Some of you sat down and heard from Paddle’s former Chief Strategy Officer, Harrison, and Senior Payments Product Manager, Quinisha, about payment processors in a recent webinar, covering what they can — and can’t — do for your SaaS business.

For those of you that couldn’t make it, no problem at all.

We’re here to give you a proper run-through of SaaS payment processing. Whether you fancy watching it or if you’re more of the reading type — we’ve got you covered.

Your revenue delivery infrastructure

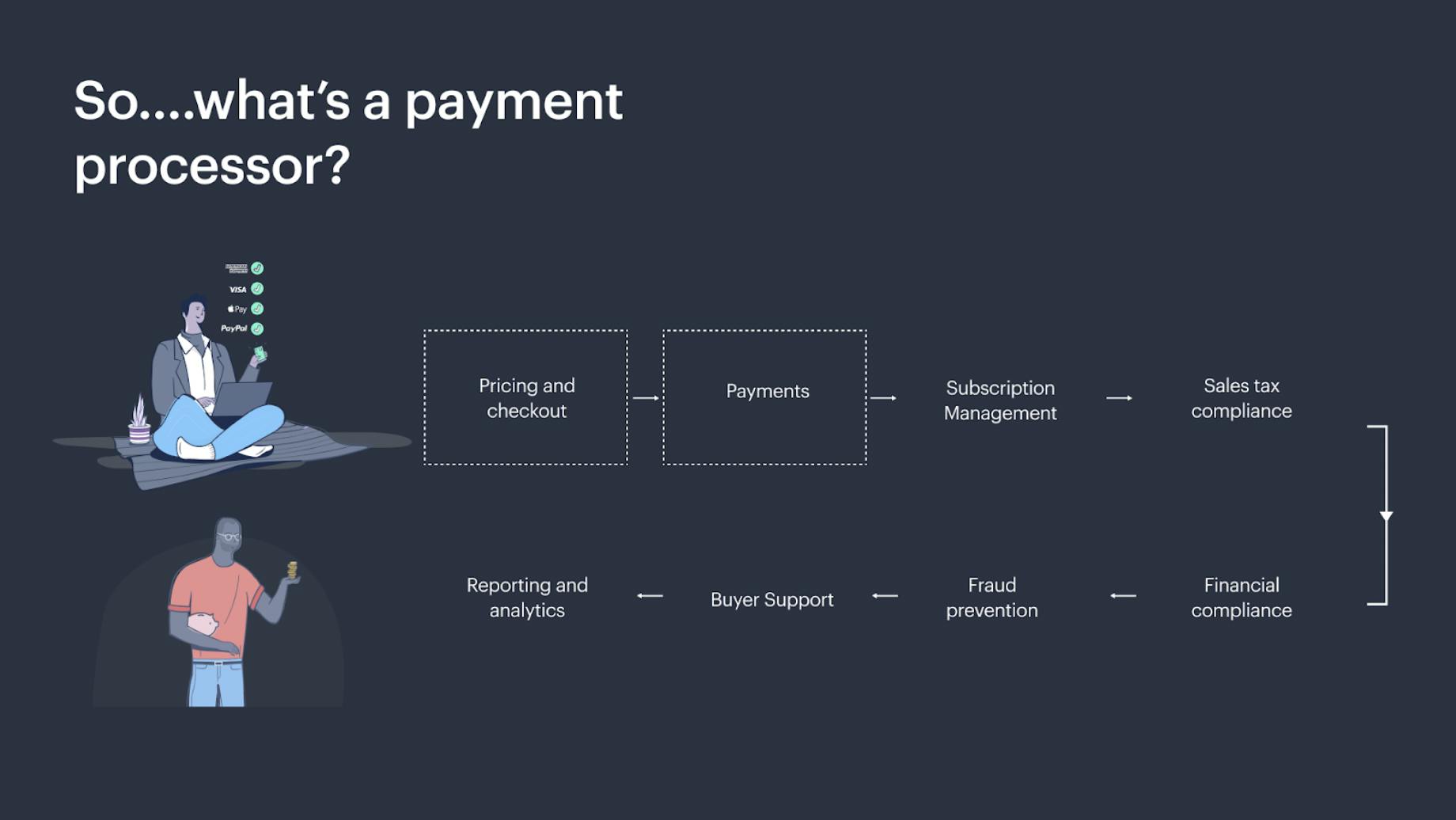

These include:

