Things at Twitter are moving quickly and everyone has an opinion. But what does the data say about the proposed subscriptions plans?

Our Chief Strategy Officer, Patrick Campbell decided to find out, analyzing a pricing study of 54.3k Twitter users.

The TL:DR?

- Verification should cost much less.

- Twitter Blue should cost much more.

- Twitter has a unique opportunity to 10x subscribers.

He shared the full findings in a thread. Here’s the round up.

What’s happening at Twitter?

Elon Musk took over the platform on 27th October. The move has been controversial from the start with news of big changes, including potential layoffs and most recently changes to paid subscriptions.

It’s perhaps the biggest open debate around subscriptions and pricing we’ve seen. But why do they need to monetize the platform in this way?

Patrick sets the scene:

Despite being one of the most popular social platforms Twitter has:

1. The least # of active users compared to competitors

2. One of the lowest avg. rev per user (ARPU) at ~$10 (FB at ~$31 for reference)

3. Major influence

This means that what Twitter really faces is a really tough physics problem. Why?

- Twitter hasn't been able to grow active users.

- Ad market CPCs are up but the growth rate is slowing, especially with ad folks preferring other networks.

- Those networks are also pulling creators.

But is a subscription enough to solve this problem?

Perhaps not.

How valuable is verification?

A successful subscription business requires a path to billions in annual revenue.

Twitter’s subscription plan is based on the assumption that everyone will want to get verified. But when you look at the data, not enough premium users care about verification.

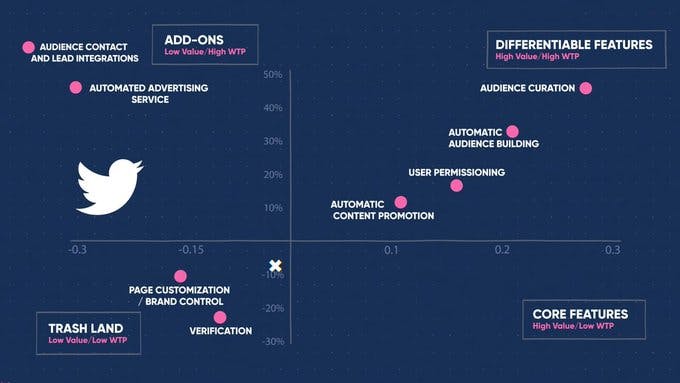

Below are the results of a structured study looking at 20k respondents who primarily use Twitter.

Relative to other features, verification is just not as valuable.

So throw more features in, right? Maybe not.

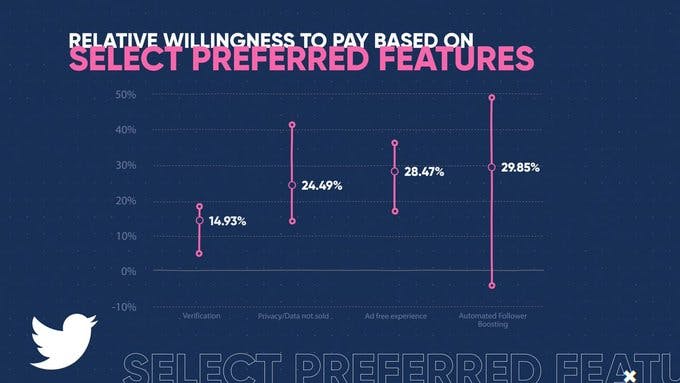

Here's a willingness to pay study from 25k general users looking at major features Twitter Blue could include.

Notice how Privacy, Ad limitations, and even Follower Boosting move the needle, but not by much.

The $8 price point

Here’s the problem. People look at verification as clout, not a utility. Elon's changing that, which is smart – get people complete a know your customer (KYC) process themselves *and* pay for it.

But why $20 or $8 per month? Why not $10-$20 per YEAR?

Here's what the $8/month means in revenue terms:

If at $8/month Twitter tripled the number of verified accounts to 1.2M (a very generous assumption).

That's only $115M in annual recurring revenue (ARR).

While ad quality and therefore ad revenue goes up, the same problem remains. Unless we drive millions of subscribers (which is doubtful given previous track record), there isn’t a clear path to billions in ARR.

So we don't get the verification volume we want for KYC and we don't get enough revenue to get us out of purgatory.

