Building sales-led growth on top of product-led growth is a pathway to longterm success for SaaS businesses.

I did not realize it at the time, but a research brief I published a few years ago at SaaS Capital is a data-rich foundation for the emerging best practice of Product Led Growth (PLG) giving way to Sales Led Growth (SLG). As I will outline below, small SaaS businesses grow faster with easily consumable products that have low Annual Contract Values, (ACV), but to maintain growth, larger SaaS businesses must grow their ACV, which typically involves a sales process.

Five years ago I went to the SaaS North conference in Ottawa and saw Tobias Lutke, the CEO of Shopify, speak. He said that, when Shopify was seven years old, large retailers started calling and asking if Shopify had an “enterprise” version of their e-commerce solution. For several years he just said, “No, the basic version is feature-rich and will work just fine for larger companies”. After a few years of hearing “Call us when you have an enterprise version”, Shopify relented and created an “Enterprise” landing page. They removed the standard pricing list and put “Call for Pricing” on the page, and then hired some sales reps to answer the phone. They also doubled the price and sent out invoices instead of credit card swipes. Business exploded while the product remained largely unchanged.

Not everyone will get away with the Shopify playbook, however, the same evolution from PLG to SLG has happened at dozens of successful SaaS businesses. Atlassian, Dropbox, Stripe, Twilio, Slack, and many others have leveraged the benefits of product-led growth in their early stages, and then complemented that with a sales-led enterprise function as they scaled.

