Please note: This is the second post of a three part series that focuses on how your SaaS metrics tie into onboarding customers, company growth, and generating the recurring revenue needed to not only stay afloat, but thrive in the booming SaaS industry. Check out the first post on Customer Acquisition Cost.

In SaaS or any monthly recurring revenue business, customer retention is critical to sustaining growth and maximizing profit. Getting customers through the door will only provide a fraction of the nourishment you need to recover the cost of leading them through the funnel. Worse yet, churning customers not only waste your CAC, but eliminate an opportunity for profit. Any major leaguer in the SaaS space will tell you you’re going to get tagged if you try to run the bases with a heavy churn rate chained to your leg.

The question then becomes: how do you reduce and eliminate churn? The simple answer is, you provide customers enough value through your service to ensure you retain them. Undoubtedly achieving this is much more complicated, because you need to make sure your products and pricing are aligned with the value and usage your potential customers seek. To better understand this, let’s first look at what churn does to your business from an analytical perspective before exploring how you can develop your pricing strategy to properly retain your customers.

Why Is Customer Retention so Important?

Simply put, retention ensures SaaS profitability. As stated above, customers who churn out potentially waste all the money you spend on customer acquisition. If you allocate money and man-hours to acquiring customers, you want to ensure they stick around so you can see a full return on your investment and generate the monthly recurring revenue needed to become profitable. When those customers aren’t a great fit and bail out on your service, you obviously won’t see the cash flow you need to continue operations.

When it comes to your pricing strategy, the actual lifetime value (LTV) of your customers can also be a great indicator of how well your positioning, packaging, and pricing are aligned to the needs of your customers. The value your business provides should correspond to the price your ideal buyers are willing to pay for that value (also known as value-based pricing), and if you have a high churn rate, it could mean your pricing strategy fails to reflect your customers’ price sensitivity. Thus, customer loyalty metrics like LTV and churn rate are crucial because they can show you if parts of your service need to be redeveloped, or if your value propositions don’t match up with the value delivered, especially over time.

How Do I Calculate Churn & LTV?

If you’re already familiar with calculating Churn and LTV, skip to the next section.

As mentioned in the first post of this series, you need to ensure you can make more money from your customers than it costs to acquire them when assessing whether your company is ready for growth (obvious, right?). Yet, it’s just as critical to determine the profitability of each customer segment through each cohort’s Lifetime Value. Many SaaS businesses choose to focus solely on their churn rates, but LTV and it’s relationship to CAC are leading indicators of business efficiency and help predict whether you’re ready for the long haul.

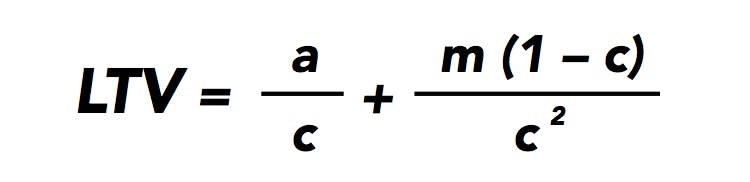

As we found out last week, the formula for calculating CAC is fairly simple, but things get a little trickier when determining LTV because most SaaS businesses need to account for expansion revenue and changes in the average revenue per account (ARPA). One way to express the LTV formula is pictured below (note: this version of the LTV formula was developed by Stan Reiss. You can find further information about LTV calculations and other SaaS metrics in David Skok's supplement to his SaaS Metrics 2.0 post).

Variables

a = initial ARPA per month

m = monthly growth in ARPA

c = customer churn rate (in months)

Now despite how complicated this formula looks, each element within it is reasonably easy to calculate. For example, to determine your customer churn rate, you simply divide the number of customers who churned by the total number of customers acquired in the same month. Your average revenue per user (or account) and the monthly growth in ARPA can be acquired by simply looking at the numbers in the given time period. The key becomes establishing a high enough LTV so that it surpasses your CAC, and in David Skok’s report on SaaS metrics, he emphasizes that a good rule to follow is the lifetime value of your customers should be at least three times the cost to acquire them.

How Do I Reduce Churn and Optimize LTV?

You can see that churn is one of the more critical factors to improve and eliminate, because it factors so heavily in the LTV formula. However, you can drastically reduce churn by ensuring your customers are paying an amount that aligns perfectly with the value they place in your product. Pricing customer fit is an essential part of keeping profitable customers onboard, so let’s take a look at how we can use our pricing strategy in this way to cut your churn rate and consequently increase customer LTV.