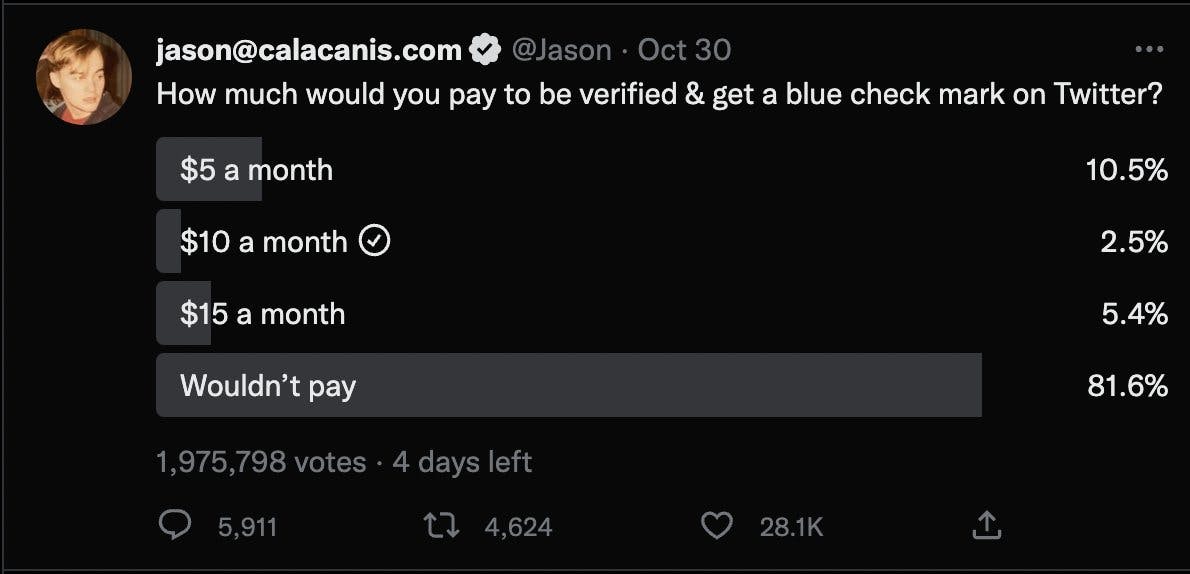

When you take it back to first principles, no data supports the $8/month price point (aside from a Twitter poll from Jason Calacanis).

Using multiple subscriptions

Here's a willingness to pay study from 20k users based on household income. It’s up to $100 per month!

The solution? Have more than one subscription.

One of the most hurtful conventions in subscription pricing is that "it has to be simple".

Do you know how many tiers the fastest growing subscription mobile apps have (upper quartile in terms of growth)? 13 or more.

A user never sees more than four in their lifetime but they use data and engagement to determine when to flag them.

For Twitter, this translates to a cheap verification tier ($10-20 per year) and then a truly premium tier for power users ($50/month). In numbers:

- 500k premiums gets us $300M ARR.

- 5M verifications gets us $100M ARR

What happens when you consider B2B?

People gave Jason Calacanis flack when he talked about B2B Twitter but in fact, he wasn’t wrong.

Here’s the willingness to pay for just under ten thousand businesses who are on Twitter. That’s $200/month.

Let's say conservatively $1k/year at 300k brands – it’s another $300M in ARR.

One thing to note though is that, while this is a solid business line that probably improves ad business, it still doesn't drive billions in subscription revenue.

More subscriptions = more subscribers

Going back to first principles, we need more subscribers. To get them, you need more daily active users (DAUs).

So, what if people subscribed to each other on Twitter?

