“Yum, yum, in our tums.”

Today on Pricing Page Teardown, we are all about food, glorious food, pitting the first mover in the home meal-delivery kit market, Blue Apron, against one of the many clones that have come after them, HelloFresh.

This battle comes down to the fundamentals of unit economics: CAC and ARPU. Both companies understand their core customer, so the winner is going to be decided by whichever can reduce costs enough and increase value enough to make the numbers work for growth.

CAC means single people need not apply

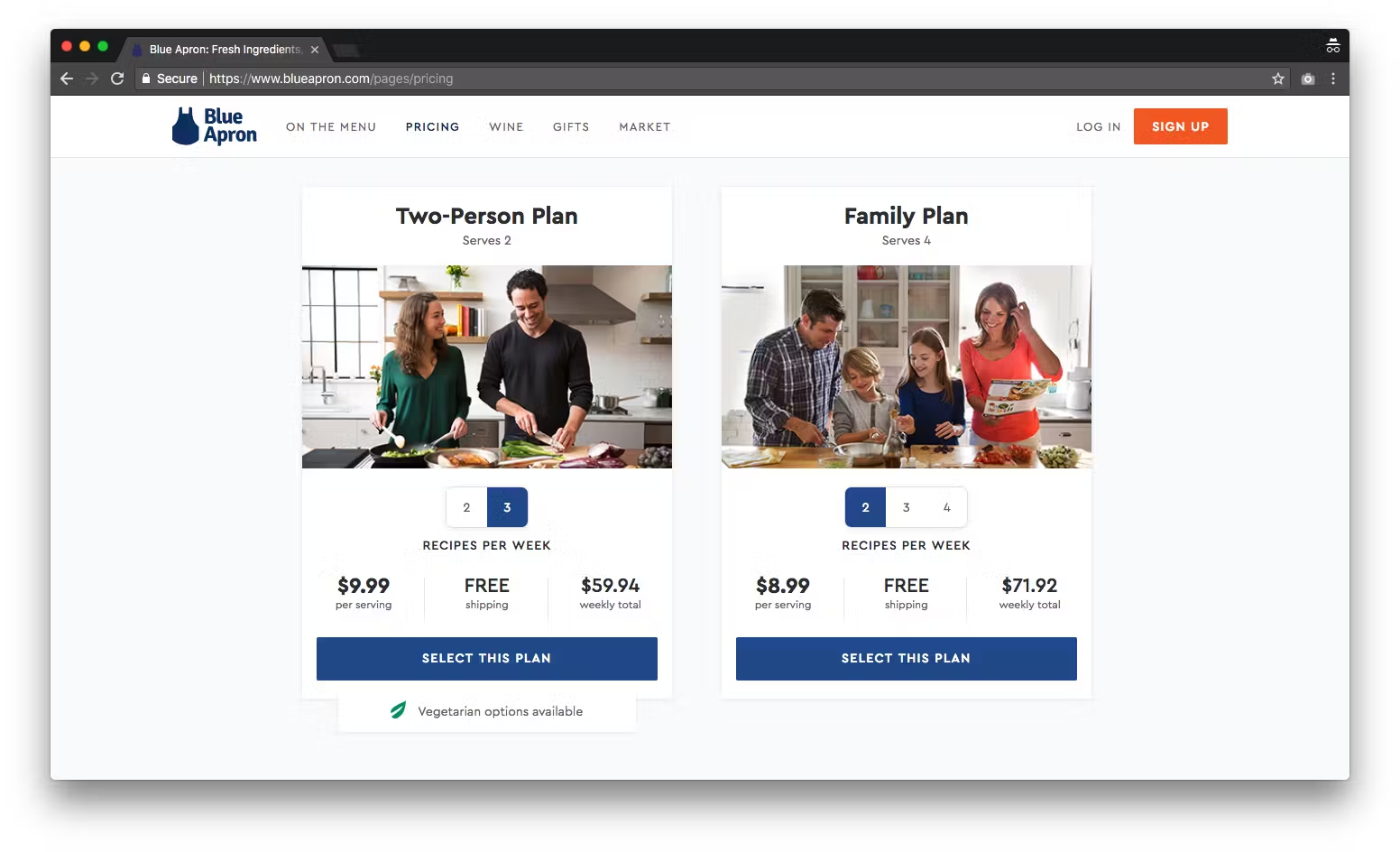

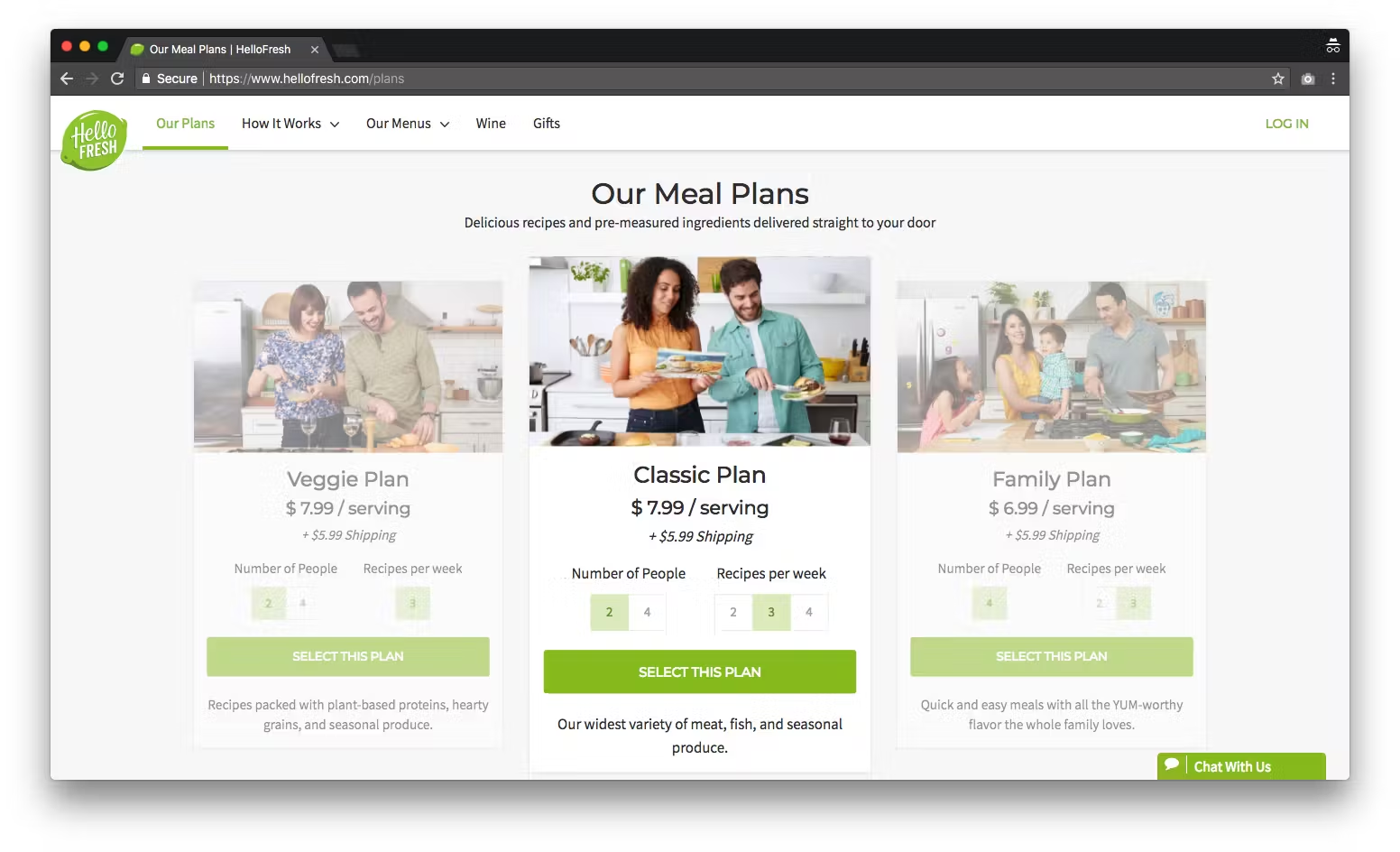

When you open the pricing pages of Blue Apron or HelloFresh, two things immediately strike you:

- There are no single-person options.

