Consolidation is a priority, with many teams looking at usage data to identify underutilized apps, duplicate functionality, or multiple instances of the same app—all strong candidates for elimination or replacement.

The SaaS industry saw remarkable growth when the pandemic hit, forcing businesses to modernize and adopt remote work practices almost overnight. As a result, SaaS providers became indispensable, and their valuations soared. However, as the world adjusted and the dust began to settle, the SaaS boom cooled, prompting companies to reassess their operations and, most critically, their spending.

To understand the factors driving this shift, we spoke with Ben Pippenger, Co-Founder and Chief Strategy Officer at Zylo. Pippenger explains that the rapid growth experienced during the pandemic led to a period of over-purchasing, which soon required companies to reevaluate their SaaS portfolios.

The Great Realization: "Following hasty software purchasing during the pandemic, many companies entered a 'Great Rationalization' phase, reassessing and slimming down their SaaS portfolios," Pippenger says. "According to our 2025 SaaS Management Index, organizations now spend an average of $49M on SaaS."

Streamlining: The pullback in SaaS spending was not just a reaction to economic pressures but part of a broader trend of synthesizing tech stacks. "SaaS portfolios have also streamlined, with companies using an average of 269 apps, down 7% year-over-year," Pippenger shares. "We’re seeing companies double down on rationalizing and consolidating their tech stacks to cut costs further. There’s also a shift toward consumption-based licensing, which increases SaaS Management complexity and the need for precise spend strategies."

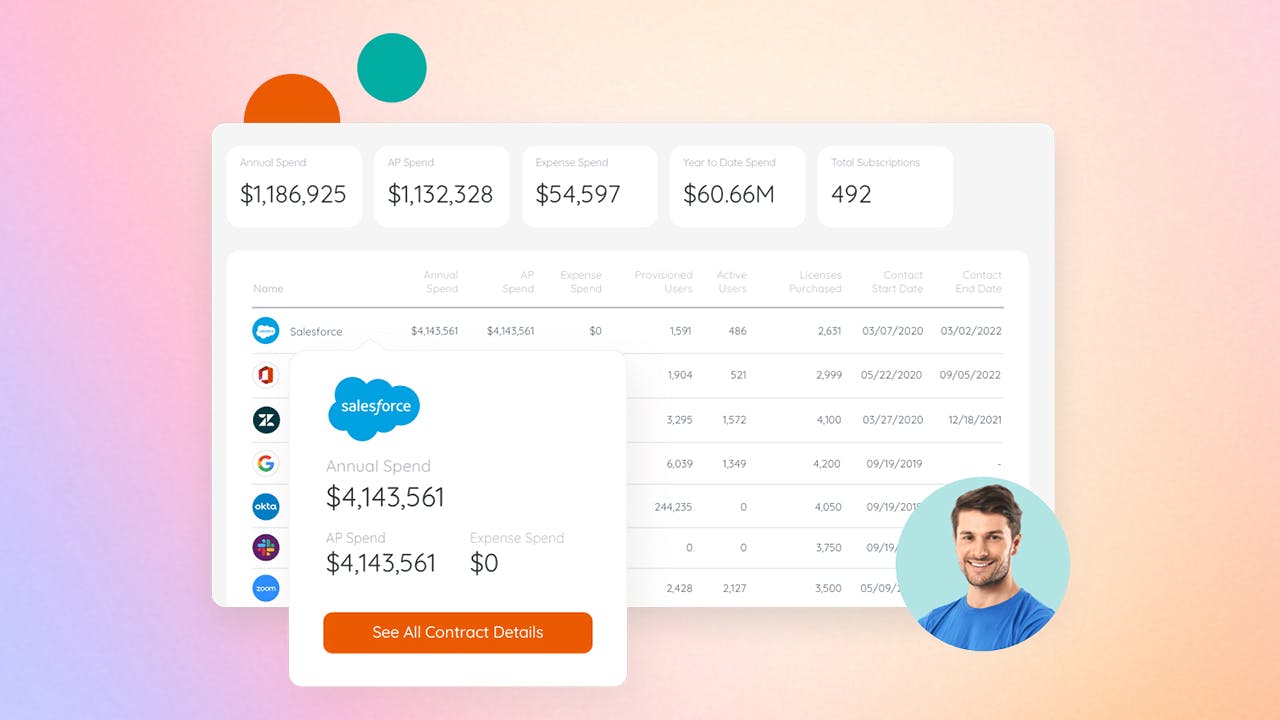

Better decisions: As the industry adjusts, Zylo, which manages over 30 million SaaS licenses and $34 billion in spend, is helping organizations optimize their SaaS investments. Zylo’s AI-powered platform is designed to help companies standardize application usage, eliminate redundancies, and identify cost-saving potential. "We focus on smart rationalization and cost-saving opportunities," Pippenger explains. "Our platform helps companies make better-informed decisions about software needs by providing detailed usage data, empowering teams to determine whether to keep or release licenses or switch to more cost-effective plans."

Following hasty software purchasing during the pandemic, many companies entered a 'Great Rationalization' phase, reassessing and slimming down their SaaS portfolios.

Removing the guesswork: Zylo’s approach emphasizes making data-driven choices. "Instead of abruptly revoking access to underutilized apps, we empower employees to make informed decisions about whether to keep licenses, downgrade to a more affordable plan, or eliminate apps altogether," Pippenger says. "By providing usage data and pricing benchmarks, we help companies negotiate better and rightsize licenses at renewal time, taking the guesswork out of those decisions."

AI in the mix: "AI is transforming SaaS management by unifying traditionally siloed data—spend, contracts, licenses, and usage data," Pippenger adds. "It can find patterns that would be nearly impossible to spot manually, helping companies focus on areas that deliver the most value."

In addition to AI, automation is streamlining manual tasks and creating newfound space for companies. "Automation is playing a crucial role in helping teams manage SaaS more efficiently," Pippenger notes. "By automating tasks like license reclamation and renewals, companies can save time and reduce errors."

Knowing your ROI: As SaaS companies continue to focus on optimization, evaluating the ROI of each application is a priority. "Companies are examining spend, utilization, and whether each app is delivering on key business outcomes," Pippenger says. "Consolidation is a priority, with many teams looking at usage data to identify underutilized apps, duplicate functionality, or multiple instances of the same app—all strong candidates for elimination or replacement."

The timing of software renewals also provides an opportunity to make the final call as to whether or not software is kept or put on the chopping block. "Renewal times are ideal for evaluating whether a subscription is still necessary," Pippenger notes. "By eliminating unnecessary software and redirecting that wasted spend, companies can free up funds for employee bonuses, salary increases, or investing in innovation like AI."