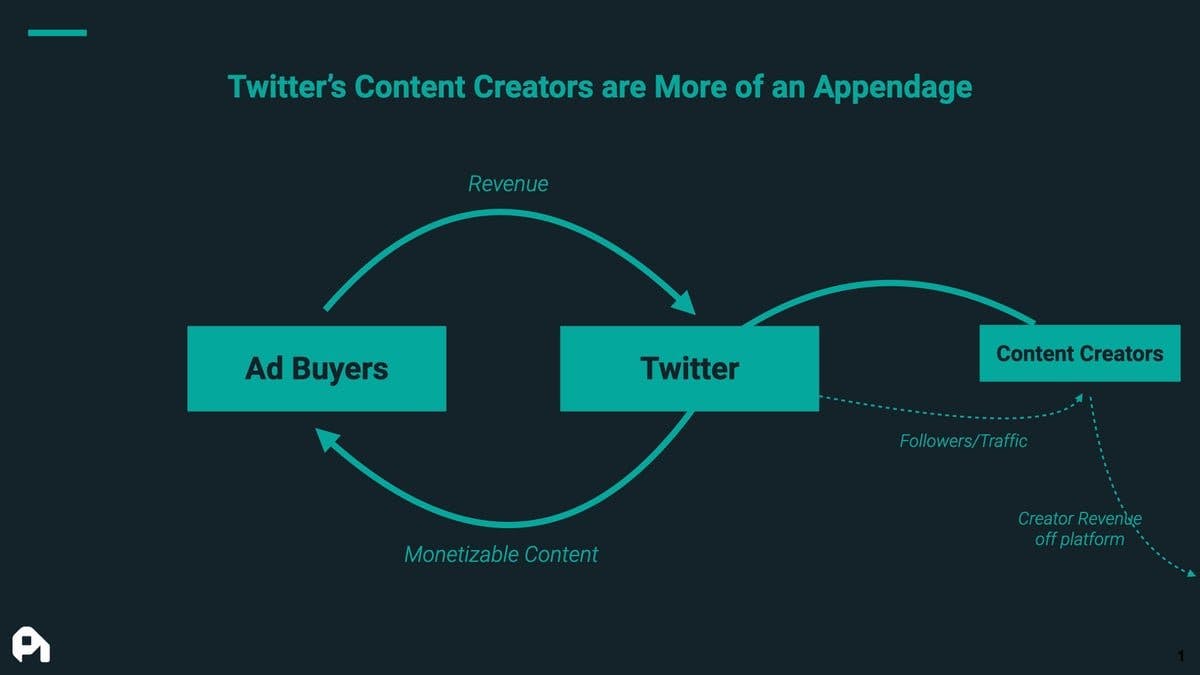

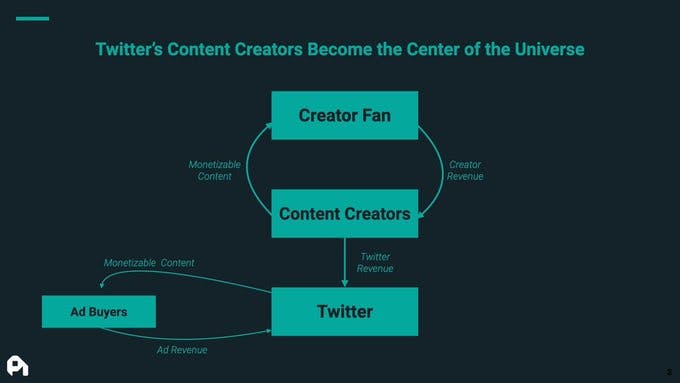

The problem Twitter has with creators is content was the appendage of the marketplace.

- No creator tools.

- Content with links gets suppressed.

Twitter put ads above all else.

Modern social networks (TikTok, OF, Substack, etc) perfectly align with creators.

- They get them subscribers.

- They get them view

- They pay them.

Ads are supplemental revenue. Not core.

Others do this but Twitter has two things none of these competitors have:

1. We're already there. We interact with creators where we follow them. No clicks off.

2. Amplification. Twitter was built from the ground up for account discovery. They have a decade on the rest of the market.

This helps revenue by creating more subscriptions. A user can only subscribe to Twitter Blue once but they can subscribe to three to five artists and podcasts. And we know this model works:

- OnlyFans has 170M people subscribing.

- Patreon has 6M.

