ARPU can help you to identify trends and implement change that can shift the trajectory of your business towards that large pool of SaaS profits we all dream of. Discover what influences ARPU, why it matters, and how to grow it.

Getting to know your customer is what separates the losers from the winners in the SaaS world. When you break down a successful business you will find 99.9% of the time that they have a strong hold on who their customers are and an even better grasp on where that customer finds value in their product.

This starts with quantifying your customer personas and trickles down deeper into your SaaS metrics as time passes and the business grows. The real secret sauce to understanding your customer is being able to understand your Average Revenue Per User (ARPU). This metric allows you to identify trends and implement change that can shift the trajectory of your business toward that large pool of SaaS profits we all dream of.

So to better understand ARPU, let's take a deep dive into what it is, why it's important, and ways that you can optimize this metric to catapult the success of your SaaS business.

What is average revenue per user (ARPU)

Average revenue per user (ARPU) is a measure of the revenue generated by each user over a given period of time, taken as an average. ARPU can be used by any business, but it's more relevant for those with a recurring revenue model - SaaS in particular. It allows businesses to deepen their analysis of growth potential on a per-customer level and helps them model revenue generation capacity. Due to its role in modeling growth, ARPU is one of the most critical revenue metrics for SaaS subscription businesses.

The difference between per user and per unit

A variation on ARPU is to look at ‘units’ instead of ‘users.’ The average revenue per unit looks at how much revenue each unit of a product line is generating. It is often used to understand how much discounting on the list price has occurred, and is especially relevant if you are selling in bulk. Average revenue per unit is more common where businesses are selling tangible products, as opposed to pure SaaS businesses that are, by definition, selling services. That said, older technology companies often retain legacy hardware products in their portfolio, so they will want to analyze ARPU on a ‘per user’ and ‘per unit’ basis.

Why understanding ARPU is important

Understanding your ARPU figure is a birds-eye view into how well your SaaS company is actually doing, especially when breaking down the information by segment and cohort. The higher the ARPU for a company, the better the chance that the company is able to extract more cash in the future. Additionally, if you're able to have a high ARPU relative to the value you're providing or the company's revenue, you know you have a product that's driving a better value ratio. In summary, though, here's why APRU is important:

Indicates the health of your business financially

If your ARPU is sub $100, then you know you need to get a metric ton of customers to grow a sustainable company. In this manner, ARPU allows you to see what kind of business you need to be from a pricing and value perspective. Most often, ARPU is the "canary in the mine", indicating that your product may be too cheap in a market that isn't big enough. Alternatively, a high ARPU in a large market indicates you're off to the races in terms of growth and prosperity.

Product validation that you're extracting enough value from your personas

One of the biggest mistakes we see from companies is that they're targeting small or enormous customers, and the ARPU isn't high enough for the provided value. For instance, if you're selling a product to Disney and they're getting $1M worth of value in time, cost, etc. efficiencies, then you should be charging at least $100k for that product. ARPU helps your product team see if they're aligning the product’s value to the right customer.

Validation that your marketing and sales teams are driving the right deals

ARPU should be increasing consistently over time, especially if you're just starting out in the SaaS game. The reason for this constant need for improvement is because it indicates that your sales and marketing value propositions and targeting are constantly getting better quarter over quarter. Essentially, you're becoming more efficient.

What does ARPU tell you about your SaaS business?

As a standalone metric, ARPU can be misleading. It can rise - a seemingly positive indicator - even if you are losing customers and overall revenue is falling. To see the full picture, you need to look at ARPU alongside other SaaS metrics, notably customer and revenue numbers in real terms.

ARPU matters more to some SaaS businesses than others. For example, a startup using discounting to attract customers may be OK with a falling ARPU if it’s as a result of new signups (i.e. more customers, each paying less). But at some point, they will want to rebalance from subscriber growth to revenue growth. Here, ARPU becomes more important, and if they aren’t able to grow it (or at least keep it stable) the business will not be sustainable.

