It's tempting to update your revenue immediately when cash lands in your account. But since cash is not revenue, treating the two similarly is a mistake and could prove fatal for your business moving forward.

Most SaaS companies use a subscription business model, meaning they don't get revenue until they earn it. In the meantime, the prepayment is a liability because customers might cancel their subscription and ask for their money back. Therefore, the business cannot treat subscription payments as money until it earns revenue. This is the revenue recognition concept, and it's critical for SaaS businesses.

This article tackles the revenue recognition process, how it applies to SaaS companies, calculating it, key complications unique to subscription businesses, and the future for SaaS models and revenue recognition.

What is revenue recognition?

Revenue recognition is a fundamental aspect of the SaaS accounting accrual basis and a generally accepted accounting principle (GAAP). It identifies the specific conditions where a business recognizes revenue and determines the accounting procedure.

A company recognizes revenue after satisfying two requirements: The occurrence of a critical event (such as the provision of a subscription service) and after it can easily measure the dollar amount received.

Basically, revenue recognition means that irrespective of when cash arrives in your account, you shouldn't recognize it as revenue until you deliver the paid-for product or service. Therefore, you will only record revenue after completing a revenue-generating process.

Many businesses have a subtle difference between cash collection and revenue recognition. It's because customers pay for products after delivery, completing the transaction, which is the revenue-generating process.

For example, cash transactions for traditional software models were revenue-generating processes. Back then, a customer bought a software copy of a product like CRM that existed on a physical disk and would then install it on their computer and use it until the company released an updated version.

However, today's SaaS companies rely on subscription-based transaction models characterized by differed revenue. Therefore, they have to use GAAP accounting principles and the new principle-based approach.

Revenue recognition criteria

The Financial Accounting Standards Board (FASB) codified specific accounting standards for software companies to follow when recognizing revenue. The guidance requires the satisfaction of the following criteria:

- Customers have a contractual right to take software possession at any time throughout the hosting period without incurring a significant penalty.

- It's feasible for customers to either run the software on their hardware or contract an unrelated third party to host it.

Since customers can immediately take software possession and run it on their hardware, the CRM vendor can recognize the revenue received immediately. If the company releases new software in January and customers purchase it the same month, they can recognize the revenue immediately after booking the sale.

Key takeaway

Companies that sell products on a one-time deal basis can recognize their revenue immediately because they're confident that they'll provide the product or service and receive payment during the same accounting period.

Still, even with this simple revenue recognition version, it's essential to understand the difference between revenue and cash. The two are not similar even if they take place simultaneously. The biggest mistake a SaaS company can make is mistaking cash with revenue, especially when moving from SaaS metrics to GAAP metrics.

5-step revenue recognition model for SaaS businesses

As of December 16, 2016, FASB and IASB (the International Accounting Standards Board) introduced ASC 606—a new 5-step revenue recognition process. It provides businesses with a straightforward framework for recognizing revenue and by how much. It consists of the following steps:

1. Identify the contract with a customer

The first step outlines the criteria for establishing a new contract with a customer. It can be written, verbal, or implied (through your company terms and conditions that customers must agree to when signing up).

2. Identify the separate performance obligations in the contract

The next step describes your performance and deliverable obligations. A performance obligation refers to a particular service that benefits customers on its own or when combined with other services you provide. It's separate from other products or services in the contract.

3. Determine the transaction price

The transaction price is how much money you expect to receive for offering your full service. This step outlines the factors to consider when establishing your transaction price.

4. Allocate the transaction price across the contract's separate performance obligations

Here, you will estimate standalone selling prices for each performance obligation in your contract. It's what a customer agrees to pay for your products or services.

5. Recognize revenue when (or as) the contracting entity satisfies a performance obligation

A business can recognize revenue over time as it meets each performance obligation.

Key takeaway

The new 5-step revenue recognition process is efficient and accurate, makes your company run smoothly, and increases transparency across the board. It includes setting up your contract with a customer. Separating the different services you provide, deciding the total service price, parceling it out to price-individual services, and finally recognizing individual revenue streams separately and over time as you deliver each performance obligation.

Setting out specific steps to follow before recognizing revenue ensures every employee understands how their decisions implicate revenue recognition. Therefore, operations, management, sales, and marketing will make specific judgments on their obligations, contracts, and delivery before feeding them to accounting, so they know how to recognize revenue.

Getting your finances in order helps your company grow. The entire premise of the company is providing products and services to make revenue. As long as everyone understands how they factor into the ultimate revenue decisions, you can gear up to that ultimate aim.

