SaaS growth once again slowed this October, after it had sharply rebounded in September, while initially showing signs of continued growth throughout Q4.

We had previously predicted that B2C would continue to grow, or at least remain stable around 12% CAGR, driven by the Fed’s interest rate cuts. B2B was also poised for growth, with a forecasted increase in sales potentially driving it to 11% CAGR.

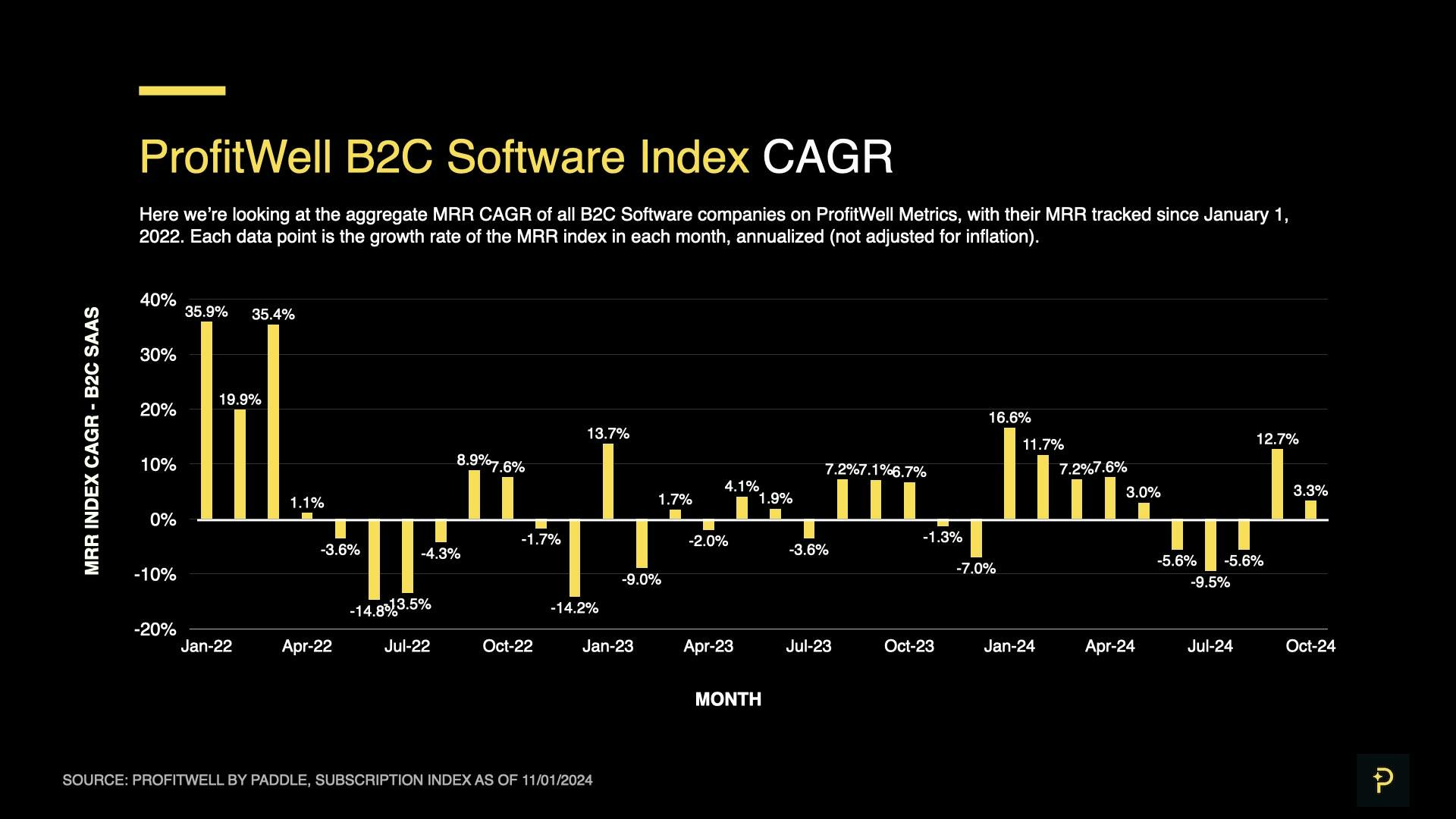

Instead, B2B growth fell to 3.1% CAGR, while B2C growth dropped to 3.3% CAGR. So, what happened?

The short answer is: simultaneous long weekends, and a “correction” in sales numbers, after a record-breaking September.

So without further adieu, let’s dig into the data behind October’s faltering growth, and figure out what lies ahead for the final quarter of 2024 👇

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine 2024 performance.

Subscribe to the SaaS Market Report newsletter to get these updates in your inbox.

KP and Gavin discuss this month's data. Scroll down to read the full report.

B2B Defies Positive Forecast

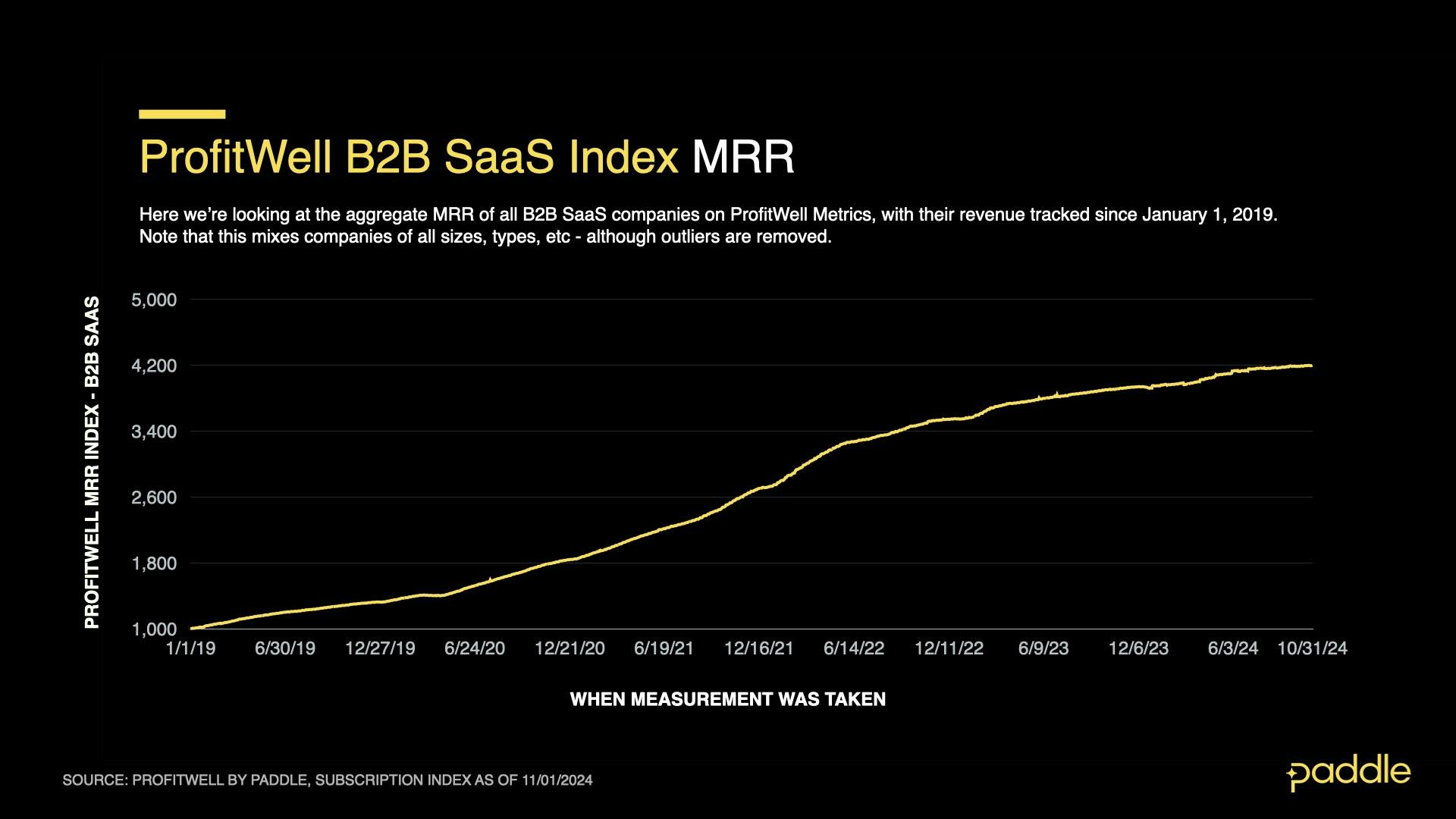

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

This October, B2B growth rates remained positive, albeit diminished. Our B2B MRR Index climbed continuously throughout the month, reaching a value of 4197 by the end of October (ie, the cumulative MRR of all ProfitWell B2B Index companies has grown by 4.197x, since the index was created in 2019).

