Choosing the right payment processor can make or break your digital product. Millions of digital businesses choose Stripe and PayPal as payment service providers (PSPs), but which one makes sense for your company? Is a PSP actually the best solution when it comes to growth? In this guide, we compare Paypal vs Stripe when it comes to features, pricing, and suitability for different business types to help you make the best choice. We’ll also drop some wisdom on alternatives to PSPs, like a merchant of record and how using one can give you more time to focus on your business. To help you decide, we will be focusing on:

- Billing models: Whether you need to process one-time and/or recurring payments.

- Payment methods and multi-currency support: Which payment methods and currencies do your customers prefer to pay with? Which payment methods will help you capture the most revenue?

- Cost: The amount you pay for payment processing services (and additional functionality like for international payments and currency conversion).

- Checkout and purchase work flows: The checkout functionality and customer experience it lets you create.

- Security and fraud prevention: What level of protection and support do you need to prevent fraud and manage customer disputes and chargebacks?

- Third-party integrations: Which provider offers integrations with the other tools and software?

- Customer support: What level of support are you looking for from your payment provider for your business, and your customers?

Stripe vs PayPal: Quick summary

Feature | Stripe | PayPal |

|---|---|---|

Best for | SaaS, software, e-commerce, marketplaces, digital product companies | E-commerce, brick-and-mortar, small businesses looking for quick setup |

Charges for one time payments | Standard fees apply: 2.9% + 30¢ per transaction | Higher than their standard fees: 2.89% - 3.49% + 49¢ per transaction |

Charges for recurring billing | Subscription Fees: 2.9% + 30¢ per recurring charge | Subscription Fees: 3.49% + 49¢ per recurring charge |

Transaction fees | Online: 2.9% + 30¢ per transaction | Online: 2.89% + 49¢ per transaction |

Stripe: Pros and cons

Pros | Cons |

|---|---|

Highly customizable checkout experience | Requires developer knowledge or resource for advanced customization |

Supports more international currencies than PayPal | Requires multiple Stripe accounts in different regions if you want to have access to specific currencies, and developer time to add to checkout flow |

Excellent developer documentation and easy to use APIs | Tax obligations are with the seller, not Stripe. Additional charge for Stripe Tax or third-party tax tools |

Limited product capabilities. Unlike other providers, doesn't provide advanced subscription metrics like lifetime value, and customer retention tools like win-backs and custom offers | |

Sellers are responsible for chargebacks raised by customers. Even if you win the dispute, you're still charged Stripe's $15 fee. |

Read more about alternatives to Stripe

PayPal: Pros and cons

Pros | Cons |

|---|---|

Simple set up for non-developers with PayPal Checkout | Limited checkout customization for UX and branding needs |

Cheaper international transaction fees | Stripe's currency conversion fees are lower (1%), whilst PayPal charges between 3-4% per conversion |

Built-in buyer and seller protection | Higher charges for recurring billing, making it less cost-effective if you're selling SaaS or digital products with a subscription offering |

Read about more Paypal Business alternatives

Which is right for your business?

Stripe is commonly used by growing companies and enterprises. Most importantly, businesses that use Stripe will need to have the development resources in-house to build the integration.

For this reason, PayPal (as the sole payment provider) is more commonly a solution used by smaller businesses.

While we are comparing them in this guide, a lot of businesses actually choose to use both PayPal and Stripe together. Offering more than one payment method gives your customers the ability to choose how they’d prefer to pay, and gives your business a better chance of capturing that revenue.

Unfortunately, you can’t currently integrate PayPal with Stripe so you need to have two accounts and two sets of integrations with some of your other tools. Alternatively, you could look for an all-in-one solution that offers both PayPal and other payment methods through a provider like Stripe – without you having to integrate with either of them directly.

Whichever payment processor you choose, remember to think about how payments fit into your wider revenue delivery infrastructure. That is, the systems, processes, and teams responsible for delivering every earned dollar as revenue.

