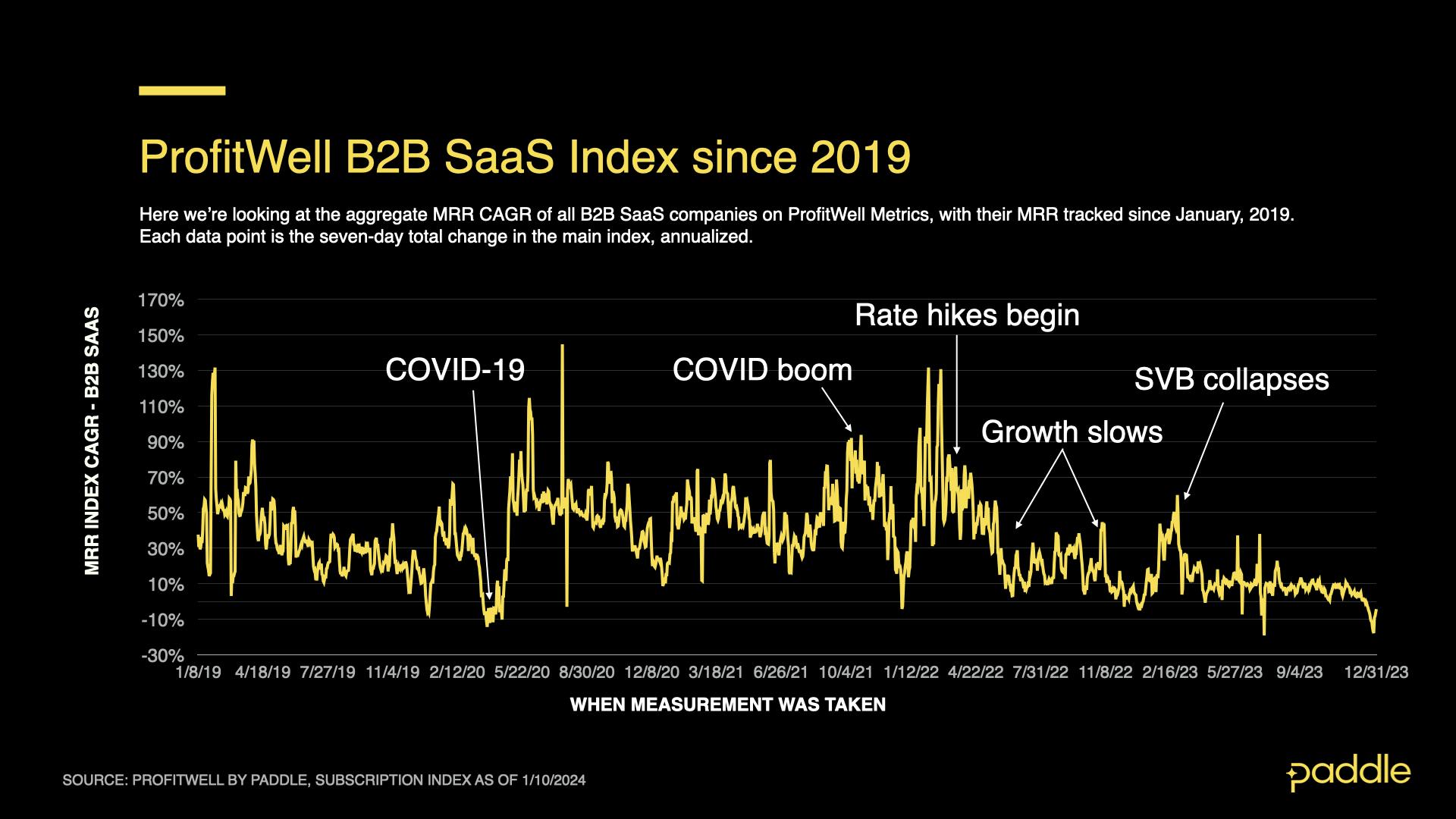

December 2023 marked the first-ever revenue decline in the ProfitWell B2B SaaS Index following a steady drop in revenue growth and caps off the worst year for B2B SaaS.

The funding tap dried up, buyers scrutinized new and existing purchases with more rigor than ever before, and companies were forced to get efficient as sales slumped and churn eroded revenue.

But there are pockets of resilience we can learn from and a growing optimism in the industry for 2024.

This is the latest in our ongoing market reports, which track the movement of the ProfitWell B2B SaaS Index, and its underlying growth and retention trends. This month, we examine December 2023 performance and recap the year.

Subscribe to the Paddle newsletter to get these updates in your inbox.

