Do you remember when there was a server room in the corner of every office? Or when teams were manually running go-to-market strategies from spreadsheets?

It wasn’t long ago but we look back now, in the time of Amazon Web Services (AWS) and Hubspot, grateful that our teams no longer have to manage those fragmented and flawed systems.

But there’s one aspect of business that hasn’t kept up. One where the systems are just as fragmented and teams are still frustrated – and it’s causing a responsive gap that prevents SaaS growth.

What is the responsiveness gap?

The responsiveness gap is when a business’ revenue delivery infrastructure either completely blocks or slows down its ability to respond to new growth opportunities, or effectively execute on its growth strategy.

It is caused by the fact that revenue delivery infrastructure hasn’t caught up with the rest of the SaaS world.

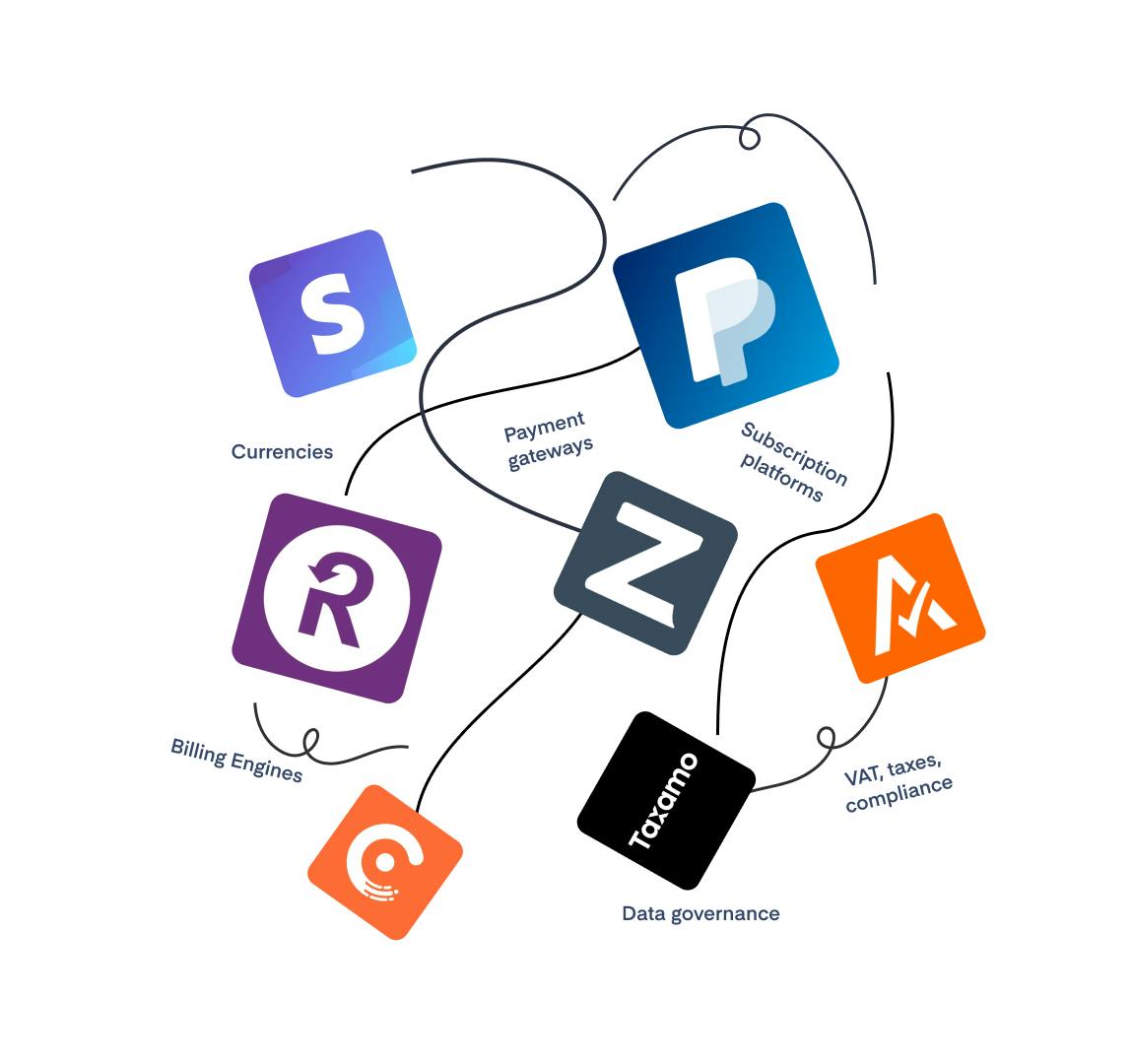

Generating and tracking sales revenue still relies on integrating any number of tools across payments, billing, subscriptions, tax compliance, fraud, security, and more. All to manage the journey of funds from your customers’ accounts to your business, before you can recognize it as revenue.

Once you’ve selected which tools (of the thousands available) are right for your business, they take time to integrate and are costly to maintain. Engineers have to continuously keep things running, finance teams have to piece together data from multiple sources – and everybody runs scared at the very thought of making changes to what is an already fragile system.

If anyone is brave enough to try, it can take months or even whole quarters to implement even the smallest of changes. In our conversations with SaaS companies, we’ve even heard of instances where it’s taken a business as long as two years just to make a pricing change.

This inability to react will leave you falling short of market demands and stuck in place instead of acting upon new opportunities.

Sound familiar?

How does the responsiveness gap prevent SaaS growth?

Today’s revenue delivery infrastructure isn’t growth-ready. Not only is it frustrating to work with, but it leaves you with:

- A lack of ownership over the revenue delivery process, yet multiple stakeholders invested in the systems being used.

- Data silos that prevent you from making informed decisions about your growth strategy.

- Static systems that stop you from optimizing processes, testing new ideas, or responding to new opportunities.

The impact of this is a chasm between where your revenue delivery is today and where it needs to be in order for it to support your growth strategy. And ultimately, your net revenue retention (NRR) performance suffers for it.

What does this look like in practice?

Well, it could be something like testing a new billing model to increase customer lifetime value. Or switching on a new currency to increase payment acceptance in a growing market.

