Another year, another State of SaaS report. Only this time, we’ve done the hard work for you.

From Openview and forEntrepreneurs to Atomico and Serena Capital, we’ve analyzed the key trends, findings and even discrepancies across the various State of SaaS reports in the market. We’ve dived into the depths of the findings - taking in 300-page goliaths, graph-heavy slide decks, extensive expert interviews, and comprehensive benchmark data - to showcase what the global SaaS landscape actually looks like (in a 15-minute read).

Whether you’re interested in exploring Covid’s impact on SaaS adoption or following the rise of European SaaS, understanding the drivers of high valuations or analyzing the momentum of product-led growth, winning the race for top talent, or taking advantage of environmental, social, and corporate governance (ESG) opportunities, this Meta Report brings together all the essential stats, quotes, and insights you need to know to prepare for 2022 and beyond.

If you'd like a copy to read in your own time, you can download the report here.

Headline stats from the reports

- 57% - European and US companies increased SaaS spending last year - Finances Online

- 36% - Median growth rate of $5M+ARR SaaS companies in 2021 - forEntrepreneurs

- 81 - European SaaS unicorns in 2021 (up from 44 in 2020) - Accel

- 119% - Average NRR of top-performing SaaS IPOs in 2021 - Meritech Capital

- 60% - PLG companies in Forbes’ 100 most valuable private cloud companies

- 21% - European tech community thinks hiring talent is the greatest challenge in the next 12 months - Atomico

- 11% - ‘Planet positive’ startups share of total European capital funding in 2021 - Atomico

SaaS revenue growth

Key stats

- 110 SaaS apps used on average by organizations (up 38%) in 2021 - BetterCloud

- +6.5% median change in year-on-year growth - forEntrepreneurs

- 3.2x - YoY growth in private SaaS funding in Europe

SaaS adoption

SaaS growth in 2021

Last year, organizations around the world were disrupted by the pandemic, but the need to connect with colleagues and continue their operations remotely also played into the hands of SaaS companies. According to Finances Online’s 2021 SaaS Industry Market Report, 30% of global companies boosted their SaaS spending because of the coronavirus, rising to 57% in Europe and the US. What’s more, SaaS companies of all shapes and sizes continued to grow at pace in 2021, underlining the resilience of the subscription model.

For example, Serena Capital’s 2021 European SaaS Benchmark found that smaller SaaS companies with less than €1 million ARR grew quicker in 2021 (+170%) than 2020 (+150%), while mid-sized companies grew slower (companies with €1–5 million ARR grew +66% versus +90% in 2020 and €5–10 million companies grew 32% versus 65%). When it comes to the big hitters, Covid-19 didn’t even seem to touch the sides:

- Shopify increased its valuation 225% from early 2020 to September 2021

- Salesforce grew from $161 billion to $251 billion over the same period

(Source: BMC’s State of SaaS 2022)

Discounting companies with less than $5 million ARR, forEntrepreneurs’ 2021 SaaS Survey predicted an average SaaS growth rate of +36% last year with a median change in year-on-year growth of +6.5%. In particular, their detailed survey of over 350 SaaS companies estimated that businesses focused on infrastructure management software (+13%), horizontal application (+10%) and cyber security (+9%) would lead the growth charge, while SaaS companies selling to developers (+19%), HR professionals (+12%) and sales & marketing (+9%) would also be in line for a good year.

Why? Because SaaS is becoming ubiquitous. In 2021, the average organization used 110 SaaS apps, up 38% from an average of 80 apps in 2020, according to BetterCloud’s 2021 State of SaaSOps Report. Furthermore, BMC predicted 99% of organizations will be using one or more SaaS solutions by the end of 2021.

Covid or no Covid, SaaS-powered workplaces are becoming the norm across every business function, organization type, and industry.

For SaaS sellers, this opens up the market, globally – and, unfortunately, increases competition. A good place to start to maximize this opportunity is to focus on the customers you can serve by looking at your total addressable market (TAM), in terms of:

- Serviceable available market (SAM)

- And serviceable obtainable market (SOM)

This will help you narrow down the customers you can serve now and those to target in the future.