Your product deserves MoR

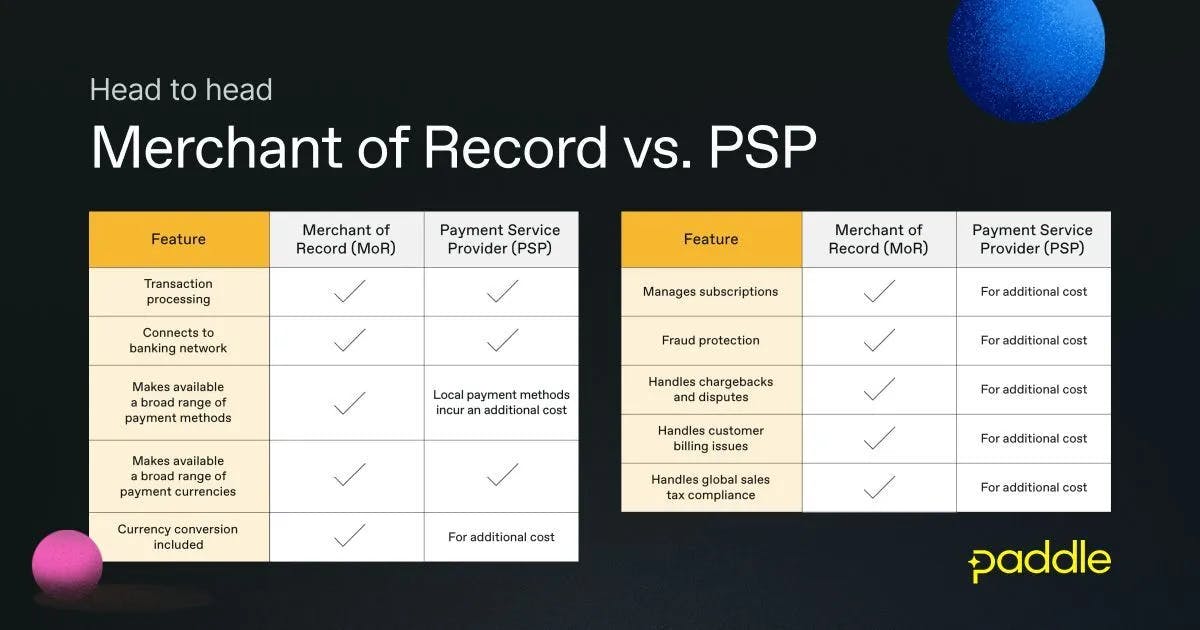

We've discussed the features of two of the most well-known payment service providers out there. However, choosing PSPs to power your billing and payments comes with limitations.

While Stripe and PayPal work well for general online payments, they aren’t designed for digital-first companies like SaaS and digital product sellers.

Why?

- They don’t handle global sales tax (VAT, GST, etc.)

- You are responsible for chargebacks and compliance

- They require extra tools for subscription management

- International expansion is complex

There is another way: the merchant of record (MoR) model. With a MoR, you can focus on putting your time into building your product, rather than building and maintaining your own payment stack, staying on top of complicated tax regulations, fighting fraudulent chargebacks and lots more.

Check out user ratings of Stripe vs PayPal, compared to that of Paddle:

Rating | Stripe | PayPal | Paddle |

|---|---|---|---|

G2 | 4.2 stars out of 5 | 4.4 stars out of 5 | 4.5 stars out of 5 |

Trustpilot | 2.1 stars out of 5 | 1.4 stars out of 5 | 4.3 stars out of 5 |

PayPal vs Stripe Fees

For the purpose of this guide, we are using pricing for US businesses. Some differences in pricing may apply to businesses outside of the US.

Card and digital wallet payments:

Stripe’s base fee is 2.9% + 30¢ per successful transaction (based on US businesses processing debit or credit card payments).

PayPal’s base fee is also 2.9% + 30¢ per successful transaction (based on US businesses processing debit or credit card payments).