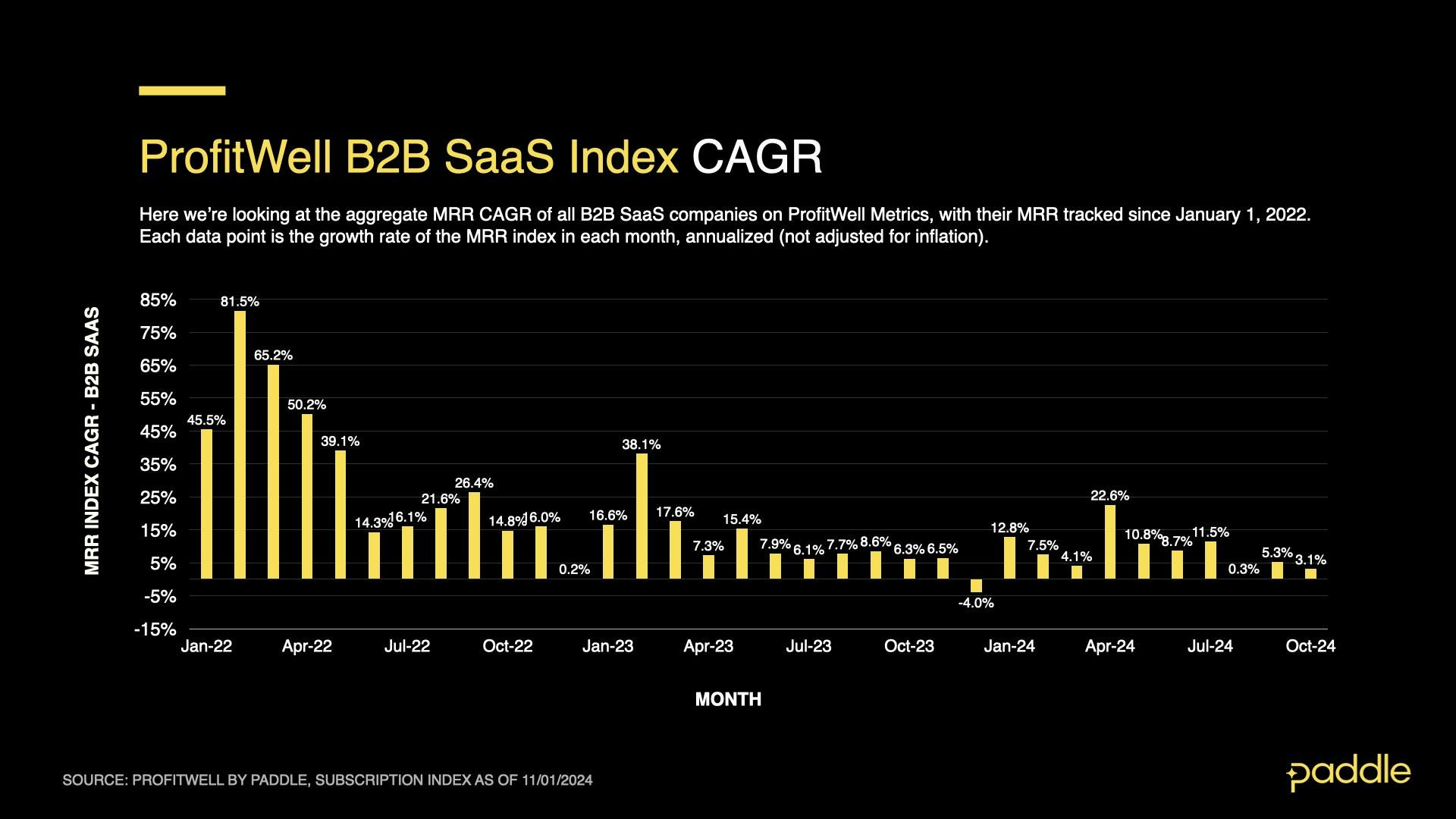

Examining October’s growth through its CAGR (compound annual growth rate), tells a similar story - positive, but diminished growth. CAGR slowed to 3.1%, from 5.3% in September. This defied our previous forecast for continued growth, potentially up to 11% this month.