- Pricing and checkout: First and foremost, you need to offer your customers an excellent purchase experience.

- Payments: This is where B2B payment processors come in because, ultimately you need to accept payments — you’ll get more details about payment solutions in a bit.

- Subscription management: You’ll need to build out your own logic or integrate specific subscription management tools in order to handle subscriptions and recurring payments, on top of any changes to customer subscriptions.

- Tax and financial compliance: As a SaaS business, it’s necessary for you to keep on top of most jurisdictions across the world or where your buyers may be located, as well as stay up to date with the ever-changing, local regulations (like PSD2 in Europe, for example).

- Fraud prevention: Preventing customers from purchasing your software using stolen cards and creating chargebacks is a consideration of any SaaS company.

- Buyer support: We need to retain customers and provide them with the best-in-class support if they have queries about their order, subscription, invoicing, or payments.

- Reporting and analytics: You need visibility into your user and revenue performance so you can make data-driven business decisions and respond quickly to new opportunities for growth.

The main takeaway here? Payment processors are just one part of your full revenue delivery infrastructure. Turns out you need a hell of a lot of tooling just to sell your SaaS products, right?

But, it’s not just the number of tools; it’s also the people and the processes behind them. And that’s what we call your Revenue Delivery.

If you want to know more about exactly what your revenue delivery infrastructure is (all businesses have one), check out our short video:

What is a payment processor?

We know that a payment processor is part of the wider revenue infrastructure, but what part of this, web of SaaS needs, do they actually cater for?

The definition of a payment processor: A company that manages the credit card transaction process, acting as a kind of mediator between the bank and the merchant.

Put simply, the payment processor communicates information from your customer’s card to your bank and the customer’s bank. If there are funds, the transaction goes through.

A key thing to remember about payment processors is they aren’t one size fits all — they’ll offer various payment methods, but rarely (if ever) cover them all. This means if you’re interested in more local payment options or if you have a key regional strategy, you’ll likely need to introduce a mixture of payment processing tools.

How payments fit into your revenue delivery process

So, which bit of your revenue delivery process does a payment processor slot into? The answer: the early part.

Some payment processors help you present your checkout (where your customers plug in all their card details), and all will help you facilitate processing payments. That ticks the two first boxes.

Some payment processors dip into other boxes of key toolings, like subscription management and compliance, for example, but this comes at an additional cost from your provider. It leaves you deciding between increasing your spend with that partner, or seeking another tool to integrate into your tech stack and help you automate as much as possible.

The hidden challenges of selling SaaS

We just mentioned "integrations," which could be enough to send a shiver down your developers’ spines, but what are the other hidden challenges of selling software as a service?

Behind each of the requirements we’ve mentioned comes a ton of complexities.

Let’s look at it box by box.

Integrating new currencies: With conversions in mind, you want to optimize your billing systems and payment process to suit your buyer, whatever location they're in, and this includes introducing new currencies.

Charges, retries, and dunning: Subscription management and maintenance gets trickier as your business grows. The more customers you have, the more work goes into ensuring their recurring payments run smoothly.

Supporting complex pricing plans: As much as you can’t predict what each customer will do and want from your product, you will need to adapt your pricing models and introduce new ones.

Keeping up with global regulations: Certainly not one to be underestimated (but often is) and quickly becomes a full-time job in itself, is compliance with all global regulations. And it's something you don’t want to slip up on.