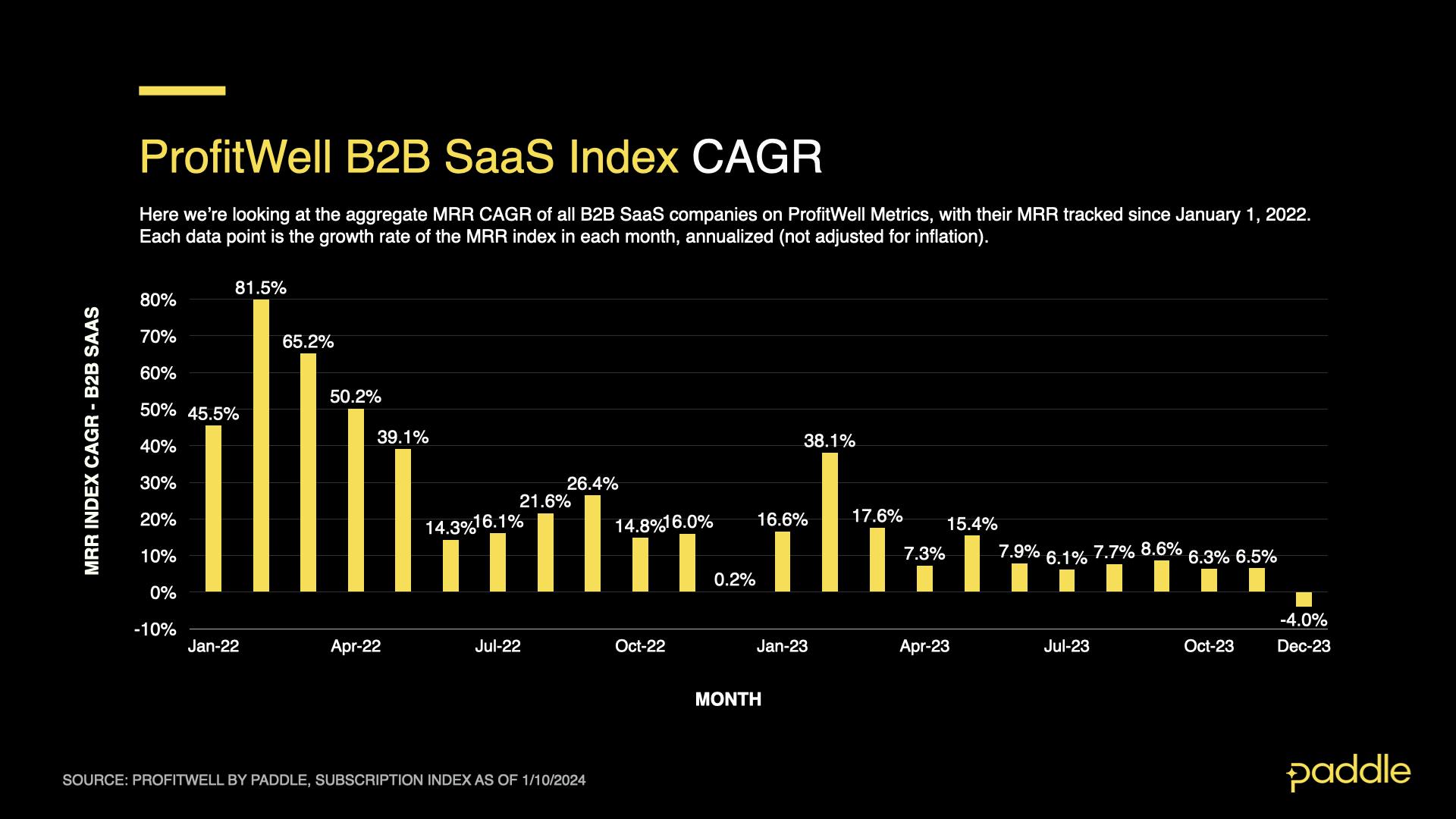

MRR growth declined 4% for the first time in December

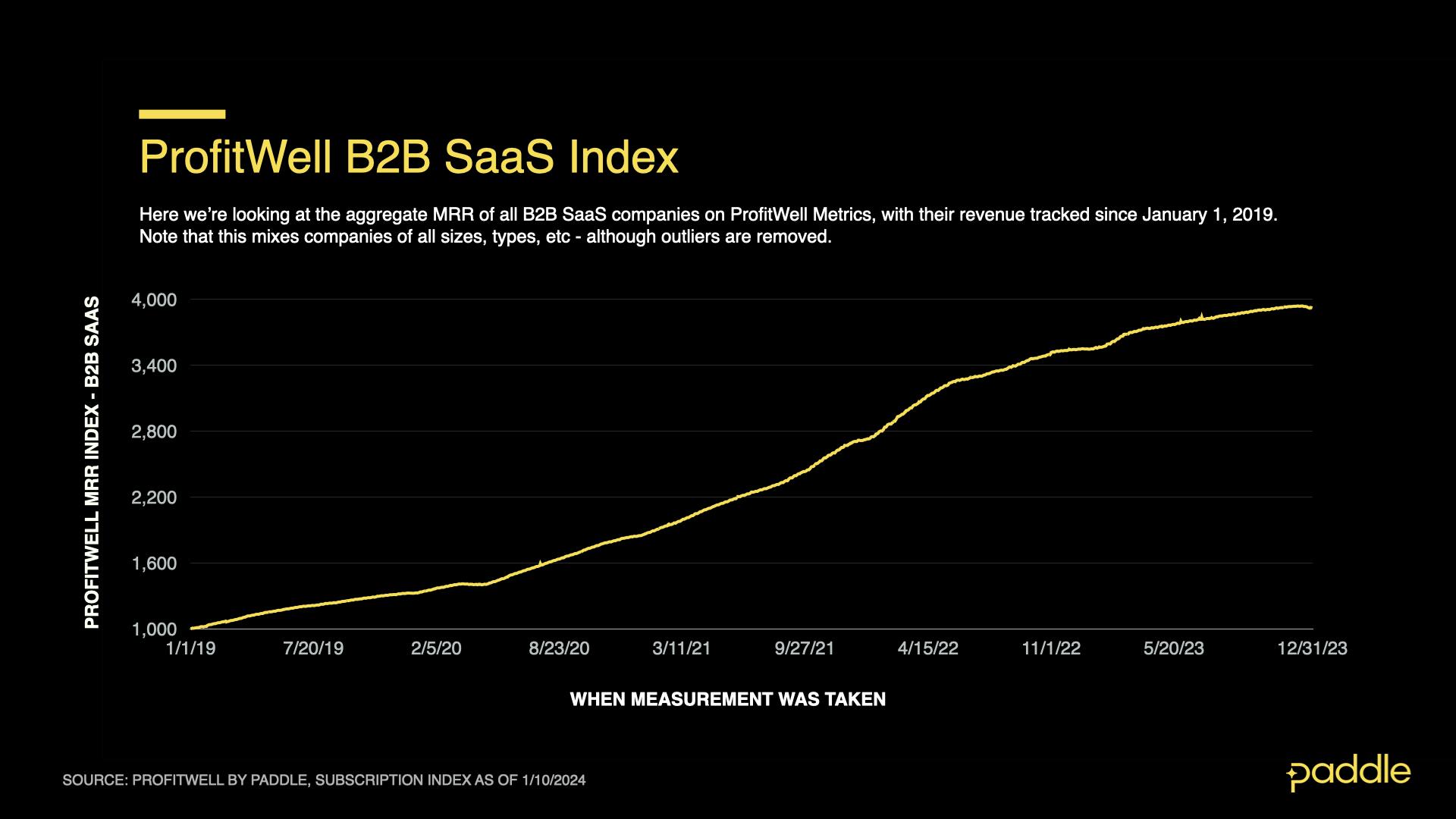

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

Explore the free demo of ProfitWell Metrics here.

The ProfitWell B2B SaaS Software Index experienced its first decline in compound annual growth rate (CAGR) since we started tracking the index in January 2019. December 2023 ended at -4.0%, down 10.5% from November 2023 and ending the year at a record low.

As we’ll go into further below, it was a double blow of a significant drop in new sales combined with a peak in customer churn that brought MRR into decline.

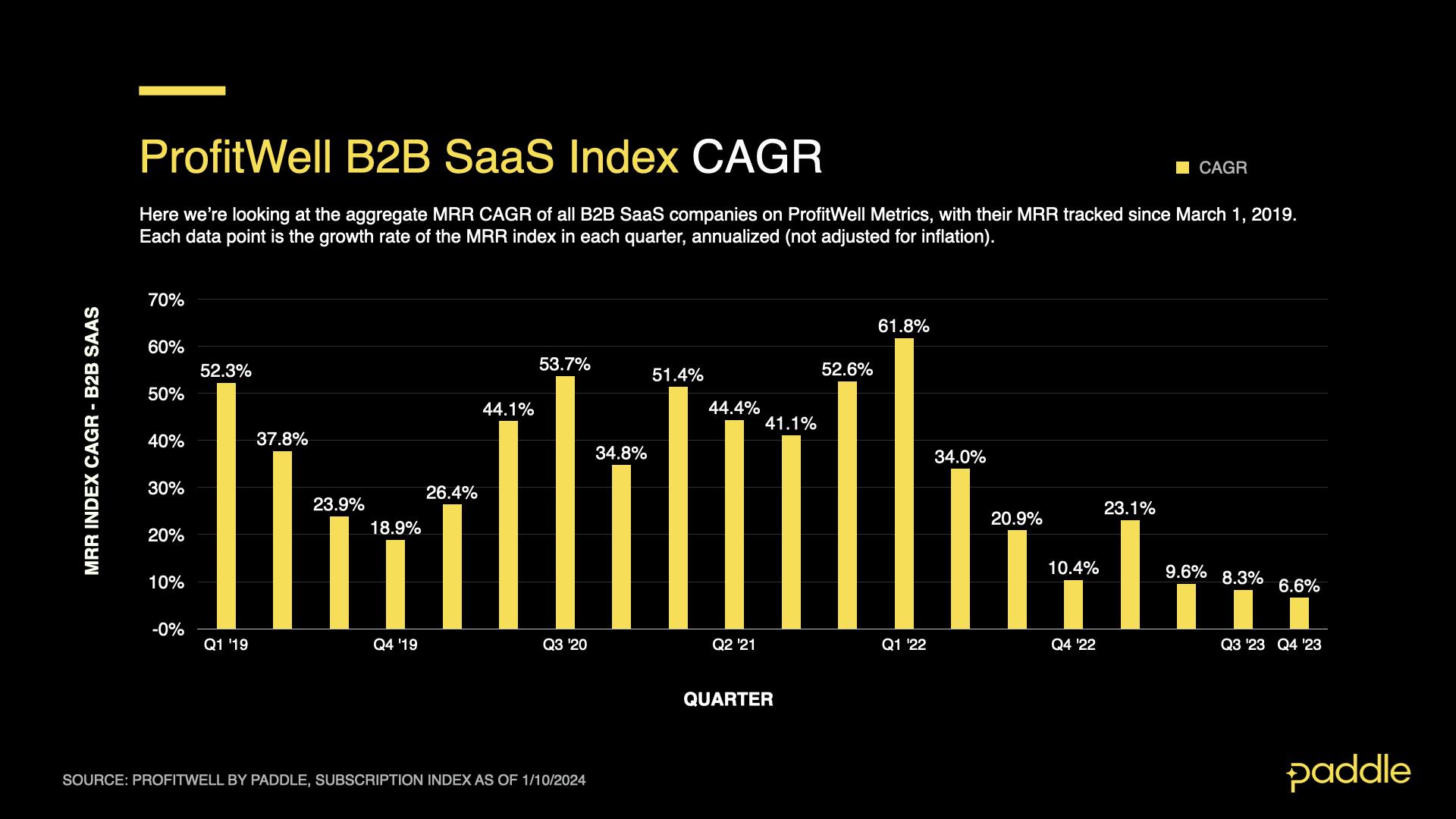

When looking at Q4 as a whole, headline MRR grew at an annualized growth rate of 6.6%, a far cry from the Q2 2022 peak of 61.8%.

