B-Side: What a PE firm would do if they bought your company

What a PE Firm would do if they bought your company

One of the dumbest ways to describe an executive is “fearless.”

I get why people do it, but are any of you reading this actually fearless?

I for one am scared crapless several times per quarter, which thankfully is down from several times per month or week. During the several times per day period of the business I was just a shell of a human.

We’re emotional.

We take things personally.

We’re scared of failure.

Yea, we use that anxiety to bust through those fears with the vigor of a charging bull, but it doesn’t mean they don’t exist (or that we don’t drown our sorrows in our vice of choice).

The problem though, is that this fear often prevents us from doing what needs to be done.

You know who doesn’t have this fear? Private Equity firms.

Sure, you may think they’re cold hearted vampires who’d sell their mother if it improved a margin. Yet, we work with a lot of them and from what I can tell, they’re allowed in sunlight. Many of them are based in Southern California.

More accurately—they’re not bogged down by the fear or baggage that surrounds a founder or executive who’s been in a business for a decade. The result is they can buy your business and within a manner of months accelerate revenue by 2-5x. It’s not because they’re smarter than you, it’s because they’re approaching your business as a business.

Would you rather accelerate your own revenue 2-5x so that if you ever choose to sell your multiple will be even higher? Cool. Let’s walk through eight things a private equity firm would do the first day they buy your business.

Start with why: PE firms care more about your customer relationships than you do.

PE firms have a reputation for being heartless, but we’ve found they care more about your customer than you do. Let me explain.

Subscriptions are all about relationships. It’s the first commerce model in history where the relationship with the customer is baked into how you make money. That’s beautiful and all, but it’s also good business. If your customer continues to get value, they’ll keep buying the subscription (and hopefully more products).

What PE firms tend to understand better than you is that the relationship is more than just the start of the relationship. They know that lifetime value (LTV) is made up over the lifetime. They also know that most founders and executives will spend almost 70% of their budget and time on acquiring customers and nearly no time on keeping them or monetizing them better (i.e., the bulk of the relationship).

So where do they focus? Well, basically on lifetime value (LTV), which is made up of your monetization and retention. These pieces you neglect are the pieces they accelerate within the first three months of buying your company, which leads you to look back a year later and think, “these buttheads underpaid me,” but in reality you didn’t do the basic things needed out of fear.

So let’s help with that—here are the first eight things a PE firm would do when they buy your company when it comes to monetization and retention.

Monetization levers they’ll pull in the first 90 days

Raise prices if NPS is over 20

On average subscription companies raise their prices once every five years, which is insane. Your price is the exchange rate on the value you’ve created. If you’ve improved the value of your product through features, brand, effectiveness, etc., you should be able to raise your prices. You don’t though, because, “what if our customer doesn’t like us and cancels.”

Here’s a secret: even if you lower your price, you’ll see some churn. If you raise prices properly, churn will be minimal.

The fastest growing companies raise prices at least once per year, especially if NPS is over 20 (which isn’t even a great NPS). Don’t infantilize your customers. They know things cost money. We’ve overseen more than 750 price increases to date and not one was a disaster.

How do you do it? In short, you need to do a little research, come up with a communication plan, roll it out to new customers, and then roll it out to existing customers.

Introduce price localization

If you have 20% or more of your customers in another country, you need to customize your pricing to each of these regions. This is known as price localization and it accelerates revenue per customer growth by double or more.

Why is price localization so effective? People like to buy in a comfortable currency. If they see a currency they aren’t used to, they hesitate because, “What if it goes wrong? Will there be additional expenses? Can I trust a company halfway across the world?” At the very least, you need to make sure when someone goes through your order or sales flow that they’re being charged in their home currency.

Advanced companies will then set actual different prices for different countries. Different regions have different willingness to pay, varying market density, and ranging competitive penetration. This means you could charge a customer out of the UK 20% more than that U.S. customer. Your mileage is going to vary, but here’s a breakdown of 1.5 million different customers with their willingness to pay relative to the U.S. (and yes this controls for exchange rate and VAT).

