The subscription economy is growing at a staggering rate. More and more software businesses are choosing recurring revenue over one-time purchases, which means that it’s more vital than ever to have a smooth payment process. After all, when you’ve done the hard work attracting new visitors to your site and showcasing your product, there’s nothing more frustrating for you and your customer if the transaction fails at the checkout.

It’s been predicted by technology research company Gartner that 75% of organizations selling direct to consumers will offer subscription services by 2023. With SaaS rapidly moving in the direction of subscription payments, getting your recurring billing right is crucial. This doesn’t just go for the initial payment from a new customer, either. You’ll want to do everything you can to keep your active paying customers too, providing a completely uninterrupted service while auto-renewing their subscription.

It’s important to remember that subscription businesses don’t require customers to go through checkout more than once. It’s, therefore, crucial to nail signup and make renewal as painless as possible. A positive experience at signup and renewal can contribute to instilling customer trust in your solution. So it’s essential to ensure that your payments run seamlessly: smoothing out the signup stage for customer acquisition and managing renewals for retention and reducing churn. Let’s look at what affects your payment acceptance on both ends and how you can improve it.

Sign up and acquisition

Surprisingly, many businesses don’t know their payment acceptance rate. Their primary metric around this is purely based on feedback from their customers having issues and the strain experienced by their customer support team. If you don’t have this data readily available in front of you, it could be that your payment acceptance at the checkout is even worse than you think. If you have 50 customers emailing in any given month with an issue, you could have another 500 who have the same problem but simply gave up and took their business elsewhere.

Here are four reasons why that first payment might not have gone through…

1. Cross border transactions

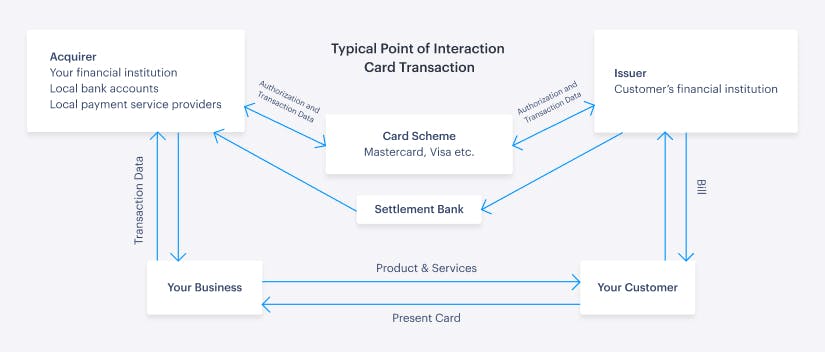

There are a couple of reasons why a cross-border transaction could cause payment failure at the checkout for your international customers. For example, if you and your receiving financial institution are in the US and your new customer is in the UK, there’s a chance it might not get approved by their local bank or credit union, which can block the credit card charge simply as a security measure. Therefore, it is advantageous to have a local payment service provider (PSP) and acquirer set up for the countries you sell to, strengthening your connection with domestic banks to get around this issue. Setting up local receiving bank accounts for the regions your customers are based in will help in a similar way.

2. Risk factors

You need to strike a delicate balance in your risk settings to ensure every genuine customer can sign up while preventing any fraudulent activity. A good compromise is to flag suspicious orders for further review. You don’t want to keep these orders in review for too long, however, so make sure they get checked and approved/declined in a timely manner by your risk team. Make sure to review your risk settings with an expert who can give guidance on how to set these based on your customer profiles and transaction history. Just like your pricing, this isn’t something you set then leave alone. It should be tested, reviewed, and tweaked on a regular basis - and it’s important to keep on top of new security measures coming into force.

3. Merchant history

What is your global transaction footprint? How many different customers have made a purchase to your receiving bank in the past few years? Has this customer’s bank made a payment to your business before? All of these questions are asked by the issuing bank when reviewing a new customer’s request to sign up to your plan before approving. Building up a good track record over the years - as well as minimizing chargebacks - is really valuable for your credibility with the issuing banks.