The last quarter of 2023 closely mirrored the last quarter of 2022, with a slight increase between October and November, and a steep decline into December. As we’ve seen from the last four years, growth generally recovers in January although it is unlikely we’ll see a major upswing as we settle into a new normal for SaaS.

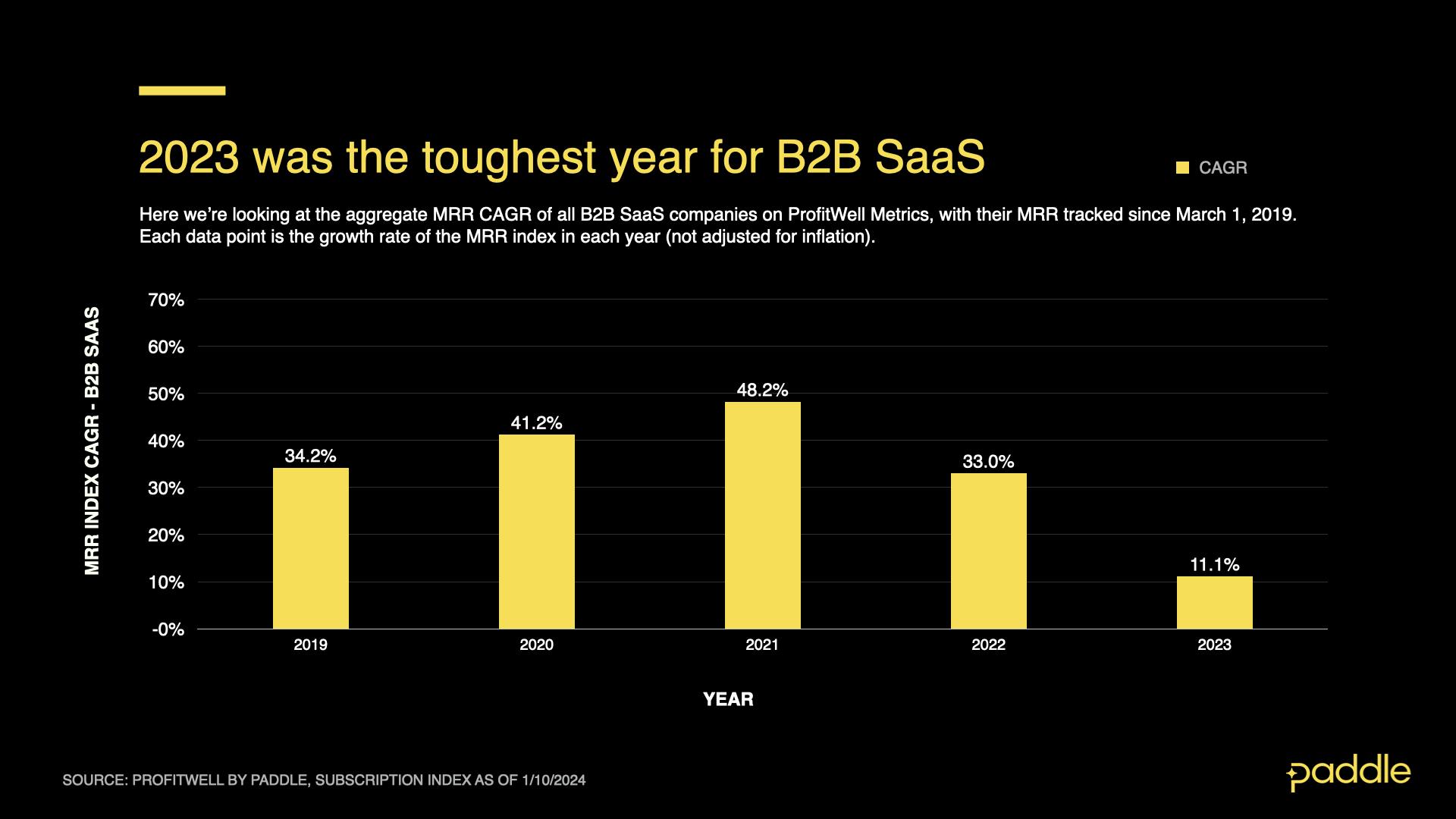

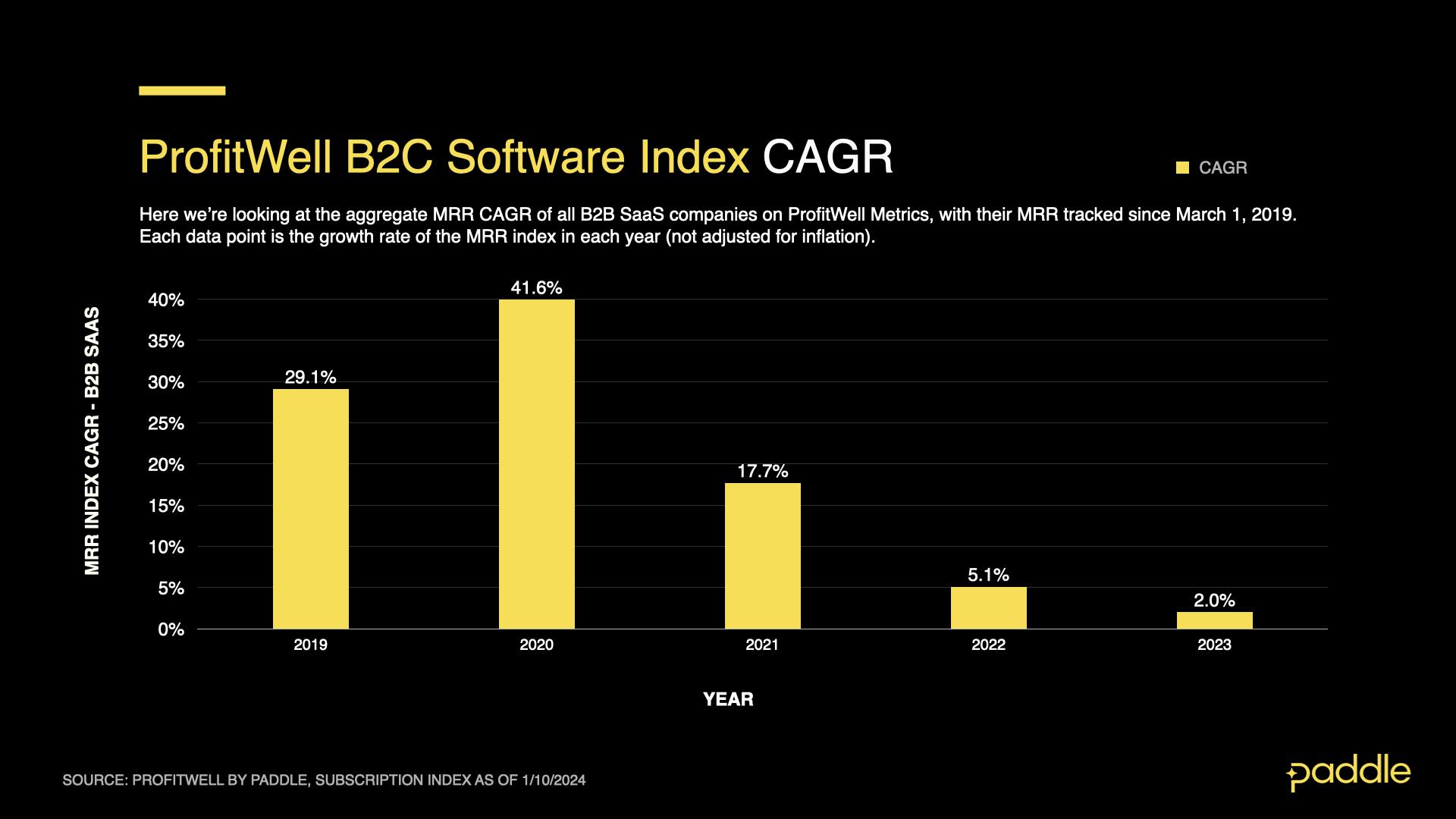

A major slowdown in growth

Taking a step back to look at performance over the last five years, we can see that the B2B SaaS Index has continued to grow year-on-year. However, 2023 was the slowest year, with YoY growth declining by 21.9% compared to 2022. When compared to 2019, before the pandemic and the substantial growth that followed, 2023 also saw a 23.1% decline.

After a spike in growth in the first quarter (which likely reflects end-of-year bookings being realized as revenue), B2B SaaS averaged an annual growth rate of 11.1%.

