Spotify is being crushed under their own weight by the makeup of their pricing and revenue model that is simple, but awful for their bottom line. Here's why.

During 2011, digital music service Spotify doubled their paying customers to more than six million and earned a whopping $236 million. Their first year in the U.S. market seemed like a smashing success, but despite the significant growth, Spotify reported a net loss of $57 million due to $293 million in expenses.

Sure, tons of companies go into the red in defense of growth, even at the eight or nine figure mark. Hell, Amazon did billions of dollars in sales last year, and still came up with a loss. We get the slow play. Yet, Spotify's current marathon is not hinged upon changing consumer’s behavior in mass like an Amazon. In fact, they’re actually playing directly into what we want in a music service. Not even new competitive entrants like Google, Twitter, and Apple lead to Spotify failing. Instead, Spotify is being crushed under their own weight by the makeup of their pricing and revenue model that is simple, but awful for their bottom line.

That’s a big statement, but fortunately we can prove it with some good old fashioned evidence. Let’s explore Spotify’s revenue model a bit more, discover where the numbers show they’re failing miserably, before digging into where Spotify (and you) can turn these mistakes around; because the last thing this music fanatic wants is to see Spotify go the way of the Dodo.

We created an episode, originally for for Paddle Studios, that broke down the pricing of Spotify:

Freemium is only as good as the revenue model to back it up

In order to truly unpack the problem, let's take a quick review of their business model. Spotify’s marketing strategy hinges upon the freemium play. We’ve all seen these before, but essentially an enormous bevy of free users are subsidized by a small proportion that end up paying for some sort of premium plan. Remember though, freemium is a marketing strategy, not a revenue model.

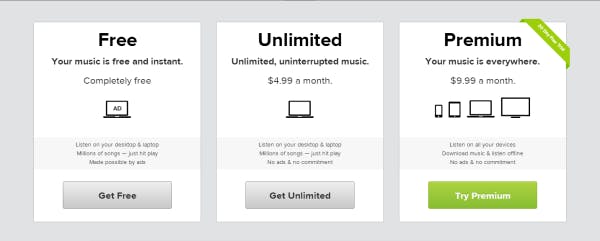

For revenue, Spotify’s free users can stream unlimited music on their desktop, but need to listen to ads every once in awhile, providing our Swedish bards with a small revenue stream (about 15% of their total revenue). Users can also pay to eliminate the ads for $4.99/month and then to eliminate the ads and stream music on any and all devices (even offline) for $9.99/month. Fortunately for Spotify their conversion numbers are pretty stellar with 25% (or 6 million) of free users converting to paid plans.

That seems ok, but here’s where it all goes down hill

This all sounds amazing, right? Any other SaaS company would kill for those kind of unit economics. Yet, even though Spotify is estimated to balloon to almost a billion dollars in revenue this year, they face two seemingly insurmountable problems: the music industry and our generation's perception of music.

Imagine the Government Levying a 70% Tax on Every Dollar You Made

Spotify is being absolutely crushed by an entertainment industry who’s grasping at every tenth of a percent they can get for the 1% of artists that actually “make it.” Sure, the Internet is democratizing music distribution, but when you mix in the negotiating reality of the major entertainment labels and the RIAA, one of America’s most powerful lobbying groups, you have an in industry that’s crumbling at a glacial pace in the context of a tech company growing at a breakneck speed. Something’s gotta give, and I doubt it’ll be LA Reid, Metallica, and their friends.

Sounds melodramatic? Well let’s look at some numbers and see the major issue of how cash is divided in streaming music. Spotify’s cost structure is absolutely insane, because 70% of every dollar goes to rights holders, leaving 30% for Spotify’s operations and expenses, clearly leaving nothing for profit. Spotify got into this mess because they negotiated with the big three labels (Sony, Universal, and Warner) for use of their entire catalogs, which was great for avoiding per song costs and users could access all the music in the world, but awful because for this access Spotify agreed to fork over $200 million or 75% of their total revenue - whichever is greater.

This means if Spotify does make $1 billion this year, $750 million will go to the big three (tweet this). Sure, Spotify is trying to renegotiate this deal, but as we explained above, the traditional music industry is crumbling, so why would these labels ever compromise to the point that they aren’t taking a crippling chunk.

We’re the only generation that won’t pay for music

To make matters worse, we are the only generation that refuses to pay market value for music. The pre-digital generation sat entrenched in the age of vinyl, cassettes, and compact discs. The generation after us is so accustomed to digital currency and goods that Apple and company has little to do, but just keep the cash cow going with the music industry’s help.