ARPU for different segments of your customer base gives you feedback on how current processes are working and helps you make decisions for the future of your company. Understanding ARPU will tell you about:

Growth of your MRR and LTV

In the short term, ARPU directly affects MRR. The more revenue individual customers contribute each month, the more monthly revenue intake for your company. ARPU also affects the long-term growth of your customers' lifetime values. The revenue a single customer contributes each month sums over their entire lifetime with the company to add up to their lifetime value—so increasing ARPU increases LTV.

The financial viability of your business

If you have low ARPU, you need a lot of customers to reach MRR goals each month. If you have high ARPU, you don't need as many customers to reach goals and grow quickly. Low ARPU in a small market might be a warning sign that your company is not set up for long-term success, while high ARPU in a large market means excellent opportunities for revenue growth.

Price alignment and product validation

if your business keeps attracting new subscribers and revenue is growing, but ARPU is stable, it may point to your product being underpriced. Low ARPU might be a sign that you're not adequately extracting value from certain buyer personas for the service that you're providing to them. For example, enterprise clients are likely seeking a lot of value from your product, which you should monetize by pricing according to the value they're receiving.

The efficiency of your sales and marketing team

ARPU should be increasing over time as sales pitches improve and value propositions get clearer and more targeted. Increasing ARPU means that you're onboarding more of the right customers and selling them on the value they're interested in. This helps you create a more efficient sales and marketing system.

Segmented ARPU can also give you concrete information about popular plans and trends in cross-selling and up-selling. Imagine you offer 4 plans: a $15/month plan, a $45/month plan, a $75/month plan, and a $150/month enterprise plan. In calculating the ARPU for each group of customers on each plan and comparing the number of customers at each ARPU level, you can see which plan is most popular.

Your $45/month plan is your most popular plan, with 500 customers paying $45 in ARPU each month. You can look at the value that's included in that plan to understand what makes this plan popular with customers.

This graph also shows that while 300 customers on your $75 plan are indeed paying $75 each month, 75 customers on the $75 plan are actually paying $90 because they were cross-sold an additional feature. This would help you conclude that you can add another tier in between your $75 tier and your $150 tier to better monetize these mid- to upper-market customers.

What to include in ARPU

Average Revenue Per User (ARPU) is a tabulation of all revenue coming in from your active users divided by the total number of customers that revenue came from.

Here are the items that you should include in your ARPU calculations:

Monthly recurring revenue: The total amount of recurring revenue that your business brought in for the month. Correct MRR calculations account for the following:

- Account upgrades: a subsection of MRR that represents the upgrade dollars from the current customer base that you have

- Account downgrades: this includes the total dollar amount of customers that have downgraded their service. This is important because downgrades represent money lost from current customers that have not churned.

- Lost MRR from churned customers: This subsection of MRR is a tallying of the MRR that you lost from customers who actually churned, not those who’ve canceled.

Total paying customers: Include all customers who have paid for your service within the month and have active accounts. If you have “free users” they shouldn't go into the ARPU calculation because they are not providing revenue for your business.

Variables to control for when calculating ARPU

One of the criticisms leveled against ARPU as a metric is that it is too general. To combat this, it’s best to analyze ARPU by specific segments, so that you calculate it in a way that makes sense to your business. Here are some of the parameters you should think about.

The user

Clearly, how you define your ‘user’ is going to change the ARPU you get.

- Paid vs free: Not every user pays, and some will be paying less for the same service.

- Accounts vs seats: Often SaaS businesses will provide an account with multiple seats to access their service. There is one subscriber, but many users.

- Active vs dormant: Some users are more enthusiastic about your service than others. Some may not have logged in for a long time. How do you decide who to include?

- Integral vs peripheral: Some users - such as early adopters, influencers, key decision-makers or project leads - will have value beyond their revenue, and conversely may bring in less revenue as a result.

- Length of service: Loyal customers who may be expected to have a higher ARPU could be dragged down by new customers that are not yet ready to spend big with you. You may want to keep these groups separate.

How users pay

Some SaaS products will charge incrementally to consume more of the service, access new features, or add more users. While some will rely on a pay-as-you-go model, making spending patterns more unpredictable than a subscription model.

How users consume

The other side of ‘how users pay’ is how they consume a service. Some SaaS businesses have fairly stable consumption patterns - for example, business productivity applications and music streaming services. Others will expect users to switch on and off (e.g. holiday apps, digital tax submission). While some services are designed to scale at a moment’s notice (e.g. cloud cybersecurity solutions).