Create a suite of add-on products

One of the most underutilized accelerants for subscription monetization is an add-ons strategy. Those customers with at least one add-on have lifetime value (LTV) 18%-54% higher than those without add-ons. These customers not only pay you more, but they retain better. Companies utilizing add-ons properly typically have eight or more.

What?! I know.

We aren’t in 2005 anymore where building one feature may take a team an entire year. We’re now able to deploy code continuously and dev productivity is through the roof. Most of us have made an error using conventional wisdom and throw all these features into the existing product.

Instead, any feature used by less than 40% of customers in a tier or segment should be pulled out and considered for a paid add-on that can be sold to the entire base. It’s a little more complicated, because really we’re looking for features where not everyone cares about the functionality, but those who do are willing to pay for the feature. Yet, the rule of 40% gives you an easier starting point.

A great one to start with is priority support. We’ve been doing this long enough to know that even a $10 per-month consumer app can charge for priority support, let alone an enterprise B2B company. You should push for ten add-ons over time. No single customer will ever see all ten, but you need enough to appeal to the different shards of your base.

Implement a value metric

A value metric is one of the most powerful aspects of all subscription pricing. At its most basic, a value metric is how you charge—per user, per 1000 contacts, per $1 saved, etc. The power comes in the metered nature of a value metric. As your customer consumes, uses, or receives more, they pay you more. The result is those companies using a value metric are typically growing at double the rate as those who aren’t.

More specifically, churn is typically half when comparing companies who utilize value metric-based pricing to those who use feature differentiation. You’ll have more downgrades as the value metric fluctuates, but since customers are getting exactly what they’re paying for you won’t have an imbalance between price paid and value received.

Expansion revenue is also double, because instead of having to convince and re-sell someone on jumping up to a more premium tier, you simply just upgrade them for their usage. It’s almost a celebration. “Congrats you must be growing, you’re now using ten thousand contacts, so we’ll just bump you up to the new tier.”

How do you set your value metric?

On a basic level think about the perfect measure of value for your product, even if you can’t measure it. In B2B, it’ll be time or money saved or revenue driven. In consumer, it may be joy or love or weight lost. If you can measure it and get your customer to agree to the measurement, then use that value metric. This is kind of like ProfitWell Retain charging based on how much churn we save you. Roughly 10% of companies will be able to use a perfect value metric.

For everyone else, you should then come up with 5-10 proxies for your ideal metric. For a company like HubSpot, the ideal metric is money driven through their marketing software, but I wrote the blog post, so I won’t believe in their measurement. Proxies for them will be number of contacts, page visits, number of pages, etc.

Once you have those proxies, you’ll need to study your current usage and collect some preference data from your customers, which will then lead you to making a decision and earning your paycheck.

This can get complicated and isn’t the easiest aspect of monetization to implement, so if you want a full breakdown reply to this email.

Retention levers they’ll pull in the first 90 days

Shore up payment failures

Fun fact: out of every 100 customers who churn from your business, 20-40 of them leave because of payment failures. It’s the single, largest bucket of lost customers.

Most of us don’t think about it though, because we think, “Well, Stripe must be so amazing that they’re taking care of these failures,” or “I’m going to fix the fundamental essence of value for my product first.” For one, this is less a Stripe issue and more a Visa/Mastercard issue. For two, your product team improving your product is a lifelong journey. Fixing your credit card failures takes a quarter at worst.

Credit and debit cards are mechanical devices that are subject to failure. This makes failed payments a purely mechanical problem that can be tactically solved. If 100 customers have their payment fail, most companies recover only 30 of those customers. The best companies are recovering between 60-80, which means you can probably double your recovery rate.

How? In short, treat these customers as a marketing channel.

Set up a 3-6 email drip that’s plain text and starts off assuming the failure is a mistake, but gets a little more pushy as the emails progress. Don’t go full collector. Remember, these are your customers, but it’s ok to remind them of the value they may lose. Also, I said plain text very specifically. Heavily designed emails have half the recovery rate as plain text.

