better than anyone else.

Step 3: User research + experimentation

Beyond your value metric and core segments, the monetization game becomes extremely tactical and research-based. Figuring out your price point involves researching those segments and then making decisions in the field. Same with discounting, add-on, and packaging strategies. The point: monetization is never finished because it’s the very essence of translating your value into an optimal framework for your target customer segments.

Practically this is why you should be experimenting with your monetization every quarter. Experimentation can get tricky and have a few quirks, but you’ll find it’s similar to most growth frameworks out there (which are all versions of the scientific method).

Here’s a good prioritization list of what business owners should attack in optimizing their monetization strategy once they have the core segments and value metric figured out:

Priority 1: Foundational [see above]

- Core customer segments

- Value metrics

Priority 2: Core

- Order of magnitude price point (are you a $10 product vs. a $500 product)

- Positioning and value props

- Packaging

Priority 3: Optimizations

- Add-on strategy

- Specific price point (are you a $10 product vs. a $11 product)

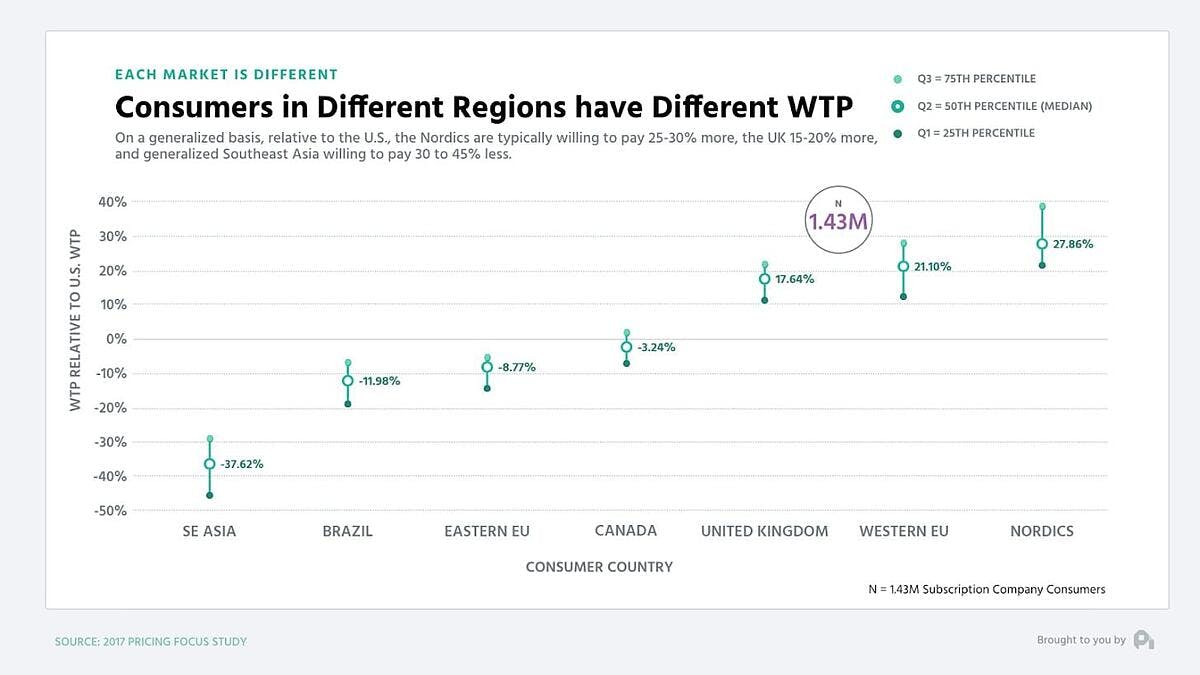

- Price localization/internationalization

- Discounting strategy

- Contract Term optimization

Priority 4: Growth accelerators

- Freemium

- Market expansion (going up or down market)

- Vertical expansion

- Multi-Product

Your true order of operations with monetization will vary, but for the most part, all companies should work through the foundational and core sections before moving to the optimizations and growth accelerators. If you’re larger or there’s a fire, you may start with an optimization. In fact, this is sometimes a good idea. Something more scoped like “price localization” can help get momentum, be a forcing function to clean up tech and experimentation stacks, and mitigate political conversations. Remember, monetization is something that’s important, uncomfortable, and something you likely don’t know much about, so progress is better than nothing. Start small. You can (and should) always do more.