SaaS growing pains

SaaS is fast becoming a flexible, affordable solution for all types of organization, but its widespread adoption is also producing some new challenges.

- Uptake - With companies increasingly reliant on SaaS, the uptake of apps has increased to levels beyond management’s control. Given senior managers think their company uses an average of 93 subscriptions (Cledara), it’s unsurprising that ‘controlling application sprawl’ (49%) and discovering unmanaged applications (26%) are the top two biggest SaaS management challenges of 2021 (Finances Online).

- Visibility - The more apps you use, the harder it is to track. 55% of BetterCloud’s survey of IT and security professionals consider the lack of visibility into user activity and data their biggest SaaS challenge. In addition, almost a third think they waste between 20-39% of their SaaS budget on underused SaaS licenses and 70% of companies would like a simple tool that gives full visibility of all subscriptions in one place (Cledara). This lack of oversight makes it hard for companies to measure the value of applications and can lead to cancellation: infrequent (30%) or unused (27%) software being the main drivers of churn (Cledara).

- Purchase decisions - With so many apps flying about, who is responsible for purchasing (or canceling) the subscriptions? According to Cledara, 33% of companies have a centralized subscription purchasing process and 52% are considering implementing one, but a fifth (21%) have no policy whatsoever for approvals. Interestingly, the larger the company workforce, the more likely it is that individual employees can purchase tools independently with just 10% of 20-100 workforce companies giving this freedom compared to a quarter (26%) of companies with 251-500 employees.

- Security - If you don’t know who’s buying software or what tools they’re using, keeping sensitive company data secure is increasingly difficult. Not knowing where this data exists is the biggest concern for companies (55%), while 72% of organizations feel that a well-meaning but negligent employee is their greatest risk of data loss (BetterCloud).

As they look to overcome these growing pains, businesses using SaaS solutions will become savvier about the number of tools they are using and crucially, how much they spend on them. For you as a SaaS company, it’s a case of making sure that your customers realize the value of your product to win out against the competition and reduce churn.

SaaS five-year predictions

The world is going through a digital transformation and given 38% believe that SaaS is the most helpful tech for realizing business goals (Finances Online), it’s no surprise to see rosy projections for the immediate future.

SaaS already accounts for 59% of the public cloud market with revenues of $156 billion, but this is expected to rise by 80% to $280 billion by 2026.

Finances Online

However, not all SaaS is born equal, so where will this rise come from? According to BMC’s IT Spending Trends of 2022, the world’s insatiable tech appetite will see $4.5 trillion spent on IT in 2022, with last year’s top IT priorities - digital transformation (56%), cybersecurity (50%), and cloud/cloud migration (48%) according to Flexera - likely to account for a sizeable portion of that budget.

Finances Online believe that the low-code to no-code boom will continue at pace, but also expects to see SaaS become the key enabler of emerging technologies, such as Augmented Reality (AR) and artificial intelligence (AI). In fact, 91% of organizations believe SaaS will help them adopt these technologies and accelerate their revenue.

What’s more, as no single SaaS solution delivers all necessary functionality for changing hybrid workplaces, there will be scope for both vertical and micro SaaS to expand in the coming years; the former covering businesses’ need for high-quality software and the latter serving as add-ons to solve niche problems.

For SaaS leaders, this means that fierce competition is here today – but equally, SaaS spend means more opportunity to sell too. Your focus should be on honing in on your value and, crucially, which customers will realize that value the most. This gives you a great starting point to target and a base from which to expand your value prop and product too.

The rise of Europe

Europe’s SaaS evolution

In November 2017, the US accounted for 63% of the world’s SaaS companies and 89% of funding, with Silicon Valley, New York, and Boston the leading hubs. Across the pond, Europe had 22% of the SaaS companies and just 5% of the world’s funding with London dominating the SaaS scene. However, the average fundraising round for London-based companies ($655,000) was still less than a quarter of the average San Francisco-based company ($3 million).

Fast forward to today and the European scene is unrecognizable. According to Atomico’s extensive State of European Tech 21 report:

“Europe is firmly positioned as a global tech player in 2021, with a record $100 billion of capital invested, 98 new unicorns, and the strongest ever startup pipeline, now on par with the US.”