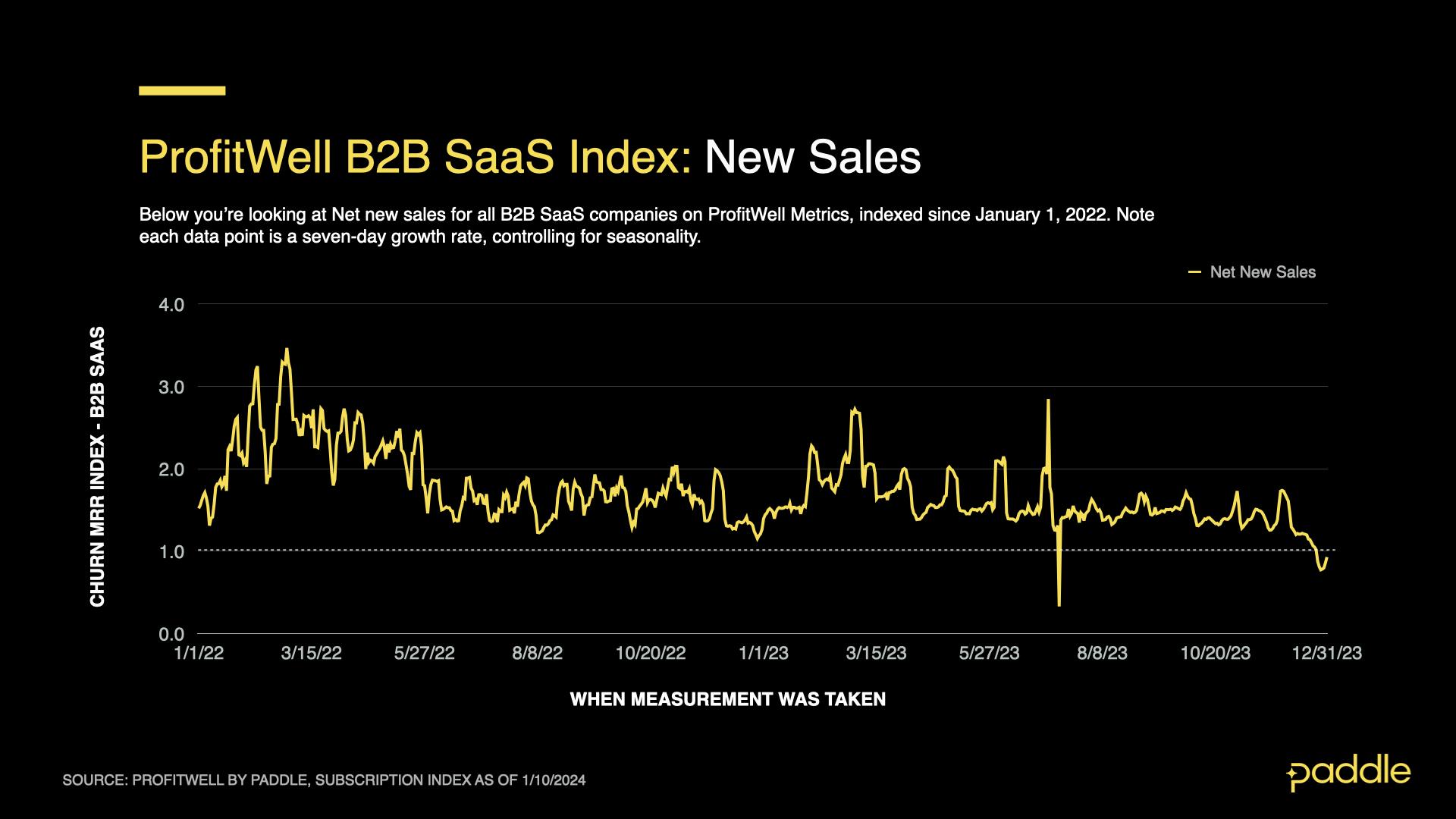

Lowest sales since 2020

The ProfitWell B2B SaaS Sales Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales (the ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators and not direct inputs into the main SaaS index.

The ProfitWell B2B SaaS Sales Index slumped to an average of 1.22 making it the lowest sales month since December 2020. It was also down 14% from November 2023 and down 15% from December 2022.

With the fourth quarter traditionally being the slowest month for B2B sales, this might not come as a surprise, but it does put it in plain sight. Net new revenue has been much more difficult to close in the past year and while there is consensus that things will pick up in 2024, we’re likely heading to a new normal from the highs of 2022.