One single source of truth: The more customers, currencies, geographies, and so on that you have, the more difficult tracking all relevant metrics and reporting becomes; having multiple tools in place and attempting to combine the data makes this process even more difficult. This can delay experimentation, but also the scaling of your business.

User management: As your customer base grows, so will the range of customer demands you’re met with. Some will want upgrades, some downgrades, and some will want their subscription to be paused. You need to cover all bases and do so smoothly.

Chargeback protection: We don’t want fraud or chargebacks to happen, because if the chargeback rate goes too high, you’ll catch the attention of Visa, Mastercard, and other card payment providers, which can pose an existential threat to your business. That’s why the right tooling to prevent fraud of this nature is critical.

Financial compliance: Regulations like PSD2 in Europe and SCA are just two areas of financial compliance you need to abide by when selling into specific areas. But it doesn’t just stop at two, and each regulation has its own set of requirements.

5 main reasons why payment processors don’t work for SaaS

1) You will have to deal with an array of complex integrations with other tools

2) Your revenue delivery will need to evolve along with your product

There’s not going to be one single subscription billing solution for the lifetime of your product. Your work toward revenue delivery doesn’t just end like that.

Your product will evolve, and so should your entire business model, revenue delivery infrastructure, and processes. Factors like moving into new markets and selling to high-end customers, larger teams and enterprises, for example, will require added support and processes to continue to offer excellent user experience.

Each element of your revenue delivery will be affected by these changes, and you’ve got to be ready to adapt your billing model and billing management system to keep up with it all.

3) You manage the tax overhead, plus full liability

As Harrison points out, it’s not just about calculating and charging the correct rate of tax for each individual buyer wherever they are in the world; it’s the responsibility of registering and remitting taxes too. And very few tools offer to cover all the above, leaving you with total liability.

Your ideal solution is to look for tooling that indemnifies you against doing your returns incorrectly to fully protect yourself against those huge (and terrifying) penalties. That might mean bringing in tax specialists yourself, or looking toward an all-in-one revenue delivery platform that will have a team to do that for you, saving you on headcount.

4) You will need more than just one payment processor

If you’re using or opting for a payment processor, it’s not all about the extra tools you need to complete your revenue stack. You’ll need to look to more than one payment processor to meet all your needs as a business — multiple, in fact.

When your goal is to convert, you want to make customers happy and make the purchasing process as streamlined as possible. This includes supporting their preferred payment method, currency, and geography. No single payment processor permits or covers all these bases.

5) The full cost ends up much higher than what you were planning

Scaling only makes this harder. As your product evolves, the whole system (or systems) you have in place needs to grow at the same pace. Whether you’re moving upmarket or expanding into new territories, you'll have to develop every element to provide for new payment methods, new geographies, and new jurisdictions.

And here’s where the next big cost comes in — one that is often overlooked by CEOs when building up and developing this stack: opportunity cost.

Rather than focusing on your product differentiation and value proposition, your team’s time will be taken up with the management and maintenance of each and every revenue delivery element. Not ideal when you want to be holding onto the customers you’ve worked so hard to attain, and gaining new customers too. And this will only get worse when trying to scale your company.

SaaS businesses need to consider the full scope of costs. The individual costs of each tool in your revenue stack are one thing, but the more hidden costs of integrating, managing, and maintaining, as well as selling compliantly, need to be factored in too.

Payment processor FAQs

What does a payment processor do?

A payment processor is a mediator between a merchant and a financial institution. Their role is to authorize and process credit card transactions to ensure a secure transfer of funds.

What is the difference between a payment gateway and a payment processor?

A payment processor ensures a transaction between a merchant and a financial institution, while a payment gateway is an application responsible for processing online payments for e-commerce businesses and online retailers, as well as processing any non-card transactions.

What is the best payment processor in the market?

The most widely used payment processors are:

- Stripe

- PayPal

- Square

- WePay

- 2Checkout