The content and data in this blog is taken from a talk given by Paddle Chief Strategy Office Patrick Campbell at SaaStock Dublin 2022.

Every SaaS leader is having to think carefully about costs and how to do more with less. Running business operations like this in practice is something bootstrapped CEOs are often tactically better at – as working under cash and resource constraints is part of their every day mindset.

In this post, we look at some of the key principles that embody bootstrapped business operations and what VC-backed businesses can learn from them.

Ensuring alignment through documentation

Alignment is how a high performing team becomes a high performing company – it should be a priority however you’re funded.

The easiest way to do this is by communicating your business’s mission, guiding principles, and core metrics with the entire team – and then documenting them internally.

Despite this, only one-in-five VC-backed companies have any form of documentation – where over half of bootstrapped companies have internal alignment documentation or wikis.*

Why? Bootstrapping allows you to maintain full artistic direction and control over business decisions. Funding your business with outside money means taking on external pressures and responsibilities to satisfy investors' interests which can mean the direction isn’t always as clear – or that priorities change more often.

So, how do you get everyone moving in the same direction?

First, you need to actually have a clear mission and guiding principles for achieving it.

When you determine guiding principles for your company think about:

- Your mission (why you exist) and your success metrics.

- How each department in the business will help you achieve those goals.

- The tempo of production or level of output that you need from those departments over a given time period.

Once you have them down, communicate them with your whole team. Use various internal communication channels to make sure everyone gets bought into what you’re trying to achieve and understands their part in how you will achieve it. Internal communication channels include:

- All-hands meetings

- Department and team level meetings

- Internal documentation (e.g. Notion or Nuclino)

- Messaging and email

- 1:1s

From here, you can reinforce your guiding principles and update your documentation accordingly, for example, at the start of a new quarter.