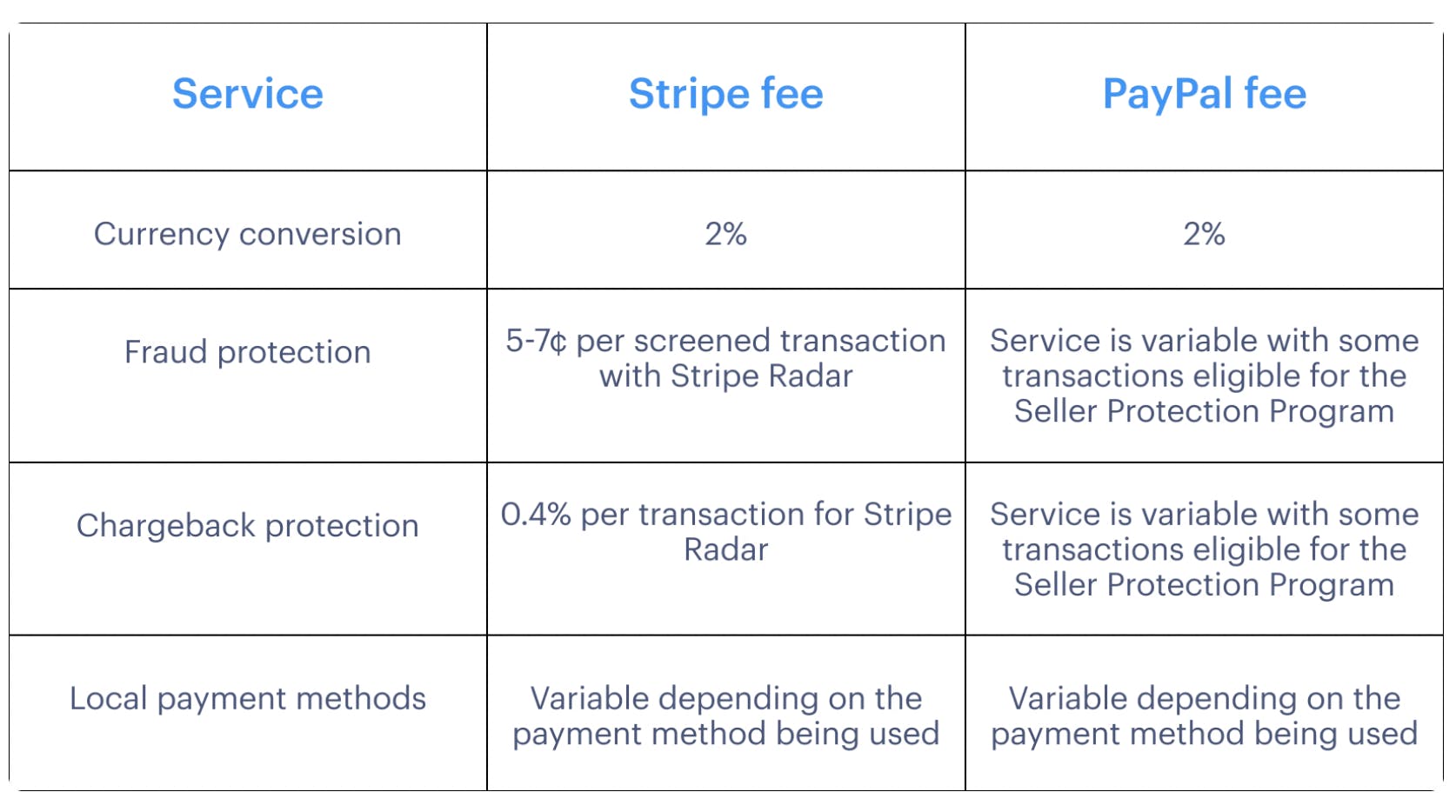

Where they differ is the additional charges for other services, including:

The fee structures for both Stripe and PayPal show why it’s important to recognize payments as just one part of your business’ revenue delivery strategy.

When you’re evaluating the cost of your payment service provider, you need to factor in how the base fees would be impacted by your business’ operations and growth strategy (for example, do you have customers internationally or are you planning on expanding to new markets?).

What to look for instead: Consider a solution like Paddle's MoR. Whilst fees look higher compared to PSPs, you're getting a lot more out of it - MoRs typically come with advanced features in their billing solution - including subscription management software and tax compliance tools, which PSPs offer at an additional cost.

Payment methods

Stripe and PayPal both provide access to a number of different payment methods.

Stripe includes:

- Credit and debit cards: Visa, Mastercard, Maestro, American Express

- Digital wallets: Apple Pay, Google Pay

With access to the following payment methods, charged at an alternative fee:

- Local credit and debit cards including Discover, Cartes Bancaires, JCB, China Union Pay

- Digital wallets including Alipay, WeChat Pay

- And others including bank debit schemes, buy now, pay later providers, wire transfer, and bank redirects.

One thing to note here is that Stripe doesn’t integrate with PayPal. To use both services, you’d need to integrate with PayPal directly or an additional payment processor.

PayPal payment methods include:

- Credit and debit cards: Visa, Mastercard, Maestro, American Express

- Digital wallet: PayPal wallet/account

Access to bank-to-bank payment methods like local wire transfer and SEPA direct debit are charged at an alternative fee.