How to calculate revenue recognition: 6 methods

Below are the different methods of recognizing revenue.

1. Accrual method

The company initially records prepayments as prepaid assets, classifying them as expenses after product or service delivery.

2. Appreciation method

This method allows a SaaS company to reduce gains recognized from selling a product at its appreciated value.

3. Sales-basis method

Businesses recognize revenue at the time of sale, whether for cash or credit (accounts receivable). The business cannot recognize revenue even after receiving money before the transaction is complete. For example, an online magazine selling a $144 annual subscription will recognize $12 as monthly revenue. If the magazine goes out of business, it will return a pro-rated portion of the subscription price since it hadn't delivered the product.

4. Percentage-of-completion method

Companies whose products or services take years to deliver still need to prove to their shareholders that they generate revenue even if they have not completed the project.

Such companies will recognize their revenue using the percentage of completion method if they satisfy two conditions:

- Have a long-term, legally enforceable contract

- Have a way of estimating the percentage of the project completed, plus future revenues and costs

This method uses the following methods to estimate the total cost:

- Milestones: A software project identifies the completion of a particular number of modules as its milestone criteria.

- Costs incurred: If the total costs are $20,000, a company could assume the project is 25% completed when the incurred expenses reach $5,000.

5. Completed contract method

Allows a company to recognize revenue once the contract is fulfilled. It's suitable for short-term projects because it ensures revenue recognition in the correct accounting period. A company can also use it for a long-term project in cases where it cannot apply the percentage of completion method because of a lack of clearly-defined progress indicators.

6. Proportional performance

The performance consists of executing more than one act. A company recognizes revenues based on the proportionate performance of an act relative to all acts at the end of the contract or plan.

Real-world revenue recognition examples for subscription services

Subscription models present various ways of accepting or billing payments such as annual, quarterly, or monthly. Hence, the ASC 606 guides companies with its five-step model for recognizing revenue.

Example one: A subscription company

Let's take the example of a subscription company charging $10 a month to provide VPN services to subscribers. It also charges a one-time $40 startup fee to learn about the service and how to protect yourself and remain anonymous online.

After completing the initial registration process, the company can recognize the $40 startup fee. However, it will charge the recurring subscription fee monthly and recognize the $10 recurring subscription fee once it earns it. Therefore, after the first month, the VPN company will recognize $10 and record the remaining $110 as deferred revenue.

Example two: An independent contractor

Independent contractors receive varying fees, presenting a challenging accounting situation. Suppose a company hires an independent digital design agency and agrees to pay $8,000 for a new custom website template, $1,500 for a brand logo design, and $4,500 for digital ads.

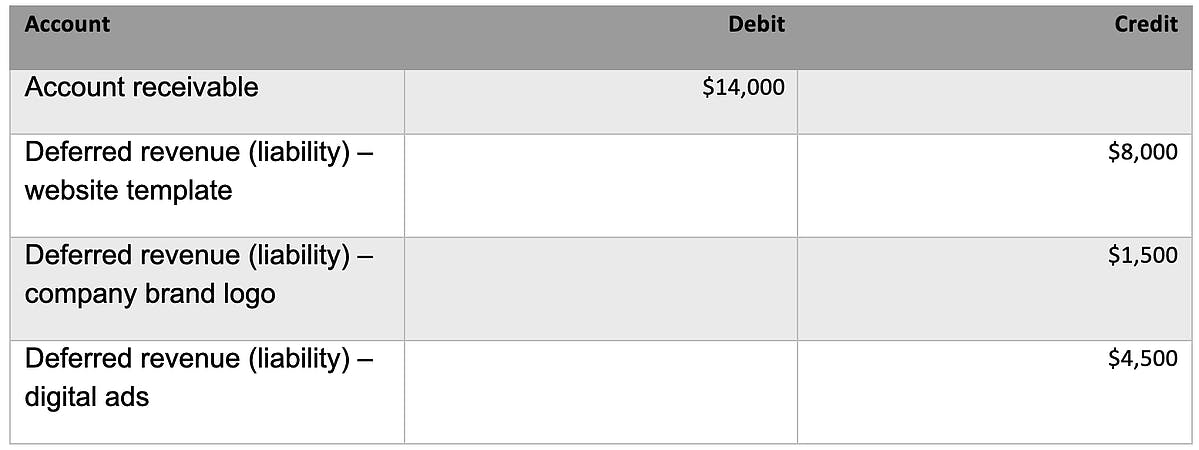

The digital design agency will debit its account receivable with $14,000 and credit each respective performance obligation as deferred revenue as follows:

