Email is a goldmine of consumer spending data. Every time you buy something online, book a hotel, or sign up for a service, there’s a record of it in your inbox.

From the moment OpenAI took NLP mainstream in 2022, leaders in nearly every industry have collectively and individually quested to find the highest and best use of the world's most powerful new tool. B2B, B2C, and researchers alike have been blessed with digital ML companions eager to sift through troves of boring data, turn over every stone, and uncover what the humans were missing.

Finding trapped value: Much of the realized upside thus far falls broadly into two categories: AI that helps make existing processes more efficient, and AI that extracts trapped value from workflows that are traditionally too cumbersome to be done by humans. One new Y-Combinator-backed company is hoping to shake up the world of personal finance and spend management by helping consumers find lost money in their inbox.

"Email is a goldmine of consumer spending data. Every time you buy something online, book a hotel, or sign up for a service, there’s a record of it in your inbox," explains Kamal Nahas, Founder of Pap!, a platform designed to automate the retrieval of unclaimed funds.

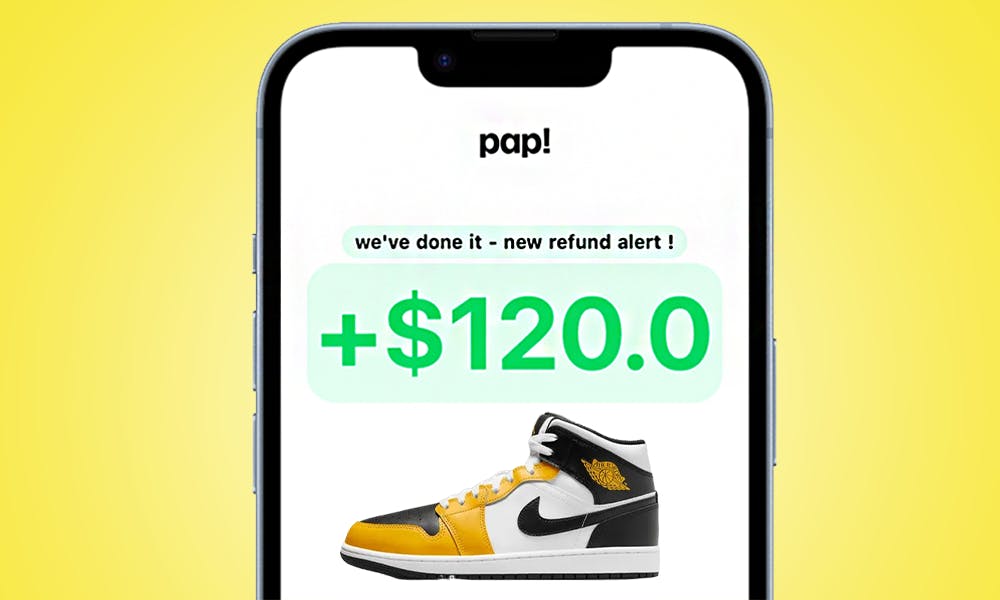

Pap! uses AI to analyze email receipts and confirmations to find opportunities for refunds and compensations people overlook. "Consumers are missing out on an estimated $70 billion every year. When we shop, travel, book hotels, or subscribe to services, there are laws, rules, and policies that entitle us to money. If everyone understood these laws and acted upon them, they would be richer today."

How it works: Once users sign up, the platform operates in the background, continuously scanning for potential refunds and retrieving them without requiring additional input. Pap! employs a commission-based revenue model, taking 25% of any successfully claimed refund.

"You don’t pay anything upfront. We only win when you win," Nahas says, noting that this alignment ensures users benefit first. Refunds can range from small amounts to hundreds of dollars, creating a sustainable revenue stream for the platform while providing tangible benefits for users.

A Lebanese native, Nahas’ personal motivation to build Pap! derived from witnessing the hardship of the 2019 Lebanese financial crisis and the millions in personal bank accounts that became inaccessible. His mission now is to ensure a wider audience is able to claim money they are entitled to.

Consumer data should be leveraged to optimize spending, not sold.

KN on Data Privacy: While leveraging consumer data is central to Pap!’s operations, Nahas emphasizes the company’s ethical stance. "Consumer data should be leveraged to optimize spending, not sold," he asserts, highlighting growing concerns about privacy.

KN on Pap!'s deeper fintech roadmap: Beyond automating refunds, Pap! is branching into spending optimization, focusing on pre-purchase and post-purchase strategies. Pre-purchase tools will help users secure the best prices, while post-purchase tools will ensure they capitalize on opportunities like price adjustments or delayed shipping compensations.

Free money: "We're all very different as consumers, but we share very few 100% commonalities, and the primary one is our desire to get free money." Nahas says. Weighing in on the future potential of Pap! He adds, "It's one of those rare opportunities where you can maximize your chances of building something that tens of millions of people are going to be impacted by because everyone cares about free money."