When a user clicks through on these emails, make sure they don’t have to log in to update their payment. It’s not a great experience and will tank your recovery rate. Most people don’t know their passwords on mobile and your billing-settings page is probably the worst designed page in your product.

There’s a bunch of other things like making sure you spin up the right retry schedule, only doing in-app or SMS messages for pre-dunning, etc., so if you want a full breakdown reply and we’ll rock.

Introduce cancellation flows

When someone tries to cancel, we tend to have this self-centered, yet insecure, view of why they’re cancelling. We say things like, “Well if the product was valuable enough, they would have stuck around,” while at the same time rationalizing through, “That customer just wasn’t for us.” While both of these statements can be true, they’re woefully incomplete.

Even worse—they lead you not to do anything.

Instead, we’ve seen in the data that when someone goes to cancel you can actually reduce those cancellations by 30% with cancellation flows. This offboarding probes why the customer is cancelling at the moment and then provides an offer if the cancellation reason is fixable.

Here are a couple of examples:

- If a customer of 10 months indicates their budget dried up for the next project, you offer a $1/month maintenance plan to save their data

- If a high-risk customer of one month indicates they didn’t have enough time to use the product, you offer a free month

- If a highly engaged customer of three months indicates they’re leaving because of support, you offer a calendly link

How should you set these up?

In short, you have 25-40 seconds before the customer becomes aggravated after clicking a cancel button, so we recommend asking two questions around why they’re leaving, but also about what they did enjoy about the product. This is not only helpful from a data perspective, but also reminds them in the moment that not everything was bad.

You’ll then align those answers with some sort of offer—to pause for 30 days, a maintenance plan, a salvage offer, support, etc.

Keep in mind that it’s ok to let people leave. You’re not going to save everyone. There’s obviously a lot more nuance to cancellation flows so reply if you want me to go deeper.