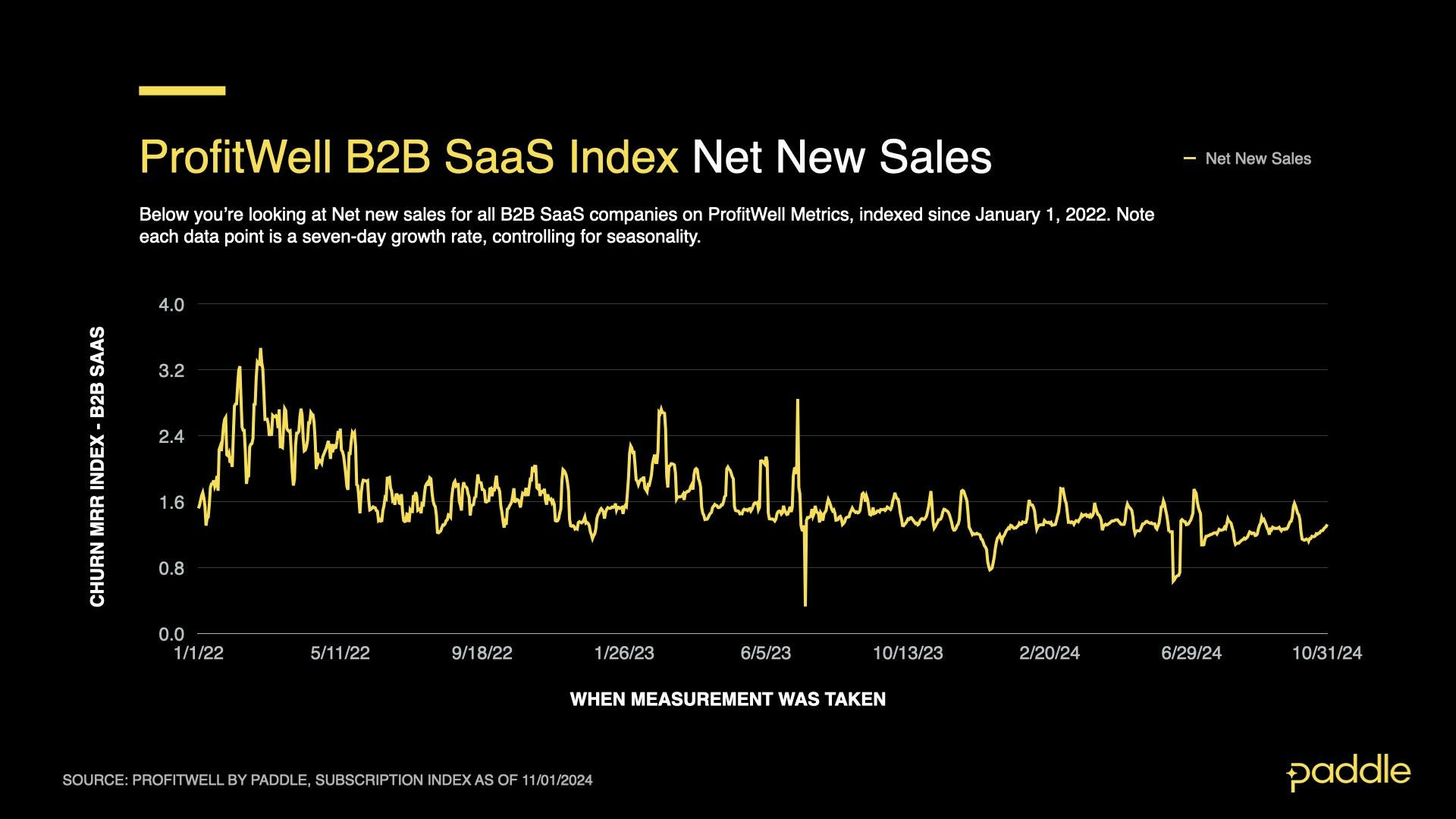

These forecasts were based on two of the driving forces behind SaaS growth - net new sales, and monthly downgrades. After September’s sharp recovery from a seasonal slump (as employees took time off for the summer), we noticed that the rate of new sales still had another ~5% to grow, in order to revert its pre-slowdown average. Likewise, the rate of downgrades was still elevated above its average by about ~15%.

However, instead of growing by another 5% this October, the ProfitWell New Sales Index contracted by 3.3%, reaching an average value of 1.264 over the entire month.

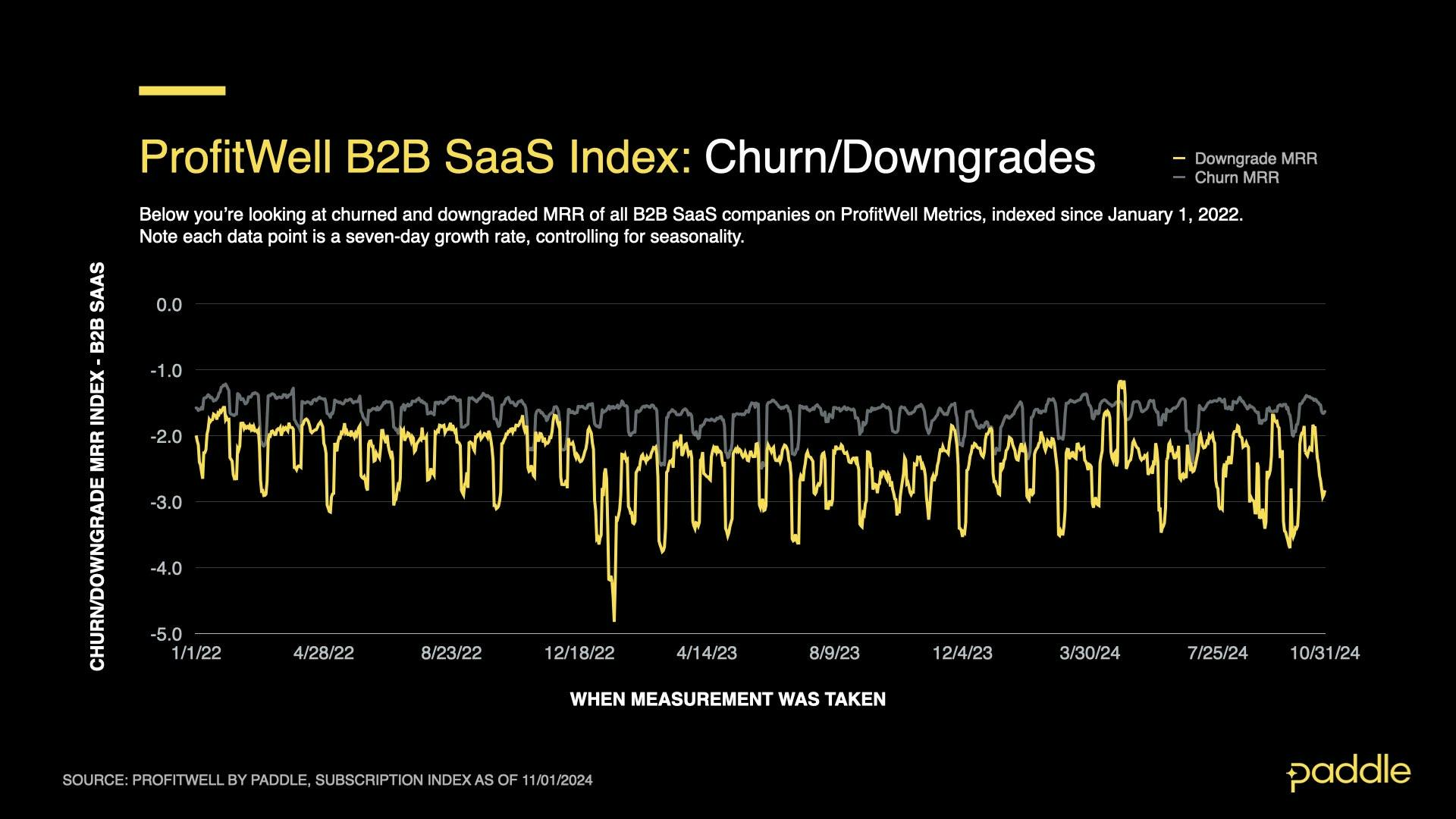

Moreover, while the B2B Downgrade Index dropped as expected, it only fell by 7.0%, instead of the expected 15%, reaching an average index value of -2.540.