Bonus: 10 rapid-fire pricing strategy tips rooted in data⚡

In case you're still hungry for more tips on nailing your pricing strategy and achieving maximum profitability, look no further. We've got you covered:

1. You should localize your pricing to the currency and willingness to pay of the prospect's region

- Revenue per customer is 30% higher when you just use the proper currency symbol

- Having different price points in different regions increases revenue per customer further, and is justified based on different consumer demands in different regions

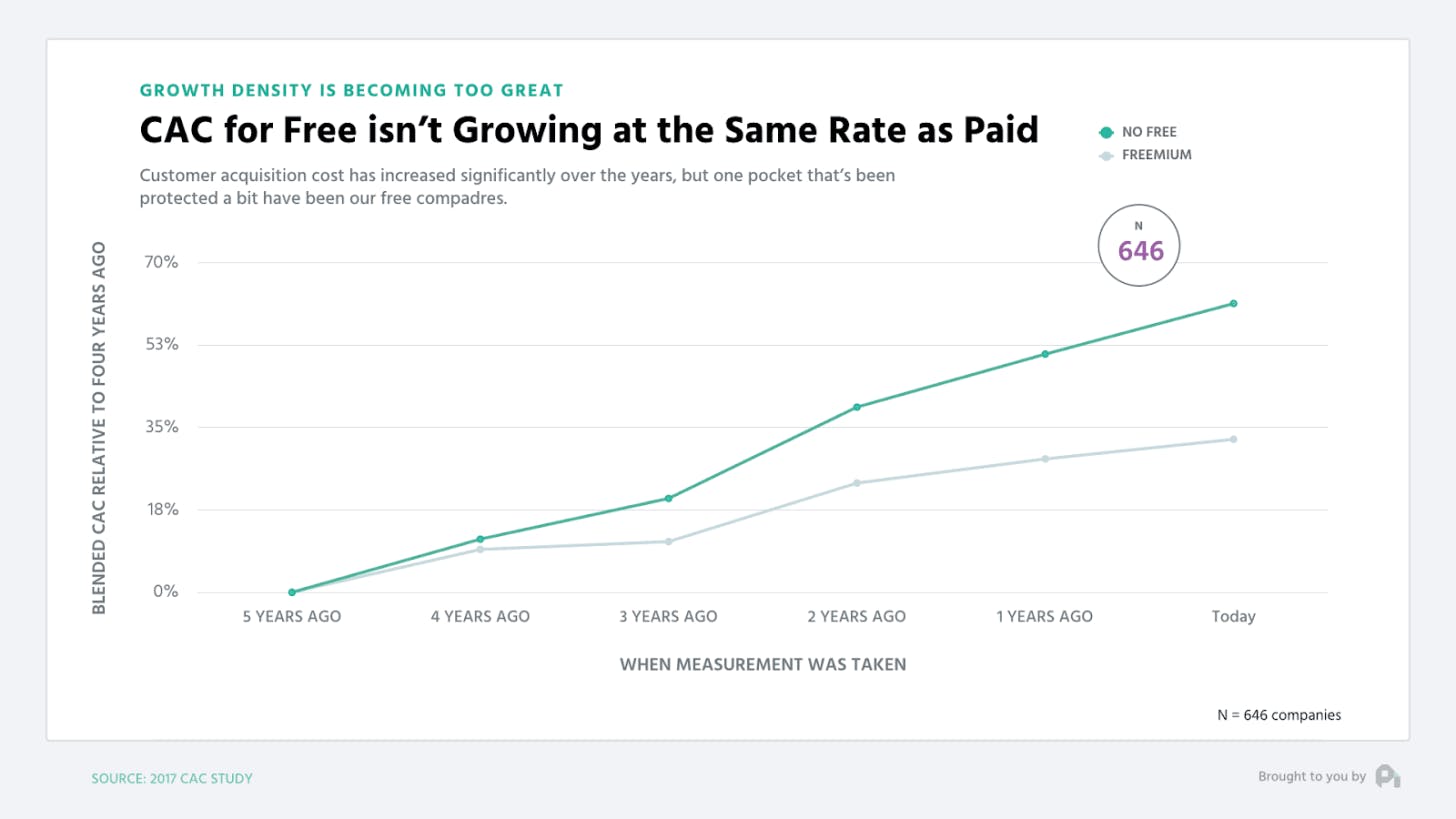

2. Freemium is an acquisition model, not a part of pricing

- Think of freemium as a premium ebook driving leads, not another pricing tier

- Don't do freemium until you truly understand how to convert leads to customers, because you’ll end up increasing noise or false positives when you’re trying to figure out your segment beachheads. The best folks who deploy free typically don’t implement freemium until two to three years into their business. The exceptions to this notion are if you have a very specific need or network effect (eg., marketplaces, social networks, etc.) or if you have a top 50 growth person on your team.

