Cash flow is the blood pumping through your business. It keeps it breathing and growing. Learn more about what cash flow is, what it isn't, and how you can track and report on it to keep your business healthy.

Just as you need blood flowing through your veins to survive, your business must have enough cash flowing through it to stay afloat. Most business owners understand this intuitively, but not everyone has a firm enough understanding of how cash flow works. Let's take a look at what cash flow is, what it isn't, and how you can track it to support all future business activities.

What is cash flow?

Cash flow is the amount of money coming in and out of your business. It's how much ready cash you have on hand. Cash flow is one of the key indicators of how well your business is doing and your business profitability. Therefore, understanding exactly what it is, how to perform cash flow analysis, and how to track cash flow is vital to understanding the financial health of your company. To get a better idea of what cash flow is, let's talk about what it isn't.

What cash flow isn't

People sometimes use the term cash flow more generically than it's meant to be used. This results in confusion about what the term actually means. Here, we'll clear up some misconceptions about the meaning of the term before continuing.

Revenue

Revenue is the money your business earns directly from the sale of your product or service. Cash flow is the net amount of cash going in (cash inflow) and out of your business (cash outflow). And where revenue can't be a negative number, cash flow can. Revenue is about the money you're bringing in, but ignores the money you are sending out. Cash flow takes both into account.

The second difference is when the money is counted and recorded. Businesses will often count revenue as soon as an invoice is sent and will record it on their income statements. Cash flow doesn't start counting the money until it is actually paid by the customer and is recorded in the cash flow statement.

Liabilities

Liabilities (or debt) can be obligations, expenses, or anything you owe. In relation to cash flow, tracking the cash flow-to-debt ratio can provide a good overview of the financial health of your business. It's important to keep your liabilities on the low end in order to maintain a positive cash flow.

Gross profit

Gross profit is one of the terms most often confused with cash flow. Both seem very similar as they account for money going into and out of a business. But gross profit is the profit a company makes after the costs associated with producing and selling your product, are deducted.

Gross Profit = Revenue – Cost of goods sold (COGS)

Gross profit is typically used to evaluate the efficiency of a company's use and management of labor and supplies associated with the production of your product or service.

How cash flow moves through a business

As you may have gathered from the section above, cash flow moves in two directions. There's money that comes into the business, and money that goes out of the business. Understanding what gets counted is an important part of accurately measuring cash flow.

Positive cash flow

Positive cash flow indicates that the liquidity of a company's assets is increasing, enabling it to cover obligations reinvest in its business, cover all repayments, pay expenses, and provide a buffer against future financial challenges. Any money that comes into your business is positive cash flow. Many SaaS companies will make the mistake of only counting their recurring revenue and neglecting to count any one-time payments they may receive. This leads to a lower positive cash flow amount than what was actually made. The goal, of course, is to have a positive cash flow.

Negative cash flow

Negative cash flow is when you have more money going out than coming in—when your revenue is not enough to cover your expenses. And though negative cash flow is not sustainable for your business, it doesn't always simply mean you're losing money. It could reflect poor management of your income and expenses.

5 types of cash flow

There are several types of cash flow depending on what you are trying to measure. Understanding the different types is important, otherwise, two people may be talking about two very different measurements without realizing it.

1. Free cash flow

Free cash flow (FCF) is the money a company has available to pay lendors and/or pay dividends and interest to their investors. It's the money left over after they've paid their operating expenses and any capital expenditures. Free cash flow is a good indicator of the health and value of the.

FCF formula: Net income + Depreciation/amortization –Any Change in Working Capital - CAPEX

2. Operating cash flow

Operating cash flow (OCF) refers specifically amount of cash generated from the day-to-day business operations. It shows whether a company can generate enough positive cash flow to uphold and scale its operations.

OCF formula: Operating Income + Depreciation –Taxes + Change in Working Capital

3. Cash flow from investing

Cash flow from investing is a section of a cash flow statement that shows how much money was generated or used for investments. Investing activities could include physical asset purchases or improvements, purchase of stocks or securities, etc.

4. Financing cash flow

Cash flow from financing (CFF) is also a section of a cash flow statement that shows the amount of money being used to fund the company and its operating activities. This may include debt, equity, or dividend payments, etc. It isn't uncommon for businesses to take out loans, or go to investors for a cash infusion. Money acquired or paid back in this way is counted in the financing cash flow category.