While Atomico’s report doesn’t focus exclusively on SaaS companies, Accel’s 2021 Euroscape report does and the figures are equally impressive. Europe and Israel produced 44 SaaS unicorns in 2020 compared to 81 in 2021, including three SaaS decacorns ($10 billion+): Checkout.com, Talkdesk, and Celonis (the latter’s $1 billion Series D was also the largest ever SaaS round in Europe). 11 European and Israeli SaaS companies also went public last year, up from three in 2020.

What’s more, all parts of Europe are getting in on the act. The region’s 321 tech (not SaaS) unicorns come from 28 countries, while the 81 SaaS unicorns hail from Israel (27), France (10), the UK (7), Germany (7) and 30 from other European countries. You only have to look at some of the year’s biggest SaaS IPOs to see the continent’s strength in depth:

- Romanian-founded UiPath ($35.8 billion)

- Ukrainian-founded Gitlab ($15 billion)

As a recent article in the Financial Times states, Europe had all the ingredients to be a tech hub, such as hosting three of the top five global computer science programs - Cambridge, Oxford and ETH Zurich - and high levels of coding literacy - 5.5 million developers compared to 4.4 million in the US - it just needed investors to wade in. In 2021, that’s exactly what they did.

The current aggression of the Russian State against Ukraine brings with it a lot of uncertainty for the region that inevitably impacts the SaaS community based there. It’s too soon to tell what the longer-term implications will be for the industry.

Closing the US funding gap

The stats speak for themselves. In 2020, the average European SaaS startup raised €1 million at seed. In 2021, it raised €2.2 million. For Series A and Series B, average investment rounds followed a similar trajectory rising from €6 million to €7.2 million (+20%) and from €12 million to €16 million (+33%) respectively (Serena Capital).

As Accel’s report succinctly shows, the European SaaS market attracted $9-9.5 billion investment in 2020, but last year netted triple that figure ($29-30 billion). Interestingly, the investment into private SaaS startups was three times higher than funds raised publicly ($11 billion), while the growth in private cloud funding (3.2x) also outstripped the growth in US private cloud investment (2.4x), despite the total US pot remaining larger at $48 billion.

Much of this rise is attributable to VC confidence. According to Atomico, a whopping 88% of VCs are feeling more confident investing in European tech in 2021 than 2020. Given the proven SaaS success, innovation and opportunity shown in the last 12 months, this confidence is only expected to increase.

The founders we see in Europe today have the best credentials yet - they have bigger ambitions, are more experienced and are better networked. The depth of talent and the size of the market opportunity provide strong foundations for European VC to continue to access the best companies and deliver world-class returns to investors.

Hiro Tamura, Partner, Atomico

As European SaaS becomes an ever more attractive investment opportunity, SaaS founders and Executives need to know how to stand out against other introductions and pitches. For those looking at venture capital firms for funding, making sure you really understand the VC investment process and what’s expected is a great place to start.

Internationalization

In the wake of Accel’s findings, Accel Partner Philippe Botteri posed the question: “are Europe and Israel on the path to global dominance?” To qualify for that title, SaaS companies from the European region need to expand beyond continental borders and many recent graduates from the European school of SaaS have set up shop in the US market to do just that.

Although the Bay Area still leads the way for US SaaS companies, the same is not true of its European counterparts seeking a US launch. According to Serena Capital’s survey of 250+ European SaaS companies, 37% of respondents address the US market, with 17% favoring New York, followed by San Francisco and Boston. The time difference, distance, cultural proximity and addressable market have all been cited as possible benefits of favoring the East Coast.

However, even the fact that European SaaS companies are launching in the US is a sign of the latter’s enduring appeal in the world of SaaS. The Europe and Israel cloud market is certainly growing quicker than the US (92% vs 29% in 2021), but the US still produced more SaaS IPOs last year (21 vs 11) and raised more cash ($827 million vs $557 million), according to Accel. The US also claimed half of all venture capital investment into tech last year, while Europe, although growing its share of worldwide venture funding by 5%, still only accounted for 18% (Atomico).