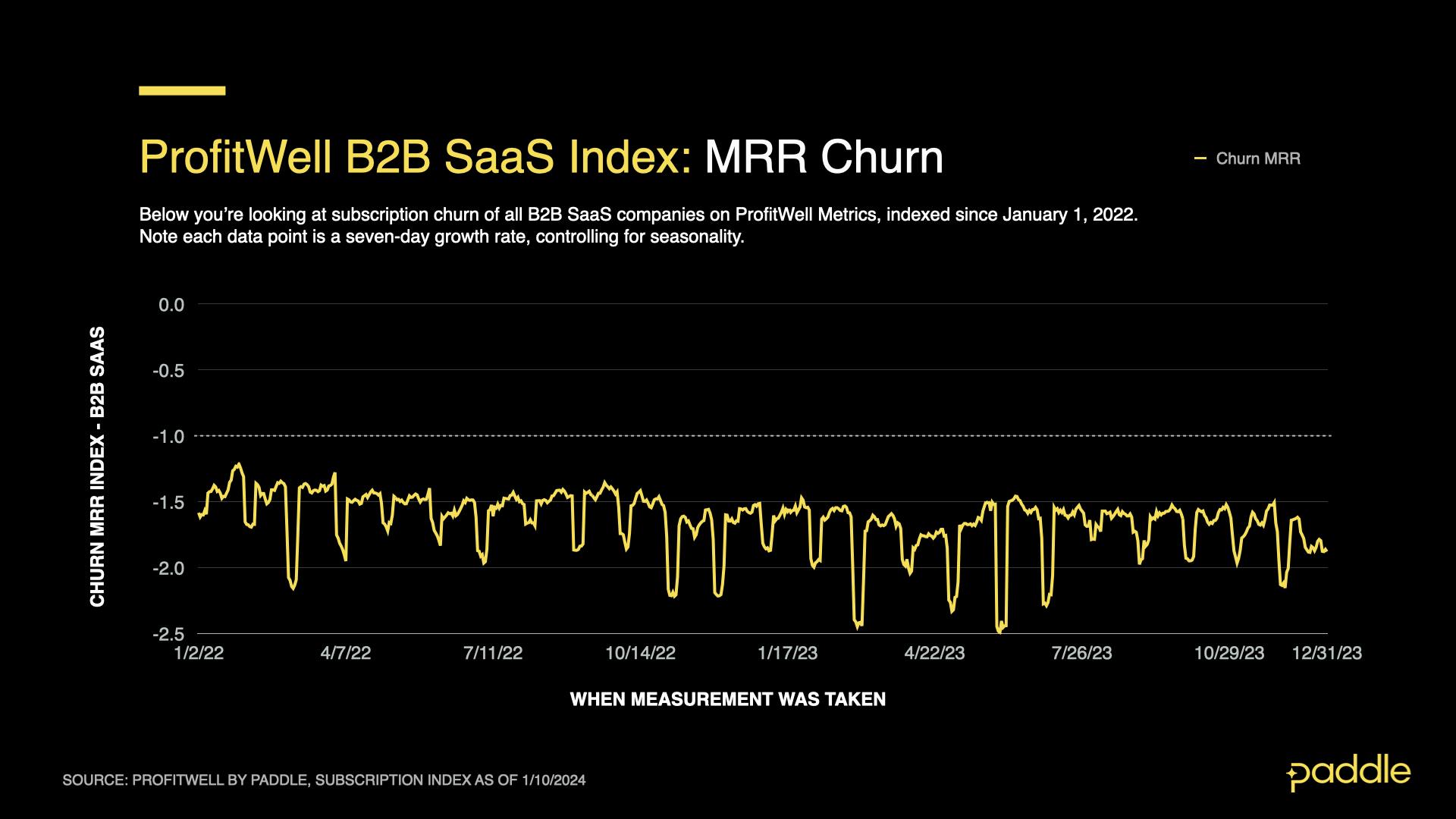

Churn reaches an all-time high

December’s MRR churn ended at an average of -1.85 making it the highest month for churn on record. This figure was also a 7% increase in churn from December 2022 and a 25% increase against December 2021 figures.

Since 2020, we’ve seen churn typically worsen in November and December as companies trim costs during their annual planning cycles and 2023’s cuts reflect a year focused on stripping back unnecessary spend.

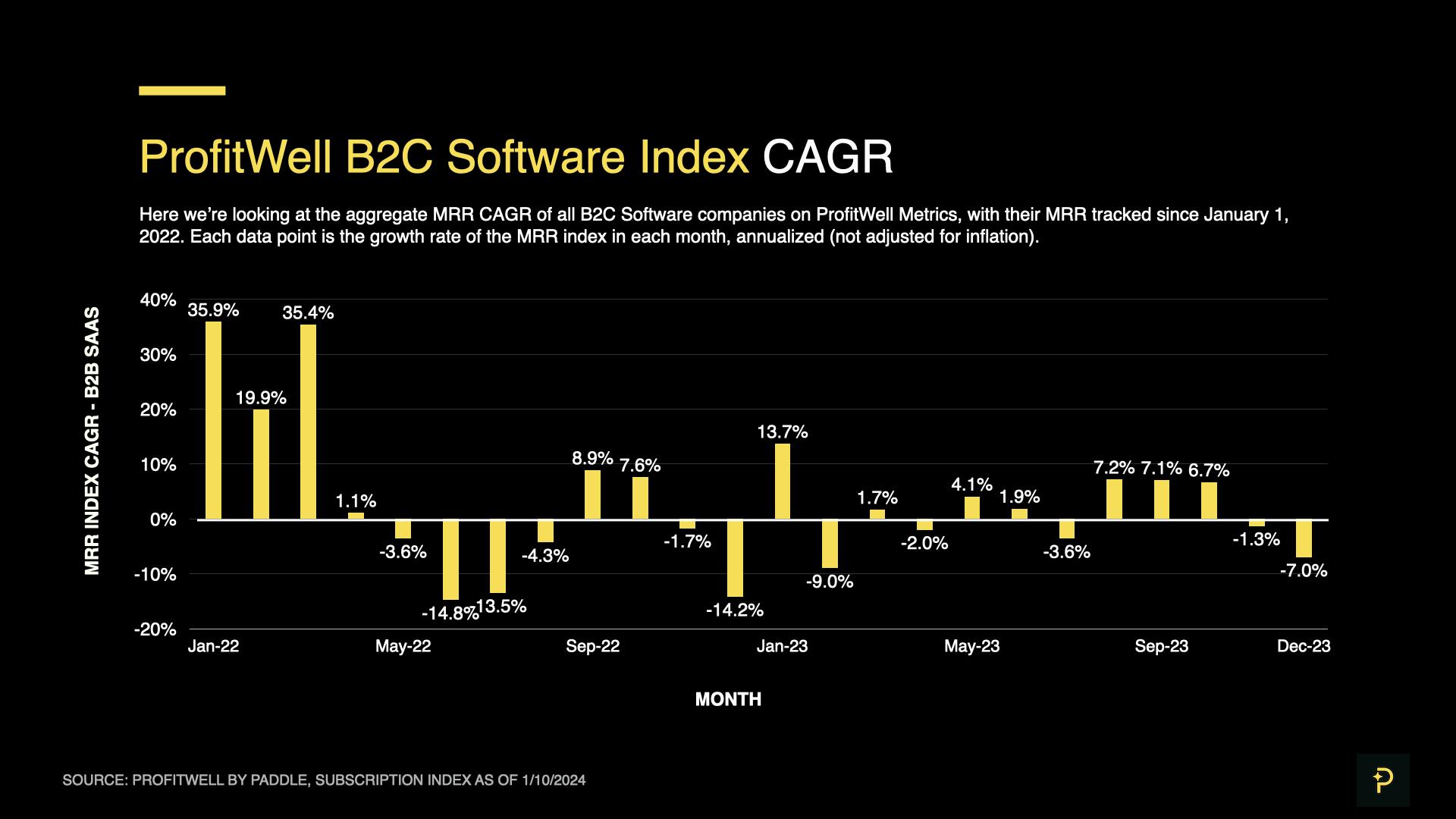

But times were tougher for B2C software

Since mid-2022, when interest rates started rising, the B2C software market has been hit by the resulting cutback in consumer spending.

Despite being part of the holiday season, December 2023 revenue further declined to -7%. This was a 5.7% drop compared to November 2023 but a 7.2% increase from December 2022.

Similar to B2B, our data showed this poor performance was due to lower sales and higher churn in December.

Looking at year-on-year growth shows just how hard B2C has been hit. Growth in 2023 was at 2%, down from 5.1% in 2022, but when compared to the 2020 pandemic-induced peak, it was down 27%.

The road ahead

Heading into 2024, it’s clear that the events of the past four years have radically shifted the B2B SaaS landscape. Promisingly, we’re seeing more companies resume their hiring and spending as getting more efficient can only get you so far. We won’t go back to major hiring sprees (and even the revenue peaks of 2022) but impending Fed rate cuts and increasing optimism will bring more opportunities to grow in 2024.