Engage win-back campaigns

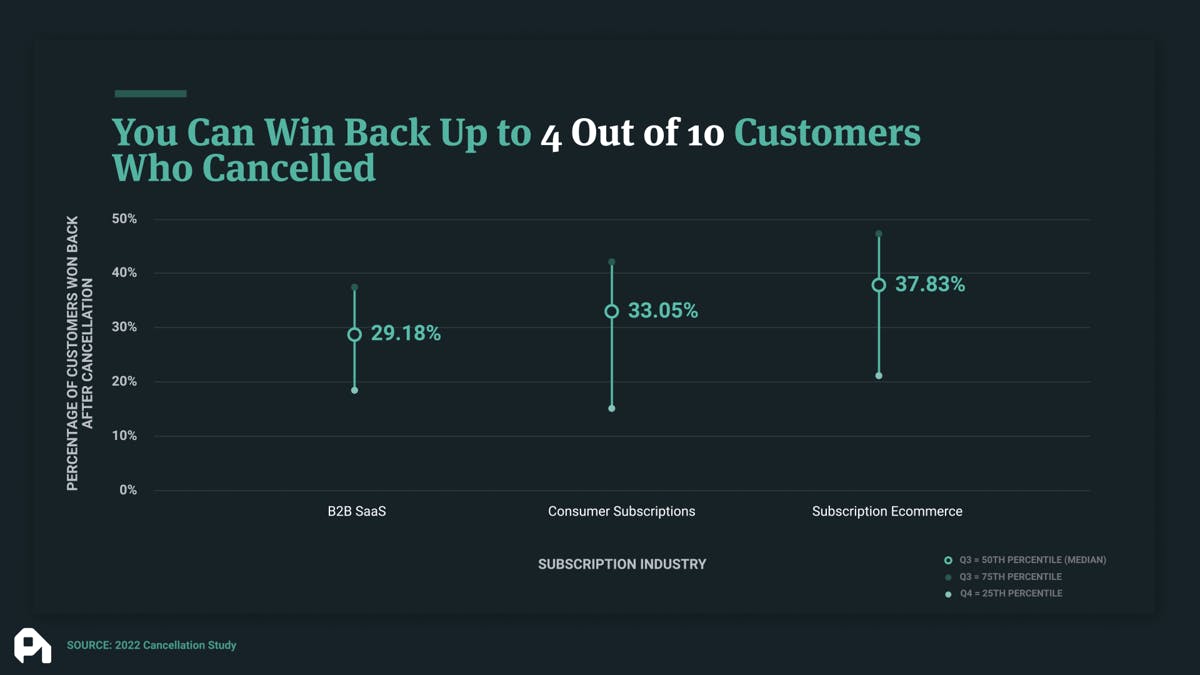

Not all who cancel are lost. Many of our churned customers can actually be recovered through win-back campaigns. In fact, most B2B and consumer companies are able to win back 20%-40% of their cancelled customers per year.

This is a really hard concept for us to understand, because we assume that if the product was valuable enough they’d stick around. What we miss with this assumption is that 4 out of 10 cancellations have nothing to do with you.

Here’s a breakdown of cancellation reasons across a spectrum of B2B and consumer products that we categorized as in the company’s control: features, support problems, etc. And those that weren’t: budget, timing, etc.

We can take advantage of this through running basic win-back campaigns. These aren’t rocket science, but involve you simply creating marketing campaigns that cater towards those customers who’ve cancelled. Make sure to pull in data, features they used, and the like. The offers should also vary depending on their experience. Power users may only need a nudge to come back whereas people who were with you for a month may need a more traditional offer.

Launch term optimization

Customers on longer-term plans—quarterly and annuals as an example—have dramatically higher lifetime value (LTV). Yet, the only time we typically ask for a longer-term commitment is when the customer first signs up, which is when they haven’t even seen the true value of the product.

To show you just how dramatic the impact here is, take a look at this data: In B2B, you’re looking at 100%-300% higher lifetime value. In consumer subscriptions, it’s 200%-500% higher lifetime value. Yea, it’s a lot.

What’s great about term optimization is it’s incredibly easy to implement. You should study to do this more precisely, but for B2B you’re typically targeting customers who are monthly and have been with you from two to 10 months. In consumer, it’s probably two to six months. Basically, you want customers who’ve experienced the product for a month, but not those customers who look like they’re going to stick around regardless of the longer-term plan.

Once you’ve identified this group, you’re going to ship offers to them that are the equivalent of one to two months. Your mileage will vary. With some consumer products you need to push much larger discounts. Yet, the most important part is to use whole numbers (i.e., “one month free” or “$100 off,” instead of “8%”).

Humans don’t understand percentages that well, so the whole numbers trigger more of a reaction. We’ve actually seen these whole-number offers perform at almost double the rate as the percentage-based offers, so it’s at least worth a test.

Just make sure the experience is smooth for the customer. Don’t make them log in and go to your billing-settings page, which probably wasn’t designed that well. Make it a one-click experience or have them simply reply to an email.

Channel the emotions. Don’t use them to avoid the necessary

Founding and running a company is hard. It’s emotional by design.

Most of us inadvertently run from those emotions. After all, “there’s plenty to do” and enough areas to channel those feelings. Unfortunately, the feels also prevent us from doing what needs to be done.

I hope the above gives you enough context to get started, or to at least realize some of this is easier than you think.

If that doesn’t work, then just know the minute you try to sell your company, these are all the things that are going to happen anyways. You just won’t get to share in the upside. :)

Do us a favor?

Part of the way we measure success is by seeing if our content is shareable. If you got value from this episode and write up, we'd appreciate a share on Twitter or LinkedIn.

00:00:00:02 - 00:00:27:15

Unknown

They are going to lose so much money. They're being idiots. I will admit. But it's not. It's not from a lack of intelligence or lack of effort. It's one of those things we see all the time because they're so disorganized. But we can help them with this It happened again. A VP of sales at one of our pricing customers decided to yell at someone on our team, and that is typically when I get involved.