In addition, US companies are still spending more on SaaS products than their European cousins, with a $521 per-employee SaaS spend accounting for a total revenue of $86.9 billion. If Europe grows its SaaS spend by an estimated 19.1% annually over the next four years, it would still be $5 billion shy (Finances Online).

While Europe has certainly entered the race for global dominance, the US still holds the better hand over the next few years, but could there soon be other players in the mix? In 2021, SaaS spending in the Asia-Pacific region grew a record 40% year-on-year to $1.5 billion, according to research by ISG. Meanwhile, SaaS is on the march in Latin America with an expected compound annual growth rate (CAGR) of 28% from 2020-2026, driven primarily by Brazil (where two in five start-ups was a SaaS business in 2020) and Mexico.

Whichever way you look at it - regardless of where it’s founded - SaaS is becoming increasingly global. And so whether you’re a startup preparing to launch, or a scaleup that’s starting to attract global users, understanding how to successfully expand into new markets should be on your agenda. From understanding tax compliance to local currencies and payment preferences – here are some tips for efficient international expansion.

The key 2021 metrics

SaaS 2021 benchmarks

2021 was a record year for SaaS IPOs with a 125% year-on-year increase in the number of companies going public (BMC), a handful boasting valuations in excess of $10 billion. For CEO-Founders dreaming to emulate these companies, what metrics and benchmarks should they be aiming for?

Helpfully, Meritech Capital analyzed 27 SaaS companies that went public last year (representing around $225 billion of market capitalization) and picked out some key trends and averages, including:

- Funding - Companies had raised ~$400 million in venture funding and burned around $200M.

- Revenue - Companies had an implied ARR of $225 million which grew on average 55% year-over-year.

- Customers - The average revenue per customer was $52K with companies also achieving a 119% net revenue retention.

- Market - On average, the companies that IPOed had a total addressable market (TAM) of $40B.

However, when it comes to key SaaS metrics for 2021, there are two that stand out above the rest: Net Revenue Retention (NRR) and Customer Acquisition Costs (CAC).

NRR and CAC

In a pandemic-hit world, NRR was arguably last year’s most important metric. With uncertainty over the length of the crisis, many SaaS companies decided to focus on retaining their customer base instead of acquiring new ones as a way of preserving cash. As a result, NRR was reflective of a company’s chance of survival: those achieving less than 100% looking ahead fearfully, those spending over 100% feeling more positive.

According to forEntrepreneurs, the median NRR last year was +101.8% - only just greater than churn. However, Meritech Capital’s figures show that the average NRR for top-performing SaaS at IPO was +119%. This chimes with Bessemer Ventures' average NRR benchmark for $10 million+ companies of 120% (140% for $1-10 million companies) and corresponds with ex-Hewlett Packard CMO Sue Barsamian’s view that “magic happens when you get above 120 percent net dollar retention”.

If NRR is the pandemic survival metric then CAC is the profit and loss marker. During the CAC payback period, you are paying back the sales and marketing money you spent on acquiring a customer, but after this juncture, it’s all profit. In 2021, Serena Capital found that a decent CAC payback was:

- For SMBs (€5–10 million ARR): < 12 months

- For mid-market (€10 million+ ARR): < 18 months

- For enterprise (€100 million ARR): < 25 months

Meanwhile, forEntrepreneurs' survey found that new customer CAC payback took an average of 26 months, while it took 18 months across new and existing customers (including upsells and upgrades).