Growth is down, but efficiency is up

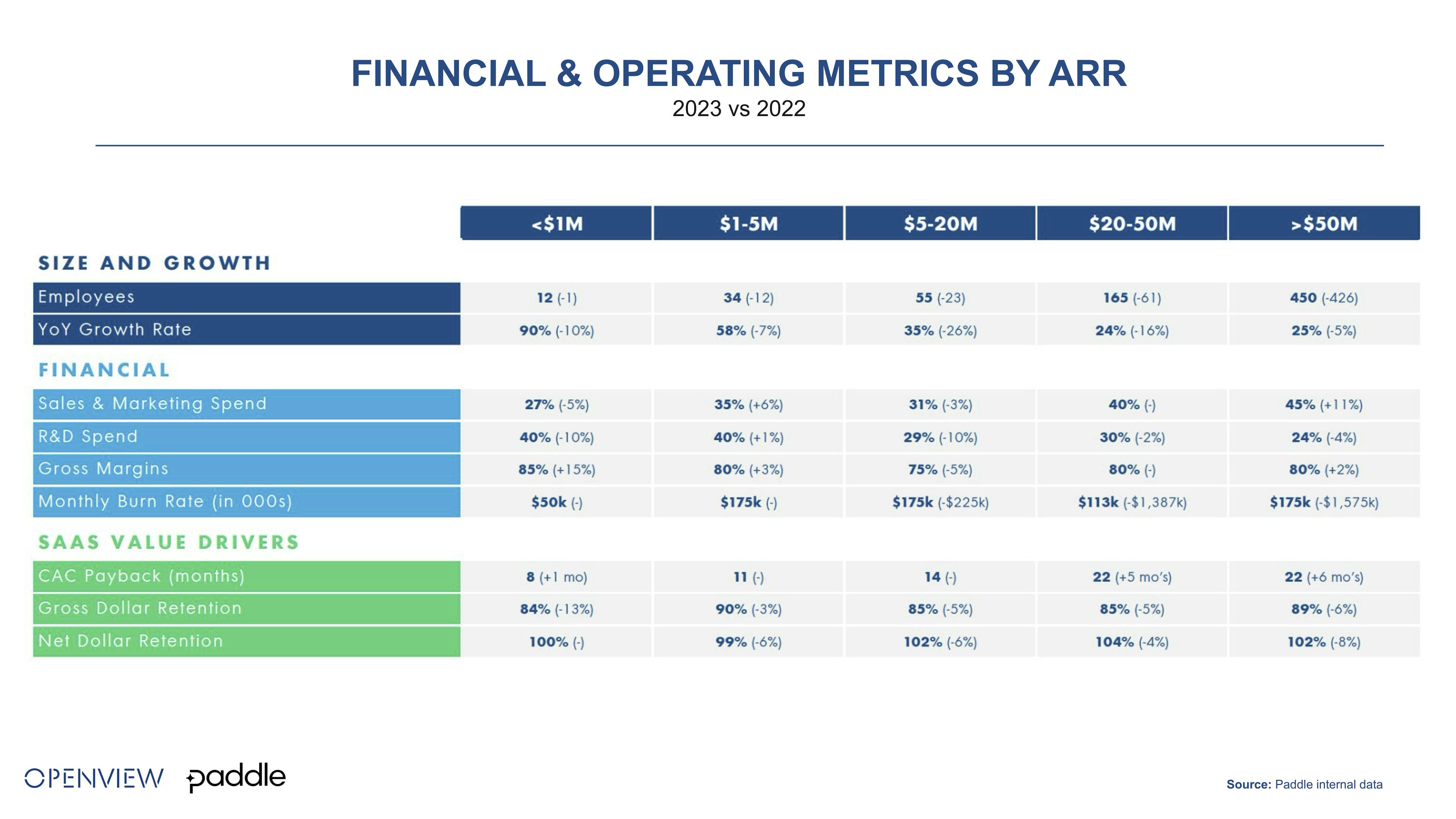

We partnered with OpenView on their 2023 SaaS Benchmarks report which showed that while growth has dropped, it has pushed companies to become more efficient.

Private companies with ARR between $5-20M saw the biggest fall in median YoY revenue growth of 26 percentage points (from 61% in 2022 to 35% in 2023). Larger companies with $20-50M ARR saw a drop from 40% growth to 24%.

It’s important to note that slower growth forced greater scrutiny of spending with monthly burn rate figures coming down significantly from 2022 across those same companies.

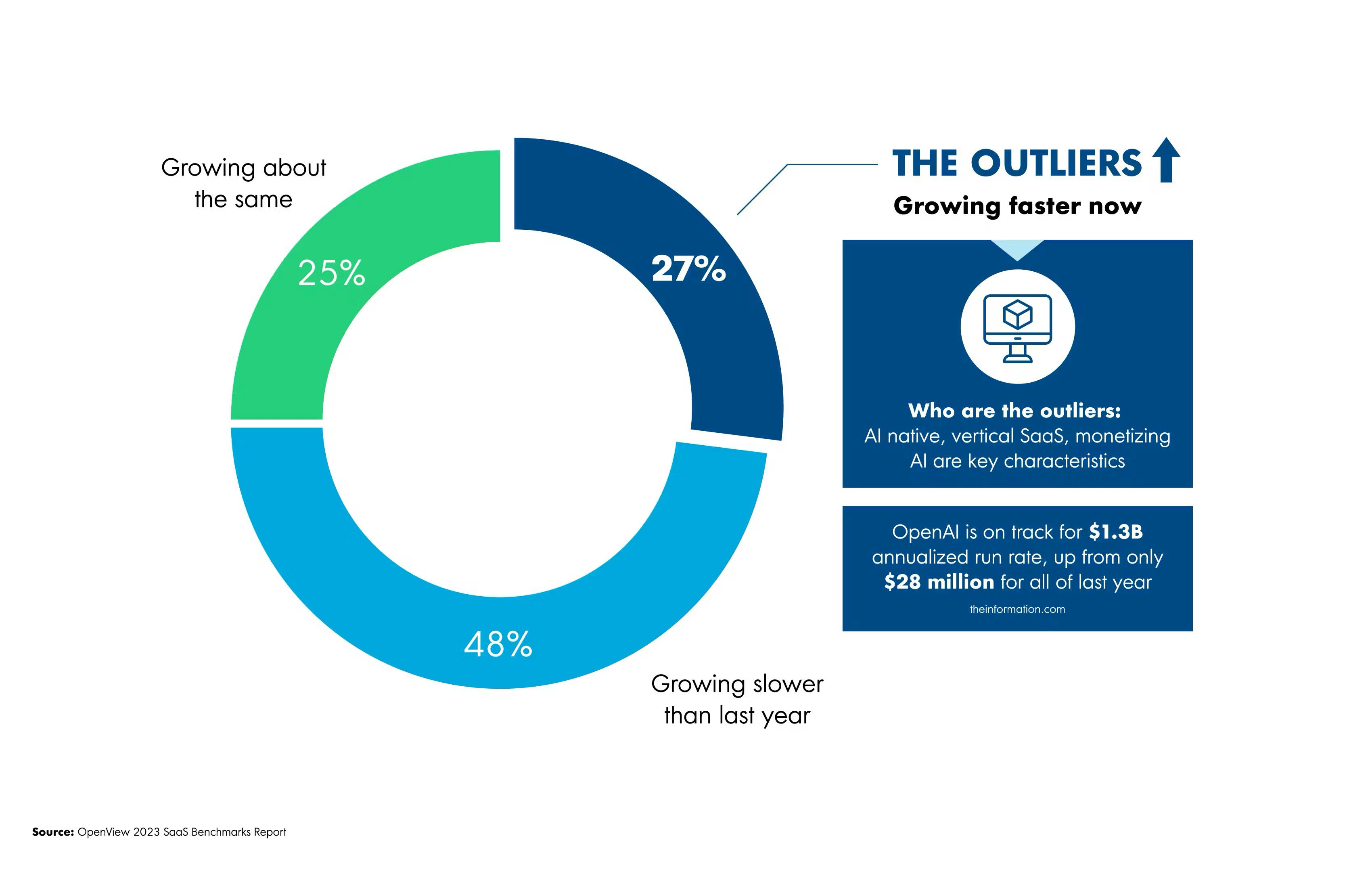

The SaaS outliers

Roughly one-quarter of companies actually reported growing faster in 2023 compared to 2022 and we deemed these the “Outliers” bucking the downward trend. They were made up of three key groups: AI-native companies, vertical SaaS, and those companies successfully monetizing AI.