Reducing churn and increasing retention

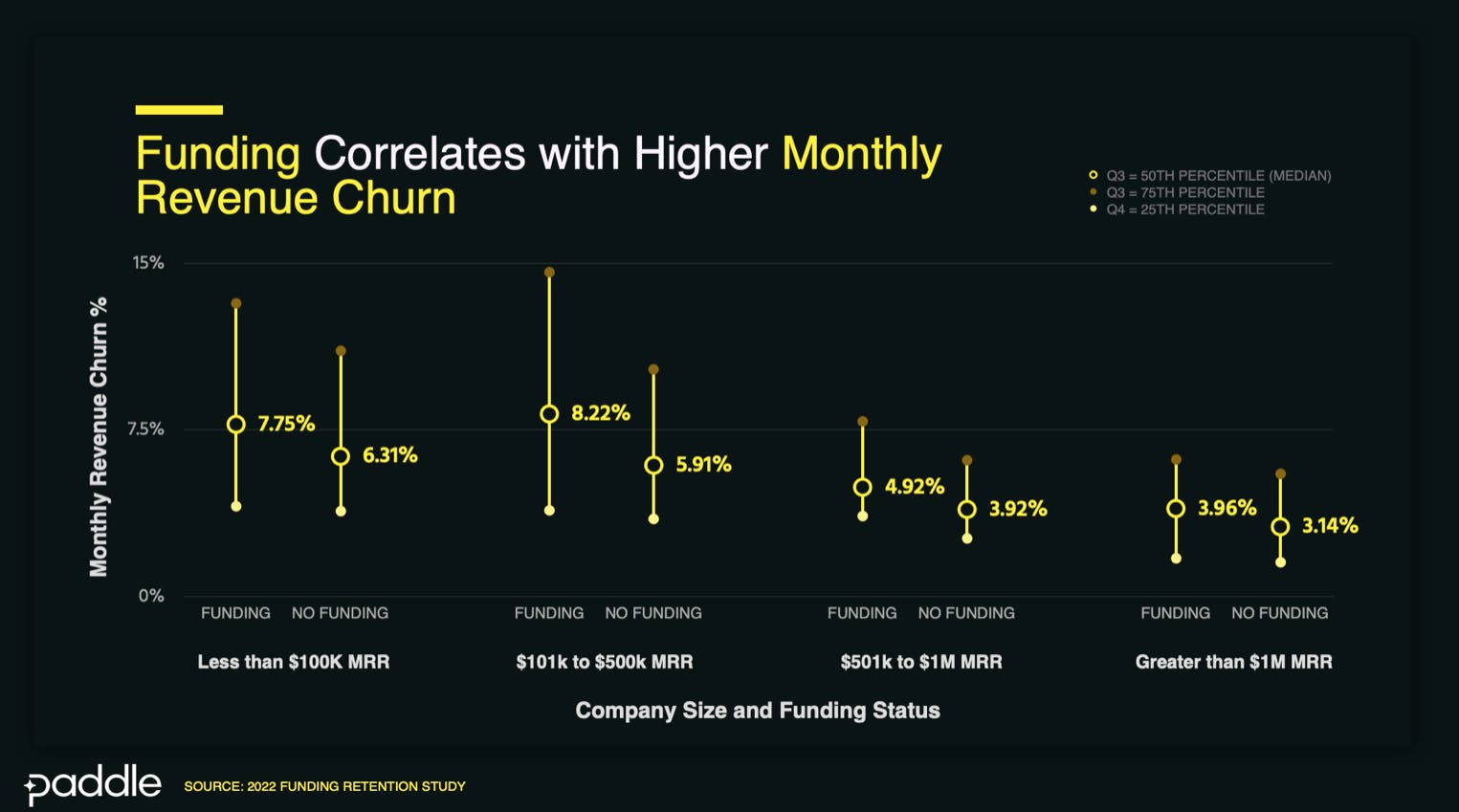

Bootstrapped companies tend to have better retention and less churn than VC-backed companies. This is because businesses with funds from outside sources tend to focus more on acquisition and worry about a retention strategy later. Whereas a lot of bootstrapped businesses think tactically about retention from the outset.

Ideally, every business owner, whether bootstrapped or VC-backed, would have a retention strategy and some tactical plays to help reduce churn and increase your customer lifetime value (CLV).

Here are three tactics to consider:

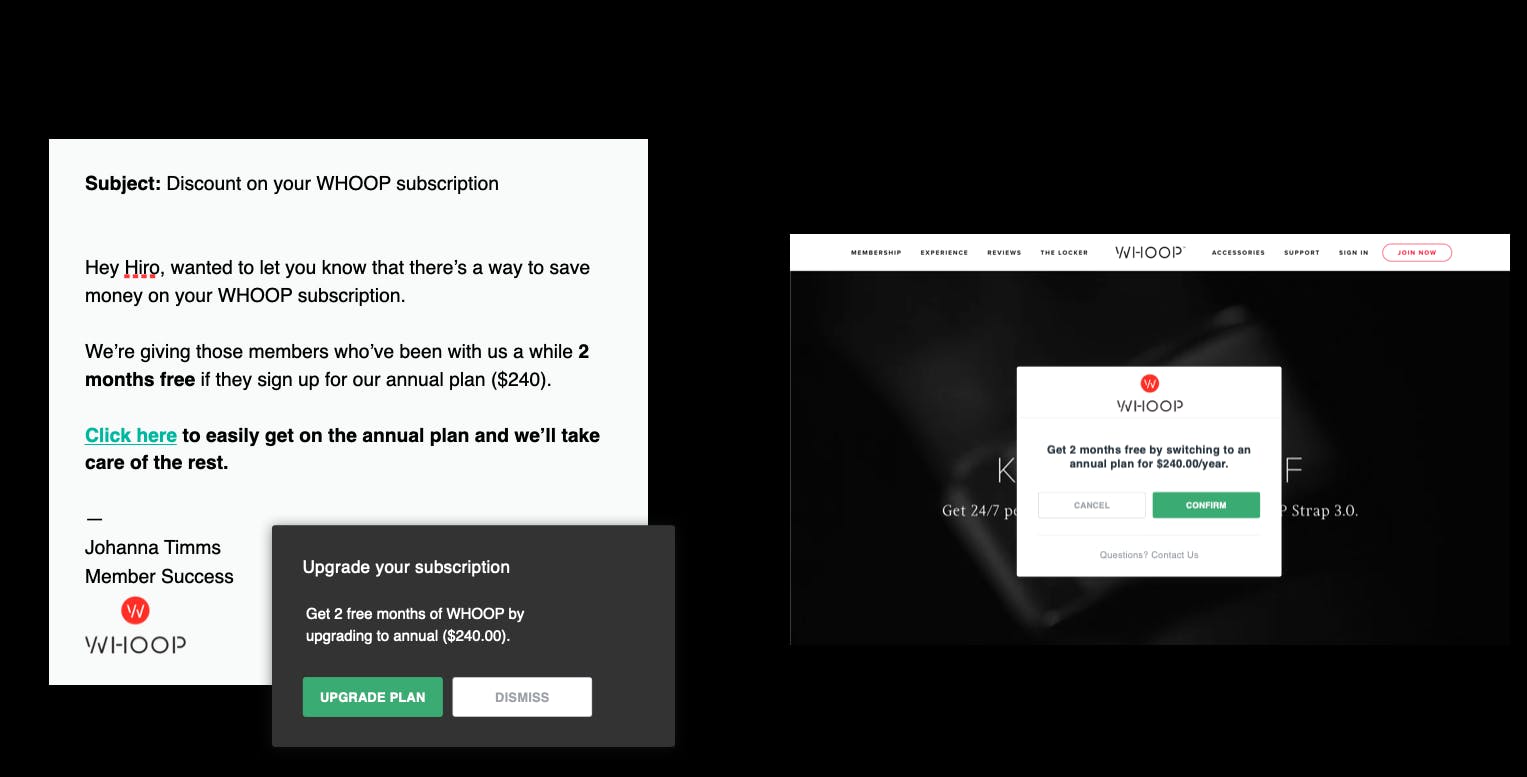

1. Optimize for longer term plans

Longer-term plans have 200%-800% higher CLV** yet most businesses don’t ask customers about term length after initial sign up.

To get more of your customers on long term and annual plans, check in with them every 45-60 days. Use incentives, including discounts (e.g. 10 months for the price of 12) to encourage your customers to commit to a longer subscription.