00:00:28:00 - 00:00:49:21

Unknown

Now, it's easy to write this person off as just some brash sales bro, and we have definitely addressed his behavior. But I've seen this over and over again to know that this is just something that happens when people try to change their pricing. You may think that the biggest barrier to optimizing your monetization is going to be data or some sort of intelligence, but nope, the biggest barrier is internal politics.

00:00:50:02 - 00:01:12:22

Unknown

I didn't see that one coming, did you? Pricing is emotional and it's impacted by every single team at the company. So everyone's got an opinion and all those opinions lead to a lot of fear of getting blamed if something goes wrong. Now, in the face of that fear, most of us either throw tantrums like a toddler, like this individual, or do absolutely nothing with analysis, paralysis and all of that fear basically costs you money.

00:01:13:10 - 00:01:33:22

Unknown

Here's a breakdown of the growth in revenue per customer ARPU RPA, ACB. However, you're measuring it, we normalized it, don't worry. But here's a breakdown of the growth in revenue per customer base on how often a company changes something about the monetization. Notice that those companies that change pricing quarterly are seeing the biggest gains in revenue per customer, and most companies actually fall into the only changing pricing every three years bucket.

00:01:33:22 - 00:01:51:12

Unknown

So chances are if you are watching this, I'm talking to you, you are one of those companies and I'd like you to actually come clean comment below what bucket you fall into. Do you change your prices every quarter, every year? Or every three years? I'll pick one person from the comments and replies for a free pricing audit and I'll wait.

00:01:51:12 - 00:01:52:20

Unknown

I'll give you a second. Oh, wait.

00:01:55:02 - 00:02:09:07

Unknown

Okay. I'm assuming you want to get better. So what are these companies doing that are changing pricing so quickly that you aren't doing currently? They have this magical superpower and that magical superpower is something known as a pricing committee.

00:02:11:15 - 00:02:31:06

Unknown

Yeah, I know that sounds boring, bureaucratic, just terrible. But this modicum of process, this little amount of process allows them to cut through the noise and emotions to move quickly and make a lot more revenue. You want a lot more revenue? Yeah, I thought so. Cool. Let's walk through the function of a pricing committee, the make up of a pricing committee and the tempo of our pricing committee.

00:02:31:14 - 00:02:53:09

Unknown

So you can implement one and get those similar gains Okay. First up, I know I have been doing this long enough to know that some of you are going Patrick, raising your prices every three months is insane. Thankfully, that's not what I'm referring to when I speak about pricing changes and optimization and your monetization is anything, absolutely anything that influences the value of your product.

00:02:53:20 - 00:03:13:00

Unknown

These could be anything from international izing. Your pricing to readjusting your value metric is anything that influences that revenue per customer. So to widen your brain a bit, here's a non-exhaustive list of pricing changes that you could be doing every single quarter. Note that some of these take a lot more effort than others. And also some of these, like raising your prices probably will only take place once per year.

00:03:13:19 - 00:03:33:00

Unknown

Pricing committees give you a central team to manage the data, the people and the infrastructure around changes to your pricing. They allow you to move with confidence at a high tempo, and all pricing committees have three main aims. First, pricing version control monetization has a lot of moving parts. So your business is a central repository for pricing history and knowledge.

00:03:33:07 - 00:03:52:13

Unknown

Adjustments you make will have unintended consequences, and some optimizations will take an enormous effort to steer the ship. All of these changes need to be tracked and documented. You also need enough people in the committee to prevent all that knowledge disappearing when one person leaves. Next up, pricing committees need to structure feedback from all stakeholders and minimize politics.

00:03:52:23 - 00:04:12:19

Unknown

One of the worst mistakes you can make in pricing is one part of the or doing all of the research and coming up with a decision. And then boom, as soon as they present that to everyone else who has to implement it. Hitting a brick wall, a feedback that basically delays implementation indefinitely. Pricing committees give clear lanes for all stakeholders to express their feedback depending on the gravity of that change.

00:04:12:19 - 00:04:32:14

Unknown

Hearing this feedback allows those leaders of the pricing committee to address it with data or adjustments going forward. Last thing a pricing committee needs to streamline implementation and track progress Deadlines and process are your friend when it comes to pricing. A good number of people will be needed for the implementation, so centralizing the committee allows that enablement to happen quickly.