- To be clear, we're not saying DON’T do freemium. we're saying it's a scalpel, not a sledgehammer that requires thought. A lot of people end up reading our articles on freemium and end up going, “Cool, let’s do freemium and we’ll be a unicorn.” I’m being pragmatic in that you need to realize freemium is fantastic, but doing freemium properly takes a lot of effort and nuance.

- Paid users who convert from free tend to have higher NPS, better retention, and much lower CAC.

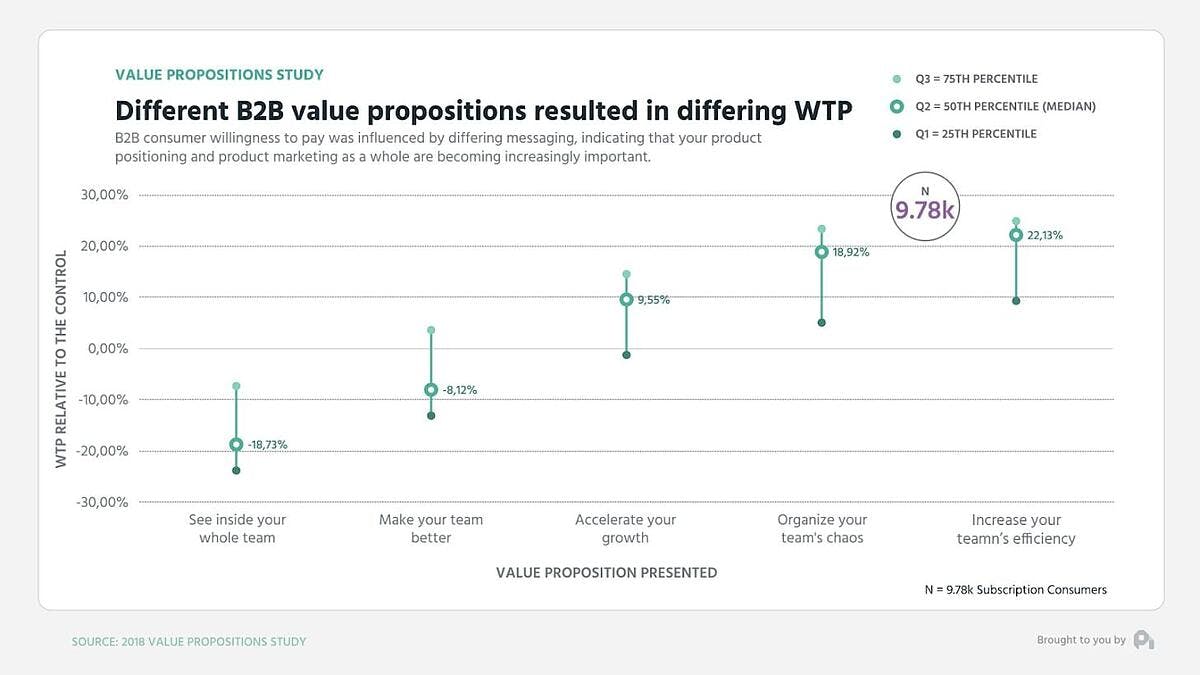

3. Value propositions matter oh so much

In B2B value propositions can swing willingness to pay ±20%, in DTC it's ±15%

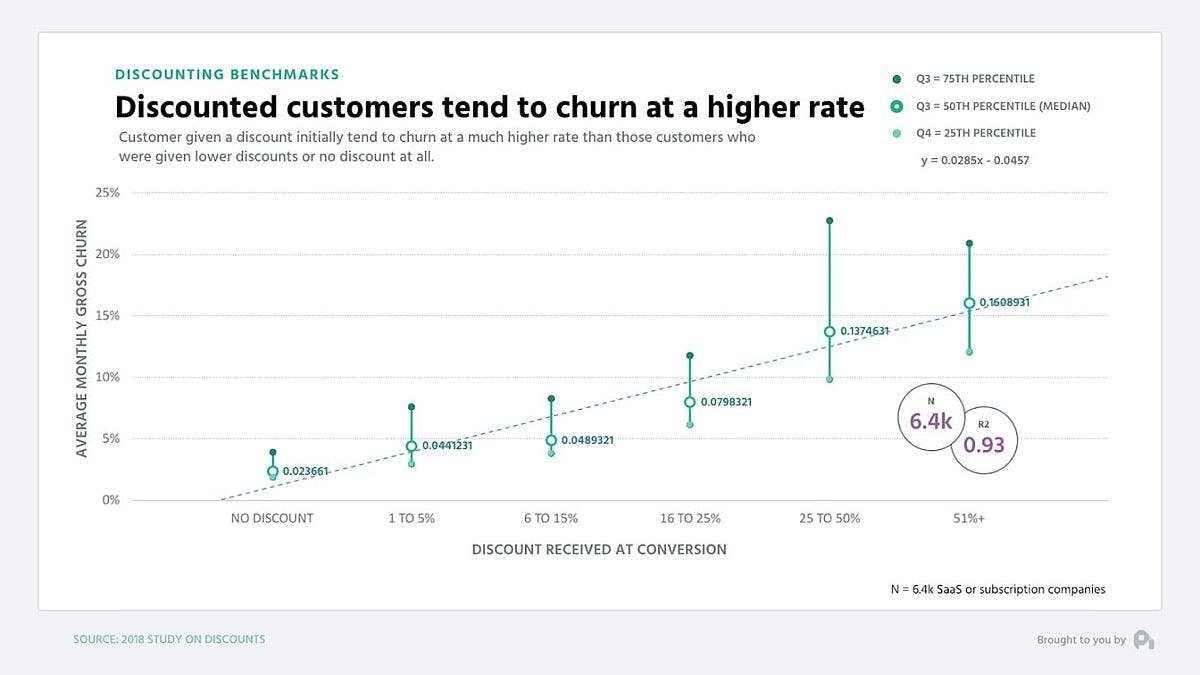

4. Don't discount over 20%

In some verticals discounting over 20% may be fine, but you're likely not in one of them (although you may think you are), but the size of the discount almost perfectly correlates with higher churn. Largely discounts get people to convert, but they don't stick around.