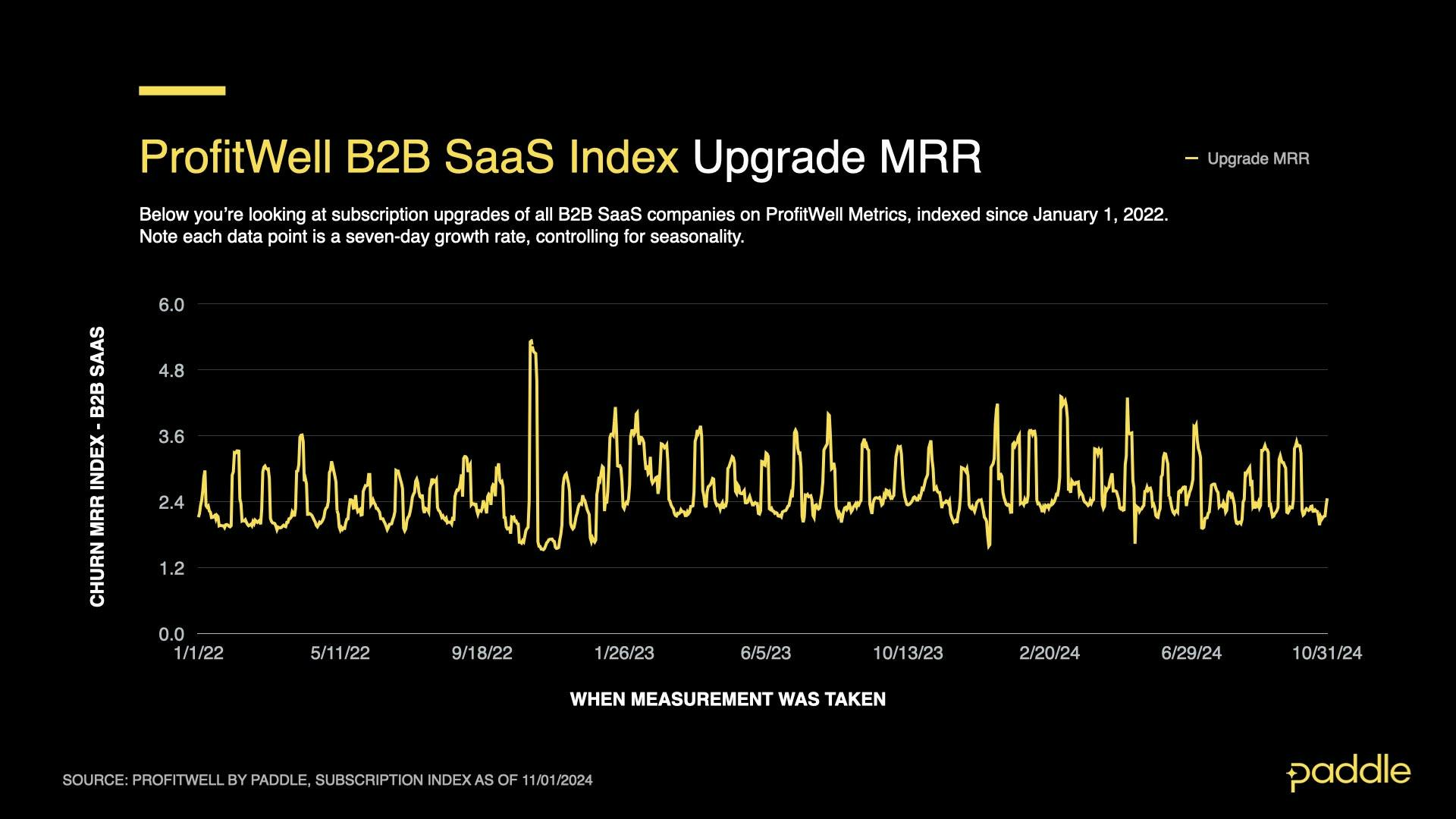

The Churn Index fell too, by 3.3%, while the rate of upgrades dropped by 8.2%.

Back-to-back holidays stymie B2B growth

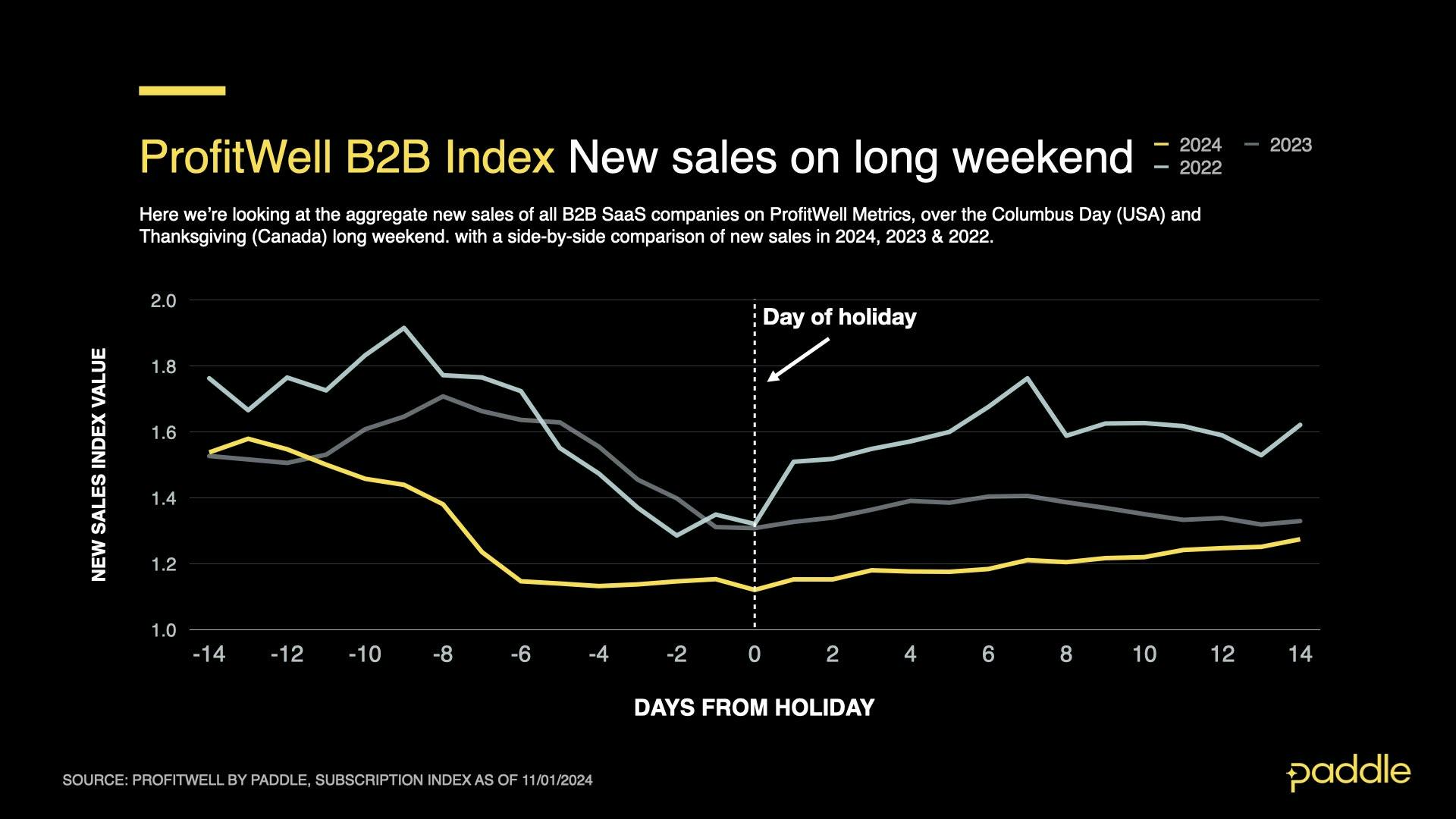

So, what caused the slowdown, despite B2B sales having more room to grow? By examining the ProfitWell New Sales index for the month of October, and comparing it to previous years, we find a clue.

For every October since the Profitwell SaaS index was started, we've seen a ~20% dip in new sales that lasts about two weeks, before recovering to previous levels.

This is caused by holidays in the United States (Columbus Day) and Canada (Thanksgiving), falling on the exact same day, and resulting in simultaneous long weekends for both countries. Unsurprisingly B2B software sales drop leading up to the holiday, then slowly recover by the end of the month, as employees return to work.

Moreover, while October’s overall 3.3% drop in new sales was alleviated by a 7.0% decrease in downgrades, it’s important to note that the four drivers of subscription revenue growth (new sales, churn, upgrades and downgrades) do not have an equal impact, with new sales and churn making up the majority of MRR growth (or contraction) for a typical SaaS company.

A typical SaaS company’s MRR breakdown. Check out the ProfitWell Demo for more!

With B2B new sales’ recovery from dual October holidays well under way, it’s important to note that we’re not out of the woods yet. Typically, November brings diminished growth rates for B2B, with companies beginning to plan for the new year, and employees occasionally taking early vacations.

While we expect to see the initial effects of the Fed’s September interest rate cuts in next month’s data, it’s difficult to say whether this will be enough to compensate for the expected sluggish growth, or if the rate cut's effects will only become apparent in the new year.