Or, like Kaleido , it could be implementing tax compliance procedures to enable global sales while avoiding problems with tax authorities further down the line.

With plans for a global product, CEO Benjamin had concerns about tax compliance. The team started to research the regulations and came across the Worldwide VAT, GST and Sales Tax Guide published annually by EY:

“...That was both a really good day but also a very bad one. We discovered a PDF with 1,300 pages. And that really described everything we needed to know. So the good thing is we had a definite answer of how to do it. But the bad thing was, yeah, it has 1,300 pages.”

This is the responsiveness gap in action. You identify a problem or area to optimize. You know what you need to do. But with your current revenue delivery infrastructure, you can’t do it and it puts your growth plans at risk.

How can SaaS businesses close the responsiveness gap?

The good news for SaaS leaders is that there is a better way.

And it starts with thinking about revenue delivery as a strategy rather than a set of disparate processes involved in running your business. Revenue delivery is as much a lever for growth as your product and your go-to-market strategies.

For businesses with the resource (or just the fear of touching a system so painstaking to build), it could be continuing to invest the money on multiple tools and hiring the additional resource to maintain these integrations in-house.

For those looking to scale and quickly respond to changing market conditions, it’s an all-in-one solution. One platform and one integration for payments, billing, subscriptions, tax compliance, fraud protection, and more. With a platform like this, you can:

- Operate with integrity, wherever your customers are based: Offload tax compliance and leave it to the experts to register, file, and remit taxes – absolving you of any liability.

- Optimize payment processes for better conversion and payment acceptance: Access multiple payment methods and currencies, without setting up new integrations or multiple accounts with your payment provider.

- Build flexible subscription plans: Create and manage subscription plans that meet your customer needs. Manage promotions, trials, upsells, and plan changes, without additional integrations.

- Make decisions with data: With everything running through one platform, you have one source of truth for your revenue data, allowing you to track performance and make decisions more effectively.

By choosing an all-in-one solution from day 1, Kaleido’s Removebg product was able to go from launch to 43,000 customers from 181 countries in just 18 months. By putting that 1,300 page PDF aside and letting someone else handle the process for them, Kaleido can operate with full integrity around the world – without adding another integration to their infrastructure.