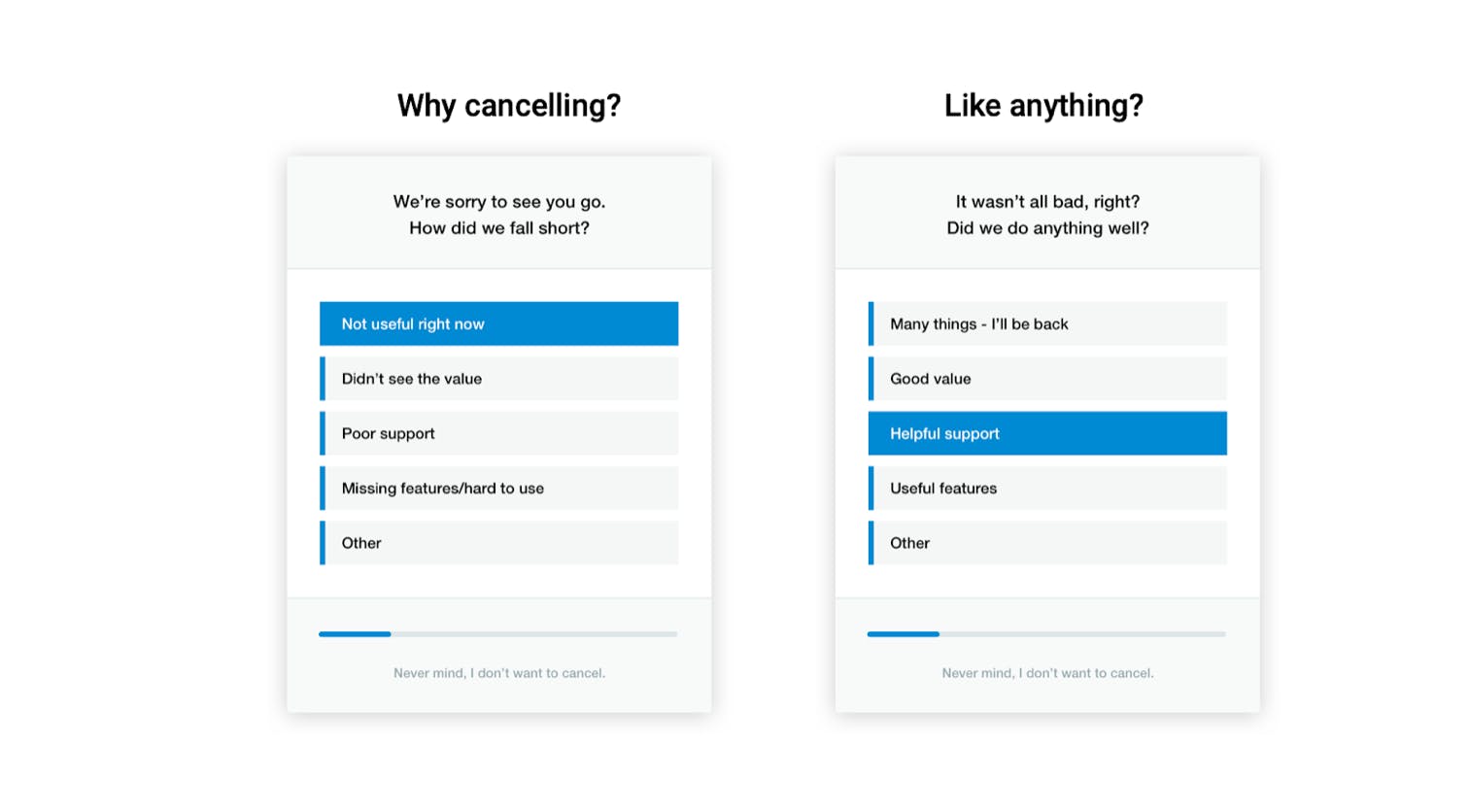

2. Implement cancellation flows

Cancellation flows give users alternatives to cancelling during the offboarding process. The idea is to remind customers of your products' value and offer suitable alternatives so that, ultimately, they remain your customers.

The result of well implemented cancellation flows? 10-15% fewer cancellations**.

In addition, these workflows allow you to gather data that you can use to prevent churn and improve customer retention more effectively going forward. For example, an exit survey will help you understand why customers are no longer interested in your products or services—you can use this data to identify the problems and prioritize improvements to your product or service offering accordingly.