What to look for: Choose a provider, like a merchant of record that offers multiple payment methods that are already configured in their checkout system. Ask their team if access to local payment methods come at an extra cost - localized payment methods can make or break your checkout conversions!

International payments

Both Stripe and PayPal enable businesses to accept international payments, with access to:

- Local currencies

- Local payment methods

- Foreign exchange on payouts

(As outlined above, some of these services are charged at different rates.)

With Stripe, you can accept payments in 135 currencies, however, the ones you have immediate access to are determined by the country of your Stripe account. This means that to charge in multiple currencies, you will need a Stripe account for each region – and some coding to integrate these with your checkout flow. This also applies to businesses wanting to receive payouts into local, separate bank accounts.

With PayPal, the process to activate and take payments in different currencies is easier but they don’t support as many.

Sales tax compliance

If you are using Stripe Payments and PayPal to accept payments from international customers, you will need to have tools or processes in place to make sure your sales are compliant with global sales tax regulations, everywhere your customers are based.

Stripe Tax is a product within Stripe’s product suite that helps businesses calculate how much tax to charge on transactions in 30 supported countries. This calculator then provides the business with reports that would then need to be filed and remitted to the authorities, either by your team, a tax accountant or another third-party tool.

With Stripe Tax, ultimate liability for sales tax lies with you as the business.

PayPal only handles payment processing, with no direct support for sales tax compliance. As such many PayPal users would be integrating with a tax tool, like Avalara, TaxJar or Quaderno to help with some of this process.

What to look for instead: As a merchant of record becomes the official reseller of your product, all tax obligations go to them, not you. So you don't need to worry about setting up in another country - we handle the calculations, collections and remittance on your behalf.

Security and fraud prevention

Stripe and PayPal are both Payment Card Industry (PCI) compliant. Which means they adhere to a set of standards when it comes to how they secure and protect credit card data.

Stripe product Radar offers additional support against fraud and chargebacks. Using machine learning, Radar detects patterns across your Stripe payments to assess the risk level of each. Radar also covers you against fraudulent disputes (chargebacks). Stripe Radar is a separate product, with its own fees that can be integrated with Stripe Payments. Disputes without this additional protection incur a $15 fee, only refundable if the issue is resolved in your favor. If you don't have Radar turned on, you still pay the fee, even if you win the dispute.

Some transactions running through PayPal are eligible for Seller Protection. The Seller Protection Program includes account monitoring in real-time for fraud prevention purposes and further representation and protection against chargebacks. If a buyer files a chargeback request and the transaction isn’t covered by the Seller Protection Programme, you will incur a $20 chargeback fee.

What to look for: Some merchant of record providers like Paddle integrate fraud and chargeback protection into its product as standard. Paddle ensures that when you win disputes, you're getting both the transaction amount AND the chargeback fee refunded to you.

Customer support

It’s important to consider the level of support you’re looking for in a payment provider as well as how easy the product itself is to use and set up.

Stripe is well known for its developer documentation and usability. Its G2 reviews reflect this too, where it’s rated highly for both ease of use and ease of setup. When there is a problem, Stripe support is available 24/7 from your account, it also offers chat support for developers.

PayPal offers customer support via instant message or telephone. It also gives users the option to ask the PayPal community. Any customers paying through PayPal will also be able to login to their own account to address transaction or account issues.

Both providers have help centres and FAQs on their website to help businesses find solutions to their problems independently.

What to look for: Pick a billing provider that you can outsource your customer support tickets to. This is something Paddle can do for you - your customer's payment and billing questions are dealt with by us, so you can focus on growing your business. Read how we helped HubX offload more than 10,000 billing queries.

Third-party integrations

Stripe and PayPal are both options for managing the payment side of your revenue delivery - but what about the rest of the revenue delivery infrastructure?

To effectively manage the journey of every earned dollar running through your business - from a customer’s first payment attempt, through to recurring billing and global sales tax compliance - you’ll need to integrate Stripe or PayPal with the other tools you use to run your business.

Stripe has a range of integrations, both with other Stripe products and third-party tools, including:

- Ecommerce and shopping experience software

- Recurring billing

- Tax compliance

- In-person payments

- Customer communications

PayPal has fewer integrations but does connect to different eCommerce, accounting, and customer relationship management software as well as others for business management and in-person payments.

Here, it’s best to evaluate the tools you currently use - or are considering - and see which payment provider has the smoothest integration, otherwise, it could leave your engineering team with an unexpected set of work to connect the different systems together (and then maintain the integrations).