00:04:32:21 - 00:04:51:08

Unknown

You'll also be able to make adjustments as bugs come up. And remember, the ultimate goal is to increase that revenue per customer over time. So as you make changes, there's going to be unintended and intended consequences A pricing committee allows you to move quickly to make adjustments while also minimizing the fallout of those unintended consequences. Okay, so you're on board because you're still watching.

00:04:51:08 - 00:05:11:00

Unknown

So let's cover who the heck is on this committee and who in the world is in charge. In short, whoever has outsized influence on implementation or outside feedback on a pricing change needs to be in the room. Putting the pricing committee together with this thesis can get really tricky, because if you're watching this, you're probably part of a mid-sized, if not a large organization.

00:05:11:07 - 00:05:26:11

Unknown

So you have a lot of people who fit this description. We've actually found following the Amazon concept of two pizza teams to be best. And basically what this means that you're committed needs to be small enough that it can be said by two pizzas, which really is a max of ten people know kind of figuring out how to game the system here.

00:05:26:19 - 00:05:42:22

Unknown

Keep in mind, this constraint doesn't mean other individuals won't be given a chance to provide feedback. We just found that anything over this number defeats most of the purposes of the pricing committee and basically makes it really, really hard to make pricing changes. Your mileage is going to vary, but here's a breakdown of who's typically in the core pricing committee.

00:05:43:08 - 00:06:00:14

Unknown

Notice a couple of things. There are core committee members and then a pricing influencer group made up of the next degree from the committee. Those influencers will be able to provide asynchronous feedback, but just won't be in the room for the final decision. Also, if your earlier stage, there may only be two of you in the entire committee, and that's totally fine.

00:06:00:15 - 00:06:19:10

Unknown

You'll ironically move a lot quicker and ultimately make more pricing changes Obviously, these are going to be very expensive meetings, but keep in mind that this committee is there for feedback and knowledge rather than doing the actual day to day of pricing that research the coordination of the committee and keeping the trains running on time is done by someone known as a pricing coordinator.

00:06:19:18 - 00:06:38:13

Unknown

In most organizations, the coordinator is a product or marketing manager who takes up pricing is 20% of their time. As your organization grows and definitely by 100 million in annual revenue, you should have a full time person dedicated to pricing. Now, two big pieces on this pricing coordinator, they need to love customer research. Pricing research has just targeted customer research.

00:06:38:13 - 00:06:59:00

Unknown

And if you think this is just going to be SL engineering, looking at U. Corp Dev and finance, this is not going to be okay. Second, they have to be able to speak truth to power. You're going to have some sort of exact try to bully the pricing process. It happens all the time. You know, like it leave and finding someone who's good at soft power and garnering feedback from more introverted personalities is absolutely crucial here.

00:06:59:16 - 00:07:14:05

Unknown

Now, keep in mind, one of the benefits of this pricing coordinator position is it is a fantastic growth opportunity for someone who could be a future exec one because they'll be dealing with all the exacts in the company, but to because they're going to get a ton of mentorship from you and how to present and how to synthesize this information.

00:07:14:10 - 00:07:32:11

Unknown

Now, who's in charge, even though you have a good crop of folks involved in the pricing committee and there's a lot of pricing influencers, you need one final decision maker one, not, two not, oh, we're going to make this decision as a group. Not well, John really needs to have buy in because you're not going to get by it.

00:07:32:11 - 00:07:55:15

Unknown

You're not going to get a decision, you're not going to get the monies that come from pricing because nothing is going to happen. And I know it sounds pedantic and condescending, but I've just seen relatively well-designed pricing committees fail because no one was deputized as being the person to make the final call on a deadline. Your org is going to vary, but if you're between zero and $100 million a year, it's typically going to be the CEO, head of marketing or head of product above 100 million.