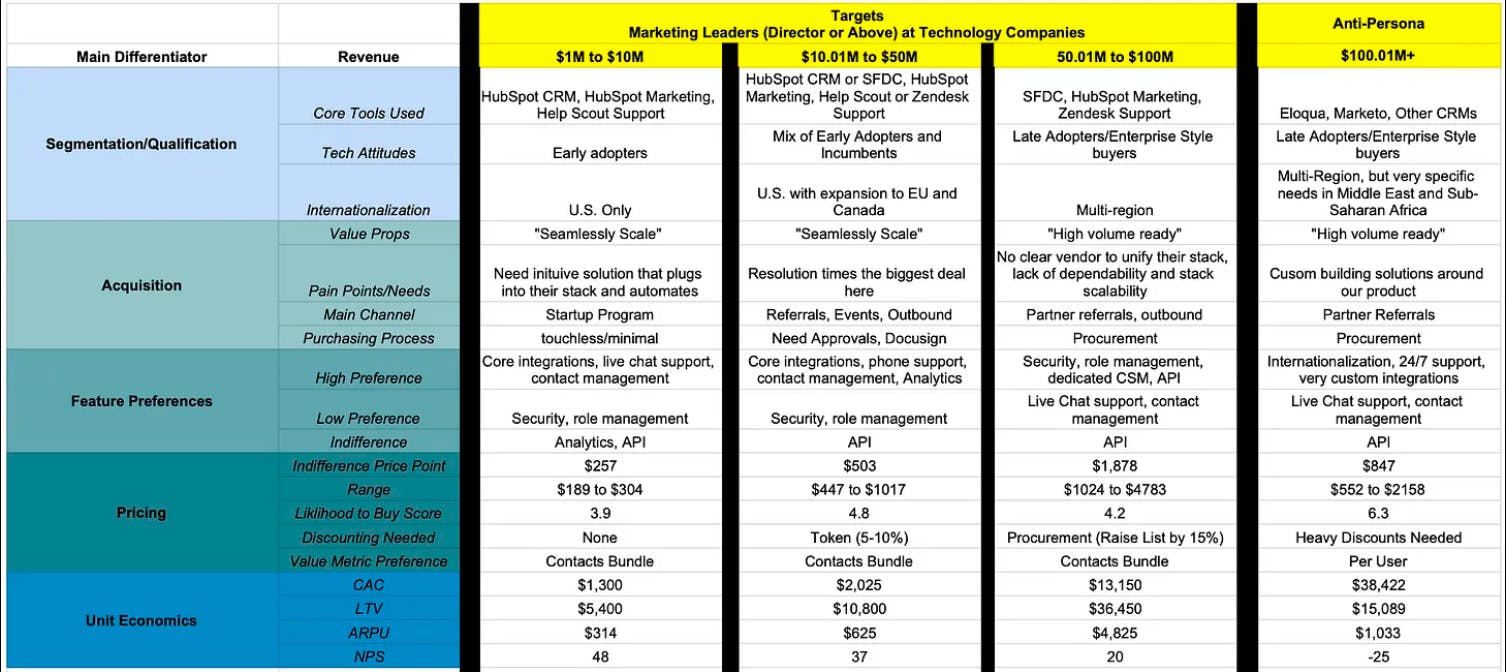

3. Understand your buyer personas

Every business needs as many customers as possible, especially in a recession. But before making efforts to attract and retain more customers, you need a snapshot of your ideal customer — a buyer persona.

Here’s why:

- Buyer personas improve targeting because you can focus and adjust your content to reach the people or businesses who will benefit most from your product and stay customers for longer as a result. Hello better conversion and higher CLV.

- They empower your sales team with clear information about who they are targeting. This enables them to address problems and present the right solution more effectively.

- They help you identify negative personas, that is prospects who aren’t the right fit for your business.

- Companies with buyer personas grow 10-20% time faster. They also have a 20-30% lower customer acquisition cost (CAC).

Despite the benefits of really understanding your ideal customers, buyer personas aren’t prominent in either VC-backed (one-in-five businesses) or bootstrapped businesses (two-in-five)*.

Get started with yours today by using the below framework to develop your business’ minimum viable personas:

Demand generation and customer acquisition

Unsurprisingly, bootstrappers are more scrappy in acquiring customers but what that also means is that they use different tactics to generate demand.

Here are three things bootstrappers do to increase demand and acquire new customers:

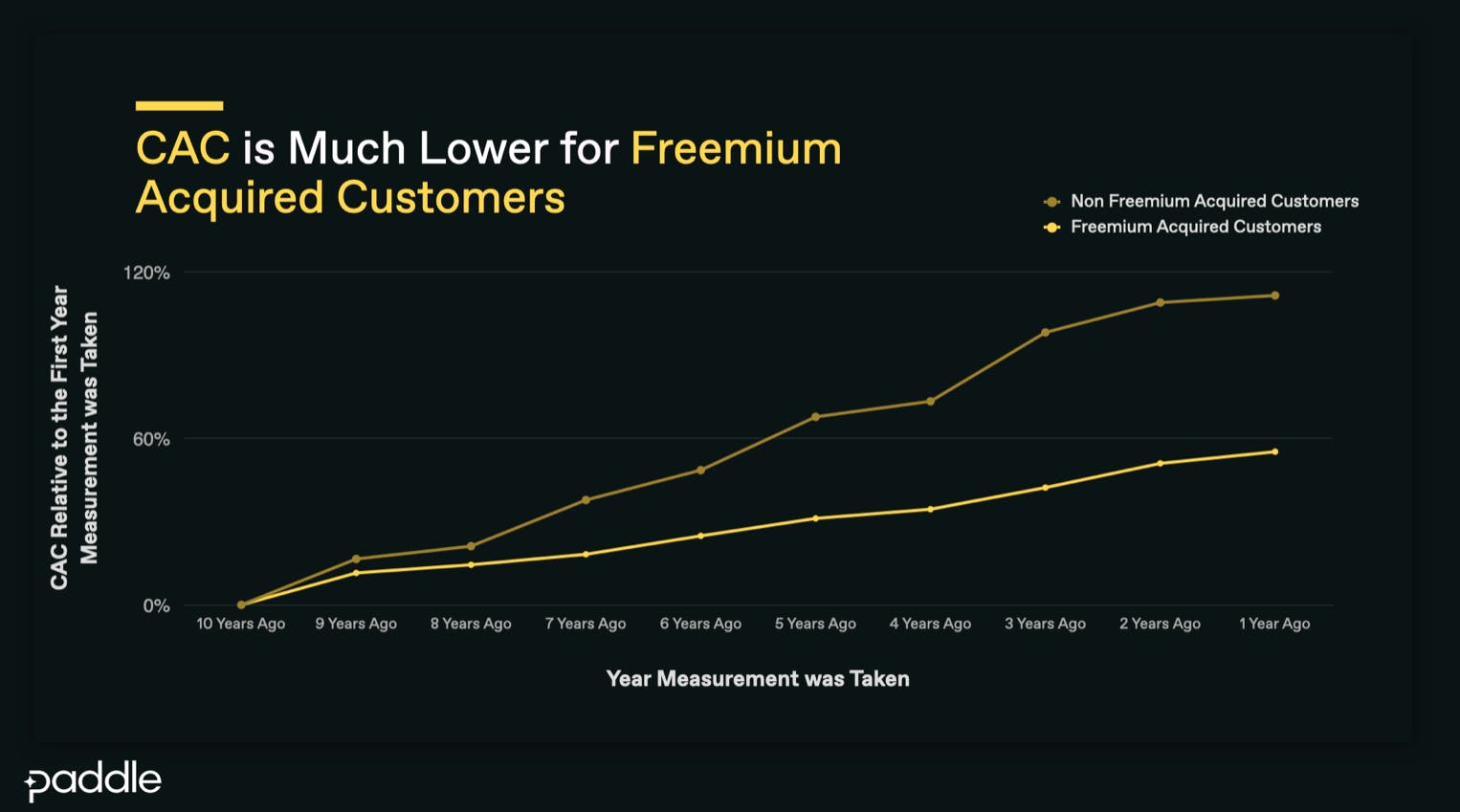

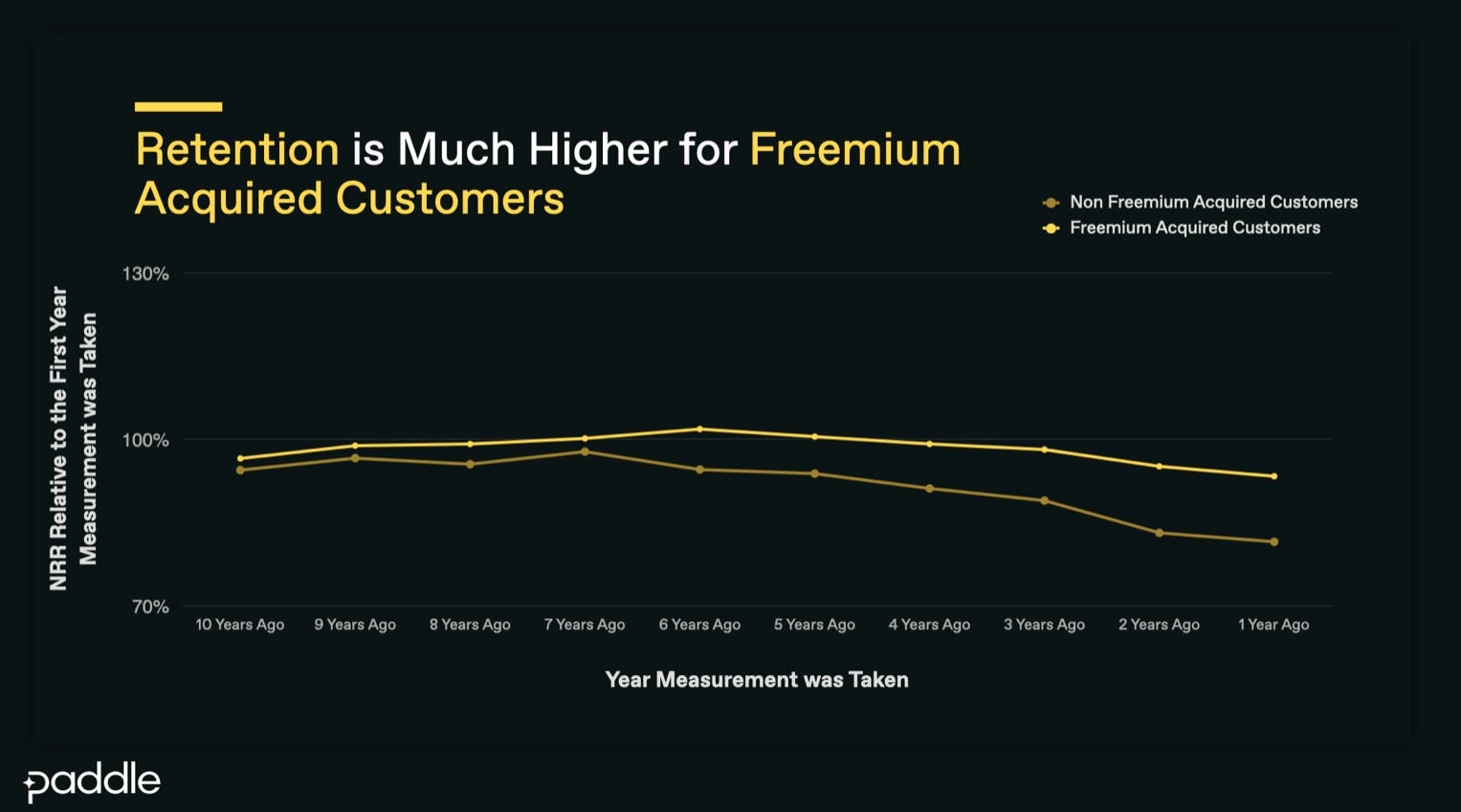

1. Use freemium as an acquisition tool

VC-backed companies tend to put most of their budget towards the top of the funnel and sales. While a certain percentage of the leads might be ready to buy right away (and might stay with you) others won't be. A freemium model gives those people a place where they can realize value from your product until they are ready to upgrade – and as a result:

- CAC is lower

- Retention and NPS are higher for freemium acquired customers

2. Inbound marketing and media

Companies, both bootstrapped and VC-backed, have various techniques for attracting new customers. But inbound marketing and media are common and practical ways to attract a large pool of customers to your business.

How do you use media to attract leads? Here are a couple of options:

- Start a podcast interviewing customers and target customers.

- Turn each of your blog posts into videos.

Let’s look at ProfitWell as an example:

ProfitWell (and now Paddle) builds its audience using media. Overall, the team has produced eight different podcasts and video series. One show, Pricing Page Teardown, has six seasons with episodes gaining over 60,000 views each month.

These viewers convert to subscribers. Those subscribers are then more likely to convert to customers now or remember your brand when they are ready to buy.

3. Review your pricing

Companies that review and update their pricing more regularly grow more quickly, yet VC-backed companies only review their pricing every 2.8 years (for bootstrapped this reduces to every 1.6 years)*.

Price Intelligently research suggests that all SaaS businesses should in fact be reviewing their pricing every six months for maximum pricing power. But how do you do it in a way that helps you convert more prospects, without losing loyal customers?

The secret to changing your pricing lies in proper messaging. How you pass the news to your customers will determine whether or not they'll continue buying your products or services. Here are some tips to help customers see the value of your price increase:

- Give people with an increase of 50% or more a phone call or personalized message.

- Make that message all about the customer and not your company.

- Go into detail about why you're reviewing the prices—perhaps you need to improve customer services or add new features.

It’s all about trade-offs

When it comes to how to fund your business, there isn’t one approach that’s “better” than the other — it's all about trade-offs.

VC-backed companies know how to spend money effectively. They hire more quickly and grow faster. Bootstrapped companies focus on retention and slow growth. They tend to hire and grow slowly.

Right now, it's about deciding what you need to do to get through the next few years – and learning from the processes and operational ways of working that help you grow in the most efficient and sustainable way.

* Source: Paddle VC vs Bootstrapped study.

** Source: Paddle retention study.