Only 15% of those who launched AI features or had AI on their product roadmap in 2023 had monetized AI. Launching your AI product without optimizing your pricing strategy will cause you problems down the line.

Pricing your AI product in 2024: Monetization strategies that move the needle

The Price Intelligently team at Paddle works with SaaS companies that are building out their AI to help them optimize and improve monetization strategies for their product and features.

Join Evan Grub and Jack Cove, from Price Intelligently by Paddle, to get the latest insights and tips in this upcoming webinar.

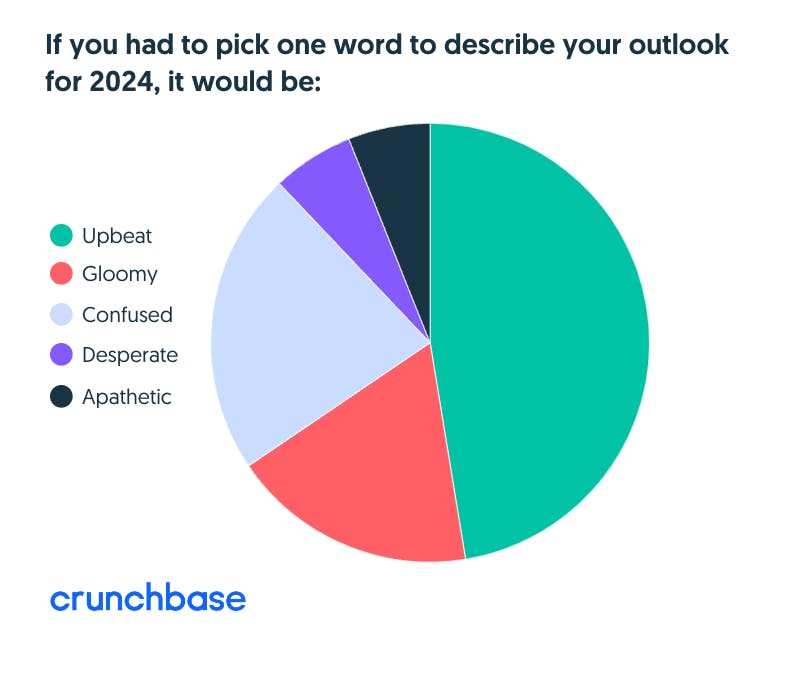

Startups remain optimistic as we kick off 2024

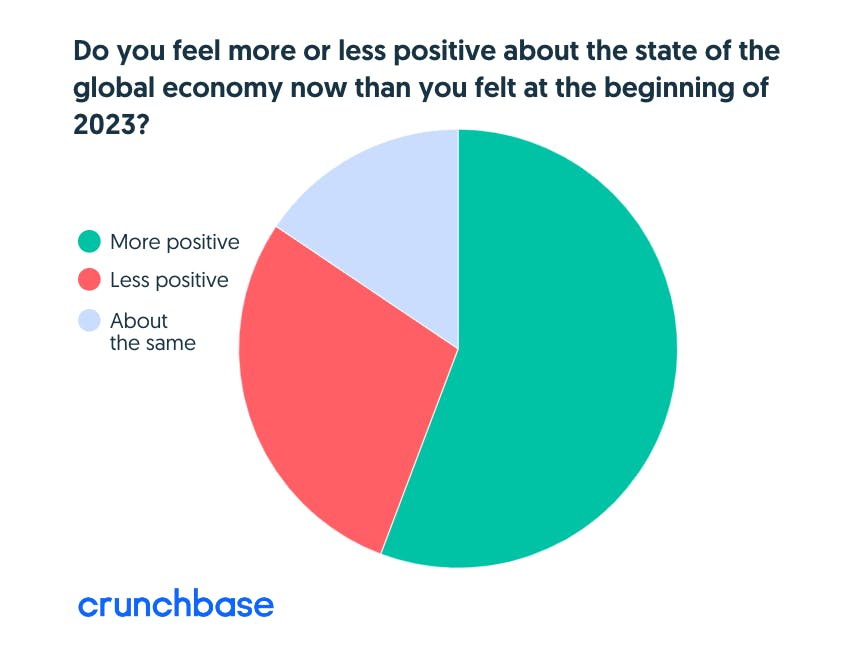

In a Crunchbase survey, 47% of respondents said they felt “Upbeat” to describe their outlook for 2024, with “Confused”, and “Gloomy” coming in at second and third place.

When asked if people expected their companies to conduct layoffs in the first half of 2024, 64.75% responded “No”. In fact, 43.44% of respondents reported that their companies were actively hiring for new roles in 2024.

How to respond in 2024: Your current customers are the key to growth

While the muted sales performance and uptick in churn reflect the end of a difficult quarter, it reinforces the need to drive expansion revenue. Acquiring a completely new customer is over four times more expensive than upselling an existing customer and SaaS leaders are driving over 30% of new revenue from expansions.

For example, if the gold standard business for net dollar retention (NDR), Snowflake, had suspended all customer acquisition activity a year before their IPO, they still would have grown by 58% that year.

But, of course, this also isn’t as straightforward to do as it once was. Net dollar retention has gone down as customers re-evaluate their cloud spending when previously you could assume that a company would grow its headcount and usage of your product over time.

Here are four key strategies to increase your expansion revenue opportunities in 2024

- Run a multi-product strategy, with cross-selling as a source of revenue.

- Create an add-on feature or service, targeting a customer segment with higher willingness to pay.

- Price on a value metric with expansion built-in (ex: usage-based, outcome-based).

- Adjust GTM roles and comp to incentivize expansion rather than just adoption or renewals.

Focus on markets that are growing faster

In this environment, leaders are now looking at all the different levers they can pull to drive efficiency and growth.