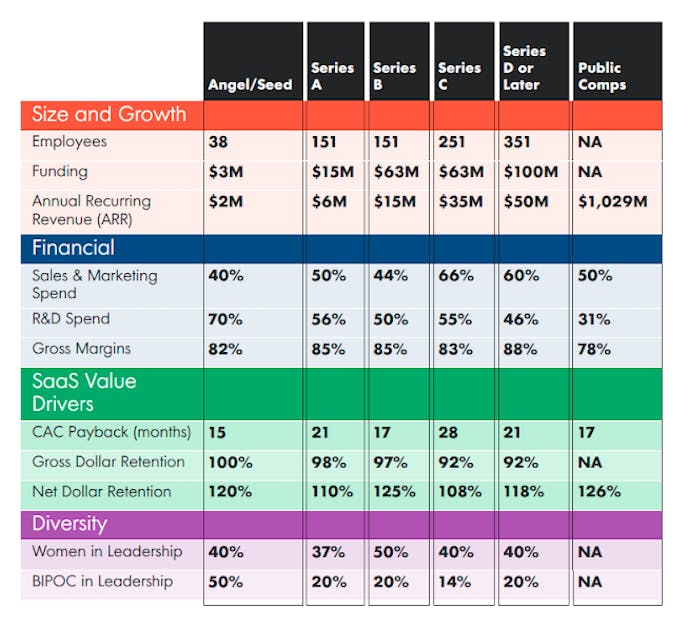

The “Value Drivers”

Having a reasonable CAC and 100%+ NRR is a must for profitable SaaS companies, but there are other metrics that act as ‘value drivers’ when it comes to funding and exit valuation.

In its 2021 Financial & Operating Benchmarks Report, Openview claimed that every company will eventually be valued on cash flow, but in the meantime, there are six key value drivers at each fundraising stage.

(Image source: Openview)

What’s more, Openview tore up the ‘Rule of 40’, claiming that investors were now more interested in the Rule of 30 (30% top-line growth) as the total addressable markets for SaaS are considerably larger than first thought (i.e. Meritech’s average of $40B TAM).

Not all reports were as keen to pour cold water on the Rule of 40, however. forEntrepreneurs found that 29% of SaaS startups with less than $5M ARR met the Rule of 40, but those companies were also the most valuable, representing 62% of the public SaaS market cap.

Other reports have highlighted the hidden value in less-used SaaS metrics such as Net Promoter Score - the average NPS is 30 for B2B software and SaaS (Retently) - but, ultimately nothing drives value like growth.

While these metrics drive valuations, what seals the deal is how you collect the data and display it in your pitch. It should tell the story of your business, in a way that grabs your potential investor's attention – and that means getting your financial model in check.

SaaS operational excellence

Key stats

- The cumulative value of PLG companies has grown more than 100x in the last six years - Bessemer Venture Partners

- 21% - European tech community thinks hiring talent is the greatest challenge in the next 12 months - Atomico

- 49% believe that social and/or sustainability goals have become more important over the past 12 months - Atomico

PLG: the ultimate growth vehicle

PLG gains momentum

Product-led growth seems to be everywhere. When Openview established its PLG index in 2018, there were 17 companies on the list, but last year that number had almost doubled to 30. The cumulative value of PLG companies has grown more than 100x in the last six years (Bessemer Venture Partners) and PLG companies make up roughly 60% of Forbes’ 100 most valuable private cloud companies.

From some of 2021’s major SaaS IPOs (i.e. Expensify and GitLab) to some of the hottest private SaaS companies ‘not’ on the market (i.e. Notion and Miro), product-led growth might give the impression of total SaaS dominance, but here’s the crux: PLG is still relatively niche.

According to forEntrepreneurs’ analysis, the primary go-to-market (GTM) motions for both smaller (<$5m ARR) and larger SaaS companies (>$5M ARR) were quite similar with field sales (60% v 55%) and inside sales (26% v 29%) dominating the sales strategies. Web-based / self-service only accounted for 3% of primary GTM motions for both sizes of company.

As such, there is a glaring dichotomy. While investors have shown their willingness (even preference in some cases) to fund cost-efficient bottoms-up PLG models, most SaaS companies are still hiring sales reps and going to market with a pocketful of sales and marketing initiatives.

At a time of increasing competition, companies have a clear financial incentive to jump on the PLG bandwagon sooner rather than later.

PLG benefits and efficiencies

There is wide-ranging literature on the advantages of PLG models (Paddle’s own TL:DR version is available here), so although we won’t labor the point, it’s worth briefly highlighting some of the core advantages that PLG companies have over traditional GTM motions.

- Shorter sales cycle - PLG enables customers to sign up, self-onboard, and upgrade with no need to hire or train sales reps.

- Net 0 CAC - As the product attracts customers, you can spend on engineering and product instead of marketing or sales to acquire customers.