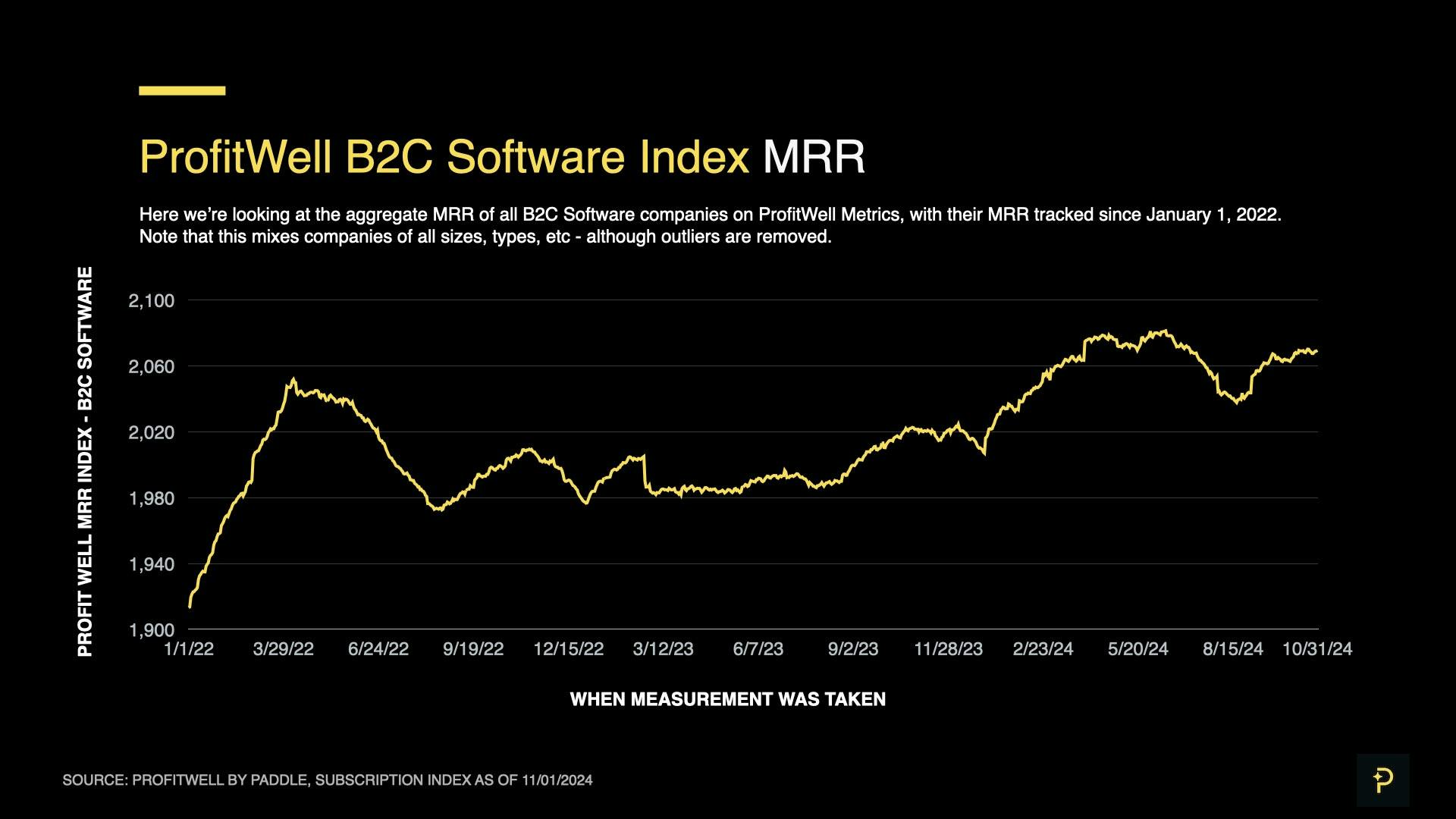

B2C growth falters, despite interest rate cuts

October also brought diminished growth to B2C with CAGR dropping to 3.3%, after its exceptional rebound in September, where it averaged 12.7%.

This brought our B2C MRR Index to a value of 2069 by the end of the month - its highest point since the beginning of this summer’s unusually long seasonal slowdown.

Using ProfitWell September data, we previously predicted that B2C would continue to grow past 12%, or at least maintain its current CAGR - rather than dropping significantly, as it did this month.

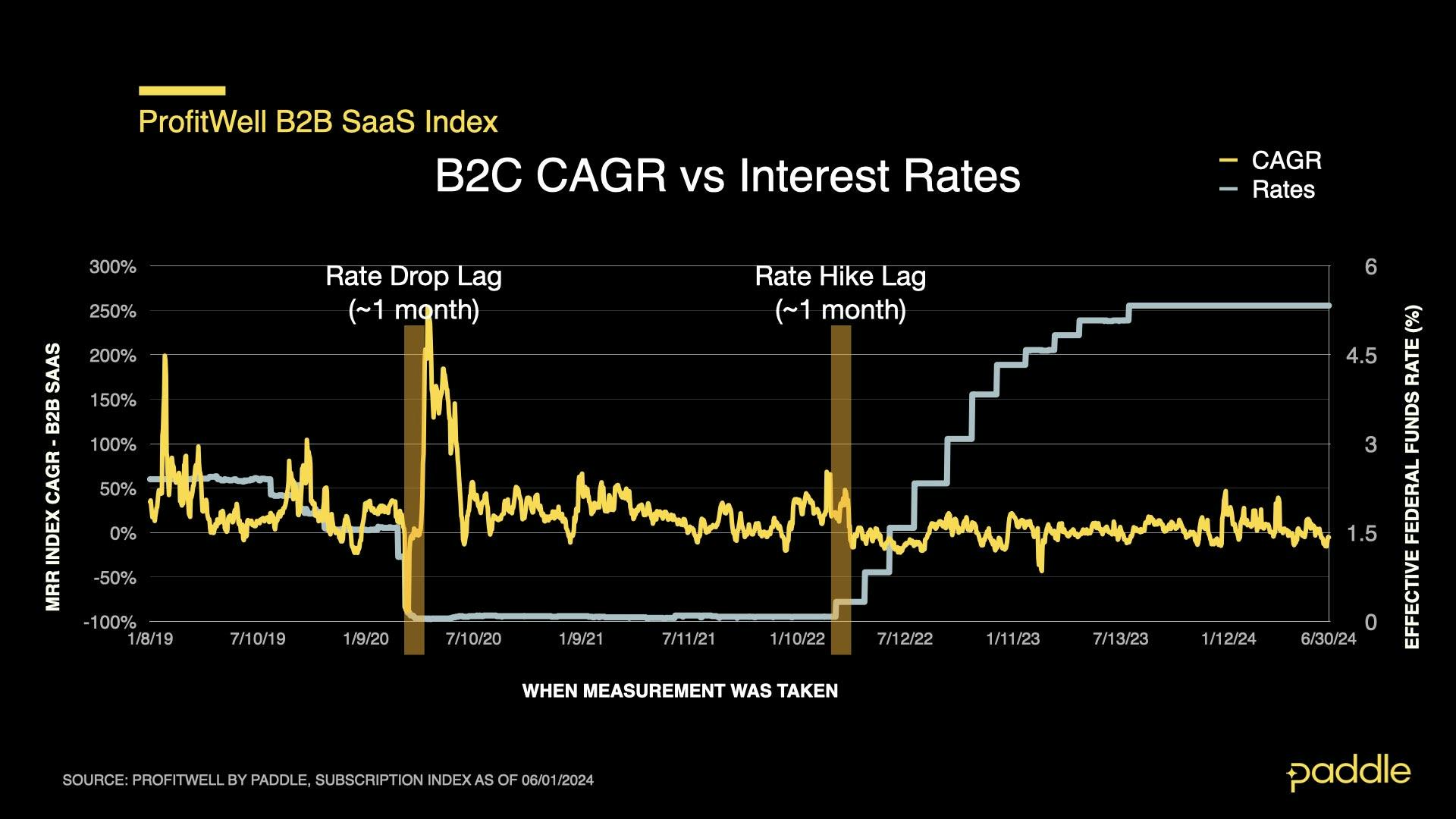

These predictions were based on historical Profitwell growth data, which showed that the B2C market typically reacts to interest rate changes within one month.

