What is outcome-based pricing?

Outcome-based pricing is when prices of a product are based on perceived value, and not costs. Businesses must understand where customers are seeing the value in their products, then adjust the pricing to align with that value. Outcome-based pricing is a fundamental shift in how to think about pricing.

By structuring our pricing based on the actual value of our product as well as the customer's perceptions of that value, we're better able to create a pricing strategy that justifies how your company monetizes.

“Your pricing is the exchange rate on the value you're creating in the world.”

You can't brute-force growth, the market is out of your control

Customers have more choices now than ever before, especially in the SaaS and subscription markets. It's important that you isolate and target the customer's desired outcomes from the very beginning or you're setting the company up for failure.

The MarTech 5000 via Chief Martech.

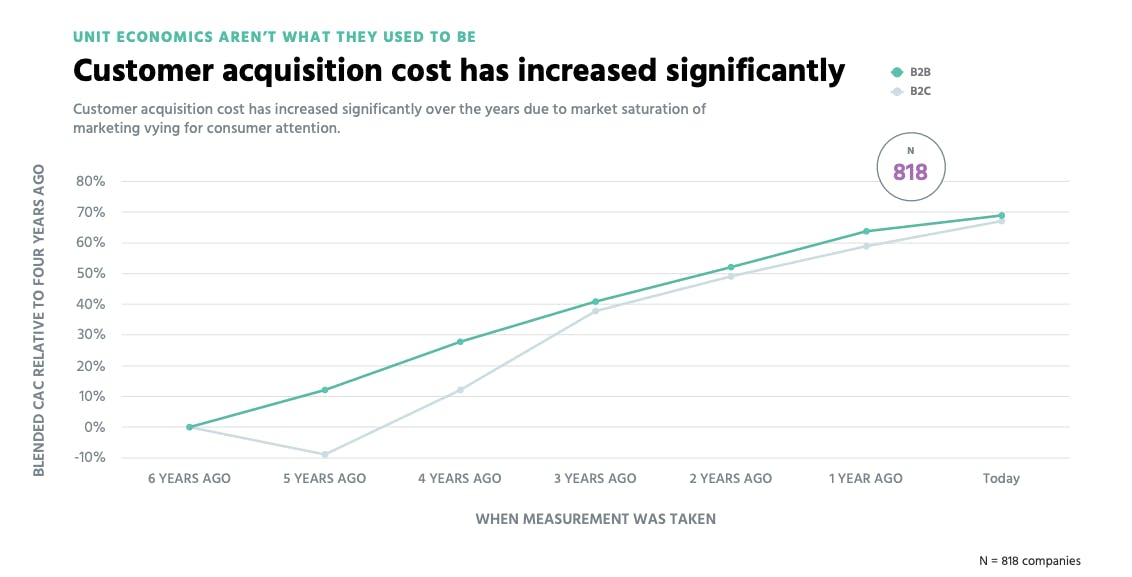

Brute-force acquisition just won't work anymore. Right now, the median expense on acquisition-based activities is 57%. That means that companies are spending more than half of their budget to bring in new customers. That's what we're all up against.

Thousands of competitors spending half of their hard-earned money trying to find and bring in the same customers as us. It's crazy. We're all building as much as we can, as fast as we can, and that's still not enough.

This also means that customer acquisition cost (CAC) is steadily increasing over time:

