Stripe serves everyone, from ecommerce to brick-and-mortar businesses. Paddle is the purpose-built Merchant of Record for SaaS, mobile apps and digital products.

With Stripe, essential features can quickly stack up to 10%+ per transaction. Paddle keeps it simple: 5% + 50c, or a 10% fee for every transaction under $10.

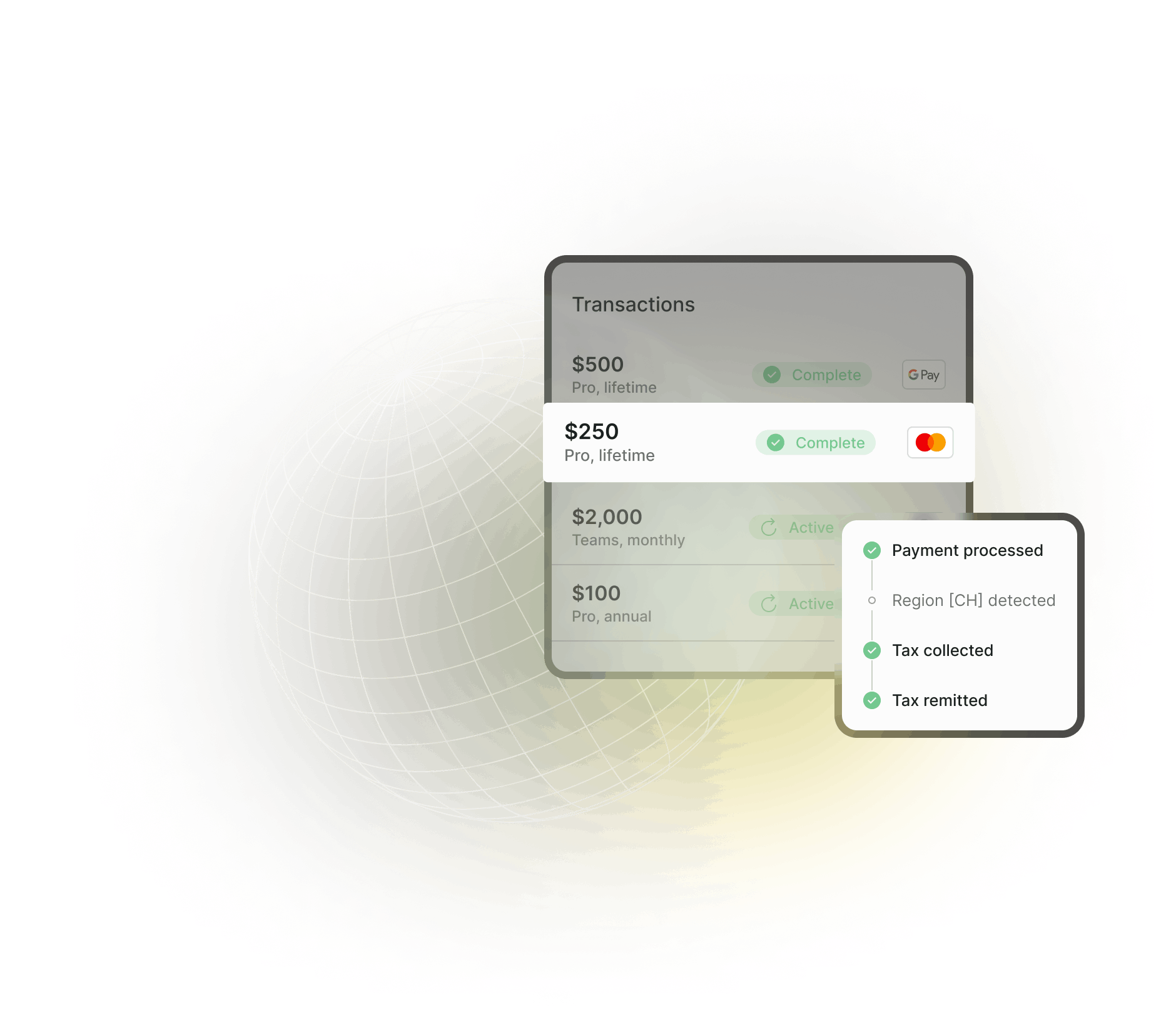

We take care of payments, tax, subscriptions, and metrics with one unified API that does it all.

