Digital product businesses like Aithor saw a 9% increase in revenue after just one week of using Paddle. Learn how Stripe and Paddle offer two completely different payment solutions

Stripe's software and APIs enable companies from any industry to accept payments, send payouts, and manage their businesses online. Direct competitors include PayPal, Adyen, and GoCardless.

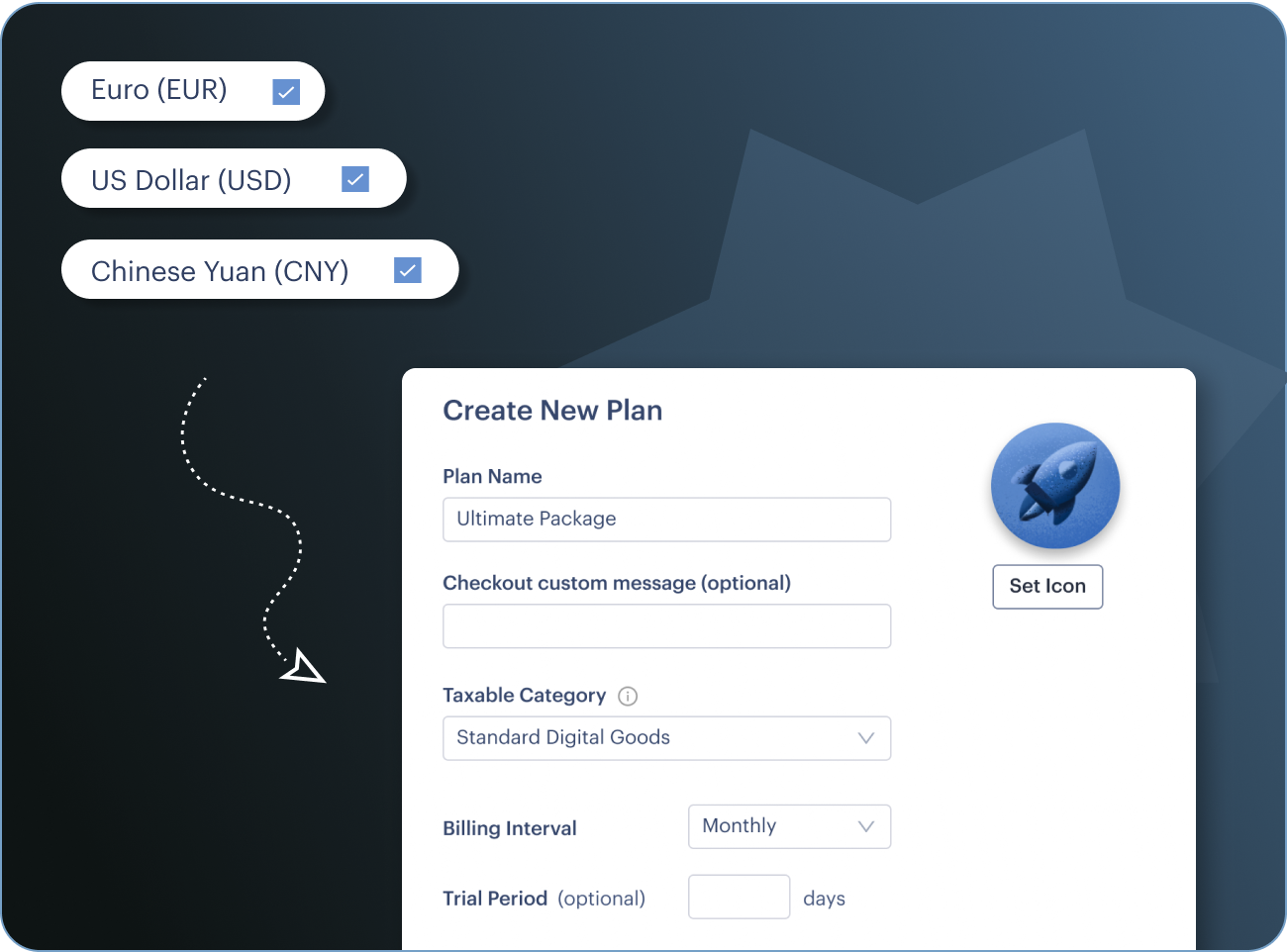

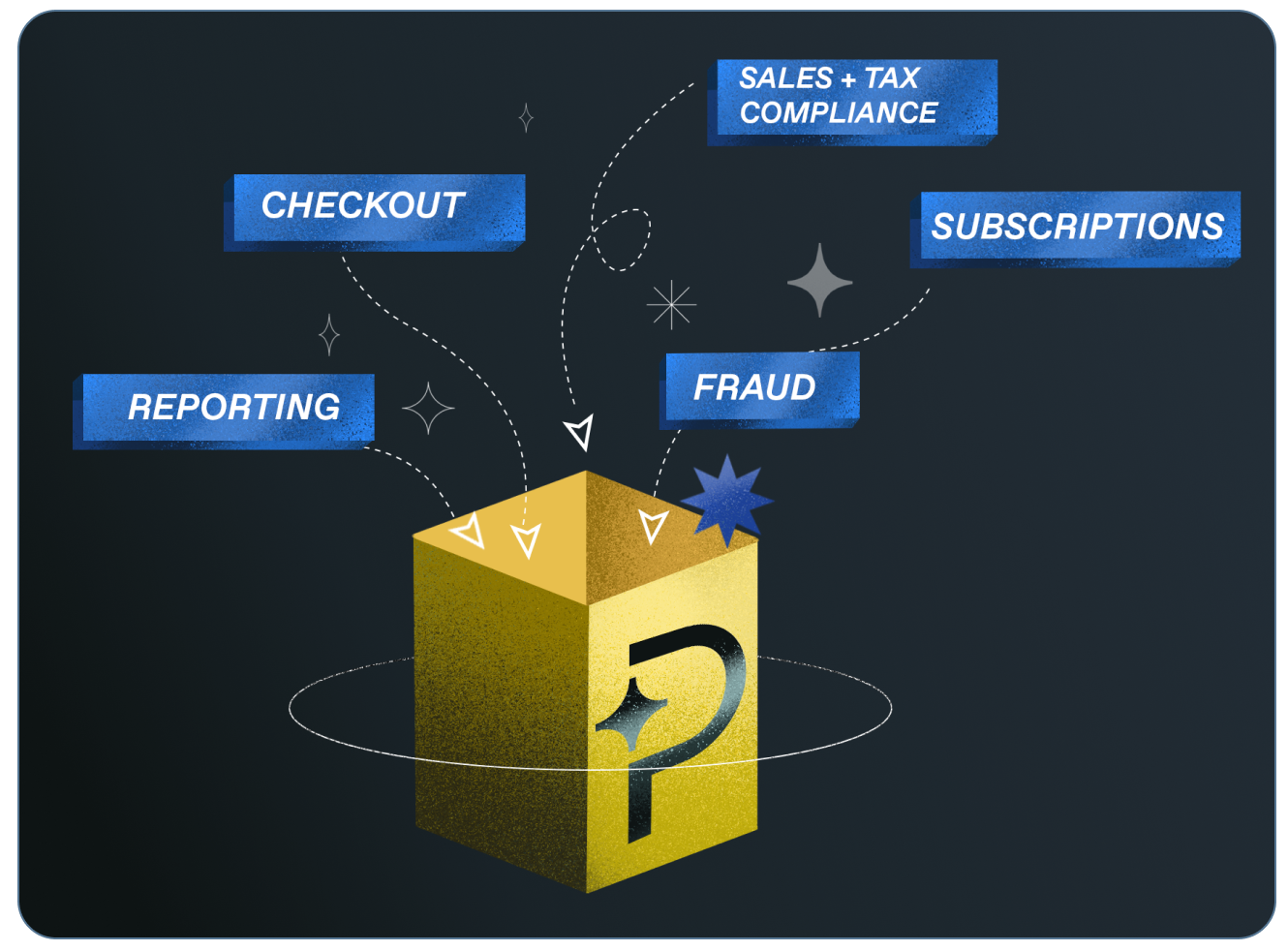

Paddle uses a merchant of record (MoR) model to provide an all-in-one payments, billing, and sales tax solution for software businesses. It is the only MoR built specifically for SaaS, app, and digital product companies.

Using Stripe as a payments processor, you'll face extra fees to access its complete payment stack. You'll need to buy additional tools to manage subscriptions, invoicing, sales tax, and more.

Paddle provides all the tooling in one and takes care of back-office admin, like sales tax compliance, chargebacks, and billing support for your customers. No extra fees, no hidden costs.

Here's the breakdown

Your complete payments infrastructure

We did a 50-50 split of new customers purchasing through Stripe and Paddle over a week...Paddle delivered 9% more revenue in total. That was like a cherry on top.

Stripe Tax automatically calculates sales tax rates on your transactions, but you remain liable and still need to file and remit your own taxes. This can be a real headache for finance teams.

A reseller like Paddle handles tax and remittance globally, taking full liability for sales tax, fighting fraud, chasing chargebacks, managing reconciliation and ensuring compliance along the way.

Learn how Paddle does this

When using a payment processor like Stripe, your developers will need to integrate and maintain all the necessary tools to support your subscriptions, taxes, invoicing, and SaaS metrics.

With an MoR, like Paddle, you get an all-in-one solution that frees up your developers’ time so they can focus on your product and help you scale quicker. It manages the full infrastructure so you don't have to.