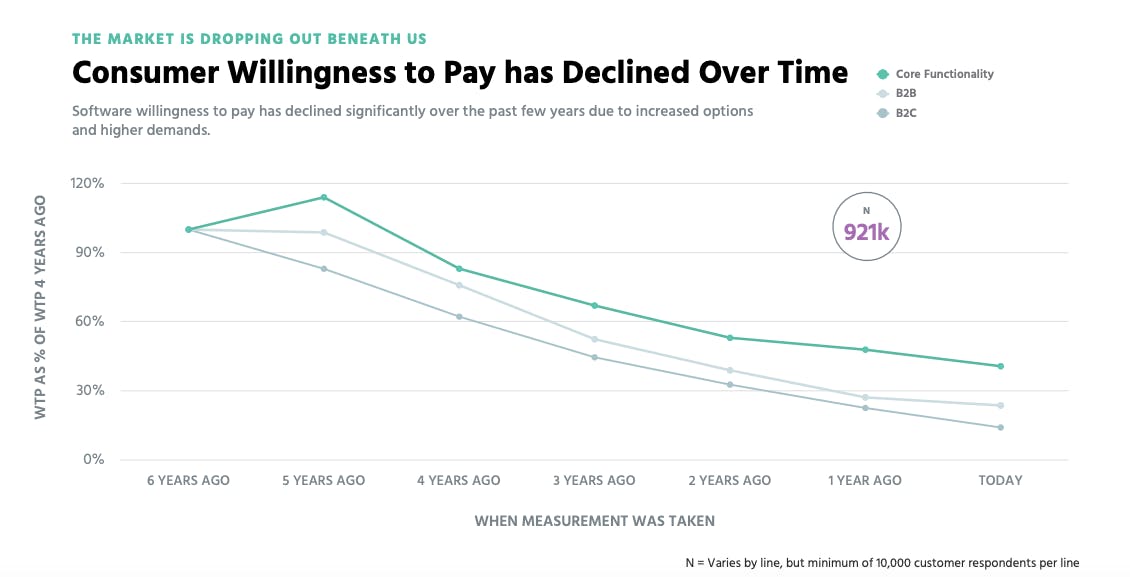

And the relative value of features is declining:

To be successful in a market that's as competitive as this, with customers that are inundated with products, features, upsells, and so much more every single day, companies need to find a way to drive home their real-world value.

And that's where the value metric comes in. It gives us a way to understand what a customer is actually willing to pay for and ensure we're always building the right product at the right time.

Use value metrics to bake value directly into monetization

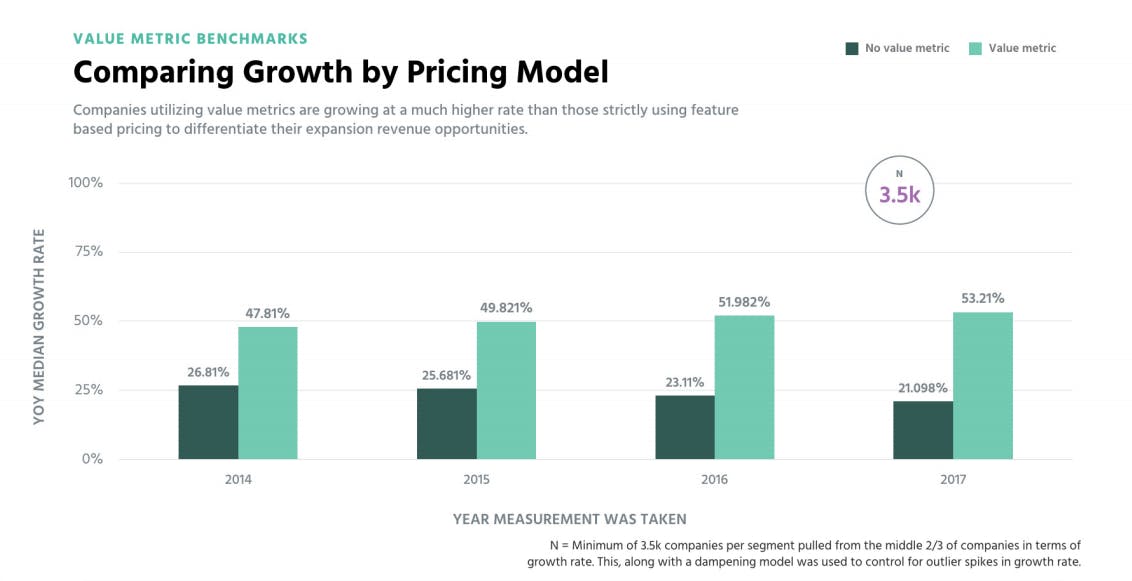

Value metrics are the way to define the axis of value you use to define your pricing. It's how you ensure that the value for your customer is at the core of how the company monetizes. We talked to our customers and found that those who were using a value metric in their pricing have experienced significantly higher growth rates of the past four years.

And the divide is continuing to grow—where in 2014, there was a 21% lift for companies using a value metric, in 2017 it increased to 32.112%.

More and more, companies who really dig into their value metrics, and price their product according to those findings, are going to be the clear winners.

It's especially important for expansion revenue.