- Higher revenue per employee (RPE) - With your product doing the legwork (word-of-mouth distribution, trials, upgrades etc.), your employees can focus on impactful activities.

- Better customer experience - Your product has to deliver value, so customers are more likely to be satisfied and renew (boosting NRR).

- Better customization - By providing data on individual product usage, you can easily customize the product to customers’ preferences.

In short: investing more in product enables companies to grow faster and become more profitable. Take Logz.io, for example. Within 12 months of launching its first self-service offer with just two engineers, it brought in half of new Logz.io customers who also increased their average spend by 300% (Openview). What’s more, adopting PLG is not the end of the growth story. You only have to look at some of the biggest SaaS companies in the world - e.g. Between 2017-2020, Shopify grew at a CAGR of 63% (Openview) - to see its long-term advantages.

Pricing: the next frontier

Freemium or free trial used to be the key debate when it comes to PLG (although analysis by Product-Led founder Wes Bush advocates freemium as a more cost-efficient converter), but growth today is all about pricing.

According to Openview, optimizing pricing is ‘your best bet at accelerating growth in the near term’. In particular, 45% of SaaS companies have experimented with usage-based pricing in 2021 - where prices change according to customers’ buying patterns - which has enabled them to acquire new customers more easily and then expand the customer base the more they use the product.

However, the revolution has only just begun and usage-based pricing (25%) is still playing second fiddle to the number of seats (41%) when it comes to primary pricing metrics, while 15% of SaaS companies also base their pricing primarily on modules or functionality (forEntrepreneurs).

Remember that however you choose to price your product, it isn’t something that you should set and forget. ProfitWell recommends adjusting your pricing every 6-9 months and that getting pricing right is a continuous process that requires an understanding of your customers and how pricing affects other aspects of your business.

Human capital efficiency

As mentioned, PLG enables SaaS companies to improve the efficiency and RPE of their employees. However, last year’s State of SaaS reports also revealed some key metrics and benchmarks for determining the productivity of your workforce.

- Human capital efficiency - The average full-time SaaS employee accounts for $120,000 of ARR, increasing to $157,000 for companies with more than $5 million ARR (forEntrepreneurs).

- Sales and marketing efficiency - Top performing sales reps bring in 10 new customers per month (13%) and achieve more than €100,000 of ARR per month (14%), while companies should be looking to bring in at least 5x the revenue per sales rep cost (Serena Capital).

- Average Customer Value (ACV) - ACVs increase the longer the sales cycle. For example, the average ACV for a two months sales cycle is below $5000, but at 3.3 months it’s $25,000-50,000 and over $100,000 after seven months. (forEntrepreneurs).

- Customer success - Best performing companies had one CS manager overseeing €1 million+ ARR (19%) and just over a quarter had one CS manager accounting for 100+ customers (27%) (forEntrepreneurs).

The race for top talent

What is happening?

According to recent articles by the likes of Bain, Forbes, and the Harvard Business Review, the competition for top talent is getting ever fiercer.

Asking its survey respondents about the ‘greatest challenge facing the European tech ecosystem in the next 12 months’, Atomico found that funding (25%) and talent (21%) were the most pressing concerns, with founders more likely to skew towards the former. In a number of countries, over 50% of founders stated it had gotten harder to hire new talent and the number of tech jobs that were ‘hard-to-fill’ (unfilled for 60+ days) was on the rise (e.g. 57% of tech jobs were hard-to-fill in the Netherlands and 37% in the UK).

Meanwhile, Openview asked founders: ‘what keeps you up at night?’

- In 2020, GTM was the most common sleep depriver with about 12-13%

- In 2021, ‘hiring fast enough’ (~15%) and hiring the best talent (~12-13%) were the biggest causes of founder insomnia.

When looking at the wide-ranging demand for tech skills, these fears would appear to be well-founded. In the US, for example, demand for software engineering (69%), machine learning (417%), data science (167%) and DevOps (443%) skills have been marching upwards over the past few years, while even non-technical roles, such as customer success (669%) and product manager (173%) have experienced a surge in demand (Bain).

Why is it happening?