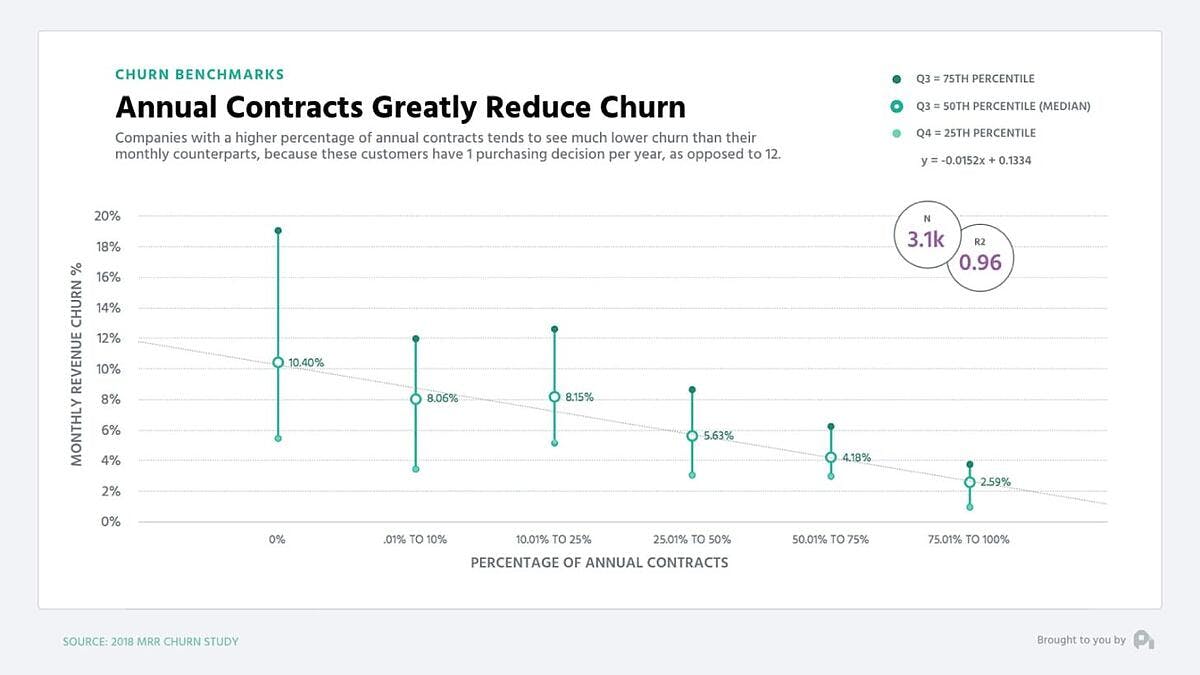

5. For upgrades to annual discounts, don't use percentages and try offers

Percentages don't work as well as whole dollar amounts for discounts (ie., "one month" will work better than "X percent off"). Annuals see much lower churn rates.

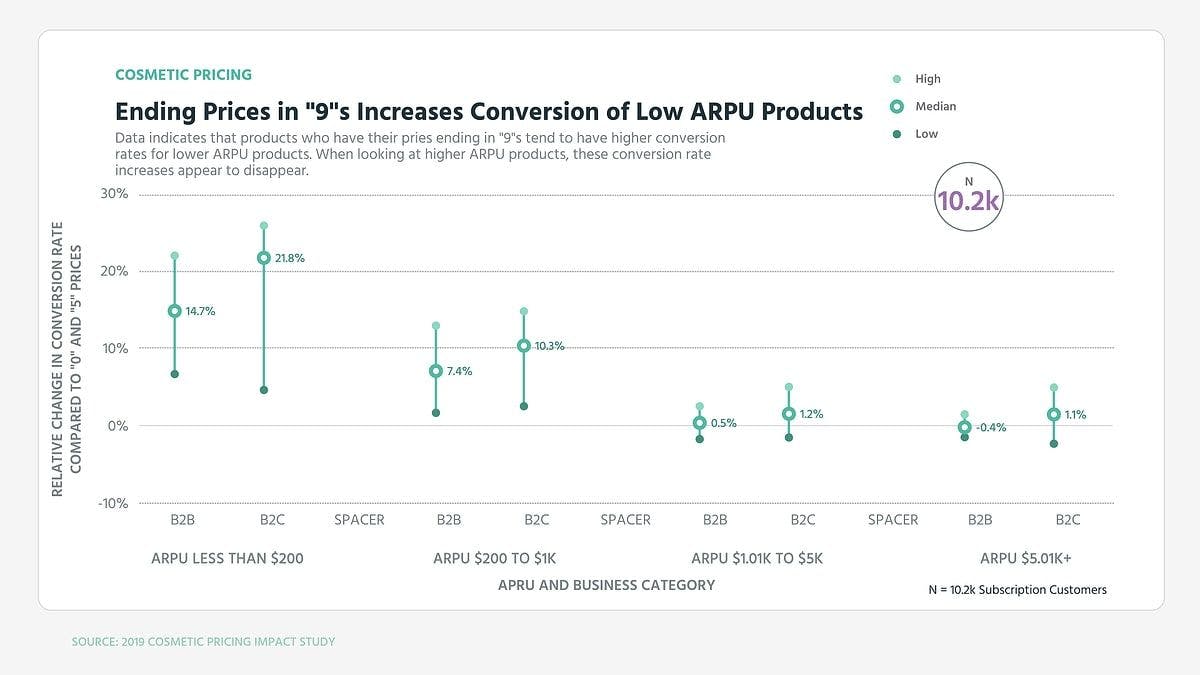

6. Should you end your price in 9s or 0s? Depends on your price point

Ending your prices in 9s evokes a discount brand, making the customer feel like they're getting something. Ending in 0 evokes luxury or premium, making them feel like they're getting a high-end product. Studies on this for technology products are inconclusive. We have seen it increase conversion in lower-cost products, but retention isn't as good with those customers.