Migrating or looking for your next revenue stream? Paddle brings hands-on support from dedicated growth experts and customer support teams.

For global businesses who want to unlock meaningful growth, Paddle handles billing, payments and subscriptions for one transparent price.

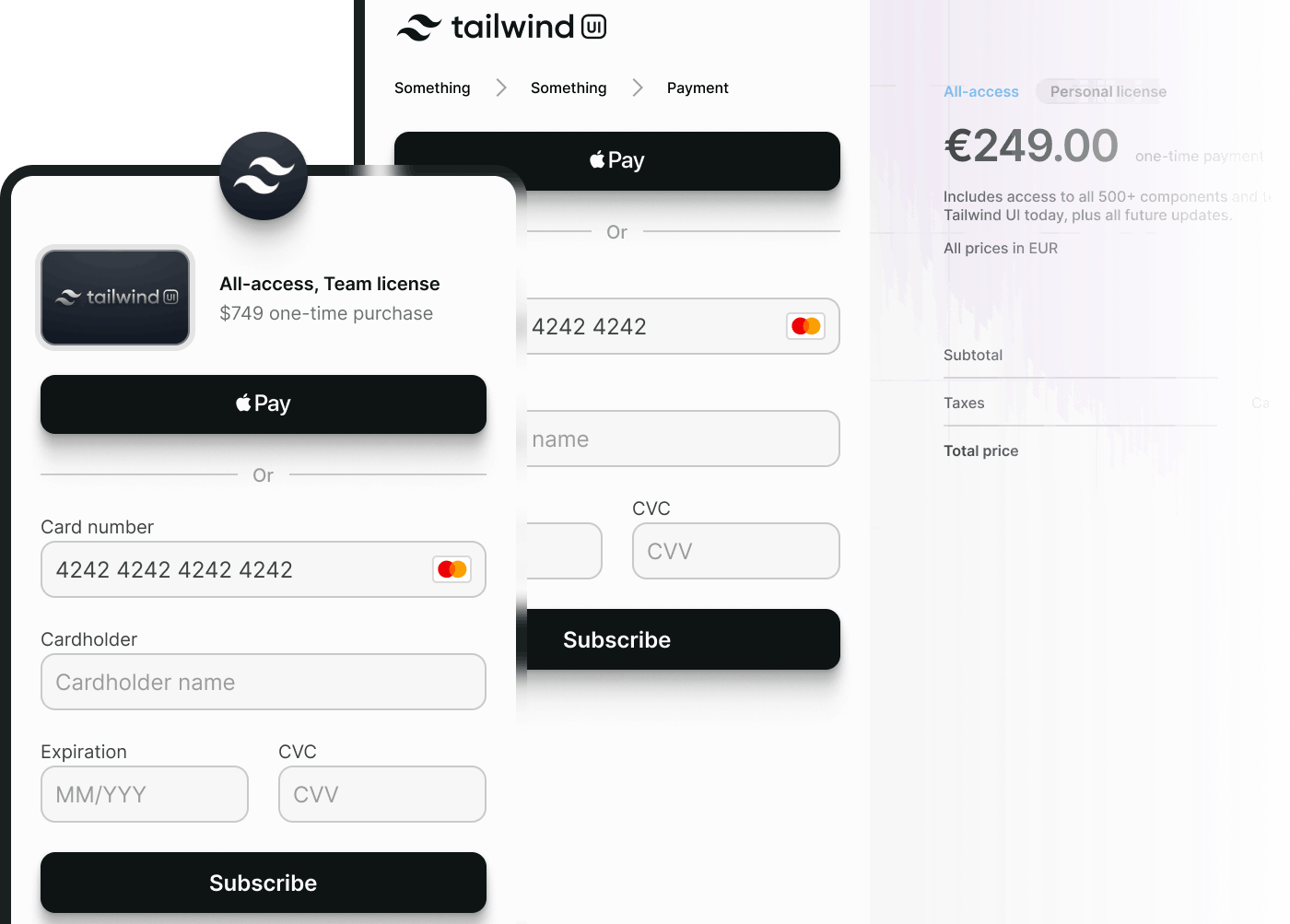

Utilize 100s of currencies, languages and payment methods.