- Their pricing is basically the same.

The pricing is slightly higher with Blue Apron, but they also offer free shipping. HelloFresh has a “Veggie Plan,” but Blue Apron has “Vegetarian options available.” Both companies know their customer.

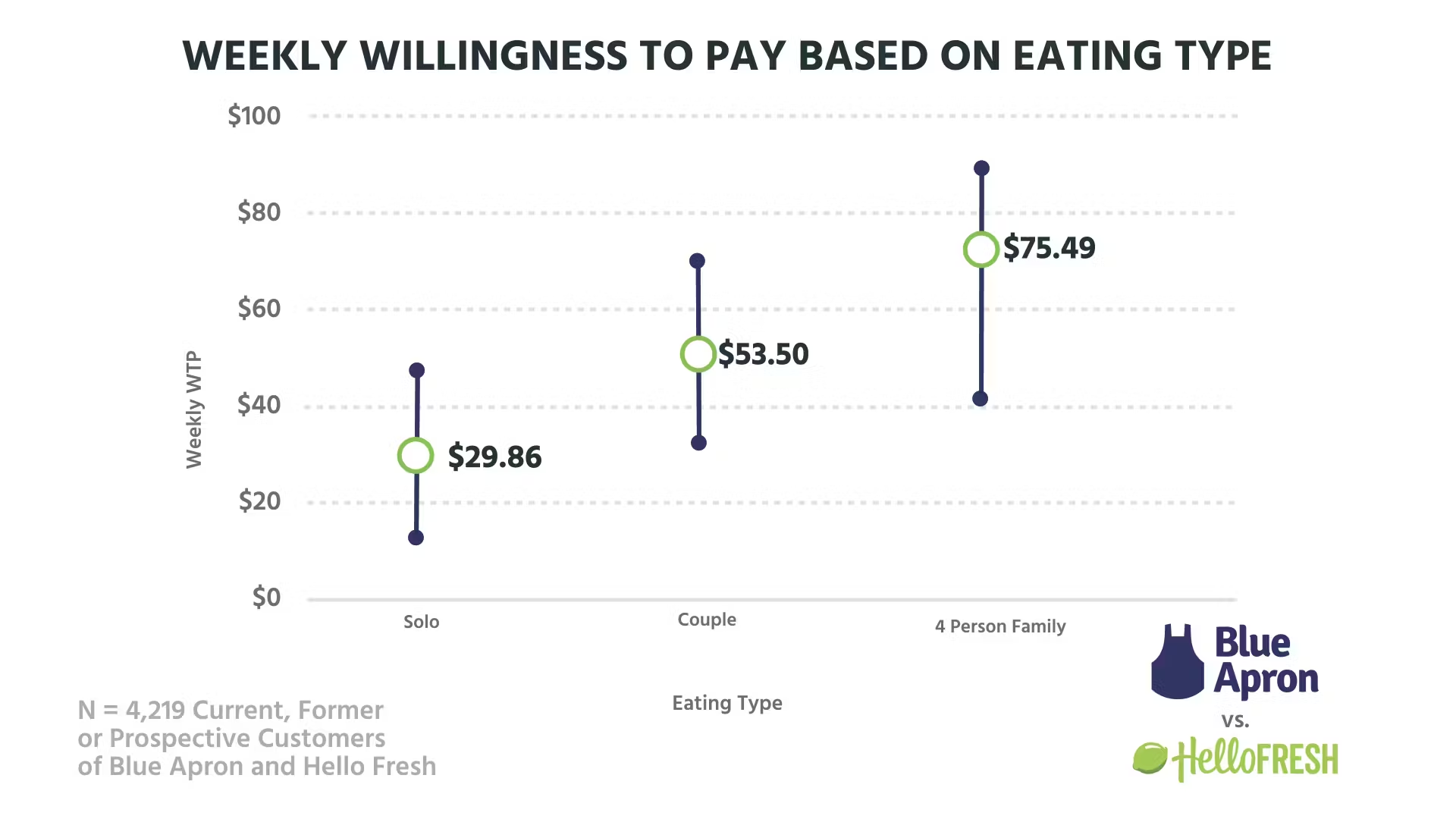

And knowing their customer, they don't offer a solo meal—they know there is no money in it:

Our data from 4,219 current, former, or prospective customers of Blue Apron and HelloFresh shows that the median weekly willingness to pay for a single individual is just $29.86. The lowest price for a Blue Apron meal kit (two recipes for two people) is almost double that at $47.95. The lowest price they push new subscribers to, the $59.94 shown above, is double the solo willingness to pay.

Customer acquisition cost (CAC) and overhead are high for home meal-delivery kits. As the market becomes crowded, Blue Apron, HelloFresh, and all the others have to spend more to acquire customers. The high expense also requires more motivation. These companies are increasing that motivation by pitching their services as entertainment rather than just a meal. You can get a meal anywhere, but great recipes and enjoyment through cooking can come only with Blue Apron or HelloFresh as far as these companies are concerned.

The overhead of food preparation, packaging, and shipping is also high. CAC and overhead together mean that there is a high floor to the lowest price these companies can charge. Single people fall below that floor.

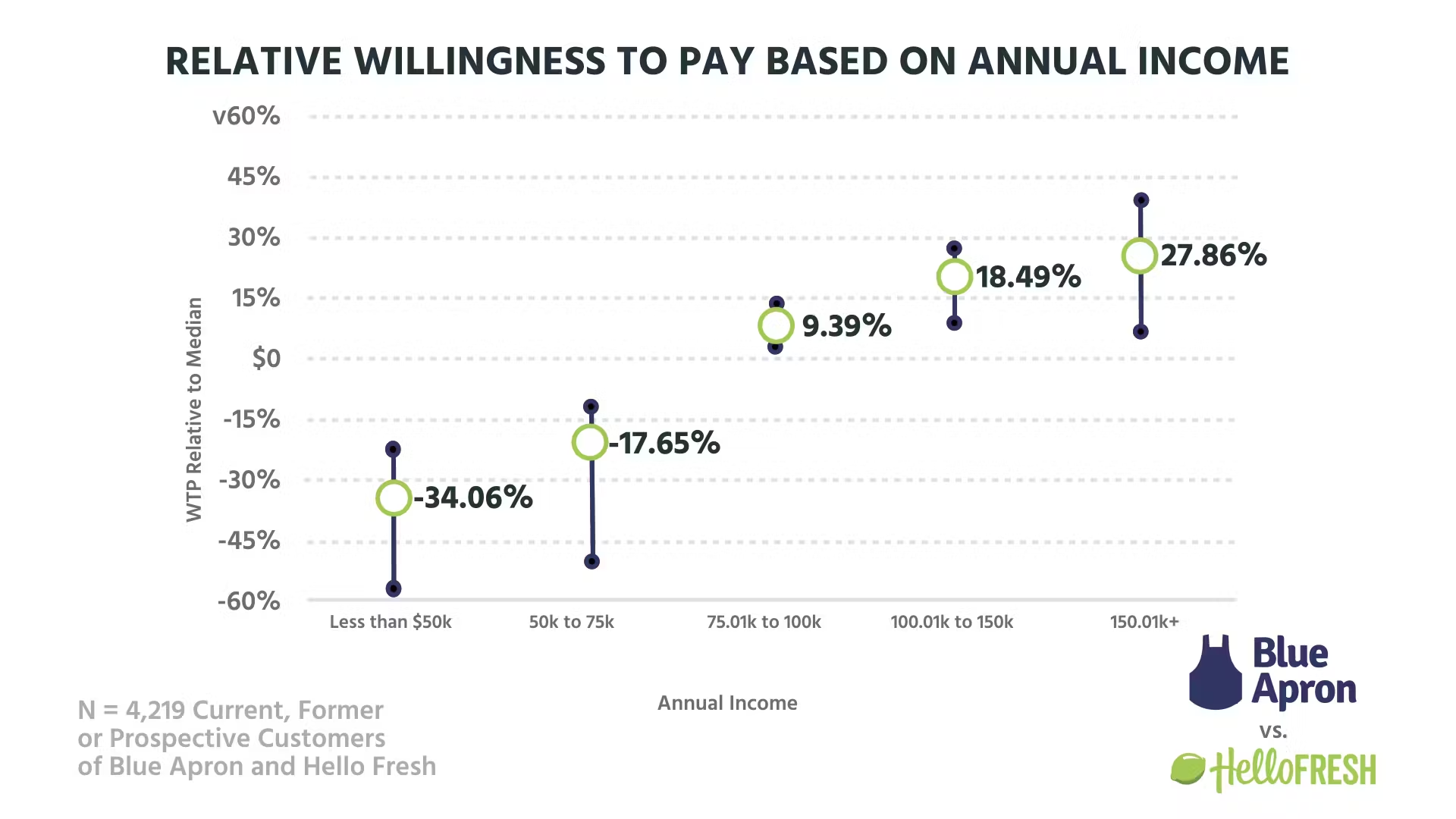

Additional data points support the idea that there is a highly specific ideal customer for companies offering home meal-delivery kits. Looking at the willingness to pay based on annual income, we can see that, relative to the median, this is much lower for those earning less than $75k per year:

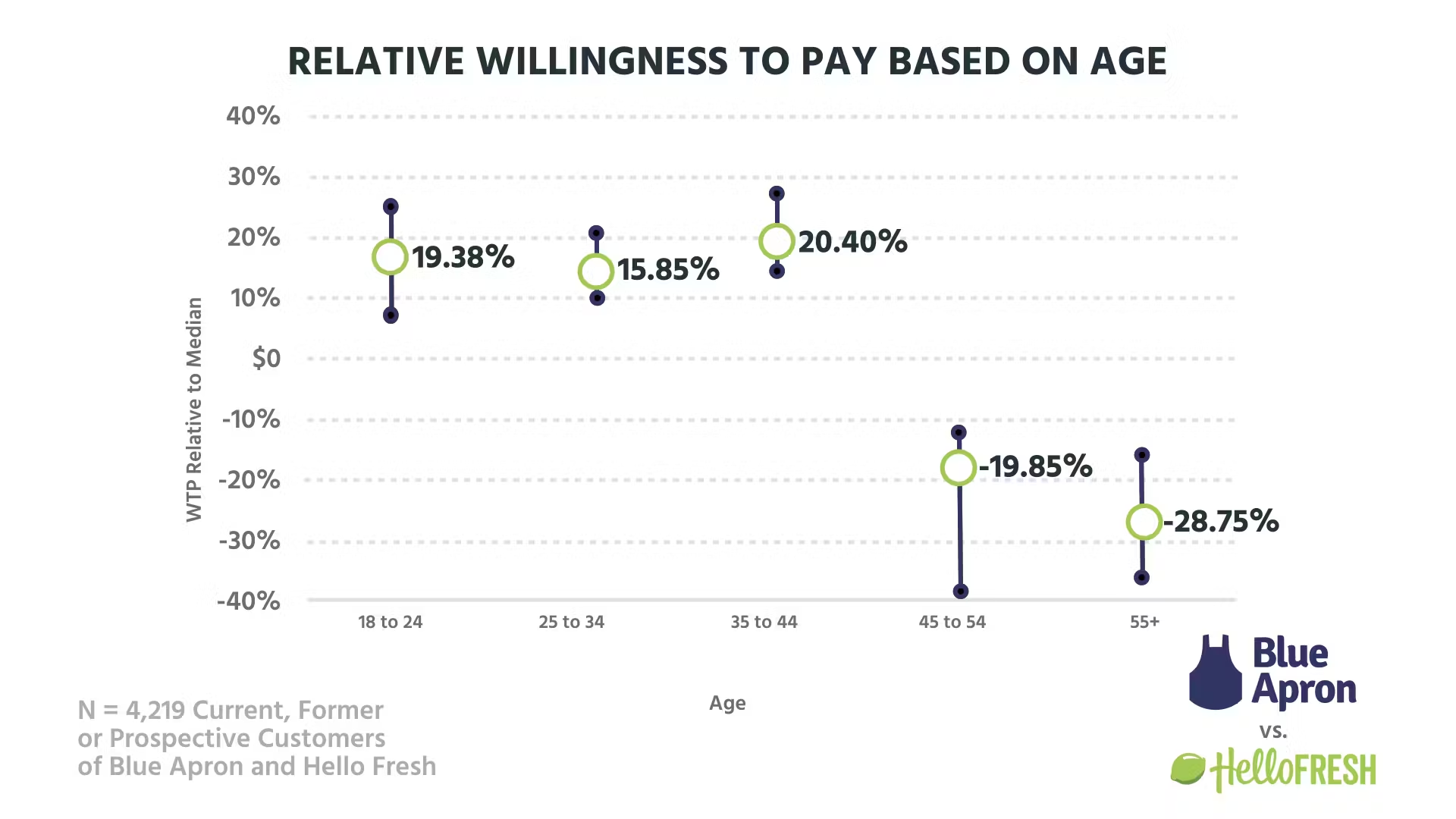

Once into the $100k-plus brackets, willingness to pay shoots up. We can also see a pattern in the relative willingness to pay based on age, though an inverse correlation:

Older cohorts have a lower willingness to pay. We see this all the time in pricing-page teardowns. Rent the Runway and Spotify—older generations aren't used to the concept of subscriptions for everything. They don't see the benefits, so they have a lower willingness to pay.

From these three data points—family size, income, and age—you can see that the ideal customers for home meal-delivery kits are families and young couples with incomes over 100k. These are the types of people who (a) don't necessarily have the time to shop and cook throughout the week and (b) have the money to continually subscribe to the kits. With these customers, Blue Apron and HelloFresh can recover CAC quickly and use higher pricing to offset overhead.

ARPU through premium and add-ons

Because margins are slim for these businesses, they have to find ways to increase expansion revenue per user. Both have opportunities through individual preferences and add-ons.