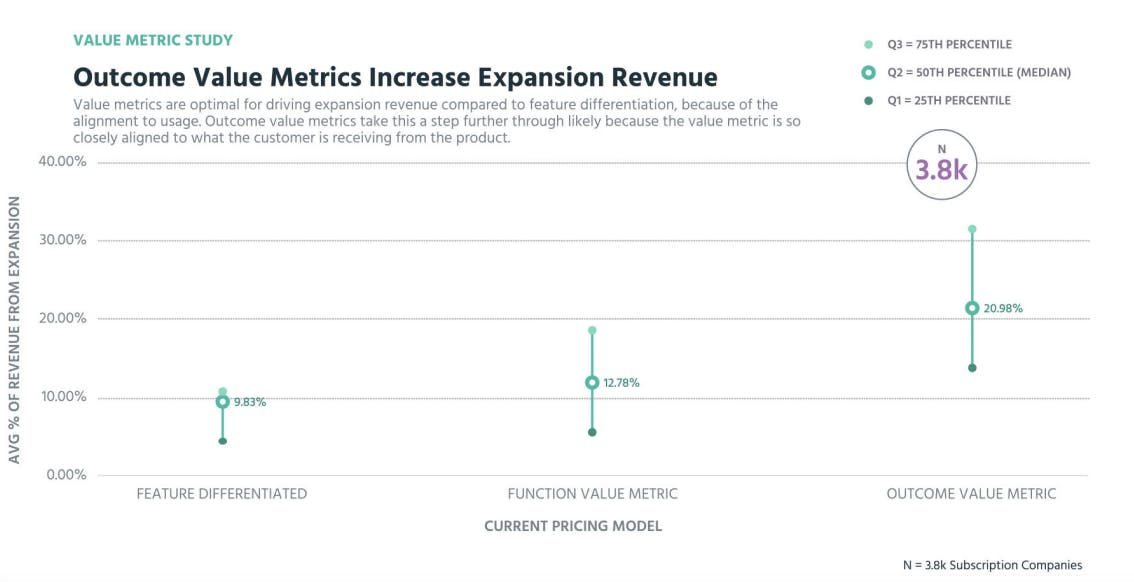

This shows the average percentage revenue from expansion based on a survey of 3.8K companies.

- Feature differentiated—These are companies that base their pricing strategies on the features available in every pricing tier.

- Function value metric—These companies are pricing their product on a per-user or per-seat model. They price according to value, but not according to outcome.

- Outcome value metric—These companies base their pricing on the idea that their product is priced based on the amount of money the customer earns as a result or the amount of cost the customer saves.

We can see that by building pricing around the outcome-based model the average percentage of revenue from expansion is 20.98%. This is much higher than a more traditional value metric at 12.78% and more than double a feature differentiated pricing model with just 9.83%.

With outcome-based pricing the clear winner, why wouldn't you start implementing that strategy on your own?

Optimizing for value isn't easy

Figuring out the outcome your customers want and showcasing value is a time-consuming and complicated process. It requires a concrete understanding of the customer's needs as well as a strategy for ensuring the customer sees that value in the long run.

So how do you do it?

Force annual subscriptions

Not everyone is going to have this opportunity, but when customers are able to experience the value of your product over a longer period of time, that gives you more opportunities to exhibit value.

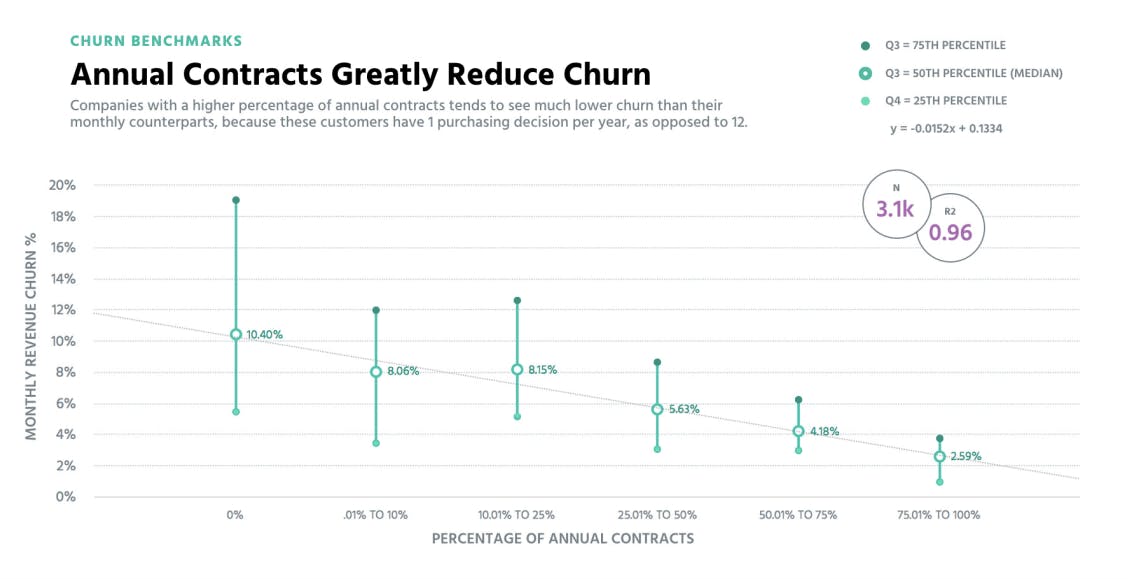

Annual contracts also have a direct impact on overall churn rates in the companies we surveyed.