Focus on growth while Paddle automatically remits your global sales tax.

Migration to Paddle on average takes 12 days. Dodge downtime with dedicated migration support and documentation.

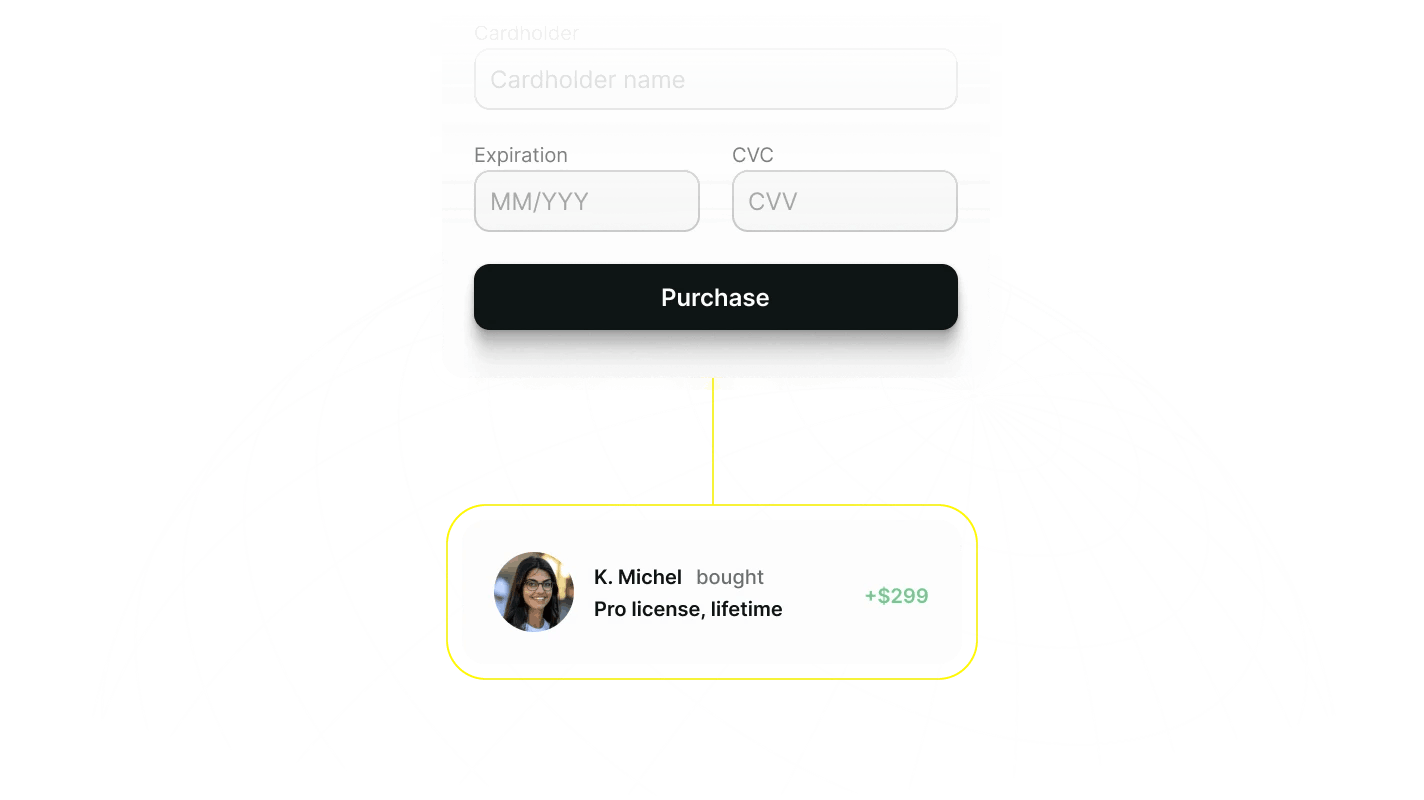

Reduce churn by up to 30% with Paddle's retention toolkit.