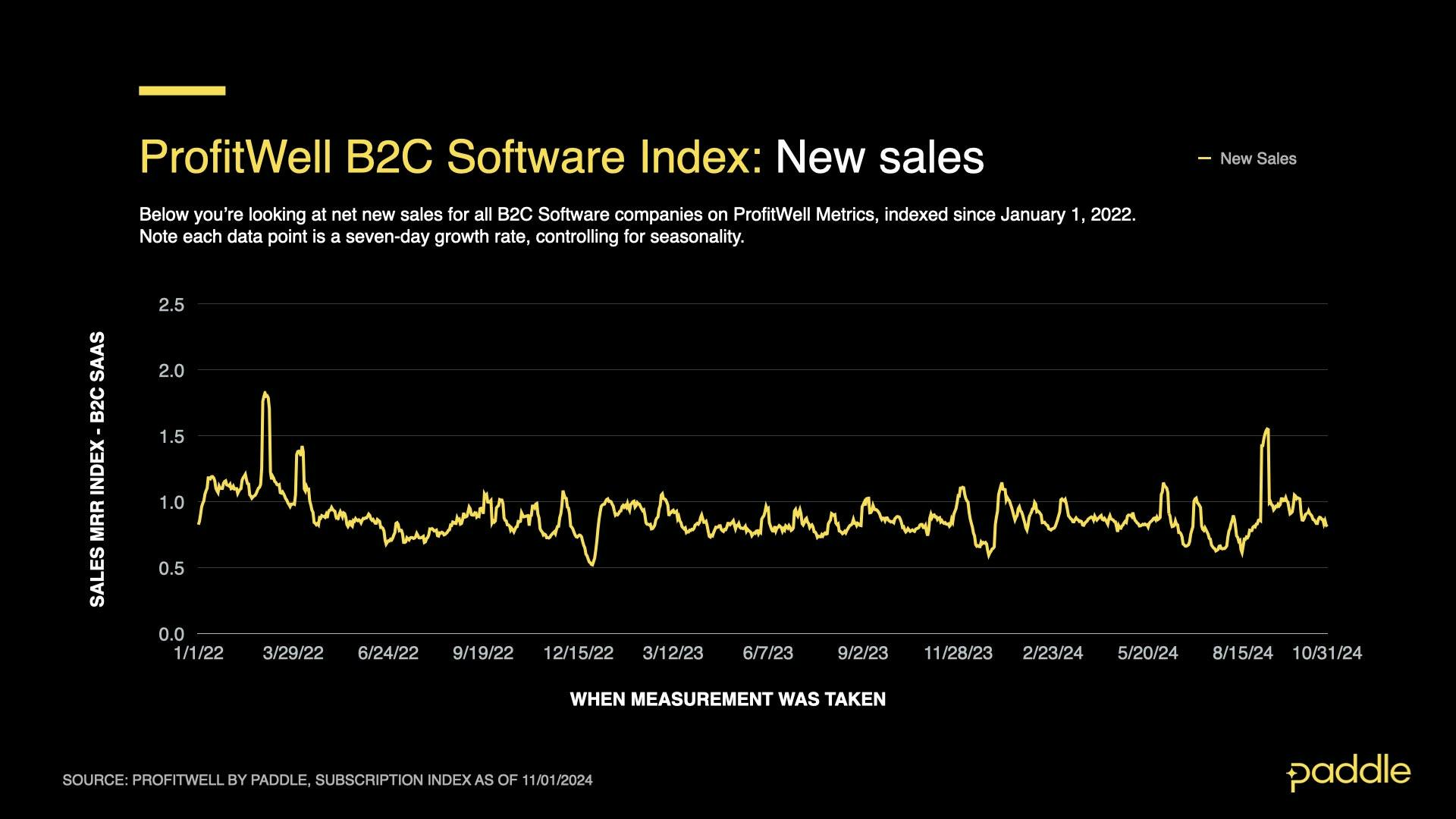

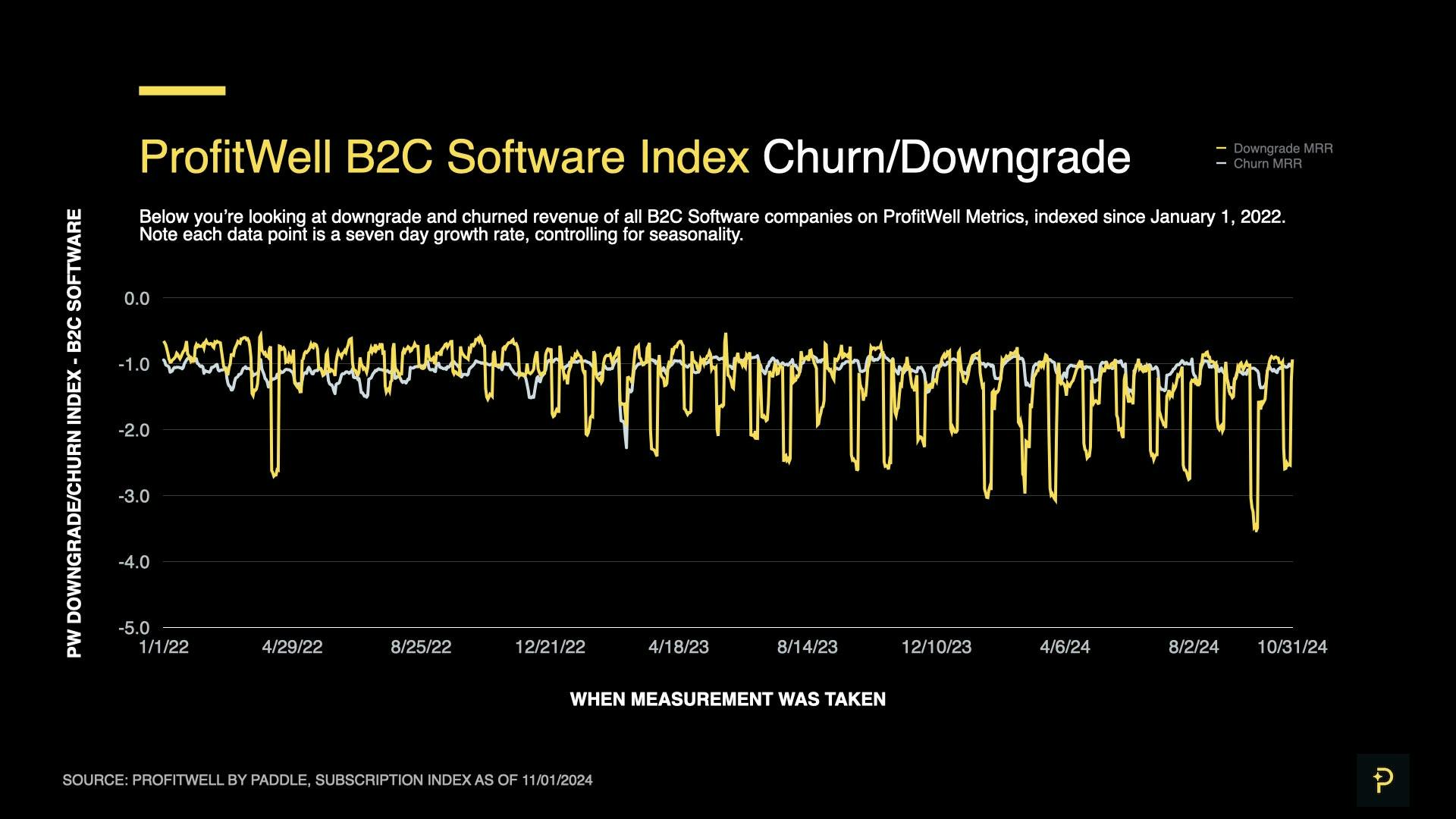

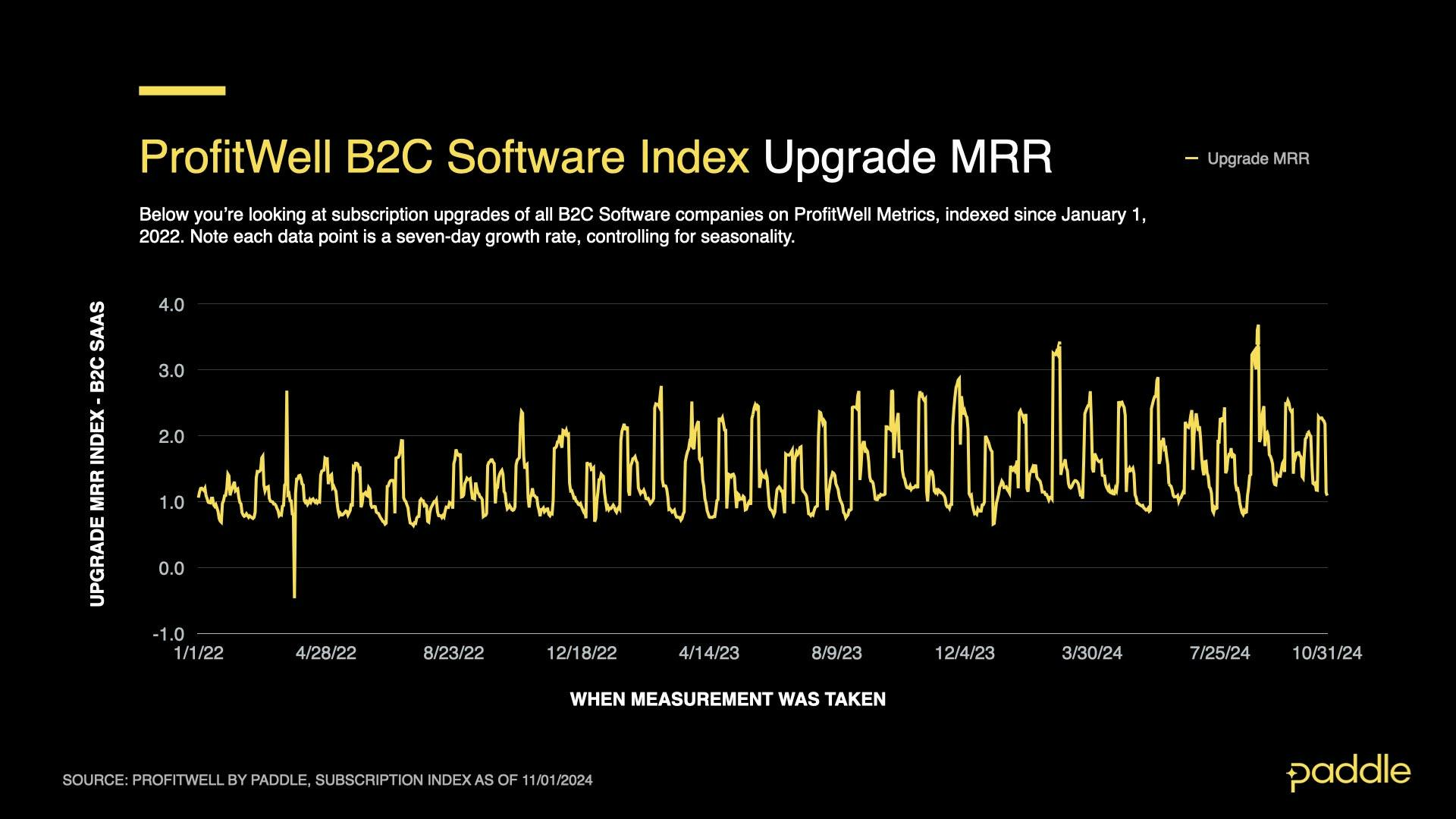

Instead, B2C growth faltered, driven down by across-the-board decreases in new sales, churn, upgrades and downgrades.

New sales were hit the hardest, with a 17% drop in October, as the New Sales Index fell to 0.905; or just 90.5% the rate of new sales seen across all ProfitWell B2C companies when the index was started in 2019.

This was followed by downgrades, which fell by 12.9%, to an average of -1.456 on the index.

Meanwhile, churn and upgrades showed smaller decreases, of 3.6% and 6.6%, averaging -1.124 and 1.737 on their respective indices.

B2C growth drivers face "correction" & slow for holidays

So what drove the simultaneous decrease in new sales, churn, upgrades and downgrades? Rewinding to September, when B2C growth had rebounded after one of its longest seasonal slowdowns on record, we saw large spikes across all four growth drivers:

- New sales spiked by 41.4%

- Downgrades spiked by 34%

- Churn spiked by 7.8%

- Upgrades spiked by 5.6%

This brought new sales and downgrades to levels far higher than their 2024 averages. In particular, new sales were ~20% above their mean, while downgrades were elevated by ~10%.

In the context of these factors “reverting to the mean”, October’s 17% drop in new sales, and 12.9% drop in downgrades begins to make more sense.

Moreover, while there was an expectation that the drop in interest rates would begin to drive B2C growth in October, rate cuts alone were unlikely to have overpowered B2C sales' reversion to the mean.