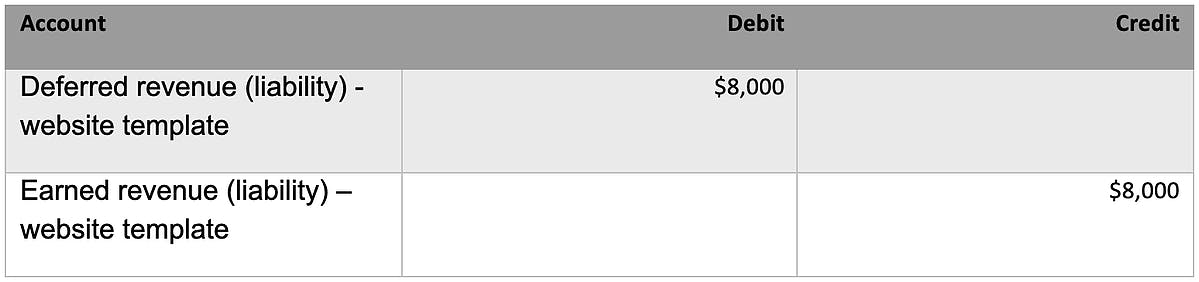

The agency delivers the website within the first month and updates its ledger immediately since it has fulfilled its performance obligation—even if it's yet to receive payment. Here is the new ledger entry:

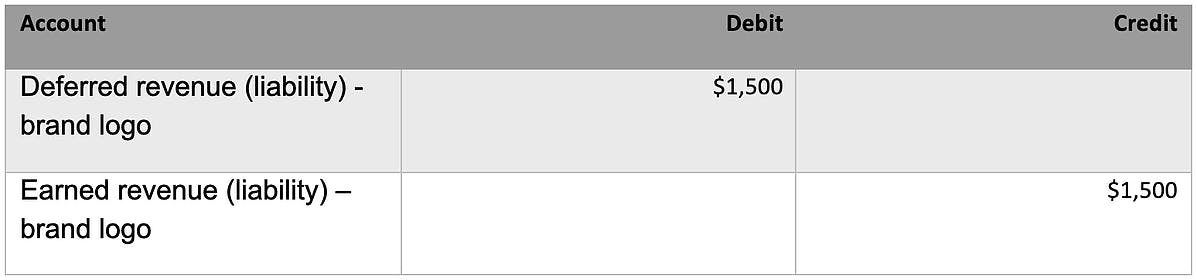

The following month the agency delivers the logo design and enters a new ledger entry:

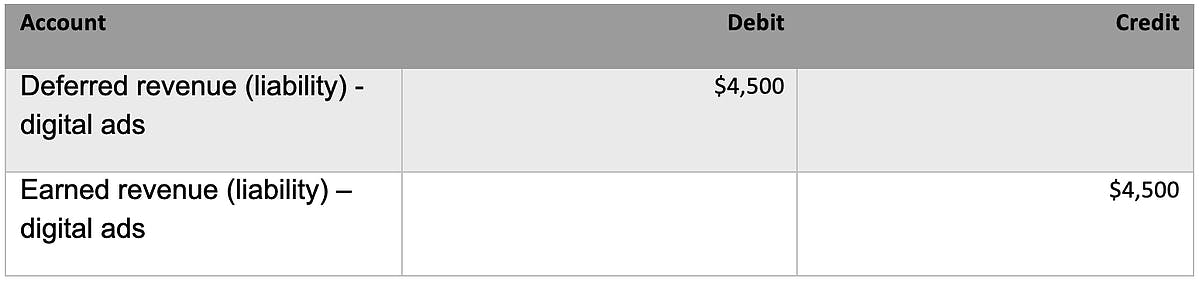

In the third month, the agency delivers the digital ads:

Revenue recognition for SaaS accounting: Key complications

The following are the key complications SaaS accounting faces when recognizing revenue.

Inability to satisfy FASB criteria

SaaS companies often find difficulties satisfying all the five FASB revenue recognition criteria. For example, customers never take software possession during the subscription period, and it's not feasible to run the software on their machines. The SaaS model is in place to host software for customers while giving them 24/7/365 access to the latest versions.