The migration from Stripe was way easier than I thought it would be... It was so so nice to have a five-step process laid out for us”

We've supported hundreds of businesses moving from Stripe.

Get up and running in days, not weeks.

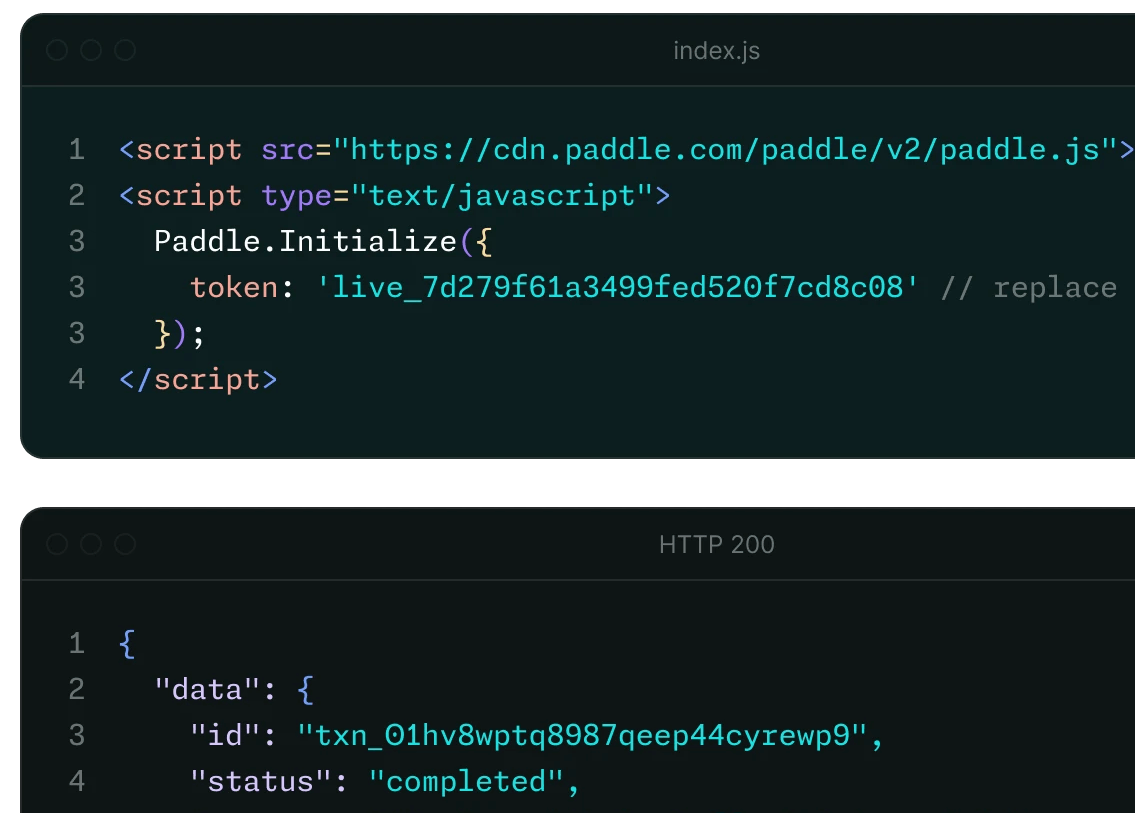

API-first design

Full REST API with JSON responses

Modern SDKs

SDKs for Python, Go, NodeJS and more.

Realtime webhooks

Get updates in realtime for purchases and events.

Migration support

Get a dedicated transition plan tailored to your needs.

Stripe Managed Payments can push fees well past 10% per transaction. Paddle gives you better global reach, a custom checkout and more payment methods for just 5% + 5¢ per transaction.

Learn more

The ex-Stripe customers unlocking meaningful growth with Paddle