Finally, it must also be noted that consumer software spend is significantly impacted by the holidays, and historical ProfitWell data shows that B2C growth typically begins to decline in October, and continues through to December, before recovering in the new year.

Strategies to consider

So, as B2B and B2C growth slow down in Q4, while remaining somewhat unpredictable, what strategies should SaaS operators use to come out ahead?

Benchmark against competitors to focus your strategy

Knowing how your company stacks up against competitors in your vertical is an important weapon when you’re planning for the new year. This is where you’ll be able to find their weaknesses (along with your own), and start to build a strategy for winning market share.

Typically, this data is dispersed, inconsistent, and difficult to find. Because of this, we’ve partnered with the VC firm High Alpha to gather it all in one place with the 2024 SaaS Benchmarks Report.

Here you’ll find benchmarking data on over 800 different SaaS companies, covering every stage and vertical. It’s an amazing resource for learning which niches are taking off, and how your company stacks up on key metrics such as Net Revenue Retention.

Go deep on subscription economics in 2025 planning

SaaS operators shouldn’t just look outwards to plan for the future. Half the battle is “knowing thyself”, especially as you set goals for the new year, and draw up your strategy.

One of the most important pieces of the puzzle is optimizing your subscription economics, so you can grow more efficiently - especially when the market begins to heat up in the new year.