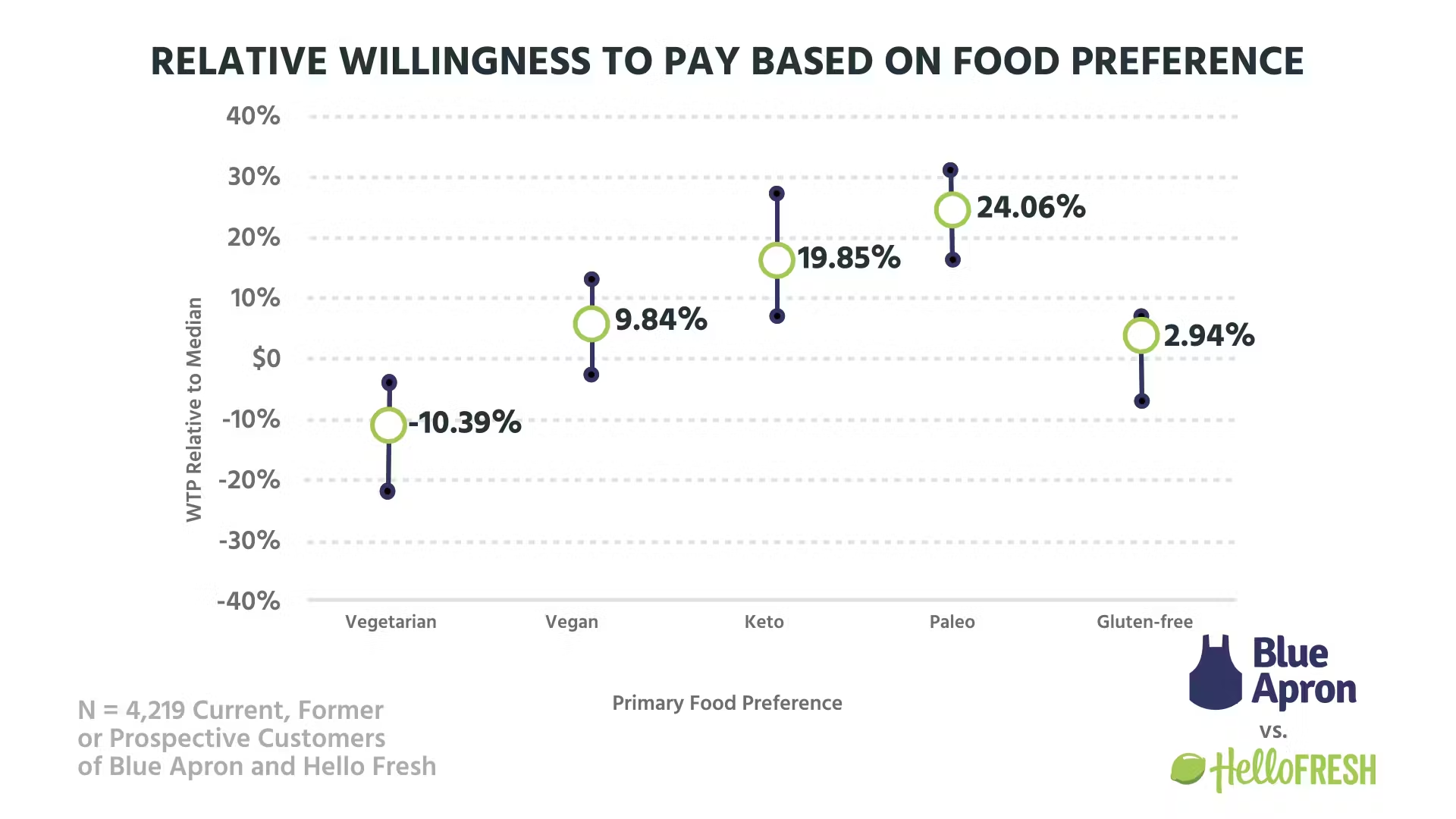

Unfortunately, both are currently using the wrong food preference to segment:

Vegetarians don't want to pay for home meal-delivery kits. Per Peter, they see the high price as subsidizing the meat eaters. Additionally, being more eco-conscious, the high level of waste associated with the packaging is a turn off for this group.

There are other food-preferences groups that offer expansion opportunities for Blue Apron and HelloFresh. Vegan, keto, Paleo, and gluten-free eaters all have a higher willingness to pay than regular omnivores. A reason for this can be seen in the value matrix:

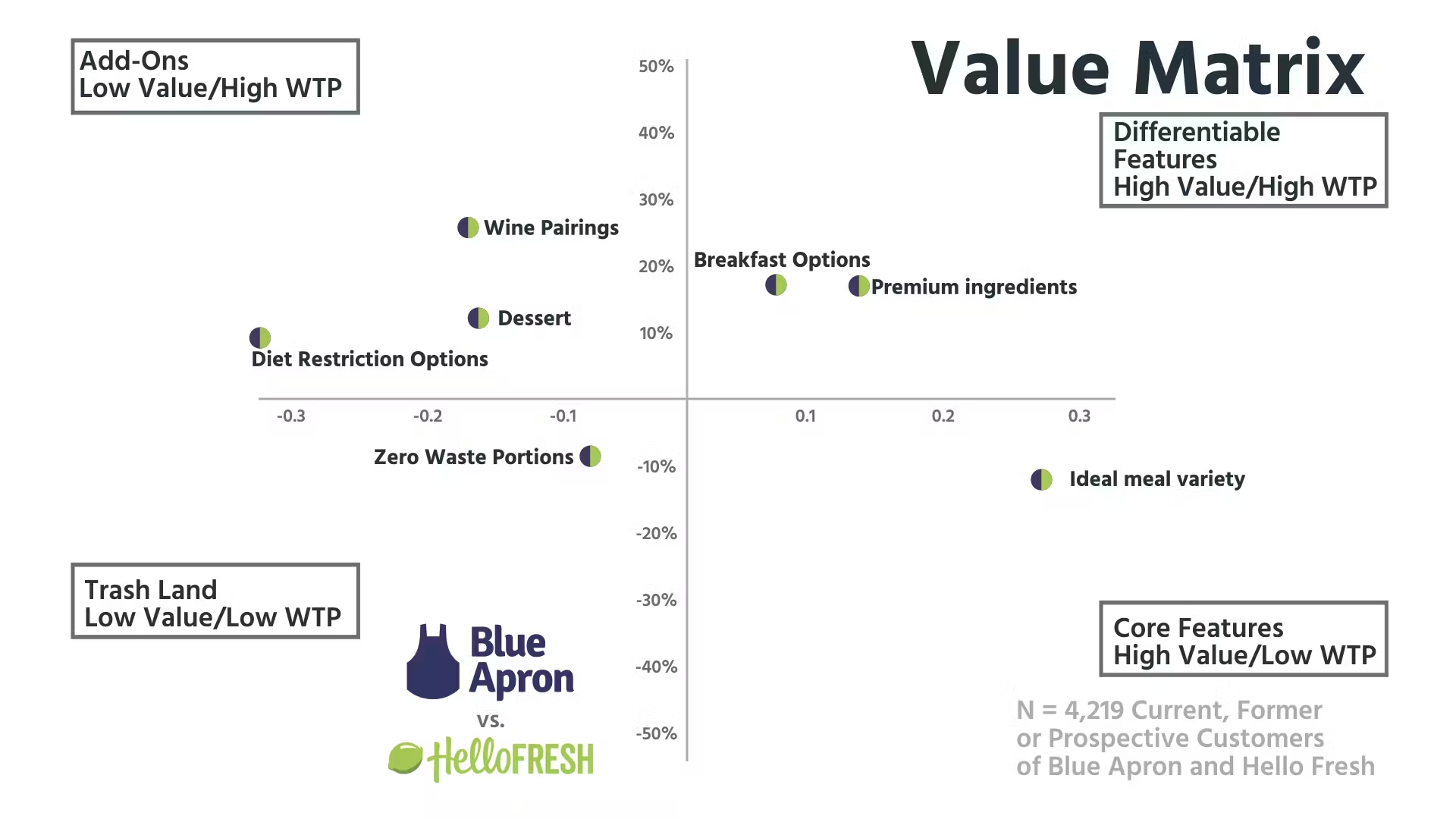

One of the High Value/High WTP features is premium ingredients. These groups need to know the provenance of their food. Offering specific kits tailored to these groups would allow both companies to price much higher. This could also work as a way to increase ARPU for regular customers as well. A further tier offering “premium” meals could be included in the plans. Ingredients would cost slightly more for Blue Apron and HelloFresh, but the overhead in other areas would be the same, leading to higher margins.

Other possibilities for higher ARPU are breakfast options, and wine and dessert to go with the meal. It is unlikely that either CAC or overhead will dramatically drop for these companies, so increasing ARPU is the only way for the unit economics to continue to make sense. Expanding out these options will allow those ideal customers—young, well-off couples— to spend more with the service and get more in return.

You know your business, we know pricing

Price Intelligently's team of monetization experts work with you to combine strategy and data to solve complex business problems and accelerate your growth.

Talk to us today

Knowing your customer can't always save you

Blue Apron, HelloFresh, and all of the other home meal-delivery kit options know who they are targeting. They have an exact ideal-customer profile and a quantified buyer persona to match.

But wishing doesn't make it so. Ultimately, the costs of logistics and acquiring customers in this market might be too much for the unit economics to handle. The only way out for both is to increase ARPU, targeting even more selective cohorts and adding on other options that increase value but can easily fit into their process. There is not much between them, and for once, the first mover doesn't necessarily have the upper hand; the one that works out the basic numbers wins in the long run.