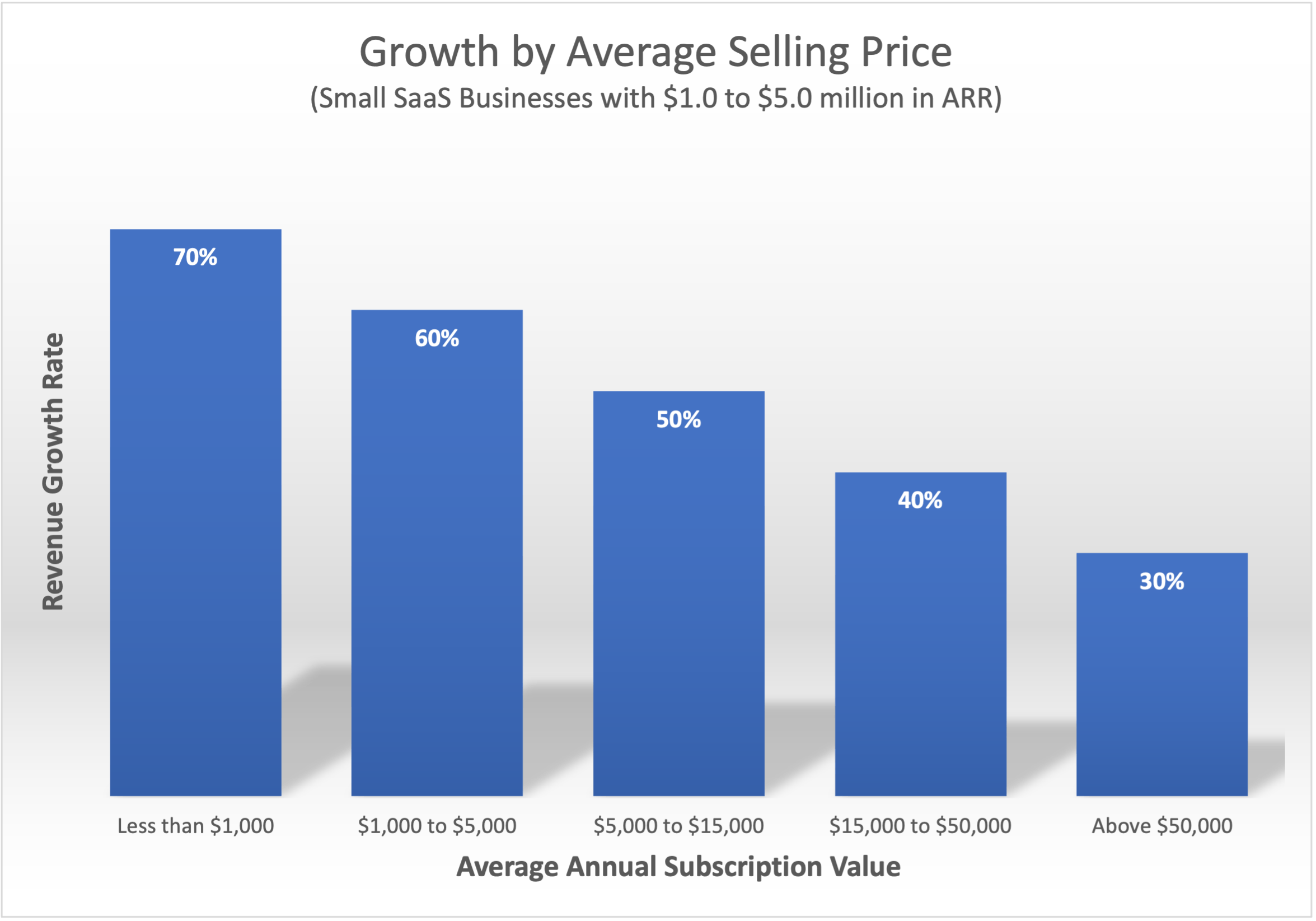

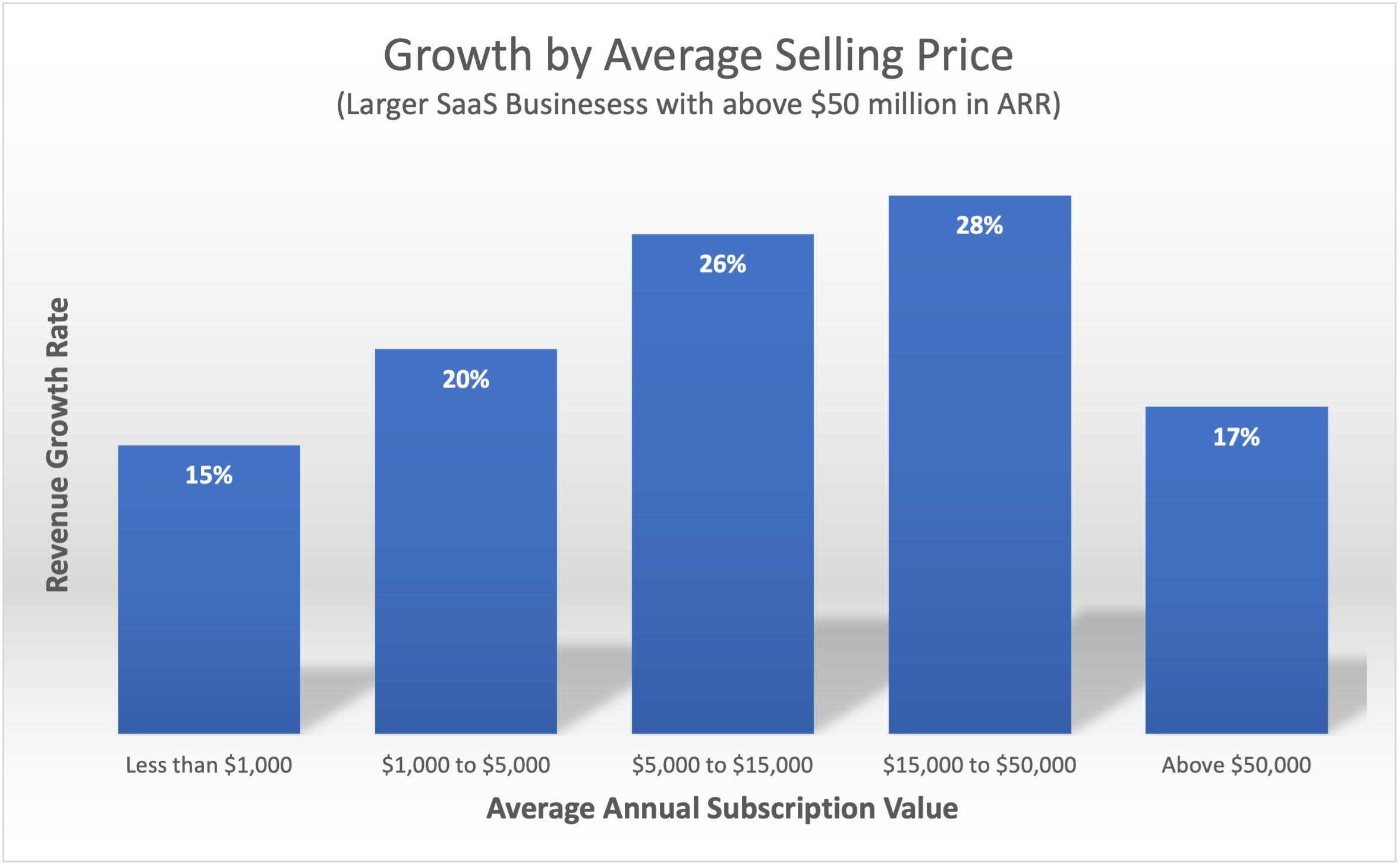

The data support this approach. In the charts below (from SaaS Capital), the growth by average selling price of smaller SaaS businesses are shown, followed by larger businesses. As you can see, the faster-growing small SaaS businesses have lower average selling prices, while the faster-growing large SaaS businesses have larger average selling prices. (This is true except for the last column in the chart which I believe is either the exception that makes the rule or simply noise in the data.)

If you have had the opportunity to work for a few different software businesses attempting to either move up or downmarket, the graphs above likely confirm your experience. Selling increasingly higher ACV products to larger customers is inherently easier and more profitable than the other way around. Unless drastically reconfigured, the sales and support costs for a $5,000 customer are very similar to those of a $50,000 customer, and yet the revenue is only 10% as much.

Exemplifying the difficulty of moving downmarket once a SaaS business is at scale is Workday. Workday very intentionally started their company by selling high ACV products to larger enterprise customers, but when faced with selling smaller ticket products they were forced to create a “company within a company” to effectively sell and support SMB customers. None of their existing corporate systems and processes could scale down to profitably support smaller businesses.

So what are some of the implications for earlier-stage SaaS operators? First off, if you can, lean in toward lower ACV products with self-provisioning capabilities. The approach is capital efficient and the best path to growth for a start-up. It’s also hard for entrenched SaaS players who do not have a lower-priced product to defend against.

Second, recognize that a “PLG only” approach will eventually suppress growth, and plan ahead for expansion into larger customers. Some enterprise features will eventually need to be added to the product (not everyone will get away with what Shopify did), and the businesses will need enhanced support, sales, and billing capabilities. Early-stage companies recognizing these future needs when building their initial infrastructure will have an advantage. Simply choosing the cheapest solutions for your needs early on will ultimately result in growing pains later when your systems will need upgrading, or worse yet, you will need to “bolt-on” new systems for the larger customers and sales reps.

Customer success is clearly one of these areas where you need a forward-looking approach when selecting a system. Success professionals supporting larger enterprises need significantly more capabilities than those supporting small customers which might be primarily self-serve.

Finance infrastructure is also an area where systems need to span multiple customer types. Revenue recognition becomes more complicated and invoicing capabilities need to match the increasing complexity of the product and sophistication of the buyer. For example: can you bill multiple departments at the same company? Also, as payment methods expand to include ACH’s and checks, the preferred payment forms of the enterprise, simply matching payments to the right customer can get complicated if your systems aren’t able to handle it.

This is not to imply all start-ups need to roll out NetSuite, but it is a call-out to CEOs and CFOs to think forward just a few years, particularly when their company is headed to market with an initial product-led growth strategy.