5. Net change in cash

Net change in cash increases or decreases in a company's cash balance in a given period of time. Once you have your three types (operating, investing, and financing) of cash flow calculated individually, you can simply add them up to give you your net change in cash. Ideally, you want your net change in cash to be an increase.

5 metrics to track for cash flow

The reason we split the cash flow into separate components in the section above was to make it easier to understand how money is moving through your business. With a tool like ProfitWell Metrics subscription analytics, you can break your cash flow down even further, to get a more granular look at your company's finances for a certain accounting period. While you can use Metrics to track nearly every metric that is important to a SaaS company, we'll focus on the metrics you should be tracking to better understand how cash flows in your business.

1. Revenue

We've already explained the difference between revenue and cash flow. Although the two are not the same thing, they are closely related. If your revenue goes up, and all other variables stay the same, then your cash flow should be higher as well. When taken as part of a complete picture, revenue can be used as a predictor for cash flow. Just remember, revenue growth doesn't necessarily mean cash flow growth. If your expenses go up in order to achieve that revenue, your cash flow and profits could take a hit.

2. Burn rate

Burn rate is the measure of how much money you're losing or spending in a given period—a measure of your negative cash flow. If you want to know how much money you'll have on hand at a given point in the future, you need to know how quickly you are burning through it. Unlike revenue and liabilities, money isn't calculated toward the burn rate until it's actually spent.

It's used typically by startup companies to track the amount of spending before it begins generating income, as well as its runway—how long it has before it runs out of money.

3. MRR

Monthly recurring revenue (MRR) is an important metric for SaaS companies. It's the amount of monthly predictable revenue that a company can expect to receive. It's calculated by taking the average revenue per user (ARPU) and multiplying that by the number of users you have. There's a lot you can learn from your MRR and ProfitWell Metrics makes it easy for you to break it down even further for proper financial forecasting and planning, and measuring growth and momentum.

4. CAC

These next two metrics are often grouped together because they make up two of the most powerful metrics SaaS companies can use. Customer acquisition cost (CAC) refers to the amount of money you must spend (usually in sales and marketing) to acquire a new customer. This is extremely important information to know, because it dictates how much you have to charge for products, and can be an indicator of how effective your marketing is.

5. LTV

All businesses have repeat customers. The amount a given customer will spend over their lifetime of shopping with the company is the lifetime value (LTV) of that customer. For subscription companies, who deal almost exclusively in repeat customers, this is an especially valuable metric. LTV fills in the blank between ARPU and retention, giving you a more robust picture of where you stand and the revenue you can expect over the course of a customer lifespan with your company.

When you know how much you will make off a given customer, you can compare that to how much you spent on acquiring them. LTV tells you what you can afford to spend to acquire a new customer. However, this metric's importance goes much deeper, which is where ProfitWell Metrics can help, so you can keep that LTV high and your CAC low.