The time period

ARPU is often measured by month, as this is when most subscription payments are taken. But it may be more relevant to look at ARPU in a shorter time frame (i.e. weekly or even daily), or longer (i.e. quarterly or annually) - depending on how regularly the service you are providing is used, when renewals take place, and how agile you need to be in the marketplace.

How to calculate average revenue per user

ARPU is calculated by dividing total revenue by the number of users during a period.

ARPU = Total revenue / total count of users

The period is usually a month. For example:

Total revenue $500,000 per month

Total subscribers 50

ARPU = $10,000 per month

ARPU is not a Generally Accepted Accounting Principle (GAAP) requirement, and therefore it can be calculated in different ways. In the next section, we’ll look at some of the factors that might influence how you calculate ARPU.

How to optimize ARPU

ARPU is the trend identifier metric that allows you to really get to know your customers. The more ARPU you can generate, the better your SaaS business is doing. Don’t forget that ARPU gives you the insight to catapult your business forward by increasing MRR/ARR and extending your customer LTV.

Here are four actionable ways you can optimize ARPU for your SaaS business.

1. Make sure you're targeting the right customer personas

Not every user is desirable. You may be absolutely deflating your ARPU by targeting too many small, distracting (and expensive) low-revenue customers. If you're not in the consumer space or a space with hundreds of thousands (if not millions) of potential customers, then you shouldn't be chasing sub $100/m customers. Make sure you quantify your buyer personas properly and target the right ones for growth.

2. Ensure your retention is on point, especially for larger customers

MRR churn is directly connected to your ARPU, as leaking customers (especially large ones) will reduce your customers and your total revenue. Make sure you're running a proper retention process.

3. Consider a pricing increase

There are lots of ways of getting customers to spend more. The easiest is to raise your prices while keeping your service affordable and competitive. New product features present new revenue streams; as do ancillary services such as technical support and training. Sometimes, simply re-communicating the benefits of your offer can encourage more use and a wider footprint with a customer.

4. Add-Ons, Value Metrics, and Upgrades

Raising your fees isn’t the only price tactic you can employ to grow ARPU. Moving customers to different price plans - for example, charging by consumption or seats - may be a less contentious way of making more revenue from each. The easiest way to do this is to ensure that a value metric is central to your pricing strategy to bake in expansionary revenue. An alternative to this strategy is to make sure you have a clear add-on and upgrade strategy.

How can a company that targets the SMB market increase ARPU?

If your company provides a low-cost solution to serve small businesses, that doesn't mean death to your ARPU. Targeting the SMB market is a good place for a growing SaaS company to start, and there are opportunities here to monetize your customers even if providing a high-cost solution won't work for your company.

The key to monetizing these customers is to add value and expand pricing over time. Catering to the SMB market can get your foot in the door at a customer's company. Then you can increase your share of their wallet over time by:

- Marketing feature upgrades

- Cross-selling additional services

- Encouraging plan expansions along a value metric

This will increase your customers' ARPU over time. It's essential to have these expansion strategies in place to cater to this market. As Constant Contact CEO Gail Goodman describes in her talk, “The Long, Slow SaaS Ramp of Death,” a business won't survive for very long with only a handful of low ARPU customers. You need to communicate value and expand quickly.

Figure out your foot in the door for your naturally-low ARPU customers in the SMB market. Then cross-sell and up-sell customers as they grow and need more value from your product. This allows you to acquire customers at a price point that works for them in their early stages, and grow their ARPU over time as their needs increase and your business matures.

What is a good ARPU?

Unfortunately, there is no universal average ARPU to serve as a benchmark. Average ARPU fluctuates based on the industry, pricing model, location, and other factors. Unlike many other SaaS metrics, ARPU is an absolute number, not a rate. Therefore, broad industry benchmarks are not helpful. Be careful to make sure you don’t end up comparing yourself to businesses with very little in common, or ones that have different priorities to yours. Here are some examples of just how much ARPU benchmarks can fluctuate.

