Selling your SaaS or digital products globally or across different states? Opting for a MoR model like Paddle frees you from navigating constantly changing and complicated sales tax compliance and being victim of huge sales tax penalties, which payment facilitators won’t protect you from.

Payment facilitators (also known as payfacs), seller of record and merchant of record (MoR) models are just some of the various pathways businesses take when handling payments. Trying to decide between payfac vs merchant of record? Read on to find out why they're different and how an MoR can help you grow your revenue.

Explore our Merchant of Record series

Merchant of Record vs Payment Facilitator: how are they different?

Payment facilitators

A payment facilitator (also known as a PayFac) is a third-party merchant service that helps businesses process payments online. Payfacs create a single master merchant account with a payment processor, and this typically used by small businesses that don’t have established relationships with merchant accounts and banks (which is a costly process and takes months to set up). Going down the PayFac route can often help businesses get on their feet quickly.

Payfacs look after:

- Setting up payment processing on behalf of the seller (known as a sub-merchant)

- Making sure payments meet compliance requirements like PCI, and so on

Examples of PayFacs include: Stripe, PayPal, Shopify and Square. The PayFac (Square or Stripe in this case) handles the connection to the banks and processors, so you don’t have to.

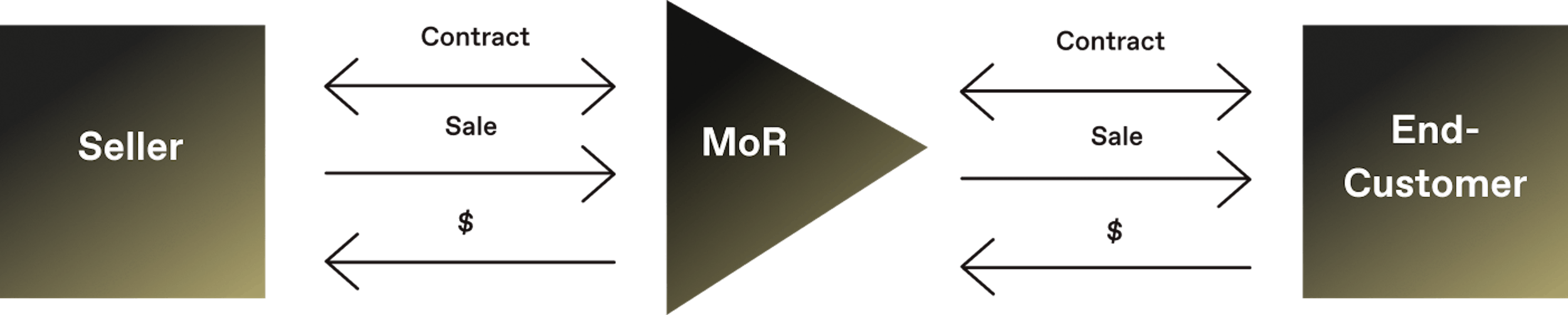

Merchant of record

A merchant of record also covers all the bases that payment facilitators do. However, because the merchant of record is legally entity selling to the customer, it has additional unique responsibilities that PayFacs don't deal with.

Examples of merchant of records include: Paddle, Apple App Store, Google Play Store, Amazon

When comparing payment facilitators vs merchant of record providers, the main difference is that payfacs are not responsible for tax calculation and filing them. That’s up to the seller to handle.

Businesses using payment facilitators still need to:

- Calculate tax on every transaction

- Remit the correct tax amount in the relevant jurisdiction

- Ensure they’re compliant with regional sales tax, global sales tax and VAT

Sellers using payment facilitators often have to purchase separate sales tax software to ensure compliance with complicated tax laws, both regionally if you’re selling in the US, and globally with VAT and global sales tax. For example, Stripe is a payment facilitator, but you have to purchase their tax platform separately.

Not only do you need to find the time to manage all these different platforms, but opting for a payment facilitator might end up costing you more in the long run, too.

Payfac vs Merchant of Record: key features

Both models are payment solutions in some form, but what is the difference?

Payment facilitators

- The payment facilitator has a master merchant account and already has established relationships with banks, so the sub-merchant (i.e. the seller) doesn't need to worry about this

- Payfacs do not own the product. They process payments and, like MoRs, are PCI compliant

- They don't come with tax support. You either need to have an in-house team that can calculate and file taxes correctly, or purchase additional software that has this capability. Lots of businesses usually use a payfac alongside tax software which can be expensive, not to mention a logistical headache

- The sub-merchant is responsible for their customer's queries. The payfac will provide support on seller's payments, but not to the seller's customers

- Sellers may incur extra fees for add-ons like checkout and payments localization, tax software etc.

Merchant of record

- MoRs like Paddle are liable for the transaction and are the legal reseller of a product or service. They handle also have established relationships with banks and payment gateways, providing payment management, localization on currencies and payments, compliance and more

- Tax is calculated and filed for you in the relevant jurisdictions. They are legally liable to be compliant with regional taxes (e.g. in the US), global sales tax and VAT

- Refunds and chargebacks are managed on your behalf with a MoR

- Some merchant of record companies, like Paddle provide customer service support for both sellers and their customers

The bottom line? MoRs manage more risk for you and are ideal for businesses of all sizes. SaaS and digital product companies are born global from day one, so if you're not selling worldwide, you're missing out on customers and revenue growth. Don't let the complexities of tax put you off. Let a merchant of record do it all for you, so you can grow.

Avoid mounting admin and costs with Paddle’s global merchant of record

When it comes to payments, Paddle covers more than what payment facilitators can manage. A payment facilitator lacks tax compliance out of the box, doesn't cover chargebacks or refunds, so app and software founders will either need to do it themselves, or pay for extra software that will do it instead.

There is a better way. Having a merchant of record like Paddle handle all your payment needs, like sales tax are looked after as standard, so you can focus on your products and growing your business.