The sweet spot seems to be the 25% to 50% bracket, which drops the monthly revenue churn percentage from 10.40% to 5.63%. While some companies still saw churn rates up over 8%, others went as low as 3%. By encouraging customers to move to an annual subscription as soon as possible, you're able to drop the number of purchase decisions from 12 to 1, meaning the customer won't feel the need to reevaluate their contract every single month.

Build an awesome customer experience

This may seem like an obvious statement to make in today's customer-centric market, but when companies are amazing at support, it has a direct effect on willingness to pay. That's because being customer-centric is a way to be more outcome-centric as well—you're invested in the customer's overall success with your product. That's the outcome.

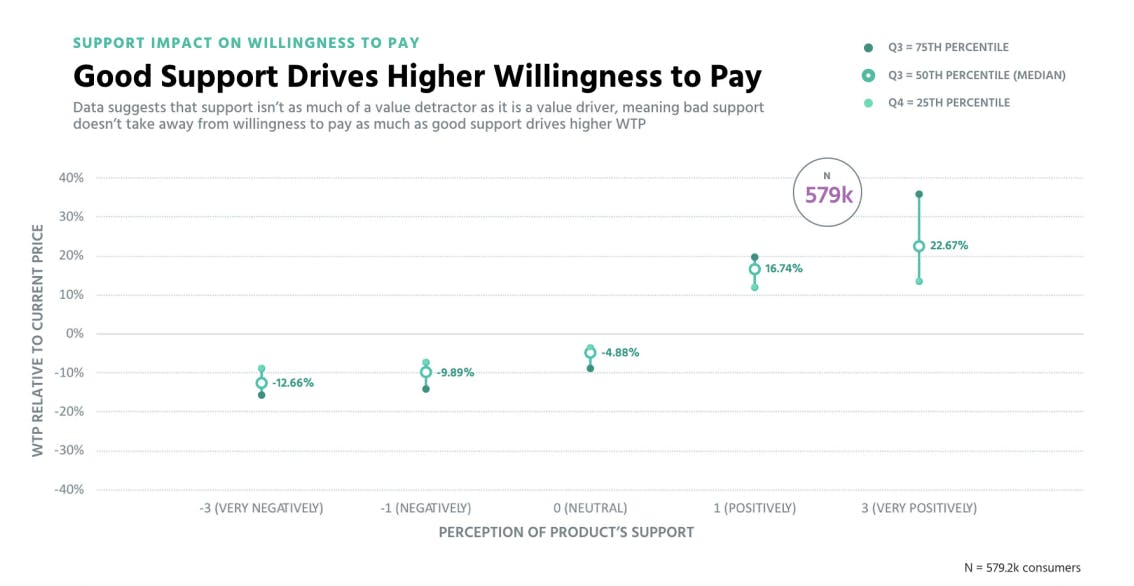

Though it goes both ways, where a bad customer experience has a negative impact on the willingness to pay and a good customer experience has a positive one, the relative percentages are definitely not one-to-one.

Any negative perception of a product's support will have, at the most, a -12.66% impact on customers' willingness to pay. Even a neutral experience doesn't break the 0% mark, sitting at -4.88%.

A marginally positive perception, however, has a 16.84% lift in willingness to pay and a very positive perception bumps up again to 22.67%. In that way, a great customer experience with support is much more a value driver as opposed to a value detractor.

Nail your onboarding

Showcasing value needs to happen as early in the process as possible. When you're able to solidify the relationship with the customer and make them understand the value of your product during the onboarding process, it can help recover CAC earlier.