Failed credit card payments account for 20-40% of churn for B2B and B2C SaaS companies

4. Your billing support team

It’s essential to have a support team on hand to assist with any issues relating to payment. Customers may need help with payment-related difficulties when signing up, refunds, or a variety of other general payment concerns, so a friendly and timely response is crucial to customer retention. A slow response to a customer query or refund request also leaves you vulnerable to a chargeback, so it’s important you have an experienced team set up here which is also aligned with your order management and payments platform.

Renewal and retention

It’s important to note that the factors already discussed also attribute to subscription renewal, but if the first month’s sign-up payment was successful it is very likely the renewal will be as well.

However, there are many moving parts that can cause involuntary churn of a subscriber. Failed payments are a big factor here, with a recent report from ProfitWell finding that failed credit card payments account for 20-40% of churn for B2B and B2C SaaS companies and, of those that don’t renew, companies are only recovering around a third of those customers. Below are the five main areas for minimizing any payment-related disruptions for your subscribers.

1. Validate card at signup

Processing a $0 authorization is an easy way to validate a card at the point of signup. No money is deducted from the customer and putting this step in place before the first subscription payment provides assurance that the next transaction will be successful. If there are problems with validating, you will also have the customer in front of you and engaged so can either try a different card or offer them direct support from your billing team.

2. Dunning and retry strategies

Retry strategies are very useful to cover for when your customers have insufficient funds or expired cards in a month. By putting this process in place, you’ll build a list of overdue payments to work with, as opposed to a list of canceled subscriptions - so much better! It’s important to set up your dunning process right from the beginning by setting retries over the best intervals and timeframes.

You should also look to automate your actions following each retry success/failure, for example, whether a failure should move a customer to suspension or even to being revoked. Revoking is a last resort, however, as it’s very unlikely you will be able to recover these customers after this. Another tip is also to align your monthly payment cycle closely after typical paydays - you stand a much better chance of a successful payment when your customers have money in the bank!

3. Offer annual subscriptions

This might seem obvious, but having a smaller volume of transactions for the same amount of gross sales will mean there are fewer opportunities for failed payments and delinquent churn to occur. Annual subscriptions also offer more consistent revenue for forecasting and better cash flow. It’s advisable to consider if your billing model is optimized for your business and to offer an annual subscription option for your product as well as a monthly plan. From conversations with our sellers, we’ve also found that one of the best ways to incentivize customers to make the commitment is to offer 2 months free use so that they can get used to your product - and importantly, integrate it into their workflow.

Take B2B lead generation platform Albacross as an example. Its monthly/annual slider not only clearly signals that it offers different subscription plans, it also flags the benefits of paying upfront for an annual subscription, with the promise of 20% off and the satisfying drop-down of cost when you switch the slider to ‘annual’.

4. Pre- and post-billing notifications

The use case for setting pre- and post-billing notifications depends on the nature of your customers and product. Some customers may want regular subscription renewal receipts. For others, a monthly email would be a nuisance. We would, however, always recommend sending an email receipt and invoice following the initial sale for customer assurance and also to provide your support team’s contact details should something be incorrect. Occasionally, buyers forget they’ve subscribed to a product and don’t recognize a transaction. Pre-billing notifications directly prevent this scenario and are a proven means of reducing chargeback rates and disputes.

Take the hassle out of your recurring billing

There are always more strategies to roll out and new tools becoming available to help improve both acquisition and retention for your SaaS business. You could work directly with a payment gateway and look to handle these on your own to improve your payments… or you could let Paddle take the stress out of the process.

Paddle is unique. As a merchant of record, we sit between you and your customers, taking care of payments, subscriptions, and international taxes so you can focus on growing your business.

By taking on the liability of the sale, Paddle can route each new customer to pay through the gateway most likely to accept the payment. We power checkouts and subscriptions for hundreds of SaaS companies and have built the experience and tools to ensure successful first transactions and a smooth renewal, all the while providing you with out-of-the-box subscription tools and a dedicated billing support team for your end customers.

Want to see how this works in practice for your SaaS company? Book a demo here.