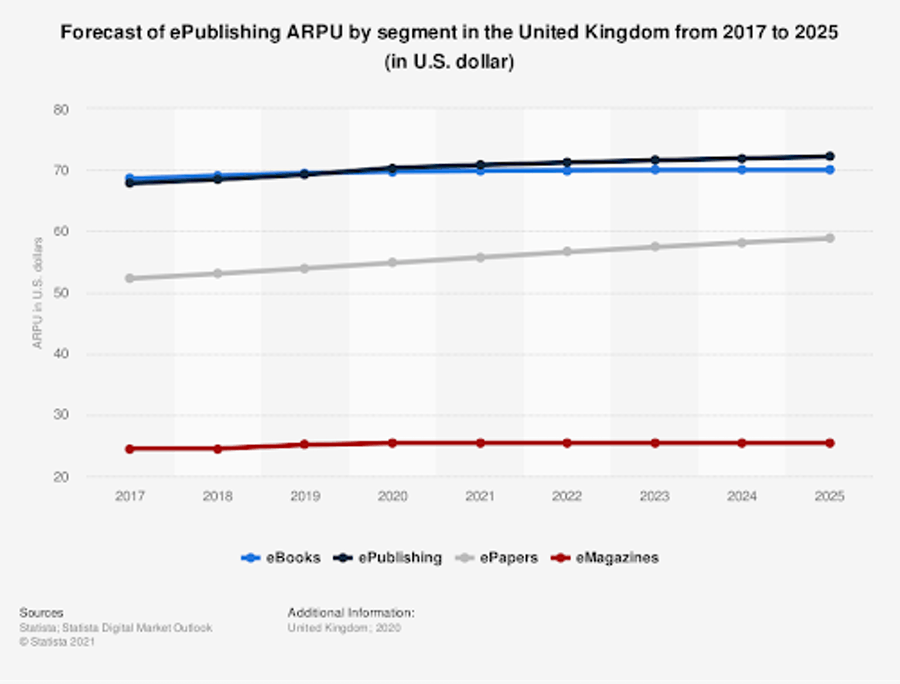

Fluctuation by country

Fluctuation by market segment

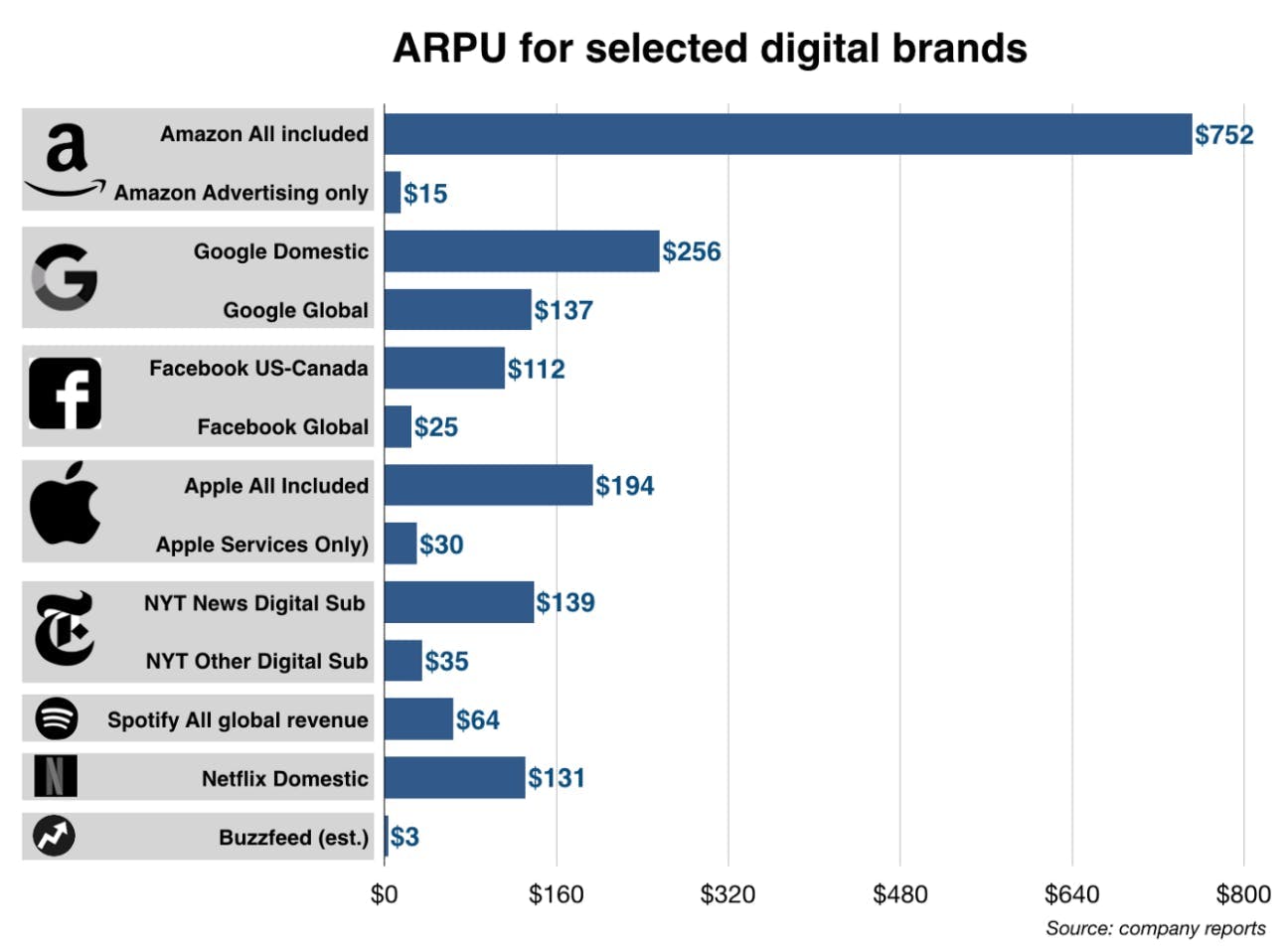

Fluctuation by product or user segment

Source: Mondaynote.com, 2019

How ARPU relates to customer churn

High ARPU customers are valuable to your SaaS company for many reasons; namely, they contribute large portions of your MRR. However, high ARPU customers are also a huge asset for your company because higher ARPU is correlated with lower user churn.

User churn is an insidious drain on your SaaS company. It dwindles your user base and as a result, you have to work much harder to replace lost users and acquire additional users in order to grow. That's why loyal customers who won't churn are so valuable to a company, and why retention is so important to SaaS companies.

Lower user churn also means customers stick around longer. This can mean higher LTVs and more opportunities for your company to monetize these customers through cross-sells and up-sells.

High ARPU customers retain better than low ARPU customers.

Our study of 941 SaaS companies found that customers with 4-digit ARPU were nearly 50% less likely to churn than customers with 1- or 2-digit ARPU.

While our data shows correlation and not causation, there are many reasons why high ARPU customers retain better than low ARPU customers. Since they pay more each month, they likely have a greater need for the service you offer and find more value in your service than low ARPU customers. High ARPU customers may also be large customers with annual contracts. As opposed to monthly subscription plans, annual plans give customers less opportunity to churn.

How your billing operations & infrastructure supports ARPU growth

Timing and ease can be two more reasons why a subscriber may be willing to move plans, pay more, or buy more. The flipside of this is that revenue growth is lost when customers can’t do what they want when they want. Operationally, there are many moving parts to executing these tactics: from being able to segment customers and prospects, to communicating to them via the most effective channels; making checkout as smooth and secure as possible, to surfacing and acting on real-time data.

All this is made harder when you have multiple systems, each running specific tasks. Conversely, a unified billing & payments infrastructure - that covers subscription management, payments, and data analysis - allows for significant automation, flexibility, and speed.

Average revenue per user (ARPU) FAQs

What is the ARPU formula?

You can use the following formula for ARPU calculation:

ARPU = Total number of active users/total number of customers

What is the difference between ARPU and ARPPU?

ARPU is short for Average Revenue Per User, while ARPPU stands for Average Revenue Per Paying User. It is a metric used to measure revenue generated by paying users and players over a specific period. Both ARPU and ARPPU are usually calculated on a monthly basis but can be measured daily, weekly, quarterly, or annually.