Simply put: the mass-acceleration of tech adoption combined with a limited and time zone-constrained talent pool.

- Tech adoption - Although trending upwards pre-pandemic, Covid-19 put rocket boosters on companies' tech adoption. Start-up to enterprise, public to private, financial services to retail - all businesses across all industries tried to jam pack years of digital transformation into a couple of months. As a result, it wasn’t just tech companies looking for the best talent with CompTIA’s 2021 workforce report finding that 40% of US companies took on tech staff during the pandemic.

- Shallow talent pool - In basic economics, when demand outstrips supply, the price goes up and many small tech start-ups have seen their hiring opportunities squeezed by large multinational corporations (MNCs) or well-backed rivals further down the fundraising chain. For example, Atomico’s report noted that Seed and Series A founders found it harder to hire talent in the last year than other fundraising stages. In addition, it found that 37% of UK-based founders said the depth of the talent pool was worse compared to 12 months ago, but 33% thought it had got better and 43% of repeat founders think the talent market has swelled. Perhaps not so doom and gloom after all.

- Time zones/clusters - Although remote-working has enabled companies to access talent and skills from beyond their backyard, there are still some structural barriers in the way.

...Talent concentration was always an issue. For certain roles, you pretty much had to go to the Bay Area for talent with relevant experience.” He added that remote working will help in a few years, but “time zones remain a big issue. US talent is still very much locked in US time zones and European talent in European time zones.

Jakub Jurovych CEO, Deepnote (Via Atomico)

What can SaaS companies do to get ahead?

In the race for hiring top talent, SaaS employers could improve their chances by:

1. Making VP hires sooner

When should you hire a VP Sales or a VP Marketing? According to Serena Capital, the average European SaaS startup makes these hires around the €1 million ARR mark. However, fully-qualified VPs for this stage don’t grow on trees and don’t come cheap. Serena, therefore, advises its portfolio companies to make these hires sooner by finding a “profile with seniority that fits the maturity of your startup”. Meanwhile, SaaStr highlights the benefits of hiring a VP of Marketing at $20,000 MRR - i.e. make your sales reps better, streamline your funnel and increase revenue per lead - and encourages SaaS companies to hire one when they have two sales reps.

2. Focusing on culture and D&I

Talent wants to work with companies that have a purpose and culture that align with their views. In a talent market where Gen Z and Millenials are the dominant tribes, that means companies that place high value on ESG (Environmental, Social and Corporate Governance) and D&I (Diversity & Inclusion).

Glassdoor reported that three-quarters of job seekers and employees consider workforce diversity as an important factor when evaluating a job. The Harvard Business Review cites a 2020 Beqom survey that half (48%) of adults would consider switching jobs if another company had a built-in DEI strategy, while also suggesting that talent was looking for a culture of coaching & development and accountable senior management. In short, SaaS companies need to bolster their D&I in a meaningful way and show off their cultural credentials to hire well in 2022.

3. Employing a PLG model

As Openview notes, adopting product-led growth is akin to adding a cheat code that enables you to swerve the competition entirely. In a model where the product can play the sales, marketing, and customer success roles, there’s less need to invest in human talent to drive your growth. What’s more, the additional costs saved by a limited team and bottom-up sales approach allows companies to channel funds towards engineering and attract the best developers with greater financial packages. Thinking you still might have to join the talent race at some point? Just remember that Twilio’s $1.2billion IPO was achieved with just 12 people in its sales team.

What this boils down to is really understanding what’s important to the talent you are trying to attract – and how is this different from the expectations and ways of working we saw before the pandemic. Here are some thoughts from Head of People Hanna Smith on how we approached this at Paddle.

ESG: growing with purpose

Rising demand for mission-focused businesses

“Building sustainability into a company's DNA isn't just the right thing to do, it's what a generation of customers and employees now expect,” Steve O’Hear, VP of Strategy at Zapp (Atomico).

Over the past few years, it’s become increasingly clear that environmental, social and governance (ESG) has progressed from a ‘nice-to-have’ to a ‘must-have’. From attracting investors and enticing talent to acquiring customers and satisfying regulations, social purpose needs to be embedded in day-to-day operations and output.