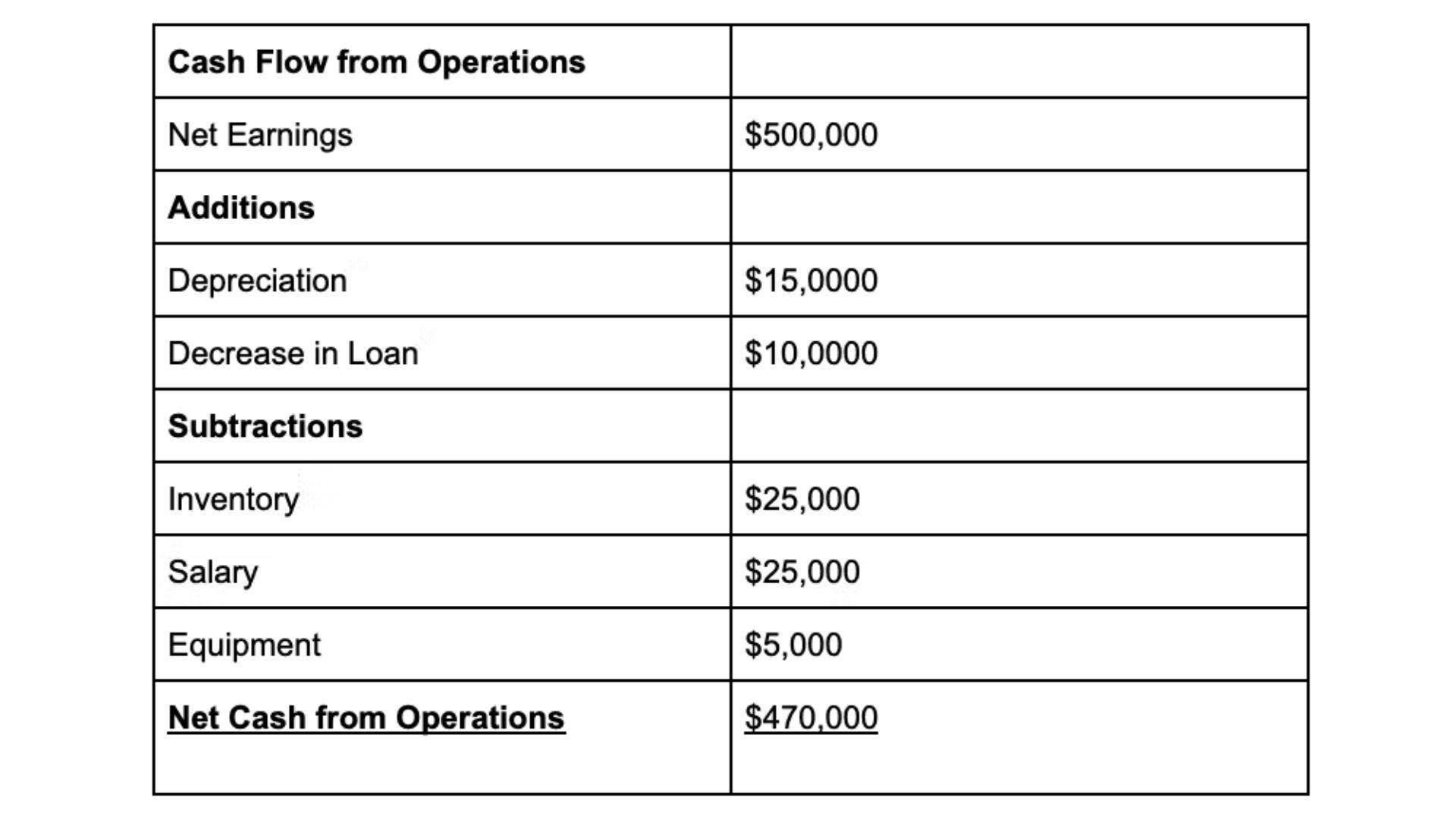

What a cash flow statement looks like

When we talked about splitting cash flow into operating cash flow, financing cash flow, and investment cash flow, it wasn't just for hypothetical purposes. A cash flow statement is a financial report that breaks down how money is moving through the company. The report splits the cash flow into the three different types and then gives an itemized list of how much was brought in or sent out in that category.

The image above demonstrates one section of the cash flow statement. The net cash flow for operating, financing, and investment will be calculated separately and added to their own section of the statement of cash flow. At the bottom will be the total cash flow for the period. Some cash flow statements may also include the beginning and ending cash balances.

Positive cash flow through RevOps

It's no coincidence that many of the metrics we listed for tracking cash flow are also relevant to sales and marketing. Revenue operations (RevOps) is all about combining sales, marketing, and customer success channels to drive growth. Performance indicators like those available with ProfitWell Metrics make it easy to get a better and bigger picture of your cash flow and revenue, to make the appropriate adjustments based on solid data. This will maximize growth for the company and increase positive cash flow.

Cash flow FAQs

Cash flow is an important topic, so we've recapped some of the key points in the list of frequently asked questions below.

What does cash flow mean?

Cash flow is the total amount of money that flows into and out of a business. It's important to note that, unlike some other metrics, cash flow refers to money moving in both directions and doesn't count money until it enters or exits the company bank account. It's how much ready cash you have on hand.

What is positive cash flow?

Positive cash flow is the total amount of cash that has been brought into the business. It includes any money that makes it into a business's bank account for any reason.

What is negative cash flow?

Negative cash flow accounts for any money that leaves the business for any reason. It's when you have more money going out than coming in—when your revenue is not enough to cover your expenses.

Is cash flow income?

No.

Cash flow is concerned only with money that has actually been received or spent by the company—the ready cash that is available. Income is the profit earned after operating expenses have been subtracted from revenue.