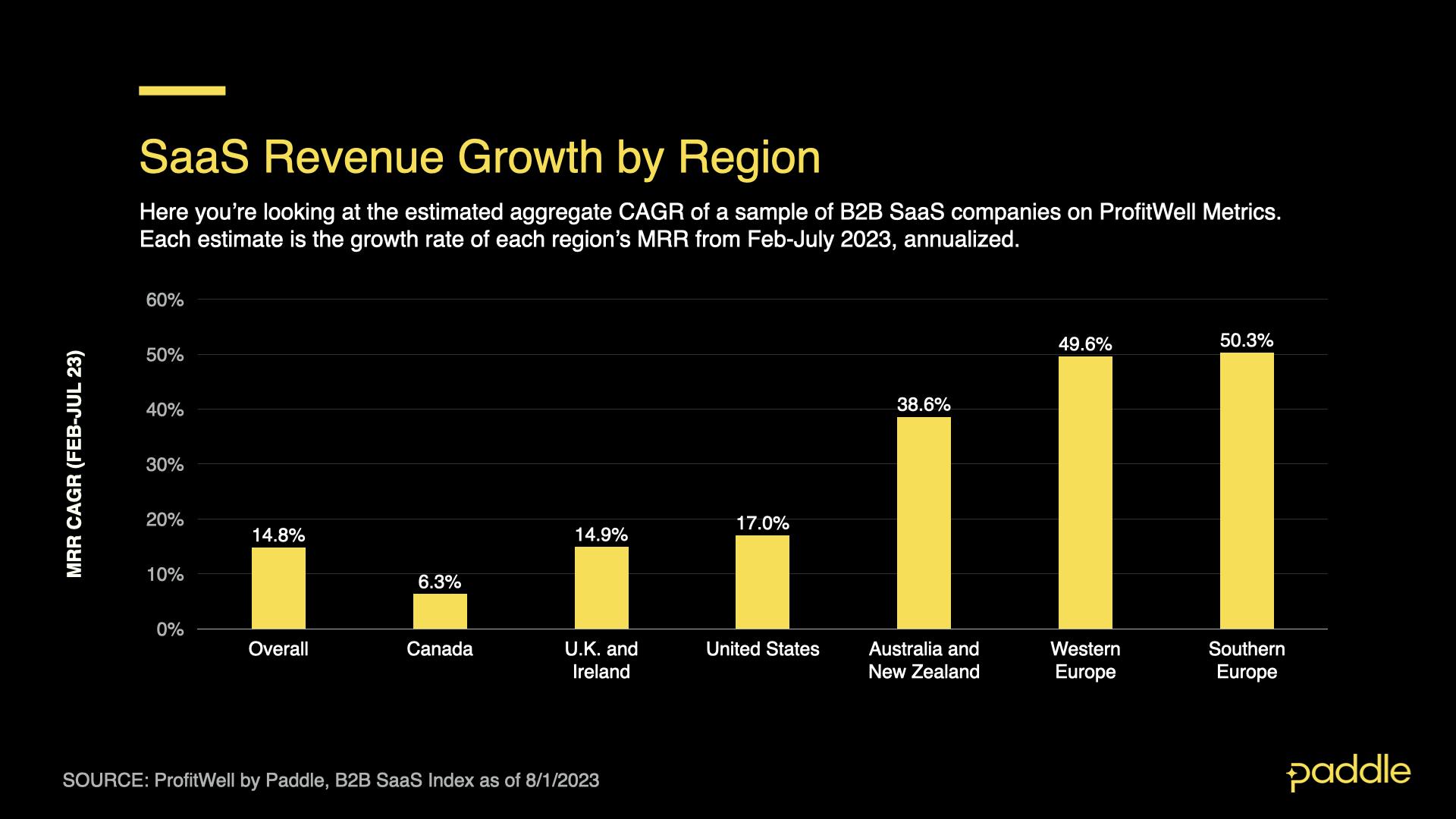

In our August report, we noted that growth has slowed in Canada, the United States, the UK, and Ireland. However, parts of Europe, Australia, and New Zealand have continued to grow significantly.

International expansion is a really clear key theme we're seeing play out as people focus on trying to find new growth outside of the typical market.

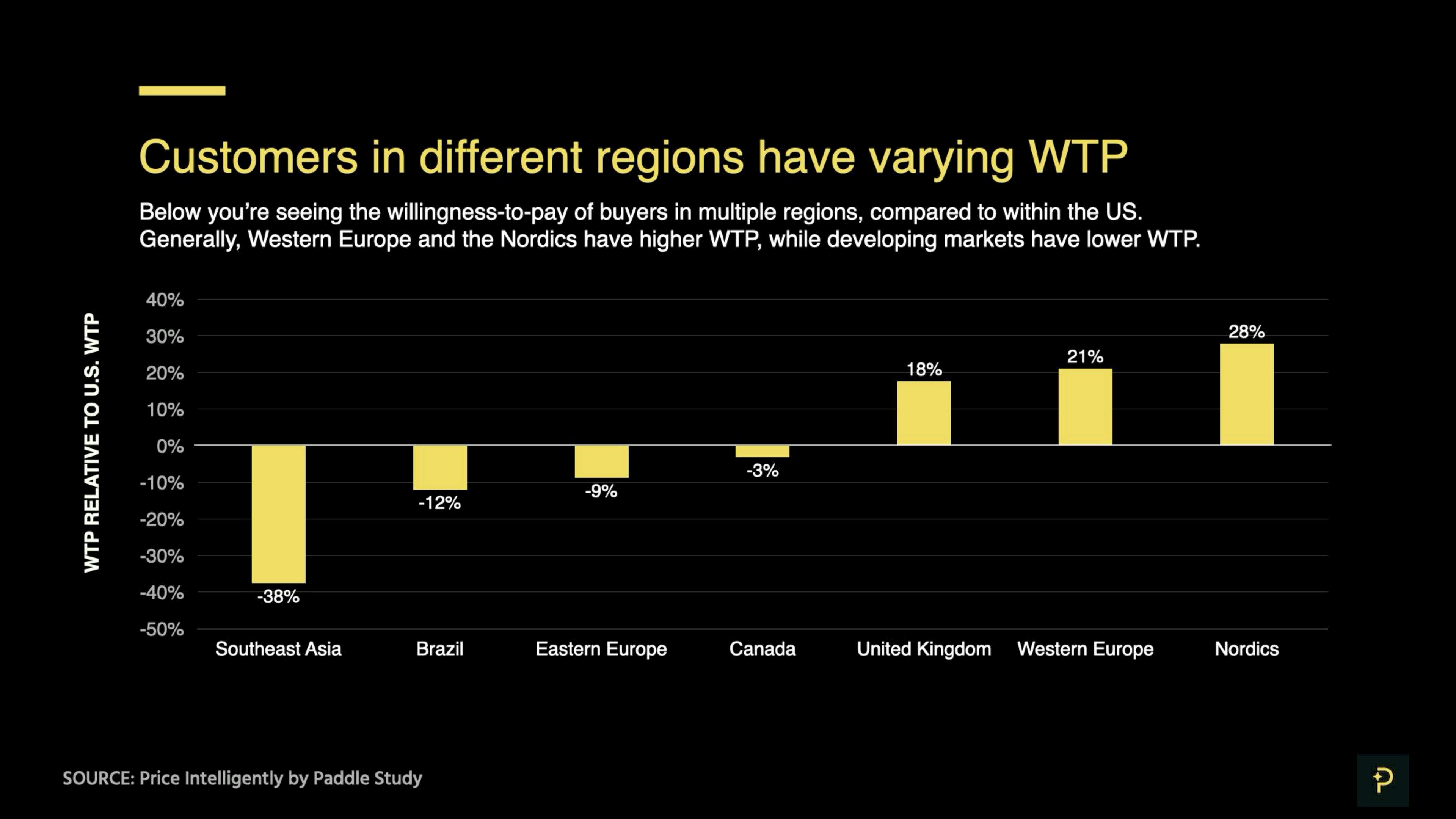

We also know that willingness to pay differs in different regions. For example, the Nordic countries have the highest willingness to pay whereas your prices will need to be lower in Southeast Asia.

Taken together, B2B sellers looking to drive growth in 2024 need to consider expanding globally into markets that have faster growth rates, while also leveraging willingness to pay. But to successfully expand globally, sellers need to take localization seriously.

True localization, not just changing the currency symbol on your pricing page, requires a strategy shift and laser focus on localizing the user experience in different regions. Start by letting customers pay you via their preferred payment methods, in their language. This reduces friction and lowers drop-off rates at checkout, meaning you can effectively expand into new regions when you may be facing saturation in your current market.

"True localization, not just changing the currency symbol on your pricing page, requires a strategy shift and laser focus on localizing the user experience in different regions. Start by letting customers pay you via their preferred payment methods, in their language. This reduces friction and lowers drop-off rates at checkout, meaning you can effectively expand into new regions when you may be facing saturation in your current market. Integrating with Smartproxy's reliable and localized proxy services can also enhance your localization efforts, ensuring a seamless and personalized experience for users across the globe".

Paddle customer, Smartproxy

Going global the right way: Proven strategies to unlock international SaaS growth

SaaS growth expert, Elena Verna, and Paddle CMO, Andrew Davies, share the blueprint to achieve your international expansion ambitions.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market’s headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market report from November 2023? Read it here

Subscribe and be the first to receive the next SaaS market report.