According to Atomico, 71% of European tech startups were already mission-focused and 21% were in the process of establishing a mission, while half of respondents (49%) believe that social and/or sustainability goals have become more important over the past 12 months.

‘Planet positive’ companies, in particular, are firmly in investors' crosshairs. In the first six months of 2021, investors spent over $570 million on environmental data startups (Protocol), while ‘planet positive’ startups brought in 11% of total European tech funding in 2021.

When it comes to investing in ‘purpose-driven’ tech companies, Europe is also leading the charge, attracting $34 billion of cumulative capital in the past five years (15% of the total) and accounting for 61% of global funding into purpose-driven tech companies with <$5 million ARR.

With 13 purpose-driven tech unicorns added to the European stable in 2021, no wonder Lilium CEO Daniel Wiegand claims the “stars are aligning for sustainable companies” in Europe.

Improving and reporting ESG

ESG may be on the agenda, but not all SaaS companies are up to scratch. According to Serena Capital’s survey, only 13% of SaaS startups have assessed their carbon footprint and just 7% are made up of at least 50% women. Given that Atomico found that more than half of newly-raised venture funds were channeled into companies with a pre-existing sustainability statement or ESG policy listed on their website, the race is on for SaaS companies to verify and improve their ESG credentials. Here are three methods:

Certifications - From B Corp to Ecovadis, getting an accredited certification is a simple way of highlighting your ESG credentials. Serena Capital found that a quarter of SaaS companies either have an ESG certification or are considering getting one.

Reporting - This rise in ESG consciousness has created a new arm of SaaS products designed to help companies verify and improve their environmental and social goals. For example, Berlin-based Plan A has developed a SaaS platform that automates ESG reporting and Silicon Valley-based pulsESG’s platform enables companies to track and improve their ESG compliance.

D&I diagnostic - To improve your D&I, the key metrics to focus on are: hiring stats, pay equality and representation.For example, the Future of SaaS’ SaaS Landscape 2021 showed how far companies still need to go with only 8% of respondents reporting a disability and just 2% of female respondents in leadership positions.

More questions than answers?

Well, there you have it. The State of SaaS 2022 in a bite size format.

In brief, the SaaS outlook boils down to a cauldron of excess: more investment, more competition, more innovation, more growth. However, as the pandemic has taught us, nothing can be taken for granted and a couple of key questions remain for the next few years:

- Will PLG become the dominant GTM?

- Will Europe rise above the US?

- Will the race for talent subside?

- Will ESG-focused SaaS monopolize funding?

And with that, we’re excited to see what 2022 has in store – and what next year’s reports will have to say.

If you'd like to refer back to anything in this guide, you can download a copy here (no email required).

About this report

Why did we spend time analyzing the various 'State of SaaS' reports on the market?

Every year tens, if not hundreds of reports are published about the state of the SaaS industry, what happened over the last year and what’s predicted to happen over the year or years ahead. Each one has helpful insights for growing SaaS companies about the industry they operate in, the benchmarks they should be aiming for, and how to scale efficiently.

But what SaaS leader has time to sift through pages of reports to fund the bit that’s useful to them.

So we did it for you.

As it’s useful for us too. At Paddle, we see the rapid growth within the SaaS industry first-hand from our work with over 3000 software and SaaS sellers, globally. We’re a team of SaaS experts building a payments infrastructure to help the startups and scaleups of today become the Shopify’s of tomorrow – with new groundbreaking valuations that will be covered in these reports in a few years' time.

References

- Accel, 2021 Euroscape

- Atomico, State of European Tech 21

- Bessemer Venture Partners, State of the Cloud 2021

- BetterCloud, 2021 State of SaaSOps Report

- BMC, IT Spending Trends of 2022

- BMC, State of SaaS 2022

- Cledara, The State of SaaS Management 2021

- Finances Online, 2021 SaaS Industry Market Report

- forEntrepreneurs, 2021 SaaS Survey

- Future of SaaS, SaaS Landscape 2021

- Meritech Capital, 2021 Review: SaaS IPOs

- Openview, 2021 Financial & Operating Benchmarks Report

- Serena Capital, 2021 European SaaS Benchmark