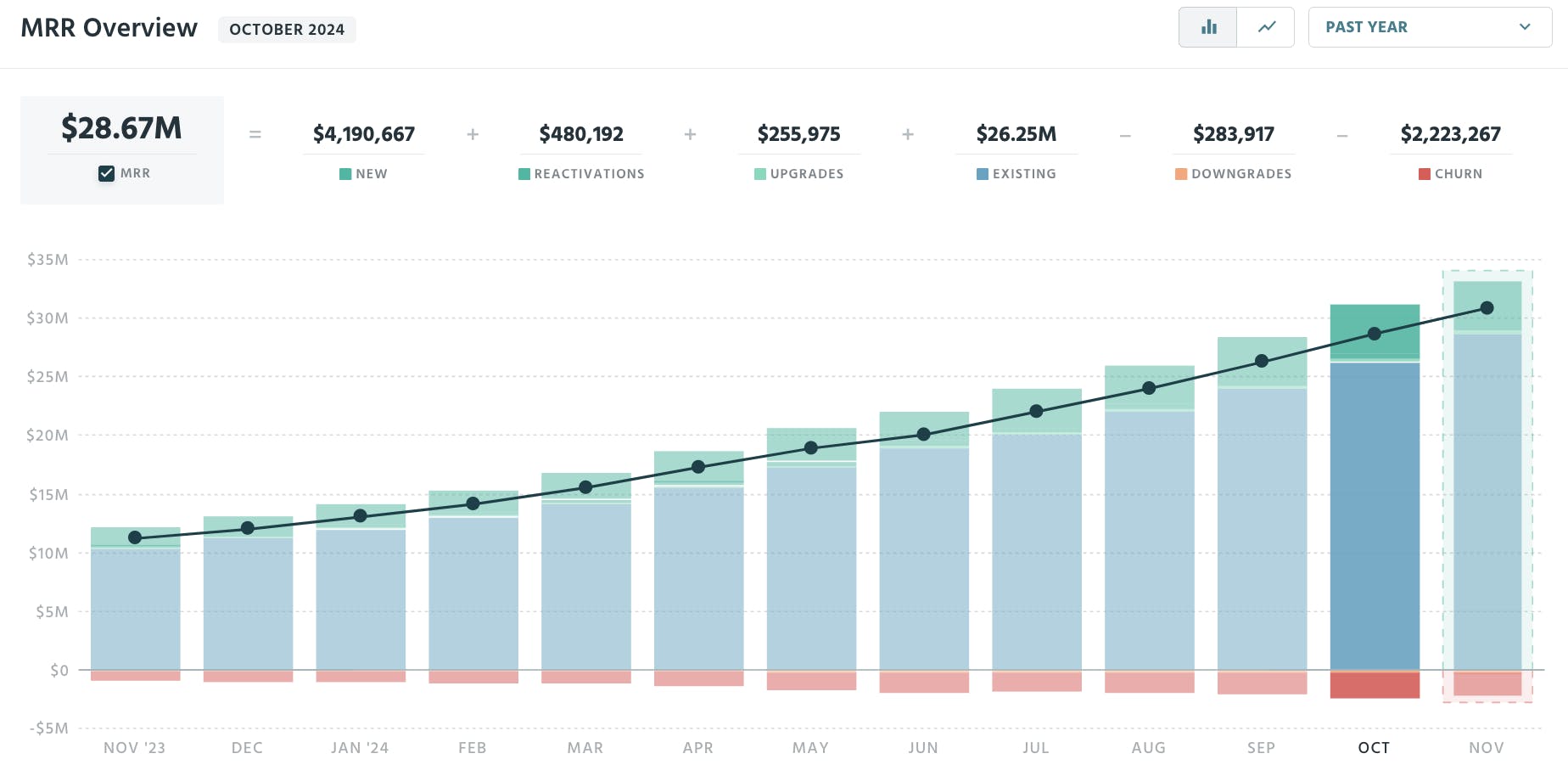

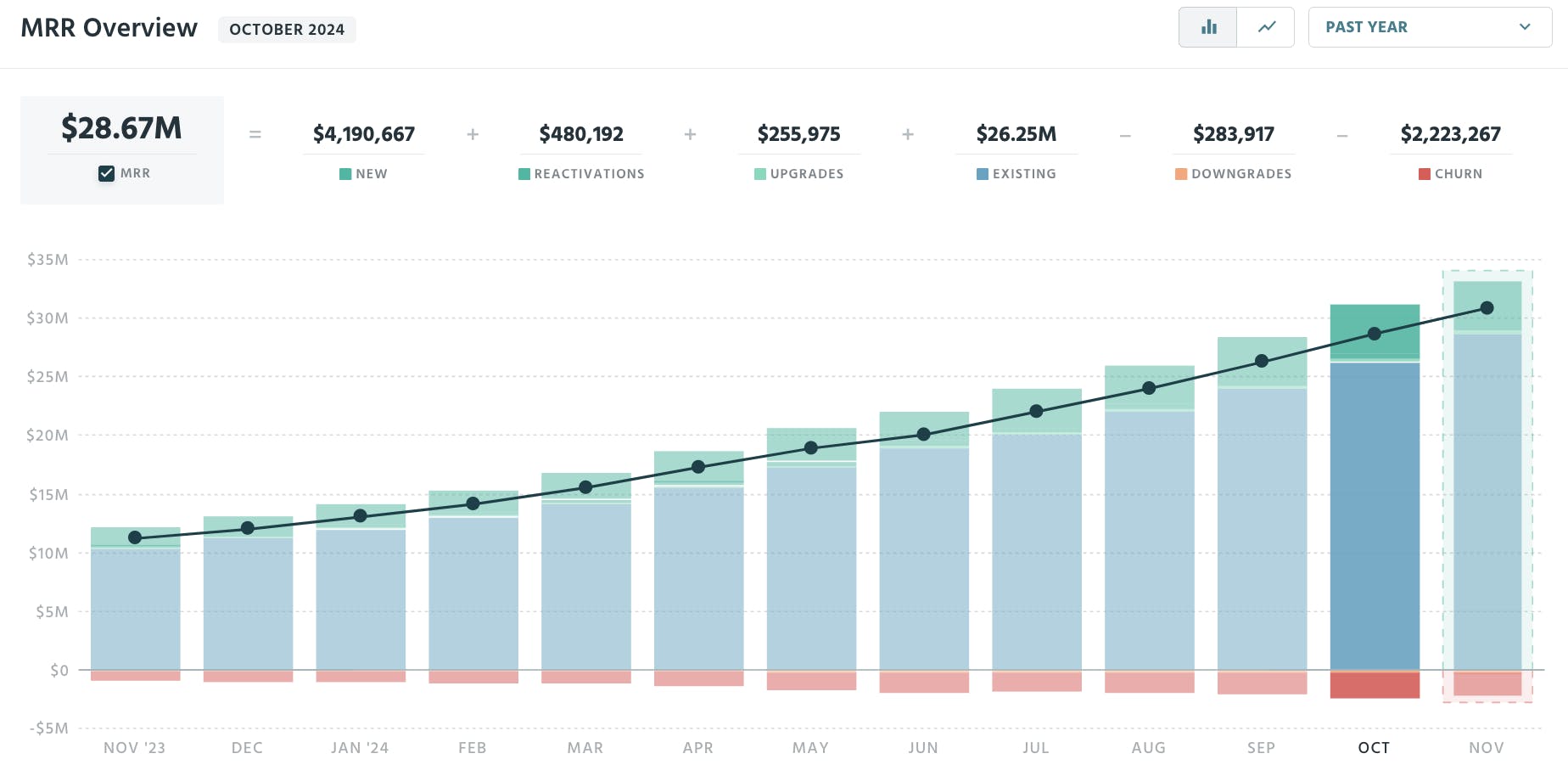

Perhaps the best example of this is knowing how your recurring revenue breaks down - what portion of your MRR growth comes from new sales vs upgrades? Should you focus your efforts on upselling, or the first sale?

As mentioned earlier in this report, for a healthy company, new sales typically far outpace churn, while downgrades and upgrades play a much smaller role.

A typical SaaS company’s MRR breakdown. Check out the ProfitWell Demo for more!

Knowing the balance of these MRR growth drivers for your company will help you find more efficiency in your paid conversion flows, and grow top line revenue without increasing your marketing spend.

Don't let involuntary churn hurt your bottom line

One thing many SaaS companies let slip through the cracks (especially those scaling quickly) is involuntary churn.

This includes customers churning because of failed payments, billing errors, and cancellation flows that fail to "win them back" before they leave.

One of the best tools to address this is Paddle Retain. With the click of a button it automates away the majority of involuntary churn, with advanced Dunning features, intelligent payment reminders and cancellation flows. Best of all, it’s offered for free with Paddle Billing.

While reducing involuntary churn may seem like a small optimization, it can have a significant impact on your bottom line. We recently spoke to HubX about scaling with Paddle, and in 72 days alone, they saved over $100k in churned revenue - without lifting a finger.

It's important to remember that exceptional subscription economics are built one optimization at a time - and this is one you don’t want to miss.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe below to be the first to receive the next SaaS Market Report.