1. Align your pricing along a value metric

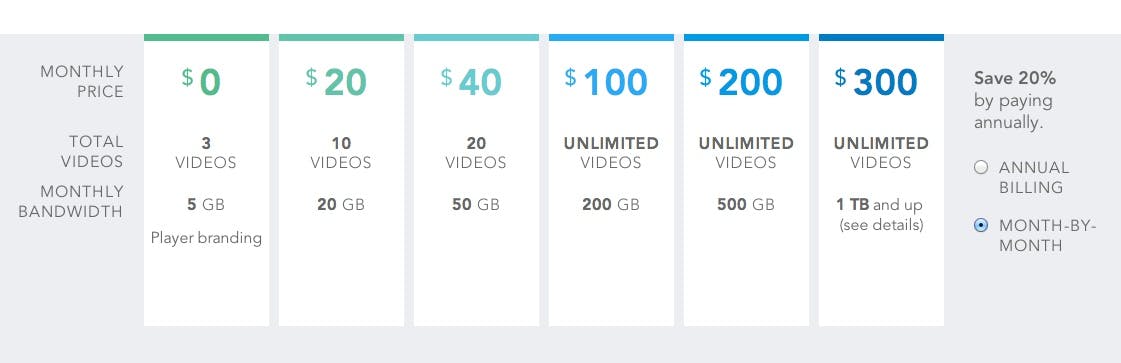

A huge proportion of customers churn out when they can’t see value in what they’re actually paying for, so a critical part of a killer pricing strategy that reduces churn is making sure your pricing is clearly aligned with the value you’re providing your customers. This is called pricing along a “value metric,” and it essentially means as customers receive more value from using your product (through number of users, bandwidth, etc.), you charge them more for each unit of value they’re receiving.

Customers will typically stick around longer and pay higher rates if they know exactly what they’re paying for and how much value they’re receiving at a particular price. Pricing along a value metric also guarantees that you can communicate changes in price and justify them from one plan to the next. If the price of each tier is proportional to the value received, it will ensure you can upsell existing customers to premium products and profitable plan upgrades as their own businesses grow (for more on value metrics and structuring your plans, check out this post on pricing page best practices here).

2. Assign a customer persona to each product tier

Price changes are definitely easier to communicate when you’re adding features and increasing functionality to justify those changes. However, it’s just as important to make sure each tier for your product is aligned to a specific customer segment that you’re targeting. We already mentioned how crucial it is to quantify the range of customer personas you can serve in last week’s post on acquisition, but once you define your customer personas, ensure every target lines up with the pricing and value provided in a particular plan. A significant reason for a high churn rate is the inability to provide an appropriate amount of service to the right buyers at a price they’re willing to pay.

3. Determine price sensitivity

It may seem obvious that your customers’ price sensitivity would have a significant impact on your churn rate, but knowing how much each of your customer personas is willing to pay is also a great indicator of whether you need to go back to the drawing board with regard to your product. If none of your target customers are willing to pay a price that allows you to quickly recoup your CAC, then it may be time to question what you're building as well as to whom you’re selling.

On the flipside, you may find that price sensitivity data collected from your customers indicates that you can raise prices without turning your customers off. In this case, the focus won’t be on decreasing your churn to increase LTV, but increasing your ARPA to produce the same result. Either way, it’s valuable data that can give you further insight into what’s affecting the health of your business and what can be done to improve it via your pricing strategy.

Your Pricing Strategy Has a Huge Impact on Churn and Customer Retention

Your customer personas, their specific price sensitivity, and the value metrics you choose to construct your product plans around are all critical factors that can either send your churn rate skyrocketing into deep space or keep that same rate in the negative. As you analyze and calculate your CAC, churn, and customer LTV, keep in mind that many aspects of your pricing strategy can have a massive influence on those numbers. The key to retaining customers and increasing their profitability is to find a balance between providing them enough value through your product and charging them an appropriate price for your business. Stay tuned for the third part of this SaaS metric series, where we’ll be discussing monetizing your customers and boosting the average revenue per user to increase cash flow.

To learn more, check out our Pricing Strategy ebook, or learn more about our price optimization software and solutions. We're here to help!