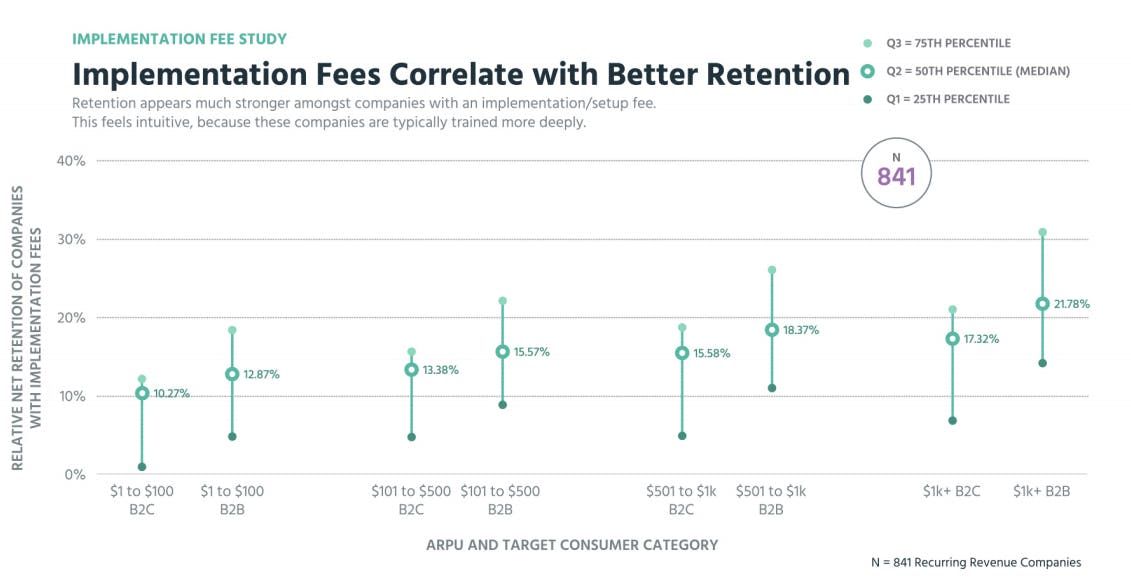

We see this with companies with forced implementation fees or training.

Customer retention is much stronger for companies with a setup fee. This makes sense, as they're taking the time early on in the relationship to ensure that customers are trained and knowledgeable in the product. It's this kind of knowledge that drives their ability to see the outcomes they are willing to pay for.

Give freemium a shot

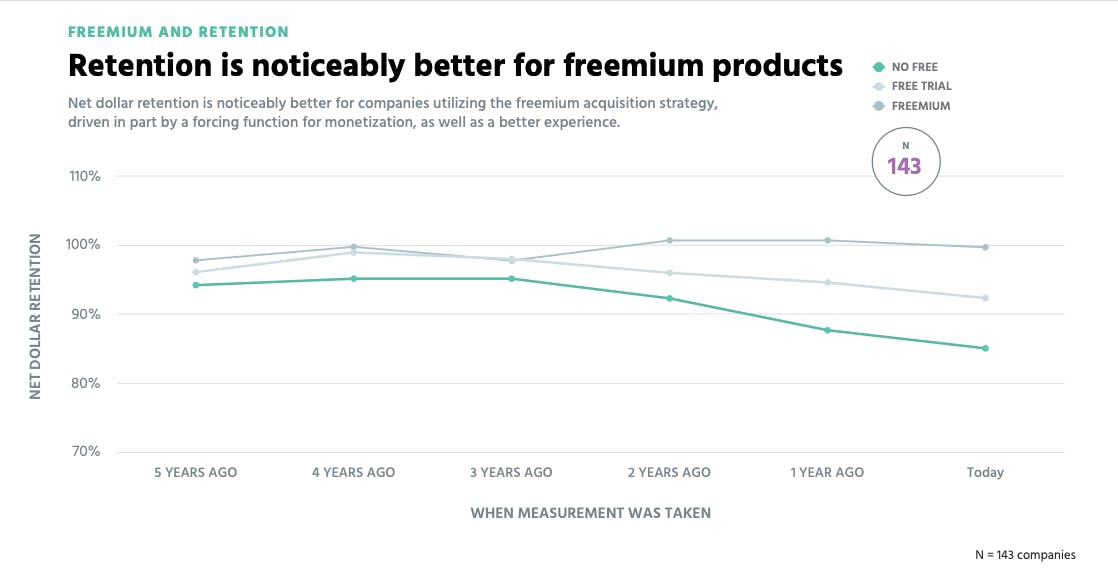

On one side of things we see that annual subscriptions help customers see value in the long term, here's the other side of that coin. Freemium subscriptions help drive retention by giving customers the ability to learn on their own time.

This is not only a better customer experience in some ways, but can also help boost perceived value for companies that don't have a way to force annual subscriptions. It puts the outcome for the customer above all. Customers can nurture and grow on their own terms and decide on how the product is affecting the outcomes they see value in.

Get to value faster or fail

So you see, the market is enormous and out of control. Since we're not able to brute- force our growth anymore, it's imperative that you bake value into your monetization strategy. When customers understand the direct effects of your product on their desired outcomes, they'll be more willing to pay for it.

While there are a number of ways to accomplish this, the most important thing to remember is the closer you are to the customer, the closer you are to winning.

Being able to showcase the value of your product in your pricing helps build a strategy that informs your company growth. You have to put in the work.