Therefore, SaaS falls between GAAP gaps, and there are no specific accounting standards for these business models. However, it does not give you the green light to ignore the criteria or make it up along the way. Proper revenue recognition is critical to determining your company's financial health. Besides, you still have to recognize revenue after earning it.

GAAP accounting principles require SaaS companies to consider their subscription revenues 'non-refundable up-front fees'. Additionally, the SEC requires that revenue be recognized only when:

- There is the existence of persuasive evidence of an arrangement

- There is a fixed or determinable seller's price

- Collectability is reasonably assured

- Delivery occurs, or services are rendered

Most SaaS companies easily satisfy the first three conditions. A customer signing up for a subscription service qualifies as evidence of an arrangement. The annual or monthly selling price is a fixed and determinable seller's price, and collecting subscription fees up front is a surety of collectability.

Service delivery is the only condition that SaaS companies don't fulfill. Instead, they recognize revenue on a straight-line basis, meaning that a customer signing up for an annual subscription and paying up front does not qualify as a revenue-generating process. You only earn it by delivering your service to the customer and recognizing revenue daily or monthly throughout their entire plan.

Additionally, the company will enter the money yet earned or recognized as deferred revenue.

Key takeaway

SaaS companies recognize most of their revenue on a straight-line basis. Unfortunately, most companies fail to recognize revenue for their services incrementally throughout the service period. Claiming all the up-front payment as revenue immediately leaves you liable for any issues with the service. Therefore, failing to deliver your service means your customers can ask for their unspent money back, leading to cash flow problems or worse.

Difficulty recognizing revenue for additional services

Some SaaS companies offer additional features and services in multi-element arrangements, further complicating their revenue recognition when they factor in bundled features such as:

- Set-up fees

- Consulting fees

- Customization

- Support services

Some might be optional and others obligatory, for example, consultancy and set-up fees. Recognizing revenue from these services depends on whether they have standalone value and whether the company considers them separate accounting units.

For example, Company J charges $8,000 annually for their CRM software, but each customer must pay an additional one-off set-up and customization fee of $2,500. The company will treat the extra fee different based on the following:

- Suppose the company does not offer these services separately and are obligatory for all customers purchasing or signing up for the CRM software. In that case, they will be part of the same service and not separate accounting units. Therefore, despite their early delivery, the company will recognize the extra fees over the entire plan's lifetime along with the CRM software.

- If the company offers these services separately and considers them distinct accounting units, it will recognize them differently from the CRM plan. For example, if Company J also offers a $2,000 six-month consulting service, it will be on a standalone basis even if the customer stops using the CRM. Therefore, the company will recognize the separate revenue on a different straight-line basis.

Key takeaway

One of the essential parts of revenue recognition for SaaS companies with multi-element arrangements is how they deliver their services—whether they offer standalone services with distinct intrinsic value or as part of the primary plan.

Trying to count the cash from these as revenue immediately, or not as its actually earned will lead you to making serious mistakes in your financial reporting, leaving you thinking you have more money than you do and leading you to spend money that isn’t yours. The opposite is also true — not understanding that you can recognize different services over different time frames could lead to leaving money on the table, and not investing cash that is rightfully yours.

Either way, by not understanding revenue recognition, you’re not allowing your company to grow to its full potential.

The future of revenue recognition

The 5-Step revenue recognition model for SaaS businesses is how companies are recognizing their revenue today. However, due to the GAAP gaps and confusion surrounding SaaS companies and the larger subscription-based economy, governing bodies like FASB and IASB are developing a revenue recognition standard that gets everyone on the same page.

Revenue recognition is a critical element separating SaaS accounting processes from SaaS revenues. While you might update your ARR and MRR immediately after a customer signs up for your plan and you receive cash up front, you cannot recognize the entire revenue until you deliver the service.

All in all, understanding your finances and when to recognize service revenue allows you to better plan and position yourself for growth. Knowing where you stand financially lets you plan for the future accordingly, and it's the future of SaaS.

Revenue recognition FAQs

When does revenue recognition occur?

A company recognizes revenue after satisfying two conditions: The occurrence of a critical event (such as the provision of a subscription service) and after it can easily measure the dollar amount received.

Why is the revenue recognition principle important?

Because it directly affects a company's financial reporting integrity and consistency. As a critical feature of accrual-basis accounting, it recognizes revenue as the company earns it, not upon payment receipt.

What is the new revenue recognition standard ASC 606?

It affects private, public, and non-profit entities entering into contracts with customers to transfer products or services. The new principle-based approach helps businesses determine revenue recognition.