00:07:55:15 - 00:08:17:20

Unknown

You should have a very clear pricing leader, but it still may be the head of marketing or product making the final decision. Most importantly, make sure it's someone with trust in authority. Pricing changes always have tradeoffs. Something's going to go wrong. Something's going to go right. There's going to be unintended consequences, and someone with authority and trust can provide enough cover to make adjustments and stay the course through all of that institutional fear that will prop up your work.

00:08:19:06 - 00:08:37:04

Unknown

All right. Your pricing committees involvement will depend on the gravity of the change you're making. We'll break down a couple of levels of changes, but normally the committee really only needs two to five times per quarter. Influencers will typically submit feedback once per quarter, and the coordinator will spend 20 to 100% of their time on pricing. Let's first look at larger changes.

00:08:37:13 - 00:09:04:07

Unknown

Now, the core tempo, you should be focused on an organization is implementing one medium to large change per quarter, running the following process. In week one, the committee meets and confirms the project for the quarter, sharing all of their initial thoughts and feedback in weeks. One through six, the coordinator goes off and utilizing the feedback designed to research sprint and goes out and collects a bunch of data to determine a course of action and a recommendation in week seven, that coordinator will present the findings and provide a recommendation to the committee.

00:09:04:13 - 00:09:26:16

Unknown

The committee almost always debates the recommendation and provides a bunch of questions which the coordinator then needs to go out and chase down. And then in week eight, the committee meets again with the coordinator walking through the objections and answering all of the fun questions. Sometimes this process will repeat a couple of times depending on the gravity of the change, and then the coordinator will send out the proposed changes in research to the influence or group to get that final feedback.

00:09:26:21 - 00:09:52:00

Unknown

And once everything's decided which nine through 13 or basically spent implementing after final approval and reporting on those initial changes. Remember, this is a framework. Your mileage is going to vary, but the coordinator will have plenty of ad hoc discussions with different stakeholders for keeping the trains moving. Now, one thing to keep in mind is I highly recommend you start with something pretty easy to implement, things like internationalizing your pricing are much easier than changes to your core pricing metric.

00:09:52:09 - 00:10:14:09

Unknown

We found that the easier the initial project looks, the more momentum you get, and then that momentum begets more momentum Don't be afraid to use your committee for smaller changes as well. Things like redesigning your pricing page, experimenting with a new discount, or even deciding if you should publish your pricing page or not. Are all really, really good projects to work the pricing committee's muscles.

00:10:14:16 - 00:10:34:22

Unknown

These optimizations normally don't require data or low risk enough to move quickly, and also the process with these can remain pretty much the same, but it'll end up being compressed and maybe even asynchronously. Just make sure the communication is flowing transparently throughout the committee. A lot of these small changes end up being optimizations. You'll want to try the opposite of in two to three years as the company evolves.

00:10:35:04 - 00:11:00:12

Unknown

So ensuring the different versions of pricing are tracked and the knowledge saved allows the organization to move quickly Tempo, tempo. Tempo. Not quite my tempo. That is the name of the game when it comes to pricing. The larger the org typically the worse the tempo and momentum. Hopefully you realize none of this is rocket science. You just need the confidence to treat this like any other project management that you've done in your company.

00:11:00:20 - 00:11:16:13

Unknown

Just focus on those fundamentals. Make changes regularly, however small, and those pricing gains will continue to roll through. I'm sure you have a ton of opinions about this, so let me know. Did I inspire you to change your pricing more frequently? Are you already hitting up your team members to form a pricing committee? Do you already have a pricing committee?

00:11:16:13 - 00:11:29:08

Unknown

And I left something out that others would learn from. Leave a comment below. And diehard profile fans know, especially if those who have been to a webinar that I've run. I answer every single question and respond to every single comment. So I'll see in the comments

Samar Owais on the Language of Email

The 6 Instruments to Keep Your Product Alive with DevSquad’s Phil Alves

Alludo's Christa Quarles on Fostering a Culture of Innovation

B-Side: HubSpot's Brian Halligan, CrazyEgg's Hiten Shah, the ProfitWell Crew | Feedback is Non-negotiable