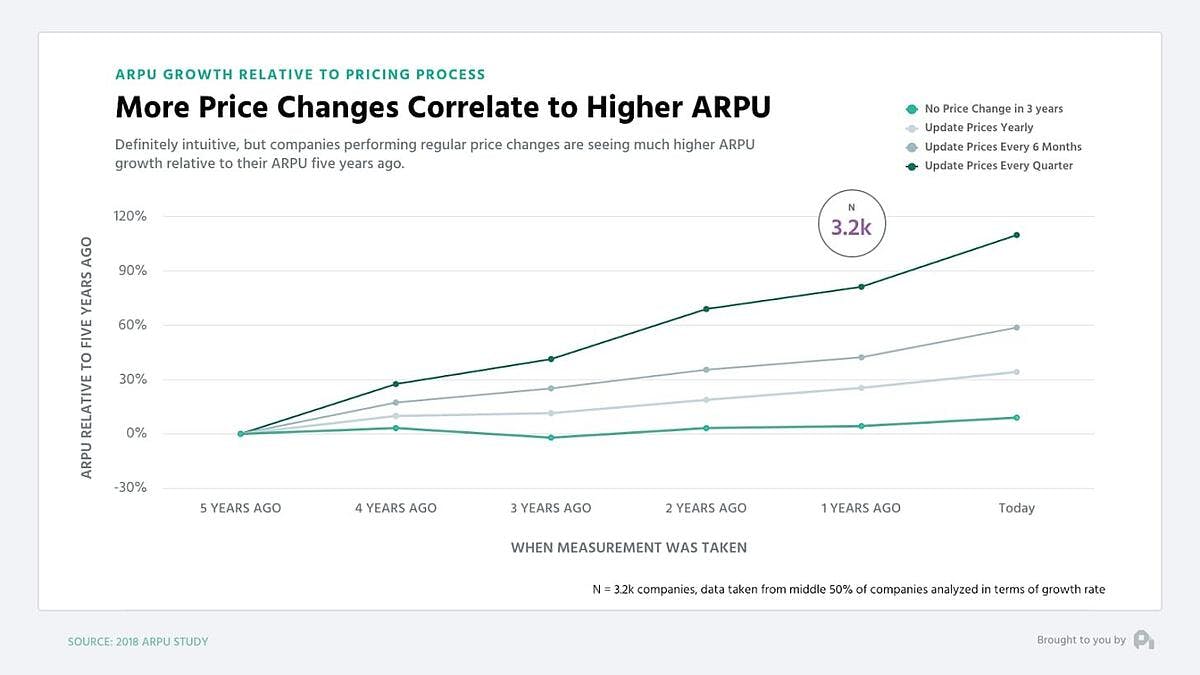

7. You should experiment with your pricing in some manner every quarter

This doesn't mean change you should the price point each quarter, but experiment with variable costs. More changes correlate with increasing revenue per customer. Like all things, focusing on something makes you improve it.