That leaves us. The generation that came of age in the peer to peer connections of file sharing. Napster was our Moses and bittorrent our wildfire. It’s not that we think artists shouldn't be paid, but a penchant for choice and openness, plus a resentment of a Metallica lead witchhunt against thrifty teens and soccer moms, left a taste in our mouth that no amount of sugary, sweet pop can cure.

Hope came swiftly upon our rhythm horizons with services like Pandora, Grooveshark, and Spotify that gave us access to Petabytes full of any lyric we ever wanted to hear - all for a measly couple of bucks a month.

Not to hit you over the head with this, but let’s make this cyrstal clear: You have access to basically every song ever recorded for free (with occasional ads) or for less than $10/month (tweet this). All the music for basically nothing. All music. Basically for free.

Spotify’s business model needs to change.

Proof Spotify can Charge More and Needs to Adjust the Business Model

Fortunately, even though tens of millions of people will frequent the pirate bay or stomach a few ads to avoid paying for music, millions of other people are more than willing to pay for their beats. Apple’s itunes sells 15k songs per minute for a total of 25 billion songs since the store began. As we discussed, Spotify has 6 million people shelling out cash. Yet, the problem exists in the structure of those sales for Spotify.

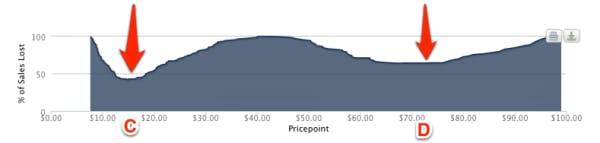

Currently, Spotify is only appealing to the fence sitters and not the audiophiles out there. To prove this we measured the price sensitivity of the market (utilizing our price optimization software and algorithm - more detail on the process in our post on Groupon’s pricing woes) amongst actual spotify customers. We found that yes, for the aggregate Spotify was priced fairly well with $9/month falling close to the base of sensitivity. Yet, notice the upward slope between points A and B. This slope indicates that there are subsets of customers willing to pay much more.

To further explore these premium personas, we ran another study, but this time focused on the hardcore users, those who identified as listening to music constantly and as a passionate hobby, not just a means to shaking your bum on the weekend. The results were fascinating. Not only was there a group willing to around double the current price (point C), another group existed that was willing to pay much, much more (point D). Of course, logically these groups are more than likely not as large as the $9/month group, but the mere fact that these groups (C and D) exist is an indication that Spotify is leaving cash on the table and creating their own demise by not taking advantage of power users.

How can Spotify turn things around, and what can you learn?

1. Utilize pricing as a weapon, not just something you slap together

Fun fact: a 1% improvement in pricing equates to an average boost in profits of 11%. I’m sure Spotify put some time into thinking about their pricing and revenue model (they’re a huge company with lots of smart people), but if they knew pricing could mean millions more to their bottom line they’d probably conduct even some relatively easy market research for better pricing. Collecting data and scientifically quantifying proper positioning, packaging, and pricing could help Spotify maintain the simplicity of their pricing while expanding the options to capture higher tiered customers.

Lesson for you: Positioning, packaging, and pricing needs to be more than an afterthought. Implement a repeatable process for evaluating, gathering data, and scientifically walking through your pricing - even if it’s only every quarter.

2. Pricing Along a Value Metric is Exceptionally Important

Your pricing model should expand with your customer’s usage, meaning if they’re getting more out of your product, then they should pay more. A theoretical value metric for Spotify would be a per song cost or limiting the number of plays lower end users can have, but we’ve already established that the digital masses tend to be mixed on paying for music and this really isn’t Spotify’s style. Instead, Spotify needs premium plans differentiated on more premium features to gather cash from their premium personas. They’re willing to pay; Spotify just needs an offering.

Lesson for you: Find a way to make sure you not only have offerings that appeal to different personas, big and small, but also gives your customers a clear upgrade path. Customers shouldn’t be stuck on the same plan forever, and when they use more, they should pay you more.

The Last Thing We Want is for Spotify to Fail

We love Spotify. We love their mission, and we think the product is phenomenal. We just don’t want to see it fail, because of the cash left on the table that’s already being scooped up so much by the music industry. Now with the entrance of Apple, Google, Twitter, Deezer into the music game (and even YouTube, the number one music streaming platform for teens), Spotify needs to step up it’s game, bring the revenue capturing noise, and make sure to mitigate the awful misalignment funk.

To learn more about pricing specifics, check out our Pricing Strategy ebook, our Pricing Page Bootcamp, or learn more about our price optimization software. We're here to help!