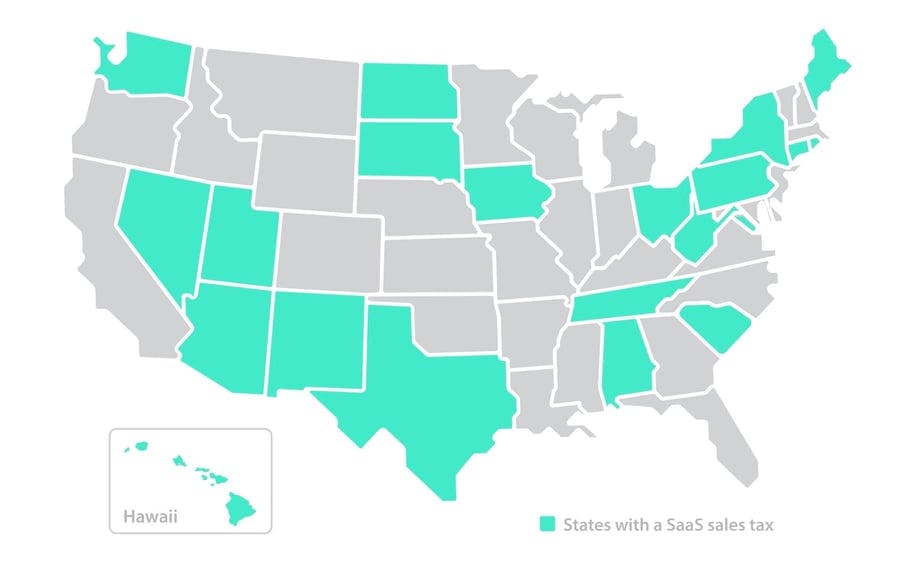

Get your SaaS sales taxes right - explore which US states SaaS companies are liable for sales tax so you don't get caught out

Tax laws are complex and, for businesses operating in the United States, every state has its own set of laws that must be followed in addition to federal tax laws. In some states, SaaS companies are required to collect and pay sales tax for their products. Each state that requires this has a different set of rules that must be followed. In this post, we'll go over what those rules are for the 21 states that have sales tax laws on the books that pertain to SaaS businesses and products. These are the laws as of 2020, but you should always talk to a tax professional as the final word in sales tax & compliance issues.

How is a SaaS company defined in the US?

For tax purposes, software companies can fall into one of three categories according to U.S. tax code. These categories are also used by some states, so properly placing your business into one (or more) of the categories is the first step to determining the taxability of your business with regard to sales tax. This post will only be discussing the last one, as that's the one that matches the definition of software-as-a-service that we're using.

Want to offload your operational headaches? Our billing platform features fully compliant VAT and sales tax software so you can focus on growing your business. Get started today.

Tangible software

When you see the phrase tangible software, they'e referring to software that is delivered in some physical form. This is becoming increasingly less common in the digital age, but if your product comes on a CD, DVD, or other form of physical media, this applies to it.

Downloadable software

A more common delivery method for software in the modern era, downloadable software, has a different set of tax rules in some localities than its physical media counterpart. If your company sells a mixture of physical and digital products, you may need to split them up by type when deciding how to apply sales tax.

Software accessed by the cloud

Here is what we refer to when we talk about software-as-a-service. In this case, the user has not downloaded or otherwise installed any software on their computer. Instead, the product is delivered entirely via the internet as it's used.

21 states that tax SaaS sales

For your convenience, we've gathered a summary of the laws in the 21 states that currently tax SaaS sales. Again, to the best of our knowledge, this data is accurate in 2020. Always talk to a tax professional to be sure of any tax liabilities.

Alabama

Alabama doesn't make the distinction between the different categories of software. As a result, all software is taxable in that state.

Arizona

Via a private letter ruling, sales tax on SaaS products was deemed by Arizona officials to be required. Private letter rulings are specific to the company that requested them, so it would be best to consult with a tax professional if your SaaS business is in Arizona.

Connecticut

SaaS products are taxed in Connecticut, but at two different rates. If the software is for personal use, the full rate is charged. SaaS products for business use gets taxed at 1%.

Hawaii

Hawaii does not have sales tax, but does require a general excise tax for some purposes. Because the use of computer software and hardware is one of those purposes, and SaaS includes both, the excise tax must be collected.