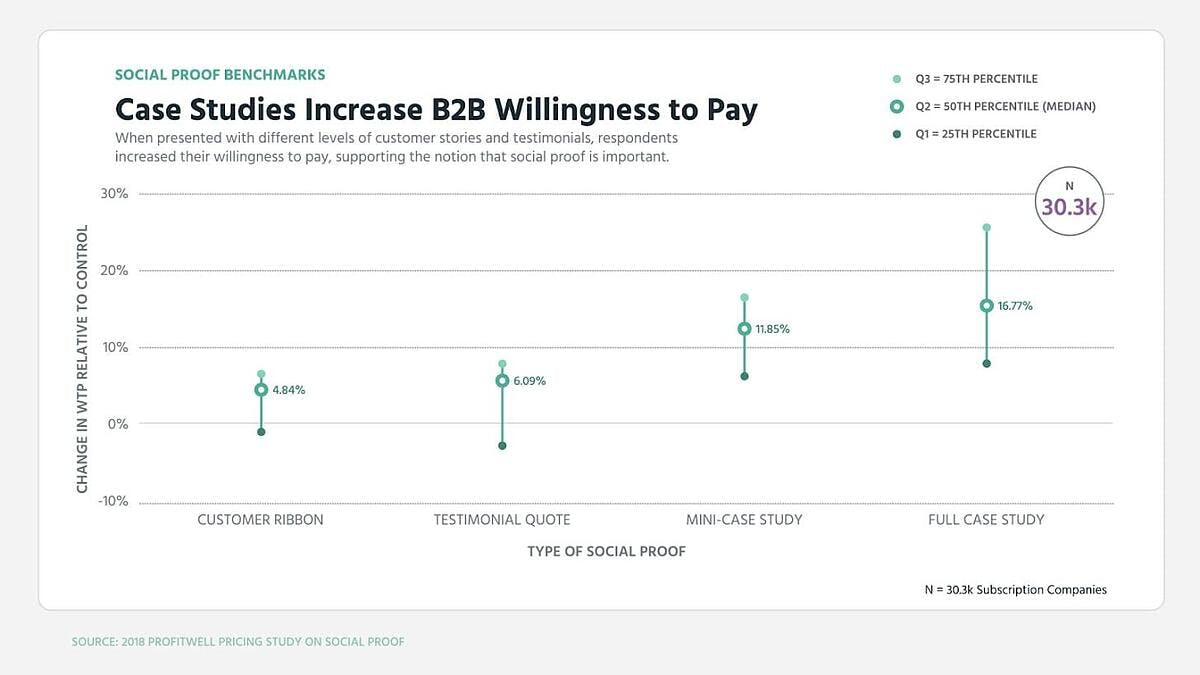

8. Case studies boost willingness to pay quite a bit

Social proof is important. Case studies that offer proof of the high quality of your products can boost willingness to pay by 10-15% in both B2B and in DTC.

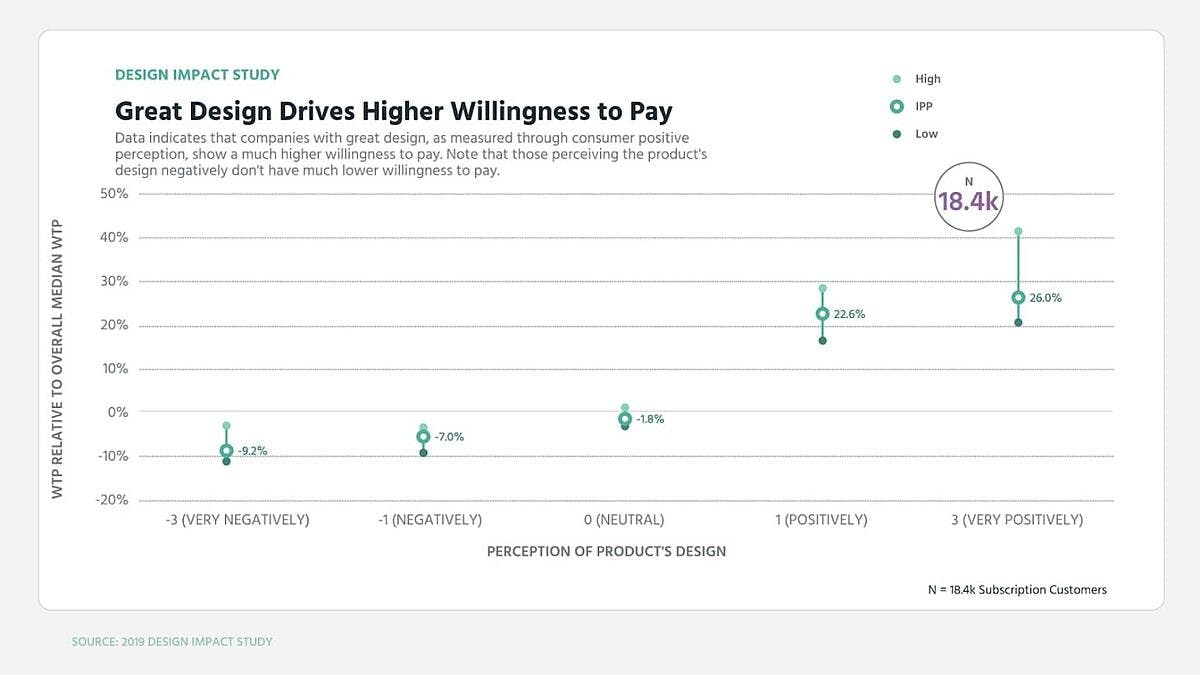

9. Design helps boost willingness to pay by 20%

This graph didn't look this way 10 years ago when design didn't do much for willingness to pay. Today, affinity for a company's design can boost willingness to pay considerably.

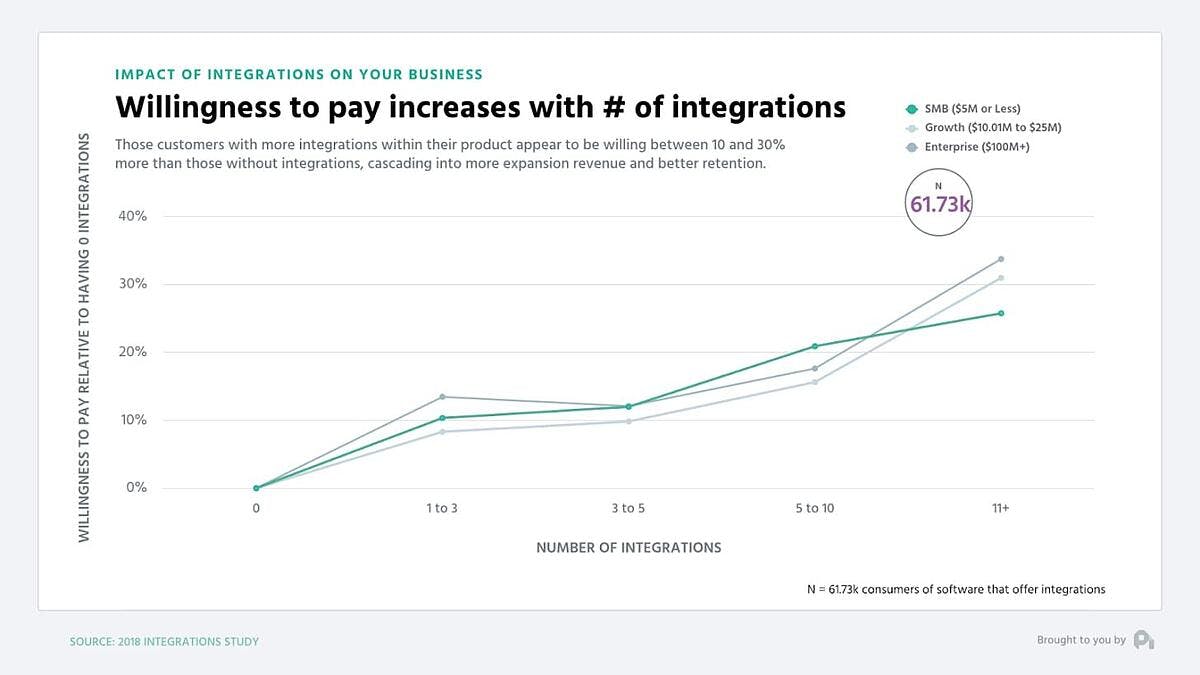

10. Integrations boost retention and willingness to pay

The more integrations a customer is using, typically the higher their willingness to pay and the better their retention. I wouldn't charge for the integrations, but I'd use this as a tool to get people hooked in and paying more or buying different add-ons.

Pricing strategies for different industries

Pricing strategies are not one size fits all. Finding the proper pricing strategy is dependent on your industry, as well as your company's unique objectives. But to give you an idea, we've listed a couple of industries and strategies that are well suited for each other.

SaaS/Subscriptions

For SaaS and subscription-based businesses,value-based pricing is the winner hands down. As long as your customers are willing to pay, you can charge much more than your competitors. Because your price is based on how much customers will spend, it isn't artificially lowered like other methods that fail to account for that.

B2B

We also like value-based pricing for B2B companies. Value-based pricing requires you to look outward and understand your customers better. This is good for finding the optimal price, but it's also good for building optimal relationships that will also help grow your company.

Pricing strategies FAQs

Which pricing strategy is best?

This depends on your business model. For SaaS and subscription companies, as well as many others, we recommend value-based pricing.

How do you determine the selling prices of a product?

First, find a pricing strategy that fits well with your business model and product. As you've seen, pricing strategies differ, but they all give clear instructions for how to use them to set prices.

What is the simplest pricing strategy?

Since you only need to add up the cost to make your product and add a percentage to it, cost-plus pricing is the simplest form of pricing to use.

What is a pricing curve?

A pricing curve is a graph that shows you the number of people who are willing to pay a given price for a product.

What are the 4 major pricing strategies?

Value-based, competition-based, cost-plus, and dynamic pricing are all models that are used frequently, depending on the industry and business model in question.