Striking it rich in the cut-throat world of subscription apps remains an elusive dream for most developers, with half of all mobile apps pulling in less than $50 a month, according to a new study by RevenueCat.

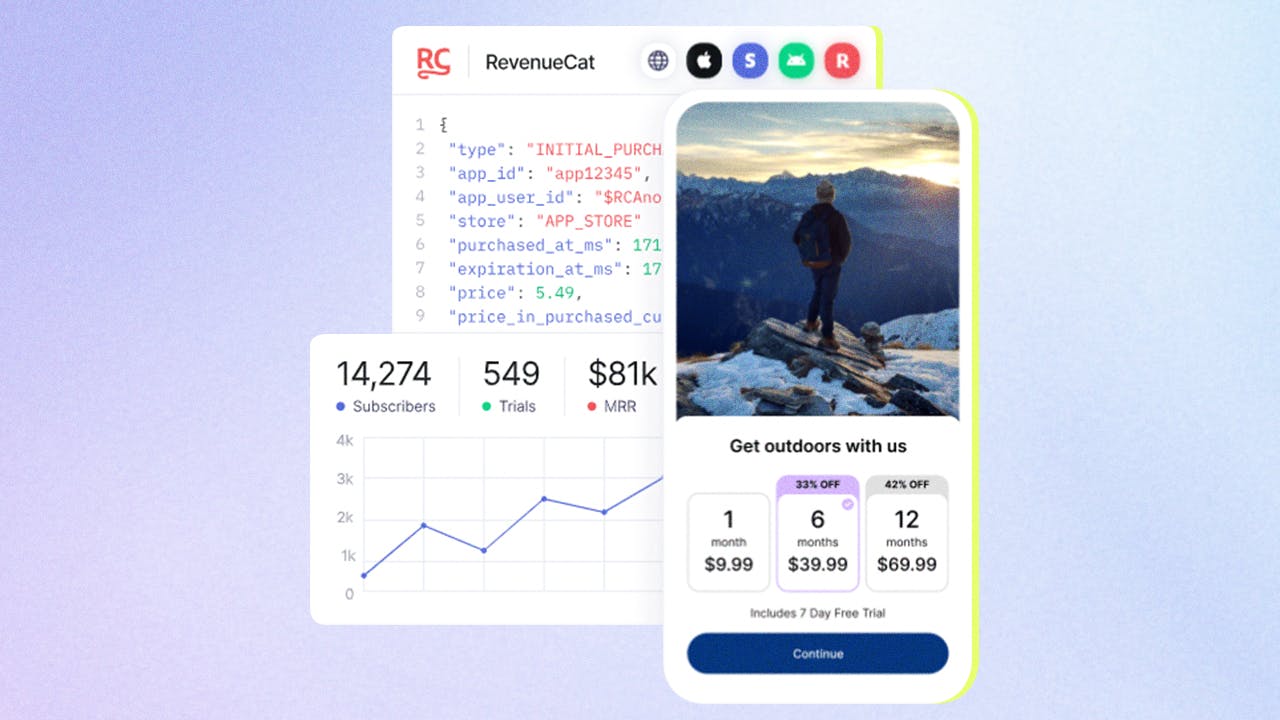

Welcome to the jungle: The subscription management platform company's 2025 State of Subscription Apps report paints a picture of a fickle subscription app market where success hinges on innovative AI integration, adoption of hybrid monetization models, proactive user retention strategies, and optimized paywall implementations. App developers and businesses must adapt to these evolving trends to thrive.

By the numbers: RevenueCat analyzed data from over 75,000 apps and $10 billion in transactions, revealing significant trends shaping the highly competitive mobile app ecosystem. Key takeaways from the report include:

- AI-powered apps lead revenue growth: Apps with an AI component achieved a median revenue per install (RPI) exceeding $0.63 after 60 days, doubling the overall median of $0.31. This performance matches that of the Health & Fitness category, indicating that AI integration, when coupled with unique and valuable features, can substantially enhance monetization.

- Revenue disparities are widening: The report highlights a growing revenue gap between top-performing apps and their counterparts. The top 5% of newly launched apps generate over 400 times more revenue after their first year compared to the bottom 25%, who earn no more than $19. This disparity has increased significantly from the previous year's 200x difference, underscoring the importance of effective pricing strategies, rapid iteration, and robust user retention efforts.

- It's not all about subscriptions: A notable shift from pure subscription models to hybrid monetization strategies is evident. Currently, 35% of apps combine subscriptions with consumables or lifetime purchases. This trend is most pronounced in gaming apps (61.7%) and social & lifestyle apps (39.4%), suggesting that diversified revenue streams can better cater to varying user preferences and enhance overall profitability.

- Subscribers love to cancel: Retention of new subscribers remains a critical challenge. Nearly 30% of annual subscriptions are canceled within the first month, indicating that initial user engagement is crucial. Apps offering low-priced annual plans retain up to 36% of users after one year, whereas high-priced monthly plans see retention rates drop to just 6.7%.