Iowa

Because Iowa requires a tax on all services that aren't exempt, and SaaS products are specifically listed as taxable, you must collect sales tax on software-as-a-service products in that state.

Maine

Maine doesn't make the distinction between the different categories of software. As a result, all software is taxable in that state.

Nevada

Whether SaaS is taxable in Nevada depends on the use. If the software is for business use, it must be taxed. If it's for personal use, there is no tax.

New Mexico

Because prewritten software, custom software, and services to create software are taxable in the state, New Mexico requires you to collect sales tax on SaaS products.

New York

New York's Department of Taxation and Finance has issued several opinions stating that cloud-based software is taxable and therefore requires you to collect sales tax on SaaS products.

North Dakota

SaaS is taxable in North Dakota depending on the use. If the software is for business use, it must be taxed. If it's for personal use, there is no tax.

Ohio

Ohio requires that sales tax be collected on any computer software that is used by businesses, regardless of how it is delivered. If your software is used by a business, you must charge them sales tax. There is no tax for personal use.

Pennsylvania

Pennsylvania considers software accessed electronically to still be tangible software and therefore requires you to collect sales tax on SaaS products. However, this is only true if the user is located in Pennsylvania.

Rhode Island

Because Rhode Island requires sales tax on all prewritten computer software regardless of how it's delivered, you are required to collect sales tax on SaaS products in that state.

South Carolina

South Carolina does not tax downloadable software, but they do tax software that is accessed by the cloud. This means almost all SaaS products will require sales tax to be collected.

South Dakota

South Dakota considers anything delivered electronically to be a tangible good. They also require taxes on fees charged to access software. For both of these reasons, you must collect sales tax on SaaS products in the state.

Tennessee

Because Tennessee requires sales tax on all prewritten computer software regardless of how it's delivered, you are required to collect sales tax on SaaS products in that state.

Texas

Texas requires SaaS businesses to collect sales tax. Some SaaS products may fit the state's definition of a data processing service and become eligible to reduce the amount of sales tax that they are required to collect.

Utah

Utah considers software that is accessed remotely to be taxable and therefore requires you to collect sales tax on SaaS products in the state.

Washington

Washington doesn't make the distinction between the different categories of software. As a result, all software is taxable in that state.

Washington DC

Washington DC requires sales tax on all content that is delivered wirelessly, therefore you'll need to collect sales tax on SaaS products in the district.

West Virginia

West Virginia taxes certain services. Because SaaS is considered a taxable service, it's taxed in the state. There are certain data processing services that are not required to be taxed; however, so, depending on the nature of your software, you may be eligible for an exemption.

Managing your SaaS sales taxes

You can find yourself in a lot of trouble if you don't keep up with tax laws. Failure to collect sales tax could result in hefty fines and will certainly result in a large bill to pay for the taxes that you failed to collect.

Stay compliant

You're responsible for remaining compliant with your taxes. As of this writing, SaaS is taxable with or without a physical presence. This also extends to countries outside the US. Learn about how to comply with SaaS sales tax, and always be sure to consult with a tax lawyer when you're opening or expanding a business.

Keep track of subscription payments

Subscription billing management can be complex. It's important for the operation of your business that you choose a subscription management platform that has the features needed to reliably capture revenue from your customers. In addition, analytics tools like ProfitWell Metrics can make your life easier by keeping track of all your subscription reporting in one place.

Offload your sales tax liability

You can rid yourself of the entire headache of managing sales tax compliance and the states and the rest of the world by partnering with a merchant of record (MoR) like Paddle. MoRs act as resellers, shifting the liability for sales tax from you, the supplier, to their inhouse dedicated tax team. They also take care of fraud and chargebacks, and generally simplify your operations, reducing costs in the process.

Conclusion

Taxes can be a pain to keep up with, but not nearly as much as the pain that will be caused by failing to do so. Thankfully, there are a lot of tools available to make this job easier for you. The important thing is that you know what your responsibilities are so the Department of Revenue doesn't come knocking on your door. SaaS is still a relatively new business model and tax agencies are often slow to keep up with changing technologies. Many states don't have specific guidance on SaaS as it relates to sales tax. As time goes on, the information presented here is likely to change for some states. Always look for the most up-to-date information to ensure that your tax liabilities are covered.