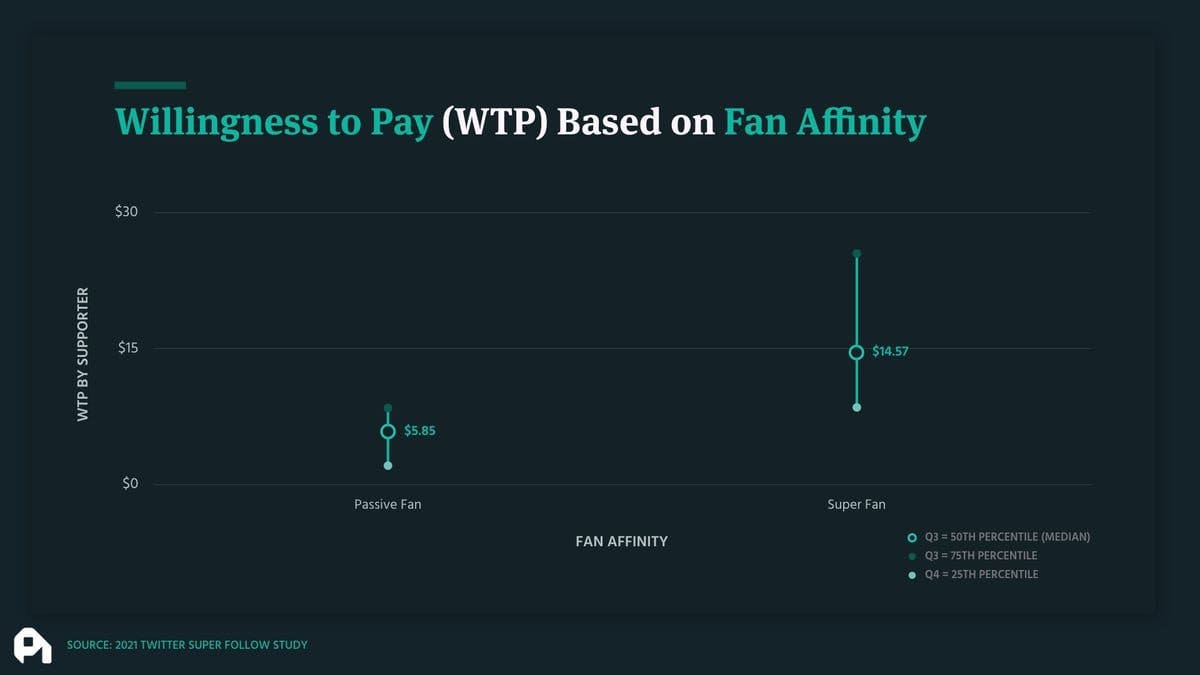

And fans are willing to pay a lot for their favorite creators. Here's a study on monthly willingness to pay from 10k+ fans.

- Passive fans are willing to pay $5/month.

- Super Fans are willing to pay $15/month.

Getting subscriptions right

Twitter tried a similar model with “Super Follows” but there’s a couple of things it got wrong.

The first is not giving creators pricing guidance. They’re not pricing experts and as such are really bad at it.

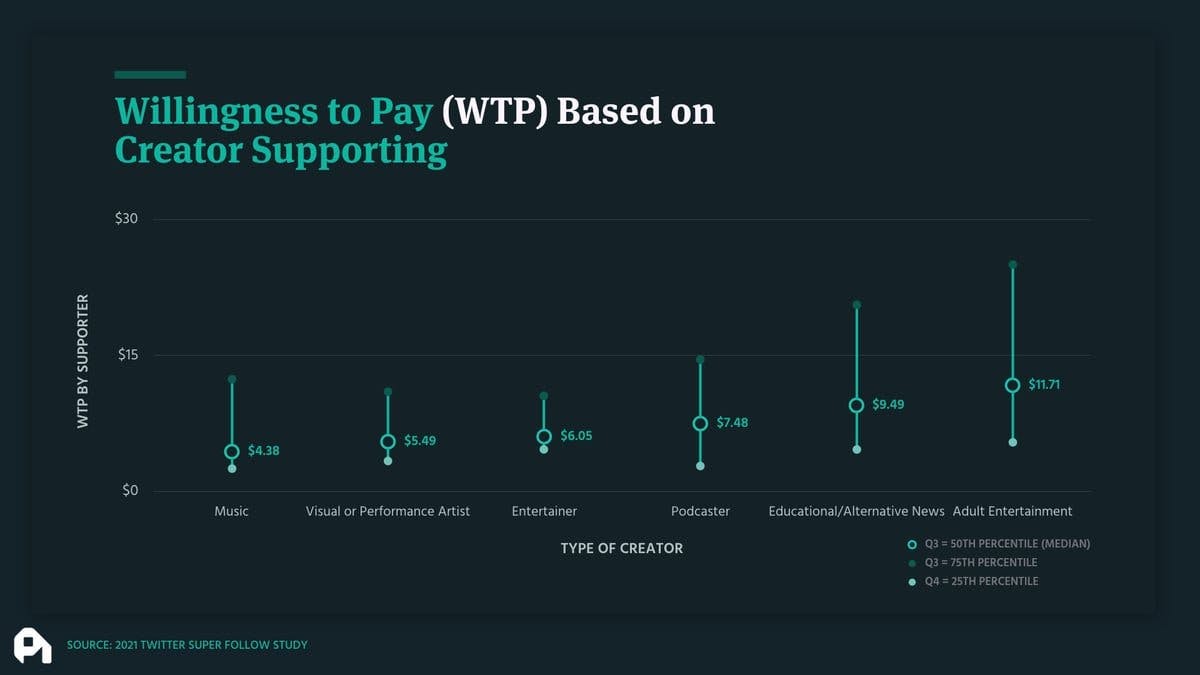

But the willingness to pay based on the type of creator is very high.

The other big problem is that Twitter didn't nail the UX and feature set.

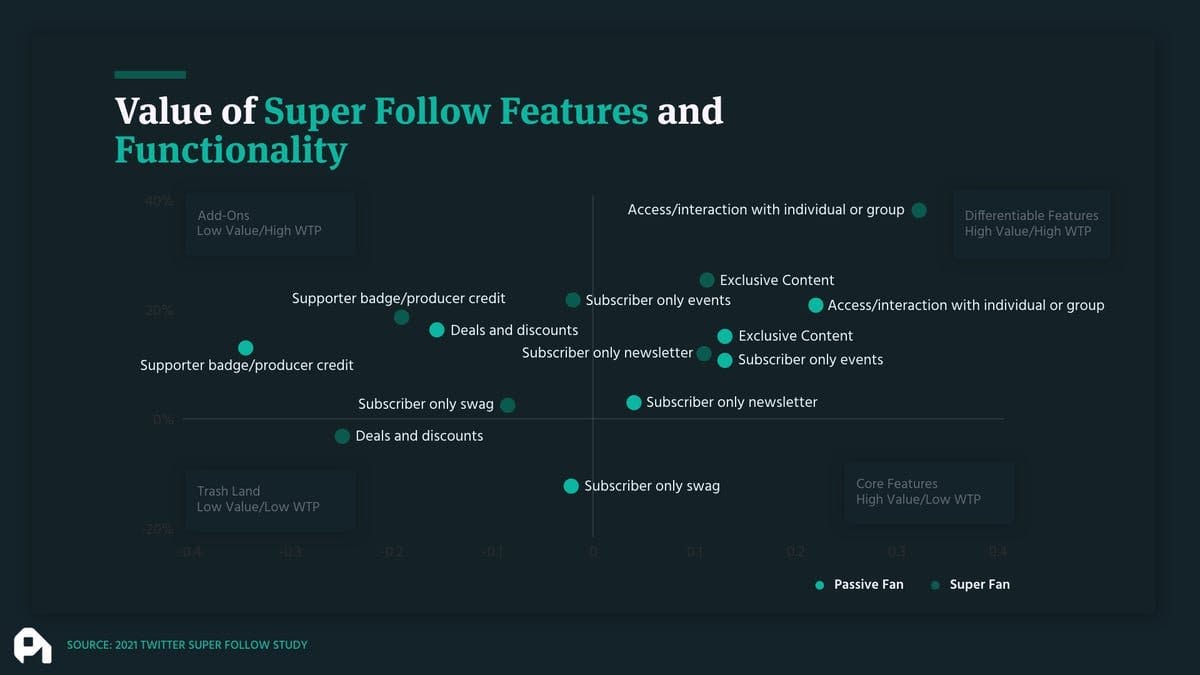

Here's a feature study on Super Follow.

People want exclusive content, but they really want the ability to get access to the creator.

The result?

If Twitter gets this right, it’s a billion dollar ARR company. Here’s how:

Let's be conservative - $5/month with 25m subscriptions and Twitter gets 20%.

That’s $300M.

More importantly - this is a subscription vector that *grows* much, much quicker than Twitter Blue or Twitter Business.

Moderately growing product lines:

- Twitter Blue: $300M

- Twitter Business: $300M

- Twitter Verification: $100M

Rapidly growing product line:

- Twitter Super Follow: $300M

Looking for more subscription and pricing insights? Follow